Cancer Registry Software Market by Type (Standalone, Integration), Delivery (On-premise, Cloud), Database (Commercial, Public), Functionality (Cancer Reporting, Patient Care, Medical Research), End User, Region - Forecast to 2024

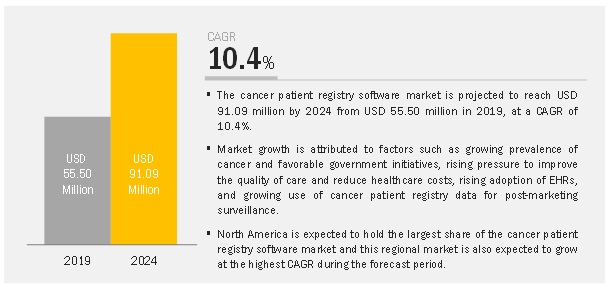

The Cancer Registry Software Market is projected to reach USD 91 million by 2024, at a CAGR of 10.4%. Growth in this market is mainly driven by the increasing prevalence of cancer and favorable government initiatives, rising pressure to improve the quality of care and reduce healthcare costs, increasing adoption of EHRs, and growing use of cancer patient registry data for post-marketing surveillance.

A cancer registry is a computerized database that uses software solutions to organize, collect, and store data on cancer patients to evaluate cancer-specific outcomes, conditions, and drug/medical device exposure. Cancer patient registry software is a tool, which helps to store, manage, and provide access to cancer-specific information that helps in building cancer registries.

Cancer Registry Software Market Dynamics

Drivers: Growing prevalence of cancer and favorable government initiatives

The growing incidence of cancer is a key factor in driving the market growth. In the US, the American Cancer Society estimated about 1,735,350 new cancer cases and 609,640 cancer deaths in 2018. Additionally, to lower the burden of cancer, various government organizations are taking initiatives and providing support to build cancer registries. With the growing demand for population health management and health information exchange, government bodies across the globe are taking initiatives to digitize and integrate healthcare systems, including the development of computerized disease registries.

In the US, federal agencies such as the NIH, CDC, CMS, and AHRQ, along with several state agencies, are focusing on developing cancer patient registries to determine the long-term outcomes of agents, devices, groups of drugs, or procedures. Major initiatives include:

- The National Program of Cancer Registries (NPCR), administered by the US CDC, funded 50 cancer registries in the US in 2018 to promote the monitoring of the cancer burden at the state and national levels and evaluating activities in cancer prevention and control (Source: CDC).

- In June 2018, the Kentucky Cancer Registry (KCR) signed a contract with National Cancer Institute (NCI) and received USD 2.6 million for its participation in NCI’s Surveillance Epidemiology and End Results (SEER) program.

- In February 2018, the Lung Cancer Foundation and the American Lung Association collaborated to launch the Lung Cancer Patient Registry to enable end-users to store detailed patient information.

Restraints: Privacy and data security-related concerns<

Cancer patient registries contain health information data that may include a broad range of demographic information and personal characteristics such as socioeconomic and marital status, the extent of formal education, developmental disabilities, cognitive capacities, emotional stability, and gender, age, and race. Also, health information generally includes information about the patients’ family members. As a result, in the situation of a data breach, the personal, private, or confidential information of patients and third parties can fall into the wrong hands. In the healthcare industry, ~30% of data breaches result in medical identity theft, mainly due to a lack of internal control over patient information, lack of top management support, obsolete policies and procedures, or non-adherence to existing ones, and insufficient personnel training. Governments of many countries in mature markets are currently struggling to address and coordinate the combined needs of privacy and freedom of information.

Opportunities: Rising number of accountable care organizations

Accountable Care Organizations (ACOs) are a group of healthcare providers that focus on offering coordinated care and effective chronic disease management. Payments for these organizations are tied to the achievement of their healthcare quality goals and outcomes that result in cost savings for the medical care delivery system. To enhance patient care, ACOs need to know their population, providers, and patients, and the state of care delivered. Cancer patient registries, with their ability to focus on specific populations and adapt to changing requirements, are powerful tools to support ACOs and other organizations participating in accountable care arrangements.

