Bio-based Coatings Market by Resin (Alkyd, Polyurethane, Acrylic), Application (Architectural, Transportation, Woodworking, Packaging), Region (Asia Pacific, North America, Europe, South America, Middle East & Africa) - Global Forecast to 2027

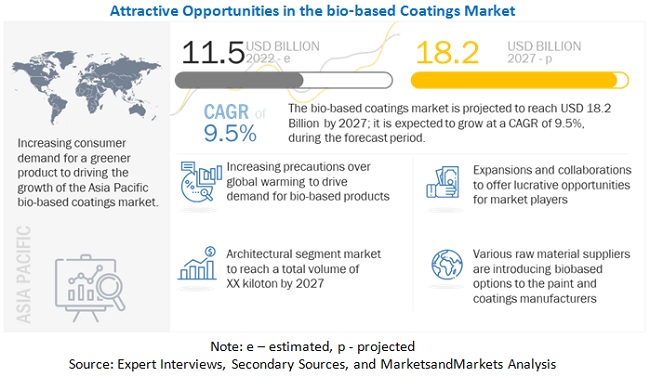

[185 Pages Report] The bio-based coatings market is projected to grow from USD 11.5 billion in 2022 to USD 18.2 billion by 2027, at a CAGR of 9.5% between 2022 and 2027. The architectural, by application segment in Asia Pacific region is expecting a boom in the forecasted period and will lead to an increase in the demand for bio-based coatings.

To know about the assumptions considered for the study, Request for Free Sample Report

Bio-based Coatings Market Dynamics

Drivers: Reduced carbon emissions of bio-based coatings

The increasing demand for environmentally friendly characteristics has been one of the most important trends observed in the coatings industry for the last ten years. The trend has been primarily influenced by stringent EU regulations regarding reducing VOCs and carbon emissions in the coating life cycle. This has shifted the demand from solvent-borne coatings to environmentally friendly products such as waterborne and powder paints and coatings.

Restraints: Less awareness about bio-based paint and coating products

North America and Europe have stringent environmental policies that reduce solvent-based paints and coatings. People are much more aware of their surroundings and health concerns. However, seeing a broader picture of the global market, no good statistics are available on the awareness of using bio-based coatings. People from emerging economies are not much educated about such concerns. A little progress is seen as companies are also trying to educate consumers through advertising.

Opportunities: Consumer demand for greater products encouraging manufacturers to use plant-based ingredients

Plant-based materials are expected to replace conventional raw materials in coating systems. Bio-based resins are used to manufacture coating systems for end-use industries, such as building & construction and furniture. The most common plant sources for the production of bio-resins are corn and soybean by-products from bio-diesel refinement. Other sources include potatoes, sugarcane, sugar beets, castor beans, lignocellulose, cashew nut shells, algae, and whey. The use of bio-based raw materials in coatings is not a recent development. Their use pre-dates the use of petrochemicals. However, to date, the majority of paints and varnishes produced are based on fossil raw materials, but the situation is now set to change. Bio-based resins, which have been considered a novelty earlier, are moving into the mainstream.

Challenges: Higher price range than that of fossil-based coating products

Rising awareness about global warming, climate change, and individual health are increasing the demand for bio-based coatings with minimal or no solvent content, but there are several hurdles to be overcome by this sector before it can compete with fossil-based coatings. On the economic front, the cost of renewable materials is much higher than petrochemical products. Bio-based coatings undergo a complex process to become environment friendly, which increases their cost on reaching their final stage. Users feel hesitant while paying an increased amount where other alternatives are available at a significantly cheaper rate.

Woodworking application accounted for the second largest segment of the bio-based coatings market between 2022 and 2027.

Bio-based wood coatings are setting a new standard in the industry. From being highly sustainable, these coatings provide high hardness, chemical and light resistance, and environmentally friendly industrial processability. Water-based wood coatings offer faster drying times than solvent-based coatings. Polishes and water repellents are among the most commonly used wood coatings due to their high effectiveness and greater non-yellowing properties.

To know about the assumptions considered for the study, download the pdf brochure

Asia Pacific is the fastest-growing bio-based coatings market.

Asia Pacific is the fastest bio-based coatings market in terms of value and volume during the forecast period. The region has witnessed significant economic growth over the last decade.

Key Market Players

AkzoNobel N.V. (Netherlands), PPG Industries (US), Sherwin-Williams Company (US), Nippon Paint Holdings Co., Ltd. (Japan), and Stora Enso OYJ (Finland) are the key players in the global bio-based coatings market.

