Bluetooth 5.0 Market by Component (Hardware, Software, Services), Application (Audio Streaming, Data Transfer, Location Services), End User (Automotive, Wearables, Consumer Electronics, Retail and Logistics) and Region - Global Forecast to 2027

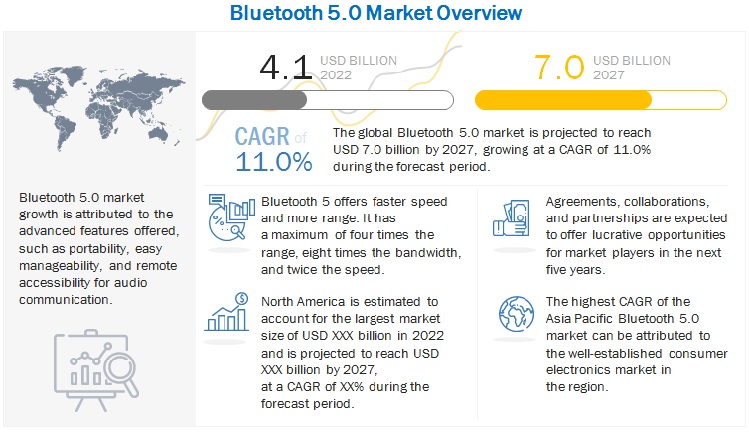

The global Bluetooth 5.0 Market is projected to grow by 11.0% resulting in a market value of $7.0 billion by 2027. The size value was USD 4.1 billion in 2022. The use of Bluetooth 5.0 in consumer electronics to communicate wirelessly is driving the market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

Bluetooth 5.0 Market Growth Dynamics

Driver: Increasing investments in IoT devices

The increasing investments in sensing technology for automating industrial activities have led to the increased revenue growth of the IoT connectivity industry. The market is experiencing a continuous expansion due to the rising demand for audio devices, automotive entertainment and diagnostic devices, smart city projects, automation, and wearable electronics integrated with Bluetooth capabilities.

The COVID-19 pandemic has boosted the adoption of the Internet of Medical Things (IoMT) and increased the demand for hands-free medical technology in hospitals and in-home use. Wearable health monitors, such as blood glucose and blood pressure monitors, have become more common in expanding home care. More hospitals have started adopting IoT connectivity to track resources and make remote appointments. These trends will continue to grow as the pandemic subsides, making healthcare more accessible.

Restraint: Packet interference

Interference has been one of the biggest challenges for any wireless technology in providing reliable data communication. Since wireless technologies, such as Bluetooth and Wi-Fi devices, share a transmission medium, there is a possibility for a data packet being transmitted to be corrupted or lost if it collides with another packet being transmitted at the same time and on the same frequency channel.

Collisions pose a major challenge in radio communication and become particularly problematic in busy radio environments. Bluetooth technology diminishes the risk of collisions using spread spectrum techniques.

Opportunity: High adoption of Bluetooth location service devices

From personal item finding and indoor navigation to asset tracking and digital key, Bluetooth technology is widely adopted as a device positioning solution for addressing the increasing demand for high-accuracy indoor location services. A Bluetooth device can determine another device's presence, distance, and direction. It delivers flexibility unlike any other positioning radio, allowing building managers and owners to scale indoor positioning solutions and match the changing needs of the building. The Bluetooth market update report 2021 shows that 79% of current Bluetooth location service implementations include indoor navigation.

Bluetooth technology is fueling rapid growth in real-time locating system (RTLS) solutions for tracking things and people, whether locating tools and workers in a warehouse or medical devices and patients in a hospital. Commercial and industrial facilities have increasingly started shifting toward Bluetooth asset management solutions for optimizing resource and inventory control. Among Bluetooth Location Services solutions, RTLS and tags have become the major drivers behind continued growth.

Challenge: Security and access concerns

Bluetooth is a widely adopted protocol that facilitates short-range communication between devices and is often used in headphones, controllers, and automobiles. In its last few years of development, Bluetooth has discovered multiple flaws and a considerable number of cases of hacks. After reviewing few cases, the cybersecurity investigators came across a family of Bluetooth security flaws named as BrakTooth. These security flaws include several vulnerabilities such as denial of service (DoS) via firmware deadlocks and crashes and arbitrary code execution in 2021.

Typically, a key fob designed to wirelessly unlock a product can communicate with the product upon command. The possibility of attackers entering mobile, laptops, building security access, and more also increases relay attacks as a cyber adversary can theoretically intercept and manipulate the communication, allowing for theft. Utilizing these hacks, millions of smart cars were universally demonstrated as vulnerable in 2022.

Retail and Logistics are expected account for the largest market share during 2022

Technologies significantly boost retailers and landlords, particularly shopping centers, and retail parks, by facilitating targeted advertising and marketing. Bluetooth technology enables the automatic sending of personalized alerts to the shoppers’ mobile phones, as Wi-Fi helps track shoppers while they hover around the shopping center. It also helps landlords understand consumer habits and preferences. Bluetooth technologies can eliminate the need to use internet data for communication about shipments to other parts of a given facility. A logistic provider can instead identify areas where repetitive data occurs.

Device Networks application is expected to account for a higher CAGR during the forecast period

Bluetooth mesh networking empowers many-to-many device communications. It is suitable for creating control, monitoring, and automation systems where tens to thousands of devices need to communicate with one another reliably and securely. Bluetooth mesh networking is enhanced for large-scale device networks that make whole-building automation.

