Blockchain Technology in Healthcare Market by Application (Supply Chain Management, Clinical Data Exchange & Interoperability, Claims Adjudication and Billing), End User (Pharmaceutical Companies, Healthcare Payers, Providers) - Global Forecast to 2023

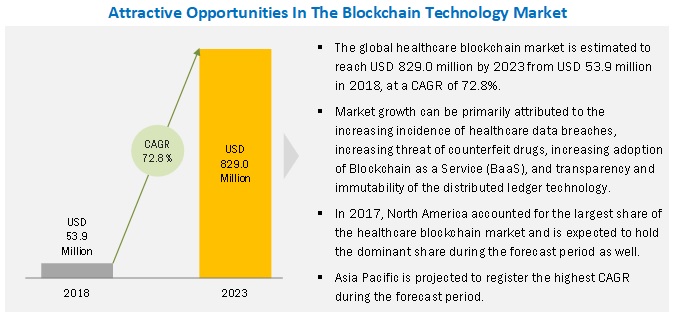

The global healthcare blockchain market is projected to reach USD 829.0 million by 2023, at a CAGR of 72.8%. The blockchain technology took the world by storm by its revolutionary work in data transaction, especially in the financial sector. Its immense success across different industries has increased the demand for this technology in the healthcare industry to bring about revolutionary changes.. The increasing incidence of healthcare data breaches, increasing threat of counterfeit drugs, increasing adoption of blockchain as a service (BaaS), and transparency & immutability of the distributed ledger technology are the significant factors driving the growth of the market. However, the reluctance to disclose data and lack of a central entity & common set of standards are expected to restrain the growth of this market to a certain extent. In this report, the healthcare blockchain market has been segmented based on application, end-user, and region.

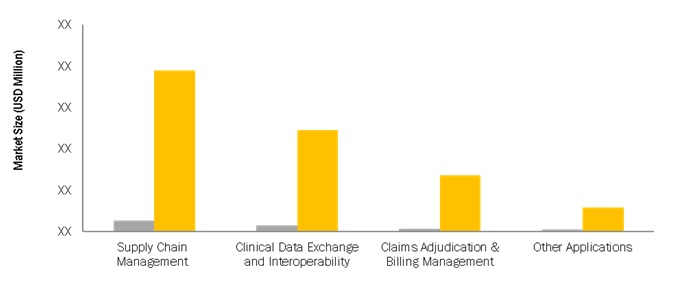

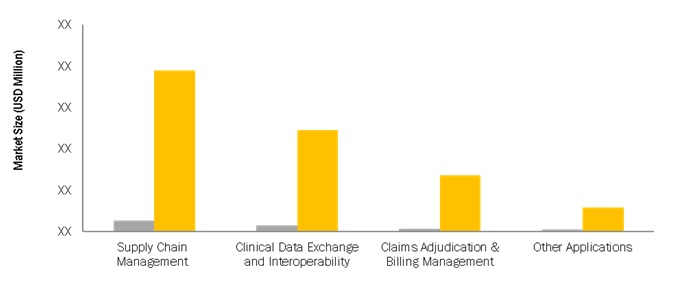

By application, the supply chain management sector is expected to hold the largest market share during the forecast period.

Based on its various applications in healthcare, the healthcare blockchain market is segmented into clinical data interoperability & identity management, supply chain management, health insurance & fraud prevention, and other applications. In 2017, the supply chain management segment accounted for the largest market share of the global healthcare blockchain market. Factors such as the increasing number of counterfeit drugs in circulation and the implementation of stringent regulations such as the Drug Quality and Security Act (DQSA) in the US and the Falsified Medicines Directive (FMD) in Europe are driving the adoption of blockchain in supply chain management.

By end-user, the pharmaceutical companies segment is projected to hold the largest market share during the forecast period.

Based on end-users, the global healthcare blockchain market is broadly segmented into pharmaceutical companies, healthcare providers, healthcare payers, and other end users. The pharmaceutical companies segment accounted for the largest share of the healthcare blockchain market, while the healthcare payers segment is expected to register the highest CAGR from 2018 to 2023. Growth in the healthcare payers segment is attributed to the increasing need for secure health information exchange between providers and payers, rising insurance fraud, growing medical tourism, and the need to improve the operational efficiency of healthcare organizations.

North America to dominate the market during the forecast period.

North America accounted for the largest share of the global healthcare blockchain market. The growth of the North American healthcare blockchain market is driven by the implementation of regulations in the region regarding the safety of patient data and improving quality of care, increasing incidence of fraudulent activities in the healthcare sector, rising need to reduce the escalating healthcare costs, and the growing need to protect medical data from tampering.

