Bleeding Disorders Treatment Market by Type (Hemophilia A, Hemophilia B, vWD), Drug Class (Plasma Derived Coagulation Factor Concentrates, Recombinant Coagulation Factor Concentrates, Desmopressin, Antibrinolytics, Fibrin Sealant) - Global Forecast to 2021

The global bleeding disorders treatment market size is projected to grow at a CAGR of 7.9%. The global market is broadly classified into type, drug class, and region.

Based on type, the bleeding disorders treatment market is segmented into hemophilia A, hemophilia B, Von Willebrand Disease (vWD), and others. The hemophilia A segment is projected to register the highest growth rate in the market. Market growth in this market segment is driven by the large number of patients suffering from hemophilia A and rising R&D investment for hemophilia product

Based on class of drug, the bleeding disorders treatment market is segmented into plasma-derived coagulation factor concentrates, recombinant coagulation factor concentrates, desmopressin, antifibrinolytics, fibrin sealants, and others. The recombinant coagulation factor concentrates segment is expected to witness the highest growth rate in the market. This growth is attributed to rising R&D activities and increasing focus of pharmaceutical companies on recombinant products resulting in launch of new products.

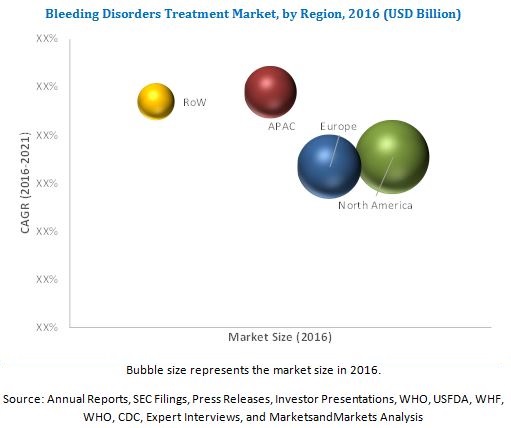

For the coming five years, APAC and LATAM regions are considered to be the lucrative markets for the bleeding disorders treatment market. Growth in this region can be attributed to increasing initiatives by local governments for increasing access to healthcare, rising disposable income, and increasing focus of global players towards emerging economies.

The key players in the bleeding disorders treatment market are Shire Plc. (earlier Baxalta) (Ireland), Bayer AG (Germany), Biogen Inc. (U.S.), CSL Behring (U.S.), Novo Nordisk (Denmark), Pfizer Inc. (U.S.), and Grifols SA (Spain).

Target Audience for this Report:

- Pharmaceutical Companies

- Vendors/Service Providers

- Public Hemophilia Foundations and Organizations

- Hospitals

- Research and Consulting Firms

- Venture Capitalists

- Health Insurance Players

- Path Labs/Diagnostic Centers

- Research Institutions

- Regulatory Authorities

Value Addition for the Buyer:

This report aims to provide insights into the bleeding disorders treatment market. It provides valuable information on the market by type and by drug class, in the market. Furthermore, a geographical analysis for these segments is also presented in this report. Leading players in the market are profiled to study their product offerings and understand their strategies to remain competitive in this market.

The above-mentioned information would benefit the buyer by helping them understand the market dynamics. In addition, the forecasts provided in the report will enable firms to understand the trends in this market and better position themselves to capitalize on the growth opportunities.

To know about the assumptions considered for the study, download the pdf brochure

Bleeding Disorders Treatment Market Report Scope

This report categorizes the bleeding disorders treatment market into the following segments:

By Type

- Hemophilia A

- Hemophilia B

- Von Willebrand Disease

- Others

By Drug Class

-

Plasma-derived Coagulation Factor Concentrates

- Factor VIII

- Factor IX

- Factor for Von Willebrand Disease

- Activated Prothrombin Complex Concentrate

-

Recombinant Coagulation Factor Concentrates

- Factor VIII

- Factor for Von Willebrand Disease

- Factor IX

- Desmopressin

- Antifibrinolytics

- Fibrin Sealants

- Others

By Region

-

North America

- U.S.

- Canada

-

Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

-

Asia-Pacific

- China

- Japan

- India

- Rest of Asia-Pacific

-

Rest of the World (RoW)

- Latin America

- Middle East and Africa

Customization Options:

- Company Information: Detailed company profiles of five or more market players

- Opportunities Assessment: A detailed report underlining the various growth opportunities available in the market

- Detailed study for emerging economies and competitive intelligence of players therein

- Geography-specific regulatory and reimbursement overview along with their market impact

The major factors driving the market growth include the growing patient population base, R&D activities, and increasing focus on recombinant products by pharmaceutical companies. Emerging markets offer significant growth opportunities for the market. On the other hand, high treatment cost for bleeding disorder treatment products coupled with limited reimbursement is expected to hinder the growth of this market during the forecast period.

