Building Information Modelling (BIM) Service Market by Deployment Type (On Premise, Cloud), by Project Lifecycle (Preconstruction, Construction, Operation), by Application, by End-user, by Service Type and by Region - Global forecast to 2030

Building Information Modelling (BIM) service is the process of creating 3D models of a specific project which includes enabling document management, coordination, and simulation during the entire life cycle of the specific project. The Process involves planning, designing, Implementing, and managing a project. BIM services are provided for owners, developers, and stakeholders to review new projects with unprecedented detail.

BIM service involves the coordination of human and material resources through the lifecycle of the project which includes project management support like BIM business strategies, and design advice, operational assessment capacity, and maintenance planning, supplier analysis, coordination, time and cost estimation, procurement.

The use of BIM services has been prevalent in the construction industry. However, in recent times, Investment in BIM is continuing to grow by many companies in this industry for BIM’s efficiency and cost-effectiveness as it attempts to gather information relating to design, functionality, and life span in forms that can be shared by the participants in the project. In this way, designers, contractors, and suppliers can have a current view of the progress of the building project and have an influence on the design and specification prior to and during execution. 3D representation is a key element of BIM. However, this can be widened to 4D, which includes time frames, and 5D.

To know about the assumptions considered for the study, Request for Free Sample Report

Drivers: Increase in government initiatives for adopting BIM

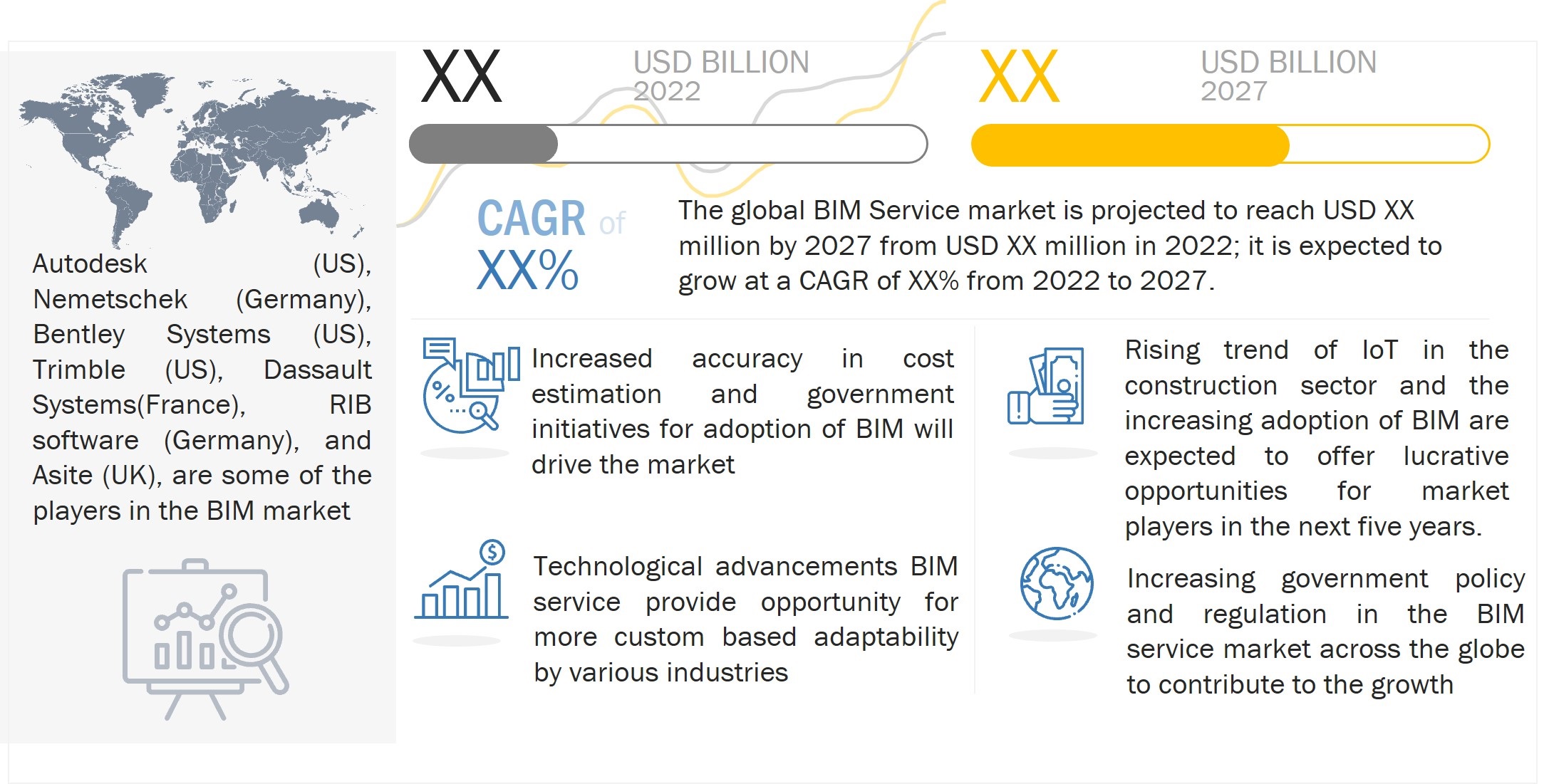

In many countries like US, and Germany, BIM is becoming prevalent and mandated. Few countries like Sweden, Denmark, and Finland government are regulating the usage of BIM standards. Policy and regulations are implemented by the government for the deployment of BIM solutions in the construction both by Public and private infrastructure organizations. For instance, the United Kingdom government has proposed a BIM solution mandate for large 2 projects. Countries like Singapore, Denmark, and Spain have reached close to 90% of the adoption of BIM solutions. Hence, the implementation done by the government will help the market to grow better.

