Biocompatible Coatings Market by Type (Antibacterial, hydrophilic), Material (Polymer, Ceramics, Metal), End-Use Industry (Healthcare, Food & Beverage, Medical Devices), & Region (APAC, Europe, North America, MEA & SA) - Global Forecast to 2028

Updated on : August 22, 2025

Biocompatible Coatings Market

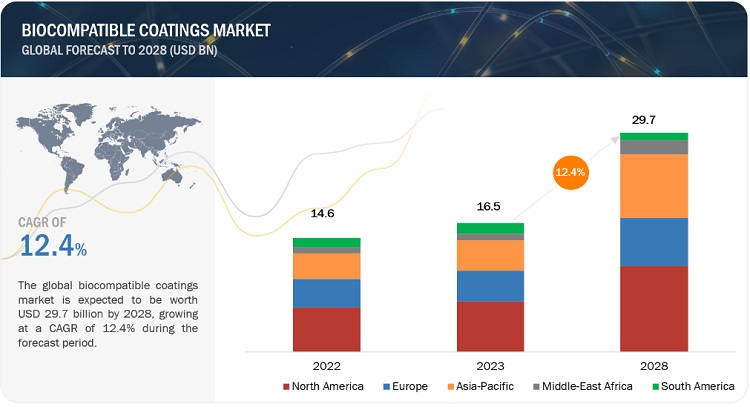

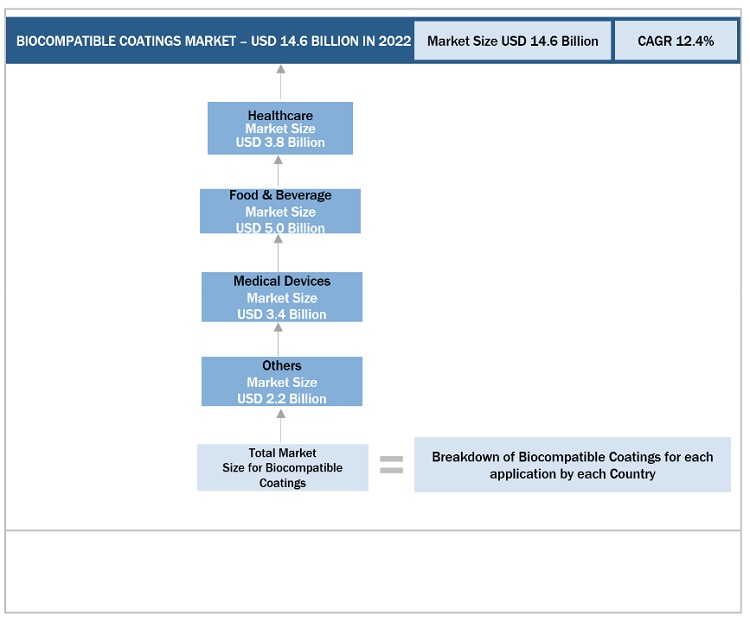

The global biocompatible coatings market was valued at USD 14.6 billion in 2022 and is projected to reach USD 29.7 billion by 2028, growing at 12.4% cagr from 2023 to 2028. The market is categorized into four end use application: Healthcare, Food & Beverage, Medical Devices, and Others. Food & Beverage application accounts the largest share of biocompatible coatings market. Biocompatible coatings are gaining popularity because of its features such as enhanced biocompatibility, improved performance, reduced infections, and technological advancements. Biocompatibility coatings sector is one of the most strictly regulated sector in the world. Biocompatibility coatings market is mainly dominated by few large players but there are many manufatueres of biocompatibility coatings at regional level. India and China have rapidly growing economies with large populations, which present significant market potential for various industries, including the healthcare sector. The market for biocompatible coatings in the healthcare sector is experiencing significant growth and holds great potential. Biocompatible coatings play a crucial role in enhancing the biocompatibility and functionality of medical devices, implants, and equipment used in the healthcare industry. the increasing focus on patient safety, the demand for advanced medical devices, regulatory compliance requirements, technological advancements, and research and development initiatives are driving the market for biocompatible coatings in the healthcare sector. The market is expected to continue growing as healthcare providers and manufacturers recognize the importance of biocompatibility in enhancing patient care and outcomes.

Biocompatible Coatings Market Forecast & Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Attractive Opportunities in Biocompatible Coatings Market

Biocompatible Coatings Market Dynamics

Driver: Growing awareness of patient safety has become a significant driving force behind the biocompatible coating market. With advancements in medical technology and an increasing emphasis on patient care, healthcare providers and regulatory bodies have recognized the importance of ensuring the safety and well-being of patients during medical procedures and device usage. Biocompatible coatings play a crucial role in this regard by providing a protective layer on medical devices, implants, and equipment to minimize the risk of adverse reactions, infections, and other complications.

The demand for biocompatible coatings has surged as healthcare professionals and patients alike seek products that offer enhanced biocompatibility and compatibility with human tissues. Also, Regulatory agencies and industry standards have also played a significant role in driving the adoption of biocompatible coatings. Authorities such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) have established guidelines and regulations that prioritize patient safety and require medical device manufacturers to meet specific biocompatibility standards. As a result, manufacturers are increasingly incorporating biocompatible coatings into their product designs to ensure compliance with these regulations and address growing concerns over patient safety.

Restraints: Developing biocompatible coatings requires extensive research and development (R&D) efforts. This R&D phase incurs substantial costs, including investment in specialized equipment, laboratory facilities, and skilled personnel. Additionally, ensuring compliance with regulatory standards and obtaining necessary certifications further adds to the development costs. The production of biocompatible coatings often requires specialized equipment and facilities, which can be costly to establish and maintain. Additionally, the use of high-quality raw materials and the need for stringent quality control protocols can contribute to the overall manufacturing costs. These higher development and manufacturing costs associated with biocompatible coatings can lead to higher prices for end-users, including healthcare providers and patients. The increased costs may create a barrier for smaller healthcare facilities or emerging markets with limited financial resources, restricting their ability to adopt and utilize biocompatible coatings.

Opportunity: Infections associated with medical devices and implants pose a significant risk to patient safety and can lead to complications, extended hospital stays, and increased healthcare costs. Biocompatible coatings offer a valuable solution to mitigate these risks and improve infection control measures.

The increasing awareness of healthcare-associated infections (HAIs) and their impact on patient outcomes has led to a heightened focus on infection control practices. Healthcare providers are actively seeking strategies and technologies to minimize the risk of HAIs, and biocompatible coatings are gaining recognition for their potential in this regard.

