BOPP Films Market by Type (Wraps, Bags & Pouches, Tapes, Labels), Thickness (Below 15 Microns, 15-30 Microns, 30-45 Microns, More Tham 45 Microns), Production Process (Tenter, Tubular), Application, and Region - Global Forecast to 2025

Updated on : March 09, 2023

BOPP Films Market

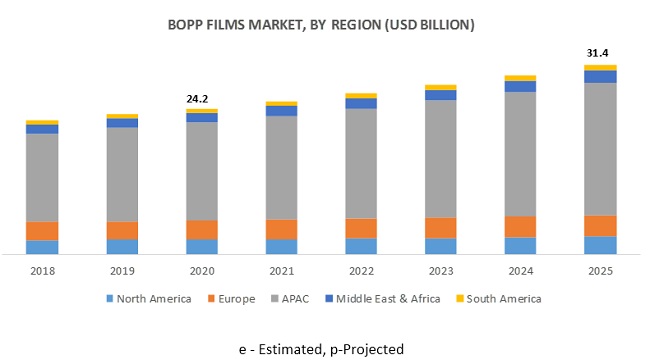

BOPP Films Market was valued at USD 24.2 billion in 2020 and is projected to reach USD 31.4 billion by 2025, growing at a cagr 5.3% from 2020 to 2025. The market has been growing in tandem with the growth in the packaging industry, replacing traditional packaging types, such as metal cans and cartons. Factors, such as growing consumer preferences for convenient packaging, growing demand from the food & beverage sector, ease of use, and lightweight nature, are driving the demand for BOPP films packaging.

In terms of both volume, bags & pouches segment to lead the BOPP films market by 2025.

BOPP bags & pouches are water resistant and have the capacity to print high resolution graphics on them. They perform extremely well with paper bag filling equipment. The acceptance of BOPP bags & pouches is rising in as they are cost-effective and 100% recyclable, which makes them environment friendly. BOPP bags & pouches offer high aesthetic value that adds an extra promotional feature to the products packaged in them. These bags & pouches can be stacked easily and have high tensile strength and barrier properties. BOPP bags & pouches primarily find applications in the packaging of cereal & pulses, pet food, grass seed, animal nutrition, fertilizers, beverages, dairy products, and cosmetics.

In terms of both value and volume, tenter production process is projected to be the fastest-growing segment from 2020 to 2025, for BOPP films.

The BOPP film thickness produced by the tenter process ranges from 8-50 micro meters while the line output is in the range 100–550 kg/hour. The double bubble method process relatively unique film structures, which is not easily possible by the standard tenter frame process. This results in balanced film properties by simultaneous stretching of a cooled and reheated bubble. Thus, film properties are similar in both orientation directions, an effect which is not realizable with standard tenter frame technologies. Tenter frame processes have much higher output than the tubular process. It is predominantly used to make BOPP and BOPET films.

The food segment is projected to be the fastest-growing application in the BOPP films market from 2020 to 2025.

The food segment is projected to be the fastest-growing segment in the BOPP films market. BOPP films are made of highly sterilized materials. These materials help in protecting the products from contamination, making them ideal for usage in food & beverage packaging. The key driver for the BOPP films market in food packaging is the growing demand for compact and lightweight packaging in baby food and pet food. BOPP films are also available for single-time use. In the food industry, BOPP films wraps and pouches are widely used in the packaging of sauces, pet food, ready-to-eat/frozen meal, candies, chocolates, snacks, dried fruits & nuts, and confectionery products.

In terms of both value and volume, the Asia Pacific BOPP films market is projected to grow at the highest CAGR during the forecast period.

In terms of value and volume, the Asia Pacific region is projected to grow at the highest CAGR from 2020 to 2025 due to the strong demand from countries such as China, India, and Japan. the growing population in these countries presents a huge customer base for FMCG products and food & beverages, which in turn, is expected to lead to the growth of the BOPP films market. Changes in packaging styles, innovations in flexible packaging designs, and increase in demand for personal care products due to the rise in the young population are expected to drive the market for BOPP films in this region.

BOPP Films Market Players

Key players, such as Cosmo Films (India), Taghleef Industries (UAE), CCL Industries (Canada), Jindal Poly Films (India), Inteplast Group (US), and Polibak (Turkey) have adopted various growth strategies, such as acquisitions, investments, and expansions, to increase their market shares and enhance their product portfolios.

Jindal Poly Films has continuously expanded its global presence over the years through strategic acquisitions and expansions. The group is involved in diverse businesses, including polyester & polypropylene films, steel pipes, thermal power generation, and photographic products. JPFL is one of the largest manufacturers of BOPET and BOPP films in India. The company has one of the largest BOPP film manufacturing capacities in the world. It also has high R&D capabilities, with several R&D centers in different regions. Its product portfolio for BOPP films is also vast and can cater to the different needs of their customers.

Read More: BOPP Films Companies

BOPP Films Market Report Scope

|

Report Metric |

Details |

|

Market size available for years |

2018–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD) and Volume (Kiloton) |

|

Segments covered |

Type, Thickness, Production Process, Application, and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, Middle East & Africa, and South America |

|

Companies covered |

Cosmo Films Limited (India), Taghleef Industries (UAE), CCL Industries (Canada), Jindal Poly Films (India), Sibur Holdings (Russia), Zhejiang Kinlead Innovative Materials (China), Inteplast Group (US), Poligal S.A. (Spain),Uflex Ltd. (India), Polinas (Turkey), Polibak (Turkey), Toray Industries (Japan) |

This research report categorizes the BOPP films market based on type, thickness, production process, application, and region.

