Business Rules Management System Market by Component (Software and Services), Organization Size (Large Enterprises and SMEs), Deployment Type, Vertical (BFSI, Government and Defense, and Telecom and IT), and Region - Global Forecast to 2025

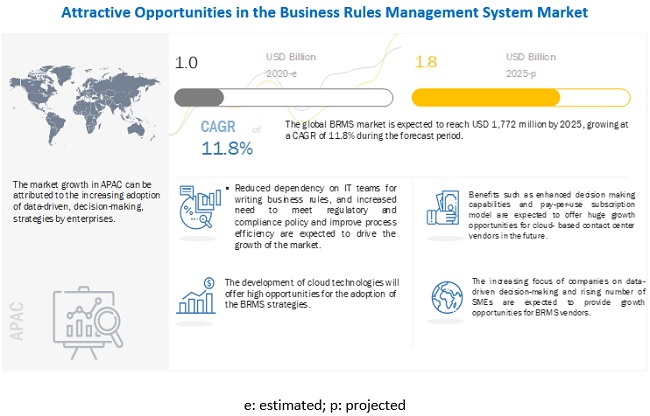

The global Business Rules Management System Market size was valued at $1.0 billion in 2020 and it is projected to reach $1.8 billion by the end of 2025 at a CAGR of 11.8% during the forecast period. Business rules management system In recent years, the demand for BRMS software and services has grown considerably due to the increasing number of web applications and the growing need to manage and change business rules according to the changing business needs and regulations. The BRMS market is expected to grow significantly in APAC, Latin America, and MEA, due to enterprises’ demand for lower Operational Expenditure (OPEX) and Capital Expenditure (CAPEX) with greater business efficiency and improved productivity. On the other hand, the companies’ resistance to adopt modern technologies and their profit-driven approaches may restrain the adoption of the BRMS software and services.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact analysis on the global business rules management system market

The impact of the COVID-19 pandemic on the market is covered throughout this report. COVID-19 is impacting the businesses and investor communities across the world. The global and interconnected nature of business environment poses serious risk of disruption of global supply chains that can result in significant loss of revenue and adversely impact the global economies. This will further impact the growth of the BRMS market during the forecast period. As per a report of Preliminary Findings on How COVID-19 Impacts Budgets and Projects, 61% of the respondents in the study admitted that COVID-19 has changed their budgets. This is expected to offer challenges in the adoption of BRMS software in coming months.

Business Rules Management System Market Dynamics

Driver: Reduced dependency on IT teams for writing business rules

Business rules can be changed easily and are written in a simpler manner for easy comprehension. Additionally, the need for development teams is reduced to a greater extent, as the business rules can be written by any individual who has the knowledge of vendor-specific business rules and software skills. IT managers can gain control over the rule editing and life cycles, which can reduce confusion and decrease dependency on IT developers. This results in lesser time required to write and deploy rules as compared to the traditional software environment. Furthermore, the rising adoption of automated rule deployment processes is driving the adoption of BRMS software and services. These software and services provide benefits, such as faster, error-free, and cost-effective development and deployment of the business rules.

Restraint: Companies’ resistance in adopting modern technologies

As per “Insight Intelligent Technology Index 2018,” seven in ten businesses are worried about their firm's ability to adopt new technology. According to the index, 48% of businesses have not increased their IT budget is the major factor that proves that companies are not adopting technologies. Automation and trending technologies have various benefits, including reduced time, lesser errors, and lower costs. Irrespective of these benefits, there are companies that are still resistant to adopt these technologies and services due to the fear of new changes in the business environment. As a result, companies limit themselves to some chosen vendors for specific protocols and tools. In today’s digital era, enterprises are not willing to adapt to emerging technologies, as these technologies need specialized skills and training. Companies rather prefer relying on traditional decision management tools and technologies. These factors may restrain the adoption of BRMS software and services globally among organizations.

Opportunity: Increasing focus of companies on data-driven decision-making

The growing shift of companies toward customer satisfaction and capturing more market share are enabling them to adopt analytics capabilities. These analytical capabilities provide major benefits, such as real-time and relevant insights into data for helping companies make enhanced business decisions. Analytics enables quick and cost-effective analysis of collected data for helping companies understand their existing policies and procedures. Additionally, it enables companies to make better decisions in the redesigning of their policies or making changes in their business rules to meet the business requirements on a continuous basis. The analytical capabilities, such as reporting analytics, predictive analytics, and data mining techniques help companies’ source information from various repositories and gain meaningful insights for helping businesses align their policies and business rules with their constantly changing business needs. The reporting analytics helps companies understand the processes and impacts of their decisions. The data mining techniques help in finding business rules using statistical analysis techniques, and predictive analytics offers more opportunities for driving processes analytically. The combination of analytics with BRMS software assists companies in automating their operational decisions. The software helps in improving precision, consistency, and agility of the operational decisions.

Challenge: Lack of documentation on business rules

Enterprises have to constantly keep updating their business rules based on changing business requirements. These updates need to be done quickly, due to which, many times, proper documentation of the business rules become difficult and is left out many times. This may result in various challenges faced by companies while collecting and presenting these rules, as tracing business rules to their sources is a difficult and time-consuming task. Moreover, many times these rules are encoded in the program coding, which makes it difficult to understand what kind of rules govern an application when the rules are triggered and how they are implemented. Furthermore, for businesses undergoing the process of change, without proper documentation of business rules, the task of upgrading systems is time-consuming and costly. These factors may affect the smooth functioning of businesses, as tracking the changes made in the business rules becomes difficult. Moreover, it also affects the creation and deployment of business rules in the future creating uncertainties for the relevance with business needs.

