Business Process Automation Market by Component, Deployment Type, Organization Size, Business Function (Sales and Marketing, HR, Accounting and Finance, Supply Chain, Customer Service Support) Vertical, and Region - Global Forecast to 2026

Updated on : May 15, 2024

The global Business Process Automation Market size was valued $9.8 billion in 2020 and it is projected to reach $19.6 billion by the end of 2026 at a CAGR of 12.2% during the forecast period.

The business process automation market will continue to grow post-COVID-19 as more enterprises across the globe plan to migrate its IT infrastrutcre to cloud, boost business continuity, and improvise busiess operations operations. While technology spending in APAC has increased, the setback due to the recent COVID-19 pandemic is imminent.Fractors such as increased need for optimized resource utilization through automated business processes, growing demand for streamlining communication across varied business functions in organizations, benefits gained due to automated IT systems, and increased demand of Business process automation solutions to continue business operations during COVID 19 crisis are driving the growth of BPA solutions and services worldwide.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact

The outbreak of the COVID-19 has globally changed the dynamics of business operations. Though the COVID-19 outbreak has thrown light on weaknesses in business models across sectors, it has also offered several opportunities for business process automation solution vendors to expand their businesses across enterprises with the adoption of cloud in the lockdown. Now that social distancing is the norm, businesses are relying on digital platforms to reach people who are staying home and are on their mobile phones, tablets, and/or laptops. Automation solutions are gaining traction due to need of improving business processes and save time and cost. Furthermore, according to IBM’s COVID 19 and the Future of Business report, The COVID-19 pandemic has accelerated digital transformation at 59% of surveyed organizations. The COVID-19 pandemic has accelerated digital transformation at 59% of surveyed organizations. The company continues to offer innovative solutions during the COVID 19 pandemic to enable businesses continue the operations. Market leader Appian has taken initiatives in response to COVID 19 crisis. It has created a free COVID-19 Response Management application for enterprises and government agencies. It tracks health status, location, travel history and any COVID-19 incident details. The company has also designed Workforce Safety solution, which enables compliance with corporate policies and government COVID-related regulations, while maintaining the privacy and security of employee health information.

Market Dynamics

Drivers: Increased need for optimized resource utilization through automated business processes

With the implementation of business process automation, solutions, processes that earlier required human intervention are automated, and workforce can focus on core competencies. This leads to the optimum utilization of resources; optimized resource utilization refers to a set of processes and practices that manage a balance between the available resources and the need of enterprises to achieve desired business goals. Optimization aims at achieving desired results within the allocated timeframe and budget with the minimum consumption of the resources. The need for resource optimization is more when demand tends to exceed the existing resources. BPA solutions help in integrating various systems in organizations and reduce the overhead time by automating various processes. The automation of business processes eliminates manual quality assurance and execution steps, and enhances business resource utilization. According to a report by Smartsheet, 69% of the employees have reported that automation reduces the wastage of time and 59% of the employees believe that they would have more than six spare hours per week if repetitive jobs were automated. Organizations operating in the global market have offices located in different regions of the world. Thus, making it difficult to onboard employees, track employee performance, maintain employees’ time and attendance, and benefit administration. The availability of BPA technology and collaboration tools is helping distributed teams and employees in managing multiple projects. The use of BPA solutions helps automate and streamline HR functions. As per Wynhurst Group, having a structured onboarding program helps employers to retain 58% of employees for at least three years. An adequate BPA system not only saves money but also sets the stage for the continuous improvement of different business functions and companies. Automated business processes make tasks quicker and easier, and help employees to be more productive, motivated, and engaged with their work.

Restraints: Persistent growth in cyber-attacks and security issues

Digital transformation has led to the generation of an ample amount of data in organizations. At present, the globalization of businesses has made business processes and flow of data utmost important in organizations. Companies are concerned about sharing their critical business data, and this concern is significantly rising in the market. Security hazards such as malware, hacker attacks, or data thefts pose major threats to the reliable execution of business processes. Any such attack or malware can have negative effects on the companies’ profit, shareholder value, or reputation. According to the Breach Level Index 2018 report, there were 945 reported data breaches and almost 4.5 billion compromised data records worldwide in the first half of 2018. Industries such as social media and healthcare where business process automation has applicability were affected. This data represents the existing barriers to the adoption of business process automation, especially in the industries mentioned above.

Challenges: Growing cultural barrier to adopt advanced solutions over traditional systems

Business processes involved in varied business functions have been dramatically changing and adopting various technology advancements. BPA has been gaining tremendous popularity across industries to simplify their workflows for better and more efficient operational processes. However, there are several organizations that stick to manual process planning, such as manually addressing inquires of potential customers, marketing and sales engagement for generating leads, tracking packages, payroll calculations, and tactical recruitment process outsourcing due to the lack of knowledge about emerging automated solutions. Several companies still consider advanced solutions as risky, complex, and costly, which are major factors for the low adoption of business process automation solutions by organizations. Some organizations are still unaware of BPA solution and service benefits, and are quite reluctant to adopt BPA technologies in their daily operations and functioning. The misconception among organizations is that the adoption of automation is going to pose a threat to the job security of their workforce, as many manual processes performed by workers or employees would be automated. Thus, the resistance to change is a major challenging factor that restricts the adoption of BPA solutions in organizations.

Opportunities: Integration of AI and ML technologies

The integration of AI technology makes business process automation smarter by offering the ability to digitalize, formalize, optimize, and automate a wide variety of tasks currently performed by skilled human experts. With Machine Learning (ML), BPA continually evaluates data to predict the future and suggest data-driven improvements to enhance operational performance. Most of the organizations around the world run their business with data-driven strategies derived through the data acquired through customer-faced applications. Hence, the organizations are expected to spend more on business intelligence and analytics in the coming years. The changing landscape of business intelligence is backed by the new generation of analytics deployed to understand the business process and define it according to set parameters. More organizations would be insisting on using analytics to provide insights. They will anticipate and predict outcomes based on both historical references and current operations. These companies would effectively plan and allocate resources, becoming more agile and efficient.

