Biodegradable Mulch Film Market by Biodegradable Plastic (TPS, AAC, Controlled Degradable Masterbatches), by Type (Starch, Starch Blended With PLA, Starch Blended With PHA), by Crop Type (Fruits & Veg, Grains, Plants) & by Region - Global Forecast to 2021

[142 Pages Report] MarketsandMarkets projects the global biodegradable mulch film market size to grow from USD 35.76 Million in 2016 to USD 52.43 Million by 2021, at a CAGR of 7.95% from 2016 to 2021. The growth of the biodegradable mulch film market can be attributed to the rising demand of biodegradable mulch films in greenhouse, increased applications in agriculture, and rising environmental concerns that shifted the focus of growers toward eco-friendly mulch films. Furthermore, market players are responding to these new opportunities of increasing crop output by expanding their global presence and product lines.

The biodegradable mulch film market is segmented on the basis of type, biodegradable plastic, crop type, and region. The years considered for the study are as follows:

- Base year – 2015

- Estimated year – 2016

- Projected year – 2021

- Forecast period – 2016 to 2021

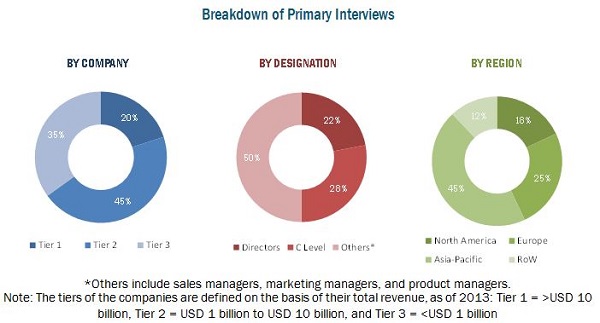

This report includes estimation of market sizes for value (USD million). Both top-down and bottom-up approaches have been used to estimate and validate the size of the mulch film market and to estimate the size of various other dependent submarkets. Key players in the market have been identified through secondary research, and their market share in their respective regions has been determined through primary and secondary research. All percentage shares, splits, and breakdowns have been determined using secondary sources and were verified through primary sources.

To know about the assumptions considered for the study, download the pdf brochure

The raw material suppliers provide the required materials to manufacturers, which are used to produce mulch films. At the end of the production process, the finished products are distributed through various channels, such as retail chains, distributors, or supply chain of respective manufacturers. End users such as farmers/crop producers and agricultural companies then purchase biodegradable mulch films for the use on agricultural farms and for horticulture purposes.

Target Audience:

- Suppliers

- R&D institutes

- Technology providers

- Mulch film manufacturers/suppliers

- Plastic film manufacturers/suppliers/processors

- Intermediary suppliers

- Wholesalers

- Dealers

- Consumers

- End users

- Retailers

BASF SE (Germany), Kingfa Sci & Tech Co Ltd (China), BioBag International AS (Norway), RKW Group (Germany), and AEP Industries, Inc. (U.S.) are the leading players in the biodegradable mulch film market in 2015. Expansions & investments and new product launches are preferred growth strategies by these players in the biodegradable mulch film market. The purpose of adopting strategic expansion is to increase the geographic presence and product portfolio. British Polyethylene Industries Plc (U.K.), Novamont (Italy), Armando Alvarez (Spain), and Al-Pack Enterprise Ltd (Canada) also have a strong presence in this market.

“The study answers several questions for stakeholders, primarily which market segments to focus on in the next two to five years for prioritizing efforts and investments.”

Scope of the Report

This research report categorizes the biodegradable mulch film market based on biodegradable plastic, type, crop type, and region.

Based on Biodegradable plastic, the market has been segmented as follows:

- Thermoplastic starch (TPS)

- Aliphatic-aromatic copolyesters (AAC)

- Controlled degradation masterbatches

- Others (naturally produced polyesters including PVB, PHB, and PHBH; renewable resource polyesters such as PLA; synthetic aliphatic polyesters including PCL and PBS; photo-biodegradable plastics)

Based on Type, the market has been segmented as follows:

- Starch

- Starch blended with polylactic acid (PLA)

- Starch blended with polyhydroxyalkanoate (PHA)

- Others [starch blended with polyhydroxyhexanoate (PHH), starch blended with polylactic acid aliphatic copolymer (CPLA)]

Based on Crop Type, the market has been segmented as follows:

- Fruits & vegetables

- Grains & oilseeds

- Flowers & plants

Based on Region, the market has been segmented as follows:

- Asia-Pacific

- Europe

- North America

- RoW (Brazil, Africa, South Africa, and Others)

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to five)

MarketsandMarkets projects the global biodegradable mulch film market size to grow from USD 35.76 Million in 2016 to USD 52.43 Million by 2021, at a CAGR of 7.95% from 2016 to 2021. The growth of the biodegradable mulch film market can be attributed to the rising demand of biodegradable mulch films in greenhouse, increased applications in agriculture, and rising environmental concerns that shifted the focus of growers toward eco-friendly mulch films.

