Behavioral Health Software Market by Component (Services, Software), Delivery (Subscription, Ownership), Functionality (Clinical, EHR, CDS, Telehealth, RCM, BI, Administrative, Financial), End User (Hospitals, Clinics) - Global Forecasts to 2026

Market Growth Outlook Summary

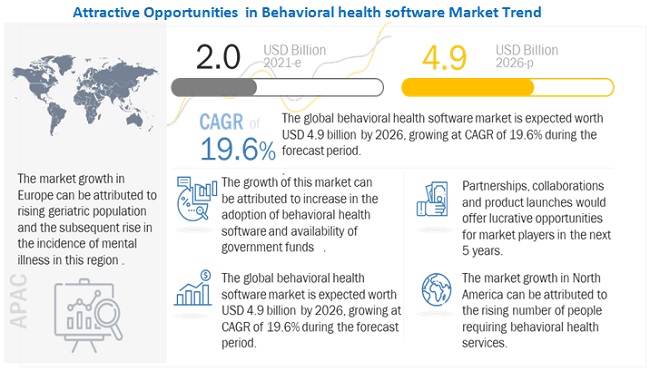

The global behavioral health software market growth forecasted to transform from $2.0 billion in 2021 to $4.9 billion by 2026, driven by a CAGR of 19.6%. Factors such as the increasing adoption of behavioral health software, availability of government funding, government initiatives to encourage EHR adoption in behavioral health organizations, medical professionals are putting a greater emphasis on providing patients with mental illness with high-quality care, favourable behavioral health reforms in the US, and high demand for mental health services amidst provider shortage are driving the growth of this market. Additionally, market participants are concentrating on new product and service launches as well as alliances to fuel the expansion of the overall market.

Behavioral Health Software Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Behavioral Health Software Market Dynamics

Driver: Increasing adoption of behavioral health software

High healthcare costs for the treatment of behavioral health-related problems or mental illnesses form a key concern for governments. Globally, depression is a common mental disorder; more than 264 million people of all ages suffer from depression. The global cost for the treatment of mental illnesses was ~USD 2.5 trillion in 2020; this figure is projected to reach USD 6 trillion by 2030 (Source: Lancet Commission). Additionally, serious mental illnesses cost the US an estimated USD 193.2 billion in lost earnings per year (Source: National Alliance of Mental Illness). In Canada, mental health problems have higher cost upto USD 42.4 billion (CAD 51 billion) every year (Source: Centre for Addiction and Mental Health). The need for and generation of excessive paperwork (resulting in loss of productivity among clinicians) and improper revenue cycle management by behavioral health organizations are the major factors resulting in the high cost of treatments. The need to resolve these issues has boosted attention on and the adoption of behavioral health software as a means of reducing medication errors and paperwork, enhancing productivity by ensuring quick patient data access, improving workflow efficiency, and minimizing healthcare costs. These benefits of behavioral health software have driven their adoption, especially among large hospitals and community clinics.

Restraint: Data privacy concern

In behavioral health, the privacy of data is the biggest concern for providers. Behavioral health providers are restrained to share information on patients suffering from some mental illness or substance abuse with anyone who is not involved in the treatment of that particular patient. However, with the data integration and advancements in IT tools, any healthcare professional unrelated to that case can access the patient’s data. In the US, the HIPAA Journal recorded 183 healthcare data breaches in its 2021 breach list, an increase of 31% over the total number of breaches tracked in 2020. While initiatives such as the passing of the HIPAA and HITECH Act in the US and the GDPR Act by the EU have been taken to strengthen data security measures, cases of data infringement and data breaches are still high.

Challenge: Financial Constraints

Overcoming financial constraints is the biggest challenge for healthcare organizations, especially in emerging economies. Nevertheless, the extent of data that is stored proves to be so important that IT infrastructure has started becoming the backbone of healthcare institutions. Currently, behavioral health software solutions are relatively high-priced software solutions. The maintenance and software update costs of these systems may sometimes be more than the actual price of the software. Support and maintenance services, which include software upgrades as per changing user requirements, represent a recurring expenditure that may amount to almost 30% of the total cost of ownership. This makes it challenging for behavioral health organizations to justify spending, at least in the short term, when they are focused on implementing EHRs and upgrading RCM systems.

Opportunity: Emerging Markets

Emerging markets such as the Asia Pacific, Latin America, and the Middle East and Africa are expected to offer significant growth opportunities for players operating in the behavioral health software market, especially those that are unable to meet the standards set by the Federal Government in the US. Government initiatives to establish standards, regulations, and infrastructure will encourage healthcare providers to adopt EMR and EHR technology in Australia. The Australian government has been taking several initiatives to increase the adoption of IT in healthcare to reduce errors and increase efficiency. On this front, in March 2013, the State of South Australia started developing the “careconnect.sa” program to fully integrate EHR systems state-wide. The Government of Australia is also actively promoting the electronic exchange of health information as part of the National E-Health Strategy. In its 2015-16 Federal Budget, the government allocated USD 485.1 million to strengthen eHealth governance arrangements (Source: Australian Digital Health Agency). Such initiatives are responsible for increasing the implementation of EMRs and EHRs in Australia.

Based on components, the support services segment is expected to account for the largest share of the behavioral health software industry, by components in 2021

Based on components, the behavioral health software market is segmented into software and support services. The support services segment is expected to account for the largest share of the behavioral health software market in 2021. The recurring requirement of support services (such as software upgrades and maintenance) is the major factor supporting its growth.

Based on end users, Community clinics segment to grow at the highest CAGR in the behavioral health software industry during the forecast period

Based on end users, the behavioral health software market has been segmented into community clinics, hospitals, and private practices. In 2021, the community clinics segment is expected to account for the largest share. Growing government initiatives to support these facilities and growing patient preference for community clinics are likely to drive behavioral health software adoption in this segment.