Challenges: The regulatory landscape for medical devices and coatings is complex and highly regulated to ensure patient safety and efficacy. Compliance with these regulations is essential for manufacturers to market and sell their biocompatible coatings.

One of the challenges is navigating the regulatory pathways and obtaining the necessary approvals and certifications. Depending on the intended use and classification of the biocompatible coating, manufacturers may need to adhere to various regulatory frameworks, such as the U.S. Food and Drug Administration (FDA) regulations in the United States or the European Union Medical Device Regulation (MDR) in Europe. These regulations often require extensive documentation, including preclinical and clinical data, risk assessments, and quality control processes, to demonstrate the safety and effectiveness of the coating.

Regulatory requirements for medical devices and coatings are subject to updates and revisions to align with advancing scientific knowledge and changing market dynamics. Manufacturers must stay updated with the latest regulations and adapt their processes and documentation accordingly, which requires continuous monitoring and engagement with regulatory authorities. stringent regulatory requirements pose a significant challenge for the biocompatible coatings market.

Middle East & Africa is estimated to register second highest CAGR during the forecast period

The MEA region has been witnessing significant growth in healthcare expenditure, driven by factors such as population growth, rising disposable income, and increased government initiatives to improve healthcare infrastructure. This increased investment in healthcare is expected to drive the demand for advanced medical devices and implants, which often require biocompatible coatings. The MEA region is a popular destination for medical tourism due to its advanced healthcare facilities, highly skilled medical professionals, and cost advantages compared to other regions. Medical tourists often seek treatments that involve the use of medical devices and implants, creating a demand for biocompatible coatings to ensure the safety and effectiveness of these devices.

China is estimated to be the second largest market for biocompatible coatings.

China has emerged as a significant player and the second-largest market for biocompatible coatings in recent years. The country's rapidly expanding healthcare industry, increasing investment in medical research and development, and a large patient population have contributed to its growth in the biocompatible coatings market. China's healthcare sector has been experiencing significant growth, driven by factors such as a rising middle class, increased healthcare spending, and government initiatives to improve healthcare infrastructure and access to quality medical services. This growth has created a substantial demand for medical devices and implants, which require biocompatible coatings to enhance their biocompatibility, performance, and safety. The Chinese government has been actively supporting the development of the domestic medical device industry, leading to the growth of local manufacturers and suppliers of medical devices and coatings. The focus on achieving self-sufficiency in healthcare technologies and reducing dependence on imports has further propelled the demand for biocompatible coatings within the country.

To know about the assumptions considered for the study, download the pdf brochure

Biocompatible Coatings Market Players

The biocompatible coatings market is dominated by a few globally established players such SurModics, Inc. (US), DSM Biomedical (US), Hydromer Inc. (US), Covalon Technologies Ltd. (Canada), Hemoteq AG (Germany), among others, are the key manufacturers. Major focus was given to the mergers & acquitions, and new product development due to the changing requirements of end industry users across the globe.

Biocompatible Coatings Market Report Scope

|

Report Metric |

Details |

|

Market size available for years |

2021-2028 |

|

Base year considered |

2022 |

|

Forecast Period |

2023-2028 |

|

Forecast Units |

Value (USD Billion) |

|

Segments Covered |

By Type, By Material, By End-Use Industry, By Region |

|

Geographies Covered |

Asia Pacific, Europe, North America, Middle East & Africa, and South America |

|

Companies covered |

SurModics, Inc. (US), DSM Biomedical (US), Hydromer Inc. (US), Covalon Technologies Ltd. (Canada), and Hemoteq AG (Germany) |

Based on type, the biocompatible coatings market has been segmented as follows:

- Antibacterial

- Hydrophilic

- Others

Based on material, the biocompatible coatings market has been segmented as follows:

- Polymer

- Ceramics

- Metal

- Others

Based on end-use industry, the biocompatible coatings market has been segmented as follows:

- Healthcare

- Food & Beverage

- Medical Devices

- Others

Based on the region, the biocompatible coatings market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In March 2022, DSM Biomedical and Svelte Medical Systems Collaboration Fuels Development of DISCREET Bioresorbable Coating Technology Used with SLENDER IDS and DIRECT RX Bioresorbable Coated Drug-Eluting Stent (DES) Systems

- In April 2020, Hydromer renewed its business agreements with many clients. The business will provide its customers specialised coating machinery, formulas for hydrophilic coatings, and full technical support.

Frequently Asked Questions (FAQ):

What is the current competitive landscape in the biocompatible coatings market in terms of new applications, production, and sales?

The market has various large, medium, and small-scale players operating across the globe. Many players are constantly innovating and developing new products and expanding to developing countries where the demand is constantly growing; thereby boosting sales.

Which all countries are considered in the report?

US, Canada, China, India, Japan, Germany, UK and France are major countries considered in the report.

Who are the major manufacturers?

SurModics, Inc. (US), DSM Biomedical (US), Hydromer Inc. (US), Covalon Technologies Ltd. (Canada), Hemoteq AG (Germany) are some of the leading players operating in the global biocompatible coatings market.

Which is the largest region in the biocompatible coatings market?

North America is the largest region in laminating adhesive market.

What is the total CAGR expected to be recorded for the biocompatible coatings market during 2023-2028?

The CAGR is expected to record 12.4% from 2023-2028

Does this report cover the different material type of biocompatible coatings market?

Yes, the report covers the different material type of biocompatible coatings. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing demand for medical devices and implants- Growing awareness of patient safetyRESTRAINTS- High development and manufacturing costsOPPORTUNITIES- Growing focus on infection control- Increasing healthcare expenditureCHALLENGES- Stringent regulatory requirements

-

5.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRY

-

5.4 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.5 MACROECONOMIC INDICATORSINTRODUCTIONTRENDS AND FORECASTS OF GDP

- 5.6 TRENDS AND FORECASTS OF GLOBAL HEALTHCARE INDUSTRY

- 5.7 TECHNOLOGY ANALYSIS

- 5.8 CASE STUDY ANALYSIS

- 5.9 PRICING ANALYSIS

- 5.10 TRADE DATA STATISTICS

-

5.11 GLOBAL ECONOMIC SCENARIO AFFECTING MARKET GROWTHIMPACT OF SLOWDOWN/RECESSION- Russia-Ukraine war- Recession in Europe- Energy crisis in Europe- Recession impact on Asia Pacific

