Cable Testing and Certification Market by Voltage (Low Voltage, Medium Voltage and High Voltage), Test (Routine Test, Sample Test and Type Test), End-User (Cable Manufacturers and Utility Providers), and Region - Global Forecast to 2023

The study involved four major activities in estimating the current market size for cable testing and certification. Exhaustive secondary research was done to collect information on the service market and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the overall market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet have been referred to, so as to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; gold standard & silver standard websites; food safety organizations; regulatory bodies; trade directories; and databases.

Primary Research

The cable testing and certification market comprises several stakeholders such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of the food & beverage, pharmaceutical, nutraceutical & dietary supplement, personal care, and feed industries and the growth in population. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both, the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

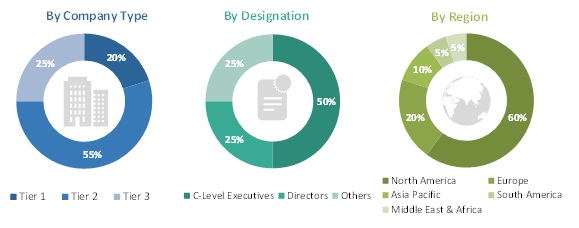

Following is the breakdown of primary respondents-

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the global cable testing and certification market and to estimate the sizes of various other dependent submarkets. The research methodology used to estimate the market size includes the following:

- The key players in the industry were identified through extensive secondary research.

- The supply chain of the industry and market size, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of key industry players along with extensive interviews with key officials, such as directors and marketing executives.

Data Triangulation

After arriving at the total market size through the estimation process explained above, the overall market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market size estimation process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size was validated by using both top-down and bottom-up approaches. Then, it was verified through primary interviews. Hence, for every data segment, there are three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed to be correct when the values arrived at from the three sources matched.

Report Objectives

- To define, describe, and forecast the size of the cable testing and certification market, in terms of value

- To provide detailed information regarding the significant factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze and forecast the market size on the basis of voltage types, tests, and end users

- To forecast the market size of different segments with respect to five main regions, namely, North America, Europe, Asia Pacific (APAC), South America, and the Middle East & Africa

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To analyze the competitive developments, such as expansions, acquisitions, agreements, and research & development (R&D) activities in the market

- To strategically profile the key players and comprehensively analyze their growth strategies

Report Objectives

|

Report Metric |

Details |

|

Market size available for years |

2016–2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018–2023 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Test, Voltage, End user and Region |

|

Geographies covered |

North America, APAC, Europe, Middle East & Africa, and South America |

|

Companies covered |

DEKRA (Germany), Underwriters Laboratories (US), British Approvals Service for Cables (UK), SGS (Switzerland), and BRE Global (UK) among the total 22 major players covered. |

This research report categorizes the global cable testing and certification market on the basis of end user, type and region.

On the basis of end user:

- Cable manufacturers

- Utility providers

On the basis of test type:

- Routine

- Sample

- Type

On the basis of voltage type:

- Low

- Medium

- High

On the basis of region:

- North America

- Europe

- APAC

- Middle East & Africa

- South America

The market is further analyzed for the key countries in each of these regions.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Geographical Analysis:

- Country-level analysis of the global cable testing and certification market

Company Information:

