Bariatric Surgery Devices Market by Device Type (Minimally Invasive (Stapling, Suturing, Vessel Sealing Devices), Non Invasive), Procedure (Sleeve Gastrectomy, Gastric Bypass, Revision Surgery, Adjustable Gastric Banding) & Region - Global Forecast to 2027

Market Growth Outlook Summary

The global bariatric surgery devices market growth forecasted to transform from $1.9 billion in 2022 to $2.4 billion by 2027, driven by a CAGR of 5.4%. The market is driven by the increasing prevalence of obesity and associated comorbidities, which have led to a rise in bariatric surgeries. Key market dynamics include a growing preference for minimally invasive surgical devices due to their advantages such as fewer complications and faster recovery. Sleeve gastrectomy is the most commonly performed procedure, while North America leads the market due to high obesity rates and increased healthcare spending. The regulatory environment in emerging markets poses a challenge, and postoperative complications remain a concern. Major players in this market include Johnson & Johnson, Medtronic, Intuitive Surgical, Apollo Endosurgery, and Olympus.

To know about the assumptions considered for the study, Request for Free Sample Report

Bariatric Surgery Devices Market Dynamics

Driver: Increasing obesity cases worldwide and subsequent rise in bariatric surgeries

Bariatric surgery was formerly considered the last resort for weight loss; however, over the years, this surgical procedure has become more popular as it is safer and more effective than standard medical approaches, including medications and dietary counseling. In the past decade, there has been a constant rise in bariatric procedures performed worldwide. According to the American Society for Metabolic and Bariatric Surgeries (ASMBS), the total number of bariatric surgeries performed in the US increased to 158,000 in 2011 from 198,851 in 2020. The growing number of bariatric surgeries performed is expected to result in the increasing demand for associated equipment & devices, thereby driving the growth of the global market. In line with this, bariatric surgery is the most effective and long-lasting treatment for morbid obesity and many related conditions. Obesity continues to be a major public health problem worldwide. Medical costs for adults who had obesity were USD 1,861 higher than medical costs for people with healthy weight. Bariatric surgery is an effective treatment for severe obesity that results in the improvement or remission of many obesity-related comorbid conditions, sustained weight loss, and improved quality of life.

Restraint: Uncertain regulatory environment in the medical device industry

Emerging countries such as India and South Korea are working hard toward establishing a regulatory regime that will distinguish between medical devices and pharmaceutical devices & instruments. As there is no clear distinction between drugs and devices, the approval procedure is unstable as of now, thus resulting in delays. Therefore, unstable regulatory frameworks are expected to increase the approval time for surgical instruments, thus restraining the market growth to a certain extent.

Challenge: Postoperative challenges associated with bariatric surgery

The laparoscopic or minimally invasive approach to bariatric surgery offers many advantages, such as fewer wound complications, shorter hospital stays, and decreased pain. However, certain complications are associated with these surgeries, such as internal hernias, gastroesophageal reflux disease (GERD), chronic nausea and vomiting, severe dumping syndrome, ulcers, malnutrition, and inflammatory bowel disease.

Minimally invasive surgical devices segment accounted for the largest share of the bariatric surgery devices market, by device type

The global market is segmented into minimally invasive surgical devices and noninvasive surgical devices based on device type. The minimally invasive surgical devices segment dominated this market in 2021. Minimally invasive or laparoscopic surgical procedures are preferred over open weight loss surgical procedures as they involve fewer smaller incisions and are, hence, less painful. They are also associated with faster recovery and significantly lower complication and mortality rates. These advantages are expected to support the market growth of the minimally invasive surgical devices segment.

Sleeve gastrectomy segment accounted for the largest share in the bariatric surgery devices market, by procedure

The global market is segmented into sleeve gastrectomy, gastric bypass, revision bariatric surgery, noninvasive bariatric surgery, mini-gastric bypass, adjustable gastric banding, and biliopancreatic diversion with duodenal switch (BPD/DS) by procedure. The sleeve gastrectomy segment accounted for the largest share of the global market. The large share of this segment can be attributed to the rising advantages of sleeve gastrectomy. Advantages include safety, effectiveness, affordability, and limited complications compared to other bariatric procedures.

