Blood Flow Measurement Devices Market by Product (Ultrasound (Transit Time Flow Meter), Laser Doppler), Application (Invasive (CABG, Microvascular Surgery), Non-invasive (Cardiovascular, Gastroenterology & Tumor Monitoring)) - Global Forecast to 2021

[126 Pages Report] The blood flow measurement devices market is projected to reach USD 533.0 Million by 2021 from USD 343.6 Million in 2016, growing at a CAGR of 9.2% in the next five years (2016 to 2021). The growth of the overall market can be contributed to the growing prevalence of cardiovascular diseases and diabetes coupled with rising geriatric population, technological advancements, and the influx of VC funding. In the coming years, the market is expected to witness the highest growth rate in the Asia-Pacific region. The high growth in the region can be attributed to the growing focus of industry players in the region, increasing geriatric population, and growing prevalence of non-communicable diseases.

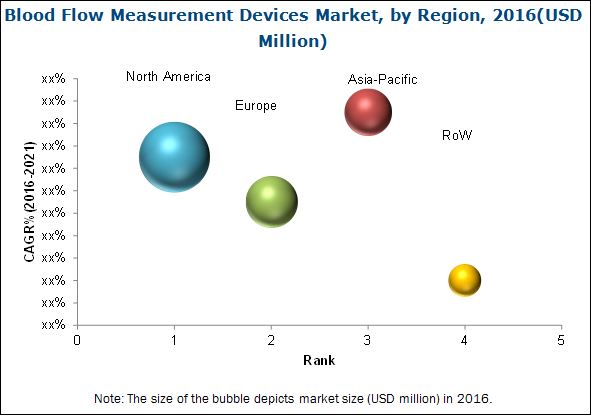

In 2016, North America accounted for the largest share of the global blood flow measurement devices market. The large share of this regional segment can be attributed to factors such as growing geriatric population and prevalence of cardiovascular diseases in the U.S., increased prevalence of hypertension in the U.S., regulatory requirements coupled with a favorable reimbursement scenario, and increased funding in the U.S. Technological advancements and the increasing number of organ transplant procedures are also likely to support market growth in the region.

On the basis of product, the market is segmented into ultrasound and laser Doppler. In 2016, the ultrasound segment accounted for the largest share of the global blood flow measurement device market. Furthermore, the ultrasound market is segmented into ultrasound Doppler and transit-time Flow Meters (TTFM). In 2016, the ultrasound Doppler segment accounted for the largest share of the global ultrasound market and is expected to grow at the highest CAGR during the forecast period.

On the basis of application, the blood flow measurement devices market is categorized into non-invasive applications and invasive applications. Non-invasive applications are further segmented into cardiovascular disease, gastroenterology, diabetes, tumor monitoring, and others (dermatology and intracranial pressure monitoring in brain injury). In 2016, cardiovascular disease accounted for the largest share of the global blood flow measurement device market. Similarly, invasive applications are further categorized into microvascular surgery, coronary arterial bypass graft (CABG), and others (organ transplants and reconstructive surgery). In 2016, CABG segment accounted for the largest share of the global market.

The key players in the blood flow measurement devices market include Transonic Systems, Inc. (U.S.), Cook Medical, Inc. (U.S.), Medistim ASA (Norway), Compumedics Ltd. (Australia), ADInstruments (Australia), Deltex Medical Group plc (U.K.), BIOPAC Systems, Inc. (U.S.), Atys Medical (France), Moor Instruments Ltd. (U.K.), Perimed AB (Sweden), and SONOTEC Ultraschallsensorik Halle GmbH (Germany).

Stakeholders of the Blood Flow Measurement Devices Market

- Blood flow measurement device manufacturers

- Suppliers and distributors of blood flow measurement devices

- Authorities framing reimbursement policies for the use of blood flow measurement devices and disposables

- Catheterization laboratories

- Venture capitalists

- Medical research institutes

- Healthcare institutions (hospitals, academic medical centers, and outpatient clinics)

- Medical device companies

- Health insurance players

- Research and consulting firms

To know about the assumptions considered for the study, download the pdf brochure

Scope of the Report:

This research report categorizes the global market into the following segments:

Blood Flow Measurement Devices Market, by Product

-

Ultrasound

- Ultrasound Doppler

- Transit-time Flow Meters (TTFM)

- Laser Doppler

Blood Flow Measurement Devices Market, by Application

-

Non-invasive

- Cardiovascular Disease

- Diabetes

- Tumor Monitoring

- Gastroenterology

- Others (Dermatology and Intracranial Pressure Monitoring in Brain Injury)

-

Invasive

- CABG

- Microvascular surgery

- Others (Reconstructive Surgery and Organ Transplantation)

Blood Flow Measurement Devices Market, by Region

-

North America

- U.S.