Mulching is a technique used to cover the soil surface around crops to create optimum conditions for crop growth. The usage of biodegradable mulch films is an eco-friendly mulching technique to carry out controlled agriculture on limited arable land, with limited irrigation. With the ability to self-degrade at the end of the cycle, it avoids the removal and disposal of plastic. Biodegradable mulch films, without having any adverse impact on environment, assist in improving crop quality and enhancing agricultural productivity by minimizing soil erosion, providing nutrients, increasing soil temperature, and suppressing the growth of weeds, among others.

Starch, in the biodegradable mulch film market, is projected to account for the largest value during the forecast period. The high demand of starch in the biodegradable mulch films market can be credited to its wide availability and low cost. Starch also degrades into harmless products when placed in contact with soil microorganisms. Additionally, it has high amylose content which helps in the formation of strong and flexible biodegradable mulch films. This has boosted the demand of starch in the biodegradable mulch film market.

The thermoplastic starch segment is projected to have the largest share in the biodegradable mulch film market. With the rising environmental issues related to the use of conventional synthetic polymers, growers have shifted their focus toward the adoption of biodegradable materials made from renewable resources. Thermoplastic starch being widely available, renewable, biodegradable, and economical has gained high demand in the biodegradable mulch films market.

The fruits & vegetables segment is estimated to have the largest value in the biodegradable mulch films market in 2015 and the current trend is expected to follow during the forecast period. The agricultural industry has recognized the visible benefits of biodegradable mulch films in reducing soil compaction, fertilizer leaching, moisture evaporation, weed problems, and increasing soil temperature to obtain higher yield and increase early growth in crops while providing the additional benefit of biodegrading, So, there is wide usage of biodegradable mulch films to ensure optimal growth of fruits & vegetables.

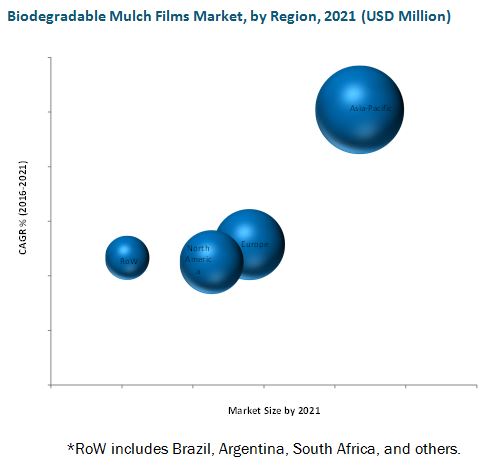

The Asia-Pacific region is projected to grow at the highest rate in the biodegradable mulch films market. China is on the top of the list in terms of sales of biodegradable mulch films. Increasing population, especially in the Asia-Pacific region, has resulted in increasing demand for food, which will lead to increased usage of biodegradable mulch films in crop production. The rising population and shrinking agricultural land due to industrialization and urbanization have compelled farmers to produce more in the same land holding. Hence, farmers are using biodegradable mulch films in large numbers owing to its lower impact on environment, while enhancing crop yield by reducing competitive weed pressure, maintaining soil moisture levels, and modulating soil temperature.

The high cost of installation of biodegradable mulch films is one of the key factors that restrict their implementation, primarily in developing nations. Despite the market having significant potential in developing nations such as India, the high initial cost has become a cause of concern for farmers. In addition, the machines used to level and shape the soil and apply the biodegradable mulch films add to the cost. The average land holding per farmer is decreasing gradually because of increasing population. This affects the purchasing power parity of farmers and lowers the sale of biodegradable mulch films. Thus, high investment in mulching becomes a limiting factor for the biodegradable mulch films market, especially in developing countries.