Software segment to hold a larger market size during the forecast period

BRMS includes a repository of various business rules; a development environment to define and manage business rules; a runtime environment to invoke business rules and execute using a business rules engine; and a management environment to manage the development and runtime environments. This software empowers businesses with enhanced control of business rules by providing an agile and flexible guiding system for determining what actions can be enabled in any given circumstance. This is expected to drive the growth of the BRMS market during the forecast period.

On-premises segment to hold a larger market size during the forecast period in the business rules management system market

The on-premises deployment of the BRMS software help the organization manage costs, maintain compliance, and serve its customers better by aiding the development of adaptive and reusable business rule flows. The on-premises deployment type is one of the oldest and traditional approaches of deploying BRMS software and is preferred by enterprises, due to factors, such as data storage within the company’s premises, availability of security measures, and elimination of third-party involvement. Even though companies are now adopting the cloud deployment type due to lower cost and greater efficiency offered by the cloud model, the on-premises deployment type is still preferred by many businesses to internally store the critical data.

Large enterprises segment to hold a larger market size during the forecast period

Business entities employing more than 1,000 people are categorized as large enterprises. The adoption of BRMS software and services among large enterprises is high, and the trend is expected to continue during the forecast period. Large enterprises are majorly investing in advanced technologies to increase their overall productivity and efficiency. Large enterprises are significantly focused on simplifying the operations and management of cloud-native applications on any cloud and even across clouds. BRMS software helps large enterprises in making effective decisions, and hence the adoption of the BRMS software and services is expected to be higher among the large enterprises. The major vendors offering BRMS software include IBM, FICO, and Oracle.

BFSI vertical to hold a majority of the market share during the forecast period

The flexibility of BRMS software in defining, developing, storing, implementing, and monitoring the execution of business rules is the major driver for the adoption of BRMS software across industry verticals. To battle away business issues, the BFSI companies are adopting advanced technologies and BRMS software and services to increase their operational efficiency. The BFSI vertical is expected to be a major contributor to the growth of the BRMS market during the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

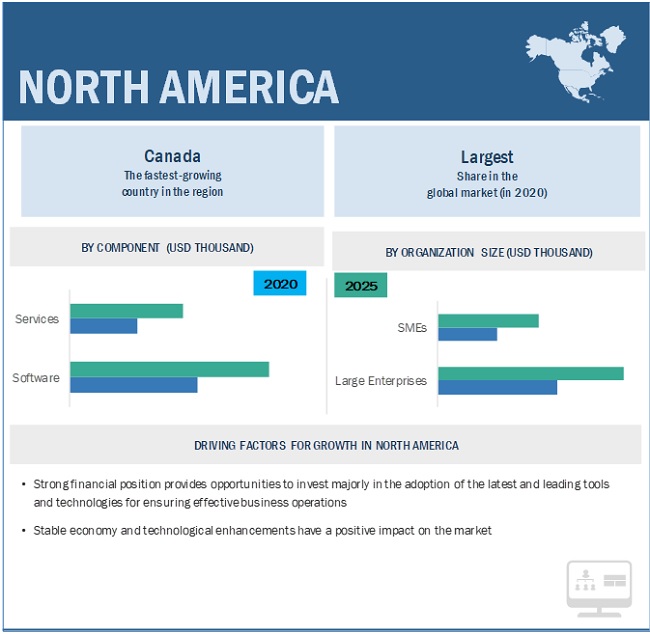

North America to account for the largest market size during the forecast period

The global business rules management system market by region covers five major geographic regions, namely, North America, Asia Pacific (APAC), Europe, Middle East & Africa (MEA), and Latin America. North America is expected to account for the largest market size during the forecast period. The presence of developed economies, such as the US and Canada, is one of the major drivers for the growth of the BRMS market in the region. The growth of the BRMS market in the US is subjected to advanced IT infrastructure and high adoption of advanced technologies, such as AI, IoT, cloud, and Software-as-a-Service (SaaS) model, is expected to boost the BRMS market in the region.

Key Market Players

The business rules management system vendors have implemented various types of organic as well as inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions, to strengthen their offerings in the market. The major vendors offering business rules management system solutions and services globally are IBM (US), FICO (US), PEGASYSTEMS (US), Oracle (US), Progress Software (US), SAP (Germany), Broadcom (US), ACTICO (Germany), SAS (US), InRule Technology (US), Software AG (Germany), OpenText (Canada), Newgen Software (India), Fujitsu (Japan), Experian (Ireland), Sparkling Logic (US), Business Rule Solutions (US), Decisions LLC (US), TIBCO (US), Intellileap (India), Agiloft (US), Signavio (Germany), Decision Management Solutions (US), CNSI (US), and Decisions on Demand (US).s

The study includes an in-depth competitive analysis of key players in the business rules management system market with their company profiles, recent developments, and key market strategies.

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2015–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Component, Service, Organization Size, Deployment Type, Vertical, and Region |

|

Geographies covered |

North America, APAC, Europe, MEA, and Latin America |

|

Companies covered |

IBM (US), FICO (US), PEGASYSTEMS (US), Oracle (US), Progress Software (US), SAP (Germany), Broadcom (US), ACTICO (Germany), SAS (US), InRule Technology (US), Software AG (Germany), OpenText (Canada), Newgen Software (India), Fujitsu (Japan), Experian (Ireland), Sparkling Logic (US), Business Rule Solutions (US), Decisions LLC (US), TIBCO (US), Intellileap (India), Agiloft (US), Signavio (Germany), Decision Management Solutions (US), CNSI (US), and Decisions on Demand (US). |

Comprehensive categorization is done based on component, billing method, deployment type, service model, organisation size, vertical, and region in the market for business rules management systems. This research study offers helpful insights into the numerous elements, billing structures, deployment choices, service models, organisational sizes, verticals, and geographic regions driving the industry's growth and development through a complete analysis and classification of the market.