Challenges: Lack of interoperability and integration

Integrating registries into hospital workflows at the point-of-care is a major challenge for software vendors. Many hospitals and physician practices that participate in observational studies use more than one data capture system and change their workflow to accommodate non-harmonized research demands.

The lack of interoperability between EHR systems with standalone cancer patient registry software has hampered the development of innovative solutions. Until a universal health information exchange system is developed across a country/ region, these types of data exchange challenges are likely to continue to require manual processes for importing or exporting patient records between different EHR systems. Thus, the widespread implementation of EHRs that are not fully interoperable poses a major challenge for cancer patient registry software vendors.

By type, integrated software segment to register the highest CAGR during the forecast period

The use of integrated software is increasing in the healthcare industry mainly due to the industry’s changing landscape, the need to streamline and optimize workflows and decrease physician workloads. Also, factors such as increasing government focus on population health management, coordinated care, and reducing healthcare costs are boosting the market growth.

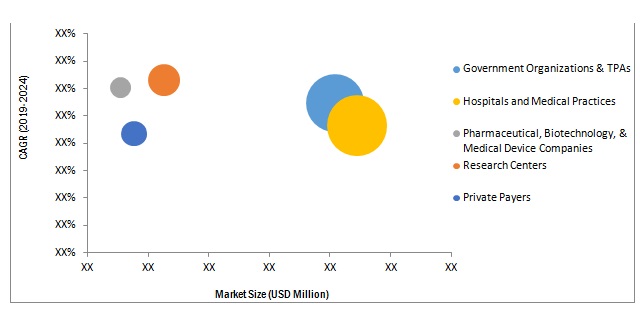

By end-user, research centers to be the fastest-growing segment of the cancer registry market during the forecast period

Research centers mainly use cancer patient registry software to track patients who are eligible for clinical trials. Researchers utilize data from the registry primarily for product development. Many research agencies have built their records to maintain a database of patients suffering from various forms of cancer. Besides, some research centers support the development of cancer patient registries in coordination with healthcare centers and associations.

North America will continue to dominate the cancer registry market the forecast period

The cancer patient registry software market is segmented into North America and Europe. North America accounted for the larger market share in 2018 and will continue to dominate the cancer registry market during the forecast period. Factors such as the high burden of cancer, government funding initiatives to encourage the development of cancer registries, high investments in healthcare IT, the presence of significant cancer registry software development market players, and the high adoption rate of these solutions in the region are contributing to the larger share of North America in the cancer registry software market.

Scope of the Cancer Registry Software Market Report

|

Report Metric |

Details |

|

Market size available for years |

2017–2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2024 |

|

Forecast units |

USD Million (Value) |

|

Segments covered |

Type, Deployment Model, Database, Functionality, End-User, and Region |

|

Geographies covered |

North America and Europe |

|

Companies covered |

Elekta (Sweden), Electronic Registry Systems, Inc. (US), Onco, Inc. (US), C/NET Solutions (US), Rocky Mountain Cancer Data Systems (US), and McKesson Corporation (US) |

This report categorizes the cancer patient registry software market into the following segments and sub-segments:

By Type

- Standalone Software

- Integrated Software

By Deployment Model

- On-premise

- Cloud-based

By Database

- Commercial Databases

- Public Databases

By Functionality

- Cancer Reporting to Meet State & Federal Regulations

- Patient Care Management

- Product Outcome Evaluation

- Medical Research and Clinical Studies

By End-User

- Government Organizations & Third-party Administrators (TPAS)

- Hospitals & Medical Practices

- Pharmaceutical, Biotechnology, & Medical Device Companies

- Private Payers

- Research Centers

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- ROE

Cancer Registry Software Market Key Players

Elekta (Sweden), Onco, Inc. &(US), CNET Global Solutions &(US), Rocky Mountain Cancer Data Systems (RMCDS) (US), McKesson Corporation &US)

Recent Developments

- In November 2018, Onco upgraded the OncoLog Version 4.4.0 to include the newest requirements mandated by NAACCR, AJCC, CoC, and SEER

- In January 2018, Elekta entered into a collaboration with IBM Watson Health to incorporate Watson for Oncology with Elekta’s cancer care solutions.