- Detailed analysis and profiles of additional market players

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

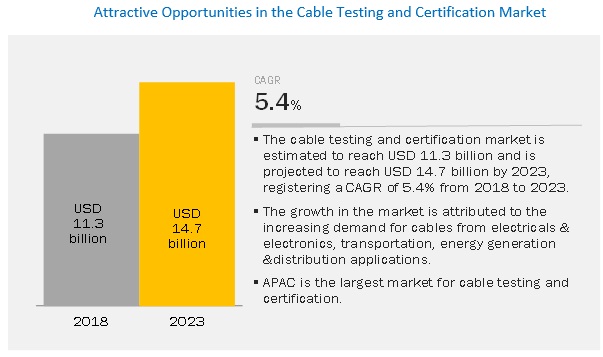

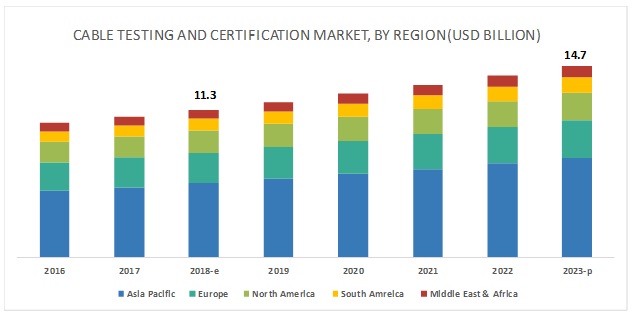

The market for cable testing and certification is projected to grow from USD 11.3 billion in 2018 to USD 14.7 billion by 2023, at a compound annual growth rate (CAGR) of 5.4% during the forecast period. Cable testing and certification are widely used to verify the cable’s safety and efficiency. The growth of the cable testing and certification market is, therefore, directly associated with the growing demand for cables in the electrical & electronics, transportation, and energy generation & distribution applications.

The low-voltage cable testing and certification segment is projected to be the second-fastest-growing market during the forecast period.

According to the IEC, cables considered under the low-voltage segment have a voltage below 1 kV. These cables are used as an essential component in the secondary distribution of electricity. Low-voltage cables account for the largest share in the overall cables market due to their wide range of applications such as commercial, industrial, and utility. Testing of these cables is mainly dependent on its raw materials and applications. The price of testing low-voltage cables is lesser than the price of testing the medium- and high-voltage cables. The growth of this segment is associated with an increase in industrial automation and infrastructural developments in various regions.

Sample test to remain the second-largest segment of the cable testing and certification market during the forecast period.

A sample test is a group of tests performed on the samples of finished cables at a specified frequency, to verify whether the cables produced meet the specified requirements. The frequency of testing may range from one month and above. This test is performed to check the quality of cables produced in the same plant in different batches and at a different time. The tests performed under this segment are mainly used to check the material of the cables. Some important tests conducted under this segment are ageing in air bomb, ageing in air oven, bending, crush testing, fiber content analysis, flexing, high voltage (water immersion) test, hot set, oil resistance, tear resistance, tensile strength and elongation at break, and water abortion test (for insulation). The demand for these tests is expected to increase with the increase in import and export of high-quality cables across the globe during the forecast period.

APAC is estimated to account for the largest market size during the forecast period

APAC is estimated to dominate the overall cable testing and certification market, in 2018. The region has emerged as the largest consumer of cable testing and certification, owing to the growth in production and consumption of cables in countries such as China, Japan, India, South Korea, and Australia. The growing industrialization in these countries is expected to drive the market for cable testing and certification in the region during the forecast period.

Some of the leading players of the cable testing and certification market are DEKRA (Germany), Underwriters Laboratories (US), British Approvals Service for Cables (UK), SGS (Switzerland), BRE Global (UK), TÜV Rheinland (Germany), Bureau Veritas (France), Intertek (UK), TÜV NORD GROUP (Germany), North Central Electric (US), RN Electronics (UK), TÜV SÜD (Germany), Eland Cables (UK), and Industrial Tests (US).

Recent Developments

- In September 2018, TÜV Rheinland (Germany) and Shenzhen No. 3 Vocational School of Technology (China) signed a strategic cooperation framework agreement to build Sino-German Industry 4.0 Demonstration and Training Center. The center will benefit the development, upgrading, and transformation of Shenzhen’s industry, and support the 'Made in China 2025’ strategy. With this agreement, TÜV Rheinland is expected to increase its presence in China.

- In June 2018, Underwriters Laboratories (US) and TISI (Thailand) signed a memorandum of understanding (MOU) to promote national safety standards for Thailand. TISI is the national standards organization for Thailand. Under this MOU, both the companies will exchange their standards information, cooperate and collaborate on safety-related standards issues, and TISI will participate in UL Standards Technical Panels.

- In December 2017, Underwriters Laboratories (US) wire and cable division signed a Memorandum of Agreement (MOA) with Korea Testing Certification (KTC), a leading testing and certification service provider in South Korea. Under this MOA, KTC will establish a laboratory in Gokseong, South Korea, by 2020 to provide testing services based on UL standards and UL will support KTC in determining facility specifications and provide training to the KTC staff on the UL standards.