- Canada

-

Europe

- E-5

- RoE

- Asia-Pacific

- Rest of the World (RoW)

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization option is available for the report:

Portfolio Assessment

Product Matrix, which gives a detailed comparison of the product portfolios of the top three companies in the market.

The blood flow measurement devices market is projected to reach USD 533.0 Million by 2021 from 343.6 Million in 2016, growing at a CAGR of 9.2% in the next five years (2016 to 2021). The growth of the overall market can be contributed to the growing prevalence of cardiovascular diseases and diabetes coupled with rising geriatric population, technological advancements, and the influx of VC funding.

The global blood flow measurement devices market is categorized on the basis of product, application, and region.

Based on application, the market is categorized into non-invasive applications and invasive applications. Invasive applications are further segmented into coronary arterial bypass graft (CABG), microvascular surgery, and others (organ transplants and reconstructive surgery). The CABG segment accounted for the largest share of the global market in 2016. The growth in this segment can be attributed to a large number of CABG surgeries performed worldwide. Similarly, non-invasive applications are further segmented into cardiovascular disease, diabetes, tumor monitoring, gastroenterology, and others (dermatology and intracranial pressure monitoring in brain injury). In 2016, cardiovascular disease accounted for the largest share of the global market, by non-invasive applications.

Based on product, the market is segmented into ultrasound and laser Doppler. The ultrasound segment accounted for the largest share of the global blood flow measurement devices market. Furthermore, the ultrasound market is segmented into ultrasound Doppler and transit-time flow meters (TTFM). In 2016, the ultrasound Doppler segment accounted for the largest share of the global ultrasound market and is expected to grow at the highest CAGR during the forecast period.

In 2016, North America accounted for the largest share of the global market. The large share of this region can be attributed to the rising geriatric population and prevalence of cardiovascular diseases, increased prevalence of hypertension, and increased funding. Similarly, technological advancements and the rising number of organ transplants are likely to boost the market for blood flow measurement devices in North America. In the coming years, the market is expected to witness the highest growth rate in the Asia-Pacific region. The high growth in the region can be attributed to the growing prevalence of non-communicable diseases, increasing geriatric population, and growing focus of industry players in the region.

The major players in the global Blood Flow Measurement Devices Market were Compumedics Ltd. (Australia), Transonic Systems, Inc. (U.S.), Cook Medical, Inc. (U.S.), Perimed AB (Sweden), Medistim ASA (Norway), ADInstruments (Australia), Deltex Medical Group plc (U.K.), BIOPAC Systems, Inc. (U.S.), Atys Medical (France), SONOTEC Ultraschallsensorik Halle GmbH (Germany), and Moor Instruments Ltd. (U.K.).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Methodology Steps

2.1.1 Secondary and Primary Research Methodology

2.1.1.1 Secondary Research

2.1.1.2 Primary Research

2.2 Market Size Estimation Methodology

2.3 Market Forecast Methodology

2.4 Market Data Validation and Triangulation

2.5 Assumptions for the Study

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 32)

4.1 Blood Flow Measurement Devices: Market Overview

4.2 Regional Snapshot: Market, By Product (2016)

4.3 Global Market, By Application, 2016 vs 2021 (USD Million)

4.4 Geographic Snapshot of the Global Market

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Prevalence of Cardiovascular Disease and Diabetes Coupled With Rising Geriatric Population

5.2.1.2 Technological Advancements

5.2.1.3 Influx of VC Funding

5.2.2 Restraints

5.2.2.1 Development of Alternative Methods to Treat Cardiovascular Diseases is Restraining the Market Growth for Transit-Time Flow Meters