Based on the component:

- Software

-

Services

- Integration and Deployment

- Support and Maintenance

- Training and Consulting

Based on the deployment type:

- On-premises

- Cloud

Based on the organization size:

- Large Enterprises

- SMEs

Based on the vertical

- BFSI

- Government and Defense

- Telecom and IT

- Manufacturing

- Retail and Consumer Goods

- Healthcare and Life Sciences

- Transportation and Logistics

- Energy and Utilities

- Others

Based on the region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- China

- ANZ

- Japan

- Rest of APAC

-

MEA

- KSA

- South Africa

- UAE

- Rest of MEA

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In Septmber 2020, Pegasystems launched Value Finder, a new AI-powered capability, to help organizations engage a neglected group of customers based on product-centric eligibility and prioritization rules.

- In July 2020, Progress Software launched Corticon.js, a serverless business rules engine that enables quick development, testing, and deployment of rules to critical JavaScript applications.

- In March 2019, FICO partnered with Equifax to jointly develop a cloud-based Data Decisions Connected Platform that utilizes former’s digital decisioning capabilities and latter’s data management and analytics capabilities. The suite integrates Equifax IgniteTM with FICO Cloud Applications and FICO Decision Management Suite (DMS) for helping companies leverage data management and analytics technologies to assess risk, protect against fraud, and improve marketing capabilities.

Frequently Asked Questions (FAQ):

What is business rules management system?

Business rules are a set of specific directives that define business activities. BRMS is a subsegment of the decision management system, which enables defining, analyzing, executing, auditing, and maintaining a wide variety of business rules. The business rules are applied to complex decision logics within organizations, and aid in capturing and automating business rules across applications. This results in easy and faster change of business rules, and reduced time and dependence on Information Technology (IT) teams for changing them.

Who are the top vendors in the business rules management system market?

The major vendors operating in the business rules management system market include IBM, FICO, PEGASYSTEMS, Oracle, Progress Software. These vendors have adopted different types of organic and inorganic growth strategies such as new product launches, product enhancements, partnerships, and agreements.

Which countries are considered in the European region?

The report includes an analysis of the UK, Germany, France and other European countries from the Europe region.

What are the major services considered in the study?

The services condisered in the study include integration and deployment, support and maintenance, and training and consulting.

Does this report include the impact of COVID-19 on the business rules management system market?

Yes, the report includes the impact of COVID-19 on the business rules management system market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 21)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2017–2019

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

FIGURE 6 BUSINESS RULES MANAGEMENT SYSTEM MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 8 MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

2.3.1 TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY ? APPROACH 1 (SUPPLY SIDE): REVENUE OF SOFTWARE/SERVICES OF THE MARKET

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 3—BOTTOM-UP (DEMAND SIDE): SIZE OF THE BUSINESS RULES MANAGEMENT SYSTEM MARKET THROUGH OVERALL SPENDING

2.4 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.5 ASSUMPTIONS FOR THE STUDY

2.6 STUDY LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 41)

FIGURE 11 BUSINESS RULES MANAGEMENT SYSTEM MARKET: GLOBAL SNAPSHOT

FIGURE 12 TOP GROWING SEGMENTS IN THE MARKET

FIGURE 13 LARGE ENTERPRISES SEGMENT TO HOLD A LARGER MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 14 BANKING, FINANCE SERVICES, AND INSURANCE INDUSTRY TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 15 MARKET: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS (Page No. - 46)

4.1 ATTRACTIVE OPPORTUNITIES IN THE BUSINESS RULES MANAGEMENT SYSTEM MARKET

FIGURE 16 REDUCED DEPENDENCY ON IT TEAMS FOR WRITING BUSINESS RULES TO DRIVE THE GROWTH OF THE MARKET

4.2 MARKET IN NORTH AMERICA, BY VERTICAL AND COUNTRY

FIGURE 17 BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL AND THE UNITED STATES TO ACCOUNT FOR THE HIGHEST SHARES IN THE MARKET IN 2020

4.3 MARKET: MAJOR COUNTRIES

FIGURE 18 AUSTRALIA AND NEW ZEALAND TO GROW AT THE FASTEST RATE DURING THE FORECAST PERIOD

4.4 MARKET INVESTMENT SCENARIO

FIGURE 19 ASIA PACIFIC TO EMERGE AS THE BEST MARKET FOR INVESTMENT OVER THE NEXT FIVE YEARS

5 MARKET OVERVIEW (Page No. - 49)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: BUSINESS RULES MANAGEMENT SYSTEM MARKET

5.2.1 DRIVERS

5.2.1.1 Reduced dependency on IT teams for writing business rules

5.2.1.2 Increasing need to manage regulatory and policy compliance

5.2.1.3 Growing need to improve process efficiency

5.2.2 RESTRAINTS

5.2.2.1 Companies’ resistance in adopting modern technologies

5.2.2.2 Profit-driven approach of companies

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing focus of companies on data-driven decision-making

5.2.3.2 Rising number of SMEs creating new revenue opportunities for vendors

FIGURE 21 SMALL AND MEDIUM-SIZED ENTERPRISES, MAJOR EUROPEAN COUNTRIES (2015-2017)

5.2.4 CHALLENGES

5.2.4.1 Lack of documentation on business rules

5.2.4.2 Fear of vendor lock-in

5.3 COVID-19-DRIVEN MARKET DYNAMICS

5.3.1 DRIVERS AND OPPORTUNITIES

5.3.2 RESTRAINTS AND CHALLENGES

5.4 INDUSTRY TRENDS

5.4.1 CASE STUDY ANALYSIS

5.4.1.1 Use case 1: Retail

5.4.1.2 Use case 2: BFSI

5.4.1.3 Use case 3: Healthcare

5.5 PRICING ANALYSIS

TABLE 3 PRICING ANALYSIS: BUSINESS RULES MANAGEMENT SYSTEM MARKET

5.6 VALUE CHAIN ANALYSIS

FIGURE 22 MARKET: VALUE CHAIN ANALYSIS

6 BUSINESS RULES MANAGEMENT SYSTEM MARKET, BY COMPONENT (Page No. - 59)

6.1 INTRODUCTION

FIGURE 23 SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

6.1.1 COMPONENT: MARKET DRIVERS

6.1.2 COMPONENT: COVID-19 IMPACT

TABLE 4 MARKET SIZE, BY COMPONENT, 2015–2019 (USD THOUSAND)

