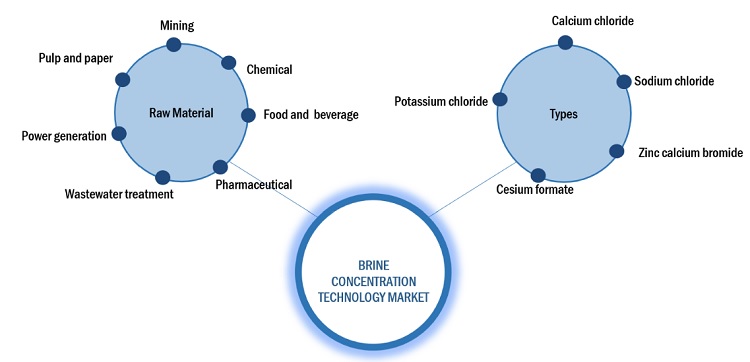

Brine Concentration Technology (BCT) Market by Type (Calcium chloride, Sodium chloride, Zinc calcium bromide, Cesium formate), Technology (High energy reverse osmosis, Mechanical vapor compression), Application, and Region - Global Forecast to 2027

Updated on : February 13, 2025

Brine Concentration Technology Market

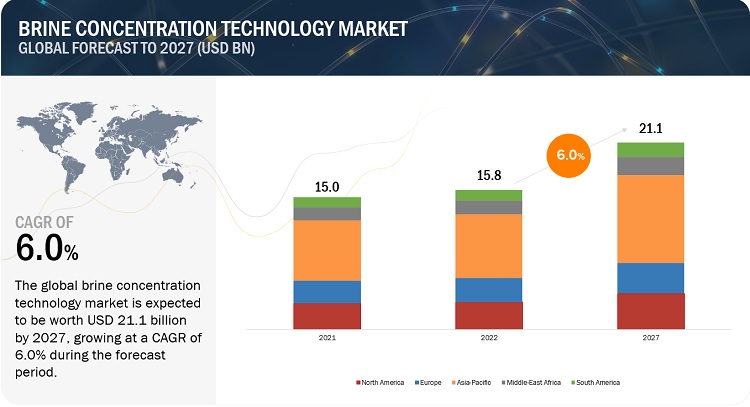

The brine concentration technology market was valued at USD 15.8 billion in 2022 and is projected to reach USD 21.1 billion by 2027, growing at 6.0% cagr from 2022 to 2027. The BCT market is mainly led by the significant usage of brine concentration technology in various end-use industries. The growing demand from the mining industry, rising demand for freshwater, and concerns for reducing the environmental impact are driving the market for brine concentration technology.

Brine Concentration Technology Market Forecast & Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Brine Concentration Technology Market Dynamics

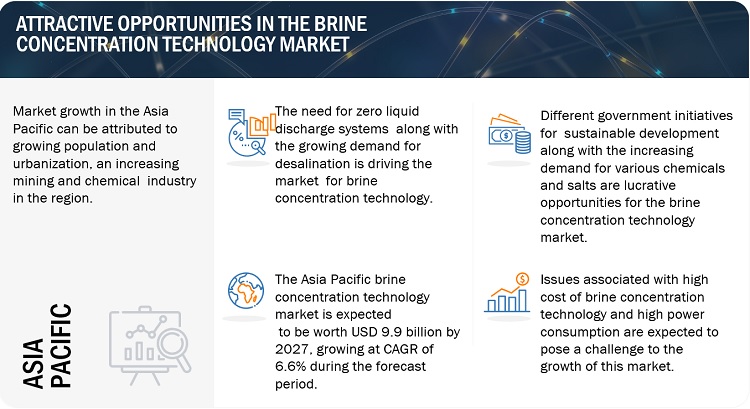

Driver: Need for zero liquid discharge systems and growing use of desalination

The concept of zero liquid discharge aims to eliminate liquid waste. Countries with the highest population, such as China and India, face a growing demand for water due to their increasing population. The water bodies are already polluted, and the brine discharge will only exacerbate the problem. Environmentalists and people are raising concerns about water pollution and decreasing water quality and quantity. Therefore, there is a need for zero liquid discharge to treat brine. In addition to that brine concentration technology market is being driven by the increasing need for water. Climate change has led to more frequent droughts and water shortages, making available freshwater insufficient for all. It is crucial to protect existing freshwater sources, reuse available sources and reduce harmful environmental impacts, strengthening the growing use of desalination.

Restraint: High cost of brine concentration technology

Brine concentration technology can be expensive, making it difficult for many countries, especially developing and low-income nations, to afford it. While various brine treatments exist, such as reverse osmosis, ion exchange, deep well injection, thermal evaporation, and thermal crystallization, low-cost solutions for brine treatment are yet to be developed. Desalination is expensive, and the added cost of brine treatment may be too much for many countries to bear. The untreated brine discharge can negatively impact the surrounding environments, which underscores the need for effective treatment.

