Black Phosphorus Market by Form (Crystal, Powder), Application (Electronic Devices, Energy Storage, Sensors), and Region (North America, Asia Pacific, Europe, South America, Middle East & Africa) - Global Forecast to 2027

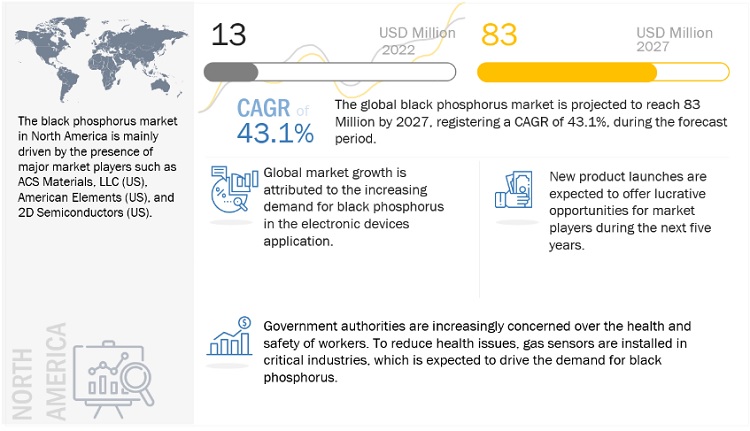

[153 Pages Report] The global black phosphorus market size is estimated to be USD 13 million in 2022 and is expected to reach USD 83 million by 2027, at a CAGR of 43.1% from 2022 to 2027. Increasing use of infrared components in consumer electronics and automobiles is expected to drive the demand for black phosphorus globally. Black phosphorus, which is an emerging 2D material, is considered a promising material for next-generation electronic and optoelectronic devices. The market for optoelectronic components is growing due to the extensive use of infrared components such as infrared LEDs, photodiodes, and phototransistors in consumer electronics and automobiles. Infrared LEDs are used extensively in consumer goods such as TV remotes and transmission systems and in security cameras to provide night vision capabilities (10 to 50 infrared LEDs for each device).

Attractive Opportunities in the Black Phosphorus Market

To know about the assumptions considered for the study, Request for Free Sample Report

Driver: Increased use of infrared components in consumer electronics and automobiles

Black phosphorus is applicable in broadband photodetection from the visible to an infrared range of spectrum due to its tunable bandgap and high carrier mobility. Short-range infrared connectivity devices are used in consumer electronic devices such as smartphones, notebook computers, set-top boxes, AC remotes, and TV remotes. On average, a single smartphone uses nine different types of sensors for multiple purposes. Each type of sensor is used to perform a certain kind of action. For instance, when in a moving vehicle, the sensor for Wi-Fi on a smartphone will stop to search for a new network automatically. Sensors for proximity and ambient light are used for motion detection and to detect precise lighting for ranges of ambient brightness. The wide-scale use of infrared components is driving the market for black phosphorus used in optoelectronic components.

Restraint: High cost of production

Extensive R&D activities and highly scalable high-energy ball milling methods are being carried out in the development of black phosphorus. This involves a high cost for developing black phosphorus from red and white phosphorus for various applications, including electronic devices, sensors, and energy storage. Due to the slow rate of commercialization and low sales volume, companies in this market find it difficult to deliver products at a low price.

Opportunity: Increasing demand from energy storage segment

Black phosphorus composite materials connected by carbon-phosphorus covalent bonds have a stable structure and high lithium-ion storage capacity. Lithium ions are the backbone of many common battery applications, including electric vehicles. Electric vehicle production is expected to increase rapidly in the next five years as the government of China is focusing on reducing pollution and providing subsidies and incentives to electric vehicles. The increasing demand for batteries for electric vehicles is providing huge opportunities for black phosphorus manufacturers globally.

Challenge: Scalable process for mass production

The black phosphorus market is in its initial stage of development, with limited manufacturers and very less work in terms of regulations and standards. The mass production of high-quality and defect-free black phosphorus is still a challenge for manufacturers as the manufacturing process is cost-intensive and time-consuming.

Black phosphorus ecosystem

“Powder is projected to be the second fastest-growing form of black phosphorus during the forecast period”

Black phosphorus in powder form is projected to be the second fastest-growing form of black phosphorus during the forecast period. Black phosphorus powder is a thermodynamic stable semiconductor material used for the preparation of black phosphorus quantum dots, nano-platelets, and thin films. These quantum dots are applicable to bioimaging, fluorescence sensing, nonlinear optical absorbers, cancer therapy, intelligent electronics, photovoltaics, optoelectronics, and flexible devices.