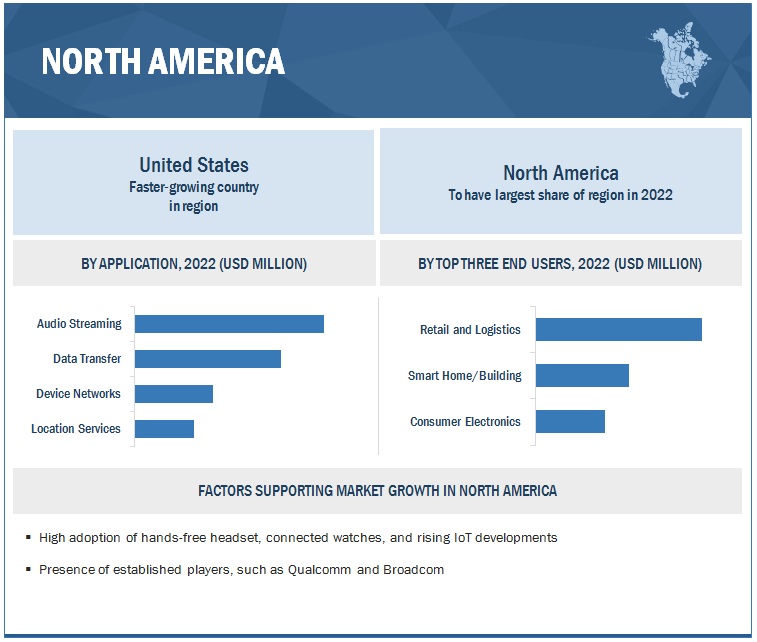

North America to account for the largest market share during the forecast period

North America is one of the most technologically advanced regions in the world. It comprises the US and Canada and is expected to account for the largest share of the global Bluetooth 5.0 market. North American countries have sustainable and well-established economies, which empower them to strongly invest in R&D activities, thereby contributing to developing new technologies. The region is well-known for its high adoption rate of new advanced technologies, such as IoT, wearable technology, automobiles, smart cities, smart industry, smart agriculture, and autonomous cars/connected cars. Bluetooth contributes to the reliable and fast connectivity required for these technologies, doubling the communications speed, quadrupling the range, and increasing the broadcast capacity by eightfold. Many major IT and telecom companies are based in the US and have invested heavily in setting up wireless communication facilities that handle heavy digital traffic across the globe.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The Bluetooth 5.0 market vendors have implemented various types of organic and inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in the global Bluetooth 5.0 market are Qualcomm (US), Nordic Semiconductor (Norway), ON Semiconductor (US), Broadcom (US), Silicon Labs (US), Realtek (Taiwan), Microchip Technology (US), NXP Semiconductors (Netherlands), Texas Instruments (US), MediaTek (Taiwan), Synopsys (US), STMicroelectronics (Switzerland), Qorvo (US), Renesas (Japan), Infineon Technologies (Germany), Goodix Technology (China), Telit (US), Espressif Systems (China), Taiyo Yuden (Japan), Feasycom (China), Atmosic Technologies (US), Ceva (France), Laird Connectivity (US), Inventek Systems (US), Insight SiP (France), and Virscient (New Zealand). The study includes an in-depth competitive analysis of these key players in the Bluetooth 5.0 market with their company profiles, recent developments, and key market strategies.

Scope of the Report

|

Report Metrics |

Details |

|

Market size value in 2022 |

USD 4.1 billion |

|

Revenue forecast for 2027 |

USD 7.0 billion |

|

Growth Rate |

11.0% CAGR |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

By component, application, end user, and regions |

|

Key Market Drivers |

|

|

Key Market Opportunities |

|

|

Regions covered |

North America, Europe, Asia Pacific, Middle East and Africa, Latin America |

|

Companies covered |

Qualcomm (US), Nordic Semiconductor (Norway), ON Semiconductor (US), Broadcom (US), Silicon Labs (US), Realtek (Taiwan), Microchip Technology (US), NXP Semiconductors (Netherlands), Texas Instruments (US), MediaTek (Taiwan), Synopsys (US), STMicroelectronics (Switzerland), Qorvo (US), Renesas (Japan), Infineon Technologies (Germany), Goodix Technology (China) |

This research report categorizes the Bluetooth 5.0 Market to forecast revenues and analyze trends in each of the following subsegments:

By Component:

-

Hardware

- System-on-chip

- RF Components

- Development Boards

- Sensors and Controls

- Solutions

- Software Development Kit

- Protocol Stacks

-

Services

-

Professional Services

- Training and Consulting

- Development and Integration

- Support and Maintenance

- Managed Services

-

Professional Services

By Application:

- Audio Streaming

- Data Transfer

- Location Services

- Device Networks

By End User:

- Consumer Electronics

- Wearables

- Automotive

- Retail and Logistics

- Healthcare

- Smart Home/Building

- Industrial Measurements and Diagnostics

- Other End Users (AR/VR and Gaming)

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- France

- Germany

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

- Middle East and Africa

- United Arab Emirates

- South Africa

- Rest of Middle East and Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- May 2022, STMicroelectronics joined forces with AWS to secure IoT links to its cloud and with Microsoft to fasten the development of highly secure IoT devices.

- In April 2022, Qualcomm acquired Arriver from SSW Partners to boost Qualcomm Technologies’ ability to offer open, fully integrated, and Advanced Driver Assistance System (ADAS) solutions to automakers and Tier-1 suppliers at scale.

- In November 2021, Nordic Semiconductor collaborated with AVSystem on Lightweight M2M for IoT device management.

Frequently Asked Questions (FAQ):

How big is the Bluetooth 5.0 market?

What is growth rate of the Bluetooth 5.0 market?

What are the applications in Bluetooth 5.0 market?

Who are the key players in Bluetooth 5.0 market?

Who will be the leading hub for Bluetooth 5.0 market?

What is the Bluetooth 5.0 market segmentation?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 BLUETOOTH 5.0 MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

FIGURE 2 MARKET: GEOGRAPHIC SCOPE

1.3.3 INCLUSIONS AND EXCLUSIONS

1.4 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES, 2019–2021

1.6 LIMITATIONS

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

FIGURE 3 BLUETOOTH 5.0 MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews with experts

2.1.2.2 List of key primary interview participants

2.1.2.3 Breakdown of primaries

2.1.2.4 Primary sources

2.1.2.5 Key industry insights

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 4 BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION USING BOTTOM-UP APPROACH (SUPPLY-SIDE): COLLECTIVE REVENUE FROM HARDWARE/SOFTWARE/SERVICES

2.2.2 TOP-DOWN APPROACH

FIGURE 6 TOP-DOWN APPROACH

2.2.3 BLUETOOTH 5.0 MARKET ESTIMATION: DEMAND-SIDE ANALYSIS

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE ANALYSIS

2.2.4 MARKET ESTIMATION: SUPPLY-SIDE ANALYSIS

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

2.2.5 GROWTH FORECAST ASSUMPTIONS

TABLE 2 MARKET GROWTH ASSUMPTIONS

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 9 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 LIMITATIONS AND RISK ASSESSMENT