The biodegradable mulch films market is diversified and competitive, with a large number of players. The key players in the biodegradable mulch films market include BASF SE (Germany), Kingfa Sci & Tech Co Ltd (China), BioBag International AS (Norway), AEP Industries Inc. (U.S.), and RKW SE (Germany), while other players include British Polythene Industries PLC (U.K.), Armando Alvarez (Spain), Al-Pack Enterprises Ltd. (Canada), Novamont S.Pa. (Italy), and AB Rani Plast OY (Finland). These players have adopted various strategies to expand their global presence and increase their market share. Expansions, agreements, joint ventures, mergers & acquisitions, and new product launches & technological advancements are some of the major strategies adopted by the market players to achieve growth in the biodegradable mulch films market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Geographic Scope

1.3.2 Years Considered

1.4 Currency Considered

1.5 Limitations

1.6 Stakeholders

2 Research Methodology

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.2.1 Breakdown of Primaries - By Company Type, Designation & Region

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Overview of the Parent Industry

2.2.3 Demand-Side Analysis

2.2.4 Supply-Side Analysis

2.3 Market Size Estimation

2.4 Market Breakdown and Data Triangulation

2.5 Market Share Estimation

2.6 Research Assumptions and Limitations

3 Executive Summary

4 Premium Insights

5 Market Overview

5.1 Introduction

5.2 Evolution

5.3 Market Segmentation

5.3.1 Bio-Degradable Mulch Film Market, By Biodegradable Plastics

5.3.2 Bio-Degradable Mulch Film Market, By Composition

5.3.3 Bio-Degradable Mulch Film Market, By Type of Crop/Application

5.3.4 Bio-Degradable Mulch Film Market, By Region

5.4 Market Dynamics

5.4.1 Drivers

5.4.2 Restraints

5.4.3 Opportunities

5.4.4 Challenges

5.5 Bio-Degradable Mulch Film Market, Price Analysis, 2014

5.6 Comparison Between Pe Based Films and Bio-Degradable Films

6 Industry Trends

6.1 Introduction

6.2 Value Chain Analysis

6.3 Industry Trends

6.4 Porter’s Five Forces Analysis

6.4.1 Threat of New Entrants

6.4.2 Threat of Substitutes

6.4.3 Bargaining Power of Suppliers

6.4.4 Bargaining Power of Buyers

6.4.5 Intensity of Competitive Rivalry

6.5 Competing Technologies

7 Bio-Degradable Mulch Film Market, By Biodegradable Plastics

7.1 Introduction

7.2 Thermoplastic Starch (TPS)

7.3 Aliphatic-Aromatic Copolyesters (AAC)

7.4 Controlled Degradation Masterbatches

8 Bio-Degradable Mulch Film Market, By Composition

8.1 Introduction

8.2 Starch

8.3 Starch Blended With Polylactic Acid (PLA)

8.4 Starch Blended With Polyhydroxyalkanoate (PHA)

8.5 Others

9 Bio-Degradable Mulch Film Market, By Type of Crop/Application

9.1 Introduction

9.2 Onion

9.3 Strawberry Crops

9.4 Flowers & Plants

9.5 Tomato

9.6 Others

10 Bio-Degradable Mulch Film Market, By Region

10.1 Introduction

10.2 Regulations

10.3 North America

10.3.1 Introduction

10.3.2 U.S.

10.3.3 Canada

10.3.4 Mexico

10.4 Europe

10.4.1 Introduction

10.4.2 Germany

10.4.3 U.K.

10.4.4 France

10.4.5 Rest of Europe

10.5 Asia-Pacific

10.5.1 Introduction

10.5.2 China

10.5.3 India

10.5.4 Japan

10.5.5 Rest of Asia-Pacific

10.6 Rest of the World

10.6.1 Introduction

10.6.2 Brazil

10.6.3 Argentina

10.6.4 South Africa

12.6.5 Others

11 Competitive Landscape

11.1 Overview

11.2 Key Players of Bio-Degradable Mulch Film Market

11.3 Competitive Situations & Trends

11.4 Investments & Expansions: the Key Strategy

11.4.1 Investments & Expansions

11.4.2 Partnerships, Agreements & Contracts

11.4.3 Mergers & Acquisitions

11.4.4 New Product Launches & Technological Advancements

11.5 Innovation Spotlight

12 Company Profiles

12.1 Introduction

12.2 BASF SE