Key Questions addressed by the report

- What are the global trends in the demand for cable testing and certification? Will the market witness an increase or decline in demand in the coming years?

- What is the estimated demand for testing and certification of the different voltage types of cables?

- What were the revenue pockets for the cable testing and certification market in 2017?

- What are the different cable certifications for environmental needs?

- Who are the major cable testing and certification service providers globally?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Assumptions and Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 30)

4 Premium Insights (Page No. - 33)

4.1 Attractive Opportunities in the Global Market

4.2 APAC: Cable Testing and Certification Market, By Test and Country

4.3 Market: By Country

4.4 Market: By Test

4.5 Market: By End User

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Use of Cables Due to the Rise in Electricity Generation in the Oecd and Non-Oecd Countries

5.2.1.2 Growth in the Global Electronics and It Industries

5.2.1.3 Growth in Industrialization and Urbanization

5.2.2 Restraints

5.2.2.1 High Cost of Cable Testing and Certification

5.2.3 Opportunities

5.2.3.1 Growing Use of Cables in the Construction and Automotive Industries

5.2.3.2 Rise in Renewable Energy Production

5.2.4 Challenges

5.2.4.1 Harmful Effects Caused While Conducting A Few Cable Tests

5.2.4.2 High Testing and Certification Lead Time

5.3 Macroeconomic Overview

5.3.1 Introduction

5.3.2 GDP Growth Rate and Forecast of Major Economies

5.4 Overview of Applicable Standards and Certifications

5.4.1 Introduction

5.4.2 IEC (International Electrotechnical Commission) Standard

5.4.3 European (EN) Standards

5.4.4 British Standard (BS)

5.4.5 UL (Underwriters Laboratories)

5.4.6 Insulated Cable Engineers Association (ICEA)

5.4.7 Institute of Electrical and Electronics Engineers (IEEE)

5.4.8 Canadian Standards Association (CSA)

5.5 Overview of Regulations

5.5.1 Construction Products Regulation (CPR)

5.5.2 Ce Marking

5.5.3 Low Voltage Directive (LVD)

5.5.4 Restriction of Hazardous Substances (RPHS)

5.5.5 Registration, Evaluation, Authorisation and Restriction of Chemicals (Reach)

5.5.6 Waste From Electrical and Electronic Equipment (WEEE)

6 Cable Testing and Certification Market, By Voltage Type (Page No. - 55)

6.1 Introduction

6.2 Low Voltage

6.2.1 Rising Demand From APAC to Drive the Low-Voltage Cable Testing and Certification Market

6.3 Medium Voltage

6.3.1 Power Distribution Application to Drive the Medium-Voltage Cable Testing and Certification Market

6.4 High Voltage

6.4.1 High-Voltage to Be the Largest Segment of the Market

7 Cable Testing and Certification Market, By Test (Page No. - 61)

7.1 Introduction

7.2 Routine Test

7.2.1 Routine Test to Remain the Largest Segment of the Market

7.3 Sample Test

7.3.1 APAC to Remain the Largest Region for the Sample Test Segment in the Market

7.4 Type Test

7.4.1 Rising Demand for Fire-Resistant Cables to Drive the Type Test Segment in the Market

8 Cable Testing and Certification Market, By End User (Page No. - 68)

8.1 Introduction

8.2 Cable Manufacturers

8.2.1 Cable Manufacturers to Remain the Largest End User Segment of the Market

8.3 Utility Providers

8.3.1 APAC to Be the Fastest-Growing Region for Utility ProvidersIn the Market

9 Cable Testing and Certification Market, By Region (Page No. - 72)

9.1 Introduction

9.2 APAC

9.2.1 China

9.2.1.1 China to Be the Fastest-Growing Market for Cable Testing and Certification in APAC

9.2.2 Japan

9.2.2.1 Rising Cables Demand in the Transportation Application to Drive the Cable Testing and Certification in Japan

9.2.3 India

9.2.3.1 Growing Demand for Cables in the Electricity Generation & Distribution Application to Drive the Cable Testing and Certification in India