TABLE 3 RISK ASSESSMENT FOR MARKET

3 EXECUTIVE SUMMARY (Page No. - 41)

FIGURE 10 MARKET, REGIONAL AND COUNTRY-WISE SHARE, 2022

4 PREMIUM INSIGHTS (Page No. - 42)

4.1 BLUETOOTH 5.0 MARKET OVERVIEW

FIGURE 11 ADDRESS POINT-TO-POINT CONNECTIVITY AND INDOOR POSITIONING AND LOCATION SERVICES TO DRIVE MARKET

4.2 MARKET, BY COMPONENT

FIGURE 12 HARDWARE SEGMENT EXPECTED TO DOMINATE MARKET BY 2027

4.3 MARKET, BY APPLICATION

FIGURE 13 AUDIO STREAMING SEGMENT EXPECTED TO DOMINATE MARKET IN 2022

4.4 MARKET, BY END USER

FIGURE 14 RETAIL AND LOGISTICS SEGMENT EXPECTED TO DOMINATE MARKET BY 2027

4.5 ASIA PACIFIC: MARKET, BY COMPONENT AND END USER

FIGURE 15 HARDWARE AND RETAIL AND LOGISTICS SEGMENTS EXPECTED TO ACCOUNT FOR SIGNIFICANT MARKET SHARE IN 2022

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 45)

5.1 MARKET OVERVIEW

5.2 MARKET DYNAMICS

FIGURE 16 BLUETOOTH 5.0 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing investments in IoT devices

5.2.1.2 Rising demand for connected wearables

5.2.1.3 Increasing acceptance of digital keys

5.2.2 RESTRAINTS

5.2.2.1 Packet interference

5.2.3 OPPORTUNITIES

5.2.3.1 High adoption of Bluetooth location service devices

5.2.3.2 Rising awareness about Bluetooth beacon technology

5.2.4 CHALLENGES

5.2.4.1 Security and access concerns

5.3 VALUE CHAIN

FIGURE 17 BLUETOOTH 5.0 MARKET: VALUE CHAIN

5.4 CASE STUDY ANALYSIS

5.4.1 CASE STUDY 1: REDUCING ENERGY COSTS WITH SMART LIGHTING

5.4.2 CASE STUDY 2: USING BLUETOOTH MESH FOR WAREHOUSES TO DECREASE COSTS

5.4.3 CASE STUDY 3: INSTALLING BLUETOOTH AR NAVIGATION IN TRAIN STATIONS FOR BETTER EXPERIENCE

5.4.4 CASE STUDY 4: DEPLOYING SMART ALERT SERVICE FOR ALZHEIMER’S PATIENTS

5.4.5 CASE STUDY 5: USING IOT GLUCOMETER FOR BETTER PATIENT CARE

5.4.6 CASE STUDY 6: BLE ENABLING EMERGENCY RESPONSE FOR CARDIAC ARRESTS

5.4.7 CASE STUDY 7: USING IOT FOR ENHANCED ACCESS

5.4.8 CASE STUDY 8: DEVELOPING AVIA BLUETOOTH SMART LOCK FOR HIGH SECURITY

5.5 PORTER’S FIVE FORCES ANALYSIS

TABLE 4 BLUETOOTH 5.0 MARKET: PORTER’S FIVE FORCES MODEL ANALYSIS

5.5.1 THREAT FROM NEW ENTRANTS

5.5.2 THREAT FROM SUBSTITUTES

5.5.3 BARGAINING POWER OF BUYERS

5.5.4 BARGAINING POWER OF SUPPLIERS

5.5.5 DEGREE OF COMPETITION

5.6 PATENT ANALYSIS

5.6.1 METHODOLOGY

5.6.2 DOCUMENT TYPES

TABLE 5 PATENTS FILED, 2020–2022

5.6.3 INNOVATION AND PATENT APPLICATIONS

FIGURE 18 NUMBER OF PATENTS GRANTED ANNUALLY, 2020–2022

5.6.3.1 Top applicants

FIGURE 19 TOP TEN PATENT APPLICANTS WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2020–2022

TABLE 6 TOP TEN PATENT OWNERS IN BLUETOOTH 5.0 MARKET, 2020–2022

TABLE 7 LIST OF PATENTS IN MARKET, 2020–2022

5.7 TECHNOLOGY ANALYSIS

5.7.1 INTRODUCTION

5.7.2 IOT

5.7.3 MESH NETWORKING

5.7.4 BEACON

5.8 ECOSYSTEM

TABLE 8 ECOSYSTEM: MARKET

5.9 PRICING MODEL OF MARKET PLAYERS

TABLE 9 PRICING MODELS AND INDICATIVE PRICE POINTS, 2021–2022

5.10 KEY CONFERENCES AND EVENTS, 2022-2023

TABLE 10 MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.11 DISRUPTIONS IMPACTING BUYERS/CLIENTS

FIGURE 20 BLUETOOTH 5.0 MARKET: DISRUPTIONS IMPACTING BUYERS/CLIENTS

5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 21 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS, FOR TOP THREE END USERS

TABLE 11 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS, FOR TOP THREE END USERS

5.12.2 BUYING CRITERIA

FIGURE 22 KEY BUYING CRITERIA FOR TOP THREE END USERS

TABLE 12 KEY BUYING CRITERIA FOR TOP THREE END USERS

5.13 REGULATORY LANDSCAPE

5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 16 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.13.1.1 North America

5.13.1.2 Europe

5.13.1.3 Asia Pacific

5.13.1.3.1 China

5.13.1.3.2 India

5.13.1.3.3 Australia

5.13.1.3.4 Japan

5.13.1.4 Middle East and Africa

5.13.1.4.1 UAE

5.13.1.4.2 Saudi Arabia

5.13.1.5 Latin America

5.13.1.5.1 Brazil

5.13.1.5.2 Mexico

6 BLUETOOTH 5.0 MARKET, BY COMPONENT (Page No. - 67)

6.1 INTRODUCTION

FIGURE 23 SERVICES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 17 MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 18 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