“Energy Storage is projected to be the fastest-growing application of black phosphorus during the forecast period”

Major countries implementing battery energy storage are the US, Japan, China, and Germany, and other countries, including Italy and South Korea, are witnessing increasing installations of advanced energy storage systems. The increased variable renewable energy sources, improved system flexibility, and technological advancements are pushing governments to install energy storage systems in their respective countries, which in turn, is expected to drive the demand for black phosphorus during the forecast period

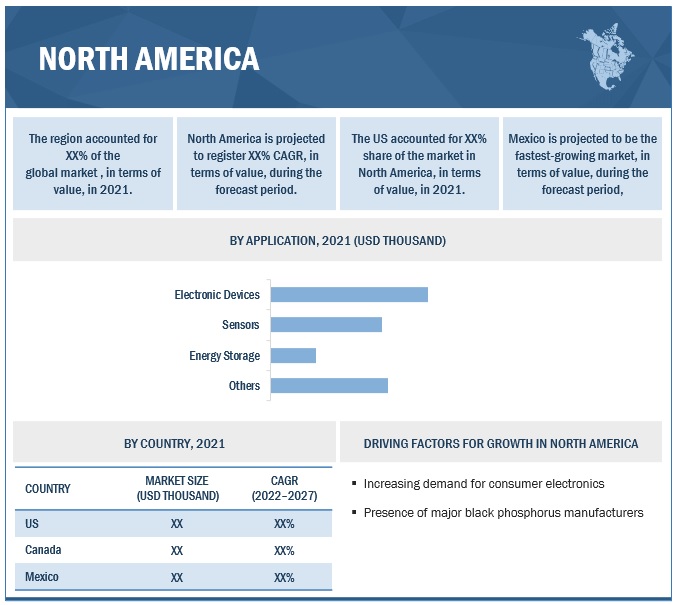

“North America accounted for the largest share of the global black phosphorus market in 2021”

North America accounted for the largest share of the global black phosphorus market in 2021. The increasing adoption of LEDs and laser diodes in the automotive industry and the rapidly rising demand for image sensors in mobile phones and consumer electronics are increasing the overall demand for black phosphorus in optoelectronic components.

The presence of black phosphorus manufacturers in the country and the high demand from end-use industries are the major factors driving the market in US. The black phosphorus manufacturers in the US are focused on innovation and expansion of their operations

Source: Secondary Research, Expert Interviews, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The black phosphorus market is dominated by a few globally established players such as ACS Material LLC (US), Ossila Ltd. (UK), Nanochemazone (Canada), American Elements LLC (US), Merck (Germany), 2D Semiconductors (US), HQ Graphene (Netherlands), Hunan Azeal Materials Co. Ltd. (China), Stanford Advanced Materials (US) and Manchester Nanomaterials (UK) among others.

Black Phosphorus Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 13 million |

|

Revenue Forecast in 2027 |

USD 83 million |

|

CAGR |

43.1% |

|

Years considered for the study |

2017 – 2027 |

|

Base Year Considered |

2021 |

|

Forecast period |

2022–2027 |

|

Units considered |

Value (USD Thousand/Million), Volume (Kilograms) |

|

Segments covered |

Form, Application and Region |

|

Regions covered |

North America, Europe, Asia Pacific, Middle East & Africa and South America |

|

Companies profiled |

ACS Material LLC (US), 2D Semiconductors (US), Nanochemazone (Canada), American Elements LLC (US), Merck (Germany), HQ Graphene (Netherlands), Hunan Azeal Materials Co. Ltd. (China), Ossila Ltd. (UK), Stanford Advanced Materials (US) and Manchester Nanomaterials (UK) among others |

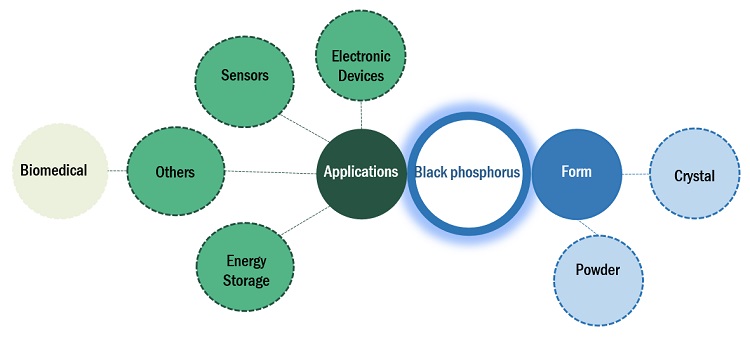

This report categorizes the global black phosphorus market based on form, application and region.

On the basis of form, the black phosphorus market has been segmented as follows:

- Crystal

- Powder

On the basis of application, the black phosphorus market has been segmented as follows:

- Electronic devices

- Energy storage

- Sensors

- Others

On the basis of region, the black phosphorus market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- In May 2021, Merck announced a partnership with Topco Scientific. Co., which is a leading semiconductor supplier, to increase the use of more sustainable materials in the electricity industry.

Frequently Asked Questions (FAQ):

What are the high growth form of black phosphorus?

Crystal is the largest form of black phosphorus in terms of both value and volume, in the global black phosphorus market in 2021.

Which is the largest application of black phosphorus?