9.2.4 South Korea

9.2.4.1 High Voltage Type to Remain the Largest Segment of the Market in South Korea

9.2.5 Australia

9.2.5.1 Routine Test to Remain the Largest Segment of the Market in Australia

9.2.6 Rest of APAC

9.2.6.1 Rising Demand for Cables in the Electrical & Electronics Application to Drive the Market in Rest of APAC

9.3 Europe

9.3.1 Germany

9.3.1.1 Germany to Be the Largest Market for Cable Testing and Certification in Europe

9.3.2 France

9.3.2.1 High Voltage Type to Remain the Largest Segment of the Market in France

9.3.3 UK

9.3.3.1 Rising Demand for Cables in the Electrical & Electronics Application to Drive the Market in the UK

9.3.4 Russia

9.3.4.1 Growing Cables Demand in Electricity Generation & Distribution Application to Drive the Cable Testing and Certification in Russia

9.3.5 Italy

9.3.5.1 Routine Test to Remain The Largest Segment of The Market in Italy

9.3.6 Spain

9.3.6.1 Rising Cables Demand in The Electricity Generation & Distribution Application to Drive The Cable Testing and Certification in Spain

9.3.7 Rest of Europe

9.3.7.1 High Voltage Type to Remain The Largest Segment of The Market in Rest of Europe

9.4 North America

9.4.1 Us

9.4.1.1 US to Be The Fastest-Growing Market for Cable Testing and Certification in North America

9.4.2 Canada

9.4.2.1 Growing Cables Demand in The Electricity Generation & Distribution Application to Drive The Cable Testing and Certification in Canada

9.4.3 Mexico

9.4.3.1 Routine Test to Remain The Largest Segment of The Market in Mexico

9.5 South America

9.5.1 Brazil

9.5.1.1 Brazil to Be The Largest Market for Cable Testing and Certification in South America

9.5.2 Argentina

9.5.2.1 Growing Demand for Cables in The Electricity Generation & Distribution Application to Drive The Cable Testing and CertificationIn Argentina

9.5.3 Rest of South America

9.5.3.1 Routine Test to Remain The Largest Segment of The Market in Rest of South America

9.6 Middle East & Africa

9.6.1 Saudi Arabia

9.6.1.1 Saudi Arabia to Be The Fastest-Growing Market for Cable Testing and Certification in The Middle East & Africa

9.6.2 UAE

9.6.2.1 Growing Demand for Cables in The Electricity Generation & Distribution Application to Drive The Cable Testing and Certification in UAE

9.6.3 Rest of Middle East & Africa

9.6.3.1 Routine Test to Remain The Largest Segment of The Market in Rest of Middle East & Africa

10 Competitive Landscape (Page No. - 115)

10.1 Overview

10.2 Competitive Scenario

10.2.1 Expansions

10.2.2 Acquisitions

10.2.3 Agreements/Collaborations/Partnerships

11 Company Profiles (Page No. - 118)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

11.1 Underwriters Laboratories (UL)

11.2 Dekra

11.3 British Approvals Service for Cables (Basec)

11.4 SGS

11.5 Tüv Rheinland

11.6 Bureau Veritas

11.7 Intertek

11.8 DNV GL (Kema Laboratories)

11.9 Kinectrics

11.10 Cesi

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

11.11 Other Players

11.11.1 Bre Group

11.11.2 Eland Cables

11.11.3 Eurofins Scientific

11.11.4 Tüv Süd

11.11.5 Applus

11.11.6 ALS

11.11.7 TUV Nord

11.11.8 Industrial Tests

11.11.9 North Central Electric

11.11.10 Rn Electronics

11.11.11 Central Power Research Institute (CPRI)

11.11.12 Japan Electric Cable Technology Center (Jectec)

12 Appendix (Page No. - 139)

12.1 Insights From Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (115 Tables)

Table 1 Trends and Forecast of GDP Growth Rates, By Country, 2016-2023

Table 2 Iec Standards and Their Titles

Table 3 En Standards and Their Titles

Table 4 British Standards and Their Titles

Table 5 Ul Standards and Their Titles

Table 6 ICEA Standards and Their Titles

Table 7 IEEE Standards and Their Titles

Table 8 Restricted Substances and Their Quantities

Table 9 Cable Testing & Certification Market Size, By Voltage Type, 2016–2023 (USD Million)