Opportunity: Chemical and salt production, along with government initiatives for sustainable development

Brine concentration technology can be a source of precious byproducts, such as chemicals and salts, which have a variety of uses. The chemicals produced through brine concentration technology include magnesium, zinc, calcium, bromides, lithium derivates, sodium hydroxide, and hydrochloric acids. There are useful byproducts from brine that can help countries generate income and can motivate other countries to treat all brine produced. Salts such as potassium chloride have many benefits and are often used in food and medication. One major contributor to environmental harm is the improper management of brine. Therefore countries have introduced rules and regulations to ensure that brine is managed and disposed of safely with minimal environmental impact. Brine concentration technology provides a sustainable way to extract chemicals from brine, reducing the need for mining on land and further protecting the environment. This is especially important for densely populated countries like India and China, facing high pollution levels and environmental concerns.

Challenge: High power consumption

Treating brine is a challenging risk, mainly due to the high cost of technology and the significant amount of energy required. The challenge with brine concentration technology is the low concentration of high-value chemicals and salts in the brine which means that a large amount of brine needs to be treated to extract a small amount of these valuable substances. In countries such as India and China, where many rural and semi-urban areas lack electricity, the high power consumption of brine concentration technology becomes a major challenge.

Market Ecosystem

A market ecosystem refers to the interconnected network of individuals, businesses, and other organizations participating in a particular Brine Concentration Technology Industry. It includes various stakeholders such as producers, distributors, retailers, customers, and regulatory bodies that interact with each other to exchange goods, services, and information. Prominent companies in the market are the ones who are well-established and financially stable and have state-of-the-art technologies and a strong global marketing network and sales record. Veolia Water Technologies( France), Evoqua Water Technologies(US), H2O Innovations (Canada), Aquatech International LLC(US), Aquachem (US), IDE Technologies(Israel), Saltworks Technologies (Canada), Samco Technologies (US), Gradiant (US) are the leading manufacturers and service provider of brine concentration technology

Brine Concentration Technology Market Ecosystem

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

"Calcium chloride is the largest type of byproduct for brine concentration technology in 2022, in terms of value"

Calcium chloride accounted for the largest market share in the global brine concentration technology market, in terms of value, in 2022. The segment is also projected to grow at the highest CAGR in value in 2022. It has many applications in food and drinks, such as electrolysis in sports drinks and canned vegetables. It is also applied for road surfacing and deicing. It also has applications in the medical industry, as it helps treat acid burns and reduces blood pressure.

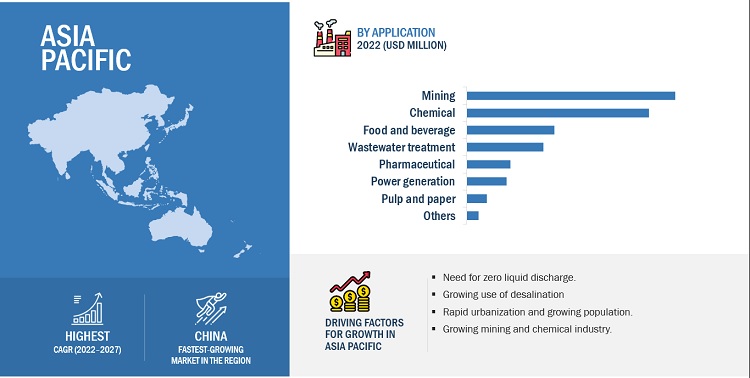

"Mining was the largest end-use industry for brine concentration technology market in 2022, in terms of value"

The mining industry, by application, accounted for the largest market share in the global brine concentration technology market, in terms of value, in 2022. However, the chemical industry is projected to grow at the highest CAGR in value during the forecast period. Most of the brine mining is done on a large scale by extensive industrial operations that employ specialized machinery to concentrate, extract and process a variety of minerals and compounds from brines that may be located far from the sea. It is considered more environmentally friendly that dry ore mining as brine mining does not require extensive land excavations, thus reducing the environmental impact.

"Asia Pacific was the largest market for brine concentration technology in 2022, in terms of value."

Asia Pacific was the largest market for the global brine concentration technology market, in terms of value, in 2022. China is the largest market in the Asia Pacific. It is projected to witness the highest growth during the forecast period considering of huge mining and chemical industry along with the increasing population and urbanization. The major players operating in the Asia Pacific region include Veolia Water Technologies, Aquatech International LLC, IDE Technologies Inc., among others.

To know about the assumptions considered for the study, download the pdf brochure

Brine Concentration Technology Market Players

The key players in this market Veolia Water Technologies( France), Evoqua Water Technologies(US), H2O Innovations (Canada), Aquatech International LLC(US), Koch Separation Solutions(US), Aquachem (US), IDE Technologies(Israel), Saltworks Technologies (Canada), Samco Technologies (US), Gradiant (US). Continuous developments in the market—including new product launches, mergers & acquisitions, agreements, and expansions—are expected to help the market grow. Leading manufacturers of brine concentration technology have opted for new product launches to sustain their market position.