TABLE 5 MARKET SIZE, BY COMPONENT, 2020–2025 (USD THOUSAND)

6.2 SOFTWARE

TABLE 6 SOFTWARE: MARKET SIZE, BY REGION, 2015–2019 (USD THOUSAND)

TABLE 7 SOFTWARE: MARKET SIZE, BY REGION, 2020–2025 (USD THOUSAND)

6.3 SERVICES

TABLE 8 SERVICES: MARKET SIZE, BY REGION, 2015–2019 (USD THOUSAND)

TABLE 9 SERVICES: MARKET SIZE, BY REGION, 2020–2025 (USD THOUSAND)

7 BUSINESS RULES MANAGEMENT SYSTEM MARKET, BY SERVICE (Page No. - 64)

7.1 INTRODUCTION

FIGURE 24 SUPPORT AND MAINTENANCE SERVICES SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

7.1.1 SERVICES: MARKET DRIVERS

7.1.2 SERVICES: COVID-19 IMPACT

TABLE 10 MARKET SIZE, BY SERVICE, 2015–2019 (USD THOUSAND)

TABLE 11 MARKET SIZE, BY SERVICE, 2020–2025 (USD THOUSAND)

7.2 INTEGRATION AND DEPLOYMENT

TABLE 12 INTEGRATION AND DEPLOYMENT: MARKET SIZE, BY REGION, 2015–2019 (USD THOUSAND)

TABLE 13 INTEGRATION AND DEPLOYMENT: MARKET SIZE, BY REGION, 2020–2025 (USD THOUSAND)

7.3 SUPPORT AND MAINTENANCE

TABLE 14 SUPPORT AND MAINTENANCE: MARKET SIZE, BY REGION, 2015–2019 (USD THOUSAND)

TABLE 15 SUPPORT AND MAINTENANCE: MARKET SIZE, BY REGION, 2020–2025 (USD THOUSAND)

7.4 TRAINING AND CONSULTING

TABLE 16 TRAINING AND CONSULTING: MARKET SIZE, BY REGION, 2015–2019 (USD THOUSAND)

TABLE 17 TRAINING AND CONSULTING: MARKET SIZE, BY REGION, 2020–2025 (USD THOUSAND)

8 BUSINESS RULES MANAGEMENT SYSTEM MARKET, BY ORGANIZATION SIZE (Page No. - 70)

8.1 INTRODUCTION

FIGURE 25 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO REGISTER A HIGHER CAGR DURING THE FORECAST PERIOD

8.1.1 ORGANIZATION SIZE: BUSINESS RULES MANAGEMENT MARKET DRIVERS

8.1.2 ORGANIZATION SIZE: COVID-19 IMPACT

TABLE 18 MARKET SIZE, BY ORGANIZATION SIZE, 2015–2019 (USD THOUSAND)

TABLE 19 MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD THOUSAND)

8.2 LARGE ENTERPRISES

TABLE 20 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2015–2019 (USD THOUSAND)

TABLE 21 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2020–2025 (USD THOUSAND)

8.3 SMALL AND MEDIUM-SIZED ENTERPRISES

TABLE 22 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2015–2019 (USD THOUSAND)

TABLE 23 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2020–2025 (USD THOUSAND)

9 BUSINESS RULES MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT TYPE (Page No. - 75)

9.1 INTRODUCTION

FIGURE 26 CLOUD DEPLOYMENT TYPE TO REGISTER A HIGHER CAGR DURING THE FORECAST PERIOD

9.1.1 DEPLOYMENT TYPE: MARKET DRIVERS

9.1.2 DEPLOYMENT TYPE: COVID-19 IMPACT

TABLE 24 MARKET SIZE, BY DEPLOYMENT TYPE, 2015–2019 (USD THOUSAND)

TABLE 25 MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2025 (USD THOUSAND)

9.2 ON-PREMISES

TABLE 26 ON-PREMISES: MARKET SIZE, BY REGION, 2015–2019 (USD THOUSAND)

TABLE 27 ON-PREMISES: MARKET SIZE, BY REGION, 2020–2025 (USD THOUSAND)

9.3 CLOUD

TABLE 28 CLOUD: MARKET SIZE, BY REGION, 2015–2019 (USD THOUSAND)

TABLE 29 CLOUD: MARKET SIZE, BY REGION, 2020–2025 (USD THOUSAND)

10 BUSINESS RULES MANAGEMENT SYSTEM MARKET, BY VERTICAL (Page No. - 80)

10.1 INTRODUCTION

FIGURE 27 RETAIL AND CONSUMER GOODS VERTICAL TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

10.1.1 VERTICAL: MARKET DRIVERS

10.1.2 VERTICAL: COVID-19 IMPACT

TABLE 30 MARKET SIZE, BY VERTICAL, 2015–2019 (USD THOUSAND)

TABLE 31 MARKET SIZE, BY VERTICAL, 2020–2025 (USD THOUSAND)

10.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

TABLE 32 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 2015–2019 (USD THOUSAND)

TABLE 33 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 2020–2025 (USD THOUSAND)

10.3 GOVERNMENT AND DEFENSE

TABLE 34 GOVERNMENT AND DEFENSE: BUSINESS RULES MANAGEMENT SYSTEM MARKET SIZE, BY REGION, 2015–2019 (USD THOUSAND)