Based on type:

- Wraps

- Bags & Pouches

- Tapes

- Labels

Based on the thickness

- Below 15 microns

- 15-30 microns

- 30-45 microns

- More than 45 microns

Based on the prodcution process

- Tenter

- Tubular

Based on the application

- Food

- Beverage

- Tobacco

- Personal Care

- Pharmaceutical

- Electrical & Electronics

- Others

Based on the region:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- In February 2020, Jindal Poly Films approved an investment of USD 99.4 million (INR 700 crores) for the expansion of its company’s operations in India, adding a polyester film line and BOPP film line.

- In July 2019, The AmTopp Division of Inteplast Group increased its stretch film manufacturing capacity by adding two cast film extrusion lines in its newly acquired facility in Remington, IN. This expansion will add 60 million pounds to Inteplast’s current 385-million-pound capacity throughout its other locations bringing its total name plate capacity to 445 million pounds.

- In January 2019, Taghleef Industries announced that it had completed the transaction to acquire Biofilm, one of Latin America’s leading manufacturers of BOPP films for flexible packaging, labels, and industrial applications. By finalizing this transaction, Taghleef has become one of the leading suppliers of BOPP films in Latin America and throughout the world, increasing its annual production capacity to more than 500,000 tons.

Key Questions Addressed by the Report:

- What are the global trends in the BOPP films market? Would the market witness an increase or decline in the demand in the coming years?

- What is the estimated demand for different applications of BOPP films?

- Where will the strategic developments take the industry in the mid to long-term?

- What are the upcoming industry applications and trends for BOPP films?

- Who are the major players in the BOPP films market globally?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 EXCLUSIONS

1.4 MARKET SCOPE

1.4.1 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY CONSIDERED

1.6 UNIT CONSIDERED

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY

2.1 RESEARCH DATA

2.2 MARKET SIZE ESTIMATION

2.3 DATA TRIANGULATION

2.3.1 ASSUMPTIONS

2.3.2 LIMITATIONS

3 EXECUTIVE SUMMARY

3.1 INTRODUCTION

4 PREMIUM INSIGHTS

4.1 EMERGING ECONOMIES TO WITNESS A RELATIVELY HIGHER DEMAND FOR BOPP FILMS

4.2 ASIA PACIFIC: BOPP FILMS MARKET, BY TYPE AND COUNTRY, 2019

4.3 BOPP FILMS MARKET, BY TYPE

4.4 BOPP FILMS MARKET, BY THICKNESS

4.5 BOPP FILMS MARKET, BY PRODUCTION PROCESS

4.6 BOPP FILMS MARKET, BY APPLICATION

4.7 BOPP FILMS MARKET, BY COUNTRY

5 MARKET OVERVIEW

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing demand for bi-axially oriented films