Brine Concentration Technology Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 15.8 billion |

|

Revenue Forecast in 2027 |

USD 21.1 billion |

|

CAGR |

6.0% |

|

Years considered for the study |

2018-2027 |

|

Base Year |

2021 |

|

Forecast period |

2022–2027 |

|

Units considered |

Value (USD Billion/Million) |

|

Segments |

Type, Technology, Application, and Region |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies |

Veolia Water Technologies( France), Evoqua Water Technologies(US), H2O Innovations (Canada), Aquatech International LLC(US),Koch Separation Solutions(US), Aquachem (US), IDE Technologies(Israel), Saltworks Technologies (Canada), Samco Technologies (US), Gradiant (US). |

This report categorizes the global brine concentration technology market based on type, technology, application and region.

On the basis of type, the brine concentration technology market has been segmented as follows:

- Calcium chloride.

- Sodium chloride.

- Zinc calcium bromide.

- Cesium formate.

- Potassium chloride.

- Others.

On the basis of technology, the brine concentration technology market has been segmented as follows:

- High energy reverse osmosis.

- Mechanical vapor compression.

- Closed circuit desalination.

- Vertical tube falling film.

- Others

On the basis of application, the brine concentration technology market has been segmented as follows:

- Mining.

- Chemical.

- Food and beverage.

- Pharmaceutical.

- Wastewater treatment.

- Power generation

- Pulp and paper.

- Others.

On the basis of region, the brine concentration technology market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In 2023 Evoqua Water Technologies acquired Bob Johnson and Associates to expand its presence in Texas by purchasing the former Bob Johnson and Associates industrial water service division from Kemco Systems.

- In 2023 Koch Separation Solutions announced its partnership with Aqanato to provide industrial customers in North America with anaerobic wastewater treatment technology.

- In 2022, H2O Innovations acquired Evaporator Co. Inc., which will improve its position in the maple industry by acquiring the leading company Evaporator CO. Inc.

- In July 2022, Veolia Water Technologies announced its partnership with TotalEnergies and will build the largest photo voltaic (PV) system in Oman to power a desalination plant.

- In May 2022, Veolia Water Technologies acquired Suez, a French company with a global presence focusing on waste management and the water sector.

- In May 2021, Aquatech International LLC announced its partnership with Pani Energy and collaborated to lower the energy requirement of seawater desalination.

Frequently Asked Questions (FAQ):

What is the expected growth rate of the Brine concentration technology market?

This study's forecast period for the brine concentration technology market is 2022-2027. The market is expected to grow at a CAGR of 6.0%, in terms of value, during the forecast period.

Who are the major key players in the brine concentration technology market?

Veolia Water Technologies( France), Evoqua Water Technologies(US), H2O Innovations (Canada), Aquatech International LLC(US), Aquachem (US), IDE Technologies(Israel), Saltworks Technologies (Canada), Samco Technologies (US), Gradiant (US) are the leading manufacturers and service provider of brine concentration technology.

What are the major regulations of the brine concentration technology market in various countries?

Environmental protection agencies of different countries have laid down certain regulations for the proper treatment and disposal of wastewater using brine concentration technology.

What are the drivers and opportunities for the brine concentration technology market?

The need for zero liquid discharge systems and the growing use of desalination drive the brine concentration technology market. The opportunities are the production of chemicals and salt and different government initiatives for sustainable development.

Which are the key technology trends prevailing in the brine concentration technology market?

The key technologies prevailing in the brine concentration technology market include membrane-based technology like reverse osmosis and nanofiltration, advanced pre-treatment systems, zero liquid discharge systems, automation, and control systems like the use of artificial intelligence and machine learning to optimize processes. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Need for zero liquid discharge- Growing use of desalinationRESTRAINTS- High cost of brine concentration technologyOPPORTUNITIES- Chemical and salt production- Government initiatives for sustainable developmentCHALLENGES- High power consumption

- 6.1 INTRODUCTION

-

6.2 SUPPLY CHAIN ANALYSISINPUT SUPPLIERS- Anti-scaling agents- Coagulants and flocculants- pH adjuster- Corrosion inhibitorsEQUIPMENT MANUFACTURERS- Evaporators- Heat exchangers- Condensers- Pumps- Controls and instrumentation- Storage tanks- Filtration system- Heat sourcesTECHNOLOGY PROVIDERSSERVICE PROVIDERSEND USERSDISTRIBUTION AND LOGISTICS

-

6.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREATS OF SUBSTITUTES- Bargaining power of suppliersBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

6.4 ECOSYSTEM MAPPING

-

6.5 BRINE CONCENTRATION TECHNOLOGY MARKET REGULATIONSREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

6.6 PATENT ANALYSISINTRODUCTIONMETHODOLOGY- Document Type- Publication trends over last ten yearsINSIGHTSLEGAL STATUS OF PATENTSJURISDICTION ANALYSISTOP APPLICANTS

-

6.7 KEY FACTORS AFFECTING BUYING DECISIONSQUALITYSERVICE

-

6.8 TRADE ANALYSISIMPORT SCENARIOEXPORT SCENARIO

-

6.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSESEMERGING TECHNOLOGIES AND ENVIRONMENTAL CONCERNS FOR BRINE TECHNOLOGY MANUFACTURERS