12.2.1 Business Overview

12.2.2 Products Offered

12.2.3 Recent Developments

12.2.4 MnM View

12.2.4.1 SWOT Analysis

12.3 Kingfa Sci & Tech Co Ltd

12.3.1 Business Overview

12.3.2 Products Offered

12.3.3 Recent Developments

12.3.4 MnM View

12.4 Biobag International as

12.4.1 Business Overview

12.4.2 Products Offered

12.4.3 Recent Developments

12.5 RKW Se

12.5.1 Business Overview

12.5.2 Products

12.5.3 Recent Developments

12.5.5 MnM View

12.5.5.1 SWOT Analysis

12.6 AEP Industries Inc.

12.6.1 Business Overview

12.6.2 Products Offered

12.6.3 Recent Developments

12.6.4 MnM View

12.6.4.1 SWOT Analysis

12.7 Al-Pack Enterprises Ltd.

12.7.1 Business Overview

12.7.2 Products Offered

12.7.3 Recent Developments

12.7.4 MnM View

12.7.4.1 SWOT Analysis

12.8 AB Rani Plast Oy.

12.8.1 Business Overview

12.8.2 Products Offered

12.8.3 Recent Developments

12.9 Novamont S.Pa.

12.9.1 Business Overview

12.9.2 Products Offered

12.9.3 Recent Developments

12.10 British Polythene Industries PLC

12.10.1 Business Overview

12.10.2 Product Offered

12.10.3 Recent Developments

12.11 Armando Alvarez

12.11.1 Business Overview

12.11.2 Products Offered

12.11.3 Recent Developments

13 Appendix

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Introducing RT:Real Time Market Intelligence

13.4 Available Customizations

13.5 Related Reports

* The Company List is Subject to Change as the Research Progresses

List of Tables (142 Tables)

Table 1 Pe-Based Mulch Films Versus Biodegradable Mulch Films

Table 2 Biodegradable Mulch Films Market, By Biodegradable Plastic, 2014–2021 (USD Million)

Table 3 Biodegradable Mulch Films Market, By Biodegradable Plastics, 2014–2021 (Million Square Meters)

Table 4 Biodegradable Mulch Films Market, By Type, 2014–2021 (USD Million)

Table 5 Biodegradable Mulch Films Market, By Type, 2014–2021 (Million Square Meters)

Table 6 Biodegradable Mulch Films Market Size, By Crop Type, 2014–2021 (USD Million)

Table 7 Biodegradable Mulch Films Market Size, By Crop Type, 2014–2021 (Million Square Meters)

Table 8 Biodegradable Mulch Films Market Size, By Region, 2014–2021 (USD Million)

Table 9 Biodegradable Mulch Films Market Size, By Region, 2014–2021 (Million Square Meters)

Table 10 Asia-Pacific: Biodegradable Mulch Film Market Size, By Country, 2014–2021 (USD Million)

Table 11 Asia-Pacific: Biodegradable Mulch Film Market Size, By Country, 2014–2021 (Million Square Meters)

Table 12 Asia-Pacific: Biodegradable Mulch Film Market Size, By Biodegradable Plastic, 2014–2021 (USD Million)

Table 13 Asia-Pacific: Biodegradable Mulch Film Market Size, By Biodegradable Plastic, 2014–2021 (Million Square Meters)

Table 14 Asia-Pacific: Biodegradable Mulch Film Market Size, By Crop Type, 2014–2021 (USD Million)

Table 15 Asia-Pacific: Biodegradable Mulch Film Market Size, By Crop Type, 2014–2021 (Million Square Meters)

Table 16 Asia-Pacific: Biodegradable Mulch Film Market Size, By Type, 2014–2021 (USD Million)

Table 17 Asia-Pacific: Biodegradable Mulch Film Market Size, By Type, 2014–2021 (Million Square Meters)

Table 18 China: Biodegradable Mulch Film Market Size, By Biodegradable Plastic, 2014–2021 (USD Million)

Table 19 China: Biodegradable Mulch Film Market Size, By Biodegradable Plastic, 2014–2021 (Million Square Meters)

Table 20 China: Biodegradable Mulch Film Market Size, By Crop Type, 2014–2021 (USD Million)

Table 21 China: Biodegradable Mulch Film Market Size, By Crop Type, 2014–2021 (Million Square Meters)

Table 22 China: Biodegradable Mulch Film Market Size, By Type, 2014–2021 (USD Million)

Table 23 China: Biodegradable Mulch Film Market Size, By Type, 2014–2021 (Million Square Meters)

Table 24 Australia: Biodegradable Mulch Film Market Size, By Biodegradable Plastic, 2014–2021 (USD Million)