5.2.1.2 Wide range of application across end-use industries

5.2.1.3 Growing industrialization in Asia Pacific region

5.2.2 RESTRAINTS

5.2.2.1 Implementation of stringent regulatory policies

5.2.3 OPPORTUNITIES

5.2.3.1 Rising environmental concern to create growth opportunities for bioplastics material based BOPP films

5.2.3.2 Substitution of traditional packaging

5.2.4 CHALLENGES

5.2.4.1 High input cost

5.2.4.2 Recycling of plastics films

5.2.5 RECYCLING OF PLASTICS FILMS

6 IMPACT OF COVID-19 ON BOPP FILMS MARKET

6.1 UPDATE ON OPERATIONS BY MANUFACTURERS IN RESPONSE TO CONTINUOUS SPREAD OF COVID-19

7 BOPP FILMS MARKET, BY TYPE

7.1 INTRODUCTION

7.2 WRAPS

7.3 BAGS & POUCHES

7.4 TAPES

7.5 LABELS

8 BOPP FILMS MARKET, BY THICKNESS

8.1 INTRODUCTION

8.1.1 BELOW 15 MICRONS

8.1.2 15-30 MICRONS

8.1.3 30-45 MICRONS

8.1.4 MORE THAN 45 MICRONS

9 BOPP FILMS MARKET, BY PRODUCTION PROCESS

9.1 INTRODUCTION

10 BOPP FILMS MARKET, BY APPLICATION

10.1 INTRODUCTION

10.2 FOOD AND BEVERAGE

10.3 PERSONAL CARE

10.4 PHARMACEUTICAL

10.5 TOBACCO PACKAGING

10.6 ELECTRICAL & ELECTRONICS

10.7 OTHERS

11 BOPP FILMS MARKET, BY REGION

11.1 INTRODUCTION

11.2 APAC

11.2.1 CHINA

11.2.1.1 China to dominate the BOPP films market in APAC

11.2.2 JAPAN

11.2.2.1 Efforts to tackle food waste drive the market for BOPP films in Japan

11.2.3 INDIA

11.2.3.1 India to be fastest-growing BOPP films market

11.2.4 SOUTH KOREA

11.2.5 REST OF APAC

11.3 EUROPE

11.3.1 GERMANY

11.3.1.1 Growing food & beverage industry to drive the market

11.3.2 UK

11.3.2.1 Increasing demand for pharmaceutical products to drive the market

11.3.3 FRANCE

11.3.3.1 Rising exports of cosmetic products provide opportunities for growth

11.3.4 RUSSIA

11.3.4.1 Russia to be fastest-growing market in Europe

11.3.5 SPAIN

11.3.5.1 Growth in export of food & beverages to propel the market

11.3.6 ITALY

11.3.6.1 Italy is largest market for BOPP films in Europe

11.3.7 REST OF EUROPE

11.4 NORTH AMERICA

11.5 NORTH AMERICA BOPP FILMS MARKET, BY PACKAGING TYPE

11.6 NORTH AMERICA BOPP FILMS MARKET, BY THICKNESS

11.7 NORTH AMERICA BOPP FILMS MARKET, BY PRODUCTION PROCESS

11.8 NORTH AMERICA BOPP FILMS MARKET, BY APPLICATION

11.9 US

11.9.1 US IS LARGEST MARKET FOR BOPP FILMS IN NORTH AMERICA

11.9.2 US BOPP FILMS MARKET, BY PACKAGING TYPE

11.9.3 US BOPP FILMS MARKET, BY THICKNESS

11.9.4 US BOPP FILMS MARKET, BY PRODUCTION PROCESS

11.9.5 US BOPP FILMS MARKET, BY APPLICATION

11.10 CANADA

11.10.1 RISE IN EXPORTS OF PACKAGED FOODS TO DRIVE MARKET FOR BOPP FILMS IN CANADA

11.10.2 CANADA BOPP FILMS MARKET, BY PACKAGING TYPE

11.10.3 CANADA BOPP FILMS MARKET, BY THICKNESS

11.10.4 CANADA BOPP FILMS MARKET, BY PRODUCTION PROCESS

11.10.5 CANADA BOPP FILMS MARKET, BY APPLICATION

11.11 MEXICO

11.11.1 MEXICO TO BE FASTEST-GROWING MARKET FOR BOPP FILMS IN NORTH AMERICA

11.11.2 MEXICO BOPP FILMS MARKET, BY PACKAGING TYPE

11.11.3 MEXICO BOPP FILMS MARKET, BY THICKNESS

11.11.4 MEXICO BOPP FILMS MARKET, BY PRODUCTION PROCESS

11.11.5 MEXICO BOPP FILMS MARKET, BY APPLICATION

11.12 MIDDLE EAST & AFRICA

11.12.1 UAE

11.12.1.1 Growing demand for FMCGs to drive the market for BOPP films in UAE

11.12.2 SAUDI ARABIA

11.12.2.1 Boost in demand for packaged food to drive the market

11.12.3 SOUTH AFRICA

11.12.3.1 South Africa to be fastest-growing market for BOPP films in Middle East & Africa

11.12.4 TURKEY

11.12.4.1 Turkey to dominate the market in Middle East & Africa

11.12.5 REST OF MIDDLE EAST & AFRICA

11.12.5.1 Rest of Middle East & Africa projected to have a significant potential for growth in BOPP films market

11.13 SOUTH AMERICA

11.13.1 BRAZIL

11.13.1.1 Brazil to lead the South American BOPP films market

11.13.2 ARGENTINA

11.13.2.1 Increasing demand for block bottom food packaging to drive the market in Argentina

11.13.3 REST OF SOUTH AMERICA

11.13.3.1 Significant growth in food industry to accelerate the BOPP films market

12 COMPETITIVE LANDSCAPE

12.1 OVERVIEW

12.2 COMPETITIVE SCENARIO

12.2.1 ACQUISITION

12.2.2 EXPANSION & INVESTMENT

12.2.3 NEW PRODUCT DEVELOPMENT

12.2.4 JOINT VENTURE & PARTNERSHIP

12.3 MARKET SHARE ANALYSIS

13 COMPETITIVE EVALUATION MATRIX

13.1 OVERVIEW

13.1.1 STAR

13.1.2 EMERGING LEADERS

13.1.3 PERVASIVE

13.1.4 EMERGING COMPANIES

13.1.5 STRENGTH OF PRODUCT PORTFOLIO

13.1.6 BUSINESS STRATEGY EXCELLENCE

14 COMPANY PROFILES

14.1 COSMO FILMS LIMITED

14.1.1 BUSINESS OVERVIEW