Electronic Devices holds the largest market share in black phosphorus market, in terms of both value and volume, in 2021,

What are the major factors impacting market growth during the forecast period?

The market growth is primarily impacted due to the high cost of production and challenges in mass production. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 24)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

1.3.1 MARKET DEFINITION AND INCLUSIONS, BY FORM

1.3.2 MARKET DEFINITION AND INCLUSIONS, BY APPLICATION

1.4 STUDY SCOPE

1.4.1 MARKET SEGMENTATION

1.4.2 REGIONS COVERED

1.4.3 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

1.6 UNITS CONSIDERED

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 28)

2.1 RESEARCH DATA

FIGURE 1 BLACK PHOSPHORUS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews—Demand and supply sides

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): COLLECTIVE SHARE OF TOP PLAYERS

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL PRODUCTS

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (DEMAND SIDE)

2.3 DATA TRIANGULATION

FIGURE 5 BLACK PHOSPHORUS MARKET: DATA TRIANGULATION

2.4 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

2.4.1 SUPPLY SIDE

FIGURE 6 SUPPLY-SIDE MARKET CAGR PROJECTIONS

2.4.2 DEMAND SIDE

FIGURE 7 DEMAND-SIDE MARKET GROWTH PROJECTIONS: DRIVERS AND OPPORTUNITIES

2.5 FACTOR ANALYSIS

2.6 RESEARCH ASSUMPTIONS

2.7 RESEARCH LIMITATIONS

2.8 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 38)

FIGURE 8 ELECTRONIC DEVICES APPLICATION LED BLACK PHOSPHORUS MARKET IN 2021

FIGURE 9 CRYSTAL FORM TO LEAD BLACK PHOSPHORUS MARKET DURING FORECAST PERIOD

FIGURE 10 NORTH AMERICA ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

4 PREMIUM INSIGHTS (Page No. - 41)

4.1 BRIEF OVERVIEW OF BLACK PHOSPHORUS MARKET

FIGURE 11 BLACK PHOSPHORUS IN CRYSTAL FORM TO DRIVE MARKET

4.2 BLACK PHOSPHORUS MARKET SIZE, BY REGION

FIGURE 12 NORTH AMERICA TO BE LARGEST MARKET FOR BLACK PHOSPHORUS DURING FORECAST PERIOD

4.3 NORTH AMERICA: BLACK PHOSPHORUS MARKET, BY APPLICATION AND COUNTRY, 2021

FIGURE 13 ELECTRONIC DEVICES SEGMENT AND US ACCOUNTED FOR LARGEST SHARES

4.4 BLACK PHOSPHORUS MARKET SIZE, APPLICATION VS. REGION

FIGURE 14 ELECTRONIC DEVICES APPLICATION LED MARKET ACROSS REGIONS IN 2021

4.5 BLACK PHOSPHORUS MARKET, BY MAJOR COUNTRIES

FIGURE 15 MARKET IN CHINA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 44)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN BLACK PHOSPHORUS MARKET

5.2.1 DRIVERS

5.2.1.1 High demand for gas sensors in critical industries

5.2.1.2 Implementation of various health and safety regulations globally

TABLE 1 LIST OF GOVERNMENT REGULATIONS/ACTS FOR AIR QUALITY MONITORING

5.2.1.3 Increased use of infrared components in consumer electronics and automobiles

5.2.2 RESTRAINTS

5.2.2.1 High cost of production

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing demand from energy storage segment

5.2.4 CHALLENGES

5.2.4.1 Scalable process for mass production

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 17 BLACK PHOSPHORUS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

TABLE 2 BLACK PHOSPHORUS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.4 KEY STAKEHOLDERS & BUYING CRITERIA

5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 18 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 APPLICATIONS

TABLE 3 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 APPLICATIONS (%)

5.4.2 BUYING CRITERIA

FIGURE 19 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

TABLE 4 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

5.5 MACROECONOMIC INDICATORS

5.5.1 GDP TRENDS AND FORECASTS FOR MAJOR ECONOMIES

TABLE 5 GDP TRENDS AND FORECASTS OF MAJOR ECONOMIES, 2019–2027 (USD BILLION)

6 INDUSTRY TRENDS (Page No. - 53)

6.1 SUPPLY CHAIN ANALYSIS

FIGURE 20 BLACK PHOSPHORUS MARKET: SUPPLY CHAIN

6.1.1 RAW MATERIALS

6.1.2 MANUFACTURERS

6.1.3 DISTRIBUTION NETWORK

6.1.4 END USERS

6.2 BLACK PHOSPHORUS MARKET: REALISTIC, PESSIMISTIC, OPTIMISTIC, AND NON-COVID-19 SCENARIOS

FIGURE 21 MARKET SIZE UNDER REALISTIC, PESSIMISTIC, OPTIMISTIC, AND NON-COVID-19 SCENARIOS

TABLE 6 BLACK PHOSPHORUS MARKET FORECAST SCENARIO, 2019–2027 (USD THOUSAND)