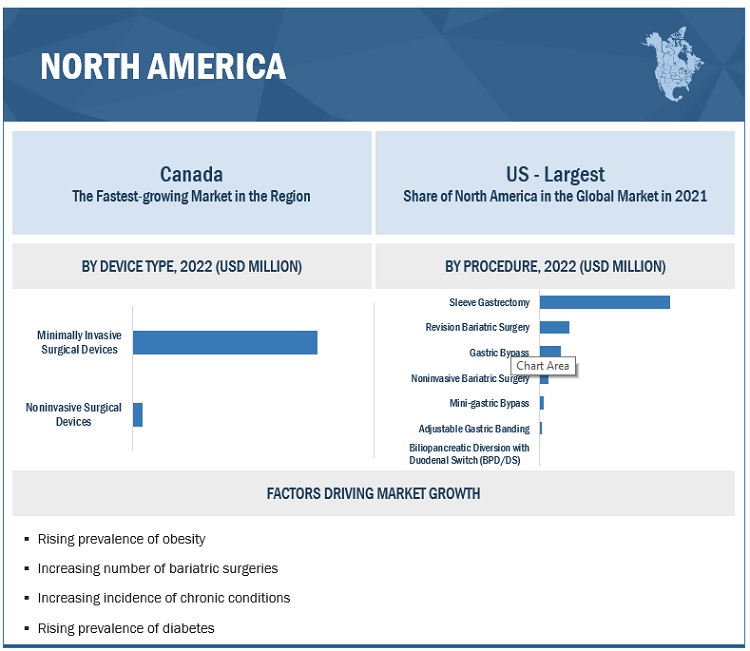

North America accounted for the largest share of the bariatric surgery devices market

The global market is segmented into five major regions namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. North America accounted for the largest share of this market in 2021. Factors such as the increasing prevalence of chronic disorders, increasing rate of obesity and diabetes, a growing number of bariatric surgeries, increasing healthcare spending, and rising demand for MIS surgeries are contributing to the large share of this regional segment.

To know about the assumptions considered for the study, download the pdf brochure

The bariatric surgery devices market is dominated by players such as Johnson & Johnson (US), Medtronic plc (Ireland), Intuitive Surgical, Inc. (US), Apollo Endosurgery, Inc. (US), and Olympus Corporation (Japan).

Bariatric Surgery Devices Market Report Scope

|

Report Metric |

Details |

|

Market Revenue in 2022 |

$1.9 billion |

|

Projected Revenue by 2027 |

$2.4 billion |

|

Revenue Rate |

poised to grow at a CAGR of 5.4% |

|

Market Driver |

Increasing obesity cases worldwide and subsequent rise in bariatric surgeries |

|

Market Opportunity |

Growth opportunities in emerging markets |

This report categorizes the bariatric surgery devices market to forecast revenue and analyze trends in each of the following submarkets:

By Device Type

-

Minimally Invasive Surgical Devices

- Stapling Devices

- Energy/Vessel-sealing Devices

- Suturing Devices

- Accessories

- Noninvasive Surgical Devices

By Procedure

- Sleeve Gastrectomy

- Gastric Bypass

- Revision Bariatric Surgery

- Noninvasive Bariatric Surgery

- Adjustable Gastric Banding

- Mini-gastric Bypass

- Biliopancreatic Diversion with Duodenal Switch (BPD/DS)

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Australia

- Rest of Asia Pacific

- Latin America

- Middle East & Africa

Recent Developments

- In January 2022, Johnson & Johnson (US) signed a strategic partnership with Microsoft (US) to further enable its digital surgery solutions.

- In October 2021, Spatz Medical (US) received US FDA approval for its product, Spatz3 Gastric Balloon, the first adjustable gastric balloon, to aid in weight loss for adult patients struggling with obesity.

