Biocontrol Market by Type (Biopesticides and Semiochemicals), Source (Microbials, Biochemicals, and Macrobials), Mode of Application, Crop Type, and Region (North America, Europe, APAC, South America, Rest of the World) - Global Forecast to 2027

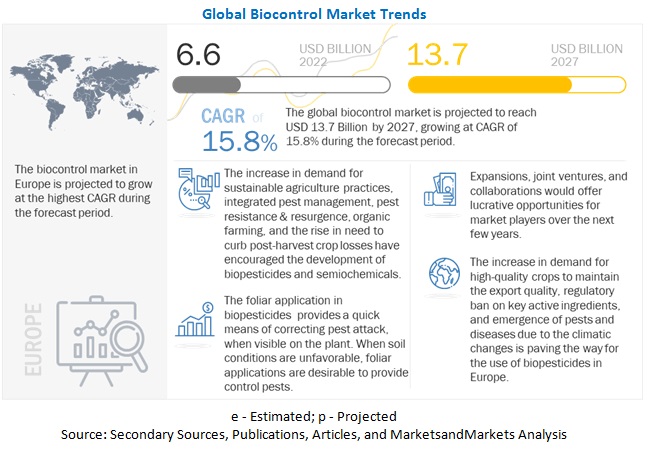

[409 Pages Report] The global biocontrol market is estimated to be valued at USD 6.6 billion in 2022. It is projected to reach USD 13.7 billion by 2027, recording a CAGR of 15.8% during the forecast period. Biocontrol solutions are naturally derived crop protection solutions such as biopesticides and semiochemicals. They are derived from natural sources such as microbials, biochemicals, and macrobials. Traditional agricultural chemicals are harmful to both the environment and people's health. Thus, policymakers across the globe, notably in the North American and European areas are regulating them to assure food safety, security, and environmental sustainability. Consumer awareness and the demand for organic food are both soaring. The market is fueled by a combination of all these factors.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Drivers: Rapid spike in pest proliferation as a consequence of climate change

Plant diseases and pests are more frequent as a result of climatic circumstances' rapid changes. Climate change has a considerable impact on agricultural productivity and pest susceptibility throughout time. Changing climatic circumstances make crops more vulnerable to various illnesses and pests, which reduces crop production as a whole. As a result, climate change not only causes farming practises to diverge but also lower crop output. These elements have increased farmers' reliance on high-quality crop protection products for efficient pest prevention, driving up market demand for biocontrol over the coming few years. Thus, it is anticipated that during the research period, demand for biocontrols will rise.

Restraints: Limitations imposed by technology for the use of biocontrols

The fact that biological solutions have a short shelf life and a significant chance of contamination is one of their main drawbacks. Thus, one of the main causes for concern is the persistence of microbes during storage. Other critical factors that affect shelf life include sunlight exposure, culture mediums, the physiological state of microorganisms at harvest, temperature management during storage, and the water activity of inoculants. The effectiveness of the active substance can occasionally be hampered by the host's bioavailability. All these technological limitations together have restrained the use of biocontrols.

Opportunities: Pests developing resistance to chemical pesticides

Major Site-specific pesticides have been able to provide crop protection over the past few decades. However, plant pathogenic bacteria & fungi and insect pests are developing resistance to chemicals and can adapt to crop protection chemicals through mutations, which, in turn, has led to reduced efficacy and pest resurgence. This rapid erosion of fungicidal activities against resistant pathogens represents a major challenge for the growth of the chemical pesticides market and an opportunity for market.

Challenges: Preference of agricultural producers in emerging economies for synthetic pesticides

Asia-Pacific and other emerging markets are extremely dynamic and fluid. In contrast to farmers in the West, those in these areas have modest landholdings. They also have little purchasing power and are vulnerable to economic swings. Additionally, local growers are unaware of the benefits of biocontrol and organic methods. As a result, they are more profit-driven and concentrated on effective production that can produce outcomes quickly. Although there are some minimal government rules, they are not as rigorous in emerging nations. As a result, in these areas, farmers favour chemical pesticides. However, import restrictions and a steady rise in cultivator knowledge are persuading farmers to choose biosolutions which will steadily push the demand for biocontrol crop protection solutions during the forecast period.

Traps mode of application in semiochemicals market is projected to grow at a highest CAGR of 15.8% during the forecast period

Semiochemicals are applied through modes such as dispensers, sprays, and traps. Traps are projected to grow at fastest CAGR during the forecast period. This is due their convenient and ready-to-use nature. Generally, pheromone traps are employed to trap certain insect species. To entice insects, a semiochemical attractant is used inside the trap. Traps are also utilised for mass monitoring and trapping. The number of traps per unit area is increasing efficiently to capture more insects in the case of mass capturing, nonetheless. Delta traps, sticky traps, winged traps, and funnel traps are some of the most used pheromone traps.

Foliar spray is the most widely used mode of application and dominates the biopesticides market with a value of USD 2,838.6 million in 2022

Foliar sprays are estimated to dominate the biopesticides segment of the market with a value of USD 2,838.6 million in 2022. To control insects and mites, foliar sprays apply microbial pesticides straight to the foliage. In the near term, it is the best instrument for pest management. When pest infestations are obvious on plants, the foliar mode of application offers a speedy way to address them. The market is expanding as a result of quick, practical, and convenient application as well as the rising demand for horticulture crops. The majority of consumers favour organic fruits and vegetables, which are some of the horticultural crops. Foliar sprays aid in distributing biocontrol agents uniformly. Foliar sprays thus dominate the market and are predicted to continue doing so in the upcoming years.

The most popular source of biocontrols are microbials, with an estimated market value of USD 3,758.9 million in 2022

Pest-specific microbial biocontrol crop protection methods help control pests without harming the environment. In a short amount of time, microbes can also be cultivated in the favourable conditions. Compared to macrobials, they have longer life cycles and can also be stored for use in the future. In comparison to other sources, the cost of creating microbial-based crop protection solutions is also lower. Therefore, the combination of all these variables has made microbials as a souce the industry leader in biocontrol. Additionally, microbials are anticipated to rule during the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

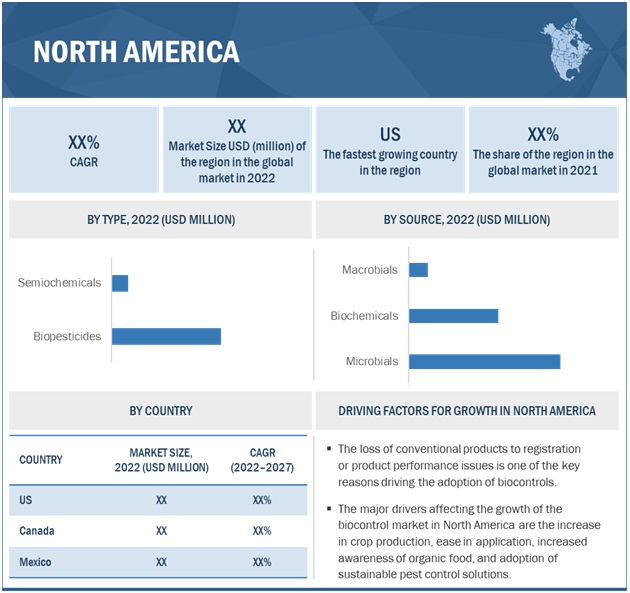

North America dominated the market, with a value of USD 2,597.3 million in 2022; it is anticipated to grow at a CAGR of 16.1% and reach USD 5,472.3 million by 2027

In 2022, North America's share of the worldwide biocontrol market was estimated to be 39.5%. US, Canada, and Mexico are among the North American nations taken into account for the study of the market. One of the main factors influencing the market adoption of biocontrol is the loss of conventional products due to registration or product performance concerns. Research is a major area of concentration for many important companies, including Corteva Agriscience, FMC Corporation, and Marrone Bio Innovations.

In terms of the end-use application industry, there is no stand-out trend. However, foliar sprays in the biopesticides segment and traps in the semiochemicals segment are projected to witness the fastest growth.

Key Market Players

The key players in this market include BASF SE (Germany), Bayer AG (Germany), Syngenta AG (Switzerland), and Corteva Agriscience (US).

Scope of the Report

|

Report Metric |

Details |

|

Market size estimation |

2022–2027 |

|

Base year considered |

2021 |

|

Forecast period considered |

2022–2027 |

|

Units considered |

Value (USD), Volume (KT) |

|

Segments covered |

By type, crop type, source, mode of application, and region |

|

Regions covered |

North America, Asia Pacific, Europe, South America and RoW |

|

Companies studied |

|

This research report categorizes the biocontrol market, based on type, crop type, source, mode of application, and region

Target Audience:

- Biocontrol raw material (active ingredients) suppliers

- Biopesticides and semiochemical manufacturers

- Intermediate suppliers, such as traders and distributors of biocontrol crop protection solutions

- Farmers, contract farmers, organic farmers, food exporting companies

- Government and agricultural research organizations

-

Associations, regulatory bodies, and other industry-related bodies:

- Food and Agriculture Organization (FAO)

- European Food Safety Authority (EFSA)

- British Pest Control Association (BPCA)

- National Pest Management Association (NPMA)

- National Pest Technicians Association

- Confederation of Europe Pest Management Association (CEPA)

- Environmental Protection Agency (EPA)

- World Health Organization (WHO)

Report Scope:

Biocontrol Market:

By Type

-

Biopesticides

- Bioinsecticides

- Biofungicides

- Bionematicides

- Bioherbicides

- Other biopesticides

-

Semiochemicals

- Pheromones

- Allelochemicals

By Crop Type

-

Cereal & Grains

- Corn

- Wheat

- Rice

- Other cereals & grains

-

Oilseeds & Pulses

- Soybean

- Sunflower

- Other oilseeds & pulses

-

Fruits & Vegetables

- Root & Tuber Vegetables

- Leafy Vegetables

- Pome fruits

- Berries

- Citrus Fruits

- Other Fruits & Vegetables

Other Crop Types

- By Source

- Microbials

-

Biochemicals

- Semiochemicals

- Plant extracts

- Organic acids

- Macrobials

By Mode of Application

-

Biopesticides Market, By Mode of Application

- Seed Treatment

- Soil Treatment

- Foliar Sprays

- Other Modes of Application

-

Semiochemicals Market, By Mode of Application

- Dispensers

- Traps

- Sprays

By Region

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW)

Recent Developments

- In March 2021, BASF launched a new biofungicides, Howler into the European market and key countries of the Middle East and Africa. Howler is based on Pseudomonas chlororaphis, strain AFS009, used in turf and golf courses. This was formulated to be effective against Pythium, Fusarium, Rhizoctonia, and Botrytis. This launch would help BASF SE broaden its BioSolutions portfolio provided by the Agricultural Solutions segment, especially in Europe.

- In March 2020, Bayer AG launched its first biofungicides, Serenade, in China, containing QST713, a biocontrol microorganism; this would help plants absorb more effective nutrients and enhance plant immunity, reducing the incidences of diseases. The launch enabled Bayer AG to expand its product offering to the Chinese market.

- In March 2021, Botanical Solution Inc. (BSI), US and Syngenta reached an agreement to commercialize BSI’s first product, BotriStop, in Peru and Mexico. BotriStop was formulated as a biofungicides to effectively control Botrytis cinerea in blueberries, vines, and vegetables. The partnership aimed to help both the companies with innovation and performance efficiency. The companies would target the fresh food production demand in Peruvian and Mexican markets.

- In May 2020, Corteva Agriscience and M2i Life Sciences (France), a leader in the field of pheromones for biological crop protection, announced multi-year global agreements for the research, development, and global commercialization of pheromone-based insect control solutions. The agreement will help Corteva expand into biocontrols.

Frequently Asked Questions (FAQ):

Which region is projected to account for the largest share in the biocontrol market?

North America dominated the biocontrol market, with a value of USD 2.6 Billion in 2022; it is projected to reach USD 5.5 Billion by 2027, at a CAGR of 16.1% during the forecast period. The Environment Protection Agency (EPA), The Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA), are the pesticide regulatory bodies in North America. Major players present in the North American biocontrol market are FMC Corporation (US), Corteva Agriscience (US), and Marrone Bio Innovations (US).