5.2.3 Opportunities

5.2.3.1 Highly Unpenetrated Market for Transit-Time Blood Flow Meters

5.2.3.2 Emerging Markets Across India and China

5.2.4 Challenges

5.2.4.1 Dearth of Skilled Professionals

6 Blood Flow Measurement Devices Market, By Product (Page No. - 41)

6.1 Introduction

6.2 Ultrasound

6.2.1 Ultrasound Doppler

6.2.2 Transit-Time Flow Meters

6.3 Laser Doppler

7 Blood Flow Measurement Devices Market, By Application (Page No. - 47)

7.1 Introduction

7.2 Non-Invasive Applications

7.2.1 Cardiovascular Disease

7.2.2 Diabetes

7.2.3 Gastroenterology

7.2.4 Tumor Monitoring

7.2.5 Other Non-Invasive Applications

7.3 Invasive Applications

7.3.1 CABG

7.3.2 Microvascular Surgery

7.3.3 Other Invasive Applications

8 Blood Flow Measurement Devices Market, By Region (Page No. - 58)

8.1 Introduction

8.2 North America

8.2.1 U.S.

8.2.1.1 Rapidly Growing Geriatric Population and the Subsequent Increase in the Prevalence of Cardiovascular Diseases

8.2.1.2 Increasing Prevalence of Hypertension

8.2.1.3 Regulatory Requirements Coupled With A Favorable Reimbursement Scenario

8.2.1.4 Increased Funding for Technological Advancement

8.2.2 Canada

8.2.2.1 Technological Advances

8.2.2.2 Increasing Number of Organ Transplant Procedures

8.3 Europe

8.3.1 Europe-5

8.3.1.1 Growing Focus of Industry Players

8.3.1.2 Increasing Prevalence of Cancer in Europe-5

8.3.2 Rest of Europe

8.3.2.1 High Diabetes Prevalence in European Countries

8.4 Asia-Pacific

8.4.1 Growing Focus of Industry Players

8.4.2 Increasing Geriatric Population and Subsequent Increase in Incidence of Non-Communicable Diseases in Asia-Pacific

8.4.3 Favorable Reimbursement Environment in Japan

8.5 Rest of the World

8.5.1 Latin America

8.5.2 The Middle East

8.5.3 Africa

9 Competitive Landscape (Page No. - 89)

9.1 Overview

9.2 Comparative Assessment of Key Players in the Market (2013–2017)

9.3 Competitive Situation and Trends

9.3.1 Product Launches, Product Enhancements, and Product Extensions

9.3.2 Collaborations, Agreements, Contracts, Joint Ventures, and Partnerships

9.3.3 Expansions

9.3.4 Other Strategies

10 Company Profiles (Page No. - 95)

10.1 Introduction

(Overview, Products and Services, Financials, Strategy & Development)*

10.2 Medistim ASA

10.3 Cook Medical, Inc.

10.4 Getinge Group

10.5 Deltex Medical Group PLC

10.6 Transonic Systems, Inc.

10.7 Compumedics Limited

10.8 Adinstruments

10.9 Sonotec Ultraschallsensorik Halle GmbH

10.10 Biopac Systems Inc.

10.11 Moor Instruments Ltd.

10.12 ATYS Medical

10.13 Perimed AB

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 116)

11.1 Discussion Guide

11.2 Other Developments (2013–2016)

11.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

11.4 Introducing RT: Real-Time Market Intelligence

11.5 Available Customizations

11.6 Related Reports

11.7 Author Details

List of Tables (70 Tables)

Table 1 Countries With the Highest Mortality Rate From Peripheral Vascular Disease (2013)

Table 2 Top 5 Countries With the Highest Number of Diabetics (Aged 20–79 Years), 2015 vs 2040

Table 3 Indicative List of Companies That Received Venture Capitalist Funding for the Blood Flow Measurement and Monitoring Segment

Table 4 Global Market Size, By Product, 2014–2021 (USD Million)

Table 5 Ultrasound Blood Flow Measurement Devices Market Size, By Type, 2014–2021 (USD Million)

Table 6 Ultrasound Market Size, By Region, 2014–2021 (USD Million)

Table 7 Ultrasound Doppler Market Size, By Region, 2014–2021 (USD Million)

Table 8 Transit-Time Flow Meters Market Size, By Region, 2014–2021 (USD Million)

Table 9 Laser Doppler Blood Flow Measuring Devices Market Size, By Region, 2014–2021 (USD Million)

Table 10 Global Market Size, By Application, 2014–2021 (USD Million)

Table 11 Market Size for Non-Invasive Applications, By Type, 2014–2021 (USD Million)