-

6.10 MACROECONOMIC INDICATORSGDP TRENDS AND FORECASTS OF MAJOR ECONOMIES

- 7.1 INTRODUCTION

- 7.2 CALCIUM CHLORIDE

- 7.3 SODIUM CHLORIDE

- 7.4 ZINC CALCIUM BROMIDE

- 7.5 CESIUM FORMATE

- 7.6 POTASSIUM CHLORIDE

-

7.7 OTHERSMAGNESIUMLITHIUM DERIVATIVES

- 8.1 INTRODUCTION

-

8.2 MININGEXTRACTION OF MINERALS FROM BRINE SOLUTIONS TO DRIVE MARKET

-

8.3 CHEMICALREFINING AND PETROCHEMICALS BUSINESS TO DRIVE MARKET- Chlor alkali

-

8.4 FOOD AND BEVERAGEPRESERVATION OF FOOD AND PRODUCTION OF CULINARY ITEMS TO INCREASE DEMAND

-

8.5 PHARMACEUTICALPURIFICATION AND CONCENTRATION OF PROTEIN AND OTHER SOLUTIONS AND SUSPENSIONS TO DRIVE MARKET

-

8.6 WASTEWATER TREATMENTTREATMENT OF HIGH CONCENTRATIONS OF DISSOLVED SOLIDS TO DRIVE MARKET

-

8.7 POWER GENERATIONEMISSION-FREE POWER GENERATION BY SUSTAINABLE APPROACH TO SUPPORT MARKET

-

8.8 PULP AND PAPERREDUCTION OF WASTEWATER LOWERING COST AND ENVIRONMENTAL IMPACT TO DRIVE DEMAND

-

8.9 OTHERSCOAL TO CHEMICALSOIL AND GASSTEELTEXTILE

- 9.1 INTRODUCTION

-

9.2 HIGH ENERGY REVERSE OSMOSIS (HE-RO)HIGH EFFICIENCY AND AFFORDABILITY TO SUPPORT DEMAND GROWTH

-

9.3 MECHANICAL VAPOR COMPRESSION (MVC)LOW ENERGY EXPENDITURES AND LOWER CARBON IMPACT TO DRIVE MARKET

-

9.4 CLOSED CIRCUIT DESALINATIONHIGH EFFICIENCY IN MINIMIZING BRINE WASTE AND ENERGY TO BOOST DEMAND

-

9.5 VERTICAL TUBE FALLING FILM (VTFF)HIGH HEAT TRANSFER COEFFICIENT AND HIGH FLEXIBILITY REGARDING APPLICATION

-

9.6 OTHERSELECTRODIALYSIS (ED) AND ELECTRODIALYSIS REVERSAL (EDR)FORWARD OSMOSIS (FO)

- 10.1 INTRODUCTION

-

10.2 ASIA PACIFICRECESSION IMPACT- China- Japan- India- South Korea- Rest of Asia Pacific

-

10.3 NORTH AMERICARECESSION IMPACT- US- Canada- Mexico

-

10.4 SOUTH AMERICARECESSION IMPACT- Brazil- Argentina- Rest of South America

-

10.5 EUROPERECESSION IMPACT- Germany- Italy- France- UK- Russia- Spain- Rest of Europe

-

10.6 MIDDLE EAST & AFRICARECESSION IMPACT- Saudi Arabia- South Africa- Rest of Middle East & Africa

- 11.1 OVERVIEW

- 11.2 MARKET SHARE ANALYSIS, 2022

- 11.3 MARKET EVALUATION FRAMEWORK

-

11.4 RECENT DEVELOPMENTSDEALS

-

11.5 COMPETITIVE LEADERSHIP AND MAPPINGSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.6 STARTUP/SME EVALUATION QUADRANTPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

12.1 KEY PLAYERSVEOLIA WATER TECHNOLOGIES- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewEVOQUA WATER TECHNOLOGIES- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewH2O INNOVATIONS- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewKOCH SEPARATION SOLUTIONS- Business overview- Products/Services/Solutions offered- Recent development- MnM viewAQUATECH INTERNATIONAL LLC- Business overview- Products/Services/Solutions offered- Recent development- MnM viewAQUACHEM- Business overview- Product offered- MnM viewIDE TECHNOLOGIES- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewSALTWORKS TECHNOLOGIES- Business overview- Product offered- Recent development- MnM viewSAMCO TECHNOLOGIES- Business overview- Products/Services/Solutions offered- Recent development- MNM viewGRADIANT- Business overview- Products/Services/Solutions offered- Recent development- MnM view

-

12.2 OTHER PLAYERSLENNTECHDURAFLOW LLCMODERN WATER PLCMEMSYS WATER TECHNOLOGIESENVIRO WATER MINERALSATLANTIS TECHNOLOGIESOSMO MEMBRANE SYSTEMSADVENT ENVIROCARE TECHNOLOGYSYNDER FILTRATIONFLUID TECHNOLOGY SOLUTIONS