On the other hand, the Asia Pacific region is expected to register the highest CAGR from 2018 to 2023. Factors such as the improving healthcare infrastructure, increasing adoption of EHR systems and other healthcare IT solutions, growing demand for health information exchange between different stakeholders in the healthcare industry owing to the rising medical tourism in this region, and increasing need to prevent counterfeit drugs from entering the supply chain are driving the growth of this regional segment.

Market Dynamics

Drivers: Increasing incidence of healthcare data breaches

Over the years, the incidence of data breaches has increased significantly in the healthcare industry. In the past five years, healthcare data breaches have grown in both size and frequency, with the most significant breaches impacting as many as 80 million people. Healthcare data breaches often expose highly sensitive information, from personally identifiable information such as Social Security numbers, names, and addresses to sensitive health data such as Medicaid ID numbers, health insurance information, and patients’ medical histories.

Restraints: Reluctance to disclose data

In the healthcare industry, a majority of healthcare providers and payers, especially in emerging nations, are reluctant to disclose data due to a lack of regulations related to medical data exchange. For healthcare providers, it is a competitive advantage to keep data to themselves as sharing of data with healthcare payers could reduce the reimbursement as they might get different rates for different patients. In this situation, where all the stakeholders in the healthcare industry are at a profit war with one another and are very reluctant to share the correct data, the implementation of a transparent technology such as a distributed ledger would be a challenge. This is expected to hamper the adoption of blockchain technology in the healthcare sector.

Opportunities: Government Initiatives

The blockchain technology is emerging as a valid solution in the healthcare industry. Many startups have started addressing major pain points in the healthcare industry (such as medical record interoperability, data security, and preventing counterfeit drugs from entering the pharmaceutical supply chain) with the help of the blockchain technology. In the last few years, blockchain technology has drawn the attention of various stakeholders in the healthcare industry. Due to the increased interest in this technology, different government bodies across the globe are investing in blockchain to research the same.

Challenges: Lack of awareness & understanding

The major limitation to the growth of blockchain technology is the lack of knowledge about the distributed ledger technology and its application in the healthcare industry. End users in the healthcare industry lack an understanding of the benefits of this disruptive technology and how it works. This could restrain companies from investing in this evolving technology. In its current form, the blockchain technology is something of a vast, unknown frontier with uncertain growth. Investors, public, and entrepreneurs are yet to leverage its potential for transforming business processes.

Blockchain uses cryptographic algorithms running across a vast network of independent computers. Therefore, sound technical knowledge about the related technology is crucial to explore the benefits of the blockchain. The lack of knowledge and public awareness is one of the biggest restraints to the adoption of blockchain. The increasing adoption and use of the distributed ledger technology would make the understanding of blockchain essential in the coming future. This would lead to the establishment and proliferation of platforms to provide training in this field. However, the challenges of legacy infrastructure would continue to be an obstacle as the practicality of implementing decentralized cryptosystems is beyond the traditional IT development skillset.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2016 - 2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018 - 2023 |

|

Forecast units |

Million (USD) |

|

Segments covered |

Application, End-User, and Region |

|

Geographies covered |

North America, Europe, APAC, RoW |

|

Companies covered |

Key market players including, |

The research report categorizes the Blockchain Technology in Healthcare Market to forecast the revenues and analyze the trends in each of the following sub-segments:

By Application

- Supply chain management

- Clinical Data Exchange & Interoperability

- Claims Adjudication & Billing Management

- Other Applications

By End-User

- Pharmaceutical Companies

- Healthcare Players

- Healthcare Providers

- Other End Users

By Region

-

North America

- US

- Mexico

- Canada

-

Europe

- UK

- Estonia

- Germany

- Rest Of Europe

- APAC

- RoW

Key Market Players

IBM (US), Microsoft (US), Guardtime (Estonia), PokitDok (US), Gem (US), and Hashed Health (US).

Recent Developments

- In 2018, Microsoft and Viant along with GSK formed a consortium named Viant Blockchain Programme aimed to accelerate the adoption of a blockchain-based supply chain in various verticals including the healthcare industry.

- In 2018, Chronicled partnered with Qtum Foundation. Through this partnership, both the companies are integrating smart devices with a secure distributed ledger back end by combining the IoT with blockchain technology.

- In 2018, Hashed Health partnered with Global Healthcare Exchange, a healthcare business and data automation company, with the aim to use blockchain technologies to solve the issues related to product tracking, auditing, data management, and order processing across the healthcare supply chain.