6.2 HARDWARE

6.2.1 INCREASE IN DEMAND FOR RELIABLE AND SECURE WIRELESS CONNECTIVITY

6.2.2 HARDWARE: MARKET DRIVERS

TABLE 19 HARDWARE: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 20 HARDWARE: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.3 SYSTEM-ON-CHIP

6.2.4 RF COMPONENTS

6.2.5 DEVELOPMENT BOARDS

6.2.6 SENSORS AND CONTROLS

6.3 SOFTWARE

6.3.1 NEED FOR REAL-TIME MONITORING OF APPLICATIONS AND CELLULAR IOT

6.3.2 SOFTWARE: BLUETOOTH 5.0 MARKET DRIVERS

TABLE 21 SOFTWARE: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 22 SOFTWARE: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.3 SOFTWARE DEVELOPMENT KIT

6.3.4 PROTOCOL STACKS

6.4 SERVICES

6.4.1 BLUETOOTH LE TO DRIVE INNOVATION IN PC/MOBILE PERIPHERAL DEVICES

6.4.2 SERVICES: MARKET DRIVERS

TABLE 23 SERVICES: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 24 SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 25 SERVICES: MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 26 SERVICES: MARKET, BY TYPE, 2022–2027 (USD MILLION)

6.4.3 PROFESSIONAL SERVICES

TABLE 27 PROFESSIONAL SERVICES: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 28 PROFESSIONAL SERVICES: BLUETOOTH 5.0 MARKET, BY REGION, 2022–2027 (USD MILLION)

6.4.3.1 Training and consulting

6.4.3.1.1 Need for use of technology to advise clients on critical issues

6.4.3.2 Deployment and integration

6.4.3.2.1 Deployment of Bluetooth 5.0 to overcome connectivity and transmission challenges

6.4.3.3 Support and maintenance

6.4.3.3.1 Technology to enhance performance analysis

6.4.4 MANAGED SERVICES

6.4.4.1 Optimum network performance through use of Bluetooth services

TABLE 29 MANAGED SERVICES: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 30 MANAGED SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

7 BLUETOOTH 5.0 MARKET, BY APPLICATION (Page No. - 77)

7.1 INTRODUCTION

FIGURE 24 AUDIO STREAMING EXPECTED TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

TABLE 31 MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 32 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

7.2 AUDIO STREAMING

7.2.1 BLUETOOTH 5 TRANSMITS EIGHT TIMES MORE DATA THAN ITS PREDECESSORS

7.2.2 AUDIO STREAMING: MARKET DRIVERS

TABLE 33 AUDIO STREAMING: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 34 AUDIO STREAMING: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.2.3 WIRELESS HEADSETS

7.2.4 WIRELESS SPEAKERS

7.2.5 IN-CAR SYSTEMS

7.3 DATA TRANSFER

7.3.1 INCREASING USE OF WIRELESS BLUETOOTH DATA TRANSFER DEVICES

7.3.2 DATA TRANSFER: BLUETOOTH 5.0 MARKET DRIVERS

TABLE 35 DATA TRANSFER: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 36 DATA TRANSFER: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3.3 SPORTS AND FITNESS

7.3.4 HEALTH AND WELLNESS

7.3.5 PC PERIPHERALS AND ACCESSORIES

7.4 LOCATION SERVICES

7.4.1 SUPPORT FOR VEHICLE-TO-EVERYTHING COMMUNICATIONS TO DRIVE 5G ADOPTION

7.4.2 LOCATION SERVICES: MARKET DRIVERS

TABLE 37 LOCATION SERVICES: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 38 LOCATION SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.4.3 POINT-OF-INTEREST INFORMATION

7.4.4 INDOOR NAVIGATION

7.4.5 ASSET AND ITEM TRACKING

7.4.6 SPACE UTILIZATION

7.5 DEVICE NETWORKS

7.5.1 BLUETOOTH DEVICE NETWORKS CONNECT THOUSANDS OF DEVICES SECURELY

7.5.2 DEVICE NETWORKS: BLUETOOTH 5.0 MARKET DRIVERS

TABLE 39 DEVICE NETWORKS: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 40 DEVICE NETWORKS: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.5.3 CONTROL SYSTEMS

7.5.4 MONITORING SYSTEMS

7.5.5 AUTOMATION SYSTEMS

8 BLUETOOTH 5.0 MARKET, BY END USER (Page No. - 85)

8.1 INTRODUCTION

FIGURE 25 WEARABLES SEGMENT EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 41 MARKET, BY END USER, 2017–2021 (USD MILLION)

TABLE 42 MARKET, BY END USER, 2022–2027 (USD MILLION)

8.2 CONSUMER ELECTRONICS

8.2.1 INCREASING USE OF WIRELESS CONNECTIVITY WITH BLUETOOTH IN CONSUMER ELECTRONICS

8.2.2 CONSUMER ELECTRONICS: MARKET DRIVERS

TABLE 43 CONSUMER ELECTRONICS: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 44 CONSUMER ELECTRONICS: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 WEARABLES

8.3.1 GROWING USE OF WELLNESS DEVICES

8.3.2 WEARABLES: BLUETOOTH 5.0 MARKET DRIVERS

TABLE 45 WEARABLES: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 46 WEARABLES: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.4 INDUSTRIAL MEASUREMENTS AND DIAGNOSTICS

8.4.1 NEED FOR BLUETOOTH PLATFORM FOR WIRELESS MEASUREMENTS

8.4.2 INDUSTRIAL MEASUREMENTS AND DIAGNOSTICS: MARKET DRIVERS

TABLE 47 INDUSTRIAL MEASUREMENTS AND DIAGNOSTICS: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 48 INDUSTRIAL MEASUREMENTS AND DIAGNOSTICS: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.5 HEALTHCARE

8.5.1 USE OF BLUETOOTH TECHNOLOGY IN PATIENT CARE

8.5.2 HEALTHCARE: BLUETOOTH 5.0 MARKET DRIVERS

TABLE 49 HEALTHCARE: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 50 HEALTHCARE: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.6 RETAIL AND LOGISTICS