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 2 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 3 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 4 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 GRANTED PATENTS ACCOUNTED FOR 36.8% OF TOTAL COUNT IN LAST 10 YEARS

- TABLE 7 IMPORT SCENARIO FOR MACHINERY FOR FILTERING AND PURIFYING LIQUIDS, HS CODE: 842129, BY KEY COUNTRIES, 2022 (USD MILLION)

- TABLE 8 EXPORT SCENARIO FOR MACHINERY FOR FILTERING AND PURIFYING LIQUIDS, HS CODE: 842129, BY KEY COUNTRIES, 2022 (USD MILLION)

- TABLE 9 GDP TRENDS AND FORECASTS, BY KEY COUNTRIES, 2019–2027

- TABLE 10 BRINE CONCENTRATION TECHNOLOGY MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 11 BRINE CONCENTRATION TECHNOLOGY MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 12 BRINE CONCENTRATION TECHNOLOGY MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 13 BRINE CONCENTRATION TECHNOLOGY MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 14 BRINE CONCENTRATION TECHNOLOGY MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 15 BRINE CONCENTRATION TECHNOLOGY MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 16 BRINE CONCENTRATION TECHNOLOGY MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 17 BRINE CONCENTRATION TECHNOLOGY MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 18 ASIA PACIFIC: BRINE CONCENTRATION TECHNOLOGY MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 19 ASIA PACIFIC: BCT MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 20 ASIA PACIFIC: BCT MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 21 ASIA PACIFIC: BCT MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 22 ASIA PACIFIC: BCT MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 23 ASIA PACIFIC: BCT MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 24 ASIA PACIFIC: BCT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 25 ASIA PACIFIC: BCT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 26 CHINA: BRINE CONCENTRATION TECHNOLOGY MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 27 CHINA: BCT MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 28 CHINA: BCT MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 29 CHINA: BCT MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 30 CHINA: BCT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 31 CHINA: BCT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 32 JAPAN: BRINE CONCENTRATION TECHNOLOGY MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 33 JAPAN: BCT MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 34 JAPAN: BCT MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 35 JAPAN: BCT MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 36 JAPAN: BCT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 37 JAPAN: BCT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 38 INDIA: BRINE CONCENTRATION TECHNOLOGY MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 39 INDIA: BCT MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 40 INDIA: BCT MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 41 INDIA: BCT MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 42 INDIA: BCT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 43 INDIA: BCT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 44 SOUTH KOREA: BRINE CONCENTRATION TECHNOLOGY MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 45 SOUTH KOREA: BCT MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 46 SOUTH KOREA: BCT MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 47 SOUTH KOREA: BCT MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 48 SOUTH KOREA: BCT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 49 SOUTH KOREA: BCT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 50 REST OF ASIA PACIFIC: BRINE CONCENTRATION TECHNOLOGY MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 51 REST OF ASIA PACIFIC: BCT MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 52 REST OF ASIA PACIFIC: BCT MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 53 REST OF ASIA PACIFIC: BCT MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 54 REST OF ASIA PACIFIC: BCT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 55 REST OF ASIA PACIFIC: BCT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 56 NORTH AMERICA: BRINE CONCENTRATION TECHNOLOGY MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 57 NORTH AMERICA: BCT MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 58 NORTH AMERICA: BCT MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 59 NORTH AMERICA: BCT MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 60 NORTH AMERICA: BCT MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 61 NORTH AMERICA: BCT MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 62 NORTH AMERICA: BCT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 63 NORTH AMERICA: BCT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 64 US: BRINE CONCENTRATION TECHNOLOGY MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 65 US: BCT MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 66 US: BCT MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 67 US: BCT MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 68 US: BCT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 69 US: BCT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 70 CANADA: BRINE CONCENTRATION TECHNOLOGY MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 71 CANADA: BCT MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 72 CANADA: BCT MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 73 CANADA: BCT MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 74 CANADA: BCT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 75 CANADA: BCT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 76 MEXICO: BRINE CONCENTRATION TECHNOLOGY MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 77 MEXICO: BCT MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 78 MEXICO: BCT MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 79 MEXICO: BCT MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 80 MEXICO: BCT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 81 MEXICO: BCT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 82 SOUTH AMERICA: BRINE CONCENTRATION TECHNOLOGY MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 83 SOUTH AMERICA: BCT MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 84 SOUTH AMERICA: BCT MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 85 SOUTH AMERICA: BCT MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 86 SOUTH AMERICA: BCT MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 87 SOUTH AMERICA: BCT MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 88 SOUTH AMERICA: BCT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 89 SOUTH AMERICA: BCT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 90 BRAZIL: BRINE CONCENTRATION TECHNOLOGY MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 91 BRAZIL: BCT MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 92 BRAZIL: BCT MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 93 BRAZIL: BCT MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 94 BRAZIL: