Bowel Management Systems Market by Product (Irrigation Systems, Nerve Modulation Devices, Colostomy Bags, and Accessories), Patient Type (Adult and Pediatric), End User (Home Care and Hospitals, Ambulatory Surgery Center) - Global Forecast to 2023

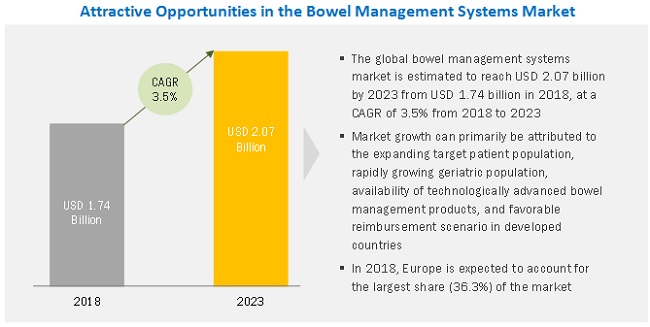

The global bowel management systems market is projected to reach USD 2.07 billion by 2023, at a CAGR of 3.5%. Some of the major factors driving the growth of this market are: expanding target patient population, rapidly growing geriatric population, availability of technologically advanced bowel management products, and favorable reimbursement scenario in developed countries. Bowel/fecal incontinence refers to a patient’s inability to control bowel movements, which results in involuntary loss of solid or liquid stool. It is caused due to diarrhea, constipation, weaker muscle tone (that controls the opening of the anus), and chronic medical conditions (such as diabetes, multiple sclerosis, and nerve damage). The clinical devices used to manage bowel activity are called bowel management systems

“By product, colostomy bags segment to witness the highest growth during the forecast period"

The colostomy bags segment is expected to account for the largest share of the bowel management systems market.

“By patient type, Adult patients segment to grow at the highest rate during the forecast period.”

The adult patient segment is estimated to account for the larger share of the bowel management systems market. While fecal incontinence (FI) affects individuals of all ages, it is more common in middle-aged and older adults due to their greater prevalence of neurologic diseases and weaker muscle tone. Additionally, the prevalence of FI is reported to be twice among women as compared to men, owing to the risk of injuries to the anal sphincter during childbirth

“The home care segment will grow at a higher CAGR during the forecast period.”

Factors such as the significant usage and growing adoption of bowel management products in home care settings, need for device replacement on a regular basis, and rising incidence of chronic disorders are expected to support the growth of the home care segment during the forecast period

“The RoW is expected to grow at the highest rate during the forecast period.”

The Rest of the World (RoW) comprises countries in Latin America (including Brazil, Mexico, Peru, and Chile), the Middle East (including Egypt, Iran, Turkey, and Iraq), and Africa (including South Africa, Egypt, Ghana, and Nigeria). Rising market growth can be attributed to the growing target patient population, the ongoing expansion of healthcare infrastructure, and initiatives to enhance patient awareness.

Market Dynamics

Driver: Favorable reimbursement scenario in developed countries

The developed countries are reported to have favorable reimbursement scenarios for bowel management products, owing to which the demand for these products is expected to grow positively during the study period.

Restraint: Patient preference for non-invasive clinical management of FI

Currently, FI can be managed invasively (surgically) or non-invasively. Standard modes of surgical treatment include the injection of biomaterials into the anal canal, radiofrequency treatment of the anal canal, surgical repair of anal muscle injuries, sacral nerve stimulation, artificial bowel sphincter, muscle transposition to reinforce the anal sphincter, and the creation of a stoma. These often require long-term patient rehabilitation and maybe highly inconvenient and even severely painful.

As a result, the preference has grown for non-invasive approaches, such as the use of disposable products, medications, dietary and lifestyle changes, exercise, biofeedback, bowel training, transanal irrigation, antegrade colonic irrigation, and electrical stimulation. Additionally, these treatment alternatives are considered by surgeons as the first line of treatment as well. The significant adoption and patient preference for non-invasive treatment alternatives are expected to hamper the optimal growth of the bowel management systems market during the forecast period.

Challenge: Underreporting of FI

FI is among the most common pathophysiological medical conditions among the elderly population and women worldwide. Geriatric women are exposed to a greater risk of FI due to anal sphincter damage during pregnancy and childbirth. However, most patients suffering from FI are reluctant to report their clinical condition mainly out of embarrassment. Healthcare professionals also often fail to inquire about FI due to insufficient training regarding the latest options of FI treatment.

