Battery-free Sensors Market by Sensor Type (Temperature Sensors, Humidity/Moisture Sensors, Pressure Sensors), Frequency, Industry (Automotive, Logistics, Healthcare, Food & Beverages), and Region (2021-2026)

Updated on : October 18 , 2023

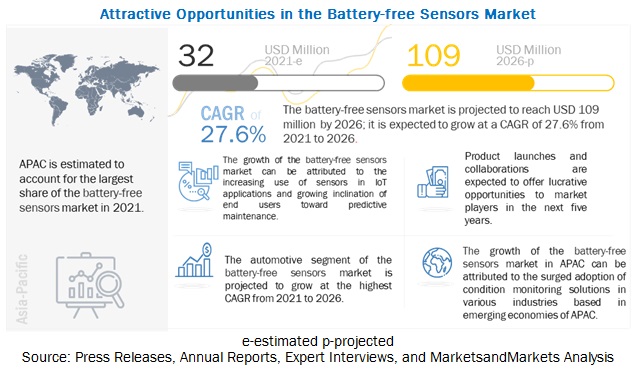

The Battery-free sensors market size is projected to grow from USD 32 million in 2022 to USD 109 million by 2026; it is expected to grow at a CAGR of 27.6% from 2021 to 2026.

With rapid technological advancements, battery-free sensors are increasingly adopted in IoT applications to improve production efficiency and reduce operational and maintenance costs in the wake of COVID-19. Additionally, the ongoing miniaturization of medical and electronic devices and the growing implementation of automated condition monitoring solutions in smart factories are expected to boost the growth of the battery-free sensors industry during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Driver: Rising use of battery-less sensors in IoT applications to reduce maintenance costs, coupled with rapid advancements in sensing technology

Significant technological developments since the past decade have resulted in a considerable reduction in the size of different types of sensors, such as temperature, level, pressure, and image sensors. The use of RFID technology instead of a battery has helped manufacturers reduce the size of sensors to a great extent. Thus, owing to the rapid reduction in the sensor size, sensors are increasingly being used in automotive, healthcare, consumer electronics, and many other industries. This has played a major role in the growth of the overall battery-free sensor market. In the last five years, sensors with a small form factor were rapidly installed in devices such as smartphones, drones, wearables, and robots.

The development of low-cost and highly reliable sensors has led to the increased use of sensing technologies in IoT applications. Initially, the cost of sensors used in IoT devices was high; therefore, their adoption was limited only to a few industries, such as consumer electronics. However, during the last decade, sensor technology has evolved, and its cost declined twofold. Hence, sensors are increasingly being used in IoT devices. Currently, sensors are used in almost every application, be it healthcare, automotive, consumer electronics, or retail.

Restraint: Data security concerns

Although IoT has a huge potential, there are concerns regarding data privacy and security associated with IoT devices. The IoT is entirely data-driven. IoT-enabled devices and sensors generate a huge volume of data per second. Companies and organizations use different types of sensors to monitor this data and make decisions based on the data. As they depend more on machine-generated data for real-time business processes, it is necessary to ensure the authenticity of data, as well as the security, resilience, and reliability of devices that collect data. As IoT connects numerous devices, it provides more decentralized entry points for malware. If the IoT infrastructure is poorly secured, then cyber attackers may use them as entry points, causing harm to other devices in the network.

Opportunity: High implementation of predictive maintenance programs in industrial environments

Predictive maintenance (PdM) is one of the key opportunity areas for the battery-free sensors market. It is an important tool for industrial, transportation, and healthcare verticals. PdM helps reduce the operating and capital costs of Industrial IoT (IIoT) by facilitating proactive servicing and repair of assets while allowing more efficient use of repair resources both human labor and replacement products. PdM gives companies the ability to accurately diagnose and prevent failures in real-time, which is vital for critical infrastructure applications. Any failure of high-tech machinery and equipment can prove to be highly expensive, in terms of repair costs, in addition to the loss of productivity from the resulting downtime. Typically, technicians are sent to carry out routine diagnostic inspections and preventive maintenance according to fixed schedules, which can be costly and labor-intensive while providing little assurance that failure would not occur between inspections. By deploying a PdM program, potential failures can be identified well in advance, and corrective measures can be initiated accordingly. Battery-free sensors can be used to detect when a critical piece of machinery is close to failing. The data generated by sensors indicates if the bearing is about to fail and predicts how long it will last before failure. Hence, the awareness about the benefits of predictive maintenance would bring lucrative opportunities for the growth of the market for smart and intelligent sensors, which can be used to detect failures much in advance

Challenge: Lack of knowledge to handle large data sets

Battery-free sensors are integrated with RFID tags to transmit tracked, identified, and monitored data to operators. The generated data is in large volumes. For instance, in a data center, tracking of assets, such as servers, tapes, media, routers, and other devices, generates terabytes of data in a single day. Thus, handling the data that keeps on increasing exponentially is a major challenge companies are facing. If this data is not handled carefully, an additional issue of load on servers or low storage capacity might arise.

Ultra high frequency is expected to contribute the largest share to the battery-free sensors market during the forecast period

At present, most battery-free sensor manufacturers offer UHF sensors for various applications. These sensors have much longer read ranges (up to 20 feet)than that of low-frequency and high-frequency sensors and can be mounted on metal; hence, UHF sensors are ideal for industrial applications. UHF sensors also allow multiple sensors to read with the help of one reader. Thus, UHF sensors work well in a wireless sensor network. These factors contribute to the high demand for UFH battery-free sensors. Similarly, high-frequency sensors hold a significant market share owing to the high deployment of these sensors in medical devices, smartphones, and supply chain applications.