Read More: Bio-based Coatings Companies

AkzoNobel N.V. is a diversified chemical company and one of the market leaders in the fields of decorative paints, performance coatings, and specialty chemicals. It operates through two business segments, namely, decorative paints and performance coatings. AkzoNobel N.V. offers specialty paints, powder paints, and other coatings for various applications such as architectural and decorative, automotive, industrial, marine, protective, and yachts. Coral, Dulux, Flexa, Hammerite, Sadolin, Sikkens, Awlgrip, International, Interpon, Dissolvine, Eka, Expancel, Jozo, Levasil, and Kromasil are some of the renowned brands of the company.

Scope of the Report

|

Report Metric |

Details |

|

Years Considered for the study |

2018-2027 |

|

Base year |

2021 |

|

Forecast period |

2022–2027 |

|

Units considered |

Value (USD) and Volume (Kiloton) |

|

Segments |

By Resin |

|

Regions covered |

Asia Pacific, Europe, North America, Middle East & Africa, South America |

|

Companies profiled |

AkzoNobel N.V. (Netherlands), PPG Industries (US), Sherwin-Williams Company (US), Nippon Paint Holdings Co., Ltd. (Japan), and Stora Enso OYJ (Finland). A total of 21 players have been covered. |

This research report categorizes the BIO-BASED COATINGS market based on type, end-use industry, and region.

By Resin:

- Alkyd

- Polyurethane

- Acrylic

- Others

By Application:

- Architectural

- Transportation

- Woodworking

- Packaging

- Others

By Region:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In August 2021, AkzoNobel N.V. launched this product in the Indian market. The product is India’s first USDA-certified bio-based paint.

- In October 2020, AkzoNobel N.V. launched this product in the Vietnam market. Air Clean Bio-based (Vietnam) contains 22 percent USDA-Certified bio-based content.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of bio-based coatings?

The global bio-based coatings market is driven by the fast growing importance of bio-based resins in coatings industry.

What are the major applications for bio-based coatings?

The major end-use industries of bio-based coatings are architectural, transportation, woodworking, packaging, and others.

Who are the major manufacturers?

AkzoNobel N.V. (Netherlands), PPG Industries (US), Sherwin-Williams Company (US), Nippon Paint Holdings Co., Ltd. (Japan), and Stora Enso OYJ (Finland) are some of the leading players operating in the global bio-based coatings market.

Why bio-based coatings are gaining market share?

The growth of this market is attributed to the growing preference for bio-based coatings in decorative coatings segment. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 MARKET INCLUSIONS & EXCLUSIONS

1.3 MARKET SEGMENTATION

1.3.1 REGIONS COVERED

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

1.5 UNITS CONSIDERED

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 31)

2.1 RESEARCH DATA

FIGURE 1 BIO-BASED COATINGS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Interviews with experts

2.1.2.2 Key data from primary sources

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of interviews with experts

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 2 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 3 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

FIGURE 4 METHODOLOGY FOR DEMAND-SIDE SIZING OF BIO-BASED COATINGS MARKET

2.3 DATA TRIANGULATION

FIGURE 5 BIO-BASED COATINGS MARKET: DATA TRIANGULATION

2.4 ASSUMPTIONS & LIMITATIONS

TABLE 1 RESEARCH ASSUMPTIONS

TABLE 2 RESEARCH LIMITATIONS

TABLE 3 RISK ANALYSIS

2.5 GROWTH RATE ASSUMPTIONS/GROWTH FORECASTS

3 EXECUTIVE SUMMARY (Page No. - 39)

TABLE 4 BIO-BASED COATINGS MARKET SNAPSHOT, 2022 VS. 2027

FIGURE 6 ACRYLIC RESIN TYPE TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD (USD MILLION)

FIGURE 7 ARCHITECTURAL APPLICATION TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 8 EUROPE TO LEAD BIO-BASED COATINGS MARKET DURING FORECAST PERIOD

FIGURE 9 ASIA PACIFIC TO BE FASTEST-GROWING BIO-BASED COATINGS MARKET

4 PREMIUM INSIGHTS (Page No. - 43)

4.1 ATTRACTIVE OPPORTUNITIES IN BIO-BASED COATINGS MARKET

FIGURE 10 SIGNIFICANT DEMAND GROWTH FOR BIO-BASED COATINGS DURING FORECAST PERIOD

4.2 BIO-BASED COATINGS MARKET, BY APPLICATION

FIGURE 11 ARCHITECTURAL TO REMAIN LARGEST SEGMENT OF BIO-BASED COATINGS MARKET

4.3 ASIA PACIFIC: BIO-BASED COATINGS MARKET, BY RESIN TYPE AND COUNTRY, 2022

FIGURE 12 CHINA ACCOUNTED FOR LARGEST MARKET SHARE

4.4 BIO-BASED COATINGS MARKET, BY DEVELOPED VS. EMERGING COUNTRIES

FIGURE 13 US TO ACCOUNT FOR LARGEST SHARE

4.5 BIO-BASED COATINGS MARKET, BY KEY COUNTRIES

FIGURE 14 INDIA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 46)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN BIO-BASED COATINGS MARKET