- In June 2021, ReShape Lifesciences Inc. (US) announced the completion of the merger with Obalon Therapeutics (US). In connection with the merger's closing, Obalon changed its name to ReShape Lifesciences Inc. The merger is expected to create opportunities for ReShape to expand its portfolio of FDA-approved weight loss solutions and reimbursed virtual care services.

- In March 2021, Johnson & Johnson (US) launched the ECHELON+ Stapler with GST Reloads, a powered surgical stapler designed to reduce complications in surgery through more uniform tissue compression and better staple formation.

- In March 2020, Intuitive Surgical, Inc. (US) received regulatory clearance in Japan to market its SynchroSeal instrument.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the bariatric surgery devices market?

The bariatric surgery devices market boasts a total revenue value of $2.4 billion by 2027.

What is the estimated growth rate (CAGR) of the bariatric surgery devices market?

The global market for bariatric surgery devices has an estimated compound annual growth rate (CAGR) of 5.4% and a revenue size in the region of $1.9 billion in 2022.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 23)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 BARIATRIC SURGERY DEVICES MARKET

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY USED

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 28)

2.1 RESEARCH DATA

FIGURE 1 GLOBAL MARKET: RESEARCH DESIGN METHODOLOGY

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.1.2 Secondary research

2.1.2 PRIMARY DATA

2.1.2.1 Primary sources

2.1.2.2 Key data from primary sources

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of primary interviews

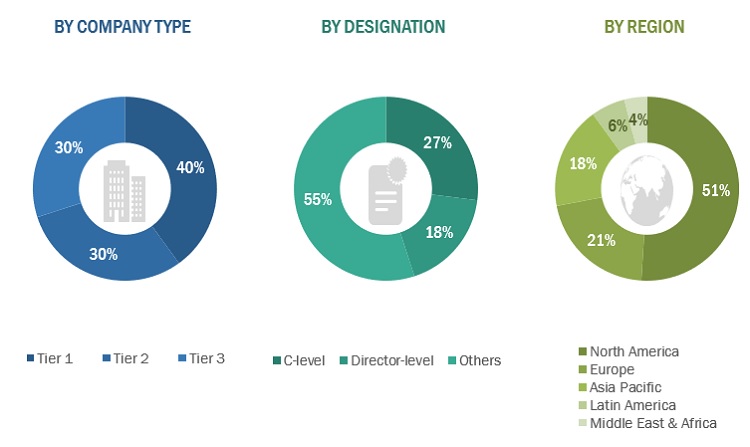

FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach 1: Company revenue estimation approach

FIGURE 4 BOTTOM-UP APPROACH: COMPANY REVENUE ESTIMATION APPROACH

2.2.1.2 Approach 2: Presentations of companies and primary interviews

2.2.1.3 Growth forecast

2.2.1.4 CAGR projections

FIGURE 5 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

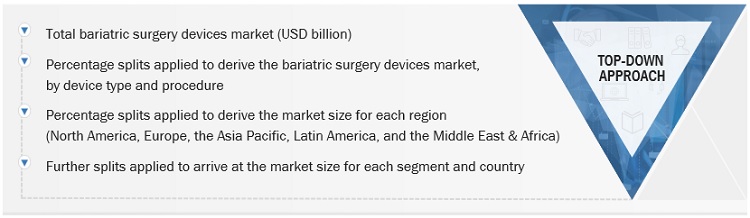

2.2.2 TOP-DOWN APPROACH

FIGURE 6 GLOBAL MARKET: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION METHODOLOGY

2.4 MARKET SHARE

2.5 ASSUMPTIONS

2.6 LIMITATIONS

2.7 GROWTH RATE ASSUMPTIONS

2.8 RISK ASSESSMENT

TABLE 1 RISK ASSESSMENT: GLOBAL MARKET

3 EXECUTIVE SUMMARY (Page No. - 41)

FIGURE 8 GLOBAL MARKET, BY DEVICE TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 9 GLOBAL MARKET, BY PROCEDURE, 2022 VS. 2027 (USD MILLION)