Automotive segment is expected to lead the battery-free sensors market in 2020

Automotive segment is expected to hold the largest share in the battery-free sensors market during the forecast period. Automobile companies across the world are emphasizing on automating and upgrading their assembly lines. Automobile manufacturers adopt battery-free sensors at a significant rate owing to their advantages, such as prediction and prevention of equipment failure by improvising the performance and efficiency of assets and equipment at reduced maintenance costs. Battery-free sensors enable predictive maintenance and help efficient handling of assembly operations in the automotive industry. Hence, the automotive industry is expected to capture the largest market share throughout the forecast period. Automobile original equipment manufacturers (OEM) and players within the mobility industry are among the worst hit by the COVID-19pandemic. Automobile OEMs increasingly rely on just-in-time manufacturing, which is presently affecting their production capabilities and overall exports owing to supply chain disruptions.

To know about the assumptions considered for the study, download the pdf brochure

Battery-free sensors market in APAC contributed the largest share in 2020.

Market in APAC is expected to grow at the highest CAGR during 2021−2026. Ongoing industrialization, growing adoption of predictive maintenance tools, and increasing competitive pressure to achieve operational efficiency are fueling the growth of market in this region. The expansion of manufacturing activities resulting from the migration of production bases to Asian countries, such as China, India, and South Korea, with low labor costs, drives the demand for battery-free sensors in the region. However, the outbreak of COVID-19 has impacted the manufacturing facilities of all verticals across the world, forcing them to shut down. However, production has resumed in a few facilities in China, thereby initiating the manufacturing of some essentials.

Key Market Players

The battery-free sensors companies have implemented various types of organic as well as inorganic growth strategies, such as product launches, product developments, partnerships, and collaborations to strengthen their offerings in the market. ON Semiconductor (UK), Farsens (Spain), Axzon (Rfmicron) (US), Inductosense (UK), Phase IV Engineering (US), Powercast (US), Distech Controls (US), EnOcean (Germany), DCO Systems (UK), and Everactive (US), are some of the major players in battery-free sensors market.

The study includes an in-depth competitive analysis of these key players in battery-free sensors market with their company profiles, recent developments, and key market strategies.

Battery-free Sensors Market Report Scope:

|

Report Metric |

Details |

| Estimated Market Size | USD 32 million in 2022 |

| Projected Market Size | USD 109 million by 2026 |

| Growth Rate | CAGR of 27.6% |

|

Years considered |

2017–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021–2026 |

|

Forecast units |

Value (USD million and USD thousand), Volume (Million Units) |

|

Segments covered |

Frequency, Sensor Type, Industry, and Region |

|

Regions covered |

North America, APAC, Europe, and RoW |

|

Companies covered |

ON Semiconductor (UK), Axzon (Rfmicron) (US), Farsens (Spain), Inductosense (UK), and Phase IV Engineering (US) |

In this report, the overall battery-free sensors market has been segmented based on frequency, sensor type, industry, and region

Battery-free sensors Market, By Frequency:

- Low Frequency

- High Frequency

- Ultra High Frequency

Battery-free sensors Market, By Sensor Type:

- Temperature Sensors

- Humidity/Moisture Sensors

- Pressure Sensors

- Motion and Position Sensors

- Light Sensors

- Others

Battery-free sensors Market, By Industry

- Automotive

- Logistics

- Healthcare

- Oil & Gas

- Food & Beverages

- IT & Telecommunications

- Others

Geographic Analysis

- North America (US, Canada, and Mexico)

- Europe (UK, Germany, Netherlands, Norway and Rest of Europe)

- Asia Pacific (China, Japan, India, and Rest of APAC)

- Rest of the World (South America, and Middle East & Africa)

Recent Developments

- In May 2021, Everactive launched a new generation of its Steam Trap Monitoring (STM) system designed to deliver predictive maintenance for large-scale steam system applications. Everactive’s STM is a batteryless IoT system for steam traps that involves batteryless Eversensors connecting to a wireless IoT gateway using the Evernet 2.0 wireless network.

- In November 2020, Phase IV and WIKA signed a partnership agreement to offer innovative IIoT solutions. In August 2020, WIKA made a majority of investment in Phase IV Engineering. Through this partnership, Phase IV will offer customers the best-in-measurement technologies and Industrial Internet of Things (IIoT).

Frequently Asked Questions (FAQ):

What is the market size of battery-free sensors market expected in 2026?

The Battery-free sensors market is expected to be valued at USD 109 million by 2026.

Which are the top players in the battery-free sensors market?

The major vendors operating in the battery-free sensors market include ON Semiconductor, Farsens (Spain), Axzon, Inductosense , and Phase IV Engineering, among others.

Which major countries are considered in the North America region?

The report includes an analysis of the US, Canada, and Mexico countries.

Which are the major industries of battery-free sensors batteries?

Consumer electronics, power generation, and automotive industries are major adopters of battery-free sensors.

Does this report include the impact of COVID-19 on the market?