5.2.1 DRIVERS

5.2.1.1 Reduced carbon emissions of bio-based coatings

5.2.1.2 Fast-gaining importance of bio-based resins in coatings industry

5.2.1.3 Preference for bio-based coatings in decorative coatings segment

5.2.2 RESTRAINTS

5.2.2.1 Less awareness about bio-based paint and coating products

5.2.2.2 Complexities associated with manufacturing sustainable products

5.2.3 OPPORTUNITIES

5.2.3.1 Consumer demand for eco-friendly products encouraging manufacturers to use plant-based ingredients

5.2.3.2 Strategic developments across value chain to offer opportunities for manufacturers

5.2.4 CHALLENGES

5.2.4.1 Higher price range than that of fossil-based coating products

5.2.4.2 Availability of renewable raw materials

5.3 VALUE CHAIN ANALYSIS

FIGURE 16 BIO-BASED COATINGS VALUE CHAIN

FIGURE 17 BIO-BASED COATINGS VALUE CHAIN: PLAYERS AT EACH NODE

5.4 PORTER'S FIVE FORCES ANALYSIS

TABLE 5 BIO-BASED COATINGS MARKET: PORTER'S FIVE FORCES ANALYSIS

FIGURE 18 PORTER'S FIVE FORCES ANALYSIS: BIO-BASED COATINGS MARKET

5.4.1 THREAT OF NEW ENTRANTS

5.4.2 THREAT OF SUBSTITUTES

5.4.3 BARGAINING POWER OF BUYERS

5.4.4 BARGAINING POWER OF SUPPLIERS

5.4.5 INTENSITY OF COMPETITIVE RIVALRY

5.5 MACRO INDICATOR ANALYSIS

5.5.1 INTRODUCTION

5.5.2 TRENDS AND FORECASTS FOR GDP

TABLE 6 TRENDS AND FORECAST OF GDP, PERCENTAGE CHANGE, 2019–2027

5.5.3 TRENDS AND FORECASTS FOR GLOBAL CONSTRUCTION INDUSTRY

FIGURE 19 GLOBAL SPENDING IN CONSTRUCTION INDUSTRY, 2014–2035

5.6 PRICING ANALYSIS

FIGURE 20 AVERAGE PRICE COMPETITIVENESS IN BIO-BASED COATINGS MARKET, BY REGION

5.7 BIO-BASED COATINGS ECOSYSTEM AND INTERCONNECTED MARKETS

TABLE 7 BIO-BASED COATINGS MARKET: SUPPLY CHAIN

FIGURE 21 BIO-BASED COATINGS: ECOSYSTEM

5.8 YC AND YCC SHIFT

5.9 TRADE ANALYSIS

TABLE 8 COUNTRY-WISE EXPORT DATA, PAINTS AND VARNISHES BASED ON SYNTHETIC OR CHEMICALLY MODIFIED POLYMERS DISPERSED AND DISSOLVED IN AQUEOUS MEDIUM, 2020

TABLE 9 COUNTRY-WISE EXPORT DATA, PAINTS AND VARNISHES BASED ON SYNTHETIC OR CHEMICALLY MODIFIED POLYMERS DISPERSED AND DISSOLVED IN NON-AQUEOUS MEDIUM, 2020

TABLE 10 COUNTRY-WISE IMPORT DATA, PAINTS AND VARNISHES BASED ON SYNTHETIC OR CHEMICALLY MODIFIED POLYMERS DISPERSED AND DISSOLVED IN AQUEOUS MEDIUM, 2020

TABLE 11 COUNTRY-WISE IMPORT DATA, PAINTS AND VARNISHES BASED ON SYNTHETIC OR CHEMICALLY MODIFIED POLYMERS DISPERSED AND DISSOLVED IN NON-AQUEOUS MEDIUM, 2020