What is the current size of the global biocontrol market?

The global biocontrol market is estimated to be valued at USD 6.6 Billion in 2022. It is projected to reach USD 13.7 Billion by 2027, recording a CAGR of 15.8% during the forecast period.

Which are the key players in the market, and how intense is the competition?

Key players in this market include BASF SE, Bayer AG, Syngenta AG, Corteva Agriscience, Shin-Etsu Chemical Co. Ltd., Marrone Bio Innovations and FMC Corporation. Since biocontrol is a fast-growing market, with a lot of unexplored potential, the existing players are fixated upon innovations, and expanding their product portfolios while startups are being established rapidly. The biocontrol market can be classified as a competitive market as it has a mix of both large and small number players and none of them account for a major part of the market share. The large players are present at the global level, and unorganized players present at the local level in several countries. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 54)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

FIGURE 1 BIOCONTROL MARKET SEGMENTATION

1.3.1 REGIONAL SEGMENTATION

1.3.2 INCLUSIONS & EXCLUSIONS

1.4 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES, 2017–2021

1.5.1 VOLUME UNIT CONSIDERED

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 60)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

2.2.1 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

FIGURE 4 BIOCONTROL MARKET SIZE ESTIMATION (DEMAND-SIDE)

FIGURE 5 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.2.2 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 6 BIOCONTROL MARKET SIZE ESTIMATION, BY TYPE (SUPPLY-SIDE)

FIGURE 7 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.4 ASSUMPTIONS

TABLE 2 ASSUMPTIONS

2.5 RESEARCH LIMITATIONS & ASSOCIATED RISKS

TABLE 3 RESEARCH LIMITATIONS & ASSOCIATED RISKS

3 EXECUTIVE SUMMARY (Page No. - 70)

TABLE 4 BIOCONTROL MARKET SNAPSHOT, 2022 VS. 2027

FIGURE 9 MARKET FOR BIOCONTROL, BY TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 10 BIOPESTICIDES MARKET, BY MODE OF APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 11 SEMIOCHEMICALS MARKET, BY MODE OF APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 12 BIOCONTROL MARKET, BY SOURCE, 2022 VS. 2027 (USD MILLION)

FIGURE 13 MARKET FOR BIOCONTROL, BY CROP TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 14 MARKET FOR BIOCONTROL: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS (Page No. - 75)

4.1 ATTRACTIVE OPPORTUNITIES IN BIOCONTROL MARKET

FIGURE 15 GRADUAL PHASE-OUT OF CONVENTIONAL CROP PROTECTION CHEMICALS TO DRIVE GROWTH OF BIOCONTROL MARKET

4.2 MARKET FOR BIOCONTROL, BY REGION

FIGURE 16 NORTH AMERICA TO DOMINATE THE MARKET

FIGURE 17 EUROPE TO GROW AT HIGHEST RATE IN TERMS OF VOLUME

4.3 MARKET FOR BIOCONTROL, BY TYPE

FIGURE 18 BIOPESTICIDES TO ACCOUNT FOR LARGER MARKET DURING FORECAST PERIOD

FIGURE 19 SEMIOCHEMICALS WERE ESTIMATED TO HOLD A SIGNIFICANT SHARE IN TERMS OF VOLUME

4.4 MARKET FOR BIOCONTROL, BY SOURCE

FIGURE 20 DEMAND FOR MICROBIALS TO BE HIGHEST DURING FORECAST PERIOD

4.5 NORTH AMERICA: MARKET FOR BIOCONTROL, BY KEY TYPE & COUNTRY

FIGURE 21 US AND BIOPESTICIDES SEGMENT ACCOUNTED FOR SIGNIFICANT SHARES IN NORTH AMERICA

4.6 BIOCONTROL MARKET GROWTH, BY KEY COUNTRY

FIGURE 22 ITALY, US, SPAIN, AND UK TO GROW AT SIGNIFICANT RATES DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 80)

5.1 INTRODUCTION

5.2 MACROECONOMIC INDICATORS

5.2.1 GROWTH IN ORGANIC AGRICULTURAL PRACTICES

FIGURE 23 ORGANIC AGRICULTURE SHARE, BY REGION, 2021

FIGURE 24 TOP TEN COUNTRIES WITH LARGE AREAS UNDER ORGANIC FARMING, 2021 (MILLION HECTARES)

5.2.2 INCREASE IN INCIDENCES OF PEST ATTACKS ON FRUITS & VEGETABLES

5.2.3 RELUCTANCE IN ADOPTING HARMFUL CHEMICAL PESTICIDES IN DEVELOPED MARKETS

5.3 MARKET DYNAMICS

FIGURE 25 MARKET DYNAMICS

5.3.1 DRIVERS

5.3.1.1 Regulatory pressure, chemical pesticide bans, and awareness programs by government agencies

5.3.1.2 Rising consumption of organic food worldwide

FIGURE 26 EUROPE: ORGANIC MARKET SHARE, BY KEY COUNTRY, 2020

FIGURE 27 GLOBAL ORGANIC FARMLAND AREA, 2011–2020 (MILLION HECTARES)

5.3.1.3 Pest proliferation as a result of rapid climate change

5.3.2 RESTRAINTS

5.3.2.1 High maintenance and production costs of agricultural semiochemicals

5.3.2.2 Technological limitations for the use of biological products

5.3.3 OPPORTUNITIES

5.3.3.1 Pests developing resistance to crop protection chemicals

5.3.3.2 Rising global consumption of high-value crops

5.3.4 CHALLENGES

5.3.4.1 Preference for chemical pesticides among farmers in developing countries

5.3.4.2 Need for developing multi-target insect semiochemical dispensers

6 INDUSTRY TRENDS (Page No. - 90)

6.1 OVERVIEW

6.2 REGULATORY FRAMEWORK

6.2.1 NORTH AMERICA

6.2.1.1 US

6.2.1.2 Canada

6.2.2 EUROPEAN UNION

6.2.3 ASIA PACIFIC

6.2.3.1 China

6.2.3.2 India

6.2.4 SOUTH AMERICA

6.2.4.1 Brazil

6.2.5 MIDDLE EAST

6.2.5.1 Egypt

6.2.5.2 UAE

6.3 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 5 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 6 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 7 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 8 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9 MIDDLE EAST: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6.4 PATENT ANALYSIS

FIGURE 28 NUMBER OF PATENTS APPROVED FOR BIOCONTROL IN THE GLOBAL MARKET, 2011–2021

FIGURE 29 JURISDICTIONS WITH MOST PATENT APPROVALS FOR BIOCONTROL, 2011–2021

TABLE 10 RECENT PATENTS GRANTED FOR BIOCONTROLS

6.5 VALUE CHAIN ANALYSIS

FIGURE 30 VALUE CHAIN ANALYSIS

6.6 TRENDS/DISRUPTIONS IMPACTING BUYERS IN BIOCONTROL MARKET

FIGURE 31 TRENDS/DISRUPTIONS IMPACTING BUYERS

6.7 MARKET ECOSYSTEM

TABLE 11 BIOCONTROL MARKET ECOSYSTEM

FIGURE 32 MARKET MAP

6.8 TRADE ANALYSIS

TABLE 12 EXPORT VALUE OF INSECTICIDES, FUNGICIDES, HERBICIDES, NEMATICIDES, AND PLANT GROWTH REGULATORS FOR KEY COUNTRIES, 2021 (USD THOUSAND)

TABLE 13 IMPORT VALUE OF INSECTICIDES, FUNGICIDES, HERBICIDES, NEMATICIDES, AND PLANT GROWTH REGULATORS FOR KEY COUNTRIES, 2021 (USD THOUSAND)

6.9 AVERAGE SELLING PRICES

6.9.1 INTRODUCTION

FIGURE 33 BIOCONTROL MARKET: PRICING ANALYSIS AMONG KEY PLAYERS, BY TYPE, 2021 (USD/KG)

FIGURE 34 MARKET FOR BIOCONTROL: PRICING ANALYSIS, BY TYPE, 2018–2021 (USD/KG)

FIGURE 35 MARKET FOR BIOCONTROL: PRICING ANALYSIS, BY REGION, 2018–2021 (USD/KG)

6.10 TECHNOLOGY ANALYSIS

6.10.1 BIOACTIVE PEPTIDE-BASED BIOPESTICIDES

6.10.2 NANO-BIOPESTICIDES

6.10.3 AGRICULTURAL PHEROMONES AND INTERNET OF THINGS (IOT)

6.10.4 ALGAL AND CYANOBACTERIAL-BASED BIOPESTICIDES

6.10.5 PECTIN AND CHITOSAN-BASED BIOPESTICIDES

6.10.6 DRONE FARMING AND PRECISION AGRICULTURE

6.11 CASE STUDY ANALYSIS

6.11.1 USE CASE 1: FMC CORPORATION ANNOUNCED DEFINITIVE AGREEMENT TO ACQUIRE BIOPHERO APS

6.11.2 USE CASE 2: UPL LIMITED ANNOUNCED NEW BUSINESS UNIT, NATURAL PLANT PROTECTION (NPP), TO FOCUS ON BIOLOGICAL SOLUTIONS

6.11.3 USE CASE 3: KOPPERT BIOLOGICAL SYSTEMS ACQUIRED GEOCOM TO FOCUS ON PRECISION AGRIFARMING

6.12 KEY CONFERENCES & EVENTS

TABLE 14 MARKET FOR BIOCONTROL: DETAILED LIST OF CONFERENCES & EVENTS, 2022–2023

6.13 KEY STAKEHOLDERS & BUYING CRITERIA

6.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 36 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 BIOCONTROL SOURCES

TABLE 15 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 BIOCONTROL SOURCES

6.13.2 BUYING CRITERIA

FIGURE 37 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TYPES OF BIOCONTROL

TABLE 16 KEY BUYING CRITERIA FOR TYPES OF BIOCONTROL

6.14 PORTER’S FIVE FORCES ANALYSIS

TABLE 17 PORTER’S FIVE FORCES ANALYSIS

6.14.1 THREAT OF NEW ENTRANTS

6.14.2 THREAT OF SUBSTITUTES

6.14.3 BARGAINING POWER OF SUPPLIERS

6.14.4 BARGAINING POWER OF BUYERS

6.14.5 INTENSITY OF COMPETITIVE RIVALRY

7 BIOCONTROL MARKET, BY TYPE (Page No. - 117)

7.1 INTRODUCTION

FIGURE 38 BIOCONTROL MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 18 MARKET FOR BIOCONTROL, BY TYPE, 2017–2021 (USD MILLION)

TABLE 19 MARKET FOR BIOCONTROL, BY TYPE, 2022–2027 (USD MILLION)

TABLE 20 MARKET FOR BIOCONTROL, BY TYPE, 2017–2021 (KT)

TABLE 21 MARKET FOR BIOCONTROL, BY TYPE, 2022–2027 (KT)

7.2 BIOPESTICIDES

7.2.1 RISING DEMAND FOR ALTERNATIVE CHEMICAL PESTICIDES

TABLE 22 BIOPESTICIDES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 23 BIOPESTICIDES MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 24 BIOPESTICIDES MARKET, BY REGION, 2017–2021 (KT)

TABLE 25 BIOPESTICIDES MARKET, BY REGION, 2022–2027 (KT)

TABLE 26 BIOPESTICIDES MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 27 BIOPESTICIDES MARKET, BY TYPE, 2022–2027 (USD MILLION)

7.3 BIOINSECTICIDES

7.3.1 RISING CASES OF PEST AND INSECT ATTACKS ON CROPS

TABLE 28 BIOINSECTICIDES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 29 BIOINSECTICIDES MARKET, BY REGION, 2022–2027 (USD MILLION)

7.4 BIOFUNGICIDES

7.4.1 RISING PLANT DISEASES AND DEVELOPMENT OF FUNGICIDE RESISTANCE IN PESTS

TABLE 30 BIOFUNGICIDES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 31 BIOFUNGICIDES MARKET, BY REGION, 2022–2027 (USD MILLION)