Yes, the report includes the impact of COVID-19 on the Battery-free sensors market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 BATTERY-FREE SENSORS MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

FIGURE 2 BATTERY-FREE SENSORS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.2 SECONDARY DATA

2.1.2.1 Key secondary sources

2.1.2.2 Secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Primary interviews with experts

2.1.3.2 Primary sources

2.1.3.3 Key industry insights

2.1.3.4 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving at market size using bottom-up analysis

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing market size using top-down analysis

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 5 METHODOLOGY USED TO ESTIMATE BATTERY-FREE SENSORS MARKET SIZE USING SUPPLY-SIDE ANALYSIS

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTION

2.5 RISK ASSESSMENTS

TABLE 1 LIMITATIONS AND ASSOCIATED RISKS

3 EXECUTIVE SUMMARY (Page No. - 42)

TABLE 2 BATTERY-FREE SENSORS MARKET, 2017–2020 (USD MILLION)

TABLE 3 MARKET, 2021–2026 (USD MILLION)

FIGURE 7 EFFECT OF COVID-19 ON MARKET

3.1 REALISTIC SCENARIO

TABLE 4 POST-COVID-19 SCENARIO: MARKET, 2021–2026 (USD MILLION)

3.2 OPTIMISTIC SCENARIO (POST-COVID-19)

TABLE 5 OPTIMISTIC SCENARIO (POST-COVID-19): MARKET, 2021–2026 (USD MILLION)

3.3 PESSIMISTIC SCENARIO (POST-COVID-19)

TABLE 6 PESSIMISTIC SCENARIO (POST-COVID-19): MARKET, 2021–2026 (USD MILLION)

FIGURE 8 TEMPERATURE BATTERY-FREE SENSORS TO HOLD LEADING POSITION IN MARKET THROUGHOUT FORECAST PERIOD

FIGURE 9 AUTOMOTIVE INDUSTRY TO RECORD HIGHEST CAGR IN MARKET FROM 2021 TO 2026

FIGURE 10 APAC TO HOLD LARGEST SHARE OF MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 48)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN BATTERY-FREE SENSORS MARKET

FIGURE 11 RISING ADOPTION OF IOT DEVICES BY MANUFACTURING COMPANIES TO FUEL GROWTH OF MARKET FROM 2021 TO 2026

4.2 MARKET, BY SENSOR TYPE

FIGURE 12 BATTERY-FREE TEMPERATURE SENSORS TO DOMINATE MARKET FROM 2021 TO 2026

4.3 MARKET, BY FREQUENCY

FIGURE 13 ULTRA-HIGH-FREQUENCY BATTERY-FREE SENSORS TO LEAD MARKET DURING FORECAST PERIOD

4.4 MARKET IN NORTH AMERICA, BY INDUSTRY AND COUNTRY

FIGURE 14 LOGISTICS INDUSTRY AND US TO HOLD LARGEST SHARE OF NORTH AMERICAN MARKET IN 2026

4.5 MARKET, BY INDUSTRY

FIGURE 15 AUTOMOTIVE INDUSTRY TO HOLD LARGEST SIZE OF BATTERY-FREE SENSORS MARKET IN 2026

4.6 MARKET, BY COUNTRY

FIGURE 16 INDIA TO EXHIBIT HIGHEST CAGR IN MARKET FROM 2021 TO 2026

5 MARKET OVERVIEW (Page No. - 53)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Rising use of battery-less sensors in IoT applications to reduce maintenance costs, coupled with rapid advancements in sensing technology

5.2.1.2 Increasing installation of battery-free sensors in manufacturing plants during COVID-19 scenario to improve productivity

5.2.1.3 Ongoing miniaturization of medical and electronic devices

5.2.1.4 Surging adoption of automated condition monitoring solutions in smart factories

FIGURE 18 IMPACT OF DRIVERS ON BATTERY-FREE SENSORS MARKET

5.2.2 RESTRAINTS

5.2.2.1 High set up costs associated with the installation of sensor networks and intense price competition

5.2.2.2 Data security concerns

FIGURE 19 IMPACT OF RESTRAINTS ON MARKET

5.2.3 OPPORTUNITIES

5.2.3.1 Supportive government initiatives and funds sanctioned for IoT projects

TABLE 7 GOVERNMENT FUNDING PLANS FOR INTERNET OF THINGS PROJECTS

5.2.3.2 High implementation of predictive maintenance programs in industrial environments

FIGURE 20 IMPACT OF OPPORTUNITIES ON MARKET

5.2.4 CHALLENGES

5.2.4.1 Restricted market growth in first half of 2020 owing to supply chain disruptions resulting from COVID-19

5.2.4.2 Lack of knowledge to handle large data sets

FIGURE 21 IMPACT OF CHALLENGES ON MARKET

5.3 VALUE CHAIN ANALYSIS

FIGURE 22 BATTERY-FREE SENSORS MARKET: MAJOR VALUE ADDED BY MANUFACTURERS

5.4 ECOSYSTEM ANALYSIS

TABLE 8 ECOSYSTEM: BATTERY-FREE SENSORS

5.5 REVENUE SHIFT AND NEW REVENUE POCKETS FOR MARKET

5.6 PORTER’S FIVE FORCES ANALYSIS

TABLE 9 IMPACT OF EACH FORCE ON MARKET (2020)

5.7 CASE STUDY ANALYSIS

TABLE 10 INDUCTOSENSE TO PROVIDE BATTERY-FREE SENSOR FOR CONSTRUCTION OF SMART OILFIELDS IN CHINA

TABLE 11 NHS ADOPTING REAL-TIME MONITORING SOLUTIONS TO IMPROVE PERFORMANCE

5.8 TECHNOLOGY ANALYSIS

5.8.1 INTERNET OF THINGS (IOT)

5.8.2 5G

5.8.3 QUANTUM DOT CMOS TECHNOLOGY

5.8.4 MULTI PIXEL TECHNOLOGY (MPT)

5.9 PRICING ANALYSIS

TABLE 12 AVERAGE SELLING PRICES OF BATTERY-FREE SENSORS OFFERED BY TOP COMPANIES, 2020

5.10 TRADE ANALYSIS

FIGURE 23 IMPORT DATA, BY COUNTRY, 2016–2020 (USD THOUSAND)