- In April 2017, McKesson Corporation acquired CoverMyMeds (US) to enhance its technology offerings to clinicians, payers, and pharmaceutical manufacturers

Key questions addressed by the report

- Where will all these developments take the industry in the mid-to-long term?

- What are the factors driving the growth of this market?

- Who are the key players in the market, and how intense is the competition?

- What are the recent collaborations key players have entered into?

- What are the current trends affecting cancer patient registry software manufacturers?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Sources

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Sources

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Assumptions for the Study

3 Executive Summary (Page No. - 27)

4 Premium Insight (Page No. - 31)

4.1 Cancer Patient Registry Software: Market Overview

4.2 Market, By Type

4.3 Market, By Deployment Model

4.4 Market, By Database Type

4.5 Market, By Functionality

4.6 Market, By End User

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Market Drivers

5.2.1.1 Growing Prevalence of Cancer and Favorable Government Initiatives

5.2.1.2 Rising Pressure to Improve the Quality of Care and Reduce Healthcare Costs

5.2.1.3 Rising Adoption of Ehrs

5.2.1.4 Growing Use of Cancer Patient Registry Data for Post-Marketing Surveillance

5.2.2 Market Restraints

5.2.2.1 Privacy and Data Security-Related Concerns

5.2.3 Market Opportunities

5.2.3.1 Rising Number of Accountable Care Organizations

5.2.3.2 Growth of Cloud-Based Cancer Patient Registry Solutions

5.2.4 Market Challenges

5.2.4.1 Lack of Interoperability and Integration

5.2.4.2 Reluctance to Adopt Advanced Solutions

5.2.4.3 Lack of Awareness

6 Cancer Patient Registry Software Market, By Type (Page No. - 40)

6.1 Introduction

6.2 Standalone Software

6.2.1 Standalone Software Accounts for the Largest Share of the Market

6.3 Integrated Software

6.3.1 Advantages Such as Flexibility and Safety are Driving the Adoption of Integrated Software

7 Cancer Patient Registry Software Market, By Deployment Model (Page No. - 46)

7.1 Introduction

7.2 On-Premise Models

7.2.1 On-Premise Models Segment Accounted for the Largest Share of the Market in 2018

7.3 Cloud-Based Models

7.3.1 Cost-Effectiveness and Flexibility Have Ensured the Growth of Cloud-Based Models

8 Cancer Patient Registry Software Market, By Database Type (Page No. - 52)

8.1 Introduction

8.2 Commercial Databases

8.2.1 Commercial Databases Segment Hold the Largest Share in the Cancer Patient Registry Software Market

8.3 Public Databases

8.3.1 Public Databases are Used for Data Collection for A Specific Research Agenda

9 Cancer Patient Registry Software Market, By Functionality (Page No. - 58)

9.1 Introduction

9.2 Cancer Reporting to Meet State and Federal Regulations

9.2.1 Stringent and Rapidly Changing State and Federal Regulations for Cancer Reporting to Drive the Growth of This Segment

9.3 Patient Care Management

9.3.1 Market Players are Expected to Focus on Developing Solutions Designed With Automated Patient Outreach Facility for Optimum Patient Care Management

9.4 Medical Research & Clinical Studies

9.4.1 Several Research Organizations are Expected to Support and Encourage the Creation of Registries for Clinical Research

9.5 Product Outcome Evaluation

9.5.1 Product Outcome Evaluation Functionality has Major Applications in Post-Marketing Surveillance in the Pharmaceutical Industry

10 Cancer Patient Registry Software Market, By End User (Page No. - 68)

10.1 Introduction

10.2 Government Organizations & Third-Party Administrators

10.2.1 Growing Government Initiatives to Drive the Demand for Cancer Patient Registry Software in This End-User Segment

10.3 Hospitals & Medical Practices

10.3.1 Improved Patient Care Management Offered By Cancer Patient Registry Software to Drive Its Demand in Hospitals and Medical Practices