7.5 BIONEMATICIDES

7.5.1 INCREASE IN NEMATODE INFESTATION

TABLE 32 BIONEMATICIDES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 33 BIONEMATICIDES MARKET, BY REGION, 2022–2027 (USD MILLION)

7.6 BIOHERBICIDES

7.6.1 RISE OF INVASIVE PLANT SPECIES AND WEEDS

TABLE 34 BIOHERBICIDES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 35 BIOHERBICIDES MARKET, BY REGION, 2022–2027 (USD MILLION)

7.7 OTHER BIOPESTICIDES

7.7.1 DAMAGE TO CROPS BY RODENTS, MOLLUSKS, SNAILS, AND SLUGS

TABLE 36 OTHER BIOPESTICIDES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 37 OTHER BIOPESTICIDES MARKET, BY REGION, 2022–2027 (USD MILLION)

7.8 SEMIOCHEMICALS

7.8.1 WIDE-SCALE APPLICATION FOR HIGH-VALUE CROPS

TABLE 38 SEMIOCHEMICALS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 39 SEMIOCHEMICALS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 40 SEMIOCHEMICALS MARKET, BY REGION, 2017–2021 (KT)

TABLE 41 SEMIOCHEMICALS MARKET, BY REGION, 2022–2027 (KT)

TABLE 42 SEMIOCHEMICALS MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 43 SEMIOCHEMICALS MARKET, BY TYPE, 2022–2027 (USD MILLION)

7.9 PHEROMONES

7.9.1 GROWING RESISTANCE WITHIN PESTS TOWARD CONVENTIONAL PESTICIDES

TABLE 44 PHEROMONES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 45 PHEROMONES MARKET, BY REGION, 2022–2027 (USD MILLION)

7.10 ALLELOCHEMICALS

7.10.1 PEST-SPECIFIC NATURE AND EXTENSIVE RESEARCH STUDIES OF ALLELOCHEMICALS

TABLE 46 ALLELOCHEMICALS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 47 ALLELOCHEMICALS MARKET, BY REGION, 2022–2027 (USD MILLION)

8 BIOCONTROL MARKET, BY CROP TYPE (Page No. - 132)

8.1 INTRODUCTION

FIGURE 39 BIOCONTROL MARKET, BY CROP TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 48 MARKET FOR BIOCONTROL, BY CROP TYPE, 2017–2021 (USD MILLION)

TABLE 49 MARKET FOR BIOCONTROL, BY CROP TYPE, 2022–2027 (USD MILLION)

8.2 CEREALS & GRAINS

8.2.1 RISING PRODUCTION OF CEREALS & GRAINS ON ACCOUNT OF GROWING DEMAND FOR PRODUCTS AMONG CONSUMERS

TABLE 50 CEREALS & GRAINS: BIOCONTROL MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 51 CEREALS & GRAINS: MARKET FOR BIOCONTROL, BY REGION, 2022–2027 (USD MILLION)

TABLE 52 CEREALS & GRAINS: MARKET FOR BIOCONTROL, BY TYPE, 2017–2021 (USD MILLION)

TABLE 53 CEREALS & GRAINS: MARKET FOR BIOCONTROL, BY TYPE, 2022–2027 (USD MILLION)

8.2.2 CORN

8.2.2.1 Rising global corn consumption, its commercial value for ethanol production, coupled with its vulnerability to nematode infestation

8.2.3 WHEAT

8.2.3.1 Rising pest infestations

8.2.4 RICE

8.2.4.1 High export demand catering to massive production

8.2.5 OTHER CEREALS & GRAINS

8.2.5.1 Rising health awareness and susceptibility to pests in barley and millets

8.3 OILSEEDS & PULSES

8.3.1 RISING IMPORTANCE OF OILSEEDS & PULSES AS CASH CROPS AND THEIR SUSCEPTIBILITY TO INSECTS

TABLE 54 OILSEEDS & PULSES: BIOCONTROL MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 55 OILSEEDS & PULSES: MARKET FOR BIOCONTROL, BY REGION, 2022–2027 (USD MILLION)

TABLE 56 OILSEEDS & PULSES: MARKET FOR BIOCONTROL, BY TYPE, 2017–2021 (USD MILLION)

TABLE 57 OILSEEDS & PULSES: MARKET FOR BIOCONTROL, BY TYPE, 2022–2027 (USD MILLION)

8.3.2 SOYBEAN

8.3.2.1 Rising soybean production, along with its vulnerability to root-node nematode infestation

8.3.3 SUNFLOWER

8.3.3.1 Preference for sunflower oil and confectionery value of sunflower seed

8.3.4 OTHER OILSEEDS & PULSES

8.3.4.1 Vulnerability of canola and safflower to pest attacks

8.4 FRUITS & VEGETABLES

8.4.1 HUGE INVESTMENTS TO CATER TO RISING DEMAND FOR HIGH-VALUE CROPS

TABLE 58 FRUITS & VEGETABLES: BIOCONTROL MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 59 FRUITS & VEGETABLES: MARKET FOR BIOCONTROL, BY REGION, 2022–2027 (USD MILLION)

TABLE 60 FRUITS & VEGETABLES: MARKET FOR BIOCONTROL, BY TYPE, 2017–2021 (USD MILLION)

TABLE 61 FRUITS & VEGETABLES: MARKET FOR BIOCONTROL, BY TYPE, 2022–2027 (USD MILLION)

8.4.2 ROOT & TUBER VEGETABLES

8.4.2.1 Range of pests, diseases, and nematodes causing economic losses in root & tuber vegetables

8.4.3 LEAFY VEGETABLES

8.4.3.1 Susceptibility of leafy vegetables to pathogens such as Myrothecium verrucaria and Streptomyces lydicus

8.4.4 POME FRUITS

8.4.4.1 Effectiveness of pheromones on pome fruits

8.4.5 BERRIES

8.4.5.1 Rising demand for berries and their susceptibility to pests

8.4.6 CITRUS FRUITS

8.4.6.1 Vulnerability of citrus fruits to post-harvest decay

8.4.7 OTHER FRUITS & VEGETABLES

8.4.7.1 Rise of fungal attacks on plums, peaches, and mangoes

8.5 OTHER CROP TYPES

8.5.1 INCREASING NUMBER OF GOLF COURTS AND DEMAND FOR MAINTENANCE OF TURF AGAINST PESTS

TABLE 62 OTHER CROP TYPES: BIOCONTROL MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 63 OTHER CROP TYPES: MARKET FOR BIOCONTROL, BY REGION, 2022–2027 (USD MILLION)

9 BIOCONTROL MARKET, BY SOURCE (Page No. - 146)

9.1 INTRODUCTION

FIGURE 40 BIOCONTROL MARKET, BY SOURCE, 2022 VS. 2027 (USD MILLION)

TABLE 64 MARKET FOR BIOCONTROL, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 65 MARKET FOR BIOCONTROL, BY SOURCE, 2022–2027 (USD MILLION)

9.2 MICROBIALS

9.2.1 REDUCED DEVELOPMENT COSTS FOR MICROBIALS, PEST-SPECIFICITY, AND RESIDUE-FREE NATURE

TABLE 66 MICROBIALS: BIOCONTROL MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 67 MICROBIALS: MARKET FOR BIOCONTROL, BY REGION, 2022–2027 (USD MILLION)

9.3 MACROBIALS

9.3.1 NATURAL AND UNIQUE MODE OF ACTION AND CONVENIENT APPLICATION TO SPUR USAGE OF MACROBIALS

TABLE 68 MACROBIALS: BIOCONTROL MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 69 MACROBIALS: MARKET FOR BIOCONTROL, BY REGION, 2022–2027 (USD MILLION)

9.4 BIOCHEMICALS

9.4.1 STRINGENT REGULATORY POLICIES ON CONVENTIONAL AGROCHEMICALS TO BE KEY DRIVER

TABLE 70 BIOCHEMICALS: BIOCONTROL MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 71 BIOCHEMICALS: MARKET FOR BIOCONTROL, BY REGION, 2022–2027 (USD MILLION)

TABLE 72 BIOCHEMICALS: MARKET FOR BIOCONTROL, BY TYPE, 2017–2021 (USD MILLION)

TABLE 73 BIOCHEMICALS: MARKET FOR BIOCONTROL, BY TYPE, 2022–2027 (USD MILLION)

9.5 SEMIOCHEMICALS

9.5.1 INNOVATIVE PEST CONTROL MECHANISM TO DRIVE MARKET FOR SEMIOCHEMICALS

TABLE 74 SEMIOCHEMICALS: BIOCONTROL MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 75 SEMIOCHEMICALS: MARKET FOR BIOCONTROL, BY REGION, 2022–2027 (USD MILLION)

9.6 PLANT EXTRACTS

9.6.1 PEST SELECTIVITY AND EXTENSIVE RESEARCH TO DRIVE PLANT-EXTRACT-BASED BIOCONTROL MARKET

TABLE 76 PLANT EXTRACTS: BIOCONTROL MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 77 PLANT EXTRACTS: MARKET FOR BIOCONTROL, BY REGION, 2022–2027 (USD MILLION)

9.7 ORGANIC ACIDS

9.7.1 PESTICIDAL PROPERTIES AND ORGANIC NATURE TO DRIVE ORGANIC ACID-BASED BIOCONTROL MARKET

TABLE 78 ORGANIC ACIDS: BIOCONTROL MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 79 ORGANIC ACIDS: MARKET FOR BIOCONTROL, BY REGION, 2022–2027 (USD MILLION)

10 BIOCONTROL MARKET, BY MODE OF APPLICATION (Page No. - 156)

10.1 INTRODUCTION

FIGURE 41 BIOPESTICIDES MARKET, BY MODE OF APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 42 SEMIOCHEMICALS MARKET, BY MODE OF APPLICATION, 2022 VS. 2027 (USD MILLION)

10.2 BIOPESTICIDES MARKET, BY MODE OF APPLICATION

10.2.1 HUGE DEMAND AND PRODUCTION OF BIOPESTICIDES

TABLE 80 BIOPESTICIDES MARKET, BY MODE OF APPLICATION, 2017–2021 (USD MILLION)

TABLE 81 BIOPESTICIDES MARKET, BY MODE OF APPLICATION, 2022–2027 (USD MILLION)

10.3 FOLIAR SPRAY

10.3.1 QUICK, EFFECTIVE APPLICATION AND RISING DEMAND FOR HORTICULTURE CROPS

TABLE 82 FOLIAR SPRAY: BIOPESTICIDES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 83 FOLIAR SPRAY: BIOPESTICIDES MARKET, BY REGION, 2022–2027 (USD MILLION)

10.4 SOIL TREATMENT

10.4.1 LESSER SOIL CONTAMINATION, COUPLED WITH INCREASING DEMAND FOR ORGANIC FOOD

TABLE 84 SOIL TREATMENT: BIOPESTICIDES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 85 SOIL TREATMENT: BIOPESTICIDES MARKET, BY REGION, 2022–2027 (USD MILLION)

10.5 SEED TREATMENT

10.5.1 HIGH DEMAND FOR SEED COATING IN COMMERCIAL AGRICULTURE OPERATIONS

TABLE 86 SEED TREATMENT: BIOPESTICIDES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 87 SEED TREATMENT: BIOPESTICIDES MARKET, BY REGION, 2022–2027 (USD MILLION)

10.6 OTHER MODES OF APPLICATION

10.6.1 RISING DEMAND FOR FRUITS AND NEED TO EXTEND SHELF-LIFE

TABLE 88 OTHER MODES OF APPLICATION: BIOPESTICIDES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 89 OTHER MODES OF APPLICATION: BIOPESTICIDES MARKET, BY REGION, 2022–2027 (USD MILLION)

10.7 SEMIOCHEMICALS MARKET, BY MODE OF APPLICATION

10.7.1 TARGET-SPECIFICITY AND RISING DEMAND FOR FRUITS

TABLE 90 SEMIOCHEMICALS MARKET, BY MODE OF APPLICATION, 2017–2021 (USD MILLION)

TABLE 91 SEMIOCHEMICALS MARKET, BY MODE OF APPLICATION, 2022–2027 (USD MILLION)