8.6.1 NEED FOR CONVENIENT RETAIL SPACE NAVIGATION

8.6.2 RETAIL AND LOGISTICS: MARKET DRIVERS

TABLE 51 RETAIL AND LOGISTICS: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 52 RETAIL AND LOGISTICS: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.7 AUTOMOTIVE

8.7.1 GROWING NEED FOR CONVENIENCE

8.7.2 AUTOMOTIVE: MARKET DRIVERS

TABLE 53 AUTOMOTIVE: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 54 AUTOMOTIVE: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.8 SMART HOME/BUILDING

8.8.1 BLUETOOTH DEVICES ENABLE AUTOMATION AND CONTROL, CONDITION MONITORING, AND INDOOR LOCATION SERVICES

8.8.2 SMART HOME/BUILDING: BLUETOOTH 5.0 MARKET DRIVERS

TABLE 55 SMART HOME/BUILDING: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 56 SMART HOME/BUILDING: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.9 OTHER END USERS

8.9.1 OTHER END USERS: MARKET DRIVERS

TABLE 57 OTHER END USERS: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 58 OTHER END USERS: MARKET, BY REGION, 2022–2027 (USD MILLION)

9 BLUETOOTH 5.0 MARKET, BY REGION (Page No. - 96)

9.1 INTRODUCTION

FIGURE 26 MARKET: REGIONAL SNAPSHOT (2022)

TABLE 59 MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 60 MARKET, BY REGION, 2022–2027 (USD MILLION)

9.2 NORTH AMERICA

9.2.1 NORTH AMERICA: PESTLE ANALYSIS

FIGURE 27 NORTH AMERICA: MARKET SNAPSHOT

TABLE 61 NORTH AMERICA: BLUETOOTH 5.0 MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 62 NORTH AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 63 NORTH AMERICA: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 64 NORTH AMERICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 65 NORTH AMERICA: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 66 NORTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 67 NORTH AMERICA: MARKET, BY END USER, 2017–2021 (USD MILLION)

TABLE 68 NORTH AMERICA: MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 69 NORTH AMERICA: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 70 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

9.2.2 US

9.2.2.1 Rising demand for wearable healthcare devices for adults

TABLE 71 US: BLUETOOTH 5.0 MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 72 US: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 73 US: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 74 US: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 75 US: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 76 US: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 77 US: MARKET, BY END USER, 2017–2021 (USD MILLION)

TABLE 78 US: MARKET, BY END USER, 2022–2027 (USD MILLION)

9.2.3 CANADA

9.2.3.1 IoT technology to assist in development of smart cities

TABLE 79 CANADA: BLUETOOTH 5.0 MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 80 CANADA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 81 CANADA: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 82 CANADA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 83 CANADA: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 84 CANADA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 85 CANADA: MARKET, BY END USER, 2017–2021 (USD MILLION)

TABLE 86 CANADA: MARKET, BY END USER, 2022–2027 (USD MILLION)

9.3 EUROPE

9.3.1 EUROPE: PESTLE ANALYSIS

TABLE 87 EUROPE: BLUETOOTH 5.0 MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 88 EUROPE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 89 EUROPE: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 90 EUROPE: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 91 EUROPE: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 92 EUROPE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 93 EUROPE: MARKET, BY END USER, 2017–2021 (USD MILLION)

TABLE 94 EUROPE: MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 95 EUROPE: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 96 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

9.3.2 UK

9.3.2.1 Increased government measures to protect privacy

TABLE 97 UK: BLUETOOTH 5.0 MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 98 UK: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 99 UK: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 100 UK: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 101 UK: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 102 UK: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 103 UK: MARKET, BY END USER, 2017–2021 (USD MILLION)

TABLE 104 UK: MARKET, BY END USER, 2022–2027 (USD MILLION)

9.3.3 GERMANY

9.3.3.1 Healthcare sector to opt for wearable devices

9.3.4 FRANCE

9.3.4.1 France to lead smart home devices market

9.3.5 REST OF EUROPE

9.4 ASIA PACIFIC

9.4.1 ASIA PACIFIC: PESTLE ANALYSIS

FIGURE 28 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 105 ASIA PACIFIC: BLUETOOTH 5.0 MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 106 ASIA PACIFIC: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 107 ASIA PACIFIC: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 108 ASIA PACIFIC: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 109 ASIA PACIFIC: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 110 ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 111 ASIA PACIFIC: MARKET, BY END USER, 2017–2021 (USD MILLION)

TABLE 112 ASIA PACIFIC: MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 113 ASIA PACIFIC: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 114 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

9.4.2 CHINA

9.4.2.1 Country’s dependence on emerging technologies

TABLE 115 CHINA: BLUETOOTH 5.0 MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 116 CHINA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 117 CHINA: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 118 CHINA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 119 CHINA: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 120 CHINA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 121 CHINA: MARKET, BY END USER, 2017–2021 (USD MILLION)

TABLE 122 CHINA: MARKET, BY END USER, 2022–2027 (USD MILLION)

9.4.3 JAPAN

9.4.3.1 Increasing IoT adoption in consumer and industrial sectors

9.4.4 INDIA

9.4.4.1 Increasing adoption of smart devices

9.4.5 REST OF ASIA PACIFIC

9.5 MIDDLE EAST AND AFRICA

9.5.1 MIDDLE EAST AND AFRICA: PESTLE ANALYSIS

TABLE 123 MIDDLE EAST AND AFRICA: BLUETOOTH 5.0 MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 124 MIDDLE EAST AND AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 125 MIDDLE EAST AND AFRICA: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 126 MIDDLE EAST AND AFRICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 127 MIDDLE EAST AND AFRICA: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 128 MIDDLE EAST AND AFRICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 129 MIDDLE EAST AND AFRICA: MARKET, BY END USER, 2017–2021 (USD MILLION)

TABLE 130 MIDDLE EAST AND AFRICA: MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 131 MIDDLE EAST AND AFRICA: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 132 MIDDLE EAST AND AFRICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

9.5.2 UAE

9.5.2.1 Bluetooth helps government access new telemedicine applications

TABLE 133 UAE: BLUETOOTH 5.0 MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 134 UAE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 135 UAE: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 136 UAE: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 137 UAE: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 138 UAE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 139 UAE: MARKET, BY END USER, 2017–2021 (USD MILLION)