To know about the assumptions considered for the study, download the pdf brochure

Based on service, support and maintenance segment to be a larger contributor to the Business Process Automation Market growth during the forecast period

Maintenance and support services are crucial as they directly deal with customer issues that impact customer satisfaction. Every software vendor has a dedicated support team to cater to its customers. Support, software maintenance, customer portal, post-deployment assistance, and client testimonials are some of the services provided under the maintenance and support services. To ensure consistent customer satisfaction, service providers focus on enhancing their product knowledge base by receiving feedback through interviews and surveys. The support and maintenance services provide a single point of contact for resolving customer issues. Customer portals, customer forums, technical tips, and software updates are some of the other helping aids made available for customers.

Based on deployment model, the on premises segment to be a larger contributor to the business rocess automation growth during the forecast period

In the on-premises delivery model, software or platforms are installed and operated from customers’ in-house server and computing infrastructure. The cost of installing on-premises platforms is included in the Capital Expenditure (CAPEX) of companies. This approach is mostly adopted for applications that involve the processing of sensitive and confidential data. Nowadays, every organization generates vast amounts of data due to the use of ML, IT devices, sensors, clickstreams, and many other devices. The on-premises deployment type enables organizations to ingest data into their own databases, thereby maintaining data security. In the on-premises deployment type, companies must install the required hardware as well as software. In addition, they must maintain hardware, implement cybersecurity applications, train staff, update new versions, and arrange backup for data or damaged parts. Due to huge initial upfront costs and the need for manual intervention, the on-premises deployment type can be afforded by large enterprises. SMEs, on the other hand, lack budget and skillsets. Therefore, it is not practical for them to install on-premises business process automation platforms. Large enterprises deploy the on-premises BPA platforms due to privacy and security concerns related to confidential data. This is expected to contribute to the segment’s larger market size.

Asia Pacific (APAC) to grow at the highest CAGR during the forecast period

APAC has witnessed the advanced and dynamic adoption of new technologies and is projected to record the highest CAGR during the forecast period. In addition, IT spending across organizations in the region is gradually increasing, which is projected to lead to a surge in the adoption of BPA Business Functions. China, India, Japan, and ANZ are the leading countries in terms of the adoption of BPA Business Functions and services in the region. BPA Business Functions automate building, tracking, and analyzing marketing campaigns and provide the assignment and management of quotas that enable markets to focus on strategy building tasks, due to which many organizations in APAC are implementing BPA platforms. The wastage of resources due to the manual management of administrative tasks, lack of visibility into incentive compensations, and rise in attrition encourages organizations in this region to invest in advanced BPA Business Functions. Due to these factors, the region is projected to grow at the highest CAGR during the forecast period.

The business process automation market is dominated by companies such as IBM (US), Pegasystems (US), Appian (US), Kissflow(India), Laserfiche (US), Nintex (US), Oracle (US), Software AG (Germany), Salesforce (US) Microsoft (US) , Bizagi (UK), OpenText (Canada), TIBCO (US), Creatio (US), Genpact (US), DXC Technology (UK), Newgen Software (India), Bonitasoft (France), Kofax (US), FlowForma (Ireland), AuraQuantic (US), AgilePoint (US), Automation Hero (US), Quickbase (US), and, Cortex (UK). These vendors have a large customer base and strong geographic footprint along with organized distribution channels, which helps them to increase revenues.

Scope of the Report

|

Report Metric |

Details |

|

Market size value in 2022 |

USD 9.8 billion |

|

Market size value in 2026 |

USD 19.6 billion |

|

Growth rate |

CAGR of 12.2% |

|

Business Process Automation Market Drivers |

|

|

Business Process Automation Market Opportunities |

|

|

Segments covered |

Component, Business Function, Deployment Type, Organization Size, Vertical, and Regions |

|

Regions covered |

North America, Europe, APAC, MEA, and Latin America |

|

Companies covered |

IBM (US), Pegasystems (US), Appian (US), Kissflow(India), LAserfiche (US), Nintex (US), Oracle (US), Software AG (Germany), Salesforce (US) Microsoft (US) , Bizagi (UK), OpenText (Canada), TIBCO (US) and many more. |

This research report categorizes the business process automation market to forecast revenue and analyze trends in each of the following submarkets:

Based on the component:

- Platforms

- Services

Based on the services:

- Consulting

- Deployment and integration

- Support and maintenance

Based on business function

- Human Resource Automation

- Supply Chain Automation

- Sales and Marketing Automation

- Accounting and Finance Automation

- Customer Service Support Automation

- Others (legal and compliance and R&D activities)

Based on the Deployment Type:

- Cloud

- On premises

Based on organization size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

Based on verticals:

- BFSI

- Manufacturing

- IT

- Telecommunications

- Retail and Consumer Goods

- Healthcare

- Others (social media and entertainment, government, and transport and logistic)

Based on Regions:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- Rest of Europe

-

APAC

- China

- Japan

- Australia

- Rest of APAC

-

MEA

- Saudi Arabia

- UAE

- South Africa

- Rest of MEA

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In May 2021, Appian released the latest version of Appian Low Code Automation Platform. The new version has features such as AI-driven Intelligent Document Processing (IDP), new design guidance and developer collaboration features, and enhanced DevSecOps capabilities.

- In May 2021, Pegasystems launched the new version of Pega Infinity. The new version includes feature such as enhnaced low-code, intelligent automation, and AI capabilities.