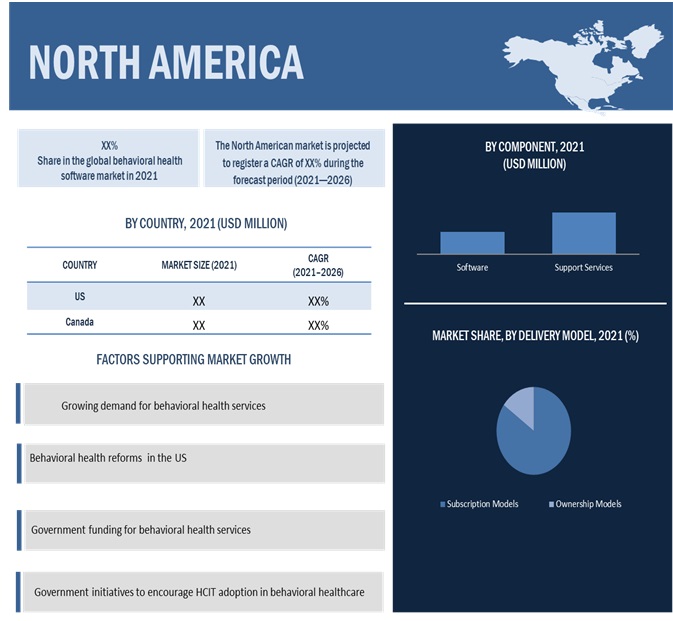

North America to dominate the behavioral health software industry

On the basis of region, the global behavioral health software market has been segmented into four major regions, namely, North America, Europe, the Asia Pacific and rest of the world. In 2021, North America is expected to dominate the market followed by Europe. The large share of this geographical segment is attributed to factors such as the rise in number of people requiring behavioral health services, various behavioral health reforms in the US, and increase in government funding for behavioral health services in the region.

To know about the assumptions considered for the study, download the pdf brochure

Major players operating in this market include Advanced Data Systems (US), AdvancedMD (US), Cerner (US), Compulink (US), Core Solutions (US), Credible Behavioral Health (US), Kareo (US), Meditab Software (US), Mindlinc (US), Netsmart (US), Nextgen Healthcare (US, Qualifacts (US), The Echo Group (US), Valant (US), Welligent (US), Cure MD (US), Epic systems corporations (US), Accumedic (US), Mediware(US), Allscripts (US)

Scope of the Behavioral Health Software Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2021 |

$2.0 billion |

|

Projected Revenue Size by 2026 |

$4.9 billion |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 19.6% |

|

Market Driver |

Increasing adoption of behavioral health software |

|

Market Opportunity |

Emerging Markets |

This report categorizes the global behavioral health software market to forecast revenue and analyze trends in each of the following submarkets:

By Component

- Support Services

-

Software

- Integrated Software

- Standalone Software

By Delivery Model

- Subscription Models

- Ownership Models

By Functionality

-

Clinical Functionality

- Electronic Health Records (EHR)

- Clinical Decision Support (CDS)

- Care Plans/Health Management

- E-Prescribing

- Telehealth

-

Administrative Functionality

- Patient/Client Scheduling

- Document/Image Management

- Case Management

- Business Intelligence (BI)

- Workforce Management

-

Financial Functionality

- Revenue Cycle Management

- Managed Care

- Accounts Payable/General Ledger

- Payroll

By End User

- Community Clinics

- Hospitals

- Private Practices

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- RoE

-

Asia

- Japan

- China

- India

- RoA

- Rest of the World (RoW)

Recent Developments:

- In July 2020, Cerner(US) collaborated with Nuance Communications, Inc. (US). This long-standing collaboration aimed to integrate Nuance’s virtual assistant technology into Cerner Millennium.

- In April 2020, Netsmart (US) partnered with The California Department of Veterans Affairs (CalVet, US). This partnership helped CalVet to implement Netsmart’s person-centered EHR platform, myUnity, to provide enhanced clinical and operational effectiveness in its delivery of day-to-day care to its residents

- In February 2021, Netsmart acquired GPM, a North Carolina-based Software-as-a-Service technology and services company. This will help Netsmart’s CareFabric platform to deliver interoperable data sharing between long-term care facilities and providers.

Frequently Asked Questions (FAQ):

Which product segment will dominate the behavioral health software market in the future?

The support services segment will dominate the behavioral health software market in the future

Emerging countries have immense opportunities for the growth and adoption of behavioral health software; will this scenario continue in the next five years?

Asia Pacific is expected to register the highest CAGR during the forecast period, emerging markets such as China and India are witnessing growth due to the increasing healthcare expenditure. This has resulted in the increasing acceptance of advanced systems in the Asia Pacific region.

Other factors such as large patient population (leading to more surgeries, invasive medical procedures, and infectious diseases); increasing cases of sepsis, bloodstream infections, and tuberculosis; poor adherence to infection control guidelines leading to greater chances of developing bloodstream infections; growing elderly population (especially in Japan); increasing healthcare expenditure; and increasing awareness about sepsis are contributing to the growth of the blood culture tests market in the Asia Pacific.

Who are the leading players in the behavioral health software market?

Major players operating in the behavioral health software market include Advanced Data Systems (US), AdvancedMD (US), Cerner (US), Compulink (US), Core Solutions (US), Credible Behavioral Health (US), Kareo (US), Meditab Software (US), Mindlinc (US), Netsmart (US), Nextgen Healthcare (US, Qualifacts (US), The Echo Group (US), Valant (US), Welligent (US), Cure MD(US), Epic systems corporations (US), Accumedic (US), Mediware(US), Allscripts (US)

What are the major end users in the behavioral health software market?

The end user behavioral health software market has been segmented into community clinics, hospitals, and private practices .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 36)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

FIGURE 1 BEHAVIORAL HEALTH SOFTWARE MARKET SEGMENTATION

1.3.1 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 40)

FIGURE 2 RESEARCH DESIGN

2.1 MARKET SIZE ESTIMATION

FIGURE 3 BOTTOM-UP APPROACH

FIGURE 4 TOP-DOWN APPROACH

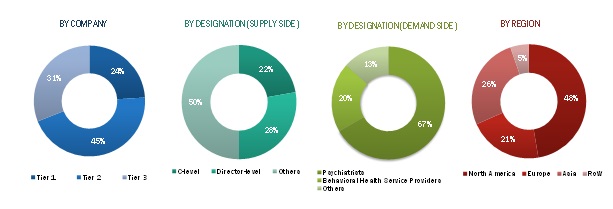

FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION METHODOLOGY

2.3 SECONDARY SOURCES

2.4 PRIMARY SOURCES

2.5 ASSUMPTIONS FOR THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 47)

FIGURE 7 BEHAVIORAL HEALTH SOFTWARE MARKET, BY COMPONENT, 2021 VS. 2026

FIGURE 8 GLOBAL MARKET, BY TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 9 GLOBAL MARKET, BY DELIVERY MODEL, 2021 VS. 2026 (USD MILLION)

FIGURE 10 GLOBAL MARKET, BY END USER, 2021 VS. 2026 (USD MILLION)

FIGURE 11 GEOGRAPHICAL SNAPSHOT OF THE GLOBAL MARKET

4 PREMIUM INSIGHTS (Page No. - 51)

4.1 MARKET OVERVIEW: BEHAVIORAL HEALTH SOFTWARE

FIGURE 12 AVAILABILITY OF GOVERNMENT FUNDING AND SUPPORT TO DRIVE THE MARKET DURING THE FORECAST PERIOD

4.2 GLOBAL MARKET, BY END USER

FIGURE 13 COMMUNITY CLINICS TO WITNESS THE HIGHEST CAGR BETWEEN 2021 AND 2026

4.3 GLOBAL MARKET: GEOGRAPHIC SNAPSHOT

FIGURE 14 THE UK TO WITNESS THE HIGHEST GROWTH RATE DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 54)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 BEHAVIORAL HEALTH SOFTWARE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing adoption of behavioral health software