TABLE 140 UAE: MARKET, BY END USER, 2022–2027 (USD MILLION)

9.5.3 SOUTH AFRICA

9.5.3.1 Smart city project initiatives, such as Silicon Delta, to increase market growth

9.5.4 REST OF MIDDLE EAST AND AFRICA

9.6 LATIN AMERICA

9.6.1 LATIN AMERICA: PESTLE ANALYSIS

TABLE 141 LATIN AMERICA: MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 142 LATIN AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 143 LATIN AMERICA: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 144 LATIN AMERICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 145 LATIN AMERICA: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 146 LATIN AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 147 LATIN AMERICA: MARKET, BY END USER, 2017–2021 (USD MILLION)

TABLE 148 LATIN AMERICA: MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 149 LATIN AMERICA: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 150 LATIN AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

9.6.2 BRAZIL

9.6.2.1 Growing use of smart medical devices

TABLE 151 BRAZIL: BLUETOOTH 5.0 MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 152 BRAZIL: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 153 BRAZIL: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 154 BRAZIL: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 155 BRAZIL: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 156 BRAZIL: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 157 BRAZIL: MARKET, BY END USER, 2017–2021 (USD MILLION)

TABLE 158 BRAZIL: MARKET, BY END USER, 2022–2027 (USD MILLION)

9.6.3 MEXICO

9.6.3.1 Rising demand for smartphones and wearable electronics

9.6.4 REST OF LATIN AMERICA

10 COMPETITIVE LANDSCAPE (Page No. - 140)

10.1 INTRODUCTION

10.2 STRATEGIES ADOPTED BY KEY PLAYERS

TABLE 159 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN BLUETOOTH 5.0 MARKET

10.3 MARKET SHARE ANALYSIS OF TOP PLAYERS

TABLE 160 MARKET: DEGREE OF COMPETITION

10.4 HISTORICAL REVENUE ANALYSIS

FIGURE 29 HISTORICAL REVENUE ANALYSIS OF LEADING PLAYERS, 2019–2021 (USD MILLION)

10.5 COMPETITIVE BENCHMARKING

TABLE 161 MARKET: DETAILED LIST OF KEY STARTUP/SMES

TABLE 162 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

TABLE 163 MARKET: COMPETITIVE BENCHMARKING OF MAJOR PLAYERS

10.6 COMPANY EVALUATION QUADRANT

10.6.1 STARS

10.6.2 EMERGING LEADERS

10.6.3 PERVASIVE PLAYERS

10.6.4 PARTICIPANTS

FIGURE 30 KEY PLAYERS OF BLUETOOTH 5.0 MARKET, COMPANY EVALUATION MATRIX, 2022

10.7 STARTUP/SME EVALUATION QUADRANT

10.7.1 PROGRESSIVE COMPANIES

10.7.2 RESPONSIVE COMPANIES

10.7.3 DYNAMIC COMPANIES

10.7.4 STARTING BLOCKS

FIGURE 31 STARTUP/SME MARKET EVALUATION MATRIX, 2022

10.8 COMPETITIVE SCENARIO

10.8.1 PRODUCT LAUNCHES

TABLE 164 PRODUCT LAUNCHES, 2019–2022

10.8.2 DEALS

TABLE 165 DEALS, 2020–2022

11 COMPANY PROFILES (Page No. - 151)

11.1 MAJOR PLAYERS

(Business Overview, Products, Solutions, Services offered, Recent Developments, MnM View)*

11.1.1 QUALCOMM

TABLE 166 QUALCOMM: BUSINESS OVERVIEW

FIGURE 32 QUALCOMM: COMPANY SNAPSHOT

TABLE 167 QUALCOMM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 168 QUALCOMM: PRODUCT LAUNCHES

TABLE 169 QUALCOMM: DEALS

11.1.2 NORDIC SEMICONDUCTOR

TABLE 170 NORDIC SEMICONDUCTOR: BUSINESS OVERVIEW

FIGURE 33 NORDIC SEMICONDUCTOR: COMPANY SNAPSHOT

TABLE 171 NORDIC SEMICONDUCTOR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 172 NORDIC SEMICONDUCTOR: PRODUCT LAUNCHES

TABLE 173 NORDIC SEMICONDUCTOR: DEALS

11.1.3 MEDIATEK

TABLE 174 MEDIATEK: BUSINESS OVERVIEW

FIGURE 34 MEDIATEK: COMPANY SNAPSHOT

TABLE 175 MEDIATEK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 176 MEDIATEK: PRODUCT LAUNCHES

11.1.4 STMICROELECTRONICS

TABLE 177 STMICROELECTRONICS: BUSINESS OVERVIEW

FIGURE 35 STMICROELECTRONICS: COMPANY SNAPSHOT

TABLE 178 STMICROELECTRONICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 179 STMICROELECTRONICS: PRODUCT LAUNCHES

TABLE 180 STMICROELECTRONICS: DEALS

11.1.5 NXP SEMICONDUCTORS

TABLE 181 NXP SEMICONDUCTORS: BUSINESS OVERVIEW

FIGURE 36 NXP SEMICONDUCTORS: COMPANY SNAPSHOT

TABLE 182 NXP SEMICONDUCTORS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 183 NXP SEMICONDUCTORS: DEALS

11.1.6 MICROCHIP TECHNOLOGY

TABLE 184 MICROCHIP TECHNOLOGY: BUSINESS OVERVIEW

FIGURE 37 MICROCHIP TECHNOLOGY: COMPANY SNAPSHOT

TABLE 185 MICROCHIP TECHNOLOGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 186 MICROCHIP TECHNOLOGY: DEALS

11.1.7 ON SEMICONDUCTOR

TABLE 187 ON SEMICONDUCTOR: BUSINESS OVERVIEW

FIGURE 38 ON SEMICONDUCTOR: COMPANY SNAPSHOT

TABLE 188 ON SEMICONDUCTOR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 189 ON SEMICONDUCTOR: DEALS

11.1.8 TEXAS INSTRUMENTS

TABLE 190 TEXAS INSTRUMENTS: BUSINESS OVERVIEW

FIGURE 39 TEXAS INSTRUMENTS: COMPANY SNAPSHOT

TABLE 191 TEXAS INSTRUMENTS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 192 TEXAS INSTRUMENTS: PRODUCT LAUNCHES

TABLE 193 TEXAS INSTRUMENTS: DEALS

11.1.9 SYNOPSYS

TABLE 194 SYNOPSYS: BUSINESS OVERVIEW

FIGURE 40 SYNOPSYS: COMPANY SNAPSHOT

TABLE 195 SYNOPSYS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 196 SYNOPSYS: DEALS