- In March 2020, Kissflow partnered with Redington, an IT distribution and supply chain firm. The partnership aims towards expanding the reach of Kissflow’s flagship product No-Code Platform in India.

- In December 2020, IBM launched new capabilities to infuse intelligence into workflows. The capabilities are designed to improve the automation of AI, provide a higher degree of precision in natural language processing, and foster greater trust in outcomes derived from AI predictions.

- In December 2020, Appian cpllaborated with Accenture. The new collaboration would accelerate acquisition modernization for government and defense organizations with BPA.

Frequently Asked Questions (FAQ):

How big is the Business Process Automation (BPA) Market?

What is growth rate of the Business Process Automation (BPA) Market?

What is the market demand for Business Process Automation Market?

- Automated IT systems help serve customers’ dynamic requirements

- Growing demand for streamlining communication across varied business functions in organizations

Who are the key players in Business Process Automation (BPA) Market?

Who will be the leading hub for Business Process Automation Market?

What are the opportunities in Business Process Automation Market?

- Integration of AI and ML technologies

- Rise in the demand for robust solutions to maximize visibility and control over processes

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 37)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2017–2019

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 47)

2.1 RESEARCH DATA

FIGURE 6 BUSINESS PROCESS AUTOMATION MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

TABLE 2 PRIMARY RESPONDENTS: MARKET

2.1.2.1 Key industry insights

2.1.2.2 Breakup of primary profiles

2.2 MARKET BREAKUP AND DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 7 BUSINESS PROCESS AUTOMATION MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 1 (TOP-DOWN): REVENUE OF VENDORS OFFERING BUSINESS PROCESS AUTOMATION SOLUTIONS AND SERVICES (1/2)

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 1 (TOP-DOWN): REVENUE OF VENDORS OFFERING BUSINESS PROCESS AUTOMATION PLATFORMS AND SERVICES (2/2)

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 2 (BOTTOM-UP): REVENUE OF BUSINESS PROCESS AUTOMATION VENDORS OFFERING PLATFORMS AND SERVICES

FIGURE 11 MARKET SIZE RESEARCH APPROACH 2: DEMAND-SIDE MARKET ESTIMATIONS THROUGH VERTICALS

2.4 MARKET REVENUE ESTIMATION

FIGURE 12 ILLUSTRATION OF BUSINESS PROCESS AUTOMATION COMPANY REVENUE ESTIMATION

2.5 GROWTH FORECAST ASSUMPTIONS

2.6 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.7 COMPANY EVALUATION QUADRANT METHODOLOGY

FIGURE 13 COMPANY EVALUATION QUADRANT: CRITERIA WEIGHTAGE

2.8 RESEARCH ASSUMPTIONS

TABLE 4 ASSUMPTIONS FOR THE STUDY

2.9 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 60)

FIGURE 14 SALES AND MARKETING AUTOMATION, LARGE ENTERPRISES, AND SUPPORT AND MAINTENANCE SEGMENTS TO HOLD HIGH SHARES IN BUSINESS PROCESS AUTOMATION MARKET IN 2020

FIGURE 15 NORTH AMERICA TO ACCOUNT FOR HIGHEST MARKET SHARE IN 2020

4 PREMIUM INSIGHTS (Page No. - 63)

4.1 ATTRACTIVE OPPORTUNITIES IN BUSINESS PROCESS AUTOMATION MARKET

FIGURE 16 GROWING DEMAND FOR STREAMLINING BUSINESS PROCESSES ACROSS VARIED BUSINESS FUNCTIONS TO DRIVE MARKET GROWTH DURING FORECAST PERIOD

4.2 MARKET, BY COMPONENT, 2020 VS. 2026

FIGURE 17 PLATFORMS SEGMENT TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

4.3 MARKET, BY ORGANIZATION SIZE, 2020 VS. 2026

FIGURE 18 LARGE ENTERPRISES SEGMENT TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

4.4 MARKET, BY VERTICAL, 2020 VS. 2026

FIGURE 19 MANUFACTURING VERTICAL TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 65)

5.1 INTRODUCTION

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: BUSINESS PROCESS AUTOMATION MARKET

