Blockchain in Banking Market - Global Forecast to 2029

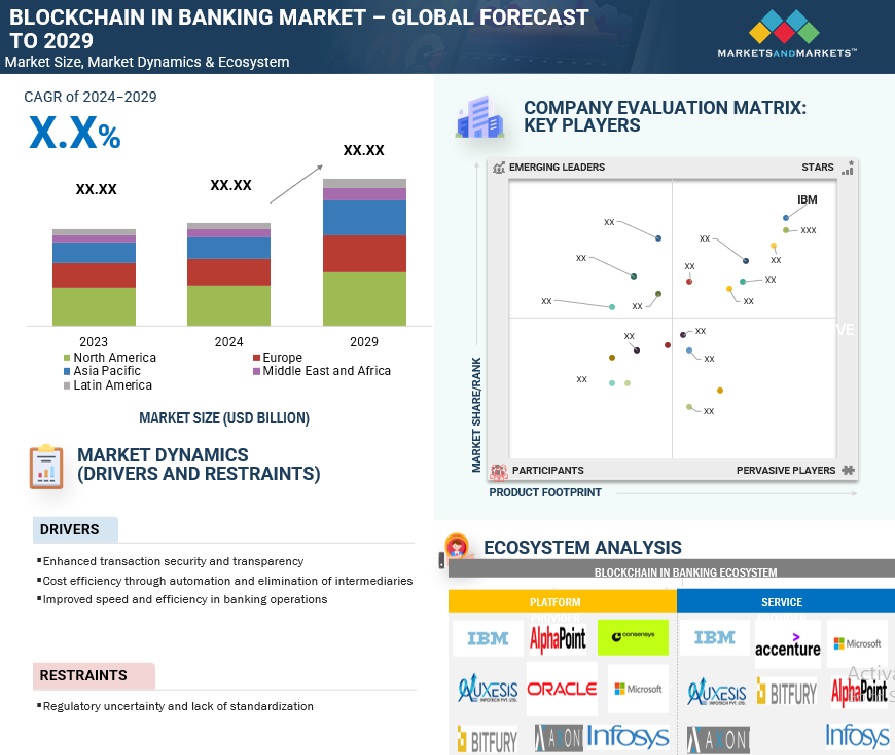

The worldwide Blockchain in Banking market is expected to increase from USD XX.XX billion in 2024 to USD XX.XX billion by 2029, with a compound annual growth rate (CAGR) of XX.X%. The market expansion is driven by the growing acceptance of digital currencies, rising demand for faster cross-border payments, and a stronger emphasis on fraud prevention.

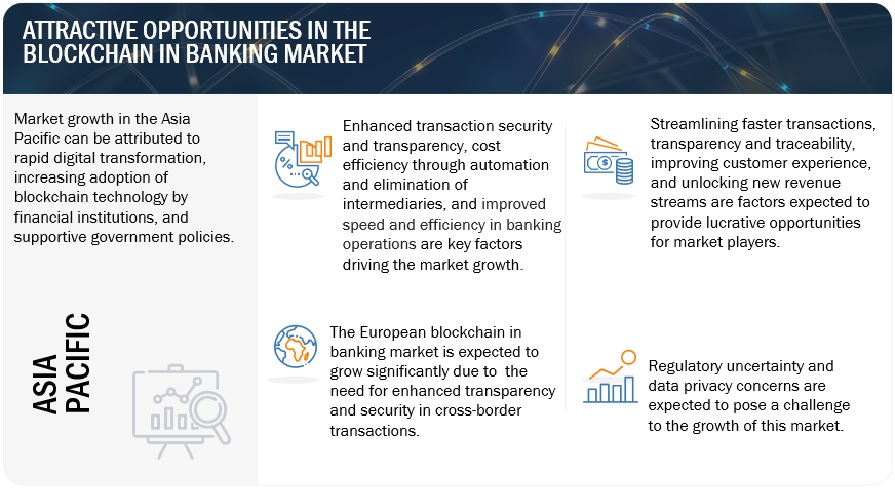

Key opportunities include integrating blockchain with decentralized finance (DeFi) platforms, developing Central Bank Digital Currencies (CBDCs), and leveraging hybrid blockchain models to address privacy and scalability concerns while enabling innovative solutions such as asset tokenization and real-time transaction systems, which will help expand the market.