FIGURE 24 EXPORT DATA, 2016–2020 (USD THOUSAND)

5.11 PATENT ANALYSIS

FIGURE 25 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

TABLE 13 TOP 20 PATENT OWNERS IN US IN LAST 10 YEARS

5.12 TARIFF LANDSCAPE

TABLE 14 TARIFF IMPOSED BY US ON EXPORT OF INSTRUMENTS AND APPARATUS FOR MEASURING OR CHECKING FLOW, LEVEL, PRESSURE, OR OTHER VARIABLES OF LIQUIDS OR GASES, BY COUNTRY, 2020

TABLE 15 TARIFF IMPOSED BY CHINA ON EXPORT OF INSTRUMENTS AND APPARATUS FOR MEASURING OR CHECKING FLOW, LEVEL, PRESSURE, OR OTHER VARIABLES OF LIQUIDS OR GASES, BY COUNTRY, 2020

TABLE 16 TARIFF IMPOSED BY GERMANY ON EXPORT OF INSTRUMENTS AND APPARATUS FOR MEASURING OR CHECKING FLOW, LEVEL, PRESSURE, OR OTHER VARIABLES OF LIQUIDS OR GASES, BY COUNTRY, 2020

5.13 REGULATORY LANDSCAPE

5.13.1 US

5.13.2 CANADA

5.13.3 EUROPE

5.13.4 INDONESIA

5.13.5 INDIA

6 BATTERY-FREE SENSORS MARKET, BY FREQUENCY (Page No. - 77)

6.1 INTRODUCTION

FIGURE 26 BATTERY-FREE SENSORS MARKET, BY FREQUENCY

TABLE 17 MARKET, BY FREQUENCY, 2017–2020 (USD MILLION)

TABLE 18 MARKET, BY FREQUENCY, 2021–2026 (USD MILLION)

6.2 LOW FREQUENCY

6.2.1 ACCESS CONTROL AND INVENTORY MANAGEMENT APPLICATIONS ARE MAJOR CONTRIBUTORS TO THE GROWTH OF LOW-FREQUENCY SEGMENT

TABLE 19 LOW-FREQUENCY MARKET, BY INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 20 LOW-FREQUENCY MARKET, BY INDUSTRY, 2021–2026 (USD THOUSAND)

6.3 HIGH FREQUENCY

6.3.1 MEDICAL DEVICES AND SUPPLY CHAIN APPLICATIONS CONTRIBUTE MOST TO RISING DEMAND FOR HIGH-FREQUENCY SENSORS

TABLE 21 HIGH-FREQUENCY MARKET, BY INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 22 HIGH-FREQUENCY MARKET, BY INDUSTRY, 2021–2026 (USD THOUSAND)

6.4 ULTRA HIGH FREQUENCY

6.4.1 ULTRA-HIGH-FREQUENCY BATTERY-FREE SENSORS ARE THE MOST IN-DEMAND SENSORS

TABLE 23 ULTRA-HIGH-FREQUENCY MARKET, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 24 ULTRA-HIGH-FREQUENCY MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

7 BATTERY-FREE SENSORS MARKET, BY SENSOR TYPE (Page No. - 84)

7.1 INTRODUCTION

FIGURE 27 BATTERY-FREE SENSORS MARKET, BY SENSOR TYPE

TABLE 25 MARKET, BY SENSOR TYPE, 2017–2020 (USD MILLION)

TABLE 26 MARKET, BY SENSOR TYPE, 2021–2026 (USD MILLION)

7.2 TEMPERATURE SENSORS

7.2.1 HIGH ADOPTION OF TEMPERATURE SENSORS IN MANUFACTURING SECTOR TO DRIVE MARKET GROWTH

TABLE 27 BATTERY-FREE TEMPERATURE SENSORS MARKET, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 28 BATTERY-FREE TEMPERATURE SENSORS MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

FIGURE 28 APAC TO LEAD BATTERY-FREE TEMPERATURE SENSORS MARKET THROUGHOUT FORECAST PERIOD

TABLE 29 BATTERY-FREE TEMPERATURE SENSORS MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 30 BATTERY-FREE TEMPERATURE SENSORS MARKET, BY REGION, 2021–2026 (USD MILLION)

7.3 HUMIDITY/MOISTURE SENSORS

7.3.1 EASY CONNECTIVITY TO DEVICES ENABLED WITH WI-FI TO BOOST DEMAND FOR BATTERY-FREE HUMIDITY SENSORS

TABLE 31 BATTERY-FREE HUMIDITY/MOISTURE SENSORS MARKET, BY INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 32 BATTERY-FREE HUMIDITY/MOISTURE SENSORS MARKET, BY INDUSTRY, 2021–2026 (USD THOUSAND)

TABLE 33 BATTERY-FREE HUMIDITY/MOISTURE SENSORS MARKET, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 34 BATTERY-FREE HUMIDITY/MOISTURE SENSORS MARKET, BY REGION, 2021–2026 (USD THOUSAND)

7.4 PRESSURE SENSORS

7.4.1 HIGH DEMAND FROM INDUSTRIES SUCH AS CHEMICALS, PETROCHEMICALS, PHARMACEUTICALS, OIL & GAS, AND FOOD & BEVERAGES PROPELS MARKET GROWTH