10.8 DISPENSERS

10.8.1 EXTENSIVE RESEARCH BY COMPANIES TO DRIVE DEMAND FOR DISPENSERS

TABLE 92 DISPENSERS: SEMIOCHEMICALS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 93 DISPENSERS: SEMIOCHEMICALS MARKET, BY REGION, 2022–2027 (USD MILLION)

10.9 SPRAYS

10.9.1 EASE OF APPLICATION AND HIGH EFFECTIVENESS TO DRIVE MARKET FOR SEMIOCHEMICAL SPRAYS

TABLE 94 SPRAYS: SEMIOCHEMICALS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 95 SPRAYS: SEMIOCHEMICALS MARKET, BY REGION, 2022–2027 (USD MILLION)

10.10 TRAPS

10.10.1 CONVENIENT AND READY-TO-USE PHEROMONE TRAPS

TABLE 96 TRAPS: SEMIOCHEMICALS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 97 TRAPS: SEMIOCHEMICALS MARKET, BY REGION, 2022–2027 (USD MILLION)

11 BIOCONTROL MARKET, BY REGION (Page No. - 168)

11.1 INTRODUCTION

FIGURE 43 ITALY TO RECORD HIGHEST CAGR IN BIOCONTROL MARKET

FIGURE 44 BIOCONTROL MARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

TABLE 98 MARKET FOR BIOCONTROL, BY REGION, 2017–2021 (USD MILLION)

TABLE 99 MARKET FOR BIOCONTROL, BY REGION, 2022–2027 (USD MILLION)

TABLE 100 MARKET FOR BIOCONTROL, BY REGION, 2017–2021 (KT)

TABLE 101 MARKET FOR BIOCONTROL, BY REGION, 2022–2027 (KT)

11.2 NORTH AMERICA

FIGURE 45 NORTH AMERICA: BIOCONTROL MARKET SNAPSHOT, 2022

TABLE 102 NORTH AMERICA: MARKET FOR BIOCONTROL, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 103 NORTH AMERICA: MARKET FOR BIOCONTROL, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 104 NORTH AMERICA: MARKET FOR BIOCONTROL, BY TYPE, 2017–2021 (USD MILLION)

TABLE 105 NORTH AMERICA: MARKET FOR BIOCONTROL, BY TYPE, 2022–2027 (USD MILLION)

TABLE 106 NORTH AMERICA: MARKET FOR BIOCONTROL, BY TYPE, 2017–2021 (KT)

TABLE 107 NORTH AMERICA: MARKET FOR BIOCONTROL, BY TYPE, 2022–2027 (KT)

TABLE 108 NORTH AMERICA: MARKET FOR BIOCONTROL, BY BIOPESTICIDES, 2017–2021 (USD MILLION)

TABLE 109 NORTH AMERICA: MARKET FOR BIOCONTROL, BY BIOPESTICIDES, 2022–2027 (USD MILLION)

TABLE 110 NORTH AMERICA: MARKET FOR BIOCONTROL, BY SEMIOCHEMICALS, 2017–2021 (USD MILLION)

TABLE 111 NORTH AMERICA: MARKET FOR BIOCONTROL, BY SEMIOCHEMICALS, 2022–2027 (USD MILLION)

TABLE 112 NORTH AMERICA: MARKET FOR BIOCONTROL, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 113 NORTH AMERICA: MARKET FOR BIOCONTROL, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 114 NORTH AMERICA: MARKET FOR BIOCONTROL, BY BIOCHEMICALS, 2017–2021 (USD MILLION)

TABLE 115 NORTH AMERICA: MARKET FOR BIOCONTROL, BY BIOCHEMICALS, 2022–2027 (USD MILLION)

TABLE 116 NORTH AMERICA: BIOPESTICIDES MARKET, BY MODE OF APPLICATION, 2017–2021 (USD MILLION)

TABLE 117 NORTH AMERICA: BIOPESTICIDES MARKET, BY MODE OF APPLICATION, 2022–2027 (USD MILLION)

TABLE 118 NORTH AMERICA: SEMIOCHEMICALS MARKET, BY MODE OF APPLICATION, 2017–2021 (USD MILLION)

TABLE 119 NORTH AMERICA: SEMIOCHEMICALS MARKET, BY MODE OF APPLICATION, 2022–2027 (USD MILLION)

TABLE 120 NORTH AMERICA: BIOCONTROL MARKET, BY CROP TYPE, 2017–2021 (USD MILLION)

TABLE 121 NORTH AMERICA: MARKET FOR BIOCONTROL, BY CROP TYPE, 2022–2027 (USD MILLION)

11.2.1 US

11.2.1.1 Phase-out of key chemical pesticides paved way for bio-based products in US

TABLE 122 US: BIOCONTROL MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 123 US: MARKET FOR BIOCONTROL, BY TYPE, 2022–2027 (USD MILLION)

TABLE 124 US: MARKET FOR BIOCONTROL, BY BIOPESTICIDES, 2017–2021 (USD MILLION)

TABLE 125 US: MARKET FOR BIOCONTROL, BY BIOPESTICIDES, 2022–2027 (USD MILLION)

TABLE 126 US: MARKET FOR BIOCONTROL, BY SEMIOCHEMICALS, 2017–2021 (USD MILLION)

TABLE 127 US: MARKET FOR BIOCONTROL, BY SEMIOCHEMICALS, 2022–2027 (USD MILLION)

TABLE 128 US: MARKET FOR BIOCONTROL, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 129 US: MARKET FOR BIOCONTROL, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 130 US: MARKET FOR BIOCONTROL, BY BIOCHEMICALS, 2017–2021 (USD MILLION)

TABLE 131 US: MARKET FOR BIOCONTROL, BY BIOCHEMICALS, 2022–2027 (USD MILLION)

11.2.2 CANADA

11.2.2.1 Growing losses in high-value cash crops

TABLE 132 CANADA: BIOCONTROL MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 133 CANADA: MARKET FOR BIOCONTROL, BY TYPE, 2022–2027 (USD MILLION)

TABLE 134 CANADA: MARKET FOR BIOCONTROL, BY BIOPESTICIDES, 2017–2021 (USD MILLION)

TABLE 135 CANADA: MARKET FOR BIOCONTROL, BY BIOPESTICIDES, 2022–2027 (USD MILLION)

TABLE 136 CANADA: MARKET FOR BIOCONTROL, BY SEMIOCHEMICALS, 2017–2021 (USD MILLION)

TABLE 137 CANADA: MARKET FOR BIOCONTROL, BY SEMIOCHEMICALS, 2022–2027 (USD MILLION)

TABLE 138 CANADA: MARKET FOR BIOCONTROL, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 139 CANADA: MARKET FOR BIOCONTROL, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 140 CANADA: MARKET FOR BIOCONTROL, BY BIOCHEMICALS, 2017–2021 (USD MILLION)

TABLE 141 CANADA: MARKET FOR BIOCONTROL, BY BIOCHEMICALS, 2022–2027 (USD MILLION)

11.2.3 MEXICO

11.2.3.1 Higher export demand for organic food from US

TABLE 142 MEXICO: BIOCONTROL MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 143 MEXICO: MARKET FOR BIOCONTROL, BY TYPE, 2022–2027 (USD MILLION)

TABLE 144 MEXICO: MARKET FOR BIOCONTROL, BY BIOPESTICIDES, 2017–2021 (USD MILLION)

TABLE 145 MEXICO: MARKET FOR BIOCONTROL, BY BIOPESTICIDES, 2022–2027 (USD MILLION)

TABLE 146 MEXICO: MARKET FOR BIOCONTROL, BY SEMIOCHEMICALS, 2017–2021 (USD MILLION)

TABLE 147 MEXICO: MARKET FOR BIOCONTROL, BY SEMIOCHEMICALS, 2022–2027 (USD MILLION)

TABLE 148 MEXICO: MARKET FOR BIOCONTROL, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 149 MEXICO: MARKET FOR BIOCONTROL, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 150 MEXICO: MARKET FOR BIOCONTROL, BY BIOCHEMICALS, 2017–2021 (USD MILLION)

TABLE 151 MEXICO: MARKET FOR BIOCONTROL, BY BIOCHEMICALS, 2022–2027 (USD MILLION)

11.3 EUROPE

FIGURE 46 EUROPE: BIOCONTROL MARKET SNAPSHOT, 2022

TABLE 152 EUROPE: MARKET FOR BIOCONTROL, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 153 EUROPE: MARKET FOR BIOCONTROL, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 154 EUROPE: MARKET FOR BIOCONTROL, BY TYPE, 2017–2021 (USD MILLION)

TABLE 155 EUROPE: MARKET FOR BIOCONTROL, BY TYPE, 2022–2027 (USD MILLION)

TABLE 156 EUROPE: MARKET FOR BIOCONTROL, BY TYPE, 2017–2021 (KT)

TABLE 157 EUROPE: MARKET FOR BIOCONTROL, BY TYPE, 2022–2027 (KT)

TABLE 158 EUROPE: MARKET FOR BIOCONTROL, BY BIOPESTICIDES, 2017–2021 (USD MILLION)

TABLE 159 EUROPE: MARKET FOR BIOCONTROL, BY BIOPESTICIDES, 2022–2027 (USD MILLION)

TABLE 160 EUROPE: MARKET FOR BIOCONTROL, BY SEMIOCHEMICALS, 2017–2021 (USD MILLION)

TABLE 161 EUROPE: MARKET FOR BIOCONTROL, BY SEMIOCHEMICALS, 2022–2027 (USD MILLION)

TABLE 162 EUROPE: MARKET FOR BIOCONTROL, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 163 EUROPE: MARKET FOR BIOCONTROL, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 164 EUROPE: MARKET FOR BIOCONTROL, BY BIOCHEMICALS, 2017–2021 (USD MILLION)

TABLE 165 EUROPE: MARKET FOR BIOCONTROL, BY BIOCHEMICALS, 2022–2027 (USD MILLION)

TABLE 166 EUROPE: BIOPESTICIDES MARKET, BY MODE OF APPLICATION, 2017–2021 (USD MILLION)

TABLE 167 EUROPE: BIOPESTICIDES MARKET, BY MODE OF APPLICATION, 2022–2027 (USD MILLION)

TABLE 168 EUROPE: SEMIOCHEMICALS MARKET, BY MODE OF APPLICATION, 2017–2021 (USD MILLION)

TABLE 169 EUROPE: SEMIOCHEMICALS MARKET, BY MODE OF APPLICATION, 2022–2027 (USD MILLION)

TABLE 170 EUROPE: BIOCONTROL MARKET, BY CROP TYPE, 2017–2021 (USD MILLION)

TABLE 171 EUROPE: MARKET FOR BIOCONTROL, BY CROP TYPE, 2022–2027 (USD MILLION)

11.3.1 GERMANY

11.3.1.1 Germany supports ban on chemical insecticides

TABLE 172 GERMANY: BIOCONTROL MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 173 GERMANY: MARKET FOR BIOCONTROL, BY TYPE, 2022–2027 (USD MILLION)

TABLE 174 GERMANY: MARKET FOR BIOCONTROL, BY BIOPESTICIDES, 2017–2021 (USD MILLION)

TABLE 175 GERMANY: MARKET FOR BIOCONTROL, BY BIOPESTICIDES, 2022–2027 (USD MILLION)

TABLE 176 GERMANY: MARKET FOR BIOCONTROL, BY SEMIOCHEMICALS, 2017–2021 (USD MILLION)

TABLE 177 GERMANY: MARKET FOR BIOCONTROL, BY SEMIOCHEMICALS, 2022–2027 (USD MILLION)

TABLE 178 GERMANY: MARKET FOR BIOCONTROL, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 179 GERMANY: MARKET FOR BIOCONTROL, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 180 GERMANY: MARKET FOR BIOCONTROL, BY BIOCHEMICALS, 2017–2021 (USD MILLION)

TABLE 181 GERMANY: MARKET FOR BIOCONTROL, BY BIOCHEMICALS, 2022–2027 (USD MILLION)

11.3.2 FRANCE

11.3.2.1 Changes in legislation and authorization procedures for registering biocontrol products in France

TABLE 182 FRANCE: BIOCONTROL MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 183 FRANCE: MARKET FOR BIOCONTROL, BY TYPE, 2022–2027 (USD MILLION)