10.4 Private Payers

10.4.1 Role of Cancer Patient Registry Software in the Effective Determination of Healthcare Coverage Policies to Drive Its Demand Among Payers

10.5 Pharmaceutical, Biotechnology, and Medical Device Companies

10.5.1 Increased Need for Post-Marketing Surveillance Driving the Demand for Cancer Patient Registry Software in This End-User Segment

10.6 Research Centers

10.6.1 Cancer Patient Registry Software Makes It Easier for Research Centers to Gather Relevant Information on Cancer Patients

11 Cancer Patient Registry Software Market, By Region (Page No. - 80)

11.1 Introduction

11.2 North America

11.2.1 US

11.2.1.1 Rising Adoption of Ehrs and Increased Government Funding to Build Cancer Registries—Key Drivers for Market Growth

11.2.2 Canada

11.2.2.1 Government Initiatives to Encourage Cancer Research and Support Data Collection for Cancer Registries to Contribute to Market Growth

11.3 Europe

11.3.1 UK

11.3.1.1 Initiatives to Promote and Develop Cancer Registration in the UK to Drive the Growth of This Market

11.3.2 Germany

11.3.2.1 Growing Incidence of Cancer and Ongoing Research Activities to Drive Demand for Registry Software

11.3.3 France

11.3.3.1 Growing Emphasis on Healthcare Interoperability to Drive the Market for Integrated Cancer Patient Registry Software in France

11.3.4 Rest of Europe (RoE)

12 Competitive Landscape (Page No. - 106)

12.1 Overview

12.2 Market Player Ranking

12.3 Competitive Situation and Trends

12.3.1 Product Enhancements

12.3.2 Acquisitions

12.3.3 Collaborations

13 Company Profiles (Page No. - 110)

(Introduction, Products & Services, Strategy, & Analyst Insights, Developments, MnM View)*

13.1 Onco, Inc.

13.2 C/Net Solutions

13.3 Elekta AB (PUB)

13.4 Rocky Mountain Cancer Data Systems

13.5 Electronic Registry Systems, Inc.

13.6 Mckesson Corporation

*Details on Marketsandmarkets View, Introduction, Product & Services, Strategy, & Analyst Insights, New Developments Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 118)

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.3 Related Reports

14.4 Author Details

List of Tables (96 Tables)

Table 1 Market, By Type, 2017–2024 (USD Million)

Table 2 Standalone Cancer Patient Registry Software: Market, By Region, 2017–2024 (USD Million)

Table 3 North America: Standalone Cancer Patient Registry Software: Market, By Country, 2017–2024 (USD Million)

Table 4 Europe: Standalone Cancer Patient Registry Software: Market, By Country, 2017–2024 (USD Million)

Table 5 Integrated Cancer Patient Registry Software: Market, By Region, 2017–2024 (USD Million)

Table 6 North America: Integrated Cancer Patient Registry Software: Market, By Country, 2017–2024 (USD Million)

Table 7 Europe: Integrated Cancer Patient Registry Software: Market, By Country, 2017–2024 (USD Million)

Table 8 Market, By Deployment Model, 2017–2024 (USD Million)

Table 9 Market for On-Premise Models, By Region, 2017–2024 (USD Million)

Table 10 North America: Market for On-Premise Models, By Country, 2017–2024 (USD Million)

Table 11 Europe: Market for On-Premise Models, By Country/Region, 2017–2024 (USD Million)

Table 12 Market for Cloud-Based Models, By Region, 2017-2024 (USD Million)

Table 13 North America: Market for Cloud-Based Models, By Country, 2017-2024 (USD Million)

Table 14 Europe: Market for Cloud-Based Models, By Country/ Region, 2017-2024 (USD Million)

Table 15 Market, By Database Type, 2017–2024 (USD Million)

Table 16 Market for Commercial Databases, By Region, 2017–2024 (USD Million)

Table 17 North America: Market for Commercial Databases, By Country, 2017–2024 (USD Million)