Thus, reluctance on the part of patients to report fecal incontinence is expected to be a key barrier for the optimal adoption of bowel management systems across respective geographies during the study period.

Bowel Management Systems Market Scope

|

Report Metric |

Details |

|

Market size available for years |

2016–2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018–2023 |

|

Forecast units |

USD million |

|

Segments covered |

Product, Patient Type, End-User, and Region. |

|

Geographies covered |

North America, Europe, APAC, and the Rest of the World (RoW) |

|

Companies covered |

Coloplast (Denmark), Medtronic (Ireland), 3M (US), B. Braun (Germany), C.R. Bard (US), ConvaTec (UK), Consure Medical (India), Cogentix Medical (US), Aquaflush Medical Limited (UK), Axonics Modulation Technologies (US), ConvaTec (UK), Hollister (US), MBH-International A/S (Denmark), Mederi Therapeutics Inc. (US), Welland Medical Limited (UK), and Wellspect HealthCare (Sweden) |

This report categorizes the global bowel management systems market into the following segments and sub-segments:

By Product

- Irrigation Systems

- Nerve Modulation Devices

- Colostomy Bags

- Other Products and Accessories*

*Note: Other products and accessories include radiofrequency devices, surgical implants, artificial anal sphincters, anal plugs, bowel management accessories (such as tubes, stool bags, pouches, and rectal catheters), and colostomy accessories.

By Patient Type

- Adult

- Pediatric

By End User

- Hospitals and Ambulatory Surgery Centers

- Home Care

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe (RoE)

-

Asia Pacific

- Japan

- China

- India

- Rest of Asia Pacific (RoAPAC)

-

Rest of the World (RoW)

- Latin America

- Middle East and Africa

Key Market Players

The key market players in the bowel management systems market are: Coloplast (Denmark), Medtronic (Ireland), Hollister (US), and ConvaTec (UK)

Coloplast develops and markets healthcare products and services and caters to hospitals, institutions, wholesalers, and retailers. The company operates through four segments, namely, Ostomy Care, Urology Care, Continence Care, and Wound & Skin Care. Coloplast offers bowel irrigation products through its Continence Care segment under the brand Peristeen. The company also offers ostomy care products under Brava, SenSura, SenSura Mio, and Assura brands. A wide product portfolio helps Coloplast to cater to the varied needs of its diverse customer segments. It also helps the company to garner a significant share in the bowel management products market.

Recent Developments

- In 2018, Coloplast acquired IncoCare, a provider of continence products. This acquisition helped Coloplast expand its presence in Germany.

- In 2018, Axonics received marketing approval for its Axonics Sacral Neuromodulation System in Australia

- In 2018, Coloplast expanded its product portfolio by introducing a new product, SenSura Mio Concave, into its SenSura Mio product line.

- In 2016, ConvaTec entered into an agreement with Vizient, Inc. According to this agreement, members of Vizient get access to ConvaTec’s stoma care, bowel management, and patient skincare products.

- In 2016, A German court affirmed ConvaTec’s patent protection on Flexi-Seal Fecal Management System and ordered the competitor to cease from placing its product (infringing patent) in the market, as well as to recall its product already sent to market and to compensate ConvaTec.

Frequently Asked Questions (FAQs):

What is the size of Bowel Management Systems Market?

The global bowel management systems market is projected to reach USD 2.07 billion by 2023, at a CAGR of 3.5%.

What are the major growth factors of Bowel Management Systems Market?

Some of the major factors driving the growth of this market are: expanding target patient population, rapidly growing geriatric population, availability of technologically advanced bowel management products, and favorable reimbursement scenario in developed countries. Bowel/fecal incontinence refers to a patient’s inability to control bowel movements, which results in involuntary loss of solid or liquid stool. It is caused due to diarrhea, constipation, weaker muscle tone (that controls the opening of the anus), and chronic medical conditions (such as diabetes, multiple sclerosis, and nerve damage).

Who all are the prominent players of Bowel Management Systems Market?