5.2.1.2 Availability of government funding

5.2.1.3 Government initiatives to encourage EHR adoption in behavioral health organizations

5.2.1.4 Favorable behavioral health reforms in the US

5.2.1.5 High demand for mental health services amidst provider shortage

5.2.2 RESTRAINTS

5.2.2.1 Data privacy concerns

5.2.2.2 Shortage of HCIT professionals

5.2.3 OPPORTUNITIES

5.2.3.1 Emerging markets

5.2.3.2 Growing emphasis on subscription models

5.2.3.3 Telehealth as a means of providing care services

5.2.4 CHALLENGES

5.2.4.1 Financial constraints

5.2.4.2 Difficulty in integration and other technical challenges in software implementation

5.3 IMPACT OF COVID-19 ON THE GLOBAL MARKET

6 BEHAVIORAL HEALTH SOFTWARE MARKET, BY COMPONENT (Page No. - 61)

6.1 INTRODUCTION

TABLE 1 GLOBAL MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 2 GLOBAL MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

6.2 SUPPORT SERVICES

6.2.1 SUPPORT SERVICES IS THE LARGEST & FASTEST-GROWING COMPONENT SEGMENT

TABLE 3 GLOBAL MARKET FOR SUPPORT SERVICES, BY REGION, 2017–2020 (USD MILLION)

TABLE 4 GLOBAL MARKET FOR SUPPORT SERVICES, BY REGION, 2021–2026 (USD MILLION)

6.3 SOFTWARE

TABLE 5 GLOBAL MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 6 GLOBAL MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 7 GLOBAL MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 8 GLOBAL MARKET, BY REGION, 2021–2026 (USD MILLION)

6.3.1 INTEGRATED SOFTWARE

6.3.1.1 Advantages offered by these systems such as ease of use and real-time data availability to support market growth

TABLE 9 BEHAVIORAL HEALTH INTEGRATED SOFTWARE MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 10 BEHAVIORAL HEALTH INTEGRATED SOFTWARE MARKET, BY REGION, 2021–2026 (USD MILLION)

6.3.2 STANDALONE SOFTWARE

6.3.2.1 Standalone solutions are less efficient as compared to integrated solutions

TABLE 11 BEHAVIORAL HEALTH STANDALONE SOFTWARE MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 12 BEHAVIORAL HEALTH STANDALONE SOFTWARE MARKET, BY REGION, 2021–2026 (USD MILLION)

7 BEHAVIORAL HEALTH SOFTWARE MARKET, BY DELIVERY MODEL (Page No. - 69)

7.1 INTRODUCTION

TABLE 13 GLOBAL MARKET, BY DELIVERY MODEL, 2017–2020 (USD MILLION)

TABLE 14 GLOBAL MARKET, BY DELIVERY MODEL, 2021–2026 (USD MILLION)

7.2 SUBSCRIPTION MODELS

7.2.1 CLOUD-BASED MODELS ARE THE MOST COST-EFFECTIVE DELIVERY MODEL DUE TO THE ELIMINATION OF THE PURCHASING COST OF SOFTWARE AND HARDWARE

TABLE 15 GLOBAL MARKET FOR SUBSCRIPTION MODELS, BY REGION, 2017–2020 (USD MILLION)

TABLE 16 GLOBAL MARKET FOR SUBSCRIPTION MODELS, BY REGION, 2021–2026 (USD MILLION)

7.3 OWNERSHIP MODELS

7.3.1 LACK OF DATA TRANSFERABILITY AND THE REQUIREMENT OF ANNUAL MAINTENANCE CONTRACTS MAY RESTRAIN MARKET GROWTH TO A CERTAIN EXTENT

TABLE 17 GLOBAL MARKET FOR OWNERSHIP MODELS, BY REGION, 2017–2020 (USD MILLION)

TABLE 18 GLOBAL MARKET FOR OWNERSHIP MODELS, BY REGION, 2021–2026 (USD MILLION)

8 BEHAVIORAL HEALTH SOFTWARE MARKET, BY FUNCTIONALITY (Page No. - 74)

8.1 INTRODUCTION

TABLE 19 GLOBAL MARKET, BY FUNCTIONALITY, 2017–2020 (USD MILLION)

TABLE 20 GLOBAL MARKET, BY FUNCTIONALITY, 2021–2026 (USD MILLION)

8.2 CLINICAL FUNCTIONALITY

TABLE 21 GLOBAL MARKET FOR CLINICAL FUNCTIONALITY, BY REGION, 2017–2020 (USD MILLION)

TABLE 22 GLOBAL MARKET FOR CLINICAL FUNCTIONALITY, BY REGION, 2021–2026 (USD MILLION)

TABLE 23 GLOBAL MARKET FOR CLINICAL FUNCTIONALITY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 24 GLOBAL MARKET FOR CLINICAL FUNCTIONALITY, BY TYPE, 2021–2026 (USD MILLION)

8.2.1 ELECTRONIC HEALTH RECORDS (EHRS)

8.2.1.1 EHR helps streamline clinical work workflows and reduce medical & prescription errors

TABLE 25 GLOBAL MARKET FOR EHRS, BY REGION, 2017–2020 (USD MILLION)

TABLE 26 GLOBAL MARKET FOR EHRS, BY REGION, 2021–2026 (USD MILLION)

8.2.2 CLINICAL DECISION SUPPORT (CDS)

8.2.2.1 CDS mainly helps evaluate drug prescription & diagnosis for interactive decision support

TABLE 27 GLOBAL MARKET FOR CDS, BY REGION, 2017–2020 (USD MILLION)

TABLE 28 GLOBAL MARKET FOR CDS, BY REGION, 2021–2026 (USD MILLION)

8.2.3 CARE PLANS

8.2.3.1 Care plans mainly help clinicians diagnose better treatment options for patients

TABLE 29 GLOBAL MARKET FOR CARE PLANS, BY REGION, 2017–2020 (USD MILLION)

TABLE 30 GLOBAL MARKET FOR CARE PLANS, BY REGION, 2021–2026 (USD MILLION)

8.2.4 E-PRESCRIBING

8.2.4.1 E-prescribing is a cost-effective method of providing valuable information to clinicians for decision making

TABLE 31 GLOBAL MARKET FOR E- PRESCRIBING, BY REGION, 2017–2020 (USD MILLION)