BCT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 95 BRAZIL: BCT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 96 ARGENTINA: BRINE CONCENTRATION TECHNOLOGY MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 97 ARGENTINA: BCT MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 98 ARGENTINA: BCT MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 99 ARGENTINA: BCT MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 100 ARGENTINA: BCT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 101 ARGENTINA: BCT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 102 REST OF SOUTH AMERICA: BRINE CONCENTRATION TECHNOLOGY MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 103 REST OF SOUTH AMERICA: BCT MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 104 REST OF SOUTH AMERICA: BCT MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 105 REST OF SOUTH AMERICA: BCT MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 106 REST OF SOUTH AMERICA: BCT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 107 REST OF SOUTH AMERICA: BCT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 108 EUROPE: BRINE CONCENTRATION TECHNOLOGY MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 109 EUROPE: BCT MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 110 EUROPE: BCT MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 111 EUROPE: BCT MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 112 EUROPE: BCT MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 113 EUROPE: BCT MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 114 EUROPE: BCT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 115 EUROPE: BCT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 116 GERMANY: BRINE CONCENTRATION TECHNOLOGY MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 117 GERMANY: BCT MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 118 GERMANY: BCT MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 119 GERMANY: BCT MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 120 GERMANY: BCT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 121 GERMANY: BCT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 122 ITALY: BRINE CONCENTRATION TECHNOLOGY MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 123 ITALY: BCT MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 124 ITALY: BCT MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 125 ITALY: BCT MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 126 ITALY: BCT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 127 ITALY: BCT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 128 FRANCE: BRINE CONCENTRATION TECHNOLOGY MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 129 FRANCE: BCT MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 130 FRANCE: BCT MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 131 FRANCE: BCT MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 132 FRANCE: BCT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 133 FRANCE: BCT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 134 UK: BRINE CONCENTRATION TECHNOLOGY MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 135 UK: BCT MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 136 UK: BCT MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 137 UK: BCT MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 138 UK: BCT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 139 UK: BCT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 140 RUSSIA: BRINE CONCENTRATION TECHNOLOGY MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 141 RUSSIA: BCT MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 142 RUSSIA: BCT MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 143 RUSSIA: BCT MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 144 RUSSIA: BCT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 145 RUSSIA: BCT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 146 SPAIN: BRINE CONCENTRATION TECHNOLOGY MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 147 SPAIN: BCT MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 148 SPAIN: BCT MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 149 SPAIN: BCT MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 150 SPAIN: BCT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 151 SPAIN: BCT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 152 REST OF EUROPE: BRINE CONCENTRATION TECHNOLOGY MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 153 REST OF EUROPE: BCT MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 154 REST OF EUROPE: BCT MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 155 REST OF EUROPE: BCT MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 156 REST OF EUROPE: BCT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 157 REST OF EUROPE: BCT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: BRINE CONCENTRATION TECHNOLOGY MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 159 MIDDLE EAST & AFRICA: BCT MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 160 MIDDLE EAST & AFRICA: BCT MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 161 MIDDLE EAST & AFRICA: BCT MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 162 MIDDLE EAST & AFRICA: BCT MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 163 MIDDLE EAST & AFRICA: BCT MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 164 MIDDLE EAST & AFRICA: BCT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 165 MIDDLE EAST & AFRICA: BCT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 166 SAUDI ARABIA: BRINE CONCENTRATION TECHNOLOGY MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 167 SAUDI ARABIA: BCT MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 168 SAUDI ARABIA: BCT MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 169 SAUDI ARABIA: BCT MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 170 SAUDI ARABIA: BCT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 171 SAUDI ARABIA: BCT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 172 SOUTH AFRICA: BRINE CONCENTRATION TECHNOLOGY MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 173 SOUTH AFRICA: BCT MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 174 SOUTH AFRICA: BCT MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 175 SOUTH AFRICA: BCT MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 176 SOUTH AFRICA: BCT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 177 SOUTH AFRICA: BCT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 178 REST OF MIDDLE EAST & AFRICA: BRINE CONCENTRATION TECHNOLOGY MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 179 REST OF MIDDLE EAST & AFRICA: BCT MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 180 REST OF MIDDLE EAST & AFRICA: BCT MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 181 REST OF MIDDLE EAST & AFRICA: BCT MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 182 REST OF MIDDLE EAST & AFRICA: BCT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 183 REST OF MIDDLE EAST & AFRICA: BCT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 184 REVIEW OF STRATEGIES ADOPTED BY KEY MANUFACTURERS OF BRINE CONCENTRATION TECHNOLOGY