Coloplast (Denmark), Medtronic (Ireland), 3M (US), B. Braun (Germany), C.R. Bard (US), ConvaTec (UK), Consure Medical (India), Cogentix Medical (US), Aquaflush Medical Limited (UK), Axonics Modulation Technologies (US), ConvaTec (UK), Hollister (US), MBH-International A/S (Denmark), Mederi Therapeutics Inc. (US), Welland Medical Limited (UK), and Wellspect HealthCare (Sweden)

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency Used for the Study

1.5 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.2 Secondary Research

2.2.1 Key Data From Secondary Sources

2.3 Primary Research

2.3.1 Key Data From Primary Sources

2.3.1.1 Breakdown of Primary Interviews

2.4 Market Size Estimation

2.4.1 Product-Based Market Estimation

2.4.2 End-User Based Market Estimation

2.4.3 Primary Research Validation

2.5 Market Breakdown and Data Triangulation

2.6 Research Assumptions

2.7 Limitations

3 Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 27)

4.1 Bowel Management Systems: Market Overview

4.2 Bowel Management Systems Market, By Product

4.3 Bowel Management Systems Market, By Patient Type

4.4 Bowel Management Systems Market, By End User

4.5 Geographic Snapshot of the Bowel Management Systems Market

5 Market Overview (Page No. - 31)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Market Drivers

5.2.1.1 Expanding Target Patient Population

5.2.1.2 Rapidly Growing Geriatric Population

5.2.1.3 Availability of Technologically Advanced Bowel Management Products

5.2.1.4 Favorable Reimbursement Scenario in Developed Countries

5.2.2 Market Restraints

5.2.2.1 Discomfort Associated With the Use of Bowel Management Devices

5.2.2.2 Patient Preference for Non-Invasive Clinical Management of Fi

5.2.3 Market Challenges

5.2.3.1 Underreporting of Fi

5.2.3.2 Disparities in Reimbursement for Bowel Management Products in Emerging Countries

6 Bowel Management Systems Market, By Product (Page No. - 36)

6.1 Introduction

6.2 Irrigation Systems

6.3 Colostomy Bags

6.4 Nerve Modulation Devices (NMD)

6.5 Other Products and Accessories

7 Bowel Management Systems Market, By Patient Type (Page No. - 52)

7.1 Introduction

7.2 Adult Patients

7.3 Pediatric Patients

8 Bowel Management Systems Market, By End User (Page No. - 56)

8.1 Introduction

8.2 Home Care

8.3 Hospitals & Ambulatory Surgery Centers

9 Bowel Management Systems Market, By Region (Page No. - 60)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.2 Canada

9.3 Europe

9.3.1 Germany

9.3.2 UK

9.3.3 France

9.3.4 Rest of Europe

9.4 Asia Pacific

9.4.1 Japan

9.4.2 China

9.4.3 India

9.4.4 Rest of Asia Pacific

9.5 Rest of the World

9.5.1 Latin America

9.5.2 Middle East and Africa

10 Competitive Landscape (Page No. - 83)

10.1 Introduction

10.2 Global Bowel Management Systems Market Ranking, 2017

10.2.1 Key Players in Bowel Management Systems Market

10.3 Competitive Scenario

10.3.1 Mergers and Acquisitions (2015-2018)

10.3.2 Product Launches and Approvals (2015-2018)

10.3.3 Expansions (2015-2018)

10.3.4 Agreement (2015-2018)

10.3.5 Other Developments (2015-2018)

11 Company Profiles (Page No. - 87)

(Introduction, Products & Services, Strategy, & Analyst Insights, Developments, MnM View)*

11.1 Aquaflush Medical Limited

11.2 Axonics Modulation Technologies

11.3 B. Braun

11.4 C. R. Bard (Now Part of Becton Dickinson)

11.5 Cogentix Medical

11.6 Coloplast

11.7 Consure

11.8 Convatec

11.9 Hollister Incorporated

11.10 Mbh-International A/S

11.11 Mederi Therapeutics Inc.

11.12 Medtronic

11.13 Welland Medical Limited (Part of Clinimed Group)

11.14 Wellspect Healthcare (Part of Dentsply Sirona Company)

11.15 3M

*Details on Marketsandmarkets View, Introduction, Product & Services, Strategy, & Analyst Insights, New Developments Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 113)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Introducing RT: Real-Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (61 Tables)

Table 1 List of Recently Launched Technologically Advanced Bowel Management Systems

Table 2 Bowel Management Systems Market, By Product, 2016–2023 (USD Million)

Table 3 Bowel Management Systems Market for Irrigation Systems, By Region, 2016–2023 (USD Million)