TABLE 32 GLOBAL MARKET FOR E- PRESCRIBING, BY REGION, 2021–2026 (USD MILLION)

8.2.5 TELEHEALTH

8.2.5.1 Telehealth provides flexibility in treatment options due to remote monitoring

TABLE 33 GLOBAL MARKET FOR TELEHEALTH, BY REGION, 2017–2020 (USD MILLION)

TABLE 34 GLOBAL MARKET FOR TELEHEALTH, BY REGION, 2021–2026 (USD MILLION)

8.3 ADMINISTRATIVE FUNCTIONALITY

TABLE 35 GLOBAL MARKET FOR ADMINISTRATIVE FUNCTIONALITY, BY REGION, 2017–2020 (USD MILLION)

TABLE 36 GLOBAL MARKET FOR ADMINISTRATIVE FUNCTIONALITY, BY REGION, 2021–2026 (USD MILLION)

TABLE 37 GLOBAL MARKET FOR ADMINISTRATIVE FUNCTIONALITY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 38 GLOBAL MARKET FOR ADMINISTRATIVE FUNCTIONALITY, BY TYPE, 2021–2026 (USD MILLION)

8.3.1 PATIENT/CLIENT SCHEDULING

8.3.1.1 Patient/client scheduling enables physicians to streamline workflows and efficiently manage patient schedules

TABLE 39 GLOBAL MARKET FOR PATIENT/CLIENT SCHEDULING, BY REGION, 2017–2020 (USD MILLION)

TABLE 40 GLOBAL MARKET FOR PATIENT/CLIENT SCHEDULING, BY REGION, 2021–2026 (USD MILLION)

8.3.2 DOCUMENT/IMAGE MANAGEMENT

8.3.2.1 Document/image management helps clinicians with the effective management of patient documents

TABLE 41 GLOBAL MARKET FOR DOCUMENT/IMAGE MANAGEMENT, BY REGION, 2017–2020 (USD MILLION)

TABLE 42 GLOBAL MARKET FOR DOCUMENT/IMAGE MANAGEMENT, BY REGION, 2021–2026 (USD MILLION)

8.3.3 CASE MANAGEMENT

8.3.3.1 Case management maximizes productivity and efficiency of treatment provided to a patient

TABLE 43 GLOBAL MARKET FOR CASE MANAGEMENT, BY REGION, 2017–2020 (USD MILLION)

TABLE 44 GLOBAL MARKET FOR CASE MANAGEMENT, BY REGION, 2021–2026 (USD MILLION)

8.3.4 BUSINESS INTELLIGENCE (BI)

8.3.4.1 Business Intelligence helps organizations gain key insights for better decision making

TABLE 45 GLOBAL MARKET FOR BUSINESS INTELLIGENCE, BY REGION, 2017–2020 (USD MILLION)

TABLE 46 GLOBAL MARKET FOR BUSINESS INTELLIGENCE, BY REGION, 2021–2026 (USD MILLION)

8.3.5 WORKFORCE MANAGEMENT

8.3.5.1 Workforce management effectively delivers behavioral health services at lower costs and provides adjustments to workforce availability

TABLE 47 GLOBAL MARKET FOR WORKFORCE MANAGEMENT, BY REGION, 2017–2020 (USD MILLION)

TABLE 48 GLOBAL MARKET FOR WORKFORCE MANAGEMENT, BY REGION, 2021–2026 (USD MILLION)

8.4 FINANCIAL FUNCTIONALITY

TABLE 49 GLOBAL MARKET FOR FINANCIAL FUNCTIONALITY, BY REGION, 2017–2020 (USD MILLION)

TABLE 50 GLOBAL MARKET FOR FINANCIAL FUNCTIONALITY, BY REGION, 2021–2026 (USD MILLION)

TABLE 51 GLOBAL MARKET FOR FINANCIAL FUNCTIONALITY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 52 GLOBAL MARKET FOR FINANCIAL FUNCTIONALITY, BY TYPE, 2021–2026 (USD MILLION)

8.4.1 REVENUE CYCLE MANAGEMENT

8.4.1.1 Revenue cycle management helps organizations analyze critical revenue cycle performance data and decrease operational costs

TABLE 53 GLOBAL MARKET FOR REVENUE CYCLE MANAGEMENT, BY REGION, 2017–2020 (USD MILLION)

TABLE 54 GLOBAL MARKET FOR REVENUE CYCLE MANAGEMENT, BY REGION, 2021–2026 (USD MILLION)

8.4.2 MANAGED CARE

8.4.2.1 Managed care helps control costs and improves the quality of healthcare provided to patients

TABLE 55 GLOBAL MARKET FOR MANAGED CARE, BY REGION, 2017–2020 (USD MILLION)

TABLE 56 GLOBAL MARKET FOR MANAGED CARE, BY REGION, 2021–2026 (USD MILLION)

8.4.3 ACCOUNTS PAYABLE/GENERAL LEDGER

8.4.3.1 Accounts payable/general ledger functionality helps maintain records of all financial transactions

TABLE 57 GLOBAL MARKET FOR ACCOUNTS PAYABLE/GENERAL LEDGER, BY REGION, 2017–2020 (USD MILLION)

TABLE 58 GLOBAL MARKET FOR ACCOUNTS PAYABLE/GENERAL LEDGER BY REGION, 2021–2026 (USD MILLION)

8.4.4 PAYROLL

8.4.4.1 Payrolls help maintain records of consultation fees and other payments

TABLE 59 GLOBAL MARKET FOR PAYROLL, BY REGION, 2017–2020 (USD MILLION)

TABLE 60 GLOBAL MARKET FOR PAYROLL, BY REGION, 2021–2026 (USD MILLION)

9 BEHAVIORAL HEALTH SOFTWARE MARKET, BY END USER (Page No. - 97)

9.1 INTRODUCTION

TABLE 61 GLOBAL MARKET, BY END USER, 2021–2026 (USD MILLION)

9.1.1 COMMUNITY CLINICS

9.1.1.1 Growing patient volume and the increasing need to improve efficiency of behavioral services to drive the market growth for community clinics

TABLE 62 GLOBAL MARKET FOR COMMUNITY CLINICS, BY REGION, 2021–2026 (USD MILLION)

9.1.2 HOSPITALS

9.1.2.1 Hospitals increasingly adopt BEHAVIORAL health software to manage patient care & records

TABLE 63 GLOBAL MARKET FOR HOSPITALS, BY REGION, 2021–2026 (USD MILLION)

9.1.3 PRIVATE PRACTICES

9.1.3.1 Private practises largely opt for behavioral health software to monitor THE daily healthcare statuses of patients

TABLE 64 GLOBAL MARKET FOR PRIVATE PRACTICES, BY REGION, 2021–2026 (USD MILLION)