14.1.2 FINANCIAL ASSESSMENT

14.1.3 OPERATIONAL ASSESSMENT

14.1.4 PRODUCTS OFFERED

14.1.5 RECENT DEVELOPMENTS

14.1.6 SWOT ANALYSIS

14.1.7 CURRENT FOCUS AND STRATEGIES

14.1.8 RIGHT TO WIN

14.2 TAGHLEEF INDUSTRIES

14.2.1 BUSINESS OVERVIEW

14.2.2 OPERATIONAL ASSESSMENT

14.2.3 PRODUCTS OFFERED

14.2.4 RECENT DEVELOPMENTS

14.2.5 RIGHT TO WIN

14.3 CCL INDUSTRIES INC.

14.3.1 BUSINESS OVERVIEW

14.3.2 FINANCIAL ASSESSMENT

14.3.3 OPERATIONAL ASSESSMENT

14.3.4 PRODUCTS OFFERED

14.3.5 RECENT DEVELOPMENTS

14.3.6 SWOT ANALYSIS

14.3.7 CURRENT FOCUS AND STRATEGIES

14.3.8 RIGHT TO WIN

14.4 JINDAL POLY FILMS

14.4.1 BUSINESS OVERVIEW

14.4.2 FINANCIAL ASSESSMENT

14.4.3 OPERATIONAL ASSESSMENT

14.4.4 PRODUCTS OFFERED

14.4.5 RECENT DEVELOPMENTS

14.4.3 SWOT ANALYSIS

14.4.4 CURRENT FOCUS AND STRATEGIES

14.4.5 RIGHT TO WIN

14.5 SIBUR HOLDINGS

14.5.1 BUSINESS OVERVIEW

14.5.2 FINANCIAL ASSESSMENT

14.5.3 OPERATIONAL ASSESSMENT

14.5.4 PRODUCTS OFFERED

14.5.5 RECENT DEVELOPMENTS

14.5.6 SWOT ANALYSIS

14.5.7 CURRENT FOCUS AND STRATEGIES

14.5.8 RIGHT TO WIN

14.6 ZHEJIANG KINLEAD INNOVATIVE MATERIALS CO LTD.

14.6.1 BUSINESS OVERVIEW

14.6.2 OPERATIONAL ASSESSMENT

14.6.3 PRODUCTS OFFERED

14.6.4 RECENT DEVELOPMENTS

14.6.5 ZHEJIANG KINLEAD’S RIGHT TO WIN

14.7 INTEPLAST GROUP

14.7.1 BUSINESS OVERVIEW

14.7.2 PRODUCTS OFFERED

14.7.3 RECENT DEVELOPMENTS

14.7.4 INTEPLAST GROUP’S RIGHT TO WIN

14.8 POLIGAL S.A.

14.8.1 BUSINESS OVERVIEW

14.8.2 PRODUCTS OFFERED

14.8.3 POLIGAL’S RIGHT TO WIN

14.9 UFLEX LTD.

14.9.1 BUSINESS OVERVIEW

14.9.2 PRODUCTS OFFERED

14.9.3 RECENT DEVELOPMENTS

14.9.4 UFLEX’S RIGHT TO WIN

14.10 POLINAS

14.10.1 BUSINESS OVERVIEW

14.10.2 PRODUCTS OFFERED

14.10.3 POLINAS’S RIGHT TO WIN

14.11.1 BUSINESS OVERVIEW

14.11.2 PRODUCTS OFFERED

14.11.3 RECENT DEVELOPMENTS

14.11.4 POLIBAK’S RIGHT TO WIN

14.12 TORAY INDUSTRIES

14.12.1 BUSINESS OVERVIEW

14.12.2 PRODUCTS OFFERED

14.12.3 RECENT DEVELOPMENTS

14.12.4 TORAY’S RIGHT TO WIN

14.13 OTHER PLAYERS

14.13.1 GETTEL HIGH-TECH MATERIALS CO. LTD.

14.13.2 JINTIAN GROUP CO., LTD.

14.13.3 ZHEJIANG JINRUI FILM MATERIALS CO., LTD.

14.13.4 KOPAFILM ELEKTROFOLIEN GMBH

14.13.5 POLYPLEX CORPORATION LTD.

14.13.6 FUTAMURA CHEMICAL

14.13.7 CHIRIPAL POLY FILMS

14.13.8 VITOPEL

14.13.9 ALTOPRO

14.13.10 VIBAC GROUP

15 APPENDIX

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

LIST OF TABLES (194 TABLES)

TABLE 1 PROPERTIES AND APPLICATIONS OF BI-AXIALLY ORIENTED FILMS

TABLE 2 BOPP FILMS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 3 BOPP FILMS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 4 BOPP FILMS MARKET SIZE, BY THICKNESS, 2018–2025 (USD MILLION)

TABLE 5 BOPP FILMS MARKET SIZE, BY THICKNESS, 2018–2025 (KILOTON)

TABLE 6 BOPP FILMS MARKET SIZE, BY PRODUCTION PROCESS, 2018–2025 (USD MILLION)

TABLE 7 BOPP FILMS MARKET SIZE, BY PRODUCTION PROCESS, 2018–2025 (KILOTON)

TABLE 8 BOPP FILMS MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 9 BOPP FILMS MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

TABLE 10 BOPP FILMS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 11 BOPP FILMS MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

TABLE 12 BOPP FILMS MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

TABLE 13 BOPP FILMS MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (KILOTON)

TABLE 14 BOPP FILMS MARKET SIZE, BY PRODUCTION PROCESS, 2018–2025 (USD MILLION)

TABLE 15 BOPP FILMS MARKET SIZE, BY PRODUCTION PROCESS, 2018–2025 (KILOTON)

TABLE 16 BOPP FILMS MARKET SIZE, BY THICKNESS, 2018–2025 (USD MILLION)

TABLE 17 BOPP FILMS MARKET SIZE, BY THICKNESS, 2018–2025 (KILOTON)

TABLE 18 BOPP FILMS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 19 BOPP FILMS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 20 APAC: BOPP FILMS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 21 APAC: BOPP FILMS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

TABLE 22 APAC: BOPP FILMS MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

TABLE 23 APAC: BOPP FILMS MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (KILOTON)

TABLE 24 APAC: BOPP FILMS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 25 APAC: BOPP FILMS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 26 CHINA: BOPP FILMS MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

TABLE 27 CHINA: BOPP FILMS MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (KILOTON)