11.1.10 QORVO

TABLE 197 QORVO: BUSINESS OVERVIEW

FIGURE 41 QORVO: COMPANY SNAPSHOT

TABLE 198 QORVO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 199 QORVO: DEALS

11.1.11 INFINEON TECHNOLOGIES

TABLE 200 INFINEON TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 42 INFINEON TECHNOLOGIES: COMPANY SNAPSHOT

TABLE 201 INFINEON TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 202 INFINEON TECHNOLOGIES: PRODUCT LAUNCHES

TABLE 203 INFINEON TECHNOLOGIES: DEALS

11.1.12 SILICON LABS

TABLE 204 SILICON LABS: BUSINESS OVERVIEW

FIGURE 43 SILICON LABS: COMPANY SNAPSHOT

TABLE 205 SILICON LABS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 206 SILICON LABS: PRODUCT LAUNCHES

TABLE 207 SILICON LABS: DEALS

11.1.13 REALTEK

TABLE 208 REALTEK: BUSINESS OVERVIEW

FIGURE 44 REALTEK: COMPANY SNAPSHOT

TABLE 209 REALTEK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 210 REALTEK: PRODUCT LAUNCHES

11.1.14 BROADCOM

TABLE 211 BROADCOM: BUSINESS OVERVIEW

FIGURE 45 BROADCOM: COMPANY SNAPSHOT

TABLE 212 BROADCOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 213 BROADCOM: PRODUCT LAUNCHES

TABLE 214 BROADCOM: DEALS

11.1.15 RENESAS

TABLE 215 RENESAS: BUSINESS OVERVIEW

FIGURE 46 RENESAS: COMPANY SNAPSHOT

TABLE 216 RENESAS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 217 RENESAS: PRODUCT LAUNCHES

TABLE 218 RENESAS: DEALS

11.1.16 GOODIX TECHNOLOGY

TABLE 219 GOODIX TECHNOLOGY: BUSINESS OVERVIEW

FIGURE 47 GOODIX TECHNOLOGY: COMPANY SNAPSHOT

TABLE 220 GOODIX TECHNOLOGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 221 GOODIX TECHNOLOGY: PRODUCT LAUNCHES

TABLE 222 GOODIX TECHNOLOGY: DEALS

11.1.17 TAIYO YUDEN

*Details on Business Overview, Products, Solutions, Services offered Recent Developments, MnM View might not be captured in case of unlisted companies.

11.2 STARTUP/SMES

11.2.1 TELIT

11.2.2 ESPRESSIF SYSTEMS

11.2.3 FEASYCOM

11.2.4 ATMOSIC TECHNOLOGIES

11.2.5 CEVA

11.2.6 LAIRD CONNECTIVITY

11.2.7 VIRSCIENT

11.2.8 INVENTEK SYSTEMS

11.2.9 INSIGHT SIP

12 ADJACENT/RELATED MARKETS (Page No. - 213)

12.1 INTRODUCTION

12.2 INDOOR LOCATION MARKET

12.2.1 INDOOR LOCATION MARKET: MARKET DEFINITION

12.2.2 INDOOR LOCATION MARKET: MARKET OVERVIEW

12.2.3 INDOOR LOCATION MARKET, BY COMPONENT

TABLE 223 INDOOR LOCATION MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 224 INDOOR LOCATION MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 225 SOLUTIONS: INDOOR LOCATION MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 226 SOLUTIONS: INDOOR LOCATION MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 227 INDOOR TRACKING: INDOOR LOCATION MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 228 INDOOR TRACKING: INDOOR LOCATION MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 229 INDOOR LOCATION MARKET, BY SERVICE, 2017–2020 (USD MILLION)

TABLE 230 INDOOR LOCATION MARKET, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 231 PROFESSIONAL SERVICES: INDOOR LOCATION MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 232 PROFESSIONAL SERVICES: INDOOR LOCATION MARKET, BY TYPE, 2021–2026 (USD MILLION)

12.2.4 INDOOR LOCATION MARKET, BY ORGANIZATION SIZE

TABLE 233 INDOOR LOCATION MARKET, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 234 INDOOR LOCATION MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

12.2.5 INDOOR LOCATION MARKET, BY TECHNOLOGY

TABLE 235 INDOOR LOCATION MARKET, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 236 INDOOR LOCATION MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

12.2.6 INDOOR LOCATION MARKET, BY DEPLOYMENT MODE

TABLE 237 INDOOR LOCATION MARKET, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 238 INDOOR LOCATION MARKET, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

12.2.7 INDOOR LOCATION MARKET, BY APPLICATION

TABLE 239 INDOOR LOCATION MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 240 INDOOR LOCATION MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

12.2.8 INDOOR LOCATION MARKET, BY VERTICAL

TABLE 241 INDOOR LOCATION MARKET, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 242 INDOOR LOCATION MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

12.2.9 INDOOR LOCATION MARKET, BY REGION

TABLE 243 INDOOR LOCATION MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 244 INDOOR LOCATION MARKET, BY REGION, 2021–2026 (USD MILLION)

12.3 SMART BUILDINGS MARKET

12.3.1 SMART BUILDINGS MARKET: MARKET DEFINITION

12.3.2 SMART BUILDINGS MARKET: MARKET OVERVIEW

12.3.3 SMART BUILDINGS MARKET, BY COMPONENT

TABLE 245 SMART BUILDINGS MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 246 SMART BUILDINGS MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 247 SERVICES: SMART BUILDINGS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 248 SERVICES: SMART BUILDING MARKET, BY TYPE, 2021–2026 (USD MILLION)