TABLE 35 GOVERNMENT AND DEFENSE: MARKET SIZE, BY REGION, 2020–2025 (USD THOUSAND)

10.4 TELECOM AND IT

TABLE 36 TELECOM AND IT: MARKET SIZE, BY REGION, 2015–2019 (USD THOUSAND)

TABLE 37 TELECOM AND IT: MARKET SIZE, BY REGION, 2020–2025 (USD THOUSAND)

10.5 MANUFACTURING

TABLE 38 MANUFACTURING: MARKET SIZE, BY REGION, 2015–2019 (USD THOUSAND)

TABLE 39 MANUFACTURING: MARKET SIZE, BY REGION, 2020–2025 (USD THOUSAND)

10.6 RETAIL AND CONSUMER GOODS

TABLE 40 RETAIL AND CONSUMER GOODS: MARKET SIZE, BY REGION, 2015–2019 (USD THOUSAND)

TABLE 41 RETAIL AND CONSUMER GOODS: MARKET SIZE, BY REGION, 2020–2025 (USD THOUSAND)

10.7 HEALTHCARE AND LIFE SCIENCES

TABLE 42 HEALTHCARE AND LIFE SCIENCES: BUSINESS RULES MANAGEMENT SYSTEM MARKET SIZE, BY REGION, 2015–2019 (USD THOUSAND)

TABLE 43 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY REGION, 2020–2025 (USD THOUSAND)

10.8 TRANSPORTATION AND LOGISTICS

TABLE 44 TRANSPORTATION AND LOGISTICS: MARKET SIZE, BY REGION, 2015–2019 (USD THOUSAND)

TABLE 45 TRANSPORTATION AND LOGISTICS: MARKET SIZE, BY REGION, 2020–2025 (USD THOUSAND)

10.9 ENERGY AND UTILITIES

TABLE 46 ENERGY AND UTILITIES: MARKET SIZE, BY REGION, 2015–2019 (USD THOUSAND)

TABLE 47 ENERGY AND UTILITIES: MARKET SIZE, BY REGION, 2020–2025 (USD THOUSAND)

10.10 OTHERS

TABLE 48 OTHERS: MARKET SIZE, BY REGION, 2015–2019 (USD THOUSAND)

TABLE 49 OTHERS: MARKET SIZE, BY REGION, 2020–2025 (USD THOUSAND)

11 BUSINESS RULES MANAGEMENT SYSTEM MARKET, BY REGION (Page No. - 94)

11.1 INTRODUCTION

FIGURE 28 ASIA PACIFIC TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 50 MARKET SIZE, BY REGION, 2015–2019 (USD THOUSAND)

TABLE 51 MARKET SIZE, BY REGION, 2020–2025 (USD THOUSAND)

11.2 NORTH AMERICA

11.2.1 NORTH AMERICA: MARKET DRIVERS

11.2.2 NORTH AMERICA: COVID-19 IMPACT

FIGURE 29 NORTH AMERICA: MARKET SNAPSHOT

TABLE 52 NORTH AMERICA: BUSINESS RULES MANAGEMENT SYSTEM MARKET SIZE, BY COMPONENT, 2015–2019 (USD THOUSAND)

TABLE 53 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2020–2025 (USD THOUSAND)

TABLE 54 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2015–2019 (USD THOUSAND)

TABLE 55 NORTH AMERICA: MARKET SIZE, BY SERVICE , 2020–2025 (USD THOUSAND)

TABLE 56 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2019 (USD THOUSAND)

TABLE 57 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD THOUSAND)

TABLE 58 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2015–2019 (USD THOUSAND)

TABLE 59 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2025 (USD THOUSAND)

TABLE 60 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2015–2019 (USD THOUSAND)

TABLE 61 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2020–2025 (USD THOUSAND)

TABLE 62 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2015–2019 (USD THOUSAND)

TABLE 63 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2025 (USD THOUSAND)

11.2.3 UNITED STATES

TABLE 64 UNITED STATES: BUSINESS RULES MANAGEMENT SYSTEM MARKET SIZE, BY COMPONENT, 2015–2019 (USD THOUSAND)

TABLE 65 UNITED STATES: MARKET SIZE, BY COMPONENT, 2020–2025 (USD THOUSAND)

TABLE 66 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2019 (USD THOUSAND)

TABLE 67 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD THOUSAND)

TABLE 68 UNITED STATES: MARKET SIZE, BY DEPLOYMENT TYPE, 2015–2019 (USD THOUSAND)

TABLE 69 UNITED STATES: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2025 (USD THOUSAND)

11.2.4 CANADA

TABLE 70 CANADA: BUSINESS RULES MANAGEMENT SYSTEM MARKET SIZE, BY COMPONENT, 2015–2019 (USD THOUSAND)

TABLE 71 CANADA: MARKET SIZE, BY COMPONENT, 2020–2025 (USD THOUSAND)

TABLE 72 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2019 (USD THOUSAND)

TABLE 73 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD THOUSAND)

TABLE 74 CANADA: MARKET SIZE, BY DEPLOYMENT TYPE, 2015–2019 (USD THOUSAND)

TABLE 75 CANADA: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2025 (USD THOUSAND)

11.3 EUROPE

11.3.1 EUROPE: MARKET DRIVERS

11.3.2 EUROPE: COVID-19 IMPACT

TABLE 76 EUROPE: BUSINESS RULES MANAGEMENT SYSTEM MARKET SIZE, BY COMPONENT, 2015–2019 (USD THOUSAND)

TABLE 77 EUROPE: MARKET SIZE, BY COMPONENT, 2020–2025 (USD THOUSAND)

TABLE 78 EUROPE: MARKET SIZE, BY SERVICE , 2015–2019 (USD THOUSAND)