Table 25 Australia: Biodegradable Mulch Film Market Size, By Biodegradable Plastic, 2014–2021 (Million Square Meters)

Table 26 Australia: Biodegradable Mulch Film Market Size, By Crop Type, 2014–2021 (USD Million)

Table 27 Australia: Biodegradable Mulch Film Market Size, By Crop Type, 2014–2021 (Million Square Meters)

Table 28 Australia: Biodegradable Mulch Film Market Size, By Type, 2014–2021 (USD Million)

Table 29 Australia: Biodegradable Mulch Film Market Size, By Type, 2014–2021 (Million Square Meters)

Table 30 India: Biodegradable Mulch Film Market Size, By Biodegradable Plastic, 2014–2021 (USD Million)

Table 31 India: Biodegradable Mulch Film Market Size, By Biodegradable Plastic, 2014–2021 (Million Square Meters)

Table 32 India: Biodegradable Mulch Film Market Size, By Crop Type, 2014–2021 (USD Million)

Table 33 India: Biodegradable Mulch Film Market Size, By Crop Type, 2014–2021 (Million Square Meters)

Table 34 India: Biodegradable Mulch Film Market Size, By Type, 2014–2021 (USD Million)

Table 35 India: Biodegradable Mulch Film Market Size, By Type, 2014–2021 (Million Square Meters)

Table 36 Rest of Asia-Pacific: Biodegradable Mulch Film Market Size, By Biodegradable Plastic, 2014–2021 (USD Million)

Table 37 Rest of Asia-Pacific: Biodegradable Mulch Film Market Size, By Biodegradable Plastic, 2014–2021 (Million Square Meters)

Table 38 Rest of Asia-Pacific: Biodegradable Mulch Film Market Size, By Crop Type, 2014–2021 (USD Million)

Table 39 Rest of Asia-Pacific: Biodegradable Mulch Film Market Size, By Crop Type, 2014–2021 (Million Square Meters)

Table 40 Rest of Asia-Pacific: Biodegradable Mulch Film Market Size, By Type, 2014–2021 (USD Million)

Table 41 Rest of Asia-Pacific: Biodegradable Mulch Film Market Size, By Type, 2014–2021 (Million Square Meters)

Table 42 Europe: Biodegradable Mulch Film Market Size, By Country, 2014–2021 (USD Million)

Table 43 Europe: Biodegradable Mulch Film Market Size, By Country, 2014–2021 (Million Square Meters)

Table 44 Europe: Biodegradable Mulch Film Market Size, By Biodegradable Plastic, 2014–2021 (USD Million)

Table 45 Europe: Biodegradable Mulch Film Market Size, By Biodegradable Plastic, 2014–2021 (Million Square Meters)

Table 46 Europe: Biodegradable Mulch Film Market Size, By Crop Type, 2014–2021 (USD Million)

Table 47 Europe: Biodegradable Mulch Film Market Size, By Crop Type, 2014–2021 (Million Square Meters)

Table 48 Europe: Biodegradable Mulch Film Market Size, By Type, 2014–2021 (USD Million)

Table 49 Europe: Biodegradable Mulch Film Market Size, By Type, 2014–2021 (Million Square Meters)

Table 50 Spain: Biodegradable Mulch Film Market Size, By Biodegradable Plastic, 2014–2021 (USD Million)

Table 51 Spain: Biodegradable Mulch Film Market Size, By Biodegradable Plastic, 2014–2021 (Million Square Meters)

Table 52 Spain: Biodegradable Mulch Film Market Size, By Crop Type, 2014–2021 (USD Million)

Table 53 Spain: Biodegradable Mulch Film Market Size, By Crop Type, 2014–2021 (Million Square Meters)

Table 54 Spain: Biodegradable Mulch Film Market Size, By Type, 2014–2021 (USD Million)

Table 55 Spain: Biodegradable Mulch Film Market Size, By Type, 2014–2021 (Million Square Meters)

Table 56 Italy: Biodegradable Mulch Film Market Size, By Biodegradable Plastic, 2014–2021 (USD Million)

Table 57 Italy: Biodegradable Mulch Film Market Size, By Biodegradable Plastic, 2014–2021 (Million Square Meters)

Table 58 Italy: Biodegradable Mulch Film Market Size, By Crop Type, 2014–2021 (USD Million)