- In 2017, Microsoft and Accenture collaborated to develop solutions for identity management.

Critical questions the report answers:

- Which segment or region will lead the Blockchain Technology in Healthcare Market and why?

- Where will all these developments take the industry in the long run??

- What are the key strategies adopted by top players to increase their revenue?

- Which key developments are expected to have a long-term impact on the market?

Frequently Asked Questions (FAQ):

How big is the Blockchain Technology in Healthcare Market?

Blockchain Technology in Healthcare Market worth $829.0 million by 2023.

What is the growth rate of Blockchain Technology in Healthcare Market?

Blockchain Technology in Healthcare Market grows at a CAGR of 72.8% during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Limitations

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Approach

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.1.2.3 Key Industry Insights

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Assumptions for the Study

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 27)

4.1 Healthcare Blockchain: Market Overview

4.2 Europe: Healthcare Blockchain Market, By Country & Application

4.3 Geographical Snapshot of the Healthcare Blockchain Market

4.4 Healthcare Blockchain Market: Regional Mix

5 Market Overview (Page No. - 31)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Incidence of Healthcare Data Breaches

5.2.1.2 Increasing Threat of Counterfeit Drugs

5.2.1.3 Increasing Adoption of Blockchain as A Service (BaaS)

5.2.1.4 Transparency & Immutability of the Distributed Ledger Technology

5.2.1.5 Cost-Effective & Secured Data Interoperability Through Blockchain

5.2.2 Restraints

5.2.2.1 Reluctance to Disclose Data

5.2.2.2 Lack of A Central Entity & Common Set of Standards

5.2.3 Opportunities

5.2.3.1 Government Initiatives

5.2.3.2 Significant Increase in Funding Through Venture Capital Investments & Initial Coin Offering (ICO)

5.2.4 Challenges

5.2.4.1 Lack of Awareness & Understanding

5.2.4.2 Technical Challenges Pertaining to Scalability

6 Technology Overview (Page No. - 39)

6.1 Introduction

6.2 Structure of Blockchain

6.3 Types of Blockchain

6.3.1 Public Blockchain

6.3.2 Private Blockchain

6.3.3 Consortium Blockchain (Permissioned Blockchain)

6.4 Healthcare Blockchain Consortiums

6.4.1 The Hyperledger Healthcare Working Group

6.4.2 Hashed Health Blockchain Consortium

6.4.3 The Mediledger Project

6.4.4 Humana, Multiplan, Optum, Quest Diagnostics and Unitedhealthcare Blockchain Group

6.4.5 Viant Blockchain Programme

6.5 Type of Blockchain Providers in Healthcare

6.5.1 Application and Solution Providers

6.5.2 Middleware, Infrastructure, and Protocol Providers

6.6 Potential Healthcare Applications of Blockchain

7 Healthcare Blockchain Market, By Application (Page No. - 44)

7.1 Introduction

7.2 Supply Chain Management

7.3 Clinical Data Exchange & Interoperability

7.4 Claims Adjudication & Billing Management

7.5 Other Applications

8 Healthcare Blockchain Market, By End User (Page No. - 57)

8.1 Introduction

8.2 Pharmaceutical Companies

8.3 Healthcare Payers

8.4 Healthcare Providers

8.5 Other End Users

9 Healthcare Blockchain Market, By Region (Page No. - 67)

9.1 Introduction

9.2 North America

9.2.1 Us

9.2.2 Canada

9.3 Europe

9.3.1 Uk

9.3.2 Estonia

9.3.3 Germany

9.3.4 Rest of Europe (RoE)

9.4 Asia Pacific (APAC)

9.5 Rest of the World (RoW)

10 Competitive Landscape (Page No. - 90)

10.1 Overview

10.2 Healthcare Blockchain Market: Vendor Venchmarking

10.3 Investments in Healthcare Blockchain Market

10.4 Competitive Scenario

10.4.1 Agreements, Collaborations, & Partnerships

10.4.2 Product Launches and Enhancements

10.4.3 Acquisitions

11 Company Profiles (Page No. - 97)

(Business Overview, Solutions Offered, Recent Developments, SWOT Analysis & MnM View)*

11.1 IBM

11.2 Microsoft

11.3 Guardtime

11.4 Pokitdok

11.5 Gem

11.6 Hashed Health

11.7 Chronicled

11.8 Isolve

11.9 Patientory

11.10 Factom

11.11 Emerging Healthcare Blockchain Companies

11.11.1 Medicalchain

11.11.2 Proof.Work

11.11.3 Simplyvital Health

11.11.4 Farmatrust

11.11.5 Blockpharma

*Details on Business Overview, Solutions Offered, Recent Developments, SWOT Analysis & MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 119)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (76 Tables)