Table 10 Low-Voltage Cable Testing & Certification Market Size, By Region, 2016–2023 (USD Million)

Table 11 Medium-Voltage Cable Testing & Certification Market Size, By Region, 2016–2023 (USD Million)

Table 12 High-Voltage Cable Testing & Certification Market Size, By Region, 2016–2023 (USD Million)

Table 13 List of Different Tests Carried Out on Cables

Table 14 Cable Testing and Certification Market Size, By Test, 2016–2023 (USD Million)

Table 15 Routine Test Market Size, By Region, 2016–2023 (USD Million)

Table 16 Sample Test Market Size, By Region, 2016–2023 (USD Million)

Table 17 Type Test Market Size, By Region, 2016–2023 (USD Million)

Table 18 By Market Size, By End User, 2016—2023 (USD Million)

Table 19 By Market Size in Cable Manufacturers Segment, By Region, 2016—2023 (USD Million)

Table 20 By Market Size in Utility Providers Segment, By Region, 2016—2023 (USD Million)

Table 21 By Market Size, By Region, 2016–2023 (USD Million)

Table 22 Major Cable Manufacturers in APAC

Table 23 APAC: By Market Size, By Country, 2016–2023 (USD Million)

Table 24 APAC: By Market Size, By Voltage Type, 2016–2023 (USD Million)

Table 25 APAC: By Market Size, By Test, 2016–2023 (USD Million)

Table 26 APAC: By Market Size, By End User, 2016–2023 (USD Million)

Table 27 China: By Market Size, By Voltage Type, 2016–2023 (USD Million)

Table 28 China: By Market Size, By Test, 2016–2023 (USD Million)

Table 29 China: By Market Size, By End User, 2016–2023 (USD Million)

Table 30 Japan: By Market Size, By Voltage Type, 2016–2023 (USD Million)

Table 31 Japan: By Market Size, By Test, 2016–2023 (USD Million)

Table 32 Japan: By Market Size, By End User, 2016–2023 (USD Million)

Table 33 India: By Market Size, By Voltage Type, 2016–2023 (USD Million)

Table 34 India: By Market Size, By Test, 2016–2023 (USD Million)

Table 35 India: By Market Size, By End User, 2016–2023 (USD Million)

Table 36 South Korea: By Market Size, By Voltage Type, 2016–2023 (USD Million)

Table 37 South Korea: By Market Size, By Test, 2016–2023 (USD Million)

Table 38 South Korea: By Market Size, By End User, 2016–2023 (USD Million)

Table 39 Australia: By Market Size, By Voltage Type, 2016–2023 (USD Million)

Table 40 Australia: By Market Size, By Test, 2016–2023 (USD Million)

Table 41 Australia: By Market Size, By End User, 2016–2023 (USD Million)

Table 42 Rest of APAC: By Market Size, By Voltage Type, 2016–2023 (USD Million)

Table 43 Rest of APAC: By Market Size, By Test, 2016–2023 (USD Million)

Table 44 Rest of APAC: By Market Size, By End User, 2016–2023 (USD Million)

Table 45 Major Cable Manufacturers in Europe

Table 46 Europe: By Market Size, By Country, 2016–2023 (USD Million)

Table 47 Europe: By Market Size, By Voltage Type, 2016–2023 (USD Million)

Table 48 Europe: By Market Size, By Test, 2016–2023 (USD Million)

Table 49 Europe: By Market Size, By End User, 2016–2023 (USD Million)

Table 50 Germany: By Market Size, By Voltage Type, 2016–2023 (USD Million)

Table 51 Germany: By Market Size, By Test, 2016–2023 (USD Million)

Table 52 Germany: By Market Size, By End User, 2016–2023 (USD Million)

Table 53 France: By Market Size, By Voltage Type, 2016–2023 (USD Million)

Table 54 France: By Market Size, By Test, 2016–2023 (USD Million)

Table 55 France: By Market Size, By End User, 2016–2023 (USD Million)