- 5.12 VALUE CHAIN ANALYSIS

-

5.13 ECOSYSTEM ANALYSIS AND INTERCONNECTED MARKETS

-

5.14 TRENDS/DISRUPTIONS IMPACTING BUYERS/CUSTOMERS

-

5.15 PATENT ANALYSISMETHODOLOGYPUBLICATION TRENDSTOP APPLICANTSJURISDICTION

-

5.16 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

5.17 REGULATORY LANDSCAPE AND STANDARDSLEGISLATIVE AND REGULATORY POLICY UPDATE- Industrial surface coating regulation update- VOC regulations- HAP regulations

- 5.18 KEY CONFERENCES AND EVENTS IN 2023

- 6.1 INTRODUCTION

-

6.2 POLYMERMINIMIZES ADVERSE REACTIONS AND PROMOTES FAVORABLE INTERACTIONS WITH BIOLOGICAL SYSTEMS

-

6.3 CERAMICSHOWS EXCELLENT MECHANICAL STRENGTH IN HIGH-PERFORMANCE APPLICATIONS

-

6.4 METALEXHIBITS SUPERIOR WEAR RESISTANCE AND IMPROVED LONG-TERM PERFORMANCE

- 6.5 OTHERS

- 7.1 INTRODUCTION

- 7.2 ANTIBACTERIAL COATINGS

- 7.3 HYDROPHILIC COATINGS

- 7.4 OTHERS

- 8.1 INTRODUCTION

-

8.2 HEALTHCARERISE IN CHRONIC DISEASES AND AGING POPULATION TO DRIVE MARKET

-

8.3 FOOD & BEVERAGEINCREASING FOCUS ON FOOD SAFETY AND SHELF LIFE EXTENSION TO DRIVE MARKET

-

8.4 MEDICAL DEVICEFOCUS ON INFECTION CONTROL TO DRIVE MARKET

- 8.5 OTHERS

-

9.1 INTRODUCTIONRECESSION IMPACT ANALYSIS

-

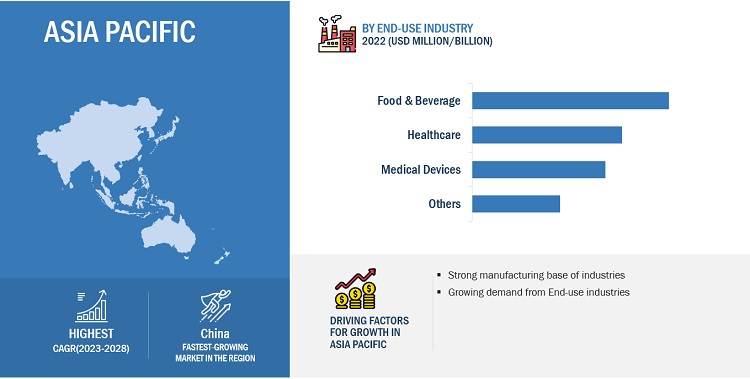

9.2 ASIA PACIFICIMPACT OF RECESSION ON ASIA PACIFICCHINA- Increased spending on healthcare to drive marketJAPAN- Focus on technological advancements in healthcare industry to drive marketINDIA- Growing healthcare industry to drive marketSOUTH KOREA- Increasing healthcare expenditure to drive marketREST OF ASIA PACIFIC

-

9.3 NORTH AMERICAIMPACT OF RECESSION ON NORTH AMERICAUS- Advancements in medical technology and food & beverage industry to drive marketCANADA- Demand from medical devices and consumer goods to drive marketMEXICO- Demand from consumer goods industry to drive market

-

9.4 EUROPEIMPACT OF RECESSION ON EUROPEGERMANY- Growing healthcare and consumer goods industries to drive marketFRANCE- Growing healthcare expenditure to drive marketUK- Strict regulatory compliance requirements to drive marketITALY- Booming healthcare industry to drive demandREST OF EUROPE

-

9.5 MIDDLE EAST & AFRICAIMPACT OF RECESSION ON MIDDLE EAST & AFRICASAUDI ARABIA- Government investments in healthcare industry to drive marketUAE- Medical tourism to drive marketREST OF MIDDLE EAST & AFRICA

-

9.6 SOUTH AMERICAIMPACT OF RECESSION ON SOUTH AMERICABRAZIL- Demand for medical devices to drive marketARGENTINA- Focus on sustainability and environmental conservation to drive marketREST OF SOUTH AMERICA

- 10.1 OVERVIEW

-

10.2 COMPANY EVALUATION MATRIX, 2022STARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTS

-

10.3 STARTUP/SME EVALUATION MATRIX, 2022PROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIES

- 10.4 COMPETITIVE BENCHMARKING

- 10.5 MARKET SHARE ANALYSIS

- 10.6 MARKET RANKING ANALYSIS

- 10.7 REVENUE ANALYSIS

-

10.8 COMPETITIVE SCENARIOMARKET EVALUATION FRAMEWORKMARKET EVALUATION MATRIX

- 10.9 STRATEGIC DEVELOPMENTS

-

11.1 KEY PLAYERSSURMODICS, INC.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewDSM BIOMEDICAL- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewHYDROMER, INC.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewAST PRODUCTS, INC.- Business overview- Products/Services/Solutions offered- MnM viewBIOCOAT INCORPORATED- Business overview- Products/Services/Solutions offered- MnM viewBIOINTERACTIONS LIMITED- Business overview- Products/Services/Solutions offeredFREUDENBERG MEDICAL- Business overview- Products/Services/Solutions offeredCOVALON TECHNOLOGIES LTD.- Business overview- Products/Services/Solutions offeredACULON, INC- Business overview- Products/Services/Solutions offeredAPPLIED MEDICAL COATINGS- Business overview- Products/Services/Solutions offered

-

11.2 OTHER KEY PLAYERSADVANSOURCE BIOMATERIALS CORPORATIONSURFACE SOLUTIONS GROUP, LLCLINCOTEK MEDICALPOLY-MED, INC.PRECISION COATING COMPANY, INC.SPECIALTY COATING SYSTEMS, INC.HEMOTEQ AGHARLAND MEDICAL SYSTEMSISURTECWHITFORD CORPORATIONMILLER-STEPHENSONENDURA COATINGSAPPLIED MEMBRANE TECHNOLOGYCOATINGS2GOFORMACOAT, LLC