To know about the assumptions considered for the study, Request for Free Sample Report

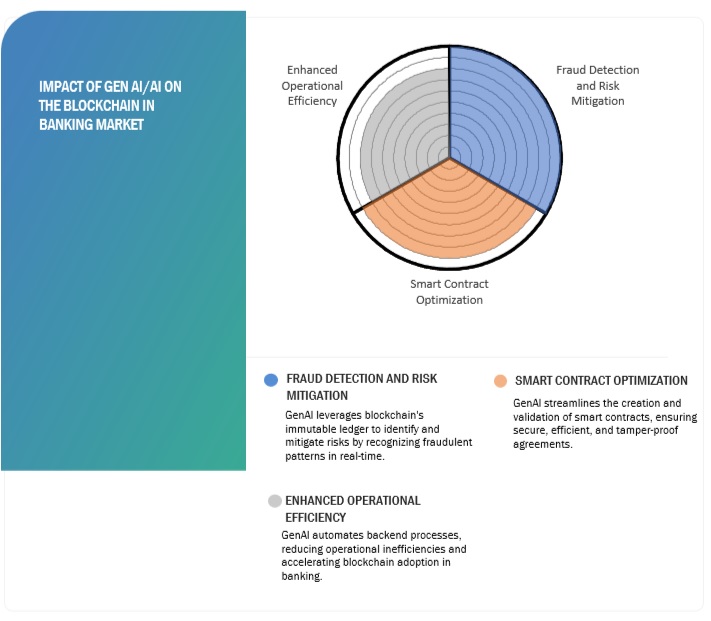

IMPACT OF GENERATIVE AI (GenAI) ON THE BLOCKCHAIN IN BANKING MARKET

In the Blockchain in Banking market, Generative AI helps improve operational efficiency, increase fraud detection, and allow new and innovative services. GenAI speeds up the development of blockchain applications by automating code generation, quality assurance, and system testing, lowering deployment time. Its capacity to generate synthetic data strengthens blockchain models, and AI-driven insights simplify compliance and fraud protection. GenAI also streamlines legacy system interaction, allowing institutions to deploy blockchain technologies more efficiently. Further, GenAI has enormous promise for accelerating blockchain adoption by providing safe, scalable, and customer-centric financial technologies.

BLOCKCHAIN IN BANKING Market Dynamics

Driver: Enhanced Security, Efficiency, and Transparency

Blockchain technology enhances the banking operation's security, transparency, and efficiency. This decentralized, immutable ledger ensures that any transaction will be recorded safely, decreasing the risk of fraud and manipulation. It is especially useful for cross-border payments since it eliminates intermediaries, accelerates processing time, and minimizes costs. Besides this, it facilitates faster settlement times of financial transactions by removing inefficiencies from the traditional banking systems. It further reduces procedural cycles like loan approval, verification of compliance, and settlement of payments through its application in smart contracts. Advanced analytics and IoT integration with blockchain allows banks to achieve real-time data sharing and tracking for enhanced operational efficiency. The growing adoption of Central Bank Digital Currencies (CBDCs) is also accelerating blockchain's role in secure and cost-effective digital currency management.

Restraint: High Costs and Integration issues

The high cost of implementation and integration concerns are considered key market restraints. Blockchain infrastructure requires a significant investment in technology, trained staff, and system integration, which may be financially difficult for small and medium-sized institutions. Connecting blockchain with older financial systems sometimes requires difficult and time-consuming operations, raising expenses. Additional issues arise from the lack of global regulatory norms, which require financial firms to manage fragmented legal frameworks across several areas. Furthermore, privacy issues exist, especially in permissionless blockchains, where sensitive financial data is available to several nodes. Scalability concerns, such as some blockchain systems' restricted transaction processing speed, further limit their use in high-volume activities.