12.3.4 SMART BUILDINGS MARKET, BY SOLUTION

TABLE 249 SMART BUILDINGS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 250 SMART BUILDINGS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 251 INFRASTRUCTURE MANAGEMENT: SMART BUILDINGS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 252 INFRASTRUCTURE MANAGEMENT: SMART BUILDINGS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 253 SAFETY AND SECURITY MANAGEMENT: SMART BUILDINGS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 254 SAFETY AND SECURITY MANAGEMENT: SMART BUILDINGS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 255 ENERGY MANAGEMENT: SMART BUILDINGS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 256 ENERGY MANAGEMENT: SMART BUILDINGS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 257 NETWORK MANAGEMENT: SMART BUILDINGS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 258 NETWORK MANAGEMENT: SMART BUILDINGS MARKET, BY TYPE, 2021–2026 (USD MILLION)

12.3.5 SMART BUILDINGS MARKET, BY BUILDING TYPE

TABLE 259 SMART BUILDINGS MARKET, BY BUILDING TYPE, 2017–2020 (USD MILLION)

TABLE 260 SMART BUILDINGS MARKET, BY BUILDING TYPE, 2021–2026 (USD MILLION)

12.3.6 SMART BUILDINGS MARKET, BY REGION

TABLE 261 SMART BUILDINGS MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 262 SMART BUILDINGS MARKET, BY REGION, 2021–2026 (USD MILLION)

13 APPENDIX (Page No. - 228)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 CUSTOMIZATION OPTIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

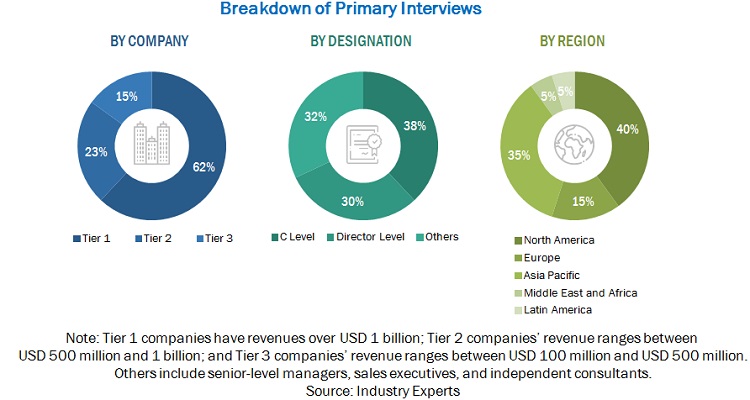

The research study involved the use of extensive secondary sources, directories, and databases, such as D&B Hoovers and Bloomberg Businessweek, to identify and collect information useful for a technical, market-oriented, and commercial study of the global Bluetooth 5.0 market. The primary sources included industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all segments of the industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess the market’s prospects.

Secondary Research

The market size of the companies offering Bluetooth 5.0 to various industries was arrived at on the basis of the secondary data available through paid and unpaid sources and by analyzing the product portfolios of major companies in the ecosystem and rating the companies based on their performance and quality. In the secondary research process, various sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports of Qualcomm; press releases of various companies, such as Nordic Semiconductor, Broadcom, and STMicroelectronics; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases, such as International Journal of Engineering Trends and Technology and Springer Nature.

Secondary research was used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives, all of which were further validated by primary sources.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), Managing Directors (MDs), technology and innovation directors, and related key executives from various key companies and organizations operating in the Bluetooth 5.0 market.

Primary interviews were conducted to gather insights, such as market statistics, data of revenue collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Demand-side stakeholders, such as Chief Information Officers (CIOs), Chief Finance Officers (CFOs), Chief Strategy Officers (CSOs), and the installation team of end users who use Bluetooth 5.0, were interviewed to understand buyers’ perspectives on suppliers, products, service providers, and their current usage of Bluetooth 5.0, which is expected to affect the overall Bluetooth 5.0 market growth.

Breakdown of Primary Interviews

To know about the assumptions considered for the study, download the pdf brochure

Bluetooth 5.0 Market Size Estimation

In the market engineering process, the top-down and bottom-up approaches were used along with multiple data triangulation methods to estimate and validate the size of the Bluetooth 5.0 market and other dependent submarkets. Key market players were identified through secondary research, and their market share in the targeted regions was determined with the help of primary and secondary research. This entire research methodology included the study of annual and financial presentations of the top market players and interviews with experts for key insights (quantitative and qualitative).

The percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary research. All the possible parameters that affect the market were verified in detail with the help of primary sources and analyzed to obtain quantitative and qualitative data. This data was supplemented with detailed inputs and analysis from MarketsandMarkets and presented in the report.

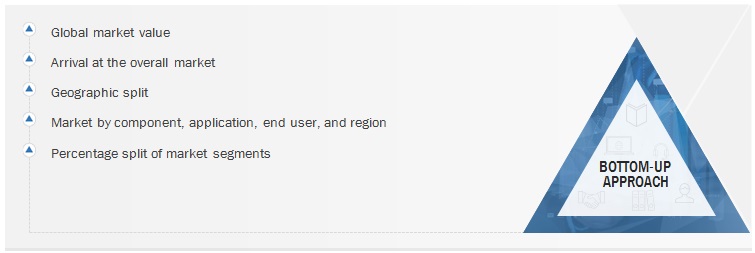

Bluetooth 5.0 Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size, the Bluetooth 5.0 market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were used, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Report Objectives

- To determine, segment, and forecast the global Bluetooth 5.0 market by component, application, end user, and region, in terms of value

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific, Latin America, Middle East and Africa

- To provide detailed information about the major factors (drivers, opportunities, threats, and challenges) influencing the growth of the market

- To study the complete value chain and related industry segments and perform a value chain analysis of the market landscape

- To strategically analyze macro and micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze industry trends, pricing data, and patents and innovations related to the market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the Bluetooth 5.0 market

- To profile key players in the market and comprehensively analyze their market share/ranking and core competencies

- To track and analyze competitive developments, such as mergers and acquisitions, new product launches and developments, partnerships, agreements, and collaborations, business expansions, and research and development (R&D) activities.

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Bluetooth 5.0 Market