Drivers: Increased accuracy in cost estimation by the adoption of BIM

BIM eliminates the time-consuming procedure of manually reading blueprints, calculating QTOs (Quantity Take Off), and eventually interpreting the drawings. This results in greater accuracy and almost nil uncertainty. Any changes in quantity or design geometry are immediately reflected in costs. Design engineers can therefore modify the blueprints without having to worry about the time-consuming procedure of starting over with calculations. By estimating with BIM, general contractors and construction managers can increase their productivity, win more contracts, and maximize project profitability. With the appropriate team and resources, 5D BIM can be fully utilized to shorten project deadlines, save costs, and improve design, construction, and operating standards.

Challenges: Digitization in the construction industry is still in a low phase

Large-scale construction projects take more time and cross the threshold of the budget. This is mainly due to less digitization in the construction industry. By following the BIM solution it will increase the efficiency to 20% but the industry has not embraced new digital technology that needs upfront investments though the benefit will be for a longer time. This Lag will be a hindrance in the adaption of BIM solutions.

Key Players in the Market

Autodesk (US), Nemetschek (Germany), Bentley Systems (US), Trimble (US), Dassault Systems(France), RIB software (Germany), Asite (UK), Aveva (UK), Hexagon (Sweden), and nCircle (India) are some of the key players in the BIM market.

Recent Developments

- In Early 2022, the French company BIM&CO announced a strategic partnership with BIMLife to deliver BIM products to the construction industry in the ASEAN market. BIM&CO has selected BIMLife to deliver its services and distribute its products to manufacturers in ASEAN

- Autodesk BMI collaborates with PRO. This will help, for instance, BIM Collaborate Pro provides a better view of your projects, giving you and your team anytime, anywhere access to the tools and information needed. With powerful co-authoring, project management, and model coordination tools.

- In January 2022, Maxon the subsidiary of Nemetschek Group, acquired Pixologic Inc. This acquisition will benefit Maxon from Pixologic's industry-leading 3D sculpting and painting expertise.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 Introduction