10 BEHAVIORAL HEALTH SOFTWARE MARKET, BY REGION (Page No. - 101)

TABLE 65 GLOBAL MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 66 GLOBAL MARKET, BY REGION, 2021–2026 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 16 NORTH AMERICA: BEHAVIORAL HEALTH SOFTWARE MARKET SNAPSHOT

TABLE 67 NORTH AMERICA: MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 68 NORTH AMERICA: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 69 NORTH AMERICA: MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 70 NORTH AMERICA: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 71 NORTH AMERICA: MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 72 NORTH AMERICA: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 73 NORTH AMERICA: MARKET, BY DELIVERY MODEL, 2017–2020 (USD MILLION)

TABLE 74 NORTH AMERICA: MARKET, BY DELIVERY MODEL, 2021–2026 (USD MILLION)

TABLE 75 NORTH AMERICA: MARKET, BY END USER, 2021–2026 (USD MILLION)

TABLE 76 NORTH AMERICA: MARKET, BY FUNCTIONALITY, 2017–2020 (USD MILLION)

TABLE 77 NORTH AMERICA: MARKET, BY FUNCTIONALITY, 2021–2026 (USD MILLION)

TABLE 78 NORTH AMERICA: MARKET FOR CLINICAL FUNCTIONALITY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 79 NORTH AMERICA: MARKET FOR CLINICAL FUNCTIONALITY, BY TYPE, 2021–2026 (USD MILLION)

TABLE 80 NORTH AMERICA: MARKET FOR ADMINISTRATIVE FUNCTIONALITY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 81 NORTH AMERICA: MARKET FOR ADMINISTRATIVE FUNCTIONALITY, BY TYPE, 2021–2026 (USD MILLION)

TABLE 82 NORTH AMERICA: MARKET FOR FINANCIAL FUNCTIONALITY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 83 NORTH AMERICA: MARKET FOR FINANCIAL FUNCTIONALITY, BY TYPE, 2021–2026 (USD MILLION)

10.2.1 US

10.2.1.1 The US is a dominant segment of the global market

TABLE 84 US: BEHAVIORAL HEALTH SOFTWARE MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 85 US: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 86 US: MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 87 US: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 88 US: MARKET, BY DELIVERY MODEL, 2017–2020 (USD MILLION)

TABLE 89 US: MARKET, BY DELIVERY MODEL, 2021–2026 (USD MILLION)

TABLE 90 US: MARKET, BY END USER, 2021–2026 (USD MILLION)

TABLE 91 US: MARKET, BY FUNCTIONALITY, 2017–2020 (USD MILLION)

TABLE 92 US: MARKET, BY FUNCTIONALITY, 2021–2026 (USD MILLION)

TABLE 93 US: MARKET FOR CLINICAL FUNCTIONALITY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 94 US: MARKET FOR CLINICAL FUNCTIONALITY, BY TYPE, 2021–2026 (USD MILLION)

TABLE 95 US: MARKET FOR ADMINISTRATIVE FUNCTIONALITY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 96 US: MARKET FOR ADMINISTRATIVE FUNCTIONALITY, BY TYPE, 2021–2026 (USD MILLION)

TABLE 97 US: MARKET FOR FINANCIAL FUNCTIONALITY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 98 US: MARKET FOR FINANCIAL FUNCTIONALITY, BY TYPE, 2021–2026 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Investments in mental health and well-being contribute to market growth

TABLE 99 CANADA: BEHAVIORAL HEALTH SOFTWARE MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 100 CANADA: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 101 CANADA: MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 102 CANADA: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 103 CANADA: MARKET, BY DELIVERY MODEL, 2017–2020 (USD MILLION)

TABLE 104 CANADA: MARKET, BY DELIVERY MODEL, 2021–2026 (USD MILLION)

TABLE 105 CANADA: MARKET, BY END USER, 2021–2026 (USD MILLION)

TABLE 106 CANADA: MARKET, BY FUNCTIONALITY, 2017–2020 (USD MILLION)

TABLE 107 CANADA: MARKET, BY FUNCTIONALITY, 2021–2026 (USD MILLION)

TABLE 108 CANADA: MARKET FOR CLINICAL FUNCTIONALITY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 109 CANADA: MARKET FOR CLINICAL FUNCTIONALITY, BY TYPE, 2021–2026 (USD MILLION)

TABLE 110 CANADA: MARKET FOR ADMINISTRATIVE FUNCTIONALITY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 111 CANADA: MARKET FOR ADMINISTRATIVE FUNCTIONALITY, BY TYPE, 2021–2026 (USD MILLION)

TABLE 112 CANADA: MARKET FOR FINANCIAL FUNCTIONALITY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 113 CANADA: MARKET FOR FINANCIAL FUNCTIONALITY, BY TYPE, 2021–2026 (USD MILLION)

10.3 EUROPE

FIGURE 17 EUROPE: BEHAVIORAL HEALTH SOFTWARE MARKET SNAPSHOT

TABLE 114 EUROPE: MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 115 EUROPE: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 116 EUROPE: MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 117 EUROPE: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 118 EUROPE: MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 119 EUROPE: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 120 EUROPE: MARKET, BY DELIVERY MODEL, 2017–2020 (USD MILLION)

TABLE 121 EUROPE: MARKET, BY DELIVERY MODEL, 2021–2026 (USD MILLION)

TABLE 122 EUROPE: MARKET, BY END USER, 2021–2026 (USD MILLION)

TABLE 123 EUROPE: MARKET, BY FUNCTIONALITY, 2017–2020 (USD MILLION)

TABLE 124 EUROPE: MARKET, BY FUNCTIONALITY, 2021–2026 (USD MILLION)

TABLE 125 EUROPE: MARKET FOR CLINICAL FUNCTIONALITY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 126 EUROPE: MARKET FOR CLINICAL FUNCTIONALITY, BY TYPE, 2021–2026 (USD MILLION)

TABLE 127 EUROPE: MARKET FOR ADMINISTRATIVE FUNCTIONALITY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 128 EUROPE: MARKET FOR ADMINISTRATIVE FUNCTIONALITY, BY TYPE, 2021–2026 (USD MILLION)

TABLE 129 EUROPE: MARKET FOR FINANCIAL FUNCTIONALITY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 130 EUROPE: MARKET FOR FINANCIAL FUNCTIONALITY, BY TYPE, 2021–2026 (USD MILLION)

10.3.1 UK

10.3.1.1 Long waiting times and inadequate access to care will favor market growth in the UK

TABLE 131 UK: BEHAVIORAL HEALTH SOFTWARE MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 132 UK: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 133 UK: MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 134 UK: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 135 UK: MARKET, BY DELIVERY MODEL, 2017–2020 (USD MILLION)