FIGURE 10 GLOBAL MARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

4 PREMIUM INSIGHTS (Page No. - 44)

4.1 GLOBAL MARKET OVERVIEW

FIGURE 11 RISING OBESITY RATE WORLDWIDE TO DRIVE MARKET GROWTH

4.2 GLOBAL MARKET SHARE, BY DEVICE TYPE, 2022 VS. 2027

FIGURE 12 MINIMALLY INVASIVE SURGICAL DEVICES SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

4.3 GLOBAL MARKET SHARE, BY PROCEDURE, 2022 VS. 2027

FIGURE 13 SLEEVE GASTRECTOMY SEGMENT TO ACCOUNT FOR HIGHER SHARE DURING FORECAST PERIOD

4.4 GLOBAL MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 14 ASIA PACIFIC TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 47)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 BARIATRIC SURGERY DEVICES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing obesity cases worldwide and subsequent rise in bariatric surgeries

TABLE 2 REMISSION RATE OF OBESITY-RELATED DISEASES POST-BARIATRIC SURGERY

5.2.1.2 Growing demand for minimally invasive surgeries

5.2.2 RESTRAINTS

5.2.2.1 Changing regulatory landscape in the medical devices industry

5.2.3 OPPORTUNITIES

5.2.3.1 Growth opportunities in emerging markets

5.2.4 CHALLENGES

5.2.4.1 Postoperative challenges associated with bariatric surgery

5.3 PRICING ANALYSIS

TABLE 3 AVERAGE SELLING PRICE OF BARIATRIC SURGERY DEVICES (2022)

5.4 PATENT ANALYSIS

FIGURE 16 LIST OF MAJOR PATENTS FOR BARIATRIC SURGERY DEVICES

TABLE 4 LIST OF KEY PATENTS

5.5 VALUE CHAIN ANALYSIS

FIGURE 17 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDED DURING MANUFACTURING & ASSEMBLY PHASES IN GLOBAL MARKET

5.6 SUPPLY CHAIN ANALYSIS

FIGURE 18 GLOBAL MARKET: SUPPLY CHAIN ANALYSIS

5.7 ECOSYSTEM ANALYSIS

FIGURE 19 GLOBAL MARKET: ECOSYSTEM MARKET MAP

TABLE 5 GLOBAL MARKET: ROLE IN ECOSYSTEM

5.8 PORTER’S FIVE FORCES ANALYSIS

TABLE 6 GLOBAL MARKET: PORTER’S FIVE FORCES ANALYSIS

5.8.1 THREAT FROM NEW ENTRANTS

5.8.2 THREAT FROM SUBSTITUTES

5.8.3 BARGAINING POWER OF BUYERS

5.8.4 BARGAINING POWER OF SUPPLIERS

5.8.5 DEGREE OF COMPETITION

5.9 REGULATORY LANDSCAPE

5.9.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 7 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 8 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.9.2 NORTH AMERICA

5.9.2.1 US

TABLE 9 US FDA: MEDICAL DEVICE CLASSIFICATION

TABLE 10 US: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

5.9.2.2 Canada

TABLE 11 CANADA: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

5.9.3 EUROPE

5.9.4 ASIA PACIFIC

5.9.4.1 China

TABLE 12 CHINA: CLASSIFICATION OF MEDICAL DEVICES

5.9.4.2 Japan

5.9.4.3 India

5.10 TRADE ANALYSIS

5.10.1 TRADE ANALYSIS FOR ARTICLES AND EQUIPMENT FOR BARIATRIC SURGERY DEVICES

TABLE 13 IMPORT DATA FOR ARTICLES AND EQUIPMENT FOR BARIATRIC SURGERY DEVICES, BY COUNTRY, 2017-2021 (USD THOUSAND)