5.10 PATENT ANALYSIS

5.10.1 METHODOLOGY

5.10.2 PUBLICATION TRENDS

TABLE 12 GRANTED PATENTS COVERING 8% OF TOTAL PATENTS IN LAST TEN YEARS

FIGURE 22 TOTAL NUMBER OF DOCUMENTS, 2011–2021

FIGURE 23 NUMBER OF PATENTS PUBLISHED, 2011–2021

5.10.3 LEGAL STATUS OF PATENTS

FIGURE 24 LEGAL STATUS OF PATENTS, 2011–2021

5.10.4 TOP JURISDICTION

FIGURE 25 PATENTS PUBLISHED BY JURISDICTION, 2021

5.10.5 TOP APPLICANTS

FIGURE 26 PATENTS PUBLISHED BY MAJOR APPLICANTS, 2021

5.11 CASE STUDY ANALYSIS

5.12 TECHNOLOGY ANALYSIS

5.13 KEY CONFERENCES & EVENTS IN 2022–2023

TABLE 13 BIO-BASED COATINGS MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.14 TARIFF AND REGULATORY LANDSCAPE

5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 16 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 17 REST OF WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6 BIO-BASED COATINGS MARKET, BY RESIN TYPE (Page No. - 78)

6.1 INTRODUCTION

FIGURE 27 ALKYD TO REMAIN LARGEST RESIN TYPE SEGMENT

TABLE 18 BIO-BASED COATINGS MARKET SIZE, BY RESIN TYPE, 2018–2021 (USD MILLION)

TABLE 19 BIO-BASED COATING MARKET SIZE, BY RESIN TYPE, 2022–2027 (USD MILLION)

TABLE 20 BIO-BASED COATINGS MARKET SIZE, BY RESIN TYPE, 2018–2021 (KILOTON)

TABLE 21 BIO-BASED COATING MARKET SIZE, BY RESIN TYPE, 2022–2027 (KILOTON)

6.2 ALKYD RESIN

6.2.1 OLDEST RESIN WITH EXTENSIVE APPLICATIONS IN COATINGS

TABLE 22 PROPERTIES AND APPLICATIONS OF ALKYD RESINS

TABLE 23 ALKYD BIO-BASED COATINGS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 24 ALKYD BIO-BASED COATING MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 25 ALKYD BIO-BASED COATINGS MARKET SIZE, BY REGION, 2018–2021 (KILOTON)

TABLE 26 ALKYD BIO-BASED COATING MARKET SIZE, BY REGION, 2022–2027 (KILOTON)

6.3 POLYURETHANE RESIN

6.3.1 PERFECT COMBINATION OF PROPERTIES TO DRIVE SEGMENT GROWTH

TABLE 27 POLYURETHANE BIO-BASED COATINGS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 28 POLYURETHANE BIO-BASED COATING MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 29 POLYURETHANE BIO-BASED COATINGS MARKET SIZE, BY REGION, 2018–2021 (KILOTON)

TABLE 30 POLYURETHANE BIO-BASED COATING MARKET SIZE, BY REGION, 2022–2027 (KILOTON)

6.4 ACRYLIC RESIN

6.4.1 FASTEST-GROWING BIO-RESIN DUE TO EXCELLENT DURABILITY

TABLE 31 PROPERTIES AND APPLICATIONS OF ACRYLIC-BASED COATINGS

TABLE 32 ACRYLIC BIO-BASED COATINGS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 33 ACRYLIC BIO-BASED COATING MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 34 ACRYLIC BIO-BASED COATINGS MARKET SIZE, BY REGION, 2018–2021 (KILOTON)

TABLE 35 ACRYLIC BIO-BASED COATING MARKET SIZE, BY REGION, 2022–2027 (KILOTON)

6.5 OTHERS

TABLE 36 OTHER BIO-BASED COATINGS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 37 OTHER BIO-BASED COATING MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 38 OTHER BIO-BASED COATINGS MARKET SIZE, BY REGION, 2018–2021 (KILOTON)

TABLE 39 OTHER BIO-BASED RESINS COATINGS MARKET SIZE, BY REGION, 2022–2027 (KILOTON)

7 BIO-BASED COATINGS MARKET, BY APPLICATION (Page No. - 89)

7.1 INTRODUCTION

FIGURE 28 ARCHITECTURAL TO REMAIN LARGEST SEGMENT OF BIO-BASED COATINGS MARKET

TABLE 40 BIO-BASED COATINGS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 41 BIO-BASED COATING MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 42 BIO-BASED COATINGS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 43 BIO-BASED COATING MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

7.2 ARCHITECTURAL

7.2.1 HIGH DEMAND FOR BIO-BASED DECORATIVE COATINGS TO DRIVE MARKET

TABLE 44 ARCHITECTURAL: BIO-BASED COATINGS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 45 ARCHITECTURAL: BIO-BASED COATING MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 46 ARCHITECTURAL: BIO-BASED COATINGS MARKET SIZE, BY REGION, 2018–2021 (KILOTON)