TABLE 136 UK: MARKET, BY DELIVERY MODEL, 2021–2026 (USD MILLION)

TABLE 137 UK: MARKET, BY END USER, 2021–2026 (USD MILLION)

TABLE 138 UK: MARKET, BY FUNCTIONALITY, 2017–2020 (USD MILLION)

TABLE 139 UK: MARKET, BY FUNCTIONALITY, 2021–2026 (USD MILLION)

TABLE 140 UK: MARKET FOR CLINICAL FUNCTIONALITY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 141 UK: MARKET FOR CLINICAL FUNCTIONALITY, BY TYPE, 2021–2026 (USD MILLION)

TABLE 142 UK: MARKET FOR ADMINISTRATIVE FUNCTIONALITY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 143 UK: MARKET FOR ADMINISTRATIVE FUNCTIONALITY, BY TYPE, 2021–2026 (USD MILLION)

TABLE 144 UK: MARKET FOR FINANCIAL FUNCTIONALITY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 145 UK: MARKET FOR FINANCIAL FUNCTIONALITY, BY TYPE, 2021–2026 (USD MILLION)

10.3.2 GERMANY

10.3.2.1 Large patient base and growing burden on health providers is driving attention toward HCIT solutions

TABLE 146 GERMANY: BEHAVIORAL HEALTH SOFTWARE MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 147 GERMANY: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 148 GERMANY: MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 149 GERMANY: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 150 GERMANY: MARKET, BY DELIVERY MODEL, 2017–2020 (USD MILLION)

TABLE 151 GERMANY: MARKET, BY DELIVERY MODEL, 2021–2026 (USD MILLION)

TABLE 152 GERMANY: MARKET, BY END USER, 2021–2026 (USD MILLION)

TABLE 153 GERMANY: MARKET, BY FUNCTIONALITY, 2017–2020 (USD MILLION)

TABLE 154 GERMANY: MARKET, BY FUNCTIONALITY, 2021–2026 (USD MILLION)

TABLE 155 GERMANY: MARKET FOR CLINICAL FUNCTIONALITY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 156 GERMANY: MARKET FOR CLINICAL FUNCTIONALITY, BY TYPE, 2021–2026 (USD MILLION)

TABLE 157 GERMANY: MARKET FOR ADMINISTRATIVE FUNCTIONALITY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 158 GERMANY: MARKET FOR ADMINISTRATIVE FUNCTIONALITY, BY TYPE, 2021–2026 (USD MILLION)

TABLE 159 GERMANY: MARKET FOR FINANCIAL FUNCTIONALITY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 160 GERMANY: MARKET FOR FINANCIAL FUNCTIONALITY, BY TYPE, 2021–2026 (USD MILLION)

10.3.3 FRANCE

10.3.3.1 The high prevalence of behavioral disorders will drive support for implementing solutions in France

TABLE 161 FRANCE: BEHAVIORAL HEALTH SOFTWARE MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 162 FRANCE: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 163 FRANCE: MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 164 FRANCE: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 165 FRANCE: MARKET, BY DELIVERY MODEL, 2017–2020 (USD MILLION)

TABLE 166 FRANCE: MARKET, BY DELIVERY MODEL, 2021–2026 (USD MILLION)

TABLE 167 FRANCE: MARKET, BY END USER, 2021–2026 (USD MILLION)

TABLE 168 FRANCE: MARKET, BY FUNCTIONALITY, 2017–2020 (USD MILLION)

TABLE 169 FRANCE: MARKET, BY FUNCTIONALITY, 2021–2026 (USD MILLION)

TABLE 170 FRANCE: MARKET FOR CLINICAL FUNCTIONALITY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 171 FRANCE: MARKET FOR CLINICAL FUNCTIONALITY, BY TYPE, 2021–2026 (USD MILLION)

TABLE 172 FRANCE: MARKET FOR ADMINISTRATIVE FUNCTIONALITY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 173 FRANCE: MARKET FOR ADMINISTRATIVE FUNCTIONALITY, BY TYPE, 2021–2026 (USD MILLION)

TABLE 174 FRANCE: MARKET FOR FINANCIAL FUNCTIONALITY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 175 FRANCE: MARKET FOR FINANCIAL FUNCTIONALITY, BY TYPE, 2021–2026 (USD MILLION)

10.3.4 REST OF EUROPE

TABLE 176 ROE: BEHAVIORAL HEALTH SOFTWARE MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 177 ROE: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 178 ROE: MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 179 ROE: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 180 ROE: MARKET, BY DELIVERY MODEL, 2017–2020 (USD MILLION)

TABLE 181 ROE: MARKET, BY DELIVERY MODEL, 2021–2026 (USD MILLION)

TABLE 182 ROE: MARKET, BY END USER, 2021–2026 (USD MILLION)

TABLE 183 ROE: MARKET, BY FUNCTIONALITY, 2017–2020 (USD MILLION)

TABLE 184 ROE: MARKET, BY FUNCTIONALITY, 2021–2026 (USD MILLION)

TABLE 185 ROE: MARKET FOR CLINICAL FUNCTIONALITY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 186 ROE: MARKET FOR CLINICAL FUNCTIONALITY, BY TYPE, 2021–2026 (USD MILLION)

TABLE 187 ROE: MARKET FOR ADMINISTRATIVE FUNCTIONALITY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 188 ROE: MARKET FOR ADMINISTRATIVE FUNCTIONALITY, BY TYPE, 2021–2026 (USD MILLION)

TABLE 189 ROE: MARKET FOR FINANCIAL FUNCTIONALITY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 190 ROE: MARKET FOR FINANCIAL FUNCTIONALITY, BY TYPE, 2021–2026 (USD MILLION)

10.4 ASIA

TABLE 191 ASIA: BEHAVIORAL HEALTH SOFTWARE MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 192 ASIA: MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 193 ASIA: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 194 ASIA: MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 195 ASIA: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 196 ASIA: MARKET, BY DELIVERY MODEL, 2017–2020 (USD MILLION)

TABLE 197 ASIA: MARKET, BY DELIVERY MODEL, 2021–2026 (USD MILLION)

TABLE 198 ASIA: MARKET, BY END USER, 2021–2026 (USD MILLION)

TABLE 199 ASIA: MARKET, BY FUNCTIONALITY, 2017–2020 (USD MILLION)

TABLE 200 ASIA: MARKET, BY FUNCTIONALITY, 2021–2026 (USD MILLION)

TABLE 201 ASIA: MARKET FOR CLINICAL FUNCTIONALITY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 202 ASIA: MARKET FOR CLINICAL FUNCTIONALITY, BY TYPE, 2021–2026 (USD MILLION)