TABLE 28 CHINA: BOPP FILMS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 29 CHINA: BOPP FILMS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 30 JAPAN: BOPP FILMS MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

TABLE 31 JAPAN: BOPP FILMS MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (KILOTON)

TABLE 32 JAPAN: BOPP FILMS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 33 JAPAN: BOPP FILMS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 34 INDIA: BOPP FILMS MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

TABLE 35 INDIA: BOPP FILMS MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (KILOTON)

TABLE 36 INDIA: BOPP FILMS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 37 INDIA: BOPP FILMS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 38 SOUTH KOREA: BOPP FILMS MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

TABLE 39 SOUTH KOREA: BOPP FILMS MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (KILOTON)

TABLE 40 SOUTH KOREA: BOPP FILMS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 41 SOUTH KOREA: BOPP FILMS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 42 REST OF APAC: BOPP FILMS MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

TABLE 43 REST OF APAC: BOPP FILMS MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (KILOTON)

TABLE 44 REST OF APAC: BOPP FILMS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 45 REST OF APAC: BOPP FILMS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 46 EUROPE: BOPP FILMS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 47 EUROPE: BOPP FILMS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

TABLE 48 EUROPE: BOPP FILMS MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

TABLE 49 EUROPE: BOPP FILMS MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (KILOTON)

TABLE 50 EUROPE: BOPP FILMS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 51 EUROPE: BOPP FILMS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 52 GERMANY: BOPP FILMS MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

TABLE 53 GERMANY: BOPP FILMS MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (KILOTON)

TABLE 54 GERMANY: BOPP FILMS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 55 GERMANY: BOPP FILMS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 56 UK: BOPP FILMS MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

TABLE 57 UK: BOPP FILMS MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (KILOTON)

TABLE 58 UK: BOPP FILMS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 59 UK: BOPP FILMS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 60 FRANCE: BOPP FILMS MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

TABLE 61 FRANCE: BOPP FILMS MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (KILOTON)

TABLE 62 FRANCE: BOPP FILMS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 63 FRANCE: BOPP FILMS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 64 RUSSIA: BOPP FILMS MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

TABLE 65 RUSSIA: BOPP FILMS MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (KILOTON)

TABLE 66 RUSSIA: BOPP FILMS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 67 RUSSIA: BOPP FILMS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 68 SPAIN: BOPP FILMS MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

TABLE 69 SPAIN: BOPP FILMS MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (KILOTON)

TABLE 70 SPAIN: BOPP FILMS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 71 SPAIN: BOPP FILMS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 72 ITALY: BOPP FILMS MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

TABLE 73 ITALY: BOPP FILMS MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (KILOTON)

TABLE 74 ITALY: BOPP FILMS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 75 ITALY: BOPP FILMS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 76 REST OF EUROPE: BOPP FILMS MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

TABLE 77 REST OF EUROPE: BOPP FILMS MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (KILOTON)

TABLE 78 REST OF EUROPE: BOPP FILMS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 79 REST OF EUROPE: BOPP FILMS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 80 LEADING MANUFACTURERS OF BOPP FILMS IN NORTH AMERICA

TABLE 81 NORTH AMERICA: BOPP FILMS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 82 NORTH AMERICA: BOPP FILMS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

TABLE 83 NORTH AMERICA: BOPP FILMS MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

TABLE 84 NORTH AMERICA: BOPP FILMS MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (KILOTON)

TABLE 85 NORTH AMERICA: BOPP FILMS MARKET SIZE, BY THICKNESS, 2018–2025 (USD MILLION)

TABLE 86 NORTH AMERICA: BOPP FILMS MARKET SIZE, BY THICKNESS, 2018–2025 (KILOTON)

TABLE 87 NORTH AMERICA: BOPP FILMS MARKET SIZE, BY POUCHES THICKNESS, 2018–2025 (USD MILLION)

TABLE 88 NORTH AMERICA: BOPP FILMS MARKET SIZE, BY POUCHES THICKNESS, 2018–2025 (KILOTON)

TABLE 89 NORTH AMERICA: BOPP FILMS MARKET SIZE, BY WRAP THICKNESS, 2018–2025 (USD MILLION)

TABLE 90 NORTH AMERICA: BOPP FILMS MARKET SIZE, BY WRAP THICKNESS, 2018–2025 (KILOTON)

TABLE 91 NORTH AMERICA: BOPP FILMS MARKET SIZE, BY LABELS THICKNESS, 2018–2025 (USD MILLION)

TABLE 92 NORTH AMERICA: BOPP FILMS MARKET SIZE, BY LABELS THICKNESS, 2018–2025 (KILOTON)

TABLE 93 NORTH AMERICA: BOPP FILMS MARKET SIZE, BY TAPES THICKNESS, 2018–2025 (USD MILLION)

TABLE 94 NORTH AMERICA: BOPP FILMS MARKET SIZE, BY TAPES THICKNESS, 2018–2025 (KILOTON)

TABLE 95 NORTH AMERICA: BOPP FILMS MARKET SIZE, BY PRODUCTION PROCESS, 2018–2025 (USD MILLION)

TABLE 96 NORTH AMERICA: BOPP FILMS MARKET SIZE, BY PRODUCTION PROCESS, 2018–2025 (KILOTON)