TABLE 79 EUROPE: MARKET SIZE, BY SERVICE , 2020–2025 (USD THOUSAND)

TABLE 80 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2019 (USD THOUSAND)

TABLE 81 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD THOUSAND)

TABLE 82 EUROPE: MARKET SIZE, BY DEPLOYMENT TYPE, 2015–2019 (USD THOUSAND)

TABLE 83 EUROPE: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2025 (USD THOUSAND)

TABLE 84 EUROPE: MARKET SIZE, BY VERTICAL, 2015–2019 (USD THOUSAND)

TABLE 85 EUROPE: MARKET SIZE, BY VERTICAL, 2020–2025 (USD THOUSAND)

TABLE 86 EUROPE: MARKET SIZE, BY COUNTRY, 2015–2019 (USD THOUSAND)

TABLE 87 EUROPE: MARKET SIZE, BY COUNTRY, 2020–2025 (USD THOUSAND)

11.3.3 UNITED KINGDOM

TABLE 88 UNITED KINGDOM: BUSINESS RULES MANAGEMENT SYSTEM MARKET SIZE, BY COMPONENT, 2015–2019 (USD THOUSAND)

TABLE 89 UNITED KINGDOM: MARKET SIZE, BY COMPONENT, 2020–2025 (USD THOUSAND)

TABLE 90 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2019 (USD THOUSAND)

TABLE 91 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD THOUSAND)

TABLE 92 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT TYPE, 2015–2019 (USD THOUSAND)

TABLE 93 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2025 (USD THOUSAND)

11.3.4 GERMANY

TABLE 94 GERMANY: BUSINESS RULES MANAGEMENT SYSTEM MARKET SIZE, BY COMPONENT, 2015–2019 (USD THOUSAND)

TABLE 95 GERMANY: MARKET SIZE, BY COMPONENT, 2020–2025 (USD THOUSAND)

TABLE 96 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2019 (USD THOUSAND)

TABLE 97 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD THOUSAND)

TABLE 98 GERMANY: MARKET SIZE, BY DEPLOYMENT TYPE, 2015–2019 (USD THOUSAND)

TABLE 99 GERMANY: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2025 (USD THOUSAND)

11.3.5 FRANCE

TABLE 100 FRANCE: BUSINESS RULES MANAGEMENT SYSTEM MARKET SIZE, BY COMPONENT, 2015–2019 (USD THOUSAND)

TABLE 101 FRANCE: MARKET SIZE, BY COMPONENT, 2020–2025 (USD THOUSAND)

TABLE 102 FRANCE: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2019 (USD THOUSAND)

TABLE 103 FRANCE: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD THOUSAND)

TABLE 104 FRANCE: MARKET SIZE, BY DEPLOYMENT TYPE, 2015–2019 (USD THOUSAND)

TABLE 105 FRANCE: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2025 (USD THOUSAND)

11.3.6 REST OF EUROPE

11.4 ASIA PACIFIC

11.4.1 ASIA PACIFIC: MARKET DRIVERS

11.4.2 ASIA PACIFIC: COVID-19 IMPACT

FIGURE 30 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 106 ASIA PACIFIC: BUSINESS RULES MANAGEMENT SYSTEM MARKET SIZE, BY COMPONENT, 2015–2019 (USD THOUSAND)

TABLE 107 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2020–2025 (USD THOUSAND)

TABLE 108 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2015–2019 (USD THOUSAND)

TABLE 109 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2020–2025 (USD THOUSAND)

TABLE 110 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2019 (USD THOUSAND)

TABLE 111 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD THOUSAND)

TABLE 112 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT TYPE, 2015–2019 (USD THOUSAND)

TABLE 113 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2025 (USD THOUSAND)

TABLE 114 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2015–2019 (USD THOUSAND)

TABLE 115 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2020–2025 (USD THOUSAND)

TABLE 116 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2015–2019 (USD THOUSAND)

TABLE 117 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2020–2025 (USD THOUSAND)

11.4.3 JAPAN

TABLE 118 JAPAN: BUSINESS RULES MANAGEMENT SYSTEM MARKET SIZE, BY COMPONENT, 2015–2019 (USD THOUSAND)

TABLE 119 JAPAN: MARKET SIZE, BY COMPONENT, 2020–2025 (USD THOUSAND)

TABLE 120 JAPAN: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2019 (USD THOUSAND)

TABLE 121 JAPAN: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD THOUSAND

TABLE 122 JAPAN: MARKET SIZE, BY DEPLOYMENT TYPE, 2015–2019 (USD THOUSAND)

TABLE 123 JAPAN: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2025 (USD THOUSAND)

11.4.4 AUSTRALIA AND NEW ZEALAND

TABLE 124 AUSTRALIA AND NEW ZEALAND: BUSINESS RULES MANAGEMENT SYSTEM MARKET SIZE, BY COMPONENT, 2015–2019 (USD THOUSAND)

TABLE 125 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY COMPONENT, 2020–2025 (USD THOUSAND)

TABLE 126 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2019 (USD THOUSAND)

TABLE 127 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD THOUSAND)

TABLE 128 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY DEPLOYMENT TYPE, 2015–2019 (USD THOUSAND)

TABLE 129 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2025 (USD THOUSAND)

11.4.5 CHINA

TABLE 130 CHINA: BUSINESS RULES MANAGEMENT SYSTEM MARKET SIZE, BY COMPONENT, 2015–2019 (USD THOUSAND)

TABLE 131 CHINA: MARKET SIZE, BY COMPONENT, 2020–2025 (USD THOUSAND)

TABLE 132 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2019 (USD THOUSAND)

TABLE 133 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD THOUSAND)

TABLE 134 CHINA: MARKET SIZE, BY DEPLOYMENT TYPE, 2015–2019 (USD THOUSAND)

TABLE 135 CHINA: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2025 (USD THOUSAND)