-

12.1 INTRODUCTIONHYDROPHILIC COATINGS MARKET LIMITATIONS

- 12.2 HYDROPHILIC COATINGS MARKET DEFINITION

-

12.3 HYDROPHILIC COATINGS MARKET OVERVIEWHYDROPHILIC COATINGS MARKET ANALYSIS, BY SUBSTRATEHYDROPHILIC COATINGS MARKET ANALYSIS, BY END USERHYDROPHILIC COATINGS MARKET ANALYSIS, BY REGION

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 BIOCOMPATIBLE COATINGS MARKET SNAPSHOT, 2022 VS. 2028

- TABLE 2 BIOCOMPATIBLE COATINGS MARKET: IMPACT OF PORTER’S FIVE FORCES

- TABLE 3 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 2 END USE INDUSTRIES (%)

- TABLE 4 KEY BUYING CRITERIA FOR BIOCOMPATIBLE COATINGS

- TABLE 5 GDP PERCENTAGE CHANGE OF KEY COUNTRIES, 2020–2028

- TABLE 6 COUNTRY-WISE EXPORT DATA, 2020–2022 (TON)

- TABLE 7 COUNTRY-WISE IMPORT DATA, 2020–2022 (TON)

- TABLE 8 COUNTRY-WISE EXPORT DATA, 2020–2022 (USD THOUSAND)

- TABLE 9 COUNTRY-WISE IMPORT DATA, 2020–2022 (USD THOUSAND)

- TABLE 10 BIOCOMPATIBLE COATINGS MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 11 RECENT PATENTS BY COMPANIES

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 INTERNATIONALLY RECOGNIZED TEST METHODS FOR BIOCOMPATIBLE COATINGS

- TABLE 17 BIOCOMPATIBLE COATINGS MARKET: KEY CONFERENCES AND EVENTS

- TABLE 18 BIOCOMPATIBLE COATINGS MARKET, BY MATERIAL TYPE, 2021–2022 (KILOTON)

- TABLE 19 BIOCOMPATIBLE COATINGS MARKET, BY MATERIAL TYPE, 2023–2028 (KILOTON)

- TABLE 20 BIOCOMPATIBLE COATINGS MARKET, BY MATERIAL TYPE, 2021–2022 (USD MILLION)

- TABLE 21 BIOCOMPATIBLE COATINGS MARKET, BY MATERIAL TYPE, 2023–2028 (USD MILLION)

- TABLE 22 POLYMER BIOCOMPATIBLE COATINGS MARKET, BY REGION, 2021–2022 (KILOTON)

- TABLE 23 POLYMER BIOCOMPATIBLE COATINGS MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 24 POLYMER BIOCOMPATIBLE COATINGS MARKET, BY REGION, 2021–2022 (USD MILLION)

- TABLE 25 POLYMER BIOCOMPATIBLE COATINGS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 26 CERAMIC BIOCOMPATIBLE COATINGS MARKET, BY REGION, 2021–2022 (KILOTON)

- TABLE 27 CERAMIC BIOCOMPATIBLE COATINGS MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 28 CERAMIC BIOCOMPATIBLE COATINGS MARKET, BY REGION, 2021–2022 (USD MILLION)

- TABLE 29 CERAMIC BIOCOMPATIBLE COATINGS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 30 METAL BIOCOMPATIBLE COATINGS MARKET, BY REGION, 2021–2022 (KILOTON)

- TABLE 31 METAL BIOCOMPATIBLE COATINGS MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 32 METAL BIOCOMPATIBLE COATINGS MARKET, BY REGION, 2021–2022 (USD MILLION)

- TABLE 33 METAL BIOCOMPATIBLE COATINGS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 34 OTHER BIOCOMPATIBLE COATINGS MARKET, BY REGION, 2021–2022 (KILOTON)

- TABLE 35 OTHER BIOCOMPATIBLE COATINGS MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 36 OTHER BIOCOMPATIBLE COATINGS MARKET, BY REGION, 2021–2022 (USD MILLION)

- TABLE 37 OTHER BIOCOMPATIBLE COATINGS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 38 BIOCOMPATIBLE COATINGS MARKET, BY END USE INDUSTRY, 2021–2022 (KILOTON)

- TABLE 39 BIOCOMPATIBLE COATINGS MARKET, BY END USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 40 BIOCOMPATIBLE COATINGS MARKET, BY END USE INDUSTRY, 2021–2022 (USD MILLION)

- TABLE 41 BIOCOMPATIBLE COATINGS MARKET, BY END USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 42 BIOCOMPATIBLE COATINGS MARKET IN HEALTHCARE END USE INDUSTRY, BY REGION, 2021–2022 (KILOTON)

- TABLE 43 BIOCOMPATIBLE COATINGS MARKET IN HEALTHCARE END USE INDUSTRY, BY REGION, 2023–2028 (KILOTON)

- TABLE 44 BIOCOMPATIBLE COATINGS MARKET IN HEALTHCARE END USE INDUSTRY, BY REGION, 2021–2022 (USD MILLION)

- TABLE 45 BIOCOMPATIBLE COATINGS MARKET IN IN HEALTHCARE END USE INDUSTRY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 46 BIOCOMPATIBLE COATINGS MARKET IN FOOD & BEVERAGE END USE INDUSTRY, BY REGION, 2021–2022 (KILOTON)

- TABLE 47 BIOCOMPATIBLE COATINGS MARKET IN FOOD & BEVERAGE END USE INDUSTRY, BY REGION, 2023–2028 (KILOTON)

- TABLE 48 BIOCOMPATIBLE COATINGS MARKET IN FOOD & BEVERAGE END USE INDUSTRY, BY REGION, 2021–2022 (USD MILLION)

- TABLE 49 BIOCOMPATIBLE COATINGS MARKET IN FOOD & BEVERAGE END USE INDUSTRY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 50 BIOCOMPATIBLE COATINGS MARKET IN MEDICAL DEVICE END USE INDUSTRY, BY REGION, 2021–2022 (KILOTON)

- TABLE 51 BIOCOMPATIBLE COATINGS MARKET IN MEDICAL DEVICE END USE INDUSTRY, BY REGION, 2023–2028 (KILOTON)

- TABLE 52 BIOCOMPATIBLE COATINGS MARKET IN MEDICAL DEVICE END USE INDUSTRY, BY REGION, 2021–2022 (USD MILLION)