TABLE 97 NORTH AMERICA: BOPP FILMS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 98 NORTH AMERICA: BOPP FILMS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 99 US: BOPP FILMS MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

TABLE 100 US: BOPP FILMS MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (KILOTON)

TABLE 101 US: BOPP FILMS MARKET SIZE, BY THICKNESS, 2018–2025 (USD MILLION)

TABLE 102 US: BOPP FILMS MARKET SIZE, BY THICKNESS, 2018–2025 (KILOTON)

TABLE 103 US: BOPP FILMS MARKET SIZE, BY POUCHES THICKNESS, 2018–2025 (USD MILLION)

TABLE 104 US: BOPP FILMS MARKET SIZE, BY POUCHES THICKNESS, 2018–2025 (KILOTON)

TABLE 105 US: BOPP FILMS MARKET SIZE, BY WRAP THICKNESS, 2018–2025 (USD MILLION)

TABLE 106 US: BOPP FILMS MARKET SIZE, BY WRAP THICKNESS, 2018–2025 (KILOTON)

TABLE 107 US: BOPP FILMS MARKET SIZE, BY LABELS THICKNESS, 2018–2025 (USD MILLION)

TABLE 108 US: BOPP FILMS MARKET SIZE, BY LABELS THICKNESS, 2018–2025 (KILOTON)

TABLE 109 US: BOPP FILMS MARKET SIZE, BY TAPE THICKNESS, 2018–2025 (USD MILLION)

TABLE 110 US: BOPP FILMS MARKET SIZE, BY TAPE THICKNESS, 2018–2025 (KILOTON)

TABLE 111 US: BOPP FILMS MARKET SIZE, BY PRODUCTION PROCESS, 2018–2025 (USD MILLION)

TABLE 112 US: BOPP FILMS MARKET SIZE, BY PRODUCTION PROCESS, 2018–2025 (KILOTON)

TABLE 113 US: BOPP FILMS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 114 US: BOPP FILMS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 115 CANADA: BOPP FILMS MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

TABLE 116 CANADA: BOPP FILMS MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (KILOTON)

TABLE 117 CANADA: BOPP FILMS MARKET SIZE, BY THICKNESS, 2018–2025 (USD MILLION)

TABLE 118 CANADA: BOPP FILMS MARKET SIZE, BY THICKNESS, 2018–2025 (KILOTON)

TABLE 119 CANADA: BOPP FILMS MARKET SIZE, BY POUCHES THICKNESS, 2018–2025 (USD MILLION)

TABLE 120 CANADA: BOPP FILMS MARKET SIZE, BY POUCHES THICKNESS, 2018–2025 (KILOTON)

TABLE 121 CANADA: BOPP FILMS MARKET SIZE, BY WRAP THICKNESS, 2018–2025 (USD MILLION)

TABLE 122 CANADA: BOPP FILMS MARKET SIZE, BY WRAP THICKNESS, 2018–2025 (KILOTON)

TABLE 123 CANADA: BOPP FILMS MARKET SIZE, BY LABELS THICKNESS, 2018–2025 (USD MILLION)

TABLE 124 CANADA: BOPP FILMS MARKET SIZE, BY LABELS THICKNESS, 2018–2025 (KILOTON)

TABLE 125 CANADA: BOPP FILMS MARKET SIZE, BY TAPES THICKNESS, 2018–2025 (USD MILLION)

TABLE 126 CANADA: BOPP FILMS MARKET SIZE, BY TAPES THICKNESS, 2018–2025 (KILOTON)

TABLE 127 CANADA: BOPP FILMS MARKET SIZE, BY PRODUCTION PROCESS, 2018–2025 (USD MILLION)

TABLE 128 CANADA: BOPP FILMS MARKET SIZE, BY PRODUCTION PROCESS, 2018–2025 (KILOTON)

TABLE 129 CANADA: BOPP FILMS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 130 CANADA: BOPP FILMS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 131 MEXICO: BOPP FILMS MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

TABLE 132 MEXICO: BOPP FILMS MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (KILOTON)

TABLE 133 MEXICO: BOPP FILMS MARKET SIZE, BY THICKNESS, 2018–2025 (USD MILLION)

TABLE 134 MEXICO: BOPP FILMS MARKET SIZE, BY THICKNESS, 2018–2025 (KILOTON)

TABLE 135 MEXICO: BOPP FILMS MARKET SIZE, BY POUCHES THICKNESS, 2018–2025 (USD MILLION)

TABLE 136 MEXICO: BOPP FILMS MARKET SIZE, BY POUCHES THICKNESS, 2018–2025 (KILOTON)

TABLE 137 MEXICO: BOPP FILMS MARKET SIZE, BY WRAPS THICKNESS, 2018–2025 (USD MILLION)

TABLE 138 MEXICO: BOPP FILMS MARKET SIZE, BY WRAPS THICKNESS, 2018–2025 (KILOTON)

TABLE 139 MEXICO: BOPP FILMS MARKET SIZE, BY LABELS THICKNESS, 2018–2025 (USD MILLION)

TABLE 140 MEXICO: BOPP FILMS MARKET SIZE, BY LABELS THICKNESS, 2018–2025 (KILOTON)

TABLE 141 MEXICO: BOPP FILMS MARKET SIZE, BY TAPES THICKNESS, 2018–2025 (USD MILLION)

TABLE 142 MEXICO: BOPP FILMS MARKET SIZE, BY TAPES THICKNESS, 2018–2025 (KILOTON)