6.2.1 NON-COVID-19 SCENARIO

6.2.2 OPTIMISTIC SCENARIO

6.2.3 PESSIMISTIC SCENARIO

6.2.4 REALISTIC SCENARIO

6.3 PRICING ANALYSIS

6.3.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY APPLICATION

FIGURE 22 AVERAGE SELLING PRICE BY KEY PLAYERS FOR TOP 3 APPLICATIONS

TABLE 7 AVERAGE SELLING PRICE BY KEY PLAYERS FOR TOP 3 APPLICATIONS (USD THOUSAND/KG)

6.3.2 AVERAGE SELLING PRICE, BY REGION

FIGURE 23 AVERAGE SELLING PRICE OF BLACK PHOSPHORUS, BY REGION

TABLE 8 AVERAGE SELLING PRICE OF BLACK PHOSPHORUS, BY REGION (USD THOUSAND/KG)

6.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

6.4.1 REVENUE SHIFTS & REVENUE POCKETS IN BLACK PHOSPHORUS MARKET

FIGURE 24 REVENUE SHIFT FOR MARKET

6.5 CONNECTED MARKETS: ECOSYSTEM

TABLE 9 MARKET: ECOSYSTEM

FIGURE 25 BLACK PHOSPHORUS: CONNECTED MARKET

6.6 TECHNOLOGY ANALYSIS

6.6.1 TWO-DIMENSIONAL (2D) MATERIALS

6.7 TRADE DATA STATISTICS

6.7.1 IMPORT SCENARIO OF BLACK PHOSPHORUS

FIGURE 26 IMPORT OF BLACK PHOSPHORUS, BY KEY COUNTRIES (2014–2021)

TABLE 10 BLACK PHOSPHORUS IMPORTS, BY REGION, 2014–2021 (USD THOUSAND)

6.7.2 EXPORT SCENARIO OF BLACK PHOSPHORUS

FIGURE 27 EXPORT OF BLACK PHOSPHORUS, BY KEY COUNTRIES (2014–2021)

TABLE 11 BLACK PHOSPHORUS EXPORTS, BY REGION, 2014–2021 (USD THOUSAND)

6.8 REGULATORY LANDSCAPE

6.8.1 REGULATORY BODIES AND REGULATIONS RELATED TO BLACK PHOSPHORUS

6.9 KEY CONFERENCES & EVENTS IN 2022–2023

TABLE 12 BLACK PHOSPHORUS MARKET: DETAILED LIST OF CONFERENCES & EVENTS

6.10 PATENT ANALYSIS

6.10.1 APPROACH

6.10.2 DOCUMENT TYPE

TABLE 13 TOTAL NUMBER OF PATENTS DURING 2011–2021

FIGURE 28 PATENTS REGISTERED IN BLACK PHOSPHORUS MARKET, 2011–2021

FIGURE 29 PATENT PUBLICATION TRENDS, 2011–2021

FIGURE 30 LEGAL STATUS OF PATENTS FILED IN BLACK PHOSPHORUS MARKET

6.10.3 JURISDICTION ANALYSIS

FIGURE 31 MAXIMUM PATENTS FILED IN JURISDICTION OF US

6.10.4 TOP APPLICANTS

FIGURE 32 SEMICONDUCTOR ENERGY LAB REGISTERED MAXIMUM NUMBER OF PATENTS BETWEEN 2011 AND 2021

TABLE 14 LIST OF PATENTS BY SEMICONDUCTOR ENERGY LAB

TABLE 15 LIST OF PATENTS BY PIONEER HI-BRED INTERNATIONAL

TABLE 16 LIST OF PATENTS BY FUJIFILM CORPORATION

TABLE 17 TOP 10 PATENT OWNERS IN US, 2011–2021

7 BLACK PHOSPHOROUS MARKET, BY FORM (Page No. - 68)

7.1 INTRODUCTION

FIGURE 33 CRYSTAL FORM TO DOMINATE BLACK PHOSPHORUS MARKET DURING FORECAST PERIOD

TABLE 18 BLACK PHOSPHOROUS MARKET SIZE, BY FORM, 2017–2020 (KILOGRAM)

TABLE 19 BLACK PHOSPHOROUS MARKET SIZE, BY FORM, 2021–2027 (KILOGRAM)

TABLE 20 BLACK PHOSPHOROUS MARKET SIZE, BY FORM, 2017–2020 (USD THOUSAND)

TABLE 21 BLACK PHOSPHOROUS MARKET SIZE, BY FORM, 2021–2027 (USD THOUSAND)