Opportunity: Unlocking New Revenue Streams

When combined with modern technologies such as artificial intelligence (AI), machine learning, and the Internet of Things (IoT), blockchain has the potential to transform banking and finance. Using blockchain for fraud detection and prevention allows banks to monitor real-time transactions, improving security and compliance. The growth of decentralized finance (DeFi) platforms will enable banks to diversify their revenue streams by offering alternatives to blockchain-based lending, borrowing, and investing. Furthermore, blockchain-enabled smart contracts may considerably increase the efficiency of trade finance, asset tokenization, and supply chain financing, making financial services more accessible and affordable. Governments and central banks are studying blockchain-based CBDCs, which increases their potential because these digital currencies require safe and scalable blockchain networks. With growing consumer demand for transparency, personalized banking experiences, and lower costs, blockchain provides a strategic edge for financial institutions to innovate and differentiate themselves in a competitive market.

Challenge: Regulatory Uncertainty and Scalability Issues

Regulatory uncertainties and scalability issues are significant obstacles to the blockchain in the banking industry. The lack of a consistent worldwide regulatory framework complicates matters for banks operating in numerous nations since they must comply with differing legal requirements. Another problem is scalability, with many blockchain platforms unable to manage enormous transaction volumes while maintaining speed and efficiency. Also, there is a problem in establishing interoperability between blockchain systems and current financial infrastructure, frequently using outdated technology. Finally, a scarcity of trained people in blockchain development and implementation hinders efforts to spread the technology throughout the financial industry, resulting in gaps in acceptance and innovation.

Blockchain in Banking Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

The Blockchain in Banking market offers platform and service offerings. The platform is provided by players such as IBM, Consensys, Oracle, Microsoft, and Infosys. The services are provided by players such as Accenture, IBM, Auxesis, and Bitfury, among others.

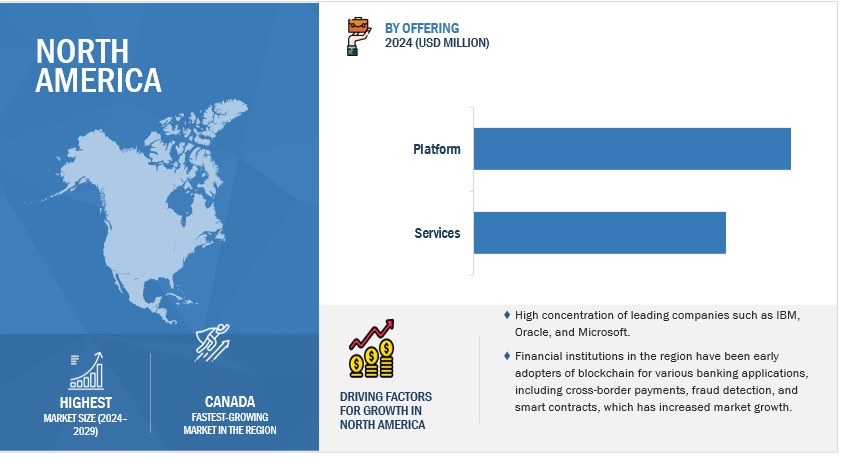

By Offering, the platform segment accounts for the largest market size during the forecast period.

The platform segment is expected to have the greatest market share in the Blockchain in Banking market due to the critical role platforms play in providing the basic infrastructure for blockchain applications inside banking. The platform allows one to build, deploy, and manage blockchain solutions, ensuring safe and transparent transactions. Banks rapidly use blockchain technology to enhance operational efficiency and reduce costs, increasing the demand for resilient platforms. In addition, platforms offer scalability and interoperability, which are essential for integrating blockchain with traditional financial systems. While consultancy and maintenance services are crucial, their primary purpose is to support the deployment and optimization of these platforms. Therefore, platforms' expansive adoption and integration capabilities position them to achieve the highest market size in the blockchain in banking sector.

By Type, the private blockchain segment is to grow at the highest CAGR during the forecast period.

When blockchain in the banking market is categorized by type, the private blockchain segment is expected to grow at the fastest CAGR. This expansion drives the growing need for safe and efficient transaction processing among financial institutions. Private blockchains provide greater control over data access and governance, making them perfect for managing sensitive financial information. They assist banks in simplifying operations, eliminating fraud, and complying with regulatory requirements. Furthermore, private blockchains' scalability and customization features enable institutions to adapt solutions to their requirements, accelerating their adoption in the banking sector.