TABLE 184 FRANCE: MARKET FOR BIOCONTROL, BY BIOPESTICIDES, 2017–2021 (USD MILLION)

TABLE 185 FRANCE: MARKET FOR BIOCONTROL, BY BIOPESTICIDES, 2022–2027 (USD MILLION)

TABLE 186 FRANCE: MARKET FOR BIOCONTROL, BY SEMIOCHEMICALS, 2017–2021 (USD MILLION)

TABLE 187 FRANCE: MARKET FOR BIOCONTROL, BY SEMIOCHEMICALS, 2022–2027 (USD MILLION)

TABLE 188 FRANCE: MARKET FOR BIOCONTROL, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 189 FRANCE: MARKET FOR BIOCONTROL, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 190 FRANCE: MARKET FOR BIOCONTROL, BY BIOCHEMICALS, 2017–2021 (USD MILLION)

TABLE 191 FRANCE: MARKET FOR BIOCONTROL, BY BIOCHEMICALS, 2022–2027 (USD MILLION)

11.3.3 ITALY

11.3.3.1 Ban on toxic pesticides

TABLE 192 ITALY: BIOCONTROL MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 193 ITALY: MARKET FOR BIOCONTROL, BY TYPE, 2022–2027 (USD MILLION)

TABLE 194 ITALY: MARKET FOR BIOCONTROL, BY BIOPESTICIDES, 2017–2021 (USD MILLION)

TABLE 195 ITALY: MARKET FOR BIOCONTROL, BY BIOPESTICIDES, 2022–2027 (USD MILLION)

TABLE 196 ITALY: MARKET FOR BIOCONTROL, BY SEMIOCHEMICALS, 2017–2021 (USD MILLION)

TABLE 197 ITALY: MARKET FOR BIOCONTROL, BY SEMIOCHEMICALS, 2022–2027 (USD MILLION)

TABLE 198 ITALY: MARKET FOR BIOCONTROL, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 199 ITALY: MARKET FOR BIOCONTROL, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 200 ITALY: MARKET FOR BIOCONTROL, BY BIOCHEMICALS, 2017–2021 (USD MILLION)

TABLE 201 ITALY: MARKET FOR BIOCONTROL, BY BIOCHEMICALS, 2022–2027 (USD MILLION)

11.3.4 SPAIN

11.3.4.1 Spain to be huge market with increasing agricultural applications of biopesticides and semiochemicals

TABLE 202 SPAIN: BIOCONTROL MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 203 SPAIN: MARKET FOR BIOCONTROL, BY TYPE, 2022–2027 (USD MILLION)

TABLE 204 SPAIN: MARKET FOR BIOCONTROL, BY BIOPESTICIDES, 2017–2021 (USD MILLION)

TABLE 205 SPAIN: MARKET FOR BIOCONTROL, BY BIOPESTICIDES, 2022–2027 (USD MILLION)

TABLE 206 SPAIN: MARKET FOR BIOCONTROL, BY SEMIOCHEMICALS, 2017–2021 (USD MILLION)

TABLE 207 SPAIN: MARKET FOR BIOCONTROL, BY SEMIOCHEMICALS, 2022–2027 (USD MILLION)

TABLE 208 SPAIN: MARKET FOR BIOCONTROL, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 209 SPAIN: MARKET FOR BIOCONTROL, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 210 SPAIN: MARKET FOR BIOCONTROL, BY BIOCHEMICALS, 2017–2021 (USD MILLION)

TABLE 211 SPAIN: MARKET FOR BIOCONTROL, BY BIOCHEMICALS, 2022–2027 (USD MILLION)

11.3.5 UK

11.3.5.1 Changing consumer preferences

TABLE 212 UK: BIOCONTROL MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 213 UK: MARKET FOR BIOCONTROL, BY TYPE, 2022–2027 (USD MILLION)

TABLE 214 UK: MARKET FOR BIOCONTROL, BY BIOPESTICIDES, 2017–2021 (USD MILLION)

TABLE 215 UK: MARKET FOR BIOCONTROL, BY BIOPESTICIDES, 2022–2027 (USD MILLION)

TABLE 216 UK: MARKET FOR BIOCONTROL, BY SEMIOCHEMICALS, 2017–2021 (USD MILLION)

TABLE 217 UK: MARKET FOR BIOCONTROL, BY SEMIOCHEMICALS, 2022–2027 (USD MILLION)

TABLE 218 UK: MARKET FOR BIOCONTROL, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 219 UK: MARKET FOR BIOCONTROL, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 220 UK: MARKET FOR BIOCONTROL, BY BIOCHEMICALS, 2017–2021 (USD MILLION)

TABLE 221 UK: MARKET FOR BIOCONTROL, BY BIOCHEMICALS, 2022–2027 (USD MILLION)

11.3.6 NETHERLANDS

11.3.6.1 Genoeg scheme to accelerate growth of bio-based products

TABLE 222 NETHERLANDS: BIOCONTROL MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 223 NETHERLANDS: MARKET FOR BIOCONTROL, BY TYPE, 2022–2027 (USD MILLION)

TABLE 224 NETHERLANDS: MARKET FOR BIOCONTROL, BY BIOPESTICIDES, 2017–2021 (USD MILLION)

TABLE 225 NETHERLANDS: MARKET FOR BIOCONTROL, BY BIOPESTICIDES, 2022–2027 (USD MILLION)

TABLE 226 NETHERLANDS: MARKET FOR BIOCONTROL, BY SEMIOCHEMICALS, 2017–2021 (USD MILLION)

TABLE 227 NETHERLANDS: MARKET FOR BIOCONTROL, BY SEMIOCHEMICALS, 2022–2027 (USD MILLION)

TABLE 228 NETHERLANDS: MARKET FOR BIOCONTROL, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 229 NETHERLANDS: MARKET FOR BIOCONTROL, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 230 NETHERLANDS: MARKET FOR BIOCONTROL, BY BIOCHEMICALS, 2017–2021 (USD MILLION)

TABLE 231 NETHERLANDS: MARKET FOR BIOCONTROL, BY BIOCHEMICALS, 2022–2027 (USD MILLION)

11.3.7 RUSSIA

11.3.7.1 Farmers to adopt biocontrol to prevent resistance against Wheat Aphid

TABLE 232 RUSSIA: BIOCONTROL MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 233 RUSSIA: MARKET FOR BIOCONTROL, BY TYPE, 2022–2027 (USD MILLION)

TABLE 234 RUSSIA: MARKET FOR BIOCONTROL, BY BIOPESTICIDES 2017–2021 (USD MILLION)

TABLE 235 RUSSIA: MARKET FOR BIOCONTROL, BY BIOPESTICIDES, 2022–2027 (USD MILLION)

TABLE 236 RUSSIA: MARKET FOR BIOCONTROL, BY SEMIOCHEMICALS, 2017–2021 (USD MILLION)

TABLE 237 RUSSIA: MARKET FOR BIOCONTROL, BY SEMIOCHEMICALS, 2022–2027 (USD MILLION)

TABLE 238 RUSSIA: MARKET FOR BIOCONTROL, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 239 RUSSIA: MARKET FOR BIOCONTROL, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 240 RUSSIA: MARKET FOR BIOCONTROL, BY BIOCHEMICALS, 2017–2021 (USD MILLION)

TABLE 241 RUSSIA: MARKET FOR BIOCONTROL, BY BIOCHEMICALS, 2022–2027 (USD MILLION)

11.3.8 REST OF EUROPE

11.3.8.1 Climate challenges in Poland and Ukraine leading to rise in fungal diseases in crops

TABLE 242 REST OF EUROPE: BIOCONTROL MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 243 REST OF EUROPE: MARKET FOR BIOCONTROL, BY TYPE, 2022–2027 (USD MILLION)

TABLE 244 REST OF EUROPE: MARKET FOR BIOCONTROL, BY BIOPESTICIDES 2017–2021 (USD MILLION)

TABLE 245 REST OF EUROPE: MARKET FOR BIOCONTROL, BY BIOPESTICIDES, 2022–2027 (USD MILLION)

TABLE 246 REST OF EUROPE: MARKET FOR BIOCONTROL, BY SEMIOCHEMICALS, 2017–2021 (USD MILLION)

TABLE 247 REST OF EUROPE: MARKET FOR BIOCONTROL, BY SEMIOCHEMICALS, 2022–2027 (USD MILLION)

TABLE 248 REST OF EUROPE: MARKET FOR BIOCONTROL, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 249 REST OF EUROPE:MARKET FOR BIOCONTROL, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 250 REST OF EUROPE: MARKET FOR BIOCONTROL, BY BIOCHEMICALS, 2017–2021 (USD MILLION)

TABLE 251 REST OF EUROPE: MARKET FOR BIOCONTROL, BY BIOCHEMICALS, 2022–2027 (USD MILLION)

11.4 ASIA PACIFIC

TABLE 252 ASIA PACIFIC: BIOCONTROL MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 253 ASIA PACIFIC: MARKET FOR BIOCONTROL, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 254 ASIA PACIFIC: MARKET FOR BIOCONTROL, BY TYPE, 2017–2021 (USD MILLION)

TABLE 255 ASIA PACIFIC: MARKET FOR BIOCONTROL, BY TYPE, 2022–2027 (USD MILLION)

TABLE 256 ASIA PACIFIC: MARKET FOR BIOCONTROL, BY TYPE, 2017–2021 (KT)

TABLE 257 ASIA PACIFIC: MARKET FOR BIOCONTROL, BY TYPE, 2022–2027 (KT)

TABLE 258 ASIA PACIFIC: MARKET FOR BIOCONTROL, BY BIOPESTICIDES, 2017–2021 (USD MILLION)

TABLE 259 ASIA PACIFIC: MARKET FOR BIOCONTROL, BY BIOPESTICIDES, 2022–2027 (USD MILLION)

TABLE 260 ASIA PACIFIC: MARKET FOR BIOCONTROL, BY SEMIOCHEMICALS, 2017–2021 (USD MILLION)

TABLE 261 ASIA PACIFIC: MARKET FOR BIOCONTROL, BY SEMIOCHEMICALS, 2022–2027 (USD MILLION)

TABLE 262 ASIA PACIFIC: MARKET FOR BIOCONTROL, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 263 ASIA PACIFIC: MARKET FOR BIOCONTROL, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 264 ASIA PACIFIC: MARKET FOR BIOCONTROL, BY BIOCHEMICALS, 2017–2021 (USD MILLION)

TABLE 265 ASIA PACIFIC: BIOCONTROL MARKET, BY BIOCHEMICALS, 2022–2027 (USD MILLION)

TABLE 266 ASIA PACIFIC: BIOPESTICIDES MARKET, BY MODE OF APPLICATION, 2017–2021 (USD MILLION)

TABLE 267 ASIA PACIFIC: BIOPESTICIDES MARKET, BY MODE OF APPLICATION, 2022–2027 (USD MILLION)

TABLE 268 ASIA PACIFIC: SEMIOCHEMICALS MARKET, BY MODE OF APPLICATION, 2017–2021 (USD MILLION)

TABLE 269 ASIA PACIFIC: SEMIOCHEMICALS MARKET, BY MODE OF APPLICATION, 2022–2027 (USD MILLION)

TABLE 270 ASIA PACIFIC: BIOCONTROL MARKET, BY CROP TYPE, 2017–2021 (USD MILLION)

TABLE 271 ASIA PACIFIC: MARKET FOR BIOCONTROL, BY CROP TYPE, 2022–2027 (USD MILLION)

11.4.1 CHINA

11.4.1.1 Rising emphasis on ecological protection contributed to surge in sales of biocontrol products in China

TABLE 272 CHINA: BIOCONTROL MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 273 CHINA: MARKET FOR BIOCONTROL, BY TYPE, 2022–2027 (USD MILLION)

TABLE 274 CHINA: MARKET FOR BIOCONTROL, BY BIOPESTICIDES, 2017–2021 (USD MILLION)

TABLE 275 CHINA: MARKET FOR BIOCONTROL, BY BIOPESTICIDES, 2022–2027 (USD MILLION)

