Binders and Scaffolders for Meat & Meat Substitutes Market by Type (Binders For Meat & Meat Substitutes, Scaffolders For Cultured Meat), Application (Meat Products, Meat Substitutes, Cultured Meat), Meat Type, & Region - Global Forecast to 2026 and 2032

The meat industry is on the rise, and with it comes a growing need for effective meat binders. In 2021, the global meat binders market is expected to be worth USD 3.7 billion, and this figure is projected to reach USD 4.2 billion by 2026. With a compound annual growth rate (CAGR) of 2.6%, the meat binders market is poised to make a significant impact in the food industry. This is fueled by the increasing demand for meat products such as beef, pork, and poultry, which require high-quality binders to maintain their texture and flavor. As the meat industry continues to expand, so does the need for reliable and efficient meat binders, making it a crucial segment in the food processing industry.

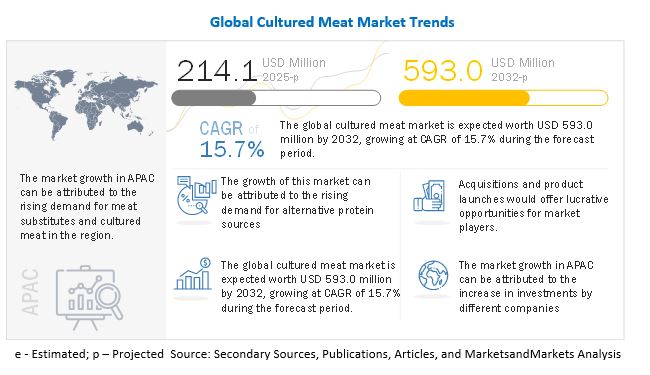

As the world becomes increasingly concerned about sustainability and ethical food practices, the demand for non-meat and greener alternatives is growing. In response, the global cultured meat market is expected to reach USD 214.0 million by 2025, with a projected CAGR of 15.7% to reach USD 593.0 million by 2032. This growth is largely driven by consumers seeking sustainable, ethical, and eco-friendly options that do not compromise on taste or nutrition. As the demand for cultured meat grows, the need for efficient and reliable scaffolding techniques in meat production becomes increasingly important. With the projected growth of the cultured meat market, the scaffolding industry is expected to see a corresponding surge, making it an important and exciting segment to watch in the coming years. The Binders and Scaffolders market for Meat & Meat Substitutes is an essential segment within the food industry, with the potential for significant growth in the coming years.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Drivers: Increasing demand for alternative protein

According to data published by the Food and Agriculture Organization (FAO), global meat production is projected to be 16% higher by 2025, than during the base period of 2013–2015. Rising consumption of meat coupled with the increasing demand for nutritional meat is expected to support the market growth of cultured meat during the forecast period. The increasing global population in developing economies coupled with the rising meat consumption is projected to drive the market growth of cultured meat across the globe. Rapid urbanization in developing countries has fueled the consumption of proteins from animal sources. Compared to rural areas, the urban population consumes more meat, beef, and poultry products. Poultry is one of the major categories in the cultured meat market, which is expected to witness significant growth during the forecast period due to the increase in demand for affordable animal protein over red meats. Developing regions such as Asia Pacific and Africa are expected to account for significant growth in the next 10 years due to the shift from a cereal-based diet to a protein-based one. This growing trend of protein consumption is expected to present several opportunities for various meat processors and food companies to invest in alternative meat protein such as cultured meat to fulfill consumer demand. Recent advancements in food technology have helped in the development of new alternate protein products such as plant-based protein, cultured meats, and edible insects. These products provide a considerable amount of protein but require less natural resources compared to common protein sources such as meat and fish. This practice is gaining popularity in the market and has high growth potential. A number of players have emerged in the animal protein sector. For instance, in insect protein, nextProtein (France), founded in 2015, provides insect-based protein for feed, under its brand, Protix, which is an ideal protein source for pet food applications. In cultured meat, a handful of startups are in the R&D phase and are about to make their cultured meat products commercially available by 2021. Meatless food products such as meat-free burgers by Impossible Food (US) and pea-based shrimp by New Wave Foods (US) have already garnered a competitive edge.