TABLE 143 MEXICO: BOPP FILMS MARKET SIZE, BY PRODUCTION PROCESS, 2018–2025 (USD MILLION)

TABLE 144 MEXICO: BOPP FILMS MARKET SIZE, BY PRODUCTION PROCESS, 2018–2025 (KILOTON)

TABLE 145 MEXICO: BOPP FILMS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 146 MEXICO: BOPP FILMS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 147 MIDDLE EAST & AFRICA: BOPP FILMS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 148 MIDDLE EAST & AFRICA: BOPP FILMS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

TABLE 149 MIDDLE EAST & AFRICA: BOPP FILMS MARKET SIZE, BY PACKAGING TYPE , 2018–2025 (USD MILLION)

TABLE 150 MIDDLE EAST & AFRICA: BOPP FILMS MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (KILOTON)

TABLE 151 MIDDLE EAST & AFRICA: BOPP FILMS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 152 MIDDLE EAST & AFRICA: BOPP FILMS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 153 UAE: BOPP FILMS MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

TABLE 154 UAE: BOPP FILMS MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (KILOTON)

TABLE 155 UAE: BOPP FILMS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 156 UAE: BOPP FILMS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 157 SAUDI ARABIA: BOPP FILMS MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

TABLE 158 SAUDI ARABIA: BOPP FILMS MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (KILOTON)

TABLE 159 SAUDI ARABIA: BOPP FILMS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 160 SAUDI ARABIA: BOPP FILMS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 161 SOUTH AFRICA: BOPP FILMS MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

TABLE 162 SOUTH AFRICA: BOPP FILMS MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (KILOTON)

TABLE 163 SOUTH AFRICA: BOPP FILMS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 164 SOUTH AFRICA: BOPP FILMS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 165 TURKEY: BOPP FILMS MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

TABLE 166 TURKEY: BOPP FILMS MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (KILOTON)

TABLE 167 TURKEY: BOPP FILMS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 168 TURKEY: BOPP FILMS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 169 REST OF MIDDLE EAST & AFRICA: BOPP FILMS MARKET SIZE, BY PACKAGING TYPE , 2018–2025 (USD MILLION)

TABLE 170 REST OF MIDDLE EAST & AFRICA: BOPP FILMS MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (KILOTON)

TABLE 171 REST OF MIDDLE EAST & AFRICA: BOPP FILMS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 172 REST OF MIDDLE EAST & AFRICA: BOPP FILMS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 173 SOUTH AMERICA: BOPP FILMS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 174 SOUTH AMERICA: BOPP FILMS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

TABLE 175 SOUTH AMERICA: BOPP FILMS MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

TABLE 176 SOUTH AMERICA: BOPP FILMS MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (KILOTON)

TABLE 177 SOUTH AMERICA: BOPP FILMS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 178 SOUTH AMERICA: BOPP FILMS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 179 BRAZIL: BOPP FILMS MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

TABLE 180 BRAZIL: BOPP FILMS MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (KILOTON)

TABLE 181 BRAZIL: BOPP FILMS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 182 BRAZIL: BOPP FILMS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 183 ARGENTINA: BOPP FILMS MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

TABLE 184 ARGENTINA: BOPP FILMS MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (KILOTON)

TABLE 185 ARGENTINA: BOPP FILMS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 186 ARGENTINA: BOPP FILMS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 187 REST OF SOUTH AMERICA: BOPP FILMS MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

TABLE 188 REST OF SOUTH AMERICA: BOPP FILMS MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (KILOTON)

TABLE 189 REST OF SOUTH AMERICA: BOPP FILMS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 190 REST OF SOUTH AMERICA: BOPP FILMS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 191 ACQUISITION

TABLE 192 EXPANSION & INVESTMENT

TABLE 193 NEW PRODUCT DEVELOPMENT

TABLE 194 JOINT VENTURE & PARTNERSHIP

LIST OF FIGURES (46 FIGURES)

FIGURE 1 BOPP FILMS MARKET SEGMENTATION

FIGURE 2 REGIONS COVERED

FIGURE 3 APPROACH 1 (BOTTOM UP)

FIGURE 4 APPROACH 2 (TOP DOWN)