5.1.1 DRIVERS

5.1.1.1 Increased need for optimized resource utilization through automated business processes

5.1.1.2 Automated IT systems help serve customers’ dynamic requirements

5.1.1.3 Growing demand for streamlining communication across varied business functions in organizations

5.1.2 RESTRAINTS

5.1.2.1 Persistent growth in cyber-attacks and security issues

5.1.3 OPPORTUNITIES

5.1.3.1 Integration of AI and ML technologies

5.1.3.2 Rise in the demand for robust solutions to maximize visibility and control over processes

5.1.4 CHALLENGES

5.1.4.1 Growing cultural barrier to adopt advanced solutions over traditional systems

5.1.4.2 Selecting the right time and right process to implement automation

5.2 COVID-19-DRIVEN MARKET DYNAMICS

5.2.1 DRIVERS AND OPPORTUNITIES

5.2.2 RESTRAINTS AND CHALLENGES

5.3 CASE STUDY ANALYSIS

5.3.1 CASE STUDY 1: MANAGING MULTI-CLOUD INFRASTRUCTURE

5.3.2 CASE STUDY 2: AUTOMATING FINANCE PROCESSES

5.3.3 CASE STUDY 3: IMPROVING BANKING OPERATIONS THROUGH AUTOMATION

5.4 VALUE CHAIN ANALYSIS

FIGURE 21 VALUE CHAIN ANALYSIS: BUSINESS PROCESS AUTOMATION MARKET

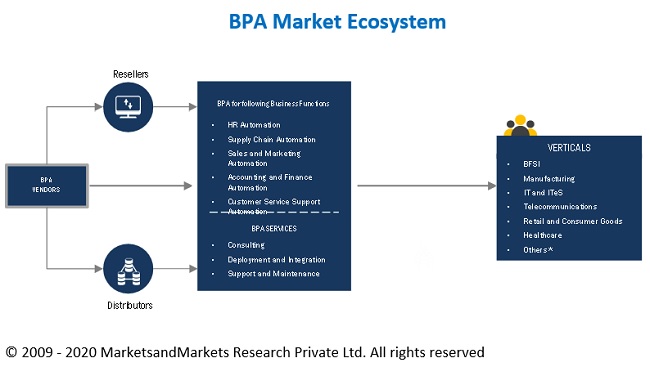

5.5 ECOSYSTEM

FIGURE 22 ECOSYSTEM: MARKET

5.6 TECHNOLOGY ANALYSIS

5.6.1 ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING

5.6.2 ANALYTICS

5.6.3 INTERNET OF THINGS

5.7 PRICING ANALYSIS

5.8 PATENT ANALYSIS

5.9 PORTER’S FIVE FORCES ANALYSIS

TABLE 5 BUSINESS PROCESS AUTOMATION MARKET: PORTER’S FIVE FORCES

5.9.1 THREAT OF NEW ENTRANTS

5.9.2 THREAT FROM SUBSTITUTES

5.9.3 BARGAINING POWER OF BUYERS

5.9.4 BARGAINING POWER OF SUPPLIERS

FIGURE 23 PORTER’S FIVE FORCES: MARKET

6 BUSINESS PROCESS AUTOMATION MARKET, BY COMPONENT (Page No. - 77)

6.1 INTRODUCTION

6.1.1 COMPONENTS: MARKET DRIVERS

6.1.2 COMPONENTS: COVID-19 IMPACT

FIGURE 24 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 6 MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 7 MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 8 COMPONENTS: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 9 COMPONENTS: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.2 PLATFORMS

FIGURE 25 CUSTOMER SERVICE SUPPORT AUTOMATION SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 10 PLATFORMS: BUSINESS PROCESS AUTOMATION MARKET SIZE, BY BUSINESS FUNCTION, 2016–2019 (USD MILLION)

TABLE 11 PLATFORMS: MARKET SIZE, BY BUSINESS FUNCTION, 2020–2026 (USD MILLION)

TABLE 12 PLATFORMS: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 13 PLATFORMS: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.2.1 HUMAN RESOURCE AUTOMATION

TABLE 14 HUMAN RESOURCE AUTOMATION MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 15 HUMAN RESOURCE AUTOMATION MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.2.2 SUPPLY CHAIN AUTOMATION

TABLE 16 SUPPLY CHAIN AUTOMATION MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 17 SUPPLY CHAIN AUTOMATION MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.2.3 SALES AND MARKETING AUTOMATION

TABLE 18 SALES AND MARKETING AUTOMATION MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 19 SALES AND MARKETING AUTOMATION MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.2.4 ACCOUNTING AND FINANCE AUTOMATION

TABLE 20 ACCOUNTING AND FINANCE AUTOMATION MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 21 ACCOUNTING AND FINANCE AUTOMATION MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.2.5 CUSTOMER SERVICE SUPPORT AUTOMATION

TABLE 22 CUSTOMER SERVICE SUPPORT AUTOMATION MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 23 CUSTOMER SERVICE SUPPORT AUTOMATION MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.2.6 OTHERS

TABLE 24 OTHERS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 25 OTHERS MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.3 SERVICES

FIGURE 26 SUPPORT AND MAINTENANCE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 26 SERVICES: BUSINESS PROCESS AUTOMATION MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 27 SERVICES: MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 28 SERVICES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 29 SERVICES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.3.1 CONSULTING

TABLE 30 CONSULTING MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 31 CONSULTING MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.3.2 INTEGRATION AND IMPLEMENTATION

TABLE 32 INTEGRATION AND IMPLEMENTATION MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 33 INTEGRATION AND IMPLEMENTATION MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.3.3 MAINTENANCE AND SUPPORT

TABLE 34 MAINTENANCE AND SUPPORT MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 35 MAINTENANCE AND SUPPORT MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

7 BUSINESS PROCESS AUTOMATION MARKET, BY DEPLOYMENT TYPE (Page No. - 92)

7.1 INTRODUCTION

7.1.1 DEPLOYMENT TYPES: MARKET DRIVERS

7.1.2 DEPLOYMENT TYPES: COVID-19 IMPACT

FIGURE 27 CLOUD SEGMENT TO GROW AT HIGHER GROWTH RATE DURING FORECAST PERIOD

TABLE 36 MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 37 MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

7.2 ON-PREMISES

TABLE 38 ON-PREMISES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 39 ON-PREMISES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 40 NORTH AMERICA: ON-PREMISES MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 41 NORTH AMERICA: ON-PREMISES MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 42 EUROPE: ON-PREMISES MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 43 EUROPE: ON-PREMISES MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 44 ASIA PACIFIC: ON-PREMISES MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 45 ASIA PACIFIC: ON-PREMISES MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 46 MIDDLE EAST AND AFRICA: ON-PREMISES MARKET SIZE, BY COUNTRY, 2016–2019 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA: ON-PREMISES MARKET SIZE, BY COUNTRY, 2020–2026 (USD THOUSAND)

TABLE 48 LATIN AMERICA: ON-PREMISES MARKET SIZE, BY COUNTRY, 2016–2019 (USD THOUSAND)

TABLE 49 LATIN AMERICA: ON-PREMISES MARKET SIZE, BY COUNTRY, 2020–2026 (USD THOUSAND)