- TABLE 185 MARKET: DEGREE OF COMPETITION

- TABLE 186 MARKET EVALUATION FRAMEWORK, 2018–2023

- TABLE 187 BRINE CONCENTRATION TECHNOLOGY MARKET: DEALS, 2018–2023

- TABLE 188 SME PLAYERS, BY APPLICATION FOOTPRINT

- TABLE 189 SME PLAYERS, BY TECHNOLOGY FOOTPRINT

- TABLE 190 SME PLAYERS, BY TYPE FOOTPRINT

- TABLE 191 SME PLAYERS, BY REGION FOOTPRINT

- TABLE 192 KEY COMPANY APPLICATION FOOTPRINT

- TABLE 193 KEY COMPANY TECHNOLOGY FOOTPRINT

- TABLE 194 KEY COMPANY TYPE FOOTPRINT

- TABLE 195 KEY COMPANY REGION FOOTPRINT

- TABLE 196 VEOLIA WATER TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 197 VEOLIA WATER TECHNOLOGIES: PRODUCT OFFERINGS

- TABLE 198 VEOLIA WATER TECHNOLOGIES: DEALS

- TABLE 199 EVOQUA WATER TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 200 EVOQUA WATER TECHNOLOGIES: PRODUCT OFFERINGS

- TABLE 201 EVOQUA WATER TECHNOLOGIES: DEALS

- TABLE 202 H2O INNOVATION: COMPANY OVERVIEW

- TABLE 203 H20 INNOVATIONS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 204 H20 INNOVATIONS: RECENT DEVELOPMENTS

- TABLE 205 KOCH SEPARATION SOLUTIONS: COMPANY OVERVIEW

- TABLE 206 KOCH SEPARATION SOLUTIONS: PRODUCTS/SOLUTIONS OFFERED

- TABLE 207 KOCH SEPARATION SOLUTIONS RECENT DEVELOPMENT

- TABLE 208 AQUATECH INTERNATIONAL: COMPANY OVERVIEW

- TABLE 209 AQUATECH INTERNATIONAL: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 210 AQUATECH INTERNATIONAL

- TABLE 211 AQUACHEM: COMPANY OVERVIEW

- TABLE 212 AQUACHEM: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 213 IDE TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 214 IDE TECHNOLOGIES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 215 IDE TECHNOLOGIES: RECENT DEVELOPMENTS

- TABLE 216 SALTWORKS TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 217 SALTWORKS TECHNOLOGIES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 218 SALTWORKS TECHNOLOGIES: RECENT DEVELOPMENT

- TABLE 219 SAMCO TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 220 SAMCO TECHNOLOGIES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 221 SAMCO TECHNOLOGIES: RECENT DEVELOPMENT

- TABLE 222 GRADIANT: COMPANY OVERVIEW

- TABLE 223 GRADIANT: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 224 GRADIANT: EXPANSION/MERGER/ACQUISITION

- FIGURE 1 BRINE CONCENTRATION TECHNOLOGY MARKET: RESEARCH DESIGN

- FIGURE 2 BRINE CONCENTRATION TECHNOLOGY MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 3 TOP-DOWN APPROACH

- FIGURE 4 BOTTOM-UP APPROACH

- FIGURE 5 BRINE CONCENTRATION TECHNOLOGY MARKET: DATA TRIANGULATION

- FIGURE 6 CALCIUM CHLORIDE TO REGISTER FASTEST CAGR IN BRINE CONCENTRATION TECHNOLOGY MARKET BETWEEN 2022 AND 2027

- FIGURE 7 HIGH ENERGY REVERSE OSMOSIS TO DOMINATE BRINE CONCENTRATION TECHNOLOGY MARKET BETWEEN 2022 AND 2027

- FIGURE 8 ASIA PACIFIC LED BRINE CONCENTRATION TECHNOLOGY MARKET IN 2022

- FIGURE 9 INCREASING DEMAND FROM VARIOUS APPLICATIONS TO DRIVE MARKET

- FIGURE 10 MINING TO BE LARGEST APPLICATION OF BRINE CONCENTRATION TECHNOLOGY MARKET IN 2022

- FIGURE 11 VERTICAL TUBE FALLING FILM TO BE FASTEST GROWING TECHNOLOGY DURING FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC BE LARGEST BRINE CONCENTRATION TECHNOLOGY MARKET IN 2022

- FIGURE 13 CALCIUM CHLORIDE TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN BRINE CONCENTRATION TECHNOLOGY MARKET

- FIGURE 15 SUPPLY CHAIN FOR BRINE CONCENTRATION TECHNOLOGY

- FIGURE 16 PORTER’S FIVE FORCES ANALYSIS: BRINE CONCENTRATION TECHNOLOGY

- FIGURE 17 PUBLICATION TRENDS (LAST TEN YEARS)

- FIGURE 18 LEGAL STATUS OF PATENTS

- FIGURE 19 TOP JURISDICTION-BY DOCUMENT

- FIGURE 20 TOP APPLICANTS/COMPANIES OF PATENTS

- FIGURE 21 SUPPLIER SELECTION CRITERION

- FIGURE 22 REVENUE SHIFT OF BRINE CONCENTRATION TECHNOLOGY PROVIDERS

- FIGURE 23 CALCIUM CHLORIDE TO LEAD BRINE CONCENTRATION TECHNOLOGY MARKET DURING FORECAST PERIOD

- FIGURE 24 MINING TO BE LARGEST APPLICATION SEGMENT DURING FORECAST PERIOD

- FIGURE 25 HIGH ENERGY REVERSE OSMOSIS TECHNOLOGY TO LEAD BRINE CONCENTRATION TECHNOLOGY MARKET DURING FORECAST PERIOD

- FIGURE 26 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 27 ASIA PACIFIC: BRINE CONCENTRATION TECHNOLOGY MARKET SNAPSHOT