- TABLE 53 BIOCOMPATIBLE COATINGS MARKET IN MEDICAL DEVICE END USE INDUSTRY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 54 BIOCOMPATIBLE COATINGS MARKET IN OTHER END USE INDUSTRIES, BY REGION, 2021–2022 (KILOTON)

- TABLE 55 BIOCOMPATIBLE COATINGS MARKET IN OTHER END USE INDUSTRIES, BY REGION, 2023–2028 (KILOTON)

- TABLE 56 BIOCOMPATIBLE COATINGS MARKET IN OTHER END USE INDUSTRIES, BY REGION, 2021–2022 (USD MILLION)

- TABLE 57 BIOCOMPATIBLE COATINGS MARKET IN OTHER END USE INDUSTRIES, BY REGION, 2023–2028 (USD MILLION)

- TABLE 58 BIOCOMPATIBLE COATINGS MARKET, BY REGION, 2021–2022 (KILOTON)

- TABLE 59 BIOCOMPATIBLE COATINGS MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 60 BIOCOMPATIBLE COATINGS MARKET, BY REGION, 2021–2022 (USD MILLION)

- TABLE 61 BIOCOMPATIBLE COATINGS MARKET BY REGION, 2023–2028 (USD MILLION)

- TABLE 62 ASIA PACIFIC: BIOCOMPATIBLE COATINGS MARKET, BY COUNTRY, 2021–2022 (KILOTON)

- TABLE 63 ASIA PACIFIC: BIOCOMPATIBLE COATINGS MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 64 ASIA PACIFIC: BIOCOMPATIBLE COATINGS MARKET, BY COUNTRY, 2021–2022 (USD MILLION)

- TABLE 65 ASIA PACIFIC: BIOCOMPATIBLE COATINGS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 66 ASIA PACIFIC: BIOCOMPATIBLE COATINGS MARKET, BY MATERIAL TYPE, 2021–2022 (KILOTON)

- TABLE 67 ASIA PACIFIC: BIOCOMPATIBLE COATINGS MARKET, BY MATERIAL TYPE, 2023–2028 (KILOTON)

- TABLE 68 ASIA PACIFIC: BIOCOMPATIBLE COATINGS MARKET, BY MATERIAL TYPE, 2021–2022 (USD MILLION)

- TABLE 69 ASIA PACIFIC: BIOCOMPATIBLE COATINGS MARKET, BY MATERIAL TYPE, 2023–2028 (USD MILLION)

- TABLE 70 ASIA PACIFIC: BIOCOMPATIBLE COATINGS MARKET, BY END USE INDUSTRY, 2021–2022 (KILOTON)

- TABLE 71 ASIA PACIFIC: BIOCOMPATIBLE COATINGS MARKET, BY END USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 72 ASIA PACIFIC: BIOCOMPATIBLE COATINGS MARKET, BY END USE INDUSTRY, 2021–2022 (USD MILLION)

- TABLE 73 ASIA PACIFIC: BIOCOMPATIBLE COATINGS MARKET, BY END USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 74 NORTH AMERICA: BIOCOMPATIBLE COATINGS MARKET, BY COUNTRY, 2021–2022 (KILOTON)

- TABLE 75 NORTH AMERICA: BIOCOMPATIBLE COATINGS MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 76 NORTH AMERICA: BIOCOMPATIBLE COATINGS MARKET, BY COUNTRY, 2021–2022 (USD MILLION)

- TABLE 77 NORTH AMERICA: BIOCOMPATIBLE COATINGS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 78 NORTH AMERICA: BIOCOMPATIBLE COATINGS MARKET, BY MATERIAL TYPE, 2021–2022 (KILOTON)

- TABLE 79 NORTH AMERICA: BIOCOMPATIBLE COATINGS MARKET, BY MATERIAL TYPE, 2023–2028 (KILOTON)

- TABLE 80 NORTH AMERICA: BIOCOMPATIBLE COATINGS MARKET, BY MATERIAL TYPE, 2021–2022 (USD MILLION)

- TABLE 81 NORTH AMERICA: BIOCOMPATIBLE COATINGS MARKET, BY MATERIAL TYPE, 2023–2028 (USD MILLION)

- TABLE 82 NORTH AMERICA: BIOCOMPATIBLE COATINGS MARKET, BY END USE INDUSTRY, 2021–2022 (KILOTON)

- TABLE 83 NORTH AMERICA: BIOCOMPATIBLE COATINGS MARKET, BY END USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 84 NORTH AMERICA: BIOCOMPATIBLE COATINGS MARKET, BY END USE INDUSTRY, 2021–2022 (USD MILLION)

- TABLE 85 NORTH AMERICA: BIOCOMPATIBLE COATINGS MARKET, BY END USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 86 EUROPE: BIOCOMPATIBLE COATINGS MARKET, BY COUNTRY, 2021–2022 (KILOTON)

- TABLE 87 EUROPE: BIOCOMPATIBLE COATINGS MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 88 EUROPE: BIOCOMPATIBLE COATINGS MARKET, BY COUNTRY, 2021–2022 (USD MILLION)

- TABLE 89 EUROPE: BIOCOMPATIBLE COATINGS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 90 EUROPE: BIOCOMPATIBLE COATINGS MARKET, BY MATERIAL TYPE, 2021–2022 (KILOTON)

- TABLE 91 EUROPE: BIOCOMPATIBLE COATINGS MARKET, BY MATERIAL TYPE, 2023–2028 (KILOTON)

- TABLE 92 EUROPE: BIOCOMPATIBLE COATINGS MARKET, BY MATERIAL TYPE, 2021–2022 (USD MILLION)

- TABLE 93 EUROPE: BIOCOMPATIBLE COATINGS MARKET, BY MATERIAL TYPE, 2023–2028 (USD MILLION)

- TABLE 94 EUROPE: BIOCOMPATIBLE COATINGS MARKET, BY END USE INDUSTRY, 2021–2022 (KILOTON)

- TABLE 95 EUROPE: BIOCOMPATIBLE COATINGS MARKET, BY END USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 96 EUROPE: BIOCOMPATIBLE COATINGS MARKET, BY END USE INDUSTRY, 2021–2022 (USD MILLION)

- TABLE 97 EUROPE: BIOCOMPATIBLE COATINGS MARKET, BY END USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 98 MIDDLE EAST & AFRICA: BIOCOMPATIBLE COATINGS MARKET, BY COUNTRY, 2021–2022 (KILOTON)