Restraints: Stringent regulatory scrutiny of scaffold meat

Cultured meat, because of the inherent novelty of its nature, is expected to face highly stringent regulatory scrutiny. Formulating meat in laboratories, though likely to yield positive outcomes in the interest of consumers and environmental stability, is expected to be minutely evaluated as meat continues to be a vital source of nutrient in recommended daily diets. This upcoming technology is being closely monitored by the United States Department of Agriculture (USDA) and the Food and Drug Administration (FDA). Companies in the US and Europe, engaged in the development of cultured meat, have to face lengthy regulatory approval procedures, which will affect the time taken for the commercialization of these products. Scaffolds are also edible for humans, FDA has approved pectin, gellan gum, chitosan, gelatin, cellulose, gluten, and alginate to be used.

Opportunities: Exploring Technological Advancements to Develop New Product Lines

The global functional non-meat ingredients market is growing as the demand for processed meat products from developed economies has increased. The main reason behind the substantial growth of the functional non-meat ingredients market is the changing consumer attitude towards the consumption of processed meat products. Binders are being adopted by various meat processing units and products are being commercialized at a rapid pace, globally. Companies can seize this opportunity by exploring new application possibilities for existing functional non-meat ingredients. By experimenting with novel combinations and formulations of raw materials from various sources, companies have the scope to develop new products with distinguished functionalities. For instance, better binders, extenders, and colorants can be used for various meat applications. Companies can leverage their technical and research capabilities to develop novel functional non-meat ingredients in the market. While developing new non-meat ingredient products, manufacturers must adhere to food safety regulations such as FDA, ICMR, FOSHU etc. to develop quality products.

Challenges: Intolerance of probiotics to stomach acid and bile

International regulatory bodies are making food safety and quality regulations more stringent. Apart from food testing and certification, these international regulatory bodies compel manufacturers to follow food labeling rules and regulations. Governments of most nations are taking initiatives to implement food labeling laws. It is challenging to mention each ingredient used in processed meat products or during meat processing on the product package. According to manufacturers, this may hamper sales as customers may not prefer to buy products with undesirable ingredients in it.

Cultured meat manufacturers are expected to dominate North American region

The US is projected to dominate the North American region by 2032, in terms of value. This is attributed to the innovations in cultured meat, which are expected to reduce the environmental impact of meat production and promote human health and food safety by eliminating harmful content such as saturated fats and pathogens. These factors are expected to drive the growth of the cultured meat market during the forecast period in this region. Moreover, high consumer acceptance for cultured meat in the country is supporting the demand for cultured meat.

Consumers shifting toward a flexitarian and vegan lifestyle is a significant factor driving the demand for meat substitutes.

The global binders and scaffolders for meat & meat substitutes market has been influenced by some of the macroeconomic and microeconomic factors occurring in some of the key countries around the globe. This would prove potential enough to significantly drive the market in value sales during the forecast period. Meat substitutes are being preferred by plant-based meat manufacturers and consumers. Consumers shifting toward a flexitarian and vegan lifestyle is a significant factor driving the demand for meat substitutes. They also help in reducing the carbon emission in the environment and protect animals. Several companies are interested in this trend of meat alternatives and focusing on developing new plant-based meat products.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Key players in this market include ADM (US), DuPont (US), Kerry (Ireland), Danagreen Co., Ltd (South Korea), Marix Meats (US), and Memphis Meat (US).

Scope of the report

|

Report Metric |

Details |

|

Market size estimation |

2016–2026 |

|

Base year considered |

2020 |

|

Forecast period considered |

2021–2026 |

|

Units considered |

Value (USD) |

|

Segments covered |

By type, application, meat type, and region |

|

Regions covered |

North America, Asia Pacific, Europe, South America and RoW |

|

Companies studied |

Binders:

Sacffolders:

|

This research report categorizes the binders and scaffolders for meat & meat substitutes market, based on application, type, meat type, and region

Target Audience

- Manufacturers, importers and exporters, traders, distributors, and suppliers of binders and scaffolders

- Cultured meat manufacturers

- Food processors and manufacturers

- Government and research organizations

- Trade associations and industry bodies

- Regulatory bodies and associations such as:

- Food Agriculture Organization (FAO)

- World Health Organization (WHO)

- The United States Cattlemen’s Association (USCA)

- Food and Drug Administration (FDA)

- United States Department of Agriculture (USDA)

Binders and scaffolders for meat & meat substitutes:

-

By Type

- Binders for meat & meat substitutes

- Scaffolders for cultured meat

-

By Application

- Meat Products

- Meat Substitutes

- Cultured Meat

-

By Meat Type

- Beef

- Pork

- Fish

- Poultry

- Other Meat

-

By Region

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW)

Recent Developments

- In January 2021, Matrix Meats collaborated with 14 cultivated meat producers across seven countries to expand its team and fasten production.

- In December 2020, Myoworks is working on a scaffolding technique for meat manufacturers to speed up their product development processes.

- In November 2020, SeaWith plans to obtain a bigger bioreactor for mass production to reach the industrialization stage more quickly.

(FAQ):

Which region is projected to account for the largest share in the binders and scaffolders for meat & meat substitutes?

North America account largest share in the consumption of meat, this demand is expected to be large than other regions.

What is the current size of the global meat binders market?

The global meat binders market is estimated to be valued at USD 3.7 billion in 2021. It is projected to reach USD 4.2 billion by 2026, recording a CAGR of 2.6% during the forecast period

Which are the key players in the market, and how intense is the competition?

Key players in the meat binders market include ADM, Kerry, and DuPont. Whereas, key players in the scaffolders market are DaNagreen, Memphis Meats, and Mosa Meat. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 12)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

FIGURE 1 BINDERS AND SCAFFOLDERS FOR MEAT & MEAT SUBSTITUTES SEGMENTATION

1.4 INCLUSIONS

FIGURE 2 BINDERS AND SCAFFOLDERS MARKET FOR MEAT & MEAT SUBSTITUTES: GEOGRAPHIC SEGMENTATION

1.5 PERIODIZATION CONSIDERED

1.6 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES CONSIDERED, 2018–2020

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 16)

2.1 RESEARCH DATA

FIGURE 3 BINDERS AND SCAFFOLDERS MARKET FOR MEAT & MEAT SUBSTITUTES: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

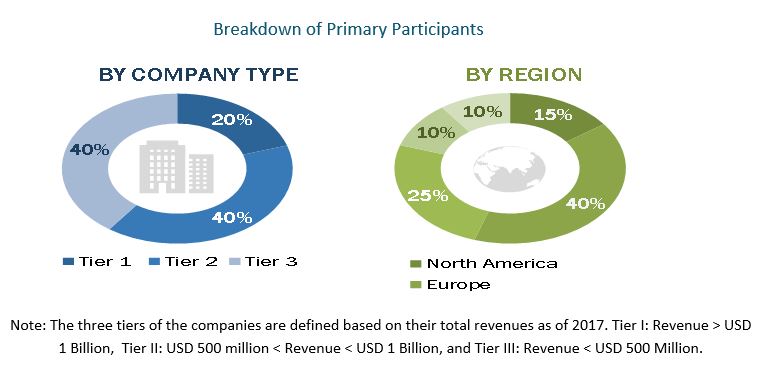

2.1.2.2 Breakdown of primary interviews

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE AND REGION

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION METHODOLOGY

2.4 RESEARCH ASSUMPTIONS

2.5 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 22)