Table 59 Italy: Biodegradable Mulch Film Market Size, By Crop Type, 2014–2021 (Million Square Meters)

Table 60 Italy: Biodegradable Mulch Film Market Size, By Type, 2014–2021 (USD Million)

Table 61 Italy: Biodegradable Mulch Film Market Size, By Type, 2014–2021 (Million Square Meters)

Table 62 France: Biodegradable Mulch Films Market Size, By Biodegradable Plastic, 2014–2021 (USD Million)

Table 63 France: Biodegradable Mulch Films Market Size, By Biodegradable Plastic, 2014–2021 (Million Square Meters)

Table 64 France: Biodegradable Mulch Films Market Size, By Crop Type, 2014–2021 (USD Million)

Table 65 France: Biodegradable Mulch Films Market Size, By Crop Type, 2014–2021 (Million Square Meters)

Table 66 France: Biodegradable Mulch Films Market Size, By Type, 2014–2021 (USD Million)

Table 67 France: Biodegradable Mulch Films Market Size, By Type, 2014–2021 (Million Square Meters)

Table 68 Germany: Biodegradable Mulch Films Market Size, By Biodegradable Plastic, 2014–2021 (USD Million)

Table 69 Germany: Biodegradable Mulch Films Market Size, By Biodegradable Plastic, 2014–2021 (Million Square Meters)

Table 70 Germany: Biodegradable Mulch Films Market Size, By Crop Type, 2014–2021 (USD Million)

Table 71 Germany: Biodegradable Mulch Films Market Size, By Crop Type, 2014–2021 (Million Square Meters)

Table 72 Germany: Biodegradable Mulch Films Market Size, By Type, 2014–2021 (USD Million)

Table 73 Germany: Biodegradable Mulch Films Market Size, By Type, 2014–2021 (Million Square Meters)

Table 74 Rest of Europe: Biodegradable Mulch Films Market Size, By Biodegradable Plastic, 2014–2021 (USD Million)

Table 75 Rest of Europe: Biodegradable Mulch Films Market Size, By Biodegradable Plastic, 2014–2021 (Million Square Meters)

Table 76 Rest of Europe: Biodegradable Mulch Films Market Size, By Crop Type, 2014–2021 (USD Million)

Table 77 Rest of Europe: Biodegradable Mulch Films Market Size, By Crop Type, 2014–2021 (Million Square Meters)

Table 78 Rest of Europe: Biodegradable Mulch Films Market Size, By Type, 2014–2021 (USD Million)

Table 79 Rest of Europe: Biodegradable Mulch Films Market Size, By Type, 2014–2021 (Million Square Meters)

Table 80 North America: Biodegradable Mulch Films Market Size, By Country, 2014–2021 (USD Million)

Table 81 North America: Biodegradable Mulch Films Market Size, By Country, 2014–2021 (Million Square Meters)

Table 82 North America: Biodegradable Mulch Films Market Size, By Biodegradable Plastic, 2014–2021 (USD Million)

Table 83 North America: Biodegradable Mulch Films Market Size, By Biodegradable Plastic, 2014–2021 (Million Square Meters)

Table 84 North America: Biodegradable Mulch Films Market Size, By Crop Type, 2014–2021 (USD Million)

Table 85 North America: Biodegradable Mulch Films Market Size, By Crop Type, 2014–2021 (Million Square Meters)

Table 86 North America: Biodegradable Mulch Films Market Size, By Type, 2014–2021 (USD Million)

Table 87 North America: Biodegradable Mulch Films Market Size, By Type, 2014–2021 (Million Square Meters)

Table 88 U.S.: Biodegradable Mulch Films Market Size, By Biodegradable Plastic, 2014–2021 (USD Million)

Table 89 U.S.: Biodegradable Mulch Films Market Size, By Biodegradable Plastic, 2014–2021 (Million Square Meters)

Table 90 U.S.: Biodegradable Mulch Films Market Size, By Crop Type, 2014–2021 (USD Million)

Table 91 U.S.: Biodegradable Mulch Films Market Size, By Crop Type, 2014–2021 (Million Square Meters)

Table 92 U.S.: Biodegradable Mulch Films Market Size, By Type, 2014–2021 (USD Million)

Table 93 U.S.: Biodegradable Mulch Films Market Size, By Type, 2014–2021 (Million Square Meters)

Table 94 Mexico: Biodegradable Mulch Films Market Size, By Biodegradable Plastic, 2014–2021 (USD Million)