- TABLE 99 MIDDLE EAST & AFRICA: BIOCOMPATIBLE COATINGS MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 100 MIDDLE EAST & AFRICA: BIOCOMPATIBLE COATINGS MARKET, BY COUNTRY, 2021–2022 (USD MILLION)

- TABLE 101 MIDDLE EAST & AFRICA: BIOCOMPATIBLE COATINGS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 102 MIDDLE EAST & AFRICA: BIOCOMPATIBLE COATINGS MARKET, BY MATERIAL TYPE, 2021–2022 (KILOTON)

- TABLE 103 MIDDLE EAST & AFRICA: BIOCOMPATIBLE COATINGS MARKET, BY MATERIAL TYPE, 2023–2028 (KILOTON)

- TABLE 104 MIDDLE EAST & AFRICA: BIOCOMPATIBLE COATINGS MARKET, BY MATERIAL TYPE, 2021–2022 (USD MILLION)

- TABLE 105 MIDDLE EAST & AFRICA: BIOCOMPATIBLE COATINGS MARKET, BY MATERIAL TYPE, 2023–2028 (USD MILLION)

- TABLE 106 MIDDLE EAST & AFRICA: BIOCOMPATIBLE COATINGS MARKET, BY END USE INDUSTRY, 2021–2022 (KILOTON)

- TABLE 107 MIDDLE EAST & AFRICA: BIOCOMPATIBLE COATINGS MARKET, BY END USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 108 MIDDLE EAST & AFRICA: BIOCOMPATIBLE COATINGS MARKET, BY END USE INDUSTRY, 2021–2022 (USD MILLION)

- TABLE 109 MIDDLE EAST & AFRICA: BIOCOMPATIBLE COATINGS MARKET, BY END USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 110 SOUTH AMERICA: BIOCOMPATIBLE COATINGS MARKET, BY COUNTRY, 2021–2022 (KILOTON)

- TABLE 111 SOUTH AMERICA: BIOCOMPATIBLE COATINGS MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 112 SOUTH AMERICA: BIOCOMPATIBLE COATINGS MARKET, BY COUNTRY, 2021–2022 (USD MILLION)

- TABLE 113 SOUTH AMERICA: BIOCOMPATIBLE COATINGS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 114 SOUTH AMERICA: BIOCOMPATIBLE COATINGS MARKET, BY MATERIAL TYPE, 2021–2022 (KILOTON)

- TABLE 115 SOUTH AMERICA: BIOCOMPATIBLE COATINGS MARKET, BY MATERIAL TYPE, 2023–2028 (KILOTON)

- TABLE 116 SOUTH AMERICA: BIOCOMPATIBLE COATINGS MARKET, BY MATERIAL TYPE, 2021–2022 (USD MILLION)

- TABLE 117 SOUTH AMERICA: BIOCOMPATIBLE COATINGS MARKET, BY MATERIAL TYPE, 2023–2028 (USD MILLION)

- TABLE 118 SOUTH AMERICA: BIOCOMPATIBLE COATINGS MARKET, BY END USE INDUSTRY, 2021–2022 (KILOTON)

- TABLE 119 SOUTH AMERICA: BIOCOMPATIBLE COATINGS MARKET, BY END USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 120 SOUTH AMERICA: BIOCOMPATIBLE COATINGS MARKET, BY END USE INDUSTRY, 2021–2022 (USD MILLION)

- TABLE 121 SOUTH AMERICA: BIOCOMPATIBLE COATINGS MARKET, BY END USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 122 STRATEGIES ADOPTED BY KEY BIOCOMPATIBLE COATINGS MARKET PLAYERS (2018–2022)

- TABLE 123 BIOCOMPATIBLE COATINGS MARKET: KEY STARTUPS/SMES

- TABLE 124 BIOCOMPATIBLE COATINGS MARKET: KEY COMPANY FOOTPRINT

- TABLE 125 BIOCOMPATIBLE COATINGS MARKET: STARTUP/SME FOOTPRINT

- TABLE 126 BIOCOMPATIBLE COATINGS MARKET: DEGREE OF COMPETITION, 2022

- TABLE 127 STRATEGIC DEVELOPMENTS, BY COMPANY

- TABLE 128 HIGHEST ADOPTED STRATEGIES

- TABLE 129 NUMBER OF GROWTH STRATEGIES ADOPTED BY KEY COMPANIES

- TABLE 130 COMPANY END USE INDUSTRY FOOTPRINT

- TABLE 131 COMPANY REGION FOOTPRINT

- TABLE 132 COMPANY OVERALL FOOTPRINT

- TABLE 133 BIOCOMPATIBLE COATINGS MARKET: DEALS, 2018–2023

- TABLE 134 SURMODICS, INC.: COMPANY OVERVIEW

- TABLE 135 SURMODICS, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 136 SURMODICS, INC.: DEALS

- TABLE 137 DSM BIOMEDICAL: COMPANY OVERVIEW

- TABLE 138 DSM BIOMEDICAL: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 139 DSM BIOMEDICAL: DEALS

- TABLE 140 HYDROMER, INC.: COMPANY OVERVIEW

- TABLE 141 HYDROMER, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 142 HYDROMER, INC.: DEALS

- TABLE 143 AST PRODUCTS, INC.: COMPANY OVERVIEW

- TABLE 144 AST PRODUCTS, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 145 BIOCOAT INCORPORATED: COMPANY OVERVIEW

- TABLE 146 BIOCOAT INCORPORATED: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 147 BIOINTERACTIONS LIMITED: COMPANY OVERVIEW

- TABLE 148 BIOINTERACTIONS LIMITED: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 149 FREUDENBERG MEDICAL: COMPANY OVERVIEW

- TABLE 150 FREUDENBERG MEDICAL: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 151 COVALON TECHNOLOGIES LTD.: COMPANY OVERVIEW

- TABLE 152 COVALON TECHNOLOGIES LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 153 ACULON, INC: COMPANY OVERVIEW

- TABLE 154 ACULON, INC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 155 APPLIED MEDICAL COATINGS: COMPANY OVERVIEW

- TABLE 156 APPLIED MEDICAL COATINGS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 157 ADVANSOURCE BIOMATERIALS CORPORATION: COMPANY OVERVIEW

- TABLE 158 ADVANSOURCE BIOMATERIALS CORPORATION: PRODUCTS/SERVICES/ SOLUTIONS OFFERED

- TABLE 159 SURFACE SOLUTIONS GROUP, LLC: COMPANY OVERVIEW

- TABLE 160 SURFACE SOLUTIONS GROUP, LLC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 161 LINCOTEK MEDICAL: COMPANY OVERVIEW