TABLE 47 ARCHITECTURAL: BIO-BASED COATING MARKET SIZE, BY REGION, 2022–2027 (KILOTON)

7.3 TRANSPORTATION

7.3.1 ELECTRIC VEHICLE TREND BOOSTING SEGMENT GROWTH

TABLE 48 TRANSPORTATION: BIO-BASED COATINGS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 49 TRANSPORTATION: BIO-BASED COATING MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 50 TRANSPORTATION: BIO-BASED COATINGS MARKET SIZE, BY REGION, 2018–2021 (KILOTON)

TABLE 51 TRANSPORTATION: BIO-BASED COATING MARKET SIZE, BY REGION, 2022–2027 (KILOTON)

7.4 WOODWORKING

7.4.1 USE OF NON-TOXIC COATINGS TO PROPEL MARKET GROWTH

TABLE 52 WOODWORKING: BIO-BASED COATINGS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 53 WOODWORKING: BIO-BASED COATING MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 54 WOODWORKING: BIO-BASED COATINGS MARKET SIZE, BY REGION, 2018–2021 (KILOTON)

TABLE 55 WOODWORKING: BIO-BASED COATING MARKET SIZE, BY REGION, 2022–2027 (KILOTON)

7.5 PACKAGING

7.5.1 GOVERNMENT REGULATIONS IN FOOD & BEVERAGE INDUSTRY TO BOOST DEMAND

TABLE 56 PACKAGING: BIO-BASED COATINGS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 57 PACKAGING: BIO-BASED COATING MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 58 PACKAGING: BIO-BASED COATINGS MARKET SIZE, BY REGION, 2018–2021 (KILOTON)

TABLE 59 PACKAGING: BIO-BASED COATING MARKET SIZE, BY REGION, 2022–2027 (KILOTON)

7.6 OTHERS

TABLE 60 OTHERS: BIO-BASED COATINGS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 61 OTHERS: BIO-BASED COATING MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 62 OTHERS: BIO-BASED COATINGS MARKET SIZE, BY REGION, 2018–2021 (KILOTON)

TABLE 63 OTHERS: BIO-BASED COATING MARKET SIZE, BY REGION, 2022–2027 (KILOTON)

8 BIO-BASED COATINGS MARKET, BY REGION (Page No. - 101)

8.1 INTRODUCTION

FIGURE 29 ASIA PACIFIC TO BE FASTEST-GROWING BIO-BASED COATINGS MARKET

TABLE 64 BIO-BASED COATINGS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 65 BIO-BASED COATING MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 66 BIO-BASED COATINGS MARKET SIZE, BY REGION, 2018–2021 (KILOTON)

TABLE 67 BIO-BASED COATING MARKET SIZE, BY REGION, 2022–2027 (KILOTON)

8.2 ASIA PACIFIC

FIGURE 30 ASIA PACIFIC: BIO-BASED COATINGS MARKET SNAPSHOT

TABLE 68 ASIA PACIFIC: BIO-BASED COATING MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 69 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 70 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2018–2021 (KILOTON)

TABLE 71 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2022–2027 (KILOTON)

TABLE 72 ASIA PACIFIC: MARKET SIZE, BY RESIN TYPE, 2018–2021 (USD MILLION)

TABLE 73 ASIA PACIFIC: MARKET SIZE, BY RESIN TYPE, 2022–2027 (USD MILLION)

TABLE 74 ASIA PACIFIC: MARKET SIZE, BY RESIN TYPE, 2018–2021 (KILOTON)

TABLE 75 ASIA PACIFIC: MARKET SIZE, BY RESIN TYPE, 2022–2027 (KILOTON)

TABLE 76 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 77 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 78 ASIA PACIFIC: PAINTS & COATINGS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 79 ASIA PACIFIC: PAINTS & COATINGS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

8.2.1 CHINA

8.2.1.1 Favorable market conditions to drive demand for bio-based coatings

8.2.2 JAPAN

8.2.2.1 High vehicle production to spur demand for bio-based coatings

8.2.3 SOUTH KOREA

8.2.3.1 Automotive industries to support market growth

8.2.4 INDIA

8.2.4.1 Boom in real estate sector to drive market

8.2.5 REST OF ASIA PACIFIC

8.3 NORTH AMERICA

FIGURE 31 NORTH AMERICA: BIO-BASED COATINGS MARKET SNAPSHOT

TABLE 80 NORTH AMERICA: BIO-BASED COATING MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 81 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 82 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2021 (KILOTON)