7.3 CLOUD

TABLE 50 CLOUD: BUSINESS PROCESS AUTOMATION MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 51 CLOUD: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 52 NORTH AMERICA: CLOUD MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 53 NORTH AMERICA: CLOUD MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 54 EUROPE: CLOUD MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 55 EUROPE: CLOUD MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 56 ASIA PACIFIC: CLOUD MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 57 ASIA PACIFIC: CLOUD MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 58 MIDDLE EAST AND AFRICA: CLOUD MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 59 MIDDLE EAST AND AFRICA: CLOUD MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 60 LATIN AMERICA: CLOUD MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 61 LATIN AMERICA: CLOUD MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

8 BUSINESS PROCESS AUTOMATION MARKET, BY ORGANIZATION SIZE (Page No. - 103)

8.1 INTRODUCTION

8.1.1 ORGANIZATION SIZE: MARKET DRIVERS

8.1.2 ORGANIZATION SIZE: COVID-19 IMPACT

FIGURE 28 LARGE ENTERPRISES TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

TABLE 62 MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 63 MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

8.2 LARGE ENTERPRISES

TABLE 64 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 65 LARGE ENTERPRISES: BUSINESS PROCESS AUTOMATION MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 66 NORTH AMERICA: LARGE ENTERPRISES MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 67 NORTH AMERICA: LARGE ENTERPRISES MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 68 EUROPE: LARGE ENTERPRISES MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 69 EUROPE: LARGE ENTERPRISES MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 70 ASIA PACIFIC: LARGE ENTERPRISES MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 71 ASIA PACIFIC: LARGE ENTERPRISES MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 72 MIDDLE EAST AND AFRICA: LARGE ENTERPRISES MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 73 MIDDLE EAST AND AFRICA: LARGE ENTERPRISES MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 74 LATIN AMERICA: LARGE ENTERPRISES MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 75 LATIN AMERICA: LARGE ENTERPRISES MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

8.3 SMALL AND MEDIUM-SIZED ENTERPRISES

TABLE 76 SMALL AND MEDIUM-SIZED ENTERPRISES: BUSINESS PROCESS AUTOMATION MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 77 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 78 NORTH AMERICA: SMALL AND MEDIUM-SIZED ENTERPRISES MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 79 NORTH AMERICA: SMALL AND MEDIUM-SIZED ENTERPRISES MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 80 EUROPE: SMALL AND MEDIUM-SIZED ENTERPRISES MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 81 EUROPE: SMALL AND MEDIUM-SIZED ENTERPRISES MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 82 ASIA PACIFIC: SMALL AND MEDIUM-SIZED ENTERPRISES MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 83 ASIA PACIFIC: SMALL AND MEDIUM-SIZED ENTERPRISES MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 84 MIDDLE EAST AND AFRICA: SMALL AND MEDIUM-SIZED ENTERPRISES MARKET SIZE, BY COUNTRY, 2016–2019 (USD THOUSAND)

TABLE 85 MIDDLE EAST AND AFRICA: SMALL AND MEDIUM-SIZED ENTERPRISES MARKET SIZE, BY COUNTRY, 2020–2026 (USD THOUSAND)

TABLE 86 LATIN AMERICA: SMALL AND MEDIUM-SIZED ENTERPRISES MARKET SIZE, BY COUNTRY, 2016–2019 (USD THOUSAND)

TABLE 87 LATIN AMERICA: SMALL AND MEDIUM-SIZED ENTERPRISES MARKET SIZE, BY COUNTRY, 2020–2026 (USD THOUSAND)

9 BUSINESS PROCESS AUTOMATION MARKET, BY VERTICAL (Page No. - 114)

9.1 INTRODUCTION

9.1.1 INDUSTRY VERTICALS: MARKET DRIVERS

9.1.2 INDUSTRY VERTICALS: COVID-19 IMPACT

FIGURE 29 RETAIL AND CONSUMER GOODS INDUSTRY VERTICAL TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 88 MARKET SIZE, BY INDUSTRY VERTICAL, 2016–2019 (USD MILLION)

TABLE 89 MARKET SIZE, BY INDUSTRY VERTICAL, 2020–2026 (USD MILLION)

9.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

TABLE 90 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 91 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.3 MANUFACTURING

TABLE 92 MANUFACTURING: BUSINESS PROCESS AUTOMATION MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 93 MANUFACTURING: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.4 INFORMATION TECHNOLOGY

TABLE 94 INFORMATION TECHNOLOGY: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 95 INFORMATION TECHNOLOGY: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.5 TELECOMMUNICATIONS

TABLE 96 TELECOMMUNICATIONS: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 97 TELECOMMUNICATIONS: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.6 RETAIL AND CONSUMER GOODS

TABLE 98 RETAIL AND CONSUMER GOODS: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 99 RETAIL AND CONSUMER GOODS: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.7 HEALTHCARE

TABLE 100 HEALTHCARE: BUSINESS PROCESS AUTOMATION MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 101 HEALTHCARE: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.8 OTHERS

TABLE 102 OTHERS: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 103 OTHERS: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

10 BUSINESS PROCESS AUTOMATION MARKET, BY REGION (Page No. - 125)

10.1 INTRODUCTION

FIGURE 30 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

TABLE 104 MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 105 MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: COVID-19 IMPACT

10.2.2 NORTH AMERICA: MARKET DRIVERS

10.2.3 NORTH AMERICA: REGULATORY LANDSCAPE

FIGURE 31 NORTH AMERICA: MARKET SNAPSHOT

TABLE 106 NORTH AMERICA: BUSINESS PROCESS AUTOMATION MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 107 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 108 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 109 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 110 NORTH AMERICA: MARKET SIZE, BY BUSINESS FUNCTION, 2016–2019 (USD MILLION)