TABLE 35 BATTERY-FREE PRESSURE SENSORS MARKET, BY INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 36 BATTERY-FREE PRESSURE SENSORS MARKET, BY INDUSTRY, 2021–2026 (USD THOUSAND)

TABLE 37 BATTERY-FREE PRESSURE SENSORS MARKET, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 38 BATTERY-FREE PRESSURE SENSORS MARKET, BY REGION, 2021–2026 (USD THOUSAND)

7.5 MOTION AND POSITION SENSORS

7.5.1 TECHNOLOGICAL ADVANCEMENTS LEAD TO INCREASING DEMAND FOR BATTERY-FREE MOTION AND POSITION SENSORS IN DIFFERENT APPLICATIONS

TABLE 39 BATTERY-FREE MOTION AND POSITION SENSORS MARKET, BY INDUSTRY, 2017–2020 (USD THOUSAND)

FIGURE 29 LOGISTICS INDUSTRY TO WITNESS HIGHEST CAGR IN BATTERY-FREE MOTION AND POSITION SENSORS MARKET DURING FORECAST PERIOD

TABLE 40 BATTERY-FREE MOTION AND POSITION SENSORS MARKET, BY INDUSTRY, 2021–2026 (USD THOUSAND)

TABLE 41 BATTERY-FREE MOTION AND POSITION SENSORS MARKET, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 42 BATTERY-FREE MOTION AND POSITION SENSORS MARKET, BY REGION, 2021–2026 (USD THOUSAND)

7.6 LIGHT SENSORS

7.6.1 STRONG DEMAND FOR LIGHT SENSORS IS PRIMARILY DRIVEN BY BUILDING AUTOMATION APPLICATIONS

TABLE 43 BATTERY-FREE LIGHT SENSORS MARKET, BY INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 44 BATTERY-FREE LIGHT SENSORS MARKET, BY INDUSTRY, 2021–2026 (USD THOUSAND)

TABLE 45 BATTERY-FREE LIGHT SENSORS MARKET, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 46 BATTERY-FREE LIGHT SENSORS MARKET, BY REGION, 2021–2026 (USD THOUSAND)

7.7 OTHER SENSORS

7.7.1 IMAGE SENSORS

7.7.2 ULTRASONIC SENSORS

7.7.3 VIBRATION SENSORS

TABLE 47 BATTERY-FREE OTHER SENSORS MARKET, BY INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 48 BATTERY-FREE OTHER SENSORS MARKET, BY INDUSTRY, 2021–2026 (USD THOUSAND)

TABLE 49 BATTERY-FREE OTHER SENSORS MARKET, BY REGION, 2017–2020 (USD THOUSAND)

FIGURE 30 APAC TO COMMAND BATTERY-FREE OTHER SENSORS MARKET DURING FORECAST PERIOD

TABLE 50 BATTERY-FREE OTHER SENSORS MARKET, BY REGION, 2021–2026 (USD THOUSAND)

8 APPLICATIONS OF BATTERY-FREE SENSORS (Page No. - 101)

8.1 INTRODUCTION

FIGURE 31 APPLICATIONS OF BATTERY-FREE SENSORS SYSTEMS

8.2 FOOD QUALITY MONITORING

8.3 SUPPLY CHAIN MANAGEMENT

8.4 CONDITION MONITORING

8.5 BUILDING AUTOMATION

8.6 DATA CENTERS

9 BATTERY-FREE SENSORS MARKET, BY INDUSTRY (Page No. - 104)

9.1 INTRODUCTION

FIGURE 32 MARKET, BY INDUSTRY

TABLE 51 MARKET, BY INDUSTRY, 2017–2020 (USD MILLION)

FIGURE 33 AUTOMOTIVE INDUSTRY TO ACCOUNT FOR LARGEST SIZE OF BATTERY-FREE SENSORS MARKET IN 2026

TABLE 52 MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

9.2 AUTOMOTIVE

9.2.1 IIOT ENABLES AUTOMOTIVE INDUSTRY TO ADOPT EASY-TO-INTEGRATE BATTERY-FREE SENSORS

TABLE 53 MARKET FOR AUTOMOTIVE INDUSTRY, BY FREQUENCY, 2017–2020 (USD MILLION)

TABLE 54 MARKET FOR AUTOMOTIVE INDUSTRY, BY FREQUENCY, 2021–2026 (USD MILLION)

TABLE 55 MARKET FOR AUTOMOTIVE INDUSTRY, BY SENSOR TYPE, 2017–2020 (USD THOUSAND)

TABLE 56 MARKET FOR AUTOMOTIVE INDUSTRY, BY SENSOR TYPE, 2021–2026 (USD THOUSAND)

TABLE 57 MARKET FOR AUTOMOTIVE INDUSTRY, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 58 MARKET FOR AUTOMOTIVE INDUSTRY, BY REGION, 2021–2026 (USD THOUSAND)

9.3 LOGISTICS

9.3.1 BATTERY-FREE SENSORS HAVE HUGE POTENTIAL IN LOGISTICS AND SUPPLY CHAIN APPLICATIONS

TABLE 59 MARKET FOR LOGISTICS INDUSTRY, BY FREQUENCY, 2017–2020 (USD THOUSAND)

FIGURE 34 ULTRA-HIGH-FREQUENCY BATTERY-FREE SENSORS TO DOMINATE MARKET THROUGHOUT FORECAST PERIOD

TABLE 60 MARKET FOR LOGISTICS INDUSTRY, BY FREQUENCY, 2021–2026 (USD THOUSAND)

TABLE 61 MARKET FOR LOGISTICS INDUSTRY, BY SENSOR TYPE, 2017–2020 (USD THOUSAND)