The global bleeding disorders treatment market is broadly classified by type and drug class. Based on type, the market is classified as hemophilia A, hemophilia B, vWD, and others. Hemophilia A is the largest segment and is projected to witness a healthy CAGR in forecast period. The growing number of patients suffering from hemophilia A, coupled with increasing awareness, and increasing R&D activities for development of novel products for treating hemophilia A by major pharmaceuticals are key drivers for this market segment.

Based on drug class, the bleeding disorders treatment market is segmented into plasma-derived coagulation factor concentrates, recombinant coagulation factor concentrates, desmopressin, antifibrinolytics, fibrin sealants, and others. The recombinant coagulation factor concentrates segment is expected to witness the highest growth rate during the forecast period. This increasing focus on developing recombinant factors due to their high efficiency in preventing bleeding episodes over plasma-derived products are driving their market demand.

The global bleeding disorders treatment market is dominated by North America, followed by Europe. North America will continue to dominate the global market in the forecast period. The high acceptance for prophylaxis treatment among all age groups in the U.S. is a key market driver in the region.

The key players in the Bleeding Disorders Treatment Market are are Shire Plc. (earlier Baxalta) (Ireland), Bayer AG (Germany), Biogen Inc. (U.S.), CSL Behring (U.S.), Novo Nordisk (Denmark), Pfizer Inc. (U.S.), and Grifols SA (Spain).

Frequently Asked Questions (FAQ):

What is the size of Bleeding Disorders Treatment Market ?

The global Bleeding Disorders Treatment Market size is growing at a CAGR of 7.9%

What are the major growth factors of Bleeding Disorders Treatment Market ?

The major factors driving the market growth include the growing patient population base, R&D activities, and increasing focus on recombinant products by pharmaceutical companies. Emerging markets offer significant growth opportunities for the market. On the other hand, high treatment cost for bleeding disorder treatment products coupled with limited reimbursement is expected to hinder the growth of this market during the forecast period.

Who all are the prominent players of Bleeding Disorders Treatment Market ?

The key players in the bleeding disorders treatment market are Shire Plc. (earlier Baxalta) (Ireland), Bayer AG (Germany), Biogen Inc. (U.S.), CSL Behring (U.S.), Novo Nordisk (Denmark), Pfizer Inc. (U.S.), and Grifols SA (Spain).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents:

1 Introduction (Page No. - 9)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

1.6 Assumptions & Limitations

2 Research Methodology (Page No. -16)

2.1 Introduction

2.2 Secondary Data

2.2.1 Key Data from Secondary Sources

2.3 Primary Data

2.3.1 Breakdown of Primaries

2.3.2 Key Data from Primary Sources

2.3.3 Assumptions

2.4 Market Size Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Market Breakdown and Data Triangulation

3 Executive Summary (Page No. - 29)

3.1 Introduction

3.2 Market Dynamics

3.3 Market Estimation

4 Market Dynamics (Page No. - 34)

4.1 Market Drivers

4.1.1 Rising R&D Investment for Development of Hemophilia Products

4.1.2 Increasing Preference for Prophylactic Treatment

4.1.3 Increasing Number of Diagnosed Hemophilia Patients

4.1.4 Increasing Healthcare Expenditure

4.2 Market Restraints

4.2.1 High Cost of Hemophilia Drugs

4.2.2 Insufficient Reimbursement

4.3 Market Opportunities

4.3.1 Local Partnerships in Pharma-emerging Countries

4.3.2 Rising Disposable Income and Improving Healthcare Infrastructure in Developing Nations

4.3.3 Growing Biosimilar Products Market

4.4 Market Threats

4.4.1 High Entry Barriers Created By Local Government in Certain Countries

4.4.2 Low Switch Rate for Hemophilia Products

4.4.3 High Competition from Established Players

5 Global Bleeding Disorders Treatment Market, By Type (Page No. - 46)

5.1 Introduction

5.2 Hemophilia A

5.3 Hemophilia B

5.4 Von Willebrand Disease (vWD)

5.5 Others

6 Global Bleeding Disorders Treatment Market, By Drug Class (Page No. - 58)

6.1 Introduction

6.2 Plasma Derived Coagulation Factor Concentrates Market

6.3 Global Recombinant Coagulation Factor Concentrate Market

6.4 Global Others Bleeding Disorders Treatment Market

7 Global Bleeding Disorders Treatment Market, By Geography (Page No. - 71)

7.1 Introduction

7.2 North America

7.3 Europe

7.4 Asia-Pacific

7.5 Rest of the World (RoW)

8 Competitive Landscape (Page No. - 101)

8.1 Market Share Analysis, By Key Players

8.2 Key Growth Strategies, 2013 -2016

8.3 Key Growth Strategies: New Product Approval/ Launch, 2013 -2016

8.4 Key Growth Strategies: Agreements, 2013 -2016

8.5 Key Growth Strategies: M&A, 2013 -2016

8.6 Key Growth Strategies: Other Strategies, 2013 -2016

9 Company Profiles (Page No. - 108)

9.1 Baxalta (Now Shire)

9.2 Bayer Pharmaceuticals

9.3 Novo Nordisk A/S

9.4 Pfizer Inc.

9.5 Biogen Idec

9.6 CSL Behring

9.7 Grifols

9.8 Octapharma

10 Appendix (Page No. - 158)

10.1 Key Industry Insights

10.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

10.3 Introducing RT: Real Time Market Intelligence

10.4 Related Reports

List of Tables (36 Tables)