Table 18 Europe: Market for Commercial Databases, By Country, 2017–2024 (USD Million)

Table 19 Market for Public Databases, By Region, 2017–2024 (USD Million)

Table 20 North America: Market for Public Databases, By Country, 2019–2024 (USD Million)

Table 21 Europe: Market for Public Databases, By Country, 2019–2024 (USD Million)

Table 22 Market, By Functionality, 2017–2024 (USD Million)

Table 23 Market for Cancer Reporting to Meet State and Federal Regulations, By Region, 2017–2024 (USD Million)

Table 24 North America: Market for Cancer Reporting to Meet State and Federal Regulations, By Country, 2017–2024 (USD Million)

Table 25 Europe: Market for Cancer Reporting to Meet State and Federal Regulations, By Country, 2017–2024 (USD Million)

Table 26 Market for Patient Care Management, By Region, 2017–2024 (USD Million)

Table 27 North America: Market for Patient Care Management, By Country, 2017–2024 (USD Million)

Table 28 Europe: Market for Patient Care Management, By Country, 2017–2024 (USD Thousand)

Table 29 Market for Medical Research & Clinical Studies, By Region, 2017–2024 (USD Million)

Table 30 North America: Market for Medical Research & Clinical Studies, By Country, 2017–2024 (USD Million)

Table 31 Europe: Market for Medical Research & Clinical Studies, By Country, 2017–2024 (USD Million)

Table 32 Market for Product Outcome Evaluation, By Region, 2017–2024 (USD Million)

Table 33 North America: Market for Product Outcome Evaluation, By Country, 2017–2024 (USD Million)

Table 34 Europe: Market for Product Outcome Evaluation, By Country, 2017–2024 (USD Million)

Table 35 Market, By End User, 2017–2024 (USD Million)

Table 36 Market for Government Organizations & Third-Party Administrators, By Region, 2017–2024 (USD Million)

Table 37 North America: Market for Government Organizations & Third-Party Administrators, By Country, 2017–2024 (USD Million)

Table 38 Europe: Market for Government Organizations & Third-Party Administrators, By Country, 2017–2024 (USD Million)

Table 39 Market for Hospitals & Medical Practices, By Region, 2017–2024 (USD Million)

Table 40 North America: Market for Hospitals & Medical Practices, By Country, 2017–2024 (USD Million)

Table 41 Europe: Market for Hospitals & Medical Practices, By Country, 2017–2024 (USD Million)

Table 42 Market for Private Payers, By Region, 2017–2024 (USD Million)

Table 43 North America: Market for Private Payers, By Country, 2017–2024 (USD Million)

Table 44 Europe: Market for Private Payers, By Country, 2017–2024 (USD Thousand)

Table 45 Cancer Registry Software Market for Pharmaceutical, Biotechnology, and Medical Device Companies, By Region, 2017–2024 (USD Million)

Table 46 North America: Cancer Registry Software Market for Pharmaceutical, Biotechnology, and Medical Device Companies, By Country, 2017–2024 (USD Million)

Table 47 Europe: Cancer Registry Software Market for Pharmaceutical, Biotechnology, and Medical Device Companies, By Country, 2017–2024 (USD Million)

Table 48 Cancer Registry Software Market for Research Centers, By Region, 2017–2024 (USD Million)

Table 49 North America: Cancer Registry Software Market for Research Centers, By Country, 2017–2024 (USD Million)

Table 50 Europe: Cancer Registry Software Market for Research Centers, By Country, 2017–2024 (USD Million)

Table 51 Cancer Registry Software Market, By Region, 2017–2024 (USD Million)

Table 52 North America: Cancer Registry Software Market, By Country, 2017–2024 (USD Million)

Table 53 North America: Cancer Registry Software Market, By Type, 2017–2024 (USD Million)

Table 54 North America: Cancer Registry Software Market, By Deployment Model, 2017–2024 (USD Million)

Table 55 North America: Cancer Registry Software Market, By Database Type, 2017–2024 (USD Million)

Table 56 North America: Cancer Registry Software Market, By Functionality, 2017–2024 (USD Million)