1.1. Study Objectives

1.2. Definition

1.3. Study Scope

1.3.1. Markets Covered

1.3.2. Geographic Scope

1.3.3. Years Considered

1.4. Currency

1.5. Key Stakeholders

1.6. Summary of Changes

2 Research Methodology

2.1. Research Data

2.2. Secondary Data

2.2.1. Major Secondary Sources

2.2.2. Key Data from Secondary Sources

2.3. Primary Data

2.3.1. Key Data from Primary Sources

2.3.2. Key Participants in Primary Processes across Market Value Chain

2.3.3. Breakdown of Primary Interviews

2.3.4. Key Industry Insights

2.4. Market Size Estimation

2.5. Market Breakdown and Data Triangulation

2.6. Risk Analysis

2.7. Research Assumptions and Limitations

3 Executive Summary

4 Premium Insights

5 Industry Trends and Market Overview

5.1. Introduction

5.2. Value Chain Analysis

5.3. Market Dynamics

5.3.1. Drivers

5.3.2. Restraints

5.3.3. Opportunities

5.3.4. Challenges

5.4. Revenue Shift and New Revenue Pockets for Market Players

5.5. Market Ecosystem/Market Map

5.6. Key Industry Trends

5.7. Pricing Analysis

5.8. Case Study Analysis

5.9. Patent Analysis

5.10. Key Stakeholders and Buying Criteria

5.11. Regulatory Landscape

6 BIM Services Market, by Type

6.1. Introduction

6.2. On-site Services

6.3. Off-site Services

6.4. Façade Services

7 BIM Services Market, by Service Type

7.1. Introduction

7.2. Consulting Services

7.3. Production & Documentation Support

7.4. Clash Detection & Coordination

7.5. Scheduling & Monitoring

7.6. Cost Planning & Monitoring

7.7. Facility Management & Operations

7.8. 3D Rendering & Visualization

7.9. Scan to BIM

7.10. Others

8 BIM Services Market, by Project Lifecycle

8.1. Introduction

8.2. Preconstruction

8.3. Construction

8.4. Operation

9 BIM Services Market, by Deployment Type

9.1. Introduction

9.2. On-premise

9.3. Cloud-based

10 BIM Services Market, by End-user

10.1. Introduction

10.2. AEC Professionals

10.3. Consultants & Facility Managers

10.4. Others

11 BIM Services Market, by Application

11.1. Introduction

11.2. Buildings

11.3. Industrial

11.4. Civil Infrastructure

11.5. Oil & Gas

11.6. Utilities

11.7. Others

12 BIM Services Market, by Region

12.1. Introduction

12.2. North America

12.2.1. US

12.2.2. Canada

12.2.3. Mexico

12.3. Europe

12.3.1. UK

12.3.2. Germany

12.3.3. France

12.3.4. Italy

12.3.5. Rest of Europe

12.4. APAC

12.4.1. China

12.4.2. Japan

12.4.3. India

12.4.4. Rest of APAC

12.5. RoW

12.5.1. South America

12.5.2. Middle East

12.5.3. Africa

13 Competitive Landscape

13.1. Overview

13.2. 5-Year Revenue Analysis- Top 5 Companies

13.3. Market Share Analysis: BIM Services Market (Top 5)

13.3.1. Global

13.3.2. North America

13.3.3. Europe

13.3.4. APAC

13.3.5. RoW

13.4. Company Evaluation Quadrant, 2021

13.4.1. Star

13.4.2. Pervasive

13.4.3. Participant

13.4.4. Emerging Leader

13.5. Competitive Benchmarking

13.6. Startup/SME Evaluation Quadrant, 2021

13.6.1. Progressive Companies

13.6.2. Responsive Companies

13.6.3. Dynamic Companies

13.6.4. Starting Blocks

13.6.5. Startup/ SME Data Table

13.6.6. Competitive Benchmarking of Key Startups/SMEs

13.7. Competitive Situations and Trends

14 Company Profiles

14.1. Introduction

14.2. Key Players

14.2.1. Autodesk

14.2.1.1. Business Overview

14.2.1.2. Products Offered

14.2.1.3. Recent Developments

14.2.1.4. MNM View

14.2.1.4.1. Key Strengths/Right to Win

14.2.1.4.2. Strategic Choices Made

14.2.1.4.3. Weaknesses And Competitive Threats

Note: Similar Information Would Be Provided for Top 5 (Key Players)

14.2.2. Nemetschek

14.2.3. Bentley Systems

14.2.4. Trimble

14.2.5. Dassault Systemes

14.2.6. RIB Software

14.2.7. ASITE

14.2.8. AVEVA

14.2.9. Hexagon

14.2.10. nCircle

14.2.11. Pinnacle

14.2.12. Neilsoft

14.2.13. Intec Infra-Technologies Pvt Ltd

14.2.14. Magnasoft

14.2.15. TaalTech

Note: The above list of companies is tentative and might change during due course of research

15 Appendix

Growth opportunities and latent adjacency in Building Information Modelling (BIM) Service Market