7.2 CRYSTAL

7.2.1 HIGH DEMAND FROM ELECTRONIC DEVICES AND SENSORS SEGMENTS TO DRIVE MARKET

7.3 POWDER

7.3.1 INCREASING USE IN BIOMEDICAL APPLICATIONS TO BOOST MARKET

8 BLACK PHOSPHORUS MARKET, BY APPLICATION (Page No. - 71)

8.1 INTRODUCTION

FIGURE 34 ELECTRONIC DEVICES SEGMENT TO DOMINATE BLACK PHOSPHORUS MARKET DURING FORECAST PERIOD

TABLE 22 MARKET SIZE, BY APPLICATION, 2017–2020 (KILOGRAM)

TABLE 23 MARKET SIZE, BY APPLICATION, 2021–2027 (KILOGRAM)

TABLE 24 MARKET SIZE, BY APPLICATION, 2017–2020 (USD THOUSAND)

TABLE 25 MARKET SIZE, BY APPLICATION, 2021–2027 (USD THOUSAND)

8.2 ELECTRONIC DEVICES

8.2.1 HIGH MOBILITY, IN-PLANE ANISOTROPY, AND DIRECT BAND GAP TO DRIVE MARKET

TABLE 26 ELECTRONIC DEVICES: BLACK PHOSPHORUS MARKET SIZE, BY REGION, 2017–2020 (KILOGRAM)

TABLE 27 ELECTRONIC DEVICES: BLACK PHOSPHORUS SIZE, BY REGION, 2021–2027 (KILOGRAM)

TABLE 28 ELECTRONIC DEVICES: BLACK PHOSPHORUS MARKET SIZE, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 29 ELECTRONIC DEVICES: BLACK PHOSPHORUS SIZE, BY REGION, 2021–2027 (USD THOUSAND)

8.3 SENSORS

8.3.1 INCREASING DEMAND FOR GAS SENSORS TO MONITOR AIR QUALITY TO BOOST MARKET

TABLE 30 SENSORS: BLACK PHOSPHORUS MARKET SIZE, BY REGION, 2017–2020 (KILOGRAM)

TABLE 31 SENSORS: BLACK PHOSPHORUS SIZE, BY REGION, 2021–2027 (KILOGRAM)

TABLE 32 SENSORS: BLACK PHOSPHORUS MARKET SIZE, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 33 SENSORS: BLACK PHOSPHORUS SIZE, BY REGION, 2021–2027 (USD THOUSAND)

8.4 ENERGY STORAGE

8.4.1 GROWING INVESTMENTS IN RENEWABLE ENERGY TO SUPPORT MARKET GROWTH

TABLE 34 ENERGY STORAGE: BLACK PHOSPHORUS MARKET SIZE, BY REGION, 2017–2020 (KILOGRAM)

TABLE 35 ENERGY STORAGE: BLACK PHOSPHORUS SIZE, BY REGION, 2021–2027 (KILOGRAM)

TABLE 36 ENERGY STORAGE: BLACK PHOSPHORUS MARKET SIZE, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 37 ENERGY STORAGE: BLACK PHOSPHORUS SIZE, BY REGION, 2021–2027 (USD THOUSAND)

8.5 OTHERS

TABLE 38 OTHER APPLICATIONS: BLACK PHOSPHORUS MARKET SIZE, BY REGION, 2017–2020 (KILOGRAM)

TABLE 39 OTHER APPLICATIONS: MARKET SIZE, BY REGION, 2021–2027 (KILOGRAM)

TABLE 40 OTHER APPLICATIONS: MARKET SIZE, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 41 OTHER APPLICATIONS: MARKET SIZE, BY REGION, 2021–2027 (USD THOUSAND)

9 BLACK PHOSPHORUS MARKET, BY REGION (Page No. - 80)

9.1 INTRODUCTION

FIGURE 35 NORTH AMERICA TO LEAD BLACK PHOSPHORUS MARKET DURING FORECAST PERIOD

TABLE 42 MARKET SIZE, BY REGION, 2017–2020 (KILOGRAM)

TABLE 43 MARKET SIZE, BY REGION, 2021–2027 (KILOGRAM)

TABLE 44 MARKET SIZE, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 45 MARKET SIZE, BY REGION, 2021–2027 (USD THOUSAND)

9.2 ASIA PACIFIC

FIGURE 36 ASIA PACIFIC: BLACK PHOSPHORUS MARKET SNAPSHOT

9.2.1 ASIA PACIFIC: MARKET, BY APPLICATION

TABLE 46 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2017–2020 (KILOGRAM)

TABLE 47 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2021–2027 (KILOGRAM)

TABLE 48 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2017–2020 (USD THOUSAND)

TABLE 49 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2021–2027 (USD THOUSAND)

9.2.2 ASIA PACIFIC: BLACK PHOSPHORUS MARKET, BY COUNTRY

TABLE 50 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2017–2020 (KILOGRAM)

TABLE 51 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2021–2027 (KILOGRAM)

TABLE 52 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2017–2020 (USD THOUSAND)

TABLE 53 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2021–2027 (USD THOUSAND)

9.2.2.1 China

9.2.2.1.1 Large consumer base to fuel market

TABLE 54 CHINA: BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2017–2020 (KILOGRAM)