Table 1 Home Healthcare Blockchain Market Snapshot

Table 2 Recent Examples of Data Breaches in the Healthcare Industry

Table 3 Drivers: Impact Analysis

Table 4 Restraints: Impact Analysis

Table 5 Opportunities: Impact Analysis

Table 6 Challenges: Impact Analysis

Table 7 Key Potential Applications of Blockchain Technology in Healthcare

Table 8 Healthcare Blockchain Market, By Application, 2016–2023 (USD Million)

Table 9 Supply Chain Management Blockchain Offerings By Key Market Players

Table 10 Key Blockchain Projects for Supply Chain Management

Table 11 Healthcare Blockchain Market for Supply Chain Management, By Region, 2016–2023 (USD Million)

Table 12 North America: Healthcare Blockchain Market for Supply Chain Management, By Country, 2016–2023 (USD Million)

Table 13 Europe: Healthcare Blockchain Market for Supply Chain Management, By Country, 2016–2023 (USD Million)

Table 14 Impact of Blockchain on Data Interoperability

Table 15 Clinical Data Exchange & Interoperability Blockchain Offerings By Key Market Players

Table 16 Key Blockchain Projects in Clinical Data Exchange & Interoperability

Table 17 Healthcare Blockchain Market for Clinical Data Exchange & Interoperability, By Region, 2016–2023 (USD Million)

Table 18 North America: Healthcare Blockchain Market for Clinical Data Exchange & Interoperability, By Country, 2016–2023 (USD Million)

Table 19 Europe: Healthcare Blockchain Market for Clinical Data Exchange & Interoperability, By Country, 2016–2023 (USD Million)

Table 20 Claims Adjudication & Billing Management Blockchain Offerings By Key Market Players

Table 21 Key Blockchain Projects in Claims Adjudication & Billing Management

Table 22 Healthcare Blockchain Market for Claims Adjudication & Billing Management, By Region, 2016–2023 (USD Million)

Table 23 North America: Healthcare Blockchain Market for Claims Adjudication & Billing Management, By Country, 2016–2023 (USD Million)

Table 24 Europe: Healthcare Blockchain Market for Claims Adjudication & Billing Management, By Country, 2016–2023 (USD Million)

Table 25 Blockchain Offerings for Other Applications By Key Market Players

Table 26 Healthcare Blockchain Market for Other Applications, By Region, 2016–2023 (USD Million)

Table 27 North America: Healthcare Blockchain Market Other Applications, By Country, 2016–2023 (USD Million)

Table 28 Europe: Healthcare Blockchain Market for Other Applications, By Country, 2016–2023 (USD Million)

Table 29 Healthcare Blockchain Market, By End Users, 2016–2023 (USD Million)

Table 30 Healthcare Blockchain Market for Pharmaceutical Companies, By Region, 2016–2023 (USD Million)

Table 31 North America: Healthcare Blockchain Market for Pharmaceutical Companies, By Country, 2016–2023 (USD Million)

Table 32 Europe: Healthcare Blockchain Market for Pharmaceutical Companies, By Country/Region, 2016–2023 (USD Million)

Table 33 Healthcare Blockchain Market for Healthcare Payers, By Region, 2016–2023 (USD Million)

Table 34 North America: Healthcare Blockchain Market for Healthcare Payers, By Country, 2016–2023 (USD Million)

Table 35 Europe: Healthcare Blockchain Market for Healthcare Payers, By Country, 2016–2023 (USD Million)

Table 36 Healthcare Blockchain Market for Healthcare Providers, By Region, 2016–2023 (USD Million)

Table 37 North America: Healthcare Blockchain Market for Healthcare Providers, By Country 2016–2023 (USD Million)

Table 38 Europe: Blockchain Market for Healthcare Providers, By Country, 2016–2023 (USD Million)

Table 39 Healthcare Blockchain Market for Other End Users, By Region, 2016–2023 (USD Million)

Table 40 North America: Healthcare Blockchain Market for Other End Users, By Country, 2016–2023 (USD Million)

Table 41 Europe: Healthcare Blockchain Market for Other End Users, By Country, 2016–2023 (USD Million)

Table 42 Healthcare Blockchain Market, By Region, 2016–2023 (USD Million)

Table 43 Key Blockchain Projects in North America

Table 44 North America: Healthcare Blockchain Market, By Country, 2016–2023 (USD Million)