Table 56 UK: By Market Size, By Voltage Type, 2016–2023 (USD Million)

Table 57 UK: By Market Size, By Test, 2016–2023 (USD Million)

Table 58 UK: By Market Size, By End User, 2016–2023 (USD Million)

Table 59 Russia: By Market Size, By Voltage Type, 2016–2023 (USD Million)

Table 60 Russia: By Market Size, By Test, 2016–2023 (USD Million)

Table 61 Russia: By Market Size, By End User, 2016–2023 (USD Million)

Table 62 Italy: By Market Size, By Voltage Type, 2016–2023 (USD Million)

Table 63 Italy: By Market Size, By Test, 2016–2023 (USD Million)

Table 64 Italy: By Market Size, By End User, 2016–2023 (USD Million)

Table 65 Spain: By Market Size, By Voltage Type, 2016–2023 (USD Million)

Table 66 Spain: By Market Size, By Test, 2016–2023 (USD Million)

Table 67 Spain: By Market Size, By End User, 2016–2023 (USD Million)

Table 68 Est of Europe: By Market Size, By Voltage Type, 2016–2023 (USD Million)

Table 69 Rest of Europe: By Market Size, By Test, 2016–2023 (USD Million)

Table 70 Rest of Europe: By Market Size, By End User, 2016–2023 (USD Million)

Table 71 Major Cable Manufacturers in North America

Table 72 North America: By Market Size, By Country, 2016–2023 (USD Million)

Table 73 North America: By Market Size, By Voltage Type, 2016–2023 (USD Million)

Table 74 North America: By Market Size, By Test, 2016–2023 (USD Million)

Table 75 North America: By Market Size, By End User, 2016–2023 (USD Million)

Table 76 US: By Market Size, By Voltage Type, 2016–2023 (USD Million)

Table 77 US: By Market Size, By Test, 2016–2023 (USD Million)

Table 78 US: By Market Size, By End User, 2016–2023 (USD Million)

Table 79 Canada: By Market Size, By Voltage Type, 2016–2023 (USD Million)

Table 80 Canada: By Market Size, By Test, 2016–2023 (USD Million)

Table 81 Canada: By Market Size, By End User, 2016–2023 (USD Million)

Table 82 Mexico: By Market Size, By Voltage Type, 2016–2023 (USD Million)

Table 83 Mexico: By Market Size, By Test, 2016–2023 (USD Million)

Table 84 Mexico: By Market Size, By End User, 2016–2023 (USD Million)

Table 85 Major Cable Manufacturers in South America

Table 86 South America: By Market Size, By Country, 2016–2023 (USD Million)

Table 87 South America: By Market Size, By Voltage Type, 2016–2023 (USD Million)

Table 88 South America: By Market Size, By Test, 2016–2023 (USD Million)

Table 89 South America: By Market Size, By End User, 2016–2023 (USD Million)

Table 90 Brazil: By Market Size, By Voltage Type, 2016–2023 (USD Million)

Table 91 Brazil: By Market Size, By Test, 2016–2023 (USD Million)

Table 92 Brazil: By Market Size, By End User, 2016–2023 (USD Million)

Table 93 Argentina: By Market Size, By Voltage Type, 2016–2023 (USD Million)

Table 94 Argentina: By Market Size, By Test, 2016–2023 (USD Million)

Table 95 Argentina: By Market Size, By End User, 2016–2023 (USD Million)

Table 96 Rest of South America: By Market Size, By Voltage Type, 2016–2023 (USD Million)

Table 97 Rest of South America: By Market Size, By Test, 2016–2023 (USD Million)

Table 98 Rest of South America: By Market Size, By End User, 2016–2023 (USD Million)

Table 99 Major Cable Manufacturers in The Middle East & Africa

Table 100 Middle East & Africa: By Market Size, By Country, 2016–2023 (USD Million)

Table 101 Middle East & Africa: By Market Size, By Voltage Type, 2016–2023 (USD Million)

Table 102 Middle East & Africa: By Market Size, By Test, 2016–2023 (USD Million)

Table 103 Middle East & Africa: By Market Size, By End User, 2016–2023 (USD Million)