Table 95 Mexico: Biodegradable Mulch Films Market Size, By Biodegradable Plastic, 2014–2021 (Million Square Meters)

Table 96 Mexico: Biodegradable Mulch Films Market Size, By Crop Type, 2014–2021 (USD Million)

Table 97 Mexico: Biodegradable Mulch Films Market Size, By Crop Type, 2014–2021 (Million Square Meters)

Table 98 Mexico: Biodegradable Mulch Films Market Size, By Type, 2014–2021 (USD Million)

Table 99 Mexico: Biodegradable Mulch Films Market Size, By Type, 2014–2021 (Million Square Meters)

Table 100 Canada: Biodegradable Mulch Films Market Size, By Biodegradable Plastic, 2014–2021 (USD Million)

Table 101 Canada: Biodegradable Mulch Films Market Size, By Biodegradable Plastic, 2014–2021 (Million Square Meters)

Table 102 Canada: Biodegradable Mulch Films Market Size, By Crop Type, 2014–2021 (USD Million)

Table 103 Canada: Biodegradable Mulch Films Market Size, By Crop Type, 2014–2021 (Million Square Meters)

Table 104 Canada: Biodegradable Mulch Films Market Size, By Type, 2014–2021 (USD Million)

Table 105 Canada: Biodegradable Mulch Films Market Size, By Type, 2014–2021 (Million Square Meters)

Table 106 RoW: Biodegradable Mulch Films Market Size, By Country, 2014–2021 (USD Million)

Table 107 RoW: Biodegradable Mulch Films Market Size, By Country, 2014–2021 (Million Square Meters)

Table 108 RoW: Biodegradable Mulch Films Market Size, By Biodegradable Plastic, 2014–2021 (USD Million)

Table 109 RoW: Biodegradable Mulch Films Market Size, By Biodegradable Plastic, 2014–2021 (Million Square Meters)

Table 110 RoW: Biodegradable Mulch Films Market Size, By Crop Type, 2014–2021 (USD Million)

Table 111 RoW: Biodegradable Mulch Films Market Size, By Crop Type, 2014–2021 (Million Square Meters)

Table 112 RoW: Biodegradable Mulch Films Market Size, By Type, |2014–2021 (USD Million)

Table 113 RoW: Biodegradable Mulch Films Market Size, By Type, 2014–2021 (Million Square Meters)

Table 114 Brazil: Biodegradable Mulch Films Market Size, By Biodegradable Plastic, 2014–2021 (USD Million)

Table 115 Brazil: Biodegradable Mulch Films Market Size, By Biodegradable Plastic, 2014–2021 (Million Square Meters)

Table 116 Brazil: Biodegradable Mulch Films Market Size, By Crop Type, 2014–2021 (USD Million)

Table 117 Brazil: Biodegradable Mulch Films Market Size, By Crop Type, 2014–2021 (Million Square Meters)

Table 118 Brazil: Biodegradable Mulch Films Market Size, By Type, 2014–2021 (USD Million)

Table 119 Brazil: Biodegradable Mulch Films Market Size, By Type, 2014–2021 (Million Square Meters)

Table 120 Argentina: Biodegradable Mulch Films Market Size, By Biodegradable Plastic, 2014–2021 (USD Million)

Table 121 Argentina: Biodegradable Mulch Films Market Size, By Biodegradable Plastic, 2014–2021 (Million Square Meters)

Table 122 Argentina: Biodegradable Mulch Films Market Size, By Crop Type, 2014–2021 (USD Million)

Table 123 Argentina: Biodegradable Mulch Films Market Size, By Crop Type, 2014–2021 (Million Square Meters)

Table 124 Argentina: Biodegradable Mulch Films Market Size, By Type, 2014–2021 (USD Million)

Table 125 Argentina: Biodegradable Mulch Films Market Size, By Type, 2014–2021 (Million Square Meters)

Table 126 South Africa: Biodegradable Mulch Films Market Size, By Biodegradable Plastic, 2014–2021 (USD Million)

Table 127 South Africa: Biodegradable Mulch Films Market Size, By Biodegradable Plastic, 2014–2021 (Million Square Meters)

Table 128 South Africa: Biodegradable Mulch Films Market Size, By Crop Type, 2014–2021 (USD Million)

Table 129 South Africa: Biodegradable Mulch Films Market Size, By Crop Type, 2014–2021 (Million Square Meters)

Table 130 South Africa: Biodegradable Mulch Films Market Size, By Type, 2014–2021 (USD Million)