TABLE 62 MARKET FOR LOGISTICS INDUSTRY, BY SENSOR TYPE, 2021–2026 (USD THOUSAND)

TABLE 63 MARKET FOR LOGISTICS INDUSTRY, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 64 MARKET FOR LOGISTICS INDUSTRY, BY REGION, 2021–2026 (USD THOUSAND)

9.4 HEALTHCARE

9.4.1 PHARMACEUTICAL COMPANIES USE BATTERY-FREE SENSORS TO SUPERVISE AND MANAGE VARIOUS PROCESSES ON PRODUCTION FLOOR

TABLE 65 BATTERY-FREE SENSORS MARKET FOR HEALTHCARE INDUSTRY, BY FREQUENCY, 2017–2020 (USD THOUSAND)

TABLE 66 MARKET FOR HEALTHCARE INDUSTRY, BY FREQUENCY, 2021–2026 (USD THOUSAND)

TABLE 67 MARKET FOR HEALTHCARE INDUSTRY, BY SENSOR TYPE, 2017–2020 (USD THOUSAND)

TABLE 68 MARKET FOR HEALTHCARE INDUSTRY, BY SENSOR TYPE, 2021–2026 (USD THOUSAND)

TABLE 69 MARKET FOR HEALTHCARE INDUSTRY, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 70 MARKET FOR HEALTHCARE INDUSTRY, BY REGION, 2021–2026 (USD THOUSAND)

9.5 OIL & GAS

9.5.1 ADVENT OF INDUSTRY 4.0 AND BATTERY-FREE SENSORS ENSURES SMOOTH MONITORING AND MANAGEMENT OF OIL & GAS PLANTS

TABLE 71 MARKET FOR OIL & GAS INDUSTRY, BY FREQUENCY, 2017–2020 (USD THOUSAND)

TABLE 72 MARKET FOR OIL & GAS INDUSTRY, BY FREQUENCY, 2021–2026 (USD THOUSAND)

TABLE 73 MARKET FOR OIL & GAS INDUSTRY, BY SENSOR TYPE, 2017–2020 (USD THOUSAND)

FIGURE 35 BATTERY-FREE TEMPERATURE SENSORS TO HOLD LARGEST MARKET SIZE FOR OIL & GAS INDUSTRY DURING FORECAST PERIOD

TABLE 74 MARKET FOR OIL & GAS INDUSTRY, BY SENSOR TYPE, 2021–2026 (USD THOUSAND)

TABLE 75 MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 76 MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2021–2026 (USD THOUSAND)

9.6 FOOD & BEVERAGES

9.6.1 RAPID TECHNOLOGICAL DEVELOPMENTS IN FOOD & BEVERAGES INDUSTRY TO ACCELERATE DEMAND FOR BATTERY-FREE SENSORS

TABLE 77 MARKET FOR FOOD & BEVERAGES INDUSTRY, BY FREQUENCY, 2017–2020 (USD THOUSAND)

TABLE 78 MARKET FOR FOOD & BEVERAGES INDUSTRY, BY FREQUENCY, 2021–2026 (USD THOUSAND)

TABLE 79 MARKET FOR FOOD & BEVERAGES INDUSTRY, BY SENSOR TYPE, 2017–2020 (USD THOUSAND)

TABLE 80 MARKET FOR FOOD & BEVERAGES INDUSTRY, BY SENSOR TYPE, 2021–2026 (USD THOUSAND)

TABLE 81 MARKET FOR FOOD & BEVERAGES INDUSTRY, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 82 BATTERY-FREE SENSORS MARKET FOR FOOD & BEVERAGES INDUSTRY, BY REGION, 2021–2026 (USD THOUSAND)

9.7 IT AND TELECOMMUNICATIONS

9.7.1 AUTOMATED DATA CENTERS TO CREATE HUGE OPPORTUNITIES FOR BATTERY-FREE SENSOR PROVIDERS

TABLE 83 MARKET FOR IT & TELECOMMUNICATIONS INDUSTRY, BY FREQUENCY, 2017–2020 (USD THOUSAND)

TABLE 84 MARKET FOR IT & TELECOMMUNICATIONS INDUSTRY, BY FREQUENCY, 2021–2026 (USD THOUSAND)

TABLE 85 MARKET FOR IT & TELECOMMUNICATIONS INDUSTRY, BY SENSOR TYPE, 2017–2020 (USD THOUSAND)

TABLE 86 MARKET FOR IT & TELECOMMUNICATIONS INDUSTRY, BY SENSOR TYPE, 2021–2026 (USD THOUSAND)

TABLE 87 MARKET FOR IT & TELECOMMUNICATIONS INDUSTRY, BY REGION, 2017–2020 (USD THOUSAND)

FIGURE 36 APAC TO COMMAND MARKET FOR IT & TELECOMMUNICATIONS INDUSTRY DURING FORECAST PERIOD

TABLE 88 MARKET FOR IT & TELECOMMUNICATIONS INDUSTRY, BY REGION, 2021–2026 (USD THOUSAND)

9.8 OTHERS

TABLE 89 MARKET FOR OTHER INDUSTRIES, BY FREQUENCY, 2017–2020 (USD THOUSAND)

TABLE 90 MARKET FOR OTHER INDUSTRIES, BY FREQUENCY, 2021–2026 (USD THOUSAND)

TABLE 91 MARKET FOR OTHER INDUSTRIES, BY SENSOR TYPE, 2017–2020 (USD THOUSAND)

TABLE 92 MARKET FOR OTHER INDUSTRIES, BY SENSOR TYPE, 2021–2026 (USD THOUSAND)