By Region, North America accounts for the largest market size during the forecast period.

The North American region will lead the market, owing to its early adoption of blockchain technology, a strong presence of important industry companies such as IBM, Oracle, and Microsoft, among others, and significant expenditures in R&D. The United States, in particular, dominates the industry due to the presence of significant financial institutions and technological businesses that employ blockchain technologies to increase operational efficiency and security. Furthermore, supportive regulatory frameworks and a sizable concentration of tech-savvy clients contribute to North America's leading position.

Key Market Players

Some of the well-established and key market players in the Blockchain in Banking market include IBM (US), JPMorgan Chase (US), Accenture (Ireland), Microsoft (US), Consensys (US), Oracle (US), Bitfury (Netherlands), Infosys (India), Auxesis (India), Alphapoint (US), Axoni (US), Tradle (US), LeewayHertz (India), Labrys (Australia), OpenXcell (US).

Recent Developments:

- Crypto.com and Ingenico in November 2024 came together to provide global cryptocurrency payment acceptance on Ingenico's platform, enhancing both customer incentives and merchant payment management capabilities. Along with this, Crypto.com revealed plans to expand into banking, credit cards, and stock trading, using blockchain technology to combine traditional and digital money seamlessly.

- In October 2024, DBS Token Services, a blockchain-powered suite of banking solutions integrating tokenization and smart contract-enabled capabilities, was introduced by DBS. Treasury Tokens, Conditional Payments, and Programmable Rewards are part of this offering, enhancing real-time settlements, automating payment workflows, and creating programmable digital rewards.

- In October 2024, Coinbase teamed up with Visa to improve blockchain-based banking services. This agreement integrates Visa Direct and Coinbase, allowing quick cash-outs using approved Visa debit cards, real-time financial transfers, and Bitcoin purchases.

- Visa launched the Visa Tokenized Asset Platform (VTAP) in October 2024, a blockchain-based platform allowing banks to issue stablecoins and other fiat-backed tokens globally. VTAP enables banks to issue, burn, and transfer tokens while incorporating blockchain technology to improve programmability, efficiency, and security.

- In September 2024, JPMorgan plans to increase its corporate banking activities in Switzerland by introducing blockchain technology to improve cash management services and attract new clients. JPMorgan's blockchain-based platform, Onyx, provides near-instant cross-border payment settlements, lower counterparty risk, and better liquidity management, making it a dependable worldwide alternative for Swiss firms.

Frequently Asked Questions (FAQ):

What are the opportunities in the global Blockchain in Banking market?

Globally, the Blockchain in Banking market opportunities are created because of the enhanced security through decentralized and tamper-proof systems, faster and cost-effective cross-border transactions, and improved customer experience with streamlined processes like KYC and loan approvals.

What is the definition of the Blockchain in Banking market?

The Blockchain in Banking Market refers to using blockchain technology in the banking industry to improve the security, transparency, and efficiency of financial transactions and processes. It comprises a variety of use cases, including blockchain-based currencies, loans, and clearing and settlement systems, all of which provide new solutions for cost reduction, real-time processing, and increased compliance. This market employs public and private blockchains to address difficulties including fraud prevention, cross-border payments, and regulatory compliance, driving modernization and inclusion in global financial services.

Which region is expected to show the highest market share in the Blockchain in Banking?

By region, the largest market size is attained by the North American region during the forecast period.

What are the challenges in the global Blockchain in Banking market?

Regulatory uncertainty due to inconsistent global frameworks, scalability limitations affecting transaction speed and cost-efficiency, and interoperability issues with legacy banking systems pose significant challenges in the Blockchain in Banking market.

What are the major market players covered in the report?

Major companies in the Blockchain in Banking market are IBM (US), JPMorgan Chase (US), Accenture (Ireland), Microsoft (US), Consensys (US), Oracle (US), Bitfury (Netherlands), Infosys (India), Auxesis (India), Alphapoint (US), and Axoni (US)..

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Growth opportunities and latent adjacency in Blockchain in Banking Market