- FIGURE 28 NORTH AMERICA: BRINE CONCENTRATION TECHNOLOGY MARKET SNAPSHOT

- FIGURE 29 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS IN BRINE CONCENTRATION TECHNOLOGY MARKET, 2022

- FIGURE 30 MARKET SHARE ANALYSIS 2022

- FIGURE 31 BRINE CONCENTRATION TECHNOLOGY MARKET: COMPETITIVE LEADERSHIP MAPPING, 2022

- FIGURE 32 EVALUATION QUADRANT FOR STARTUPS/SMES, 2022

- FIGURE 33 VEOLIA WATER TECHNOLOGIES: COMPANY SNAPSHOT

- FIGURE 34 EVOQUA WATER TECHNOLOGIES: COMPANY SNAPSHOT

- FIGURE 35 H2O INNOVATION: COMPANY SNAPSHOT

The study involved four major activities in estimating the market size of the brine concentration technology market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, articles from recognized authors, the gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, the monetary chain of the market, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The Brine Concentration Technology Industry comprises several stakeholders in the value chain, which include input suppliers, equipment manufacturers, technology providers, service providers, distribution and logistics, and end users. Various primary sources from the supply and demand sides of the brine concentration technology market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the brine concentration technology industry.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, type, application, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of brine concentration technology and the future outlook of their business, which will affect the overall market.

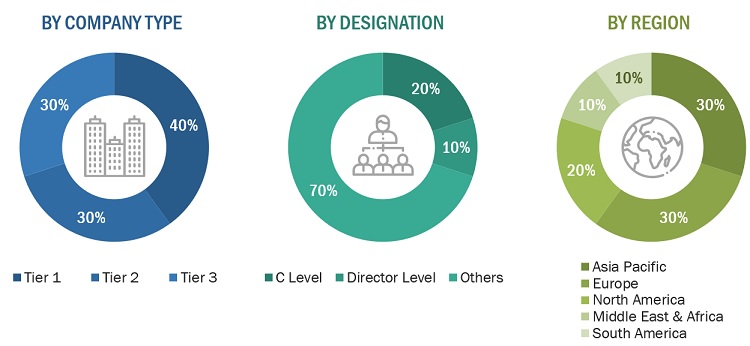

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2021 available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

|

Company Name |

Designation |

|

VeoliaWater Technologies |

Individual Industry Expert |

|

Evoqua Water Technologies |

Sales Manager |

|

H2O Innovationsl |

Director |

|

Koch Separation Solutions |

Marketing Manager |

|

Aquatech International LLC |

R&D Manager |

|

|

|

Market Size Estimation

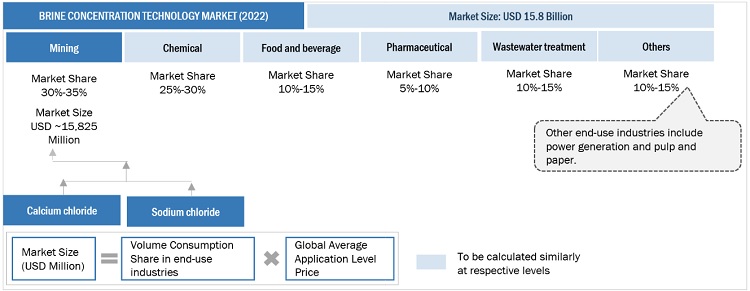

The top-down and bottom-up approaches have been used to estimate and validate the size of the brine concentration technology market.

- The key players in the industry have been identified through extensive secondary research.

- The industry's supply chain has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of the key market players, along with extensive interviews for opinions with leaders such as directors and marketing executives.

Brine Concentration Technology Market: Bottum-Up Approach

Note: All the shares are based on the global market size.

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Brine Concentration Technology Market: Top-Down Approach

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

Brine concentration technology refers to the process of increasing the salt concentration of a liquid solution, generally water, by removing the water content.

Key Stakeholders

- Raw material suppliers.

- Brine concentration technology manufacturers.

- Brine concentration technology traders, distributors, and suppliers.

- End-use industry participants.

- Government and research organizations.

- Associations and industrial bodies.

- Research and consulting firms.

- Research & development (R&D) institutions..

- Environmental support agencies.

Report Objectives

- To define, describe, and forecast the size of the brine concentration technology market, in terms of value.

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size based on technology, type, application and region.

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, Middle East & Africa, and South America, along with their key countries.

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market.

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders.

- To track and analyze recent developments such as expansions, new product launches, partnerships & agreements, and acquisitions in the market.

- To strategically profile key market players and comprehensively analyze their core competencies.

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application

Company Information

- Detailed analysis and profiles of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Brine Concentration Technology (BCT) Market