TABLE 93 MARKET FOR OTHER INDUSTRIES, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 94 MARKET FOR OTHER INDUSTRIES, BY REGION, 2021–2026 (USD THOUSAND)

10 GEOGRAPHIC ANALYSIS (Page No. - 127)

10.1 INTRODUCTION

FIGURE 37 BATTERY-FREE SENSORS MARKET IN INDIA TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

TABLE 95 MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 96 MARKET, BY REGION, 2021–2026 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 38 SNAPSHOT: MARKET IN NORTH AMERICA

TABLE 97 MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD THOUSAND)

TABLE 98 MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD THOUSAND)

TABLE 99 MARKET IN NORTH AMERICA, BY SENSOR TYPE, 2017–2020 (USD THOUSAND)

TABLE 100 MARKET IN NORTH AMERICA, BY SENSOR TYPE, 2021–2026 (USD THOUSAND)

TABLE 101 MARKET IN NORTH AMERICA, BY INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 102 MARKET IN NORTH AMERICA, BY INDUSTRY, 2021–2026 (USD THOUSAND)

10.2.1 US

10.2.1.1 Product launch and collaboration strategies of key players to stimulate the growth of market in the US

10.2.2 CANADA

10.2.2.1 Adoption of smart factory solutions in Canada to propel the growth of market in-country

10.2.3 MEXICO

10.2.3.1 Growth of industrial automation market in Mexico to create lucrative opportunities for market in-country

10.3 EUROPE

TABLE 103 BATTERY-FREE SENSORS MARKET IN EUROPE, BY COUNTRY, 2017–2020 (USD THOUSAND)

TABLE 104 MARKET IN EUROPE, BY COUNTRY, 2021–2026 (USD THOUSAND)

TABLE 105 MARKET IN EUROPE, BY SENSOR TYPE, 2017–2020 (USD THOUSAND)

TABLE 106 MARKET IN EUROPE, BY SENSOR TYPE, 2021–2026 (USD THOUSAND)

TABLE 107 MARKET IN EUROPE, BY INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 108 MARKET IN EUROPE, BY INDUSTRY, 2021–2026 (USD THOUSAND)

10.3.1 GERMANY

10.3.1.1 Implementation of Industry 4.0 to support growth of market in Germany

10.3.2 UK

10.3.2.1 Deployment of IoT in manufacturing sector to drive growth of market in UK

10.3.3 FRANCE

10.3.3.1 Focus on technological research and development and government support to promote market growth in France

10.3.4 REST OF EUROPE

10.4 APAC

FIGURE 39 SNAPSHOT: BATTERY-FREE SENSORS MARKET IN APAC

TABLE 109 MARKET IN APAC, BY COUNTRY, 2017–2020 (USD THOUSAND)

TABLE 110 MARKET IN APAC, BY COUNTRY, 2021–2026 (USD THOUSAND)

TABLE 111 IN APAC, BY SENSOR TYPE, 2017–2020 (USD THOUSAND)

TABLE 112 MARKET IN APAC, BY SENSOR TYPE, 2021–2026 (USD THOUSAND)

TABLE 113 MARKET IN APAC, BY INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 114 MARKET IN APAC, BY INDUSTRY, 2021–2026 (USD THOUSAND)

10.4.1 CHINA

10.4.1.1 High labor costs in China encouraging manufacturers to use battery-free sensors

10.4.2 JAPAN

10.4.2.1 Notable growth of automotive industry of Japan to elevate demand for battery-free sensors in country

10.4.3 INDIA

10.4.3.1 Make in India initiative to drive utilization of battery-free sensors in manufacturing sector in India

10.4.4 REST OF APAC

10.5 REST OF THE WORLD (ROW)

TABLE 115 MARKET IN ROW, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 116 MARKET IN ROW, BY REGION, 2021–2026 (USD THOUSAND)

TABLE 117 MARKET IN ROW, BY SENSOR TYPE, 2017–2020 (USD THOUSAND)

TABLE 118 MARKET IN ROW, BY SENSOR TYPE, 2021–2026 (USD THOUSAND)

TABLE 119 MARKET IN ROW, BY INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 120 BATTERY-FREE SENSORS MARKET IN ROW, BY INDUSTRY, 2021–2026 (USD THOUSAND)

10.5.1 MIDDLE EAST AND AFRICA

10.5.1.1 High adoption of battery-free sensors by oil and gas companies in Middle East to propel market growth

10.5.2 SOUTH AMERICA

10.5.2.1 Heavy investments of South American economies in shipbuilding, mining, and automobile manufacturing activities to spur demand for battery-free sensors

11 COMPETITIVE LANDSCAPE (Page No. - 148)

11.1 OVERVIEW

11.2 TOP 5 COMPANY REVENUE ANALYSIS

FIGURE 40 MARKET: REVENUE ANALYSIS OF TOP PLAYERS, 2016–2020

11.3 MARKET SHARE ANALYSIS, 2020

TABLE 121 MARKET: MARKET SHARE ANALYSIS (2020)