11.4.6 REST OF ASIA PACIFIC

11.5 MIDDLE EAST AND AFRICA

11.5.1 MIDDLE EAST AND AFRICA: BUSINESS RULES MANAGEMENT SYSTEM MARKET DRIVERS

11.5.2 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

TABLE 136 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2015–2019 (USD THOUSAND)

TABLE 137 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2020–2025 (USD THOUSAND)

TABLE 138 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2015–2019 (USD THOUSAND)

TABLE 139 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2020–2025 (USD THOUSAND)

TABLE 140 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2019 (USD THOUSAND)

TABLE 141 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD THOUSAND)

TABLE 142 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2015–2019 (USD THOUSAND)

TABLE 143 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2025 (USD THOUSAND)

TABLE 144 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2015–2019 (USD THOUSAND)

TABLE 145 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2020–2025 (USD THOUSAND)

TABLE 146 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2015–2019 (USD THOUSAND)

TABLE 147 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2020–2025 (USD THOUSAND)

11.5.3 KINGDOM OF SAUDI ARABIA

TABLE 148 KINGDOM OF SAUDI ARABIA : BUSINESS RULES MANAGEMENT SYSTEM MARKET SIZE, BY COMPONENT, 2015–2019 (USD THOUSAND)

TABLE 149 KINGDOM OF SAUDI ARABIA : MARKET SIZE, BY COMPONENT, 2020–2025 (USD THOUSAND)

TABLE 150 KINGDOM OF SAUDI ARABIA : MARKET SIZE, BY ORGANIZATION SIZE, 2015–2019 (USD THOUSAND)

TABLE 151 KINGDOM OF SAUDI ARABIA : MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD THOUSAND)

TABLE 152 KINGDOM OF SAUDI ARABIA : MARKET SIZE, BY DEPLOYMENT TYPE, 2015–2019 (USD THOUSAND)

TABLE 153 KINGDOM OF SAUDI ARABIA S: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2025 (USD THOUSAND)

11.5.4 SOUTH AFRICA

TABLE 154 SOUTH AFRICA: BUSINESS RULES MANAGEMENT SYSTEM MARKET SIZE, BY COMPONENT, 2015–2019 (USD THOUSAND)

TABLE 155 SOUTH AFRICA: MARKET SIZE, BY COMPONENT, 2020–2025 (USD THOUSAND)

TABLE 156 SOUTH AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2019 (USD THOUSAND)

TABLE 157 SOUTH AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD THOUSAND)

TABLE 158 SOUTH AFRICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2015–2019 (USD THOUSAND)

TABLE 159 SOUTH AFRICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2025 (USD THOUSAND)

11.5.5 UNITED ARAB EMIRATES

TABLE 160 UNITED ARAB EMIRATES: BUSINESS RULES MANAGEMENT SYSTEM MARKET SIZE, BY COMPONENT, 2015–2019 (USD THOUSAND)

TABLE 161 UNITED ARAB EMIRATES: MARKET SIZE, BY COMPONENT, 2020–2025 (USD THOUSAND)

TABLE 162 UNITED ARAB EMIRATES : MARKET SIZE, BY ORGANIZATION SIZE, 2015–2019 (USD THOUSAND)

TABLE 163 UNITED ARAB EMIRATES: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD THOUSAND)

TABLE 164 UNITED ARAB EMIRATES: MARKET SIZE, BY DEPLOYMENT TYPE, 2015–2019 (USD THOUSAND)

TABLE 165 UNITED ARAB EMIRATES: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2025 (USD THOUSAND)

11.5.6 REST OF MIDDLE EAST AND AFRICA

11.6 LATIN AMERICA

11.6.1 LATIN AMERICA: BUSINESS RULES MANAGEMENT SYSTEM MARKET DRIVERS

11.6.2 LATIN AMERICA: COVID-19 IMPACT

TABLE 166 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2015–2019 (USD THOUSAND)

TABLE 167 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2020–2025 (USD THOUSAND)

TABLE 168 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2015–2019 (USD THOUSAND)

TABLE 169 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2020–2025 (USD THOUSAND)

TABLE 170 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2019 (USD THOUSAND)

TABLE 171 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD THOUSAND)

TABLE 172 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2015–2019 (USD THOUSAND)

TABLE 173 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2025 (USD THOUSAND)

TABLE 174 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2015–2019 (USD THOUSAND)

TABLE 175 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2020–2025 (USD THOUSAND)

TABLE 176 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2015–2019 (USD THOUSAND)

TABLE 177 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2020–2025 (USD THOUSAND)

11.6.3 BRAZIL

TABLE 178 BRAZIL: BUSINESS RULES MANAGEMENT SYSTEM MARKET SIZE, BY COMPONENT, 2015–2019 (USD THOUSAND)

TABLE 179 BRAZIL: MARKET SIZE, BY COMPONENT, 2020–2025 (USD THOUSAND)

TABLE 180 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2019 (USD THOUSAND)

TABLE 181 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD THOUSAND)

TABLE 182 BRAZIL: MARKET SIZE, BY DEPLOYMENT TYPE, 2015–2019 (USD THOUSAND)

TABLE 183 BRAZIL: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2025 (USD THOUSAND)

11.6.4 MEXICO

TABLE 184 MEXICO: BUSINESS RULES MANAGEMENT SYSTEM MARKET SIZE, BY COMPONENT, 2015–2019 (USD THOUSAND)

TABLE 185 MEXICO: MARKET SIZE, BY COMPONENT, 2020–2025 (USD THOUSAND)

TABLE 186 MEXICO: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2019 (USD THOUSAND)

TABLE 187 MEXICO: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD THOUSAND)

TABLE 188 MEXICO: MARKET SIZE, BY DEPLOYMENT TYPE, 2015–2019 (USD THOUSAND)