Table 12 Market Size for Non-Invasive Applications, By Region, 2014–2021 (USD Million)

Table 13 Cardiovascular Disease Applications Market Size, By Region, 2014–2021 (USD Million)

Table 14 Diabetes Applications Market Size, By Region, 2014–2021 (USD Million)

Table 15 Gastroenterology Applications Market Size, By Region, 2014–2021 (USD Million)

Table 16 Tumor Monitoring Applications Market Size, By Region, 2014–2021 (USD Million)

Table 17 Other Non-Invasive Applications Market Size, By Region, 2014–2021 (USD Million)

Table 18 Market Size for Invasive Applications, By Type, 2014–2021 (USD Million)

Table 19 Market Size for Invasive Applications, By Region, 2014–2021 (USD Million)

Table 20 CABG Surgery Applications Market Size, By Region, 2014–2021 (USD Million)

Table 21 Microvascular Surgery Applications Market, By Region, 2014–2021 (USD Million)

Table 22 Other Invasive Applications Market, By Region, 2014–2021 (USD Million)

Table 23 Market Size, By Region, 2014–2021 (USD Million)

Table 24 North America: Market Size, By Country, 2014–2021 (USD Million)

Table 25 North America: Market Size, By Product, 2014–2021 (USD Million)

Table 26 North America: Ultrasound Blood Flow Measurement Devices Market Size, By Type, 2014–2021 (USD Million)

Table 27 North America: Market Size, By Application, 2014–2021 (USD Million)

Table 28 North America: Market Size for Non-Invasive Applications, By Type, 2014–2021 (USD Million)

Table 29 North America: Market Size for Invasive Applications, By Type, 2014–2021 (USD Million)

Table 30 U.S.: Market Size, By Product, 2014–2021 (USD Million)

Table 31 U.S.: Ultrasound Blood Flow Measurement Devices Market Size, By Type, 2014–2021 (USD Million)

Table 32 U.S.: Market Size, By Application, 2014–2021 (USD Million)

Table 33 U.S.: Market Size for Non-Invasive Applications, By Type, 2014–2021 (USD Million)

Table 34 U.S.: Market Size for Invasive Applications, By Type, 2014–2021 (USD Million)

Table 35 Organ Transplant Procedures Performed in Canada (2012–2014)

Table 36 Canada: Market Size, By Product, 2014–2021 (USD Million)

Table 37 Canada: Ultrasound Blood Flow Measurement Devices Market Size, By Type, 2014–2021 (USD Million)

Table 38 Canada: Market Size, By Application, 2014–2021 (USD Million)

Table 39 Canada: Market Size for Non-Invasive Applications, By Type, 2014–2021 (USD Million)

Table 40 Canada: Market Size for Invasive Applications, By Type, 2014–2021 (USD Million)

Table 41 Europe: Market Size, By Region, 2014–2021 (USD Million)

Table 42 Europe: Market Size, By Product, 2014–2021 (USD Million)

Table 43 Europe: Ultrasound Blood Flow Measurement Devices Market Size, By Type, 2014–2021 (USD Million)

Table 44 Europe: Market Size, By Application, 2014–2021 (USD Million)

Table 45 Europe: Market Size for Non-Invasive Applications, By Type, 2014–2021 (USD Million)

Table 46 Europe: Market Size for Invasive Applications, By Type, 2014–2021 (USD Million)

Table 47 Europe-5: Market Size, By Product, 2014–2021 (USD Million)

Table 48 Europe-5: Ultrasound Blood Flow Measurement Devices Market Size, By Type, 2014–2021 (USD Million)

Table 49 Europe-5: Market Size, By Application, 2014–2021 (USD Million)

Table 50 Europe-5: Market Size for Non-Invasive Applications, By Type, 2014–2021 (USD Million)

Table 51 Europe-5: Market Size for Invasive Applications, By Type, 2014–2021 (USD Million)

Table 52 RoE: Market Size, By Product, 2014–2021 (USD Million)

Table 53 RoE: Ultrasound Blood Flow Measurement Devices Market Size, By Type, 2014–2021 (USD Million)

Table 54 RoE: Market Size, By Application, 2014–2021 (USD Million)

Table 55 RoE: Market Size for Non-Invasive Applications, By Type, 2014–2021 (USD Million)

Table 56 RoE: Market Size for Invasive Applications, By Type, 2014–2021 (USD Million)