TABLE 203 ASIA: MARKET FOR ADMINISTRATIVE FUNCTIONALITY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 204 ASIA: MARKET FOR ADMINISTRATIVE FUNCTIONALITY, BY TYPE, 2021–2026 (USD MILLION)

TABLE 205 ASIA: MARKET FOR FINANCIAL FUNCTIONALITY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 206 ASIA: BEHAVIORAL HEALTH SOFTWARE MARKET FOR FINANCIAL FUNCTIONALITY, BY TYPE, 2021–2026 (USD MILLION)

10.4.1 JAPAN

10.4.1.1 Japan dominates the APAC market for behavioral health software

TABLE 207 JAPAN: BEHAVIORAL HEALTH SOFTWARE MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 208 JAPAN: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 209 JAPAN: MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 210 JAPAN: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 211 JAPAN: MARKET, BY DELIVERY MODEL, 2017–2020 (USD MILLION)

TABLE 212 JAPAN: MARKET, BY DELIVERY MODEL, 2021–2026 (USD MILLION)

TABLE 213 JAPAN: MARKET, BY END USER, 2021–2026 (USD MILLION)

TABLE 214 JAPAN: MARKET, BY FUNCTIONALITY, 2017–2020 (USD MILLION)

TABLE 215 JAPAN: MARKET, BY FUNCTIONALITY, 2021–2026 (USD MILLION)

TABLE 216 JAPAN: MARKET FOR CLINICAL FUNCTIONALITY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 217 JAPAN: MARKET FOR CLINICAL FUNCTIONALITY, BY TYPE, 2021–2026 (USD MILLION)

TABLE 218 JAPAN: MARKET FOR ADMINISTRATIVE FUNCTIONALITY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 219 JAPAN: MARKET FOR ADMINISTRATIVE FUNCTIONALITY, BY TYPE, 2021–2026 (USD MILLION)

TABLE 220 JAPAN: MARKET FOR FINANCIAL FUNCTIONALITY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 221 JAPAN: MARKET FOR FINANCIAL FUNCTIONALITY, BY TYPE, 2021–2026 (USD MILLION)

10.4.2 CHINA

10.4.2.1 The rising incidence of mental illnesses drives demand for care solutions in China

TABLE 222 CHINA: BEHAVIORAL HEALTH SOFTWARE MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 223 CHINA: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 224 CHINA: MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 225 CHINA: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 226 CHINA: MARKET, BY DELIVERY MODEL, 2017–2020 (USD MILLION)

TABLE 227 CHINA: MARKET, BY DELIVERY MODEL, 2021–2026 (USD MILLION)

TABLE 228 CHINA: MARKET, BY END USER, 2021–2026 (USD MILLION)

TABLE 229 CHINA: MARKET, BY FUNCTIONALITY, 2017–2020 (USD MILLION)

TABLE 230 CHINA: MARKET, BY FUNCTIONALITY, 2021–2026 (USD MILLION)

TABLE 231 CHINA: MARKET FOR CLINICAL FUNCTIONALITY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 232 CHINA: MARKET FOR CLINICAL FUNCTIONALITY, BY TYPE, 2021–2026 (USD MILLION)

TABLE 233 CHINA: MARKET FOR ADMINISTRATIVE FUNCTIONALITY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 234 CHINA: MARKET FOR ADMINISTRATIVE FUNCTIONALITY, BY TYPE, 2021–2026 (USD MILLION)

TABLE 235 CHINA: MARKET FOR FINANCIAL FUNCTIONALITY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 236 CHINA: MARKET FOR FINANCIAL FUNCTIONALITY, BY TYPE, 2021–2026 (USD MILLION)

10.4.3 INDIA

10.4.3.1 Inadequate workforce and lack of access will drive adoption of solutions

TABLE 237 INDIA: BEHAVIORAL HEALTH SOFTWARE MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 238 INDIA: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 239 INDIA: MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 240 INDIA: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 241 INDIA: MARKET, BY DELIVERY MODEL, 2017–2020 (USD MILLION)

TABLE 242 INDIA: MARKET, BY DELIVERY MODEL, 2021–2026 (USD MILLION)

TABLE 243 INDIA: MARKET, BY END USER, 2021–2026 (USD MILLION)

TABLE 244 INDIA: MARKET, BY FUNCTIONALITY, 2017–2020 (USD MILLION)

TABLE 245 INDIA: MARKET, BY FUNCTIONALITY, 2021–2026 (USD MILLION)

TABLE 246 INDIA: MARKET FOR CLINICAL FUNCTIONALITY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 247 INDIA: MARKET FOR CLINICAL FUNCTIONALITY, BY TYPE, 2021–2026 (USD MILLION)

TABLE 248 INDIA: MARKET FOR ADMINISTRATIVE FUNCTIONALITY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 249 INDIA: MARKET FOR ADMINISTRATIVE FUNCTIONALITY, BY TYPE, 2021–2026 (USD MILLION)

TABLE 250 INDIA: MARKET FOR FINANCIAL FUNCTIONALITY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 251 INDIA: MARKET FOR FINANCIAL FUNCTIONALITY, BY TYPE, 2021–2026 (USD MILLION)

10.4.4 ROA

TABLE 252 ROA: BEHAVIORAL HEALTH SOFTWARE MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 253 ROA: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 254 ROA: MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 255 ROA: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 256 ROA: MARKET, BY DELIVERY MODEL, 2017–2020 (USD MILLION)

TABLE 257 ROA: MARKET, BY DELIVERY MODEL, 2021–2026 (USD MILLION)

TABLE 258 ROA: MARKET, BY END USER, 2021–2026 (USD MILLION)

TABLE 259 ROA: MARKET, BY FUNCTIONALITY, 2017–2020 (USD MILLION)

TABLE 260 ROA: MARKET, BY FUNCTIONALITY, 2021–2026 (USD MILLION)

TABLE 261 ROA: MARKET FOR CLINICAL FUNCTIONALITY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 262 ROA: MARKET FOR CLINICAL FUNCTIONALITY, BY TYPE, 2021–2026 (USD MILLION)

TABLE 263 ROA: MARKET FOR ADMINISTRATIVE FUNCTIONALITY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 264 ROA: MARKET FOR ADMINISTRATIVE FUNCTIONALITY, BY TYPE, 2021–2026 (USD MILLION)

TABLE 265 ROA: MARKET FOR FINANCIAL FUNCTIONALITY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 266 ROA: MARKET FOR FINANCIAL FUNCTIONALITY, BY TYPE, 2021–2026 (USD MILLION)

10.5 REST OF THE WORLD

TABLE 267 ROW: BEHAVIORAL HEALTH SOFTWARE MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 268 ROW: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 269 ROW: MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 270 ROW: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 271 ROW: MARKET, BY DELIVERY MODEL, 2017–2020 (USD MILLION)