TABLE 276 CHINA: MARKET FOR BIOCONTROL, BY SEMIOCHEMICALS, 2017–2021 (USD MILLION)

TABLE 277 CHINA: MARKET FOR BIOCONTROL, BY SEMIOCHEMICALS, 2022–2027 (USD MILLION)

TABLE 278 CHINA: MARKET FOR BIOCONTROL, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 279 CHINA: MARKET FOR BIOCONTROL, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 280 CHINA: MARKET FOR BIOCONTROL, BY BIOCHEMICALS, 2017–2021 (USD MILLION)

TABLE 281 CHINA: MARKET FOR BIOCONTROL, BY BIOCHEMICALS, 2022–2027 (USD MILLION)

11.4.2 INDIA

11.4.2.1 Rising area under organic farming

TABLE 282 INDIA: BIOCONTROL MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 283 INDIA: MARKET FOR BIOCONTROL, BY TYPE, 2022–2027 (USD MILLION)

TABLE 284 INDIA: MARKET FOR BIOCONTROL, BY BIOPESTICIDES, 2017–2021 (USD MILLION)

TABLE 285 INDIA: MARKET FOR BIOCONTROL, BY BIOPESTICIDES, 2022–2027 (USD MILLION)

TABLE 286 INDIA: MARKET FOR BIOCONTROL, BY SEMIOCHEMICALS, 2017–2021 (USD MILLION)

TABLE 287 INDIA: MARKET FOR BIOCONTROL, BY SEMIOCHEMICALS, 2022–2027 (USD MILLION)

TABLE 288 INDIA: MARKET FOR BIOCONTROL, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 289 INDIA: MARKET FOR BIOCONTROL, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 290 INDIA: MARKET FOR BIOCONTROL, BY BIOCHEMICALS, 2017–2021 (USD MILLION)

TABLE 291 INDIA: MARKET FOR BIOCONTROL, BY BIOCHEMICALS, 2022–2027 (USD MILLION)

11.4.3 JAPAN

11.4.3.1 Government regulations to minimize usage of chemical pesticides

TABLE 292 JAPAN: BIOCONTROL MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 293 JAPAN: MARKET FOR BIOCONTROL, BY TYPE, 2022–2027 (USD MILLION)

TABLE 294 JAPAN: MARKET FOR BIOCONTROL, BY BIOPESTICIDES, 2017–2021 (USD MILLION)

TABLE 295 JAPAN: MARKET FOR BIOCONTROL, BY BIOPESTICIDES, 2022–2027 (USD MILLION)

TABLE 296 JAPAN: MARKET FOR BIOCONTROL, BY SEMIOCHEMICALS, 2017–2021 (USD MILLION)

TABLE 297 JAPAN: MARKET FOR BIOCONTROL, BY SEMIOCHEMICALS, 2022–2027 (USD MILLION)

TABLE 298 JAPAN: MARKET FOR BIOCONTROL, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 299 JAPAN: MARKET FOR BIOCONTROL, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 300 JAPAN: MARKET FOR BIOCONTROL, BY BIOCHEMICALS, 2017–2021 (USD MILLION)

TABLE 301 JAPAN: BIOCONTROL MARKET, BY BIOCHEMICALS, 2022–2027 (USD MILLION)

11.4.4 AUSTRALIA

11.4.4.1 Rising usage of organic agricultural inputs

TABLE 302 AUSTRALIA: BIOCONTROL MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 303 AUSTRALIA: MARKET FOR BIOCONTROL, BY TYPE, 2022–2027 (USD MILLION)

TABLE 304 AUSTRALIA: MARKET FOR BIOCONTROL, BY BIOPESTICIDES, 2017–2021 (USD MILLION)

TABLE 305 AUSTRALIA: MARKET FOR BIOCONTROL, BY BIOPESTICIDES, 2022–2027 (USD MILLION)

TABLE 306 AUSTRALIA: MARKET FOR BIOCONTROL, BY SEMIOCHEMICALS, 2017–2021 (USD MILLION)

TABLE 307 AUSTRALIA: MARKET FOR BIOCONTROL, BY SEMIOCHEMICALS, 2022–2027 (USD MILLION)

TABLE 308 AUSTRALIA: MARKET FOR BIOCONTROL, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 309 AUSTRALIA: MARKET FOR BIOCONTROL, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 310 AUSTRALIA: MARKET FOR BIOCONTROL, BY BIOCHEMICALS, 2017–2021 (USD MILLION)

TABLE 311 AUSTRALIA: MARKET FOR BIOCONTROL, BY BIOCHEMICALS, 2022–2027 (USD MILLION)

11.4.5 THAILAND

11.4.5.1 Rising demand for organic vegetables from Thai tourism industry

TABLE 312 THAILAND: BIOCONTROL MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 313 THAILAND: MARKET FOR BIOCONTROL, BY TYPE, 2022–2027 (USD MILLION)

TABLE 314 THAILAND: MARKET FOR BIOCONTROL, BY BIOPESTICIDES, 2017–2021 (USD MILLION)

TABLE 315 THAILAND: MARKET FOR BIOCONTROL, BY BIOPESTICIDES, 2022–2027 (USD MILLION)

TABLE 316 THAILAND: MARKET FOR BIOCONTROL, BY SEMIOCHEMICALS, 2017–2021 (USD MILLION)

TABLE 317 THAILAND: MARKET FOR BIOCONTROL, BY SEMIOCHEMICALS, 2022–2027 (USD MILLION)

TABLE 318 THAILAND: MARKET FOR BIOCONTROL, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 319 THAILAND: MARKET FOR BIOCONTROL, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 320 THAILAND: MARKET FOR BIOCONTROL, BY BIOCHEMICALS, 2017–2021 (USD MILLION)

TABLE 321 THAILAND: BIOCONTROL MARKET, BY BIOCHEMICALS, 2022–2027 (USD MILLION)

11.4.6 INDONESIA

11.4.6.1 Implementation of IPM practices in Indonesia to control pests

TABLE 322 INDONESIA: BIOCONTROL MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 323 INDONESIA: MARKET FOR BIOCONTROL, BY TYPE, 2022–2027 (USD MILLION)

TABLE 324 INDONESIA: MARKET FOR BIOCONTROL, BY BIOPESTICIDES, 2017–2021 (USD MILLION)

TABLE 325 INDONESIA: MARKET FOR BIOCONTROL, BY BIOPESTICIDES, 2022–2027 (USD MILLION)

TABLE 326 INDONESIA: MARKET FOR BIOCONTROL, BY SEMIOCHEMICALS, 2017–2021 (USD MILLION)

TABLE 327 INDONESIA: MARKET FOR BIOCONTROL, BY SEMIOCHEMICALS, 2022–2027 (USD MILLION)

TABLE 328 INDONESIA: MARKET FOR BIOCONTROL, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 329 INDONESIA: MARKET FOR BIOCONTROL, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 330 INDONESIA: MARKET FOR BIOCONTROL, BY BIOCHEMICALS, 2017–2021 (USD MILLION)

TABLE 331 INDONESIA: MARKET FOR BIOCONTROL, BY BIOCHEMICALS, 2022–2027 (USD MILLION)

11.4.7 REST OF ASIA PACIFIC

11.4.7.1 Demand for agricultural products to drive biocontrol market

TABLE 332 REST OF ASIA PACIFIC: BIOCONTROL MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 333 REST OF ASIA PACIFIC: MARKET FOR BIOCONTROL, BY TYPE, 2022–2027 (USD MILLION)

TABLE 334 REST OF ASIA PACIFIC: MARKET FOR BIOCONTROL, BY BIOPESTICIDES, 2017–2021 (USD MILLION)

TABLE 335 REST OF ASIA PACIFIC: MARKET FOR BIOCONTROL, BY BIOPESTICIDES, 2022–2027 (USD MILLION)

TABLE 336 REST OF ASIA PACIFIC: MARKET FOR BIOCONTROL, BY SEMIOCHEMICALS, 2017–2021 (USD MILLION)

TABLE 337 REST OF ASIA PACIFIC: MARKET FOR BIOCONTROL, BY SEMIOCHEMICALS, 2022–2027 (USD MILLION)

TABLE 338 REST OF ASIA PACIFIC: MARKET FOR BIOCONTROL, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 339 REST OF ASIA PACIFIC: MARKET FOR BIOCONTROL, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 340 REST OF ASIA PACIFIC: MARKET FOR BIOCONTROL, BY BIOCHEMICALS, 2017–2021 (USD MILLION)

TABLE 341 REST OF ASIA PACIFIC: BIOCONTROL MARKET, BY BIOCHEMICALS, 2022–2027 (USD MILLION)

11.5 SOUTH AMERICA

TABLE 342 SOUTH AMERICA: BIOCONTROL MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 343 SOUTH AMERICA: MARKET FOR BIOCONTROL, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 344 SOUTH AMERICA: MARKET FOR BIOCONTROL, BY TYPE, 2017–2021 (USD MILLION)

TABLE 345 SOUTH AMERICA: MARKET FOR BIOCONTROL, BY TYPE, 2022–2027 (USD MILLION)

TABLE 346 SOUTH AMERICA: MARKET FOR BIOCONTROL, BY TYPE, 2017–2021 (KT)

TABLE 347 SOUTH AMERICA: MARKET FOR BIOCONTROL, BY TYPE, 2022–2027 (KT)

TABLE 348 SOUTH AMERICA: MARKET FOR BIOCONTROL, BY BIOPESTICIDES, 2017–2021 (USD MILLION)

TABLE 349 SOUTH AMERICA: MARKET FOR BIOCONTROL, BY BIOPESTICIDES, 2022–2027 (USD MILLION)

TABLE 350 SOUTH AMERICA: MARKET FOR BIOCONTROL, BY SEMIOCHEMICALS, 2017–2021 (USD MILLION)

TABLE 351 SOUTH AMERICA: MARKET FOR BIOCONTROL, BY SEMIOCHEMICALS, 2022–2027 (USD MILLION)

TABLE 352 SOUTH AMERICA: MARKET FOR BIOCONTROL, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 353 SOUTH AMERICA: MARKET FOR BIOCONTROL, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 354 SOUTH AMERICA: MARKET FOR BIOCONTROL, BY BIOCHEMICALS, 2017–2021 (USD MILLION)

TABLE 355 SOUTH AMERICA: MARKET FOR BIOCONTROL, BY BIOCHEMICALS, 2022–2027 (USD MILLION)

TABLE 356 SOUTH AMERICA: BIOPESTICIDES MARKET, BY MODE OF APPLICATION, 2017–2021 (USD MILLION)

TABLE 357 SOUTH AMERICA: BIOPESTICIDES MARKET, BY MODE OF APPLICATION, 2022–2027 (USD MILLION)

TABLE 358 SOUTH AMERICA: SEMIOCHEMICALS MARKET, BY MODE OF APPLICATION, 2017–2021 (USD MILLION)

TABLE 359 SOUTH AMERICA: SEMIOCHEMICALS MARKET, BY MODE OF APPLICATION, 2022–2027 (USD MILLION)

TABLE 360 SOUTH AMERICA: MARKET FOR BIOCONTROL, BY CROP TYPE, 2017–2021 (USD MILLION)

TABLE 361 SOUTH AMERICA: BIOCONTROL MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

11.5.1 BRAZIL

11.5.1.1 Hampered soybean production by various pests causing economic losses creates need for sustainable alternatives

TABLE 362 BRAZIL: BIOCONTROL MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 363 BRAZIL: MARKET FOR BIOCONTROL, BY TYPE, 2022–2027 (USD MILLION)

TABLE 364 BRAZIL: MARKET FOR BIOCONTROL, BY BIOPESTICIDES, 2017–2021 (USD MILLION)

TABLE 365 BRAZIL: MARKET FOR BIOCONTROL, BY BIOPESTICIDES, 2022–2027 (USD MILLION)

TABLE 366 BRAZIL: MARKET FOR BIOCONTROL, BY SEMIOCHEMICALS, 2017–2021 (USD MILLION)

TABLE 367 BRAZIL: MARKET FOR BIOCONTROL, BY SEMIOCHEMICALS, 2022–2027 (USD MILLION)