Table 131 South Africa: Biodegradable Mulch Films Market Size, By Type, 2014–2021 (Million Square Meters)

Table 132 Others in RoW: Biodegradable Mulch Films Market Size, By Biodegradable Plastic, 2014–2021 (USD Million)

Table 133 Others in RoW: Biodegradable Mulch Films Market Size, By Biodegradable Plastic, 2014–2021 (Million Square Meters)

Table 134 Others in RoW: Biodegradable Mulch Films Market Size, By Crop Type, 2014–2021 (USD Million)

Table 135 Others in RoW: Biodegradable Mulch Films Market Size, By Crop Type, 2014–2021 (Million Square Meters)

Table 136 Others in RoW: Biodegradable Mulch Films Market Size, By Type, 2014–2021 (USD Million)

Table 137 Others in RoW: Biodegradable Mulch Films Market Size, By Type, 2014–2021 (Million Square Meters)

Table 138 Rank of Companies in the Biodegradable Mulch Films Market, 2015

Table 139 New Product Launches, 2011–2015

Table 140 Acquisitions, 2011–2015

Table 141 Agreements, 2011–2015

Table 142 Expansions & Investments, 2011-2015

List of Figures (37 Figures)

Figure 1 Biodegradable Mulch Films Market Segmentation

Figure 2 Biodegradable Mulch Films Market: Research Design

Figure 3 Biodegradable Mulch Film Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Biodegradable Mulch Film Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation Methodology

Figure 6 Fruits & Vegetables: Largest Market for Biodegradable Mulch Films

Figure 7 Thermoplastic Starch to Dominate the Biodegradable Mulch Films Market By 2021

Figure 8 Starch Projected to Be the Largest Segment Among Types in the Biodegradable Mulch Films Market By 2021

Figure 9 Asia-Pacific Region Projected to Be the Largest and Fastest-Growing Market By 2021

Figure 10 Leading Market Players Adopted New Product Developments, Acquisitions, Expansions & Joint Ventures as Key Strategies From 2011 to 2016

Figure 11 Asia-Pacific Offers Lucrative Opportunities in the Biodegradable Mulch Films Market

Figure 12 Asia-Pacific is Projected to Grow at the Highest Rate Between 2016 & 2021

Figure 13 Thermoplastic Starch Witnessed Largest Consumption in the Biodegradable Mulch Films Market in 2015

Figure 14 Starch Witnessed Largest Consumption in the Biodegradable Mulch Films Market in 2015

Figure 15 Fruits & Vegetables Dominated the Biodegradable Mulch Films Market in 2015

Figure 16 History & Evolution of Biodegradable Mulch Films Market

Figure 17 Biodegradable Mulch Films Market Segmentation

Figure 18 Increased Applications Drive the Growth of Biodegradable Mulch Films Market

Figure 19 Biodegradable Mulch Films Value Chain Analysis

Figure 20 Porter’s Five Forces Analysis of the Biodegradable Mulch Films Market

Figure 21 Biodegradable Mulch Films Market, By Biodegradable Plastic, 2016 vs 2021 (USD Million)

Figure 22 Starch is Estimated to Account for the Largest Share in the Biodegradable Mulch Films Market in 2016

Figure 23 Biodegradable Mulch Films Market Size, By Crop Type, 2016 vs 2021, (USD Million)

Figure 24 Biodegradable Mulch Films Market Growth Analysis, 2016–2021

Figure 25 Biodegradable Mulch Films Market Size, By Region, 2016 vs 2021 (USD Million)

Figure 26 Asia-Pacific: Biodegradable Mulch Film Market Snapshot

Figure 27 Europe: Biodegradable Mulch Film Market Snapshot

Figure 28 Expansions & Investments: Leading Approach of Key Companies

Figure 29 Expanding Revenue Base Through Expansions, 2011–2015

Figure 30 Expansions & Investments: the Key Strategy, 2011–2015

Figure 31 Geographic Revenue Mix of Key Players

Figure 32 BASF SE: Company Snapshot

Figure 33 BASF SE: SWOT Analysis

Figure 34 AEP Industries Inc.: Company Snapshot

Figure 35 AEP Industries Inc.: SWOT Analysis

Figure 36 RKW Group: SWOT Analysis

Figure 37 British Polythene Industries PLC: Company Snapshot

Growth opportunities and latent adjacency in Biodegradable Mulch Film Market