TABLE 14 EXPORT DATA FOR ARTICLES AND EQUIPMENT FOR BARIATRIC SURGERY DEVICES, BY COUNTRY, 2017-2021 (USD THOUSAND)

5.11 TECHNOLOGY ANALYSIS

5.12 KEY CONFERENCES & EVENTS IN 2022−2023

TABLE 15 GLOBAL MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

5.13.1 REVENUE SOURCES GRADUALLY SHIFTING TOWARD TECHNOLOGY-BASED SOLUTIONS

5.13.2 REVENUE SHIFT FOR GLOBAL MARKET

5.14 KEY STAKEHOLDERS & BUYING CRITERIA

5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 20 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS OF BARIATRIC SURGERY DEVICES

TABLE 16 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS OF BARIATRIC SURGERY DEVICES (%)

5.14.2 BUYING CRITERIA

FIGURE 21 KEY BUYING CRITERIA FOR BARIATRIC SURGERY DEVICES

TABLE 17 KEY BUYING CRITERIA FOR BARIATRIC SURGERY DEVICES

5.15 CASE STUDY

5.16 PESTLE ANALYSIS

6 BARIATRIC SURGERY DEVICES MARKET, BY DEVICE TYPE (Page No. - 70)

6.1 INTRODUCTION

TABLE 18 GLOBAL MARKET, BY DEVICE TYPE, 2020–2027 (USD MILLION)

6.1.1 PRIMARY INSIGHTS

6.1.1.1 Key primary insights

6.2 MINIMALLY INVASIVE SURGICAL DEVICES

TABLE 19 KEY PRODUCTS FOR MINIMALLY INVASIVE SURGICAL DEVICES

TABLE 20 GLOBAL MARKET FOR MINIMALLY INVASIVE SURGICAL DEVICES, BY REGION, 2020–2027 (USD MILLION)

TABLE 21 GLOBAL MARKET FOR MINIMALLY INVASIVE SURGICAL DEVICES, BY TYPE, 2020–2027 (USD MILLION)

6.2.1 STAPLING DEVICES

6.2.1.1 Introduction of new & evolved stapling technologies to drive market

TABLE 22 GLOBAL MARKET FOR STAPLING DEVICES, BY REGION, 2020–2027 (USD MILLION)

6.2.2 ENERGY/VESSEL-SEALING DEVICES

6.2.2.1 Energy/vessel sealing devices result in reliable hemostasis

TABLE 23 GLOBAL MARKET FOR ENERGY/VESSEL-SEALING DEVICES, BY REGION, 2020–2027 (USD MILLION)

6.2.3 SUTURING DEVICES

6.2.3.1 Surgical errors associated with suturing devices to restrain market growth

TABLE 24 GLOBAL MARKET FOR SUTURING DEVICES, BY REGION, 2020–2027 (USD MILLION)

6.2.4 ACCESSORIES

6.2.4.1 Rising number of minimally invasive bariatric techniques drives demand for accessories

TABLE 25 GLOBAL MARKET FOR ACCESSORIES, BY REGION, 2020–2027 (USD MILLION)

6.3 NONINVASIVE SURGICAL DEVICES

6.3.1 LOWER WEIGHT LOSS EFFECTIVENESS OF NONINVASIVE SURGICAL DEVICES TO LIMIT UPTAKE

TABLE 26 KEY PRODUCTS IN NONINVASIVE BARIATRIC-SURGERY DEVICES MARKET

TABLE 27 GLOBAL MARKET FOR NONINVASIVE SURGICAL DEVICES, BY REGION, 2020–2027 (USD MILLION)

7 BARIATRIC SURGERY DEVICES MARKET, BY PROCEDURE (Page No. - 80)

7.1 INTRODUCTION

TABLE 28 GLOBAL MARKET, BY PROCEDURE, 2020–2027 (USD MILLION)

7.2 SLEEVE GASTRECTOMY

7.2.1 SLEEVE GASTRECTOMY AIDS IN ACHIEVING LONG-TERM WEIGHT LOSS

TABLE 29 GLOBAL MARKET FOR SLEEVE GASTRECTOMY, BY REGION, 2020–2027 (USD MILLION)