TABLE 55 CHINA: MARKET SIZE, BY APPLICATION, 2021–2027 (KILOGRAM)

TABLE 56 CHINA: MARKET SIZE, BY APPLICATION, 2017–2020 (USD THOUSAND)

TABLE 57 CHINA: MARKET SIZE, BY APPLICATION, 2021–2027 (USD THOUSAND)

9.2.2.2 Japan

9.2.2.2.1 Electric passenger cars to drive demand for black phosphorus

TABLE 58 JAPAN: BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2017–2020 (KILOGRAM)

TABLE 59 JAPAN: MARKET SIZE, BY APPLICATION, 2021–2027 (KILOGRAM)

TABLE 60 JAPAN: MARKET SIZE, BY APPLICATION, 2017–2020 (USD THOUSAND)

TABLE 61 JAPAN: MARKET SIZE, BY APPLICATION, 2021–2027 (USD THOUSAND)

9.2.2.3 South Korea

9.2.2.3.1 Increasing FDI to generate high demand from end-use industries

TABLE 62 SOUTH KOREA: BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2017–2020 (KILOGRAM)

TABLE 63 SOUTH KOREA: MARKET SIZE, BY APPLICATION, 2021–2027 (KILOGRAM)

TABLE 64 SOUTH KOREA: MARKET SIZE, BY APPLICATION, 2017–2020 (USD THOUSAND)

TABLE 65 SOUTH KOREA: MARKET SIZE, BY APPLICATION, 2021–2027 (USD THOUSAND)

9.3 NORTH AMERICA

FIGURE 37 NORTH AMERICA: BLACK PHOSPHORUS MARKET SNAPSHOT

9.3.1 NORTH AMERICA: MARKET, BY APPLICATION

TABLE 66 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2017–2020 (KILOGRAM)

TABLE 67 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2021–2027 (KILOGRAM)

TABLE 68 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2017–2020 (USD THOUSAND)

TABLE 69 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2021–2027 (USD THOUSAND)

9.3.2 NORTH AMERICA: MARKET, BY COUNTRY

TABLE 70 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2020 (KILOGRAM)

TABLE 71 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2027 (KILOGRAM)

TABLE 72 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2020 (USD THOUSAND)

TABLE 73 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2027 (USD THOUSAND)

9.3.2.1 US

9.3.2.1.1 Growing automotive industry and strong customer base to boost market

TABLE 74 US: BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2017–2020 (KILOGRAM)

TABLE 75 US: MARKET SIZE, BY APPLICATION, 2021–2027 (KILOGRAM)

TABLE 76 US: MARKET SIZE, BY APPLICATION, 2017–2020 (USD THOUSAND)

TABLE 77 US: MARKET SIZE, BY APPLICATION, 2021–2027 (USD THOUSAND)

9.3.2.2 Mexico

9.3.2.2.1 Increasing industrialization to drive market

TABLE 78 MEXICO: BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2017–2020 (KILOGRAM)

TABLE 79 MEXICO: MARKET SIZE, BY APPLICATION, 2021–2027 (KILOGRAM)

TABLE 80 MEXICO: MARKET SIZE, BY APPLICATION, 2017–2020 (USD THOUSAND)

TABLE 81 MEXICO: MARKET SIZE, BY APPLICATION, 2021–2027 (USD THOUSAND)

9.3.2.3 Canada

9.3.2.3.1 Rising demand from electronic devices and sensors segments to boost market

TABLE 82 CANADA: MARKET SIZE, BY APPLICATION, 2017–2020 (KILOGRAM)

TABLE 83 CANADA: BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2021–2027 (KILOGRAM)

TABLE 84 CANADA: MARKET SIZE, BY APPLICATION, 2017–2020 (USD THOUSAND)

TABLE 85 CANADA: MARKET SIZE, BY APPLICATION, 2021–2027 (USD THOUSAND)

9.4 EUROPE

FIGURE 38 EUROPE: BLACK PHOSPHORUS MARKET SNAPSHOT

9.4.1 EUROPE: MARKET, BY APPLICATION

TABLE 86 EUROPE: MARKET SIZE, BY APPLICATION, 2017–2020 (KILOGRAM)

TABLE 87 EUROPE: MARKET SIZE, BY APPLICATION, 2021–2027 (KILOGRAM)

TABLE 88 EUROPE: MARKET SIZE, BY APPLICATION, 2017–2020 (USD THOUSAND)

TABLE 89 EUROPE: MARKET SIZE, BY APPLICATION, 2021–2027 (USD THOUSAND)

9.4.2 EUROPE: MARKET, BY COUNTRY

TABLE 90 EUROPE: MARKET SIZE, BY COUNTRY, 2017–2020 (KILOGRAM)

TABLE 91 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2027 (KILOGRAM)

TABLE 92 EUROPE: MARKET SIZE, BY COUNTRY, 2017–2020 (USD THOUSAND)