Table 57 North America: Cancer Registry Software Market, By End User, 2017–2024 (USD Million)

Table 58 US: Cancer Registry Software Market, By Type, 2017–2024 (USD Million)

Table 59 US: Cancer Registry Software Market, By Deployment Model, 2017–2024 (USD Million)

Table 60 US: Cancer Registry Software Market, By Database Type, 2017–2024 (USD Million)

Table 61 US: Cancer Registry Software Market, By Functionality, 2017–2024 (USD Million)

Table 62 US: Cancer Registry Software Market, By End User, 2017–2024 (USD Million)

Table 63 Canada: Cancer Registry Software Market, By Type, 2017–2024 (USD Million)

Table 64 Canada: Cancer Registry Software Market, By Deployment Model, 2017–2024 (USD Million)

Table 65 Canada: Cancer Registry Software Market, By Database Type, 2017–2024 (USD Million)

Table 66 Canada: Cancer Registry Software Market, By Functionality, 2017–2024 (USD Million)

Table 67 Canada: Cancer Registry Software Market, By End User, 2017–2024 (USD Million)

Table 68 Europe: Cancer Registry Software Market, By Country, 2017–2024 (USD Million)

Table 69 Europe: Cancer Registry Software Market, By Type, 2017–2024 (USD Million)

Table 70 Europe: Cancer Registry Software Market, By Deployment Model, 2017–2024 (USD Million)

Table 71 Europe: Cancer Registry Software Market, By Database Type, 2017–2024 (USD Million)

Table 72 Europe: Cancer Registry Software Market, By Functionality, 2017–2024 (USD Million)

Table 73 Europe: Cancer Registry Software Market, By End User, 2017–2024 (USD Million)

Table 74 UK: Cancer Registry Software Market, By Type, 2017–2024 (USD Million)

Table 75 UK: Cancer Registry Software Market, By Deployment Model, 2017–2024 (USD Million)

Table 76 UK: Cancer Registry Software Market, By Database Type, 2017–2024 (USD Million)

Table 77 UK: Cancer Registry Software Market, By Functionality, 2017–2024 (USD Million)

Table 78 UK: Cancer Registry Software Market, By End User, 2017–2024 (USD Million)

Table 79 Germany: Patient Registry Software Market, By Type, 2017–2024 (USD Million)

Table 80 Germany: Patient Registry Software Market, By Deployment Model, 2017–2024 (USD Million)

Table 81 Germany: Cancer Registry Software Market, By Database Type, 2017–2024 (USD Million)

Table 82 Germany: Cancer Registry Software Market, By Functionality, 2017–2024 (USD Million)

Table 83 Germany: Cancer Registry Software Market, By End User, 2017–2024 (USD Million)

Table 84 France: Cancer Registry Software Market, By Type, 2017–2024 (USD Million)

Table 85 France: Cancer Registry Software Market, By Deployment Model, 2017–2024 (USD Million)

Table 86 France: Cancer Registry Software Market, By Database Type, 2017–2024 (USD Million)

Table 87 France: Cancer Registry Software Market, By Functionality, 2017–2024 (USD Million)

Table 88 France: Cancer Registry Software Market, By End User, 2017–2024 (USD Million)

Table 89 RoE: Market, By Type, 2017–2024 (USD Million)

Table 90 RoE: Market, By Deployment Model, 2017–2024 (USD Million)

Table 91 RoE: Market, By Database Type, 2017–2024 (USD Million)

Table 92 RoE: Market, By Functionality, 2017–2024 (USD Million)

Table 93 RoE: Market, By End User, 2017–2024 (USD Million)

Table 94 Product Enhancements, 2016–2018

Table 95 Acquisitions, 2016–2018

Table 96 Collaborations, 2016–2018

List of Figures (29 Figures)