FIGURE 8 COMPANIES CAPITAL INVESTMENT IN CULTURE MEAT INDUSTRY

4 PREMIUM INSIGHTS (Page No. - 24)

4.1 SCAFFOLDERS FOR CULTURED MEAT

FIGURE 9 OPPORTUNITIES FOR SCAFFOLDING SOLUTIONS IN THE FUTURISTIC CULTURED MEAT MARKET

4.2 MEAT BINDERS MARKET

FIGURE 10 MEAT BINDERS MARKET, BY REGION

FIGURE 11 REGIONAL OPPORTUNITIES FOR SCAFFOLDING SOLUTIONS IN THE FUTURISTIC CULTURED MEAT MARKET

5 MARKET OVERVIEW (Page No. - 26)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing demand for alternative protein

5.2.1.2 Enhanced food safety

5.2.1.3 Investment by key industry giants

5.2.1.4 Health benefits of scaffolding to increase in protein content

5.2.2 RESTRAINTS

5.2.2.1 Stringent regulatory scrutiny of scaffold meat

5.2.2.2 High setup cost

5.2.3 OPPORTUNITIES

5.2.3.1 Exploring Technological Advancements to Develop New Product Lines

FIGURE 12 USAGE OF MEAT BINDERS, BY MEAT TYPE

5.2.4 CHALLENGES

5.2.4.1 Product Labeling

6 INDUSTRY TRENDS (Page No. - 31)

6.1 INTRODUCTION

6.2 VALUE CHAIN

6.2.1 RESEARCH & DEVELOPMENT

6.2.2 RAW MATERIAL SOURCING

6.2.3 PRODUCTION AND PROCESSING

6.2.4 PACKAGING

6.2.5 MARKETING & DISTRIBUTION

6.2.6 END-USE INDUSTRY

FIGURE 13 VALUE CHAIN ANALYSIS OF BINDERS AND SCAFFOLDERS FOR MEAT & MEAT SUBSTITUTES MARKET: RESEARCH & DEVELOPMENT AND RAW MATERIAL SOURCING ARE KEY CONTRIBUTORS

6.3 SUPPLY CHAIN ANALYSIS

FIGURE 14 SUPPLY CHAIN ANALYSIS OF THE BINDERS AND SCAFFOLDERS FOR MEAT & MEAT SUBSTITUTES

6.4 TECHNOLOGY ANALYSIS

6.4.1 SCAFFOLDING TECHNOLOGY

6.5 PRICING ANALYSIS: THE BINDERS AND SCAFFOLDERS FOR MEAT & MEAT SUBSTITUTES MARKET

TABLE 2 GLOBAL BINDERS AVERAGE SELLING PRICE (ASP), 2019–2021 (USD/TONS)

6.6 MARKET MAP AND ECOSYSTEM

6.6.1 DEMAND SIDE

6.6.2 SUPPLY SIDE

6.6.3 BINDERS AND SCAFFOLDERS FOR MEAT & MEAT SUBSTITUTES: MARKET MAP

TABLE 3 SUPPLY CHAIN (ECOSYSTEM)

6.7 TRENDS/DISRUPTIONS IMPACTING THE CUSTOMER’S BUSINESS

FIGURE 15 YC-YCC SHIFT FOR THE BINDERS AND SCAFFOLDERS FOR MEAT & MEAT SUBSTITUTES

6.8 PATENT ANALYSIS

TABLE 4 SOME OF THE PATENTS PERTAINING TO BINDERS AND SCAFFOLDERS, 2020–2021

6.9 TRADE ANALYSIS

6.9.1 SOYA BEANS

TABLE 5 TOP TEN IMPORTERS AND EXPORTERS OF SOYA BEANS, 2020 (KT)

6.9.2 WHEAT

TABLE 6 TOP TEN IMPORTERS AND EXPORTERS OF WHEAT, 2020 (KT)

6.9.3 PEA

TABLE 7 TOP TEN IMPORTERS AND EXPORTERS OF PEA, 2020 (KT)

6.10 PORTER’S FIVE FORCES ANALYSIS

TABLE 8 BINDERS AND SCAFFOLDERS FOR MEAT & MEAT SUBSTITUTES: PORTER’S FIVE FORCES ANALYSIS

6.10.1 DEGREE OF COMPETITION

6.10.2 BARGAINING POWER OF SUPPLIERS

6.10.3 BARGAINING POWER OF BUYERS

6.10.4 THREAT OF SUBSTITUTES

6.10.5 THREAT OF NEW ENTRANTS

6.11 CASE STUDIES

6.11.1 GROWING DEMAND FOR MEAT ALTERNATIVES

6.11.2 INCREASING DEMAND FOR CLEAN LABEL PRODUCTS

7 REGULATORY SCENARIO (Page No. - 44)

7.1 NORTH AMERICA

7.1.1 US

7.1.2 CANADA

7.2 EUROPE

7.3 ASIA PACIFIC

8 BINDERS AND SCAFFOLDERS MARKET FOR MEAT & MEAT SUBSTITUTES, BY TYPE (Page No. - 48)

8.1 BINDERS FOR MEAT & MEAT SUBSTITUTES

TABLE 9 MEAT BINDERS MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 10 MEAT BINDERS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.2 SCAFFOLDERS FOR CULTURED MEAT