TABLE 83 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2022–2027 (KILOTON)

TABLE 84 NORTH AMERICA: MARKET SIZE, BY RESIN TYPE, 2018–2021 (USD MILLION)

TABLE 85 NORTH AMERICA: MARKET SIZE, BY RESIN TYPE, 2022–2027 (USD MILLION)

TABLE 86 NORTH AMERICA: MARKET SIZE, BY RESIN TYPE, 2018–2021 (KILOTON)

TABLE 87 NORTH AMERICA: MARKET SIZE, BY RESIN TYPE, 2022–2027 (KILOTON)

TABLE 88 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 89 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 90 NORTH AMERICA: PAINTS & COATINGS MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 91 NORTH AMERICA: PAINTS & COATINGS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

8.3.1 US

8.3.1.1 Increasing residential and non-residential construction to boost market

TABLE 92 US PAINTS & COATINGS TOLL MANUFACTURERS

8.3.2 CANADA

8.3.2.1 Residential construction contributing significantly to market growth

8.3.3 MEXICO

8.3.3.1 New construction in residential segment to drive market

8.4 EUROPE

FIGURE 32 EUROPE: BIO-BASED COATINGS MARKET SNAPSHOT

TABLE 93 EUROPE: BIO-BASED COATING MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 94 EUROPE: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 95 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2021 (KILOTON)

TABLE 96 EUROPE: MARKET SIZE, BY COUNTRY, 2022–2027 (KILOTON)

TABLE 97 EUROPE: MARKET SIZE, BY RESIN TYPE, 2018–2021 (USD MILLION)

TABLE 98 EUROPE: MARKET SIZE, BY RESIN TYPE, 2022–2027 (USD MILLION)

TABLE 99 EUROPE: MARKET SIZE, BY RESIN TYPE, 2018–2021 (KILOTON)

TABLE 100 EUROPE: MARKET SIZE, BY RESIN TYPE, 2022–2027 (KILOTON)

TABLE 101 EUROPE: MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 102 EUROPE: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 103 EUROPE: MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 104 EUROPE: MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

8.4.1 GERMANY

8.4.1.1 Favorable economic environment for construction sector and rising demand for homes for migrants

8.4.2 UK

8.4.2.1 Growing construction sector along with government spending to boost demand for architectural coatings

8.4.3 FRANCE

8.4.3.1 Reviving economy and investment in infrastructure to increase demand for coatings

8.4.4 RUSSIA

8.4.4.1 Architectural and woodworking applications to drive market

8.4.5 ITALY

8.4.5.1 New project finance rules and investment policies in construction sector to support market growth

8.4.6 TURKEY

8.4.6.1 Rapid urbanization, rising middle-class population, and increasing purchasing power to drive market

8.4.7 REST OF EUROPE

8.5 SOUTH AMERICA

TABLE 105 SOUTH AMERICA: BIO-BASED COATINGS MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 106 SOUTH AMERICA: BIO-BASED COATING MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 107 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2021 (KILOTON)

TABLE 108 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2022–2027 (KILOTON)

TABLE 109 SOUTH AMERICA: MARKET SIZE, BY RESIN TYPE, 2018–2021 (USD MILLION)

TABLE 110 SOUTH AMERICA: MARKET SIZE, BY RESIN TYPE, 2022–2027 (USD MILLION)

TABLE 111 SOUTH AMERICA: MARKET SIZE, BY RESIN TYPE, 2018–2021 (KILOTON)

TABLE 112 SOUTH AMERICA: MARKET SIZE, BY RESIN TYPE, 2022–2027 (KILOTON)

TABLE 113 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 114 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 115 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 116 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

8.5.1 BRAZIL

8.5.1.1 Rising home ownership and living standards and easier credit availability to fuel demand

8.5.2 ARGENTINA

8.5.2.1 Increased population and improved economic conditions to drive use of decorative paints and coatings

8.5.3 REST OF SOUTH AMERICA

8.6 MIDDLE EAST & AFRICA

TABLE 117 MIDDLE EAST & AFRICA: BIO-BASED COATINGS MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 118 MIDDLE EAST & AFRICA: BIO-BASED COATING MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 119 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2018–2021 (KILOTON)

TABLE 120 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2022–2027 (KILOTON)

TABLE 121 MIDDLE EAST & AFRICA: MARKET SIZE, BY RESIN TYPE, 2018–2021 (USD MILLION)

TABLE 122 MIDDLE EAST & AFRICA: MARKET SIZE, BY RESIN TYPE, 2022–2027 (USD MILLION)