TABLE 368 BRAZIL: MARKET FOR BIOCONTROL, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 369 BRAZIL: MARKET FOR BIOCONTROL, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 370 BRAZIL: MARKET FOR BIOCONTROL, BY BIOCHEMICALS, 2017–2021 (USD MILLION)

TABLE 371 BRAZIL: BIOCONTROL MARKET, BY BIOCHEMICALS, 2022–2027 (USD MILLION)

11.5.2 ARGENTINA

11.5.2.1 Biocontrol market booming in Argentina to maintain international export quality of crops

TABLE 372 ARGENTINA: BIOCONTROL MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 373 ARGENTINA: MARKET FOR BIOCONTROL, BY TYPE, 2022–2027 (USD MILLION)

TABLE 374 ARGENTINA: MARKET FOR BIOCONTROL, BY BIOPESTICIDES, 2017–2021 (USD MILLION)

TABLE 375 ARGENTINA: MARKET FOR BIOCONTROL, BY BIOPESTICIDES, 2022–2027 (USD MILLION)

TABLE 376 ARGENTINA: MARKET FOR BIOCONTROL, BY SEMIOCHEMICALS, 2017–2021 (USD MILLION)

TABLE 377 ARGENTINA: MARKET FOR BIOCONTROL, BY SEMIOCHEMICALS, 2022–2027 (USD MILLION)

TABLE 378 ARGENTINA: MARKET FOR BIOCONTROL, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 379 ARGENTINA: MARKET FOR BIOCONTROL, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 380 ARGENTINA: MARKET FOR BIOCONTROL, BY BIOCHEMICALS, 2017–2021 (USD MILLION)

TABLE 381 ARGENTINA: MARKET FOR BIOCONTROL, BY BIOCHEMICALS, 2022–2027 (USD MILLION)

11.5.3 CHILE

11.5.3.1 Greater demand for organically grown fruits in Chile leading to adoption of biocontrol methods

TABLE 382 CHILE: BIOCONTROL MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 383 CHILE: MARKET FOR BIOCONTROL, BY TYPE, 2022–2027 (USD MILLION)

TABLE 384 CHILE: MARKET FOR BIOCONTROL, BY BIOPESTICIDES, 2017–2021 (USD MILLION)

TABLE 385 CHILE: MARKET FOR BIOCONTROL, BY BIOPESTICIDES, 2022–2027 (USD MILLION)

TABLE 386 CHILE: MARKET FOR BIOCONTROL, BY SEMIOCHEMICALS, 2017–2021 (USD MILLION)

TABLE 387 CHILE: MARKET FOR BIOCONTROL, BY SEMIOCHEMICALS, 2022–2027 (USD MILLION)

TABLE 388 CHILE: MARKET FOR BIOCONTROL, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 389 CHILE: MARKET FOR BIOCONTROL, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 390 CHILE: MARKET FOR BIOCONTROL, BY BIOCHEMICALS, 2017–2021 (USD MILLION)

TABLE 391 CHILE: MARKET FOR BIOCONTROL, BY BIOCHEMICALS, 2022–2027 (USD MILLION)

11.5.4 REST OF SOUTH AMERICA

11.5.4.1 Rising production of cash crops

TABLE 392 REST OF SOUTH AMERICA: BIOCONTROL MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 393 REST OF SOUTH AMERICA: MARKET FOR BIOCONTROL, BY TYPE, 2022–2027 (USD MILLION)

TABLE 394 REST OF SOUTH AMERICA: MARKET FOR BIOCONTROL, BY BIOPESTICIDES, 2017–2021 (USD MILLION)

TABLE 395 REST OF SOUTH AMERICA: MARKET FOR BIOCONTROL, BY BIOPESTICIDES, 2022–2027 (USD MILLION)

TABLE 396 REST OF SOUTH AMERICA: MARKET FOR BIOCONTROL, BY SEMIOCHEMICALS, 2017–2021 (USD MILLION)

TABLE 397 REST OF SOUTH AMERICA: MARKET FOR BIOCONTROL, BY SEMIOCHEMICALS, 2022–2027 (USD MILLION)

TABLE 398 REST OF SOUTH AMERICA: MARKET FOR BIOCONTROL, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 399 REST OF SOUTH AMERICA: MARKET FOR BIOCONTROL, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 400 REST OF SOUTH AMERICA: MARKET FOR BIOCONTROL, BY BIOCHEMICALS, 2017–2021 (USD MILLION)

TABLE 401 REST OF SOUTH AMERICA: BIOCONTROL MARKET, BY BIOCHEMICALS, 2022–2027 (USD MILLION)

11.6 REST OF THE WORLD (ROW)

TABLE 402 ROW: BIOCONTROL MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 403 ROW: MARKET FOR BIOCONTROL, BY REGION, 2022–2027 (USD MILLION)

TABLE 404 ROW: MARKET FOR BIOCONTROL, BY TYPE, 2017–2021 (USD MILLION)

TABLE 405 ROW: MARKET FOR BIOCONTROL, BY TYPE, 2022–2027 (USD MILLION)

TABLE 406 ROW: MARKET FOR BIOCONTROL, BY TYPE, 2017–2021 (KT)

TABLE 407 ROW: MARKET FOR BIOCONTROL, BY TYPE, 2022–2027 (KT)

TABLE 408 ROW: MARKET FOR BIOCONTROL, BY BIOPESTICIDES, 2017–2021 (USD MILLION)

TABLE 409 ROW: MARKET FOR BIOCONTROL, BY BIOPESTICIDES, 2022–2027 (USD MILLION)

TABLE 410 ROW: MARKET FOR BIOCONTROL, BY SEMIOCHEMICALS, 2017–2021 (USD MILLION)

TABLE 411 ROW: MARKET FOR BIOCONTROL, BY SEMIOCHEMICALS, 2022–2027 (USD MILLION)

TABLE 412 ROW: MARKET FOR BIOCONTROL, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 413 ROW: MARKET FOR BIOCONTROL, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 414 ROW: MARKET FOR BIOCONTROL, BY BIOCHEMICALS, 2017–2021 (USD MILLION)

TABLE 415 ROW: MARKET FOR BIOCONTROL, BY BIOCHEMICALS, 2022–2027 (USD MILLION)

TABLE 416 ROW: BIOPESTICIDES MARKET, BY MODE OF APPLICATION, 2017–2021 (USD MILLION)

TABLE 417 ROW: BIOPESTICIDES MARKET, BY MODE OF APPLICATION, 2022–2027 (USD MILLION)

TABLE 418 ROW: SEMIOCHEMICALS MARKET, BY MODE OF APPLICATION, 2017–2021 (USD MILLION)

TABLE 419 ROW: SEMIOCHEMICALS MARKET, BY MODE OF APPLICATION, 2022–2027 (USD MILLION)

TABLE 420 ROW: BIOCONTROL MARKET, BY CROP TYPE, 2017–2021 (USD MILLION)

TABLE 421 ROW: BIOCONTROL MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

11.6.1 AFRICA

11.6.1.1 Rising infestation of Botrytis cinerea in grapes

TABLE 422 AFRICA: BIOCONTROL MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 423 AFRICA: BIOCONTROL MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 424 AFRICA: BIOCONTROL MARKET, BY BIOPESTICIDES, 2017–2021 (USD MILLION)

TABLE 425 AFRICA: BIOCONTROL MARKET, BY BIOPESTICIDES, 2022–2027 (USD MILLION)

TABLE 426 AFRICA: BIOCONTROL MARKET, BY SEMIOCHEMICALS, 2017–2021 (USD MILLION)

TABLE 427 AFRICA: BIOCONTROL MARKET, BY SEMIOCHEMICALS, 2022–2027 (USD MILLION)

TABLE 428 AFRICA: BIOCONTROL MARKET, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 429 AFRICA: BIOCONTROL MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 430 AFRICA: BIOCONTROL MARKET, BY BIOCHEMICALS, 2017–2021 (USD MILLION)

TABLE 431 AFRICA: BIOCONTROL MARKET, BY BIOCHEMICALS, 2022–2027 (USD MILLION)

11.6.2 MIDDLE EAST

11.6.2.1 Middle East at nascent stage and growing gradually

TABLE 432 MIDDLE EAST: BIOCONTROL MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 433 MIDDLE EAST: BIOCONTROL MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 434 MIDDLE EAST: BIOCONTROL MARKET, BY BIOPESTICIDES, 2017–2021 (USD MILLION)

TABLE 435 MIDDLE EAST: BIOCONTROL MARKET, BY BIOPESTICIDES, 2022–2027 (USD MILLION)

TABLE 436 MIDDLE EAST: BIOCONTROL MARKET, BY SEMIOCHEMICALS, 2017–2021 (USD MILLION)

TABLE 437 MIDDLE EAST: BIOCONTROL MARKET, BY SEMIOCHEMICALS, 2022–2027 (USD MILLION)

TABLE 438 MIDDLE EAST: BIOCONTROL MARKET, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 439 MIDDLE EAST: BIOCONTROL MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 440 MIDDLE EAST: BIOCONTROL MARKET, BY BIOCHEMICALS, 2017–2021 (USD MILLION)

TABLE 441 MIDDLE EAST: BIOCONTROL MARKET, BY BIOCHEMICALS, 2022–2027 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 280)

12.1 OVERVIEW

12.2 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

FIGURE 47 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS, 2017–2021 (USD BILLION)

12.3 MARKET SHARE ANALYSIS

TABLE 442 BIOCONTROL MARKET: DEGREE OF COMPETITION (COMPETITIVE), 2021

12.4 KEY PLAYER STRATEGIES

12.5 KEY PLAYER EVALUATION QUADRANT (KEY PLAYERS)

12.5.1 STARS

12.5.2 EMERGING LEADERS

12.5.3 PERVASIVE PLAYERS

12.5.4 PARTICIPANTS

FIGURE 48 BIOCONTROL MARKET: COMPANY EVALUATION QUADRANT, 2021 (KEY PLAYERS)

12.6 PRODUCT FOOTPRINT

TABLE 443 COMPANY PRODUCT TYPE FOOTPRINT

TABLE 444 COMPANY CROP TYPE FOOTPRINT

TABLE 445 COMPANY REGIONAL FOOTPRINT

TABLE 446 OVERALL COMPANY FOOTPRINT

12.7 COMPETITIVE LEADERSHIP MAPPING (START-UPS/SMES)

12.7.1 PROGRESSIVE COMPANIES

12.7.2 STARTING BLOCKS

12.7.3 RESPONSIVE COMPANIES

12.7.4 DYNAMIC COMPANIES

FIGURE 49 BIOCONTROL MARKET: COMPANY EVALUATION QUADRANT, 2021 (START-UP/SME)