Table 4 North America: Bowel Management Systems Market for Irrigation Systems, By Country, 2016–2023 (USD Million)

Table 5 Europe: Bowel Management Systems Market for Irrigation Systems, By Country, 2016–2023 (USD Million)

Table 6 APAC: Bowel Management Systems Market for Irrigation Systems, By Country, 2016–2023 (USD Million)

Table 7 RoW: Bowel Management Systems Market for Irrigation Systems, By Region, 2016–2023 (USD Million)

Table 8 Bowel Management Systems Market for Irrigation Systems, By End User, 2016–2023 (USD Million)

Table 9 Bowel Management Systems Market for Colostomy Bags, By Region, 2016–2023 (USD Million)

Table 10 North America: Bowel Management Systems Market for Colostomy Bags, By Country, 2016–2023 (USD Million)

Table 11 Europe: Bowel Management Systems Market for Colostomy Bags, By Country, 2016–2023 (USD Million)

Table 12 APAC: Bowel Management Systems Market for Colostomy Bags, By Country, 2016–2023 (USD Million)

Table 13 RoW: Bowel Management Systems Market for Colostomy Bags, By Region, 2016–2023 (USD Million)

Table 14 Bowel Management Systems Market for Colostomy Bags, By End User, 2016–2023 (USD Million)

Table 15 Bowel Management Systems Market for Nerve Modulation Devices, By Region, 2016–2023 (USD Million)

Table 16 North America: Bowel Management Systems Market for Nerve Modulation Devices, By Country, 2016–2023 (USD Million)

Table 17 Europe: Bowel Management Systems Market for Nerve Modulation Devices, By Country, 2016–2023 (USD Million)

Table 18 APAC: Bowel Management Systems Market for Nerve Modulation Devices, By Country, 2016–2023 (USD Million)

Table 19 RoW: Bowel Management Systems Market for Nerve Modulation Devices, By Region, 2016–2023 (USD Million)

Table 20 Bowel Management Systems Market for Nerve Modulation Devices, By End User, 2016–2023 (USD Million)

Table 21 Bowel Management Systems Market for Other Products and Accessories, By Region, 2016–2023 (USD Million)

Table 22 North America: Bowel Management Systems Market for Other Products and Accessories, By Country, 2016–2023 (USD Million)

Table 23 Europe: Bowel Management Systems Market for Other Products and Accessories, By Country, 2016–2023 (USD Million)

Table 24 APAC: Bowel Management Systems Market for Other Products and Accessories, By Country, 2016–2023 (USD Million)

Table 25 RoW: Bowel Management Systems Market for Other Products and Accessories, By Region, 2016–2023 (USD Million)

Table 26 Bowel Management Systems Market for Other Products and Accessories, By End User, 2016–2023 (USD Million)

Table 27 Bowel Management Systems Market, By Patient Type, 2016–2023 (USD Million)

Table 28 Bowel Management Systems Market for Adult Patients, By Region, 2016–2023 (USD Million)

Table 29 Bowel Management Systems Market for Pediatric Patients, By Region, 2016–2023 (USD Million)

Table 30 Bowel Management Systems Market, By End User, 2016–2023 (USD Million)

Table 31 Bowel Management Systems Market for Home Care, By Region, 2016–2023 (USD Million)

Table 32 Bowel Management Systems Market for Hospitals & Ambulatory Surgery Centers, By Region, 2016–2023 (USD Million)

Table 33 Bowel Management Systems Market, By Region, 2016–2023 (USD Million)

Table 34 North America: Bowel Management Systems Market, By Country, 2016–2023 (USD Million)

Table 35 North America: Bowel Management Systems Market, By Product, 2016–2023 (USD Million)

Table 36 North America: Bowel Management Systems Market, By Patient Type, 2016–2023 (USD Million)

Table 37 North America: Bowel Management Systems Market, By End User, 2016–2023 (USD Million)

Table 38 US: Bowel Management Systems Market, By Product, 2016–2023 (USD Million)

Table 39 Canada: Bowel Management Systems Market, By Product, 2016–2023(USD Million)

Table 40 Europe: Bowel Management Systems Market, By Country, 2016–2023 (USD Million)

Table 41 Europe: Bowel Management Systems Market, By Product, 2016–2023 (USD Million)

Table 42 Europe: Bowel Management Systems Market, By Patient Type, 2016–2023 (USD Million)