11.4 COMPETITIVE LEADERSHIP MAPPING

11.4.1 STAR

11.4.2 EMERGING LEADER

11.4.3 PERVASIVE

11.4.4 PARTICIPANT

FIGURE 41 BATTERY-FREE SENSORS MARKET: COMPETITIVE LEADERSHIP MAPPING, 2020

11.5 SMALL AND MEDIUM ENTERPRISES (SME) EVALUATION MATRIX, 2020

11.5.1 PROGRESSIVE COMPANY

11.5.2 RESPONSIVE COMPANY

11.5.3 DYNAMIC COMPANY

11.5.4 STARTING BLOCK

FIGURE 42 MARKET (GLOBAL), SME EVALUATION MATRIX, 2020

11.6 MARKET: PRODUCT FOOTPRINT

TABLE 122 COMPANY FOOTPRINT

TABLE 123 INDUSTRY FOOTPRINT OF COMPANIES

TABLE 124 REGIONAL FOOTPRINT OF COMPANIES

11.7 COMPETITIVE SITUATIONS AND TRENDS

11.7.1 MARKET: PRODUCT LAUNCHES, SEPTEMBER 2020–MAY 2021

11.7.2 MARKET: DEALS, OCTOBER 2018–NOVEMBER 2020

12 COMPANY PROFILES (Page No. - 160)

12.1 INTRODUCTION

12.1.1 IMPACT OF COVID-19 ON COMPANIES OPERATING IN BATTERY-FREE SENSORS MARKET

12.2 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

12.2.1 ON SEMICONDUCTOR

FIGURE 43 ON SEMICONDUCTOR: COMPANY SNAPSHOT

12.2.2 FARSENS

12.2.3 AXZON (RFMICRON, INC.)

12.2.4 INDUCTOSENSE LTD.

12.2.5 PHASE IV ENGINEERING

12.2.6 POWERCAST CORP.

12.2.7 DISTECH CONTROLS

12.2.8 ENOCEAN GMBH

12.2.9 DCO SYSTEMS LTD.

12.2.10 EVERACTIVE

12.3 OTHER KEY PLAYERS

12.3.1 FUJI ELECTRIC CO., LTD

12.3.2 BRIDG INC.

12.3.3 GENERAL ELECTRIC

12.3.4 INFINEON TECHNOLOGIES AG

12.3.5 METALCRAFT

12.3.6 GA0 GROUP

12.3.7 TEXAS INSTRUMENTS INC.

12.3.8 OMNI-ID

12.3.9 NXP SEMICONDUCTORS

12.3.10 ZEBRA TECHNOLOGIES

12.3.11 ALIEN TECHNOLOGY

12.3.12 IMPINJ

12.3.13 CAEN RFID S.R.L.

12.3.14 IDENTIV

12.3.15 SECURITAG ASSEMBLY GROUP (SAG)

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 194)

13.1 INSIGHTS OF INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

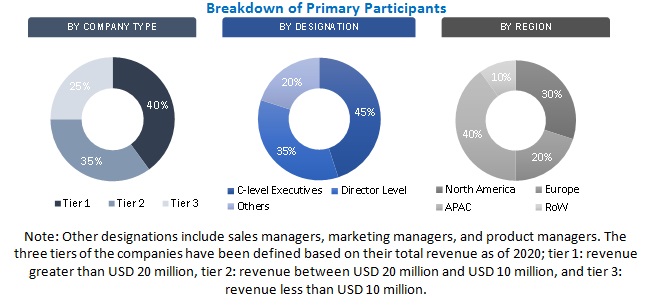

The study involves four major activities for estimating the size of the battery-free sensors market. Exhaustive secondary research has been conducted to collect information related to the market. The next step has been the validation of these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the overall size of the battery-free sensors market. After that, market breakdown and data triangulation procedures have been used to determine the extent of different segments and subsegments of the market.

Secondary Research

Secondary sources referred to in this research study include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers, certified publications, articles from recognized authors; directories; and databases. The secondary data has been collected and analyzed to arrive at the overall market size estimations, which have been further validated by primary research.

Primary Research

In the primary research process, a number of primary sources from both supply and demand sides have been interviewed to obtain the qualitative and quantitative information pertaining to this report. Several primary interviews have been conducted with market experts from both demand and supply sides (Battery-free sensors manufacturers and distributors). This primary data has been collected through questionnaires, emails, and telephonic interviews. Approximately 20% of the primary interviews have been conducted with the demand side and 80% with the supply side. This primary data has been collected mainly through telephonic interviews, which accounted for 80% of the total primary interviews. Additionally, questionnaires and emails were used to collect the data.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the battery-free sensors market and other dependent submarkets listed in this report.

- The key players in the industry and markets have been identified through extensive secondary research.

- Both the supply chain of the industry and the market size, in terms of value and volume, have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size, the total market has been split into several segments. To complete the overall market engineering process and arrive at exact statistics for all segments, the market breakdown and data triangulation procedures have been employed wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Study Objectives:

- To define and forecast the size of the battery-free sensors market, by frequency, sensor type, and industry, in terms of value

- To describe and forecast the size of the battery-free sensors market in four key regions, namely, North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW), along with their respective country-level market sizes, in terms of value

- To describe applications of battery-free sensors

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To provide a value chain analysis of the global battery-free sensors market, along with critical information about price and technology trends, ecosystem analysis, Porter’s five forces analysis, patent analysis, trade scenario, and regulatory landscape

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market size

- To study the complete value chain of the battery-free sensors market

- To provide a detailed impact of the COVID-19 pandemic on the battery-free sensors market

- To analyze the impact of COVID-19 on the market segments and players operating in the battery-free sensors market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the battery-free sensors ecosystem

- To strategically profile the key players and comprehensively analyze their market positions in terms of their rankings and core competencies2 and provide a detailed overview of the competitive landscape

- To analyze competitive developments, such as product launches, collaborations, and partnerships, in the battery-free sensors market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company's specific needs. The following customization options are available for this report:

- Detailed analysis and profiling of additional market players (Up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Battery-free Sensors Market