TABLE 111 NORTH AMERICA: MARKET SIZE, BY BUSINESS FUNCTION, 2020–2026 (USD MILLION)

TABLE 112 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 113 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 114 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 115 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

TABLE 116 NORTH AMERICA: MARKET SIZE, BY INDUSTRY VERTICAL, 2016–2019 (USD MILLION)

TABLE 117 NORTH AMERICA: MARKET SIZE, BY INDUSTRY VERTICAL, 2020–2026 (USD MILLION)

TABLE 118 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 119 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

10.2.4 UNITED STATES

TABLE 120 UNITED STATES: BUSINESS PROCESS AUTOMATION MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 121 UNITED STATES: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 122 UNITED STATES: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 123 UNITED STATES: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

TABLE 124 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 125 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

10.2.5 CANADA

TABLE 126 CANADA: BUSINESS PROCESS AUTOMATION MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 127 CANADA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 128 CANADA: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 129 CANADA: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

TABLE 130 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 131 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

10.3 EUROPE

10.3.1 EUROPE: COVID-19 IMPACT

10.3.2 EUROPE: MARKET DRIVERS

10.3.3 EUROPE: REGULATORY LANDSCAPE

TABLE 132 EUROPE: BUSINESS PROCESS AUTOMATION MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 133 EUROPE: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 134 EUROPE: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 135 EUROPE: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 136 EUROPE: MARKET SIZE, BY BUSINESS FUNCTION, 2016–2019 (USD MILLION)

TABLE 137 EUROPE: MARKET SIZE, BY BUSINESS FUNCTION, 2020–2026 (USD MILLION)

TABLE 138 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 139 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 140 EUROPE: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 141 EUROPE: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

TABLE 142 EUROPE: MARKET SIZE, BY INDUSTRY VERTICAL, 2016–2019 (USD MILLION)

TABLE 143 EUROPE: MARKET SIZE, BY INDUSTRY VERTICAL, 2020–2026 (USD MILLION)

TABLE 144 EUROPE: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 145 EUROPE: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

10.3.4 UNITED KINGDOM

TABLE 146 UNITED KINGDOM: BUSINESS PROCESS AUTOMATION MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 147 UNITED KINGDOM: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 148 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 149 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

TABLE 150 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 151 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

10.3.5 GERMANY

TABLE 152 GERMANY: BUSINESS PROCESS AUTOMATION MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 153 GERMANY: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 154 GERMANY: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 155 GERMANY: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

TABLE 156 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 157 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

10.3.6 FRANCE

TABLE 158 FRANCE: BUSINESS PROCESS AUTOMATION MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 159 FRANCE: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 160 FRANCE: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 161 FRANCE: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

TABLE 162 FRANCE: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 163 FRANCE: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

10.3.7 REST OF EUROPE

TABLE 164 REST OF EUROPE: BUSINESS PROCESS AUTOMATION MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 165 REST OF EUROPE: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 166 REST OF EUROPE: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 167 REST OF EUROPE: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

TABLE 168 REST OF EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 169 REST OF EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

10.4 ASIA PACIFIC

10.4.1 ASIA PACIFIC: COVID-19 IMPACT

10.4.2 ASIA PACIFIC: MARKET DRIVERS

10.4.3 ASIA PACIFIC: REGULATORY LANDSCAPE

FIGURE 32 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 170 ASIA PACIFIC: BUSINESS PROCESS AUTOMATION MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 171 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 172 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 173 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 174 ASIA PACIFIC: MARKET SIZE, BY BUSINESS FUNCTION, 2016–2019 (USD MILLION)

TABLE 175 ASIA PACIFIC: MARKET SIZE, BY BUSINESS FUNCTION, 2020–2026 (USD MILLION)

TABLE 176 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 177 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 178 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 179 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

TABLE 180 ASIA PACIFIC: MARKET SIZE, BY INDUSTRY VERTICAL, 2016–2019 (USD MILLION)

TABLE 181 ASIA PACIFIC: MARKET SIZE, BY INDUSTRY VERTICAL, 2020–2026 (USD MILLION)

TABLE 182 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 183 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

10.4.4 CHINA

TABLE 184 CHINA: BUSINESS PROCESS AUTOMATION MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 185 CHINA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 186 CHINA: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 187 CHINA: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

TABLE 188 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 189 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

10.4.5 JAPAN

TABLE 190 JAPAN: BUSINESS PROCESS AUTOMATION MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 191 JAPAN: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 192 JAPAN: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 193 JAPAN: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

TABLE 194 JAPAN: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 195 JAPAN: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

10.4.6 REST OF ASIA PACIFIC

TABLE 196 REST OF ASIA PACIFIC: BUSINESS PROCESS AUTOMATION MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 197 REST OF ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 198 REST OF ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 199 REST OF ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

TABLE 200 REST OF ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 201 REST OF ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

10.5 MIDDLE EAST AND AFRICA

10.5.1 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

10.5.2 MIDDLE EAST AND AFRICA: MARKET DRIVERS

10.5.3 MIDDLE EAST AND AFRICA: REGULATORY LANDSCAPE

TABLE 202 MIDDLE EAST AND AFRICA: BUSINESS PROCESS AUTOMATION MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 203 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 204 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 205 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 206 MIDDLE EAST AND AFRICA: MARKET SIZE, BY BUSINESS FUNCTION, 2016–2019 (USD MILLION)

TABLE 207 MIDDLE EAST AND AFRICA: MARKET SIZE, BY BUSINESS FUNCTION, 2020–2026 (USD MILLION)

TABLE 208 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 209 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 210 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 211 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

TABLE 212 MIDDLE EAST AND AFRICA: MARKET SIZE, BY INDUSTRY VERTICAL, 2016–2019 (USD MILLION)