TABLE 93 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2027 (USD THOUSAND)

9.4.2.1 Germany

9.4.2.1.1 Increasing demand from energy storage and sensors segments to drive market

TABLE 94 GERMANY: BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2017–2020 (KILOGRAM)

TABLE 95 GERMANY: MARKET SIZE, BY APPLICATION, 2021–2027 (KILOGRAM)

TABLE 96 GERMANY: MARKET SIZE, BY APPLICATION, 2017–2020 (USD THOUSAND)

TABLE 97 GERMANY: MARKET SIZE, BY APPLICATION, 2021–2027 (USD THOUSAND)

9.4.2.2 France

9.4.2.2.1 Strong workforce, excellent industrial hub, and presence of international companies to drive market

TABLE 98 FRANCE: BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2017–2020 (KILOGRAM)

TABLE 99 FRANCE: MARKET SIZE, BY APPLICATION, 2021–2027 (KILOGRAM)

TABLE 100 FRANCE: MARKET SIZE, BY APPLICATION, 2017–2020 (USD THOUSAND)

TABLE 101 FRANCE: MARKET SIZE, BY APPLICATION, 2021–2027 (USD THOUSAND)

9.4.2.3 UK

9.4.2.3.1 Government policies to promote sales of electric vehicles

TABLE 102 UK: BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2017–2020 (KILOGRAM)

TABLE 103 UK: MARKET SIZE, BY APPLICATION, 2021–2027 (KILOGRAM)

TABLE 104 UK: MARKET SIZE, BY APPLICATION, 2017–2020 (USD THOUSAND)

TABLE 105 UK: MARKET SIZE, BY APPLICATION, 2021–2027 (USD THOUSAND)

9.5 REST OF WORLD

9.5.1 REST OF WORLD: BLACK PHOSPHORUS MARKET, BY APPLICATION

TABLE 106 REST OF WORLD: MARKET SIZE, BY APPLICATION, 2017–2020 (KILOGRAM)

TABLE 107 REST OF WORLD: MARKET SIZE, BY APPLICATION, 2021–2027 (KILOGRAM)

TABLE 108 REST OF WORLD: MARKET SIZE, BY APPLICATION, 2017–2020 (USD THOUSAND)

TABLE 109 REST OF WORLD: MARKET SIZE, BY APPLICATION, 2021–2027 (USD THOUSAND)

10 COMPETITIVE LANDSCAPE (Page No. - 110)

10.1 INTRODUCTION

10.2 STRATEGIES ADOPTED BY KEY PLAYERS

TABLE 110 OVERVIEW OF STRATEGIES ADOPTED BY KEY BLACK PHOSPHORUS MANUFACTURERS

10.3 MARKET SHARE ANALYSIS

10.3.1 RANKING OF KEY MARKET PLAYERS, 2021

FIGURE 39 RANKING OF TOP 5 PLAYERS IN BLACK PHOSPHORUS MARKET, 2021

10.3.2 MARKET SHARE OF KEY PLAYERS

TABLE 111 BLACK PHOSPHORUS MARKET: DEGREE OF COMPETITION

FIGURE 40 OSSILA LTD. LED BLACK PHOSPHORUS MARKET IN 2021

10.3.2.1 Ossila Ltd.

10.3.2.2 Merck

10.3.2.3 Nanochemazone

10.3.2.4 American Elements

10.3.2.5 ACS Material, LLC

10.3.3 REVENUE ANALYSIS OF TOP 5 PLAYERS

FIGURE 41 REVENUE ANALYSIS OF TOP 5 COMPANIES IN LAST 5 YEARS

10.4 COMPANY PRODUCT FOOTPRINT ANALYSIS

FIGURE 42 BLACK PHOSPHORUS MARKET: COMPANY FOOTPRINT

TABLE 112 MARKET: APPLICATION FOOTPRINT

TABLE 113 MARKET: FORM FOOTPRINT

TABLE 114 MARKET: COMPANY REGION FOOTPRINT

10.5 COMPANY EVALUATION QUADRANT (TIER 1)

10.5.1 STARS

10.5.2 EMERGING LEADERS

10.5.3 PARTICIPANTS

FIGURE 43 TIER 1 COMPANY EVALUATION QUADRANT FOR BLACK PHOSPHORUS MARKET

10.6 COMPETITIVE BENCHMARKING

TABLE 115 MARKET: DETAILED LIST OF KEY START-UPS/SMES

TABLE 116 BLACK PHOSPHORUS MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

10.7 START-UP/SME EVALUATION QUADRANT

10.7.1 PROGRESSIVE COMPANIES

10.7.2 RESPONSIVE COMPANIES

10.7.3 STARTING BLOCKS

FIGURE 44 START-UP/SME EVALUATION QUADRANT FOR BLACK PHOSPHORUS MARKET

10.8 COMPETITIVE SITUATIONS & TRENDS

10.8.1 DEALS

TABLE 117 BLACK PHOSPHORUS MARKET: DEALS (2018–2022)