Table 1 Pipeline Analysis (Recently Approved)

Table 2 Pipeline Analysis (To Be Approved)

Table 3 Global Bleeding Disorders Treatment Market, By Type, 2014 –2021 (USD Million)

Table 4 Hemophilia A Treatment Market, By Region, 2014 –2021 (USD Million)

Table 5 Hemophilia A Treatment Market, By Disease Management, 2014 –2021 (USD Million)

Table 6 Hemophilia B Treatment Market, By Region, 2014 –2021 (USD Million)

Table 7 Hemophilia B Treatment Market, By Disease Management, 2014 –2021 (USD Million)

Table 8 vWD Treatment Market, By Region, 2014 –2021 (USD Million)

Table 9 Others Treatment Market, By Region, 2014 –2021 (USD Million)

Table 10 Global Hemophilia Treatment Market, By Drug Class, 2014 –2021 (USD Million)

Table 11 Global Plasma Derived Coagulation Factor Concentrate Market, By Class, 2014 –2021 (USD Million)

Table 12 Global Plasma Derived Coagulation Factor Concentrate Market, By Geography, 2014 –2021 (USD Million)

Table 13 Global Recombinant Coagulation Factor Concentrate Market, By Class, 2014 –2021 (USD Million)

Table 14 Global Recombinant Coagulation Factor Concentrate Market, By Geography, 2014 –2021 (USD Million)

Table 15 Other Bleeding Disorders Treatment Market, By Geography, 2014 –2021 (USD Million)

Table 16 Global Market Share, By Region, 2014 -2021 (USD Million)

Table 17 North America: Market Share, By Country, 2014 -2021 (USD Million)

Table 18 North America: Market Share, By Product Type, 2014 -2021 (USD Million)

Table 19 North America: Market Share, By Class, 2014 -2021 (USD Million)

Table 20 North America: Market, By Disease Management, 2014 -2021 (USD Million)

Table 21 Europe: Market Share, By Country,2014 -2021 (USD Million)

Table 22 Europe: Market Share, By Product Type, 2014 -2021 (USD Million)

Table 23 Europe: Market Share, By Class, 2014 -2021 (USD Million)

Table 24 Europe: Market, By Disease Management, 2014 -2021 (USD Million)

Table 25 Asia-Pacific: Market Share, By Country, 2014 -2021 (USD Million)

Table 26 Asia-Pacific Market Share, By Product Type, 2014 -2021 (USD Million)

Table 27 Asia-Pacific: Market Share, By Class, 2014 -2021 (USD Million)

Table 28 Asia-Pacific Market, By Disease Management, 2014 -2021 (USD Million)

Table 29 Row: Market Share, By Country, 2014 -2021 (USD Million)

Table 30 Row: Market Share, By Product Type, 2014 -2021 (USD Million)

Table 31 Row: Market Share, By Class, 2014 -2021 (USD Million)

Table 32 Row: Market, By Disease Management, 2014 -2021 (USD Million)

Table 33 New Product Approval/ Launch, 2013 -2016

Table 34 Agreements, 2013 -2016

Table 35 M&A, 2013 -2016

Table 36 Other Strategies, 2013 -2016

List of Figures (20 Figures)

Fig 1 Global Hemophilia Treatment Market Segmentation

Fig 2 Research Design

Fig 3 Breakdown of Supply-Side Primary Interviews: By Company Type, Designation, Region

Fig 4 Market Size Estimation Diagram

Fig 5 Market Data Triangulation Methodology

Fig 6 Comparative Analysis, Global Market By Type 2015 vs 2021

Fig 7 Comparative Analysis, Global Market By Drug Class 2015 vs 2021

Fig 8 Global Snapshot: Market Scenario, 2015

Fig 9 Impact Analysis: Drivers, Restraints, Opportunities & Challenges

Fig 10 Market: Drivers, Restraints, Opportunities & Challenges

Fig 11 Market Attractiveness, By Type

Fig 12 Market Attractiveness, By Drug Class

Fig 13 Global Market Share, By Region, 2015 (USD Million)

Fig 14 Global Market Scenario, By Geography, 2015

Fig 15 North America: Bleeding Disorders Treatment Market Overview

Fig 16 Europe: Bleeding Disorders Treatment Market Overview

Fig 17 Asia-Pacific: Bleeding Disorders Treatment Market Overview

Fig 18 RoW: Bleeding Disorders Treatment Market Overview

Fig 19 Market Share Analysis, By Key Players, 2015 (%)

Fig 20 Competitive Landscape: Key Developments

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Bleeding Disorders Treatment Market