TABLE 213 MIDDLE EAST AND AFRICA: MARKET SIZE, BY INDUSTRY VERTICAL, 2020–2026 (USD MILLION)

TABLE 214 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 215 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

10.5.4 UNITED ARAB EMIRATES

TABLE 216 UNITED ARAB EMIRATES: BUSINESS PROCESS AUTOMATION MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 217 UNITED ARAB EMIRATES: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 218 UNITED ARAB EMIRATES: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 219 UNITED ARAB EMIRATES: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

TABLE 220 UNITED ARAB EMIRATES: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 221 UNITED ARAB EMIRATES: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

10.5.5 KINGDOM OF SAUDI ARABIA

TABLE 222 KINGDOM OF SAUDI ARABIA: BUSINESS PROCESS AUTOMATION MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 223 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 224 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 225 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

TABLE 226 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 227 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

10.5.6 REST OF MIDDLE EAST AND AFRICA

TABLE 228 REST OF MIDDLE EAST AND AFRICA: BUSINESS PROCESS AUTOMATION MARKET SIZE, BY COMPONENT, 2016–2019 (USD THOUSAND)

TABLE 229 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD THOUSAND)

TABLE 230 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD THOUSAND)

TABLE 231 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD THOUSAND)

TABLE 232 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD THOUSAND)

TABLE 233 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD THOUSAND)

10.6 LATIN AMERICA

10.6.1 LATIN AMERICA: COVID-19 IMPACT

10.6.2 LATIN AMERICA: MARKET DRIVERS

10.6.3 LATIN AMERICA: REGULATORY LANDSCAPE

TABLE 234 LATIN AMERICA: BUSINESS PROCESS AUTOMATION MARKET SIZE, BY COMPONENT, 2016–2019 (USD THOUSAND)

TABLE 235 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD THOUSAND)

TABLE 236 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2016–2019 (USD THOUSAND)

TABLE 237 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2020–2026 (USD THOUSAND)

TABLE 238 LATIN AMERICA: MARKET SIZE, BY BUSINESS FUNCTION, 2016–2019 (USD THOUSAND)

TABLE 239 LATIN AMERICA: MARKET SIZE, BY BUSINESS FUNCTION, 2020–2026 (USD THOUSAND)

TABLE 240 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD THOUSAND)

TABLE 241 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD THOUSAND)

TABLE 242 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD THOUSAND)

TABLE 243 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD THOUSAND)

TABLE 244 LATIN AMERICA: MARKET SIZE, BY INDUSTRY VERTICAL, 2016–2019 (USD MILLION)

TABLE 245 LATIN AMERICA: MARKET SIZE, BY INDUSTRY VERTICAL, 2020–2026 (USD MILLION)

TABLE 246 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 247 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

10.6.4 BRAZIL

TABLE 248 BRAZIL: BUSINESS PROCESS AUTOMATION MARKET SIZE, BY COMPONENT, 2016–2019 (USD THOUSAND)

TABLE 249 BRAZIL: MARKET SIZE, BY COMPONENT, 2020–2026 (USD THOUSAND)

TABLE 250 BRAZIL: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD THOUSAND)

TABLE 251 BRAZIL: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD THOUSAND)

TABLE 252 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD THOUSAND)

TABLE 253 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD THOUSAND)

10.6.5 MEXICO

TABLE 254 MEXICO: BUSINESS PROCESS AUTOMATION MARKET SIZE, BY COMPONENT, 2016–2019 (USD THOUSAND)

TABLE 255 MEXICO: MARKET SIZE, BY COMPONENT, 2020–2026 (USD THOUSAND)

TABLE 256 MEXICO: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD THOUSAND)

TABLE 257 MEXICO: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD THOUSAND)

TABLE 258 MEXICO: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD THOUSAND)

TABLE 259 MEXICO: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD THOUSAND)

10.6.6 REST OF LATIN AMERICA

TABLE 260 REST OF LATIN AMERICA: BUSINESS PROCESS AUTOMATION MARKET SIZE, BY COMPONENT, 2016–2019 (USD THOUSAND)

TABLE 261 REST OF LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD THOUSAND)

TABLE 262 REST OF LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD THOUSAND)

TABLE 263 REST OF LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD THOUSAND)

TABLE 264 REST OF LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD THOUSAND)

TABLE 265 REST OF LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD THOUSAND)

11 COMPETITIVE LANDSCAPE (Page No. - 180)

11.1 INTRODUCTION

11.2 MARKET EVALUATION FRAMEWORK

FIGURE 33 MARKET EVALUATION FRAMEWORK

11.3 KEY MARKET DEVELOPMENTS

11.3.1 PRODUCT LAUNCHES

TABLE 266 BUSINESS PROCESS AUTOMATION MARKET: PRODUCT LAUNCHES

11.3.2 DEALS

TABLE 267 MARKET: DEALS

11.4 COMPANY PRODUCT FOOTPRINT ANALYSIS

TABLE 268 COMPANY PRODUCT FOOTPRINT

TABLE 269 COMPANY APPLICATION FOOTPRINT ANALYSIS

FIGURE 34 COMPANY INDUSTRY FOOTPRINT ANALYSIS

TABLE 270 COMPANY REGION FOOTPRINT ANALYSIS

11.5 MARKET SHARE OF TOP VENDORS

FIGURE 35 VENDOR MARKET SHARE ANALYSIS

11.6 REVENUE ANALYSIS OF TOP VENDORS

FIGURE 36 HISTORICAL FIVE YEAR REVENUE ANALYSIS

11.7 MARKET SHARE ANALYSIS OF TOP MARKET PLAYERS

TABLE 271 BUSINESS PROCESS AUTOMATION MARKET: DEGREE OF COMPETITION

11.8 COMPANY EVALUATION QUADRANT

11.8.1 DEFINITIONS AND METHODOLOGY

TABLE 272 COMPANY EVALUATION QUADRANT: CRITERIA

11.8.2 STAR

11.8.3 EMERGING LEADERS

11.8.4 PERVASIVE

11.8.5 PARTICIPANTS

FIGURE 37 BUSINESS PROCESS AUTOMATION MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2020