FIGURE 16 REGIONAL OPPORTUNITIES FOR SCAFFOLDING SOLUTIONS IN THE FUTURISTIC CULTURED MEAT MARKET

9 BINDERS AND SCAFFOLDERS FOR MEAT & MEAT SUBSTITUTES, BY APPLICATION (Page No. - 50)

9.1 INTRODUCTION

9.2 MEAT PRODUCTS

9.3 MEAT SUBSTITUTES

9.4 CULTURED MEAT

10 BINDERS AND SCAFFOLDERS FOR MEAT & MEAT SUBSTITUTES, BY MEAT TYPE (Page No. - 52)

10.1 INTRODUCTION

10.2 BEEF

10.3 PORK

10.4 FISH

10.5 POULTRY

10.6 OTHER MEAT

11 BINDERS AND SCAFFOLDERS MARKET FOR MEAT & MEAT SUBSTITUTES, BY REGION (Page No. - 54)

11.1 INTRODUCTION

11.2 NORTH AMERICA

11.2.1 US

11.2.2 CANADA

11.3 EUROPE

11.3.1 GERMANY

11.3.2 UK

11.3.3 NETHERLANDS

11.3.4 REST OF EUROPE

11.4 ASIA PACIFIC

11.4.1 CHINA

11.4.2 JAPAN

11.4.3 SINGAPORE

11.4.4 SOUTH KOREA

11.4.5 REST OF ASIA PACIFIC

11.5 SOUTH AMERICA

11.5.1 BRAZIL

11.5.2 REST OF SOUTH AMERICA

11.6 ROW

11.6.1 ISRAEL

11.6.2 UNITED ARAB EMIRATES

11.6.3 REST OF THE ROW

12 COMPETITIVE LANDSCAPE (Page No. - 64)

12.1 OVERVIEW

12.2 MARKET SHARE ANALYSIS, 2020

TABLE 11 BINDERS AND SCAFFOLDERS MARKET FOR MEAT & MEAT SUBSTITUTES: DEGREE OF COMPETITION

12.3 KEY PLAYER STRATEGIES

12.4 COVID-19-SPECIFIC COMPANY RESPONSES

12.4.1 ADM

12.4.2 DUPONT

12.4.3 KERRY GROUP

12.5 COMPANY EVALUATION QUADRANT (MEAT BINDER COMPANIES)

12.5.1 STAR

12.5.2 PERVASIVE

12.5.3 EMERGING LEADERS

12.5.4 PARTICIPANTS

FIGURE 17 BINDERS AND SCAFFOLDERS MARKET FOR MEAT AND MEAT SUBSTITUTES: COMPANY EVALUATION QUADRANT, 2020 (MEAT BINDER COMPANIES)

12.5.5 PRODUCT FOOTPRINT

TABLE 12 COMPANY, BY APPLICATION FOOTPRINT

12.6 SCAFFOLDER COMPANIES EVALUATION QUADRANT

12.6.1 PROGRESSIVE COMPANIES

12.6.2 STARTING BLOCKS

12.6.3 RESPONSIVE COMPANIES

12.6.4 DYNAMIC COMPANIES

FIGURE 18 BINDERS AND SCAFFOLDERS MARKET FOR MEAT AND MEAT SUBSTITUTES: COMPANY EVALUATION QUADRANT, 2020 (SCAFFOLDER COMPANIES)

12.7 COMPETITIVE SCENARIO AND TRENDS

12.7.1 PRODUCT LAUNCHES, DEALS, AND OTHER DEVELOPMENTS

TABLE 13 BINDERS AND SCAFFOLDERS MARKET FOR MEAT & MEAT SUBSTITUTES: PRODUCT LAUNCHES, DEALS, AND OTHER DEVELOPMENTS, JUNE 2018–SEPTEMBER 2021