- TABLE 162 LINCOTEK MEDICAL: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 163 POLY-MED, INC.: COMPANY OVERVIEW

- TABLE 164 POLY-MED, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 165 PRECISION COATING COMPANY, INC.: COMPANY OVERVIEW

- TABLE 166 PRECISION COATING COMPANY, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 167 SPECIALTY COATING SYSTEMS, INC.: COMPANY OVERVIEW

- TABLE 168 SPECIALTY COATING SYSTEMS, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 169 HEMOTEQ AG: COMPANY OVERVIEW

- TABLE 170 HEMOTEQ AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 171 HARLAND MEDICAL SYSTEMS: COMPANY OVERVIEW

- TABLE 172 HARLAND MEDICAL SYSTEMS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 173 ISURTEC: COMPANY OVERVIEW

- TABLE 174 ISURTEC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 175 WHITFORD CORPORATION: COMPANY OVERVIEW

- TABLE 176 WHITFORD CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 177 MILLER-STEPHENSON: COMPANY OVERVIEW

- TABLE 178 MILLER-STEPHENSON: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 179 ENDURA COATINGS: COMPANY OVERVIEW

- TABLE 180 ENDURA COATINGS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 181 APPLIED MEMBRANE TECHNOLOGY: COMPANY OVERVIEW

- TABLE 182 APPLIED MEMBRANE TECHNOLOGY: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 183 COATINGS2GO: COMPANY OVERVIEW

- TABLE 184 COATINGS2GO: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 185 FORMACOAT, LLC: COMPANY OVERVIEW

- TABLE 186 FORMACOAT, LLC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 187 HYDROPHILIC COATINGS MARKET, BY SUBSTRATE, 2018–2021 (USD MILLION)

- TABLE 188 HYDROPHILIC COATINGS MARKET, BY SUBSTRATE, 2022–2027 (USD MILLION)

- TABLE 189 HYDROPHILIC COATINGS MARKET, BY SUBSTRATE, 2018–2021 (KILOTON)

- TABLE 190 HYDROPHILIC COATINGS MARKET, BY SUBSTRATE, 2022–2027 (KILOTON)

- TABLE 191 HYDROPHILIC COATINGS MARKET, BY END USER, 2018–2021 (USD MILLION)

- TABLE 192 HYDROPHILIC COATINGS MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 193 HYDROPHILIC COATINGS MARKET, BY END USER, 2018–2021 (KILOTON)

- TABLE 194 HYDROPHILIC COATINGS MARKET, BY END USER, 2022–2027 (KILOTON)

- TABLE 195 HYDROPHILIC COATINGS MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 196 HYDROPHILIC COATINGS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 197 HYDROPHILIC COATINGS MARKET, BY REGION, 2018–2021 (KILOTON)

- TABLE 198 HYDROPHILIC COATINGS MARKET, BY REGION, 2022–2027 (KILOTON)

- FIGURE 1 BIOCOMPATIBLE COATINGS MARKET: RESEARCH DESIGN

- FIGURE 2 BIOCOMPATIBLE COATINGS MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 3 BIOCOMPATIBLE COATINGS MARKET SIZE ESTIMATION, BY VALUE

- FIGURE 4 BIOCOMPATIBLE COATINGS MARKET SIZE ESTIMATION, BY REGION

- FIGURE 5 BIOCOMPATIBLE COATINGS MARKET SIZE ESTIMATION, BY MATERIAL TYPE

- FIGURE 6 BIOCOMPATIBLE COATINGS MARKET SIZE ESTIMATION, BY END USE INDUSTRY

- FIGURE 7 BIOCOMPATIBLE COATINGS MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 8 METHODOLOGY FOR SUPPLY-SIDE SIZING OF BIOCOMPATIBLE COATINGS MARKET

- FIGURE 9 BIOCOMPATIBLE COATINGS MARKET: SUPPLY-SIDE FORECAST

- FIGURE 10 BIOCOMPATIBLE COATINGS MARKET: DEMAND-SIDE FORECAST

- FIGURE 11 BIOCOMPATIBLE COATINGS MARKET: FACTOR ANALYSIS

- FIGURE 12 BIOCOMPATIBLE COATINGS MARKET: DATA TRIANGULATION

- FIGURE 13 ASIA PACIFIC BIOCOMPATIBLE COATINGS MARKET TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 14 MEDICAL DEVICE END USE INDUSTRY TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD IN BIOCOMPATIBLE COATINGS MARKET

- FIGURE 15 POLYMER BIOCOMPATIBLE COATINGS TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 16 NORTH AMERICA WAS LARGEST BIOCOMPATIBLE COATINGS MARKET IN 2022

- FIGURE 17 EMERGING ECONOMIES TO OFFER OPPORTUNITIES TO BIOCOMPATIBLE COATING MANUFACTURERS

- FIGURE 18 POLYMER BIOCOMPATIBLE COATINGS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2028

- FIGURE 19 CHINA AND FOOD & BEVERAGE SEGMENTS ACCOUNTED FOR LARGEST MARKET SHARES

- FIGURE 20 BIOCOMPATIBLE COATINGS MARKET TO REGISTER HIGHER CAGR IN EMERGING ECONOMIES

- FIGURE 21 INDIA TO REGISTER HIGHEST CAGR BETWEEN 2023 AND 2028

- FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN BIOCOMPATIBLE COATINGS MARKET

- FIGURE 23 PORTER’S FIVE FORCES ANALYSIS OF BIOCOMPATIBLE COATINGS MARKET

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 25 KEY BUYING CRITERIA FOR BIOCOMPATIBLE COATINGS

- FIGURE 26 HEALTHCARE TECH INVESTMENT, 2011-2021

- FIGURE 27 AVERAGE PRICE COMPETITIVENESS IN BIOCOMPATIBLE COATINGS MARKET, BY REGION, 2022

- FIGURE 28 AVERAGE PRICE COMPETITIVENESS IN BIOCOMPATIBLE COATINGS MARKET, BY MATERIAL TYPE, 2022

- FIGURE 29 AVERAGE PRICE COMPETITIVENESS IN BIOCOMPATIBLE COATINGS MARKET, BY END USE INDUSTRY, 2022

- FIGURE 30 PAINTS & COATINGS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 31 REVENUE SHIFT IN BIOCOMPATIBLE COATINGS MARKET