Table 45 North America: Healthcare Blockchain Market, By Application, 2016–2023 (USD Million)

Table 46 North America: Healthcare Blockchain Market, By End User, 2016–2023 (USD Million)

Table 47 US: Key Macroindicators

Table 48 US: Healthcare Blockchain Market, By Application, 2016–2023 (USD Million)

Table 49 US: Healthcare Blockchain Market, By End User, 2016–2023 (USD Million)

Table 50 Canada: Key Macroindicators

Table 51 Canada: Healthcare Blockchain Market, By Application, 2016–2023 (USD Million)

Table 52 Canada: Healthcare Blockchain Market, By End User, 2016–2023 (USD Million)

Table 53 Europe: Healthcare Blockchain Market, By Country, 2016–2023 (USD Million)

Table 54 Europe: Healthcare Blockchain Market, By Application, 2016–2023 (USD Million)

Table 55 Europe: Healthcare Blockchain Market, By End User, 2016–2023 (USD Million)

Table 56 UK: Key Macroindicators

Table 57 UK: Healthcare Blockchain Market, By Application, 2016–2023 (USD Million)

Table 58 UK: Healthcare Blockchain Market, By End User, 2016–2023 (USD Million)

Table 59 Estonia: Key Macroindicators

Table 60 Estonia: Healthcare Blockchain Market, By Application, 2016–2023 (USD Million)

Table 61 Estonia: Healthcare Blockchain Market, By End User, 2016–2023 (USD Million)

Table 62 Germany: Key Macroindicators

Table 63 Germany: Healthcare Blockchain Market, By Application, 2016–2023 (USD Million)

Table 64 Germany: Healthcare Blockchain Market, By End User, 2016–2023 (USD Million)

Table 65 RoE: Healthcare Blockchain Market, By Application, 2016–2023 (USD Million)

Table 66 RoE: Healthcare Blockchain Market, By End User, 2016–2023 (USD Million)

Table 67 APAC: Healthcare Blockchain Market, By Application, 2016–2023 (USD Million)

Table 68 APAC: Healthcare Blockchain Market, By End User, 2016–2023 (USD Million)

Table 69 RoW: Healthcare Blockchain Market, By Application, 2016–2023 (USD Million)

Table 70 RoW: Healthcare Blockchain Market, By End User, 2016–2023 (USD Million)

Table 71 Growth Strategy Matrix (2015–2018)

Table 72 Healthcare Blockchain Market: Product Portfolio Assessment of Key Market Players

Table 73 Key Healthcare Blockchain Funding

Table 74 Agreements, Collaborations & Partnerships, 2015–2018

Table 75 Product Launches, 2015–2018

Table 76 Acquisitions, 2015–2018

List of Figures (25 Figures)

Figure 1 Healthcare Blockchain Market Segmentation

Figure 2 Research Design

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 4 Bottom-Up Approach

Figure 5 Top-Down Approach

Figure 6 Data Triangulation Methodology

Figure 7 Healthcare Blockchain Market, By Application, 2018 vs 2023 (USD Million)

Figure 8 Healthcare Blockchain Market, By End User, 2018 vs 2023 (USD Million)

Figure 9 North America Dominated the Healthcare Blockchain Market in 2017

Figure 10 Rising Incidence of Healthcare Data Breaches is Driving Market Growth

Figure 11 UK Accounted for the Largest Market Share in 2017

Figure 12 US Commanded the Largest Share of the Healthcare Blockchain Market in 2017

Figure 13 Asia Pacific to Register the Highest CAGR During the Forecast Period

Figure 14 Healthcare Blockchain Market: Drivers, Restraints, Opportunities, & Challenges

Figure 15 Centralized vs Distributed Blockchain

Figure 16 Claims Adjudication & Billing Management to Witness the Highest Growth in the Healthcare Blockchain Applications Market During the Forecast Period

Figure 17 Healthcare Payers to Witness the Highest Growth During the Forecast Period

Figure 18 Healthcare Blockchain Market, By Region, 2018 vs 2023 (USD Million)

Figure 19 Healthcare Blockchain Market: Geographic Snapshot

Figure 20 North America: Healthcare Blockchain Market Snapshot

Figure 21 Europe: Healthcare Blockchain Market Snapshot

Figure 22 Key Developments in the Healthcare Blockchain Market Between January 2015 and June 2018

Figure 23 Vendor Benchmarking: Market Attractiveness vs Company Strength

Figure 24 IBM: Company Snapshot

Figure 25 Microsoft: Company Snapshot

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Blockchain Technology in Healthcare Market