13 COMPANY PROFILES (Page No. - 72)

(Business overview, Products offered, Recent developments & MnM View)*

13.1 KEY PLAYERS

13.1.1 ARCHER DANIELS MIDLAND COMPANY

TABLE 14 ARCHER DANIELS MIDLAND COMPANY: BUSINESS OVERVIEW

FIGURE 19 ARCHER DANIELS MIDLAND COMPANY: COMPANY SNAPSHOT

TABLE 15 ARCHER DANIELS MIDLAND COMPANY: PRODUCTS OFFERED

TABLE 16 BINDERS AND SCAFFOLDERS FOR MEAT & MEAT SUBTITUES MARKET: PRODUCT LAUNCHES, SEPTEMBER 2020

TABLE 17 INGREDIENTSBINDERS AND SCAFFOLDERS FOR MEAT & MEAT SUBTITUES MARKET: DEALS, NOVEMBER 2020

TABLE 18 BINDERS AND SCAFFOLDERS FOR MEAT & MEAT SUBTITUES MARKET: OTHERS, NOVEMBER 2020-MAY 2021

13.1.2 DUPONT

TABLE 19 DUPONT: BUSINESS OVERVIEW

FIGURE 20 DUPONT: COMPANY SNAPSHOT

TABLE 20 DUPONT: PRODUCTS OFFERED

TABLE 21 BINDERS AND SCAFFOLDERS FOR MEAT & MEAT SUBSTITUES MARKET: DEALS, DECEMBER 2019

13.1.3 KERRY GROUP

TABLE 22 KERRY GROUP: BUSINESS OVERVIEW

FIGURE 21 KERRY GROUP: COMPANY SNAPSHOT

TABLE 23 KERRY GROUP: PRODUCTS OFFERED

TABLE 24 BINDERS AND SCAFFOLDERS FOR MEAT & MEAT SUBSTITUES MARKET: OTHERS, MAY 2021

13.1.4 INGREDION INCORPORATED

TABLE 25 INGREDION INCORPORATED: BUSINESS OVERVIEW

FIGURE 22 INGREDION INCORPORATED: COMPANY SNAPSHOT

TABLE 26 INGREDION INCORPORATED: PRODUCTS OFFERED

TABLE 27 BINDERS AND SCAFFOLDERS FOR MEAT & MEAT SUBSTITUTES MARKET: DEALS, FEBRUARY 2021

13.1.5 ROQUETTE FRÈRES

TABLE 28 ROQUETTE FRERES: BUSINESS OVERVIEW

TABLE 29 ROQUETTE FRERES: PRODUCTS OFFERED

TABLE 30 BINDERS AND SCAFFOLDERS FOR MEAT & MEAT SUBSTITUTES RMARKET: PRODUCT LAUNCHES, MAY 2020 – JANUARY 2021

TABLE 31 BINDERS AND SCAFFOLDERS FOR MEAT & MEAT SUBSTITUTES MARKET: OTHERS, JUNE 2020

*Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

13.2 OTHER PLAYERS

13.2.1 WIBERG GMBH

TABLE 32 WIBERG GMBH: COMPANY OVERVIEW

13.2.2 ADVANCED FOOD SYSTEMS, INC.

TABLE 33 ADVANCED FOOD SYSTEMS, INC.: COMPANY OVERVIEW

13.2.3 AVEBE

TABLE 34 AVEBE: COMPANY OVERVIEW

13.2.4 J.M. HUBER CORPORATION

TABLE 35 J. M. HUBER CORPORATION: COMPANY OVERVIEW

13.2.5 GELITA AG

TABLE 36 GELITA AG: COMPANY OVERVIEW

13.2.6 NEXIRA

TABLE 37 NEXIRA

13.2.7 DANAGREEN CO., LTD

TABLE 38 DANAGREEN CO., LTD.: COMPANY OVERVIEW

13.2.8 EXCELL

TABLE 39 EXCELL: COMPANY OVERVIEW

13.2.9 MATRIX MEATS

TABLE 40 MATRIX MEATS: COMPANY OVERVIEW

13.2.10 MYOWORKS PVT LTD

TABLE 41 MYOWORKS PVT LTD: COMPANY OVERVIEW

13.2.11 MOSA MEAT

TABLE 42 MOSA MEAT: COMPANY OVERVIEW

13.2.12 SEAWITH

TABLE 43 SEAWITH: COMPANY OVERVIEW

13.2.13 ALEPH FARMS LTD.

TABLE 44 ALEPH FARMS LTD.: COMPANY OVERVIEW

13.2.14 MEMPHIS MEATS

TABLE 45 MEMPHIS MEATS: COMPANY OVERVIEW

13.2.15 SUPERMEAT

TABLE 46 SUPERMEAT: COMPANY OVERVIEW

14 APPENDIX (Page No. - 104)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

This research study involved the extensive use of secondary sources, directories, and databases such as Bloomberg Businessweek and Factiva to identify and collect information useful for a technical, market-oriented, and commercial study of the Binders and scaffolders market for meat & meat substitutes. In-depth interviews were conducted with various primary respondents—such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants—to obtain and verify the critical qualitative and quantitative information as well as to assess prospects. The following figure depicts the research design applied in drafting this report on the Binders and scaffolders market for meat & meat substitutes.

Secondary Research

In the secondary research process, various secondary sources such as the Food and Agriculture Organization (FAO), US Department of Agriculture (USDA), Cultured Meat Foundation, Future Food, United States Cattlemen's Association (USCA), British Meat Processors Association, and National Cattlemen's Beef Association have been referred to, to identify and collect information for this study. The secondary sources included press releases, blogs of companies, white papers, certified publications, articles from recognized authors, gold & silver standard websites, regulatory bodies, trade directories, and paid databases.