Table 104 Saudi Arabia: By Market Size, By Voltage Type, 2016–2023 (USD Million)

Table 105 Saudi Arabia: By Market Size, By Test, 2016–2023 (USD Million)

Table 106 Saudi Arabia: By Market Size, By End User, 2016–2023 (USD Million)

Table 107 UAE: By Market Size, By Voltage Type, 2016–2023 (USD Million)

Table 108 UAE: By Market Size, By Test, 2016–2023 (USD Million)

Table 109 UAE: By Market Size, By End User, 2016–2023 (USD Million)

Table 110 Rest of Middle East & Africa: By Market Size, By Voltage Type, 2016–2023 (USD Million)

Table 111 Rest of Middle East & Africa: By Market Size, By Test, 2016–2023 (USD Million)

Table 112 Rest of Middle East & Africa: By Market Size, By End User, 2016–2023 (USD Million)

Table 113 Expansion, 2015–1018

Table 114 Acquisitions, 2015–2018

Table 115 Agreements/Collaborations/Partnerships, 2015–1018

List of Figures (38 Figures)

Figure 1 Market Segmentation

Figure 2 Market: Research Design

Figure 3 Bottom-Up Approach

Figure 4 Top-Down Approach

Figure 5 Cable Testing and Certification Market: Data Triangulation

Figure 6 High-Voltage Cables to Be The Largest Segment in The Global Market

Figure 7 Routine Test to Remain The Dominant Test for Cable Testing and Certification

Figure 8 APAC Accounted for The Largest Share of The Cable Testing and Certification Market

Figure 9 Increasing Demand for Cables From Various Applications to Drive The Global Market

Figure 10 China Was The Largest Market Cable Testing and Certification Market

in 2017

Figure 11 China to Be The Largest Cable Testing and Certification Market

Figure 12 Routine Test to Be The Largest Segment Between 2018 and 2023

Figure 13 Manufacturer to Be The Fastest-Growing End-User Segment Between 2018 and 2023

Figure 14 Overview of Factors Governing The Cable Testing and Certification Market

Figure 15 Electricity Generation in Oecd and Non-Oecd Countries, 2015–2040

Figure 16 Global Renewable Electricity Generation, 2015–2040

Figure 17 High-Voltage Was The Largest Segment of The Cable Testing and Certification Market

Figure 18 APAC to Be The Largest Market for Low-Voltage Cable Testing & Certification

Figure 19 APAC to Be The Largest Market for Medium-Voltage Cable Testing & Certification

Figure 20 APAC to Be The Largest Market for High-Voltage Cable Testing & Certification

Figure 21 Routine Test Was The Largest Segment of The Market, 2017

Figure 22 APAC to Be The Largest Market for Routine Tests

Figure 23 APAC to Be The Largest Market for Sample Tests

Figure 24 APAC to Be The Largest Market for Type Tests

Figure 25 Cable Manufacturers Was The Dominant Segment of The Market in 2017

Figure 26 APAC to Be The Largest Market in The Cable Manufacturers Segment

Figure 27 APAC to Be The Largest Market in The Utility Providers Segment

Figure 28 China to Witness The Highest Growth in The Cable Testing and Certification Market, 2018–2023

Figure 29 APAC: Cable Testing and Certification Market Snapshot

Figure 30 China: Cable Testing and Certification Market Snapshot, 2018 vs. 2023

Figure 31 Europe: Cable Testing and Certification Market Snapshot

Figure 32 Companies Adopted Agreements/Collaborations/Partnerships as The Key Growth Strategy Between 2015 and 2018

Figure 33 Dekra: Cable Testing and Certification Market Company Snapshot

Figure 34 SGS: Cable Testing and Certification Market Company Snapshot

Figure 35 TUV Rheinland: Cable Testing and Certification Market Company Snapshot

Figure 36 Bureau Veritas: Cable Testing and Certification Market Company Snapshot

Figure 37 Intertek: Cable Testing and Certification Market Company Snapshot

Figure 38 DNV GL: Cable Testing and Certification Market Company Snapshot

Growth opportunities and latent adjacency in Cable Testing and Certification Market