Figure 1 Cancer Patient Registry Software: Market Segmentation

Figure 2 Research Design

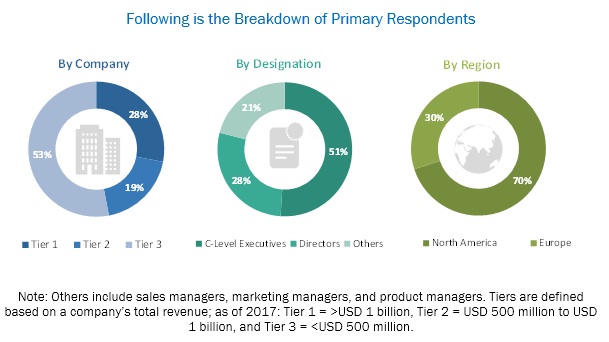

Figure 3 Breakdown of Primary Interviews

Figure 4 Bottom-Up Approach

Figure 5 Top-Down Approach

Figure 6 Data Triangulation Methodology

Figure 7 Cancer Patient Registry Software: Market, By Type, 2019 vs 2024 (USD Million)

Figure 8 Cancer Patient Registry Software: Market, By Deployment Model, 2019 vs 2024 (USD Million)

Figure 9 Cancer Patient Registry Software: Market, By Database Type, 2019 vs 2024 (USD Million)

Figure 10 Cancer Patient Registry Software: Market, By Functionality, 2019 vs 2024 (USD Million)

Figure 11 Research Centers Segment is Expected to Witness the Highest CAGR During the Forecast Period

Figure 12 Rising Pressure to Improve the Quality of Care and Reduce Healthcare Costs to Drive Market Growth

Figure 13 Integrated Software Segment to Grow at the Fastest Rate During the Forecast Period

Figure 14 On-Premise Models to Hold the Largest Share of the Market in 2019

Figure 15 Commercial Database Segment to Dominate the Market in 2019

Figure 16 Cancer Reporting to Meet State & Federal Regulations Segment to Dominate the Market in 2019

Figure 17 Hospitals and Medical Practices Segment to Dominate the Market in 2019

Figure 18 Cancer Patient Registry Software: Drivers, Restraints, Opportunities, and Challenges

Figure 19 Integrated Software Segment is Expected to Register High Growth During the Forecast Period

Figure 20 Cloud-Based Models Segment is Expected to Witness the Higher CAGR During the Forecast Period

Figure 21 Commercial Databases Segment to Dominate the Cancer Patient Registry Software: Market During the Forecast Period

Figure 22 Medical Research & Clinical Studies Segment is Expected to Witness the Highest Growth Rate During the Forecast Period

Figure 23 Research Centers - the Fastest-Growing End-User Segment in the Cancer Patient Registry Software: Market

Figure 24 North America: Cancer Patient Registry Software: Market Snapshot

Figure 25 Europe: Cancer Patient Registry Software: Market Snapshot

Figure 26 Key Developments in the Cancer Patient Registry Software: Market From 2016 to November 2018

Figure 27 Cancer Patient Registry Software: Market Player Ranking, 2018

Figure 28 Elekta AB (PUB): Company Snapshot

Figure 29 Mckesson Corporation: Company Snapshot

This study involved four major activities to estimate the current size of the cancer patient registry software market. Information on the market and its peer & parent markets was collected through exhaustive secondary research. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the size of segments and subsegments.

Secondary Research

Secondary research was mainly used to identify and collect information for the extensive, technical, market-oriented, and commercial study of the cancer patient registry software market. Secondary sources such as directories; databases such as Bloomberg Business, Factiva, and Wall Street Journal; white papers; and annual reports were used to obtain key information about major players, market classification, and segmentation according to industry trends, regional/country-level markets, market developments, and technology perspectives.

Primary Research

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess future prospects of the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

Cancer Registry Software Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the cancer patient registry software market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- Revenue generated by leading players through cancer patient registry software has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the market size estimation process, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the cancer patient registry software market on the basis of type, deployment model, database type, functionality, end user, and region

- To provide detailed information regarding the factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of market segments in North America and Europe

- To profile key market players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze competitive developments such as product enhancements, acquisitions, and collaborations in the cancer patient registry software market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company‘s specific needs. The following customization options are available for this report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Cancer Registry Software Market