Table 57 Asia-Pacific: Market Size, By Product, 2014–2021 (USD Million)

Table 58 Asia-Pacific: Ultrasound Blood Flow Measurement Devices Market Size, By Type, 2014–2021 (USD Million)

Table 59 Asia-Pacific: Market Size, By Application, 2014–2021 (USD Million)

Table 60 Asia-Pacific: Market Size for Non-Invasive Applications, By Type 2014–2021 (USD Million)

Table 61 Asia-Pacific: Market Size for Invasive Applications, By Type, 2014–2021 (USD Million)

Table 62 RoW: Market Size, By Product, 2014–2021 (USD Million)

Table 63 RoW: Ultrasound Blood Flow Measurement Devices Market Size, By Type, 2014–2021 (USD Million)

Table 64 RoW: Market Size, By Application, 2014–2021 (USD Million)

Table 65 RoW: Market Size for Non-Invasive Applications, By Type, 2014–2021 (USD Million)

Table 66 RoW: Market Size for Invasive Applications, By Type, 2014–2021 (USD Million)

Table 67 Product Launches, Product Enhancements, and Product Extensions, By Company (2013–2017)

Table 68 Collaborations, Agreements, Contracts, Joint Ventures, and Partnerships, 2013–2017

Table 69 Expansions and Market Development (2013–2017)

Table 70 Other Strategies (2013–2017)

List of Figures (42 Figures)

Figure 1 Research Methodology: Global Market

Figure 2 Key Data From Secondary Sources

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 4 Sampling Frame: Primary Research

Figure 5 Key Data From Primary Sources

Figure 6 Key Insights From Primary Sources

Figure 7 Key Industry Insights

Figure 8 Market Size Estimation Methodology: Bottom-Up Approach

Figure 9 Market Size Estimation Methodology: Top-Down Approach

Figure 10 Research Design

Figure 11 Data Triangulation Methodology

Figure 12 Global Market Share, By Application (2016)

Figure 13 Global Market, By Product (2016 vs 2021)

Figure 14 Global Ultrasound Blood Flow Measurement Devices Market, By Type (2016 vs 2021)

Figure 15 Asia-Pacific Market to Witness the Highest Growth During the Forecast Period

Figure 16 Growing Prevalence of Cvd is A Key Market Driver for

Figure 17 Ultrasound Products Dominated the Global Market in 2016

Figure 18 Non-Invasive Applications to Dominate the Market During the Forecast Period

Figure 19 Asia-Pacific to Witness the Highest Growth in the Global Market From 2016 to 2021

Figure 20 Market: Drivers, Restraints, Opportunities, and Challenges

Figure 21 Ultrasound Products Commanded the Largest Share of the Market in 2016

Figure 22 Ultrasound Doppler to Dominate the Ultrasound Blood Flow Measurement Devices Market in 2016

Figure 23 Non-Invasive Applications to Account for the Largest Share of the Market in 2016

Figure 24 Cardiovascular Disease Segment to Account for the Largest Share in 2016

Figure 25 Coronary Arterial Bypass Graft Application Segment to Account for the Largest Share in 2016

Figure 26 North America Dominated the Market in 2016

Figure 27 North America: Market Snapshot

Figure 28 Europe: Market Snapshot

Figure 29 Europe: Number of Diabetics, By Country, 2015 (Million Cases)

Figure 30 Asia-Pacific: Market Snapshot

Figure 31 RoW: Market Snapshot

Figure 32 Key Developments of the Prominent Players in the Market (2013–2017)

Figure 33 Battle for Market Share: Product Launches, Product Enhancements, and Product Extensions Formed the Key Growth Strategy

Figure 34 Product Launches, Product Enhancements, and Product Extensions, By Company (2013–2017)

Figure 35 Collaborations, Agreements, Contracts, Joint Ventures, and Partnerships, By Company (2013–2017)

Figure 36 Expansions, By Company (2013-2017)

Figure 37 Key Players Focusing on Other Strategies, By Company (2013–2017)

Figure 38 Geographic Revenue Mix of the Top 4 Market Players

Figure 39 Medistim Group: Company Snapshot (2015)

Figure 40 Getinge Group: Company Snapshot (2015)

Figure 41 Deltex Medical Group PLC: Company Snapshot (2015)

Figure 42 Compumedics Limited: Company Snapshot (2016)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Blood Flow Measurement Devices Market