12 COMPANY PROFILES (Page No. - 190)

12.1 INTRODUCTION

(Business Overview, Products and Services Offered, Recent Developments, MNM View, Key Strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats)*

12.2 IBM

TABLE 273 IBM: BUSINESS OVERVIEW

FIGURE 38 IBM: COMPANY SNAPSHOT

12.3 APPIAN

TABLE 274 APPIAN: BUSINESS OVERVIEW

FIGURE 39 APPIAN: COMPANY SNAPSHOT

12.4 PEGASYSTEMS

TABLE 275 PEGASYSTEMS: BUSINESS OVERVIEW

FIGURE 40 PEGASYSTEMS : COMPANY SNAPSHOT

12.5 KISSFLOW

TABLE 276 KISSFLOW: BUSINESS OVERVIEW

12.6 LASERFICHE

TABLE 277 LASERFICHE: BUSINESS OVERVIEW

12.7 ORACLE

TABLE 278 ORACLE: BUSINESS OVERVIEW

FIGURE 41 ORACLE: COMPANY SNAPSHOT

12.8 NINTEX

TABLE 279 NINTEX: BUSINESS OVERVIEW

12.9 SOFTWARE AG

TABLE 280 SOFTWARE AG: BUSINESS OVERVIEW

FIGURE 42 SOFTWARE AG: COMPANY SNAPSHOT

12.10 SALESFORCE

TABLE 281 SALESFORCE: BUSINESS OVERVIEW

FIGURE 43 SALESFORCE: COMPANY SNAPSHOT

12.11 MICROSOFT

TABLE 282 MICROSOFT: BUSINESS OVERVIEW

FIGURE 44 MICROSOFT: COMPANY SNAPSHOT

12.12 BIZAGI

12.13 OPENTEXT

12.14 TIBCO

12.15 CREATIO

12.16 GENPACT

12.17 DXC TECHNOLOGY

12.18 NEWGEN SOFTWARE

12.19 BONITASOFT

12.20 KOFAX

12.21 FLOWFORMA

12.22 AURAQUANTIC

12.23 AGILEPOINT

12.24 AUTOMATION HERO

12.25 QUICKBASE

12.26 CORTEX

*Details on Business Overview, Products and Services Offered, Recent Developments, MNM View, Key Strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats might not be captured in case of unlisted companies.

13 ADJACENT MARKET (Page No. - 232)

13.1 INTRODUCTION

13.2 BUSINESS PROCESS MANAGEMENT MARKET

TABLE 283 BUSINESS PROCESS MANAGEMENT MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 284 BUSINESS PROCESS MANAGEMENT MARKET SIZE, BY BUSINESS FUNCTION, 2018–2025 (USD MILLION)

TABLE 285 BUSINESS PROCESS MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

14 APPENDIX (Page No. - 234)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

The study involved 4 major activities to estimate the current market size of Business Process Automation (BPA) solutions. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies; whitepapers such as Cisco Cloud Index; certified publications; and articles from recognized associations, such as data center knowledge and government publishing sources. The research study involved the use of extensive secondary sources, directories, and databases, such as D&B Hoovers, DiscoverOrg, Factiva, Bloomberg BusinessWeek, Statista.com, Cloud Computing Association, Asia Cloud Computing Association, The Software Alliance, Mena Cloud Alliance, The European Commission, Cloud Security Alliance, The European Cloud Alliance, EuroCloud to identify and collect information useful for this technical, market-oriented, and commercial study of the BPA market. Secondary research was mainly used to obtain key information about the industry’s value chain, the total pool of key players, market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply-side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations providing BPA solutions. The primary sources from the demand side included the end-users of evet management software solutions, which included Chief Information Officers (CIOs), IT technicians and technologists, and IT managers at public and investor-owned utilities.

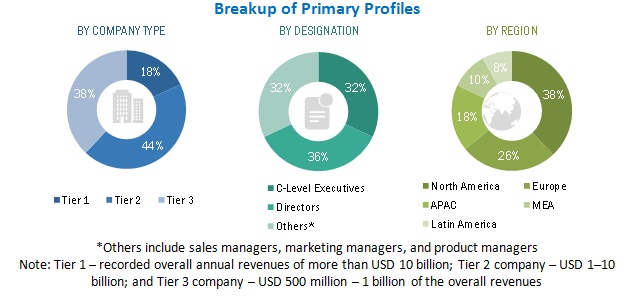

The following figure depicts the breakup of the primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the BPA market. They were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakup procedures were employed, wherever applicable. The data was triangulated by studying several factors and trends from both, the demand and supply sides, in the BPA market.

Report Objectives

- To define, describe, and forecast the Business Process Automation (BPA) market based on components, business functions, verticals, organization size, deployment types, and regions

- To provide detailed information about major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the BPA market

- To analyze the impact of COVID-19 on components, verticals, organization size, deployment types, and regions across the globe

- To analyze the market with respect to individual growth trends, prospects, and contributions to the BPA market

- To forecast the market size of five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the BPA market

- To profile key players in the BPA market and comprehensively analyze their core competencies in each microsegment

- To analyze key players based on their pricing models, market shares, and technology analysis

- To analyze competitive developments, such as new product launches, product enhancements, partnerships, and mergers and acquisitions, in the BPA market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs and on best effort basis for profiling of additional market players.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Business Process Automation Market