FIGURE 5 BOPP FILMS MARKET: DATA TRIANGULATION

FIGURE 6 KEY MARKET INSIGHTS

FIGURE 7 LIST OF STAKEHOLDERS INVOLVED AND BREAKDOWN OF PRIMARY INTERVIEWS

FIGURE 8 BAGS & POUCHES TO BE THE LARGEST SEGMENT OF THE BOPP FILMS MARKET

FIGURE 9 15-30 MICRONS SEGMENT TO BE THE FASTEST GROWING SEGMENT OF THE BOPP FILMS MARKET

FIGURE 10 TENTER TO BE THE LARGER AND FASTER-GROWING SEGMENT OF THE BOPP FILMS MARKET

FIGURE 11 FOOD SEGMENT TO BE THE LEADING APPLICATION OF BOPP FILMS

FIGURE 12 ASIA PACIFIC DOMINATED THE BOPP FILMS MARKET IN 2019

FIGURE 13 EMERGING ECONOMIES TO OFFER ATTRACTIVE OPPORTUNITIES IN THE BOPP FILMS MARKET BETWEEN 2020 AND 2025

FIGURE 14 CHINA AND BAGS & POUCHES ACCOUNTED FOR THE LARGEST SHARES

FIGURE 15 BAGS & POUCHES SEGMENT TO LEAD THE BOPP FILMS MARKET

FIGURE 16 15-30 MICRONS TO BE THE FASTEST-GROWING SEGMENT OF THE BOPP FILMS MARKET

FIGURE 17 TENTER METHOD TO DOMINATE THE BOPP FILMS MARKET

FIGURE 18 FOOD PACKAGING TO BE THE LARGEST APPLICATION OF BOPP FILMS

FIGURE 19 BOPP FILMS MARKET IN INDIA TO GROW AT THE HIGHEST CAGR FROM 2020 TO 2025

FIGURE 20 FACTORS GOVERNING THE BOPP FILMS MARKET

FIGURE 21 YC, YCC DRIVERS

FIGURE 22 BAGS & POUCHES TO BE THE LARGEST TYPE OF BOPP FILMS

FIGURE 23 15-30 MICRONS TO BE THE LARGEST SEGMENT

FIGURE 24 TENTER TO BE THE LARGER PRODUCTION PROCESS FOR BOPP FILMS

FIGURE 25 FOOD TO BE THE LARGEST APPLICATION OF BOPP FILMS

FIGURE 26 INDIA PROJECTED TO BE FASTEST-GROWING MARKET, 2020–2025

FIGURE 27 APAC: BOPP FILMS MARKET SNAPSHOT

FIGURE 28 NORTH AMERICA: BOPP FILMS MARKET SNAPSHOT

FIGURE 29 COMPANIES ADOPTED EXPANSION AS THE KEY GROWTH STRATEGY BETWEEN 2017 AND 2020

FIGURE 30 MARKET RANKING OF KEY PLAYERS, 2019

FIGURE 31 BOPP FILMS MARKET: COMPETITIVE EVALUATION MATRIX, 2020

FIGURE 32 COSMO FILMS: COMPANY SNAPSHOT

FIGURE 33 COSMO FILMS: SWOT ANALYSIS

FIGURE 34 WINNING IMPERATIVES

FIGURE 35 CCL INDUSTRIES INC.: COMPANY SNAPSHOT

FIGURE 36 CCL INDUSTRIES INC.: SWOT ANALYSIS

FIGURE 37 WINNING IMPERATIVES

FIGURE 38 JINDAL POLY FILMS: COMPANY SNAPSHOT

FIGURE 39 JINDAL POLY FILMS: SWOT ANALYSIS

FIGURE 40 WINNING IMPERATIVES

FIGURE 41 SIBUR HOLDINGS: COMPANY SNAPSHOT

FIGURE 42 SIBUR HOLDINGS: SWOT ANALYSIS

FIGURE 43 WINNING IMPERATIVES

FIGURE 44 UFLEX LTD.: COMPANY SNAPSHOT

FIGURE 45 POLINAS: SNAPSHOT

FIGURE 46 TORAY INDUSTRIES: COMPANY SNAPSHOT

The study involved four major activities for estimating the current global size of the BOPP films market. The exhaustive secondary research was carried out to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions and sizes with the industry experts across the value chain of BOPP films through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the bopp films market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, to identify and collect information for this study on the BOPP films market. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

Primary Research

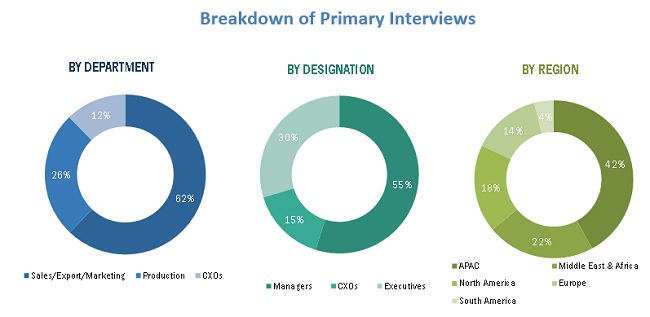

Various primary sources from both the supply and demand sides of the BOP films market were interviewed to obtain qualitative and quantitative information. The primary sources from the supply-side included industry experts, such as Chief Executive Officers (CEOs), vice presidents, marketing directors, sales professionals, and related key executives from various leading companies and organizations operating in the BOPP film industry. The primary sources from the demand-side included key executives from banks, government organizations, and educational institutions. The breakdown of the profiles of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the global size of the BOPP films market. These approaches were also used extensively to estimate the size of various dependent segments of the market. The research methodology used to estimate the market size included the following details:

- The key players were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments of the BOPP films market. The data was triangulated by studying various factors and trends from both the demand- and supply-side.

Research Objectives

- To estimate and forecast the biaxially oriented polypropylene (BOPP) films market, in terms of value and volume

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To define, describe, and forecast the market size, based on packaging type, thickness, production process, application, and region

- To forecast the market size along with segments and submarkets, in key regions: North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and South America along with their key countries

- To strategically analyze micromarkets, with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze growth opportunities in the market for stakeholders and provide details on the competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To analyze competitive developments, such as merger & acquisition, expansion & investment, agreement, and new product development in the BOPP films market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the BOPP films report:

Product Analysis

- Product matrix, which offers a detailed comparison of the product portfolio of companies

Regional Analysis

- Further analysis of the BOPP films market for additional countries

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in BOPP Films Market