Table 43 Europe: Bowel Management Systems Market, By End User, 2016–2023 (USD Million)

Table 44 Germany: Bowel Management Systems Market, By Product, 2016–2023 (USD Million)

Table 45 UK: Bowel Management Systems Market, By Product, 2016–2023 (USD Million)

Table 46 France: Bowel Management Systems Market, By Product, 2016–2023 (USD Million)

Table 47 RoE: Bowel Management Systems Market, By Product, 2016–2023 (USD Million)

Table 48 Asia Pacific: Bowel Management Systems Market, By Country, 2016–2023 (USD Million)

Table 49 Asia Pacific: Bowel Management Systems Market, By Product, 2016–2023(USD Million)

Table 50 Asia Pacific: Bowel Management Systems Market, By Patient Type, 2016–2023 (USD Million)

Table 51 Asia Pacific: Bowel Management Systems Market, By End User, 2016–2023 (USD Million)

Table 52 Japan: Bowel Management Systems Market, By Product, 2016–2023 (USD Million)

Table 53 China: Bowel Management Systems Market, By Product, 2016–2023 (USD Million)

Table 54 India: Bowel Management Systems Market, By Product, 2016–2023 (USD Million)

Table 55 RoAPAC: Bowel Management Systems Market, By Product, 2016–2023 (USD Million)

Table 56 RoW: Bowel Management Systems Market, By Region, 2016–2023 (USD Million)

Table 57 RoW: Bowel Management Systems Market, By Product, 2016–2023 (USD Million)

Table 58 RoW: Bowel Management Systems Market, By Patient Type, 2016–2023 (USD Million)

Table 59 RoW: Bowel Management Systems Market, By End User, 2016–2023 (USD Million)

Table 60 Latin America: Bowel Management Systems Market, By Product, 2016–2023 (USD Million)

Table 61 Middle East and Africa: Bowel Management Systems Market, By Product, 2016–2023 (USD Million)

List of Figures (31 Figures)

Figure 1 Bowel Management Systems Market: Research Design

Figure 2 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 3 Market Size Estimation: Bowel Management Systems Market

Figure 4 Data Triangulation Methodology

Figure 5 Bowel Management Systems Market, By Product, 2018

Figure 6 Bowel Management Systems Market, By Patient Type (USD Million), 2018

Figure 7 Bowel Management Systems Market, By End User, 2018

Figure 8 Europe is Estimated to Account for the Largest Share in 2018

Figure 9 Growing Availability of Medical Reimbursements for Bowel Management Systems is Driving Market Growth

Figure 10 Colostomy Bags Will Continue to Dominate the Market in 2023

Figure 11 Adult Patient Segment to Dominate the Market During the Forecast Period

Figure 12 Home Care Segment to Dominate the Market During the Forecast Period

Figure 13 Rest of the World to Register the Highest CAGR During the Forecast Period

Figure 14 Bowel Management Systems Market: Drivers, Restraints, & Challenges

Figure 15 Absolute Number of People Suffering From Colorectal Cancer, By Country and Age (2012 vs 2015 vs 2020)

Figure 16 Colostomy Bags Segment to Witness the Highest Growth During the Forecast Period

Figure 17 Adult Patients Segment to Grow at the Highest Rate in the Bowel Management Systems Market

Figure 18 Home Care Segment to Grow at A Higher CAGR During the Forecast Period

Figure 19 North America: Bowel Management Systems Market Snapshot

Figure 20 Europe: Bowel Management Systems Market Snapshot

Figure 21 Asia Pacific: Bowel Management Systems Market Snapshot

Figure 22 Key Developments By Leading Market Players in the Bowel Management Systems Market, 2015–2018

Figure 23 Bowel Management Systems Market Ranking, By Key Players, (2017)

Figure 24 Product Launches and Approvals Were Widely Adopted By Key Players During 2015 to 2018

Figure 25 B. Braun Melsungen AG: Company Snapshot (2017)

Figure 26 Becton Dickinson: Company Snapshot (2017)

Figure 27 Cogentix Medical: Company Snapshot (2017)

Figure 28 Coloplast A/S: Company Snapshot (2017)

Figure 29 Convatec Group PLC: Company Snapshot (2017)

Figure 30 Dentsply Sirona: Company Snapshot (2017)

Figure 31 3M Company: Company Snapshot (2017)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Bowel Management Systems Market