11 COMPANY PROFILES (Page No. - 124)

(Business overview, Products offered, Recent Developments, MNM view)*

11.1 OSSILA LTD.

TABLE 118 OSSILA LTD.: COMPANY OVERVIEW

11.2 ACS MATERIAL, LLC

TABLE 119 ACS MATERIAL, LLC: COMPANY OVERVIEW

11.3 NANOCHEMAZONE

TABLE 120 NANOCHEMAZONE: COMPANY OVERVIEW

11.4 AMERICAN ELEMENTS

TABLE 121 AMERICAN ELEMENTS: COMPANY OVERVIEW

11.5 MERCK

TABLE 122 MERCK: COMPANY OVERVIEW

11.6 HQ GRAPHENE

TABLE 123 HQ GRAPHENE: COMPANY OVERVIEW

11.7 HUNAN AZEAL MATERIALS CO. LTD.

TABLE 124 HUNAN AZEAL MATERIALS CO. LTD.: COMPANY OVERVIEW

11.8 STANFORD ADVANCED MATERIALS

TABLE 125 STANFORD ADVANCED MATERIALS: COMPANY OVERVIEW

11.9 MANCHESTER NANOMATERIALS

TABLE 126 MANCHESTER NANOMATERIALS: COMPANY OVERVIEW

11.10 NANJING XFNANO MATERIALS TECH CO. LTD

TABLE 127 NANJING XFNANO MATERIALS TECH CO. LTD.: COMPANY OVERVIEW

11.11 WEISTRON CO. LTD.

TABLE 128 WEISTRON CO. LTD.: COMPANY OVERVIEW

11.12 TAIZHOU SUNANO ENERGY CO., LTD.

TABLE 129 TAIZHOU SUNANO ENERGY CO., LTD.: COMPANY OVERVIEW

11.13 ULTRANANOTECH PRIVATE LIMITED

TABLE 130 ULTRANANOTECH PRIVATE LIMITED.: COMPANY OVERVIEW

11.14 SMART ELEMENTS

TABLE 131 SMART ELEMENTS: COMPANY OVERVIEW

*Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

12 ADJACENT & RELATED MARKETS (Page No. - 144)

12.1 INTRODUCTION

12.2 LIMITATIONS

12.3 ELECTRONIC CHEMICALS AND MATERIALS MARKET

12.3.1 MARKET DEFINITION

12.3.2 MARKET OVERVIEW

12.3.3 ELECTRONIC CHEMICALS AND MATERIALS MARKET, BY REGION

TABLE 132 ELECTRONIC CHEMICALS AND MATERIALS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

12.3.3.1 North America

TABLE 133 NORTH AMERICA: ELECTRONIC CHEMICALS AND MATERIALS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

12.3.3.2 Europe

TABLE 134 EUROPE: ELECTRONIC CHEMICALS AND MATERIALS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

12.3.3.3 APAC

TABLE 135 APAC: ELECTRONIC CHEMICALS AND MATERIALS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

12.3.3.4 Rest of World

TABLE 136 ROW: ELECTRONIC CHEMICALS AND MATERIALS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

13 APPENDIX (Page No. - 147)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 CUSTOMIZATION OPTIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

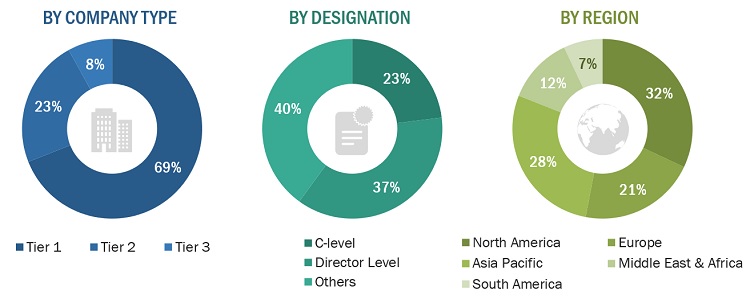

The study involved four major activities in estimating the market size for the black phosphorus market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Post that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. Findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives.

Primary Research

The black phosphorus market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of electronics, energy storage, sensors and other industries. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Breakdown of Primary Participants

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the black phosphorus market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

The key players in the industry were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the food, pharmaceuticals, cosmetics, among other industries.

Report Objectives

- To analyze and forecast the size of the black phosphorus market in terms of value and volume

- To provide detailed information regarding key factors, such as drivers, restraints, challenges and opportunities influencing the growth of the market

- To define, describe, and segment the black phosphorus market based on form, and application.

- To forecast the size of the market segments for regions such as North America, Europe, Asia Pacific, Middle East & Africa and South America.

- To strategically analyze the segmented markets with respect to individual growth trends, prospects, and contribution to the overall market

- To identify and analyze opportunities for stakeholders in the market

- To strategically profile key players and comprehensively analyze their core competencies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Black Phosphorus Market