TABLE 272 ROW: MARKET, BY DELIVERY MODEL, 2021–2026 (USD MILLION)

TABLE 273 ROW: MARKET, BY END USER, 2021–2026 (USD MILLION)

TABLE 274 ROW: MARKET, BY FUNCTIONALITY, 2017–2020 (USD MILLION)

TABLE 275 ROW: MARKET, BY FUNCTIONALITY, 2021–2026 (USD MILLION)

TABLE 276 ROW: MARKET FOR CLINICAL FUNCTIONALITY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 277 ROW: MARKET FOR CLINICAL FUNCTIONALITY, BY TYPE, 2021–2026 (USD MILLION)

TABLE 278 ROW: MARKET FOR ADMINISTRATIVE FUNCTIONALITY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 279 ROW: MARKET FOR ADMINISTRATIVE FUNCTIONALITY, BY TYPE, 2021–2026 (USD MILLION)

TABLE 280 ROW: MARKET FOR FINANCIAL FUNCTIONALITY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 281 ROW: MARKET FOR FINANCIAL FUNCTIONALITY, BY TYPE, 2021–2026 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 181)

11.1 OVERVIEW

FIGURE 18 KEY PLAYERS ADOPTED ORGANIC AS WELL AS INORGANIC GROWTH STRATEGIES BETWEEN JANUARY 2018 AND MAY 2021

11.2 MARKET PLAYER RANKING, 2020

TABLE 282 BEHAVIORAL HEALTH SOFTWARE MARKET RANKING, BY KEY PLAYER, 2020

11.3 COMPETITIVE SCENARIO

11.3.1 PARTNERSHIPS, AGREEMENTS, AND COLLABORATIONS, JANUARY 2018 TO MAY 2021

11.3.2 PRODUCT LAUNCHES, JANUARY 2018 TO MAY 2021

11.3.3 ACQUISITIONS, JANUARY 2018 TO MAY 2021

12 COMPANY EVALUATION MATRIX (Page No. - 185)

12.1 COMPANY EVALUATION MATRIX

12.1.1 COMPANY EVALUATION MATRIX: DEFINITIONS AND METHODOLOGY

12.1.2 STARS

12.1.3 EMERGING LEADERS

12.1.4 PERVASIVE PLAYERS

12.1.5 PARTICIPANTS

FIGURE 19 COMPANY EVALUATION MATRIX: BEHAVIORAL HEALTH SOFTWARE MARKET

12.2 COMPANY PROFILES

12.2.1 CERNER CORPORATION

12.2.1.1 Business overview

FIGURE 20 CERNER CORPORATION: COMPANY SNAPSHOT (2020)

12.2.1.2 Products offered

12.2.1.3 Recent developments

12.2.1.4 MnM view

12.2.2 NETSMART TECHNOLOGIES

12.2.2.1 Business overview

12.2.2.2 Products offered

12.2.2.3 Recent developments

12.2.2.4 MnM view

12.2.3 QUALIFACTS

12.2.3.1 Business overview

12.2.3.2 Products offered

12.2.3.3 Recent developments

12.2.3.4 MnM view

12.2.4 VALANT

12.2.4.1 Business overview

12.2.4.2 Products offered

12.2.4.3 Recent developments

12.2.4.4 MnM view

12.2.5 NEXTGEN HEALTHCARE

12.2.5.1 Business overview

FIGURE 21 NEXTGEN HEALTHCARE: COMPANY SNAPSHOT (2020)

12.2.5.2 Products offered

12.2.5.3 Recent developments

12.2.5.4 MnM view

12.2.6 CORE SOLUTIONS

12.2.6.1 Business overview

12.2.6.2 Products offered

12.2.6.3 Recent developments

12.2.7 MINDLINC

12.2.7.1 Business overview

12.2.7.2 Products offered

12.2.8 ECHO GROUP

12.2.8.1 Business overview

12.2.8.2 Products offered

12.2.9 WELLIGENT, INC.

12.2.9.1 Business overview

12.2.9.2 Products offered

12.2.9.3 Recent developments

12.2.10 CREDIBLE BEHAVIORAL HEALTH, INC.

12.2.10.1 Business overview

12.2.10.2 Products offered

12.2.10.3 Recent developments

12.2.11 MEDITAB SOFTWARE INC.

12.2.11.1 Business overview

12.2.11.2 Products offered

12.2.12 KAREO

12.2.12.1 Business overview

12.2.12.2 Products offered

12.2.12.3 Recent developments

12.2.13 COMPULINK HEALTHCARE SOLUTIONS

12.2.13.1 Business overview

12.2.13.2 Products offered

12.2.13.3 Recent developments

12.2.14 ADVANCED DATA SYSTEMS CORPORATION

12.2.14.1 Business overview

12.2.14.2 Products offered

12.2.14.3 Recent developments

12.2.15 ADVANCEDMD, INC.

12.2.15.1 Business overview

12.2.15.2 Products offered

12.3 OTHER COMPANIES

12.3.1 CUREMD

12.3.2 EPIC SYSTEMS CORPORATION

12.3.3 ACCUMEDIC

12.3.4 MEDIWARE

12.3.5 ALLSCRIPTS

13 APPENDIX (Page No. - 210)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

The study involved four major activities in estimating the current market size for behavioral health software. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter market breakdown and data triangulation was used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as D&B Hoovers, Bloomberg Business, and Factiva have been referred to, so as to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, regulatory bodies, and databases.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives. Primary sources from the demand side include expert researchers, psychiatrists, nurses, third-party administrators, health insurers, behavioral health associations, behavioral health service providers, and hospital purchase managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the sizes of the market and various other dependent submarkets of the behavioral health software market. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and markets have been identified through extensive secondary research

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market was validated using both top-down and bottom-up approaches.

Report Objectives

- To define, describe, segment, and forecast the behavioral health software market by component, delivery model, functionality, end user, and region

- To provide detailed information about the major factors influencing the market growth (key drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contributions to the overall behavioral health software market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the market value of various segments and subsegments with respect to North America, Europe, Asia, and the Rest of the world

- To profile the key players active in the behavioral health software market and comprehensively analyze their global revenue shares and core competencies2

- To track and analyze competitive market-specific developments such as product launches; collaborations and partnerships; and mergers & acquisitions in the behavioral health software market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the present behavioral health software market report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company (Top 3 companies)

Company Information

- Detailed analysis and profiling of additional market players (up to 3)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Behavioral Health Software Market

Which is the fastest growing market of Single use Behavioral Health Software Market?

Can you enlighten us with your market intelligence to grow and sustain in Behavioral Health Software Market?

What are the growth estimates for Behavioral Health Software Market till 2026?