TABLE 189 MEXICO: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2025 (USD THOUSAND)

11.6.5 REST OF LATIN AMERICA

12 COMPETITIVE LANDSCAPE (Page No. - 153)

12.1 OVERVIEW

FIGURE 31 KEY DEVELOPMENTS BY THE LEADING PLAYERS IN THE BUSINESS RULES MANAGEMENT SYSTEM MARKET DURING 2018–2020

12.2 COMPETITIVE SCENARIO

12.2.1 NEW PRODUCT LAUNCHES/PRODUCT UPGRADATIONS

TABLE 190 NEW PRODUCT LAUNCHES/PRODUCT UPGRADATIONS, 2019–2020

12.2.2 PARTNERSHIPS AND AGREEMENTS

TABLE 191 PARTNERSHIPS, AGREEMENTS, AND COLLABORATIONS, 2017–2020

13 COMPANY PROFILES (Page No. - 157)

13.1 INTRODUCTION

(Business Overview, Solutions & Services, Key Insights, Recent Developments, COVID-19 Impact, MnM View)*

FIGURE 32 GEOGRAPHIC REVENUE MIX OF MAJOR PLAYERS

13.2 IBM

FIGURE 33 IBM: COMPANY SNAPSHOT

13.3 FICO

FIGURE 34 FICO: COMPANY SNAPSHOT

13.4 PEGASYSTEMS

FIGURE 35 PEGASYSTEMS: COMPANY SNAPSHOT

13.5 ORACLE

FIGURE 36 ORACLE: COMPANY SNAPSHOT

13.6 PROGRESS SOFTWARE

FIGURE 37 PROGRESS SOFTWARE: COMPANY SNAPSHOT

13.7 SAP

FIGURE 38 SAP: COMPANY SNAPSHOT

13.8 BROADCOM

FIGURE 39 BROADCOM: COMPANY SNAPSHOT

13.9 ACTICO

13.10 SAS

FIGURE 40 SAS: COMPANY SNAPSHOT

13.11 INRULE TECHNOLOGY

13.12 SOFTWARE AG

FIGURE 41 SOFTWARE AG: COMPANY SNAPSHOT

13.13 OPENTEXT

FIGURE 42 OPENTEXT: COMPANY SNAPSHOT

13.14 NEWGEN SOFTWARE

FIGURE 43 NEWGEN SOFTWARE: COMPANY SNAPSHOT

13.15 FUJITSU

FIGURE 44 FUJITSU: COMPANY SNAPSHOT

13.16 EXPERIAN

FIGURE 45 EXPERIAN: COMPANY SNAPSHOT

13.17 SPARKLING LOGIC

13.18 BUSINESS RULE SOLUTIONS

13.19 DECISIONS LLC

13.20 TIBCO

13.21 INTELLILEAP

13.22 AGILOFT

13.23 SIGNAVIO

13.24 DECISION MANAGEMENT SOLUTIONS

13.25 CNSI

13.26 DECISIONS ON DEMAND

*Details on Business Overview, Solutions & Services, Key Insights, Recent Developments, COVID-19 Impact, MnM View might not be captured in case of unlisted companies.

14 ADJACENT AND RELATED MARKET (Page No. - 201)

14.1 INTRODUCTION

14.1.1 RELATED MARKET

14.1.2 LIMITATIONS

14.2 BUSINESS DECISION MANAGEMENT MARKET

14.2.1 MARKET DEFINITION

14.2.2 INTRODUCTION

TABLE 192 BUSINESS DECISION MANAGEMENT MARKET SIZE, BY COMPONENT, 2015–2022 (USD MILLION)

15 APPENDIX (Page No. - 203)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

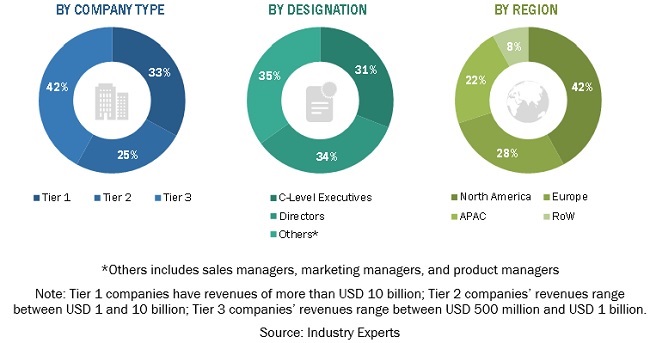

The study involved four major activities in estimating the current size of the global business rules management system market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total business rules management system market size. After that, the market breakup and data triangulation techniques were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Bloomberg and BusinessWeek, have been referred to identify and collect information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers; and journals, such as Linux Journal and Container Journal, and articles from recognized authors, directories, and databases.

Primary Research

Various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Marketing Officers (CMO), Vice Presidents (VPs), Managing Directors (MDs), technology and innovation directors, and related key executives from various key companies and organizations operating in the business rules management system market along with the associated service providers, and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. Following is the breakup of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For making market estimates and forecasting the business rules management system market, and other dependent submarkets, the top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the global business rules management system market using key companies’ revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the business rules management system market have been identified through extensive secondary research.

- The market size, in terms of value, has been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and forecast the global Business Rules Management System (BRMS) market by component (software and services), deployment type, organization size, vertical, and region

- To provide detailed information about the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To forecast the market size of five major regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To analyze the market subsegments as per the individual growth trends, prospects, and contributions to the total market

- To analyze the opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To profile the key players and comprehensively analyze their market rankings and core competencies

- To track and analyze competitive developments, such as mergers and acquisitions, new product developments, and Research and Development (R&D) activities, in the market

- To analyze the impact of the COVID-19 pandemic on the BRMS market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of an additional five market players

Growth opportunities and latent adjacency in Business Rules Management System Market