TABLE 447 BIOCONTROL: DETAILED LIST OF KEY START-UPS/SMES

TABLE 448 BIOCONTROL: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

12.8 PRODUCT LAUNCHES, DEALS, AND OTHER DEVELOPMENTS

12.8.1 PRODUCT LAUNCHES

TABLE 449 PRODUCT LAUNCHES, 2020–2022

12.8.2 DEALS

TABLE 450 DEALS, 2020–2022

12.8.3 OTHERS

TABLE 451 OTHERS, 2020–2022

13 COMPANY PROFILES (Page No. - 306)

(Business overview, Products offered, Recent Developments, MNM view)*

13.1 KEY PLAYERS

13.1.1 BASF SE

TABLE 452 BASF SE: BUSINESS OVERVIEW, 2021

FIGURE 50 BASF SE: COMPANY SNAPSHOT

TABLE 453 BASF SE: PRODUCTS OFFERED

TABLE 454 BASF SE: NEW PRODUCT LAUNCHES

TABLE 455 BASF SE: DEALS

13.1.2 BAYER AG

TABLE 456 BAYER AG: BUSINESS OVERVIEW, 2021

FIGURE 51 BAYER AG: COMPANY SNAPSHOT

TABLE 457 BAYER AG: PRODUCTS OFFERED

TABLE 458 BAYER AG: NEW PRODUCT LAUNCHES

13.1.3 SYNGENTA AG

TABLE 459 SYNGENTA AG: BUSINESS OVERVIEW, 2021

FIGURE 52 SYNGENTA AG: COMPANY SNAPSHOT

TABLE 460 SYNGENTA AG: PRODUCTS OFFERED

TABLE 461 SYNGENTA AG: NEW PRODUCT LAUNCHES

TABLE 462 SYNGENTA AG: DEALS

13.1.4 UPL LIMITED

TABLE 463 UPL LIMITED: BUSINESS OVERVIEW, 2020

FIGURE 53 UPL LIMITED: COMPANY SNAPSHOT

TABLE 464 UPL LIMITED: PRODUCTS OFFERED

TABLE 465 UPL: NEW PRODUCT LAUNCHES

TABLE 466 UPL LIMITED: DEALS

TABLE 467 UPL LIMITED: OTHERS

13.1.5 FMC CORPORATION

TABLE 468 FMC CORPORATION: BUSINESS OVERVIEW, 2021

FIGURE 54 FMC CORPORATION: COMPANY SNAPSHOT

TABLE 469 FMC CORPORATION: PRODUCTS OFFERED

TABLE 470 FMC CORPORATION: NEW PRODUCT LAUNCHES

TABLE 471 FMC CORPORATION: DEALS

13.1.6 CORTEVA AGRISCIENCE

TABLE 472 CORTEVA AGRISCIENCE: BUSINESS OVERVIEW, 2021

FIGURE 55 CORTEVA AGRISCIENCE: COMPANY SNAPSHOT

TABLE 473 CORTEVA, INC.: PRODUCTS OFFERED

TABLE 474 CORTEVA, INC.: DEALS

13.1.7 SHIN-ETSU CHEMICAL CO., LTD

TABLE 475 SHIN-ETSU CHEMICAL CO., LTD: BUSINESS OVERVIEW, 2020

FIGURE 56 SHIN-ETSU CHEMICAL CO., LTD: COMPANY SNAPSHOT

TABLE 476 SHIN-ETSU CHEMICAL CO., LTD: PRODUCTS OFFERED

13.1.8 SUTERRA LLC

TABLE 477 SUTERRA LLC: BUSINESS OVERVIEW, 2021

TABLE 478 SUTERRA LLC: PRODUCTS OFFERED

TABLE 479 SUTERRA LLC: NEW PRODUCT LAUNCHES

TABLE 480 SUTERRA LLC: DEALS

13.1.9 MARRONE BIO INNOVATIONS

TABLE 481 MARRONE BIO INNOVATIONS: BUSINESS OVERVIEW, 2021

FIGURE 57 MARRONE BIO INNOVATIONS: COMPANY SNAPSHOT

TABLE 482 MARRONE BIO INNOVATIONS: PRODUCTS OFFERED

TABLE 483 MARRONE BIO INNOVATIONS: NEW PRODUCT LAUNCHES

TABLE 484 MARRONE BIO INNOVATIONS: DEALS

13.1.10 NOVOZYMES A/S

TABLE 485 NOVOZYMES A/S: BUSINESS OVERVIEW, 2021

FIGURE 58 NOVOZYMES A/S: COMPANY SNAPSHOT

TABLE 486 NOVOZYMES A/S: PRODUCTS OFFERED

TABLE 487 NOVOZYMES A/S: DEALS

13.1.11 ISAGRO S.P.A.

TABLE 488 ISAGRO S.P.A.: BUSINESS OVERVIEW, 2021

TABLE 489 ISAGRO S.P.A.: PRODUCTS OFFERED

TABLE 490 ISAGRO S.P.A.: DEALS

13.1.12 RUSSELL IPM

TABLE 491 RUSSELL IPM: BUSINESS OVERVIEW, 2021

TABLE 492 RUSSELL IPM: PRODUCTS OFFERED

13.1.13 CERTIS USA L.L.C.

TABLE 493 CERTIS USA L.L.C.: BUSINESS OVERVIEW, 2021

TABLE 494 CERTIS USA L.L.C.: PRODUCTS OFFERED

TABLE 495 CERTIS USA L.L.C.: NEW PRODUCT LAUNCHES

TABLE 496 CERTIS USA L.L.C.: OTHERS

13.1.14 KOPPERT BIOLOGICAL SYSTEMS

TABLE 497 KOPPERT BIOLOGICAL SYSTEMS: BUSINESS OVERVIEW, 2021

TABLE 498 KOPPERT BIOLOGICAL SYSTEMS: PRODUCTS OFFERED

TABLE 499 KOPPERT BIOLOGICAL SYSTEMS: DEALS

13.1.15 PHEROBANK B.V.

TABLE 500 PHEROBANK B.V.: BUSINESS OVERVIEW, 2021

TABLE 501 PHEROBANK B.V.: PRODUCTS OFFERED

TABLE 502 PHEROBANK B.V.: NEW PRODUCT LAUNCHES

13.1.16 VALENT BIOSCIENCES LLC

TABLE 503 VALENT BIOSCIENCES LLC: BUSINESS OVERVIEW, 2021

TABLE 504 VALENT BIOSCIENCES LLC: PRODUCTS OFFERED

TABLE 505 VALENT BIOSCIENCES LLC: DEALS

13.1.17 STK BIO-AG TECHNOLOGIES

TABLE 506 STK BIO-AG TECHNOLOGIES: BUSINESS OVERVIEW, 2021

TABLE 507 STK BIO-AG TECHNOLOGIES: PRODUCTS OFFERED

TABLE 508 STK BIO-AG TECHNOLOGIES: DEALS

13.1.18 BIOBEST GROUP NV

TABLE 509 BIOBEST GROUP NV: BUSINESS OVERVIEW, 2021

TABLE 510 BIOBEST GROUP NV: PRODUCTS OFFERED

TABLE 511 BIOBEST GROUP NV: NEW PRODUCT LAUNCHES

TABLE 512 BIOBEST GROUP NV: DEALS

13.2 START-UPS/SMES/OTHER PLAYERS

13.2.1 ANDERMATT BIOCONTROL AG

TABLE 513 ANDERMATT BIOCONTROL AG: BUSINESS OVERVIEW

TABLE 514 ANDERMATT BIOCONTROL AG: PRODUCTS OFFERED, 2021

TABLE 515 ANDERMATT BIOCONTROL AG: DEALS

TABLE 516 ANDERMATT BIOCONTROL AG: OTHERS

13.2.2 IPL BIOLOGICALS LTD

TABLE 517 IPL BIOLOGICALS LTD: BUSINESS OVERVIEW, 2021

TABLE 518 IPL BIOLOGICALS LTD: PRODUCTS OFFERED

TABLE 519 IPL BIOLOGICALS LTD: OTHERS

13.2.3 VEGALAB S.A

TABLE 520 VEGALAB S.A: BUSINESS OVERVIEW, 2021

TABLE 521 VEGALAB S.A: PRODUCTS OFFERED

13.2.4 BIOWORKS, INC.

TABLE 522 BIOWORKS, INC.: BUSINESS OVERVIEW, 2021

TABLE 523 BIOWORKS, INC.: PRODUCTS OFFERED

TABLE 524 BIOWORKS INC: NEW PRODUCT LAUNCHES

13.2.5 BIONEMA

TABLE 525 BIONEMA: BUSINESS OVERVIEW, 2021

TABLE 526 BIONEMA: PRODUCTS OFFERED

TABLE 527 BIONEMA: DEALS

13.2.6 VESTARON CORPORATION

TABLE 528 VESTARON CORPORATION: BUSINESS OVERVIEW, 2021

TABLE 529 VESTARON CORPORATION: PRODUCTS OFFERED

TABLE 530 VESTARON CORPORATION: DEALS

13.2.7 INNOVATE AG

TABLE 531 INNOVATE AG: BUSINESS OVERVIEW, 2021

TABLE 532 INNOVATE AG: PRODUCTS OFFERED

13.2.8 PROVIVI

13.2.9 M2I LIFE SCIENCES

13.2.10 BIOTALYS

13.2.11 FYTOFEND S.A.

13.2.12 BIOLOGIC INSECTICIDE

14 ADJACENT & RELATED MARKETS (Page No. - 390)

14.1 INTRODUCTION

14.2 BIOPESTICIDES MARKET

14.2.1 LIMITATIONS

14.2.2 MARKET DEFINITION

14.2.3 MARKET OVERVIEW

14.2.4 BIOPESTICIDES MARKET, BY SOURCE

TABLE 533 BIOPESTICIDES MARKET, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 534 BIOPESTICIDES MARKET, BY SOURCE, 2022–2027 (USD MILLION)

14.2.5 BIOPESTICIDES MARKET, BY REGION

TABLE 535 BIOPESTICIDES MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 536 BIOPESTICIDES MARKET, BY REGION, 2022–2027 (USD MILLION)

14.3 AGRICULTURAL BIOLOGICALS MARKET

14.3.1 LIMITATIONS

14.3.2 MARKET DEFINITION

14.3.3 MARKET OVERVIEW

14.3.4 AGRICULTURAL BIOLOGICALS MARKET, BY FUNCTION

TABLE 537 AGRICULTURAL BIOLOGICALS MARKET, BY FUNCTION, 2017–2020 (USD MILLION)

TABLE 538 AGRICULTURAL BIOLOGICALS MARKET, BY FUNCTION, 2021–2027 (USD MILLION)

14.3.5 AGRICULTURAL BIOLOGICALS MARKET, BY REGION

TABLE 539 AGRICULTURAL BIOLOGICALS MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 540 AGRICULTURAL BIOLOGICALS MARKET, BY REGION, 2021–2027 (USD MILLION)

14.4 AGRICULTURAL MICROBIALS MARKET

14.4.1 LIMITATIONS

14.4.2 MARKET DEFINITION

14.4.3 MARKET OVERVIEW

14.4.4 AGRICULTURAL MICROBIALS MARKET, BY FORMULATION

TABLE 541 AGRICULTURAL MICROBIALS MARKET, BY FORMULATION, 2018–2025 (USD MILLION)

14.4.5 AGRICULTURAL MICROBIALS MARKET, BY REGION

TABLE 542 AGRICULTURAL MICROBIALS MARKET, BY REGION, 2018–2025 (USD MILLION)

15 APPENDIX (Page No. - 400)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

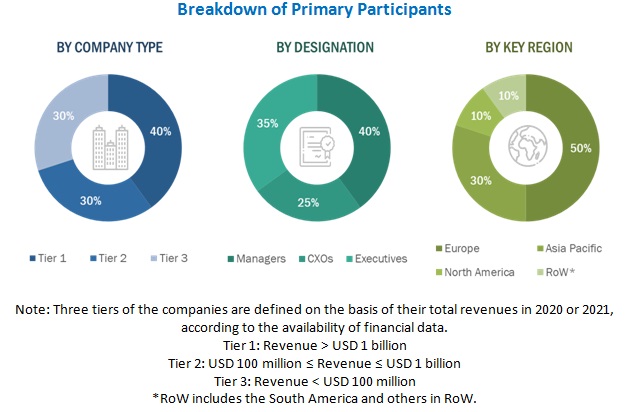

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the biocontrol market. In-depth interviews were conducted with various primary respondents—such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants—to obtain and verify critical qualitative and quantitative information as well as to assess prospects. The following figure depicts the research design applied in drafting this report on the biocontrol market.

Secondary Research

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, gold & silver standard websites, directories, and databases, were referred to identify and collect information.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology oriented perspectives

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information. The primary sources from the supply side included industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the biocontrol market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the biocontrol market. These methods were also used extensively to estimate the size of the various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research.

- The revenues of major biopesticides and semiochemical manufacturers were determined through primary and secondary research, such as paid databases, which were used as the basis for market estimation.

- All macroeconomic and microeconomic factors affecting the growth of the biocontrol market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using the top-down and bottom-up approaches.

Report Objectives

- To define, segment, and project the global market for biocontrol on the basis of type, crop type, source, mode of application, and region

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape of the market leaders

- To project the size of the market and its submarkets, in terms of value and volume, with respect to the regions (along with the key countries)

- To strategically profile the key players and comprehensively analyze their market position and core competencies

- To analyze the competitive developments such as joint ventures, mergers & acquisitions, new product developments, and research & developments in the biopesticides market