TABLE 123 MIDDLE EAST & AFRICA: MARKET SIZE, BY RESIN TYPE, 2018–2021 (KILOTON)

TABLE 124 MIDDLE EAST & AFRICA: MARKET SIZE, BY RESIN TYPE, 2022–2027 (KILOTON)

TABLE 125 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 126 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 127 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 128 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

8.6.1 SAUDI ARABIA

8.6.1.1 Mega housing projects to boost demand for architectural paints and coatings

8.6.2 SOUTH AFRICA

8.6.2.1 Substantial demand for architectural paints and coatings in building projects

8.6.3 REST OF MIDDLE EAST & AFRICA

9 COMPETITIVE LANDSCAPE (Page No. - 138)

9.1 OVERVIEW

TABLE 129 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

9.2 COMPANY EVALUATION QUADRANT MATRIX: DEFINITIONS AND METHODOLOGY, 2021

9.2.1 STAR

9.2.2 EMERGING LEADERS

9.2.3 PERVASIVE

9.2.4 EMERGING COMPANIES

FIGURE 33 BIO-BASED COATINGS MARKET (GLOBAL): COMPETITIVE LEADERSHIP MAPPING, 2021

9.3 MARKET SHARE ANALYSIS

FIGURE 34 MARKET SHARE, BY KEY PLAYERS, 2021

9.4 REVENUE ANALYSIS

FIGURE 35 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2017–2021

9.4.1 SHERWIN-WILLIAMS COMPANY

9.4.2 PPG INDUSTRIES

9.4.3 STORA ENSO OYJ

9.4.4 AKZONOBEL N.V.

9.4.5 NIPPON PAINT HOLDINGS CO. LTD.

9.5 COMPETITIVE BENCHMARKING

TABLE 130 BIO-BASED COATINGS MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

9.6 COMPETITIVE SITUATIONS AND TRENDS

TABLE 131 BIO-BASED COATINGS MARKET: PRODUCT LAUNCHES, 2017–2022

TABLE 132 BIO-BASED COATING MARKET: DEALS, 2017–2022

10 COMPANY PROFILES (Page No. - 146)

10.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, Product launches, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats)*