- FIGURE 32 NUMBER OF PATENTS PUBLISHED, 2018–2023

- FIGURE 33 PATENTS PUBLISHED BY MAJOR PLAYERS, 2018–2022

- FIGURE 34 PATENTS PUBLISHED, BY JURISDICTION, 2018–2022

- FIGURE 35 POLYMER BIOCOMPATIBLE COATINGS TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 36 MEDICAL DEVICE TO BE FASTEST-GROWING END-USE INDUSTRY DURING FORECAST PERIOD

- FIGURE 37 NORTH AMERICA TO DOMINATE BIOCOMPATIBLE COATINGS MARKET DURING FORECAST PERIOD

- FIGURE 38 ASIA PACIFIC: BIOCOMPATIBLE COATINGS MARKET SNAPSHOT

- FIGURE 39 NORTH AMERICA: BIOCOMPATIBLE COATINGS MARKET SNAPSHOT

- FIGURE 40 EUROPE: BIOCOMPATIBLE COATINGS MARKET SNAPSHOT

- FIGURE 41 MIDDLE EAST & AFRICA: BIOCOMPATIBLE COATINGS MARKET SNAPSHOT

- FIGURE 42 SOUTH AMERICA: BIOCOMPATIBLE COATINGS MARKET SNAPSHOT

- FIGURE 43 BIOCOMPATIBLE COATINGS MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 44 BIOCOMPATIBLE COATINGS MARKET: COMPANY EVALUATION MATRIX FOR STARTUPS/SMES, 2022

- FIGURE 45 BIOCOMPATIBLE COATINGS MARKET SHARE ANALYSIS FOR KEY PLAYERS (2022)

- FIGURE 46 RANKING OF LEADING PLAYERS IN BIOCOMPATIBLE COATINGS MARKET, 2022

- FIGURE 47 REVENUE ANALYSIS OF TOP 5 PLAYERS, 2018–2022

- FIGURE 48 SURMODICS, INC.: COMPANY SNAPSHOT

- FIGURE 49 DSM BIOMEDICAL: COMPANY SNAPSHOT

- FIGURE 50 HYDROMER, INC.: COMPANY SNAPSHOT

The study involved four major activities in order to estimating the current size of the biocompatible coatings market. Exhaustive secondary research conducted to gather information on the market. The next step was to conduct primary research to validate these findings, assumptions, and sizing with the industry experts across the value chain. Both top-down and bottom-up approaches were used to estimate the total market size. The market size of segments and subsegments was then estimated using market breakdown and data triangulation.

Secondary Research

Secondary sources include annual reports of companies, press releases, investor presentations, white papers, articles by recognized authors, and databases, such as D&B, Bloomberg, Chemical Weekly, and Factiva; and publications and databases from associations, including the Society for Biomaterials (SFB), Medical Device Manufacturers Association (MDMA), Society for Protective Coatings (SSPC), American Chemical Society (ACS), European Society for Biomaterials (ESB) and European Inventory of Existing Commercial Chemical Substances (EINECS).

Primary Research

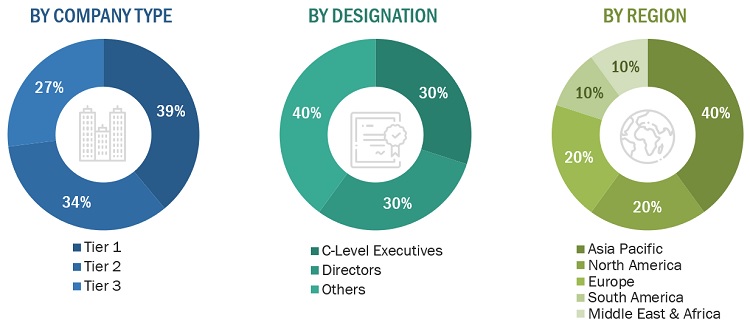

Extensive primary research was carried out after gathering information about biocompatible coatings market through secondary research. In the primary research process, experts from the supply and demand sides have been interviewed to obtain qualitative and quantitative information and validate the data for this report. Questionnaires, emails, and telephonic interviews were used to collect primary data. Primary sources from the supply side include industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the biocompatible coatings market. Primary interviews were conducted to elicit information such as market statistics, revenue data collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also assisted in comprehending the various trends associated to resin type, technology, product type, applications, and region.

The breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

|

CoMPANY NAME |

DESIGNATION |

|

SunModics, Inc. |

Sales Manager |

|

DSM Biomedical |

Project Manager |

|

Hydromer Inc. |

Individual Industry Expert |

|

Hemoteq AG |

Manager |

Market Size Estimation

The following information is part of the research methodology used to estimate the size of the biocompatible coatings market. The market sizing of the biocompatible coatings market was undertaken from the demand side. The market size was estimated based on procurements and advancement in the healthcare industry at a regional level. Such procurements provide information on the demand for biocompatible coatings.

Global Biocompatible Coatings Market Size: Bottom Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Biocompatible Coatings Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size, the market has been split into several segments.To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Biocompatible coatings are thin layers of materials that are applied to medical devices, implants, or other surfaces that encounter living tissues. These coatings are designed to be compatible with the body and minimize adverse reactions or complications. They promote biocompatibility, enhance tissue integration, reduce friction, prevent corrosion, inhibit bacterial adhesion, and may act as drug delivery systems. Biocompatible coatings play a crucial role in improving the performance, safety, and longevity of medical devices and implants, enhancing patient outcomes in various healthcare applications.

Key Stakeholders

- End User

- Raw Material Suppliers

- Senior Management

- Procurement Department

Report Objectives

- To define, describe, segment, and forecast the size of the biocompatible coatings market based on type, material, end-use industry, and region.

- To forecast the market size of segments with respect to various regions, including North America, Europe, Asia Pacific, South America, Middle East & Africa, along with major countries in each region

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the texture paint market

- To analyze technological advancements and product launches in the market

- To strategically analyze micromarkets, with respect to their growth trends, prospects, and their contribution to the market

- To identify financial positions, key products, and key developments of leading companies in the market

- To provide a detailed competitive landscape of the market, along with market share analysis

- To provide a comprehensive analysis of business and corporate strategies adopted by the key players in the market

- To strategically profile key players in the market and comprehensively analyze their core competencies

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the biocompatible coatings market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the biocompatible coatings Market

Growth opportunities and latent adjacency in Biocompatible Coatings Market