Secondary research has mainly been used to obtain key information about the industry’s supply chain, the market’s monetary chain, the total pool of key players, and market classification and segmentation according to industry trends to the bottom-most level and geographical markets. It has also been used to obtain information on the key developments from a market-oriented perspective.

Primary Research

The market comprises several stakeholders in the supply chain, which include ingredient manufacturers, suppliers, meat processors, researchers, equipment manufacturers, scientists, and cellular agriculture technology providers. Various primary sources from both the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include research institutions involved in R&D, government agencies, NGOs, entrepreneurs, food companies, and investors. The primary sources from the supply side include binding ingredients manufacturers and suppliers of bioreactor and laboratory equipment used in the production of cultured meat.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Binders and scaffolders market for meat & meat substitutes. These approaches have also been used extensively to determine the size of the various subsegments in the market. The research methodology used to estimate the market size includes the following details

- The Binders and scaffolders market for meat & meat substitutes size has been determined through primary and secondary research.

- The key players have been identified through extensive secondary research.

- Investments and developments of the companies were taken into consideration while calculating the market opportunity.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All the macroeconomic and microeconomic factors affecting the growth of the binders and scaffolders markets were considered while estimating the market sizes.

- All the possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. To arrive at the exact statistics for all the segments and subsegments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches..

Report Objectives

- To define, segment, and project the global market for binders and scaffolders for meat & meat substitutes on the basis of distribution channel, ingredients, product type, and region

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape of the market leaders

- To project the size of the market and its submarkets, in terms of value and volume, with respect to the regions (along with the key countries)

- To strategically profile the key players and comprehensively analyze their market position and core competencies

- To analyze the competitive developments such as joint ventures, mergers & acquisitions, new product developments, and research & developments in the binders and scaffolders for meat & meat substitutes market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to the company-specific scientific needs.

- Further breakdown of the Rest of Europe market for binders and scaffolders for meat & meat substitutes into the UK, and Greece

- Further breakdown of the Rest of Asia Pacific market for binders and scaffolders for meat & meat substitutes into South Korea, Thailand, and Indonesia

- Further breakdown of the Rest of South America market for binders and scaffolders for meat & meat substitutes into Chile, Peru, and Ecuador

- Further breakdown of other countries in the RoW market for binders and scaffolders for meat & meat substitutes into Egypt, Israel, and Turkey

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Binders and Scaffolders for Meat & Meat Substitutes Market

Interested in meat binders market growth estimates and growth opportunities in North American region along with key countries around the globe.

Looks interesting! Can I get more details about the growth rate of the market for the next 6 years.

What are the key market dynamics influencing market growth? How will they turn into strengths or weaknesses of companies operating in the market space?