10.1.1 AKZONOBEL N.V.

TABLE 133 AKZONOBEL N.V.: COMPANY OVERVIEW

FIGURE 36 AKZONOBEL N.V.: COMPANY SNAPSHOT

TABLE 134 AKZONOBEL N.V.: PRODUCTS

TABLE 135 AKZONOBEL N.V.: PRODUCT LAUNCHES

10.1.2 PPG INDUSTRIES

TABLE 136 PPG INDUSTRIES: COMPANY OVERVIEW

FIGURE 37 PPG INDUSTRIES: COMPANY SNAPSHOT

TABLE 137 PPG INDUSTRIES: PRODUCTS

TABLE 138 PPG INDUSTRIES: PRODUCT LAUNCHES

TABLE 139 PPG INDUSTRIES: DEALS

TABLE 140 PPG INDUSTRIES: OTHERS

10.1.3 SHERWIN-WILLIAMS COMPANY

TABLE 141 SHERWIN-WILLIAMS COMPANY: COMPANY OVERVIEW

FIGURE 38 SHERWIN-WILLIAMS COMPANY: COMPANY SNAPSHOT

TABLE 142 SHERWIN-WILLIAMS COMPANY: PRODUCTS

TABLE 143 SHERWIN-WILLIAMS COMPANY: DEALS

TABLE 144 SHERWIN-WILLIAMS COMPANY: OTHERS

10.1.4 NIPPON PAINT HOLDINGS CO. LTD.

TABLE 145 NIPPON PAINT HOLDINGS CO. LTD.: COMPANY OVERVIEW

FIGURE 39 NIPPON PAINT HOLDINGS CO. LTD.: COMPANY SNAPSHOT

TABLE 146 NIPPON PAINT HOLDINGS CO. LTD.: PRODUCTS

TABLE 147 NIPPON PAINT HOLDING CO. LTD.: PRODUCT LAUNCHES

TABLE 148 NIPPON PAINT HOLDING CO. LTD.: DEALS

10.1.5 STORA ENSO OYJ

TABLE 149 STORA ENSO OYJ: COMPANY OVERVIEW

FIGURE 40 STORA ENSO OYJ: COMPANY SNAPSHOT

TABLE 150 STORA ENSO OYJ: PRODUCTS

TABLE 151 STORA ENSO OYJ: PRODUCT LAUNCHES

TABLE 152 STORA ENSO: DEALS

TABLE 153 STORA ENSO: OTHERS

10.1.6 TREMCO ROOFING & BUILDING MAINTENANCE (TREMCO)

TABLE 154 TREMCO: COMPANY OVERVIEW

TABLE 155 TREMCO: PRODUCTS

10.1.7 ICA GROUP

TABLE 156 ICA GROUP: COMPANY OVERVIEW

TABLE 157 ICA GROUP: PRODUCTS

TABLE 158 ICA GROUP: OTHERS

10.1.8 INDUSTRIAS QUÍMICAS MASQUELACK S.A. (MASQUELACK)

TABLE 159 MASQUELACK: COMPANY OVERVIEW

TABLE 160 MASQUELACK: PRODUCTS

10.1.9 CHENYANG GROUP

TABLE 161 CHENYANG GROUP: COMPANY OVERVIEW

TABLE 162 CHENYANG GROUP: PRODUCTS

10.1.10 CIRANOVA

TABLE 163 CIRANOVA: COMPANY OVERVIEW

TABLE 164 CIRANOVA: PRODUCTS

10.1.11 COPPERANT

TABLE 165 COPPERANT: COMPANY OVERVIEW

TABLE 166 COPPERANT: PRODUCTS

10.1.12 CORTEC CORPORATION

TABLE 167 CORTEC CORPORATION: COMPANY OVERVIEW

TABLE 168 CORTEC CORPORATION: PRODUCTS

TABLE 169 CORTEC CORPORATION: PRODUCT LAUNCHES

10.1.13 ECO SAFETY PRODUCTS

TABLE 170 ECO SAFETY PRODUCTS: COMPANY OVERVIEW

TABLE 171 ECO SAFETY PRODUCTS: PRODUCTS

10.2 OTHER PLAYERS

10.2.1 COVESTRO AG

TABLE 172 COVESTRO AG: PRODUCTS

10.2.2 ARKEMA

10.2.3 KANSAI PAINT CO. LTD.

10.2.4 TEKNOS

10.2.5 DSM

10.2.6 THE DOW CHEMICAL COMPANY

10.2.7 STAHL HOLDINGS B.V.

10.2.8 GENOMATICA

*Details on Business Overview, Products Offered, Recent Developments, Product launches, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats might not be captured in case of unlisted companies.

11 APPENDIX (Page No. - 179)

11.1 DISCUSSION GUIDE

11.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

11.3 AVAILABLE CUSTOMIZATIONS

11.4 RELATED REPORTS

11.5 AUTHORS DETAILS

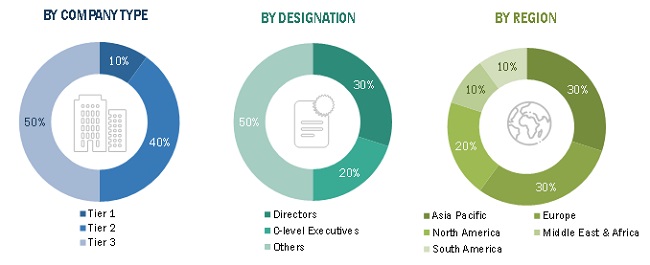

The study involves four major activities in estimating the current market size of bio-based coatings. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methods were used to estimate the size of the segments and sub-segments of the overall market.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, have been referred to for identifying and collecting information for this study. These secondary sources also included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; gold standard & silver standard websites; regulatory bodies; trade directories; and databases.

Primary Research

The bio-based coatings market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations. The demand side of this market is characterized by the development in applications, such as architectural, transportation, woodworking, packaging, and others. The supply side is characterized by advancements in technology. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the bio-based coatings market. These methods were also used extensively to estimate the sizes of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Bio-based coatings Market Size: Top-down Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To analyze and forecast the size of the bio-based coatings market in terms of value and volume

- To define, describe, and forecast the bio-based coatings market by resin type, application, and region

- To forecast the bio-based coatings market size with respect to five main regions: North America, Europe, Asia Pacific, the Middle East & Africa, and South America

- To provide detailed information about the significant drivers, restraints, opportunities, and challenges influencing market growth

- To strategically analyze micromarkets1 with respect to their growth trends, growth prospects, and contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments, such as mergers & acquisitions, new product launches, and investments & expansions, in the bio-based coatings market

- To strategically profile key players and comprehensively analyze their market shares and core competencies2

Note: 1. Micromarkets are defined as the sub-segments of the BIO-BASED COATINGS market included in the report.

Note 2: Core competencies of the companies are captured in terms of their key developments and key strategies adopted to sustain their position in the market.

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the bio-based coatings market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Bio-based Coatings Market