7.3 REVISION BARIATRIC SURGERY

7.3.1 RISING NEED TO MANAGE ACUTE & CHRONIC POSTOPERATIVE COMPLICATIONS TO DRIVE DEMAND FOR REVISION SURGERIES

TABLE 30 GLOBAL MARKET FOR REVISION BARIATRIC SURGERY, BY REGION, 2020–2027 (USD MILLION)

7.4 GASTRIC BYPASS

7.4.1 HIGHER COMPLEXITIES ASSOCIATED WITH GASTRIC BYPASS TO RESTRAIN MARKET GROWTH

TABLE 31 GLOBAL MARKET FOR GASTRIC BYPASS, BY REGION, 2020–2027 (USD MILLION)

7.5 NONINVASIVE BARIATRIC SURGERY

7.5.1 LONG-TERM WEIGHT REGAIN TO LIMIT ADOPTION

TABLE 32 GLOBAL MARKET FOR NONINVASIVE BARIATRIC SURGERY, BY REGION, 2020–2027 (USD MILLION)

7.6 MINI-GASTRIC BYPASS

7.6.1 ADVANTAGES OF MINI-GASTRIC BYPASS OVER TRADITIONAL GASTRIC BYPASS PROCEDURES TO PROPEL MARKET

TABLE 33 GLOBAL MARKET FOR MINI-GASTRIC BYPASS, BY REGION, 2020–2027 (USD MILLION)

7.7 ADJUSTABLE GASTRIC BANDING

7.7.1 INCREASING PRODUCT RECALLS TO RESTRAIN MARKET GROWTH

TABLE 34 GLOBAL MARKET FOR ADJUSTABLE GASTRIC BANDING, BY REGION, 2020–2027 (USD MILLION)

7.8 BILIOPANCREATIC DIVERSION WITH DUODENAL SWITCH (BPD/DS)

7.8.1 LONGER RECOVERY PERIOD AND MALABSORPTION COMPLICATIONS TO RESTRAIN MARKET

TABLE 35 GLOBAL MARKET FOR BPD/DS, BY REGION, 2020–2027 (USD MILLION)

8 BARIATRIC SURGERY DEVICES MARKET, BY REGION (Page No. - 89)

8.1 INTRODUCTION

TABLE 36 GLOBAL MARKET, BY REGION, 2020–2027 (USD MILLION)

8.2 NORTH AMERICA

FIGURE 22 NORTH AMERICA: MARKET SNAPSHOT

TABLE 37 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 38 NORTH AMERICA: MARKET, BY DEVICE TYPE, 2020–2027 (USD MILLION)

TABLE 39 NORTH AMERICA: MINIMALLY INVASIVE SURGICAL DEVICES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 40 NORTH AMERICA: MARKET, BY PROCEDURE, 2020–2027 (USD MILLION)

8.2.1 US

8.2.1.1 Increasing prevalence of obesity and growing acceptance of bariatric surgery devices to drive market

TABLE 41 US: ESTIMATED NUMBER OF BARIATRIC SURGERIES, 2011-2020

TABLE 42 US: MARKET, BY DEVICE TYPE, 2020–2027 (USD MILLION)

TABLE 43 US: MINIMALLY INVASIVE BARIATRIC SURGICAL DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 44 US: MARKET, BY PROCEDURE, 2020–2027 (USD MILLION)

8.2.2 CANADA

8.2.2.1 Rising government initiatives to curb obesity to drive market

TABLE 45 CANADA: BARIATRIC SURGERY DEVICES MARKET, BY DEVICE TYPE, 2020–2027 (USD MILLION)

TABLE 46 CANADA: MINIMALLY INVASIVE BARIATRIC SURGICAL DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 47 CANADA: MARKET, BY PROCEDURE, 2020–2027 (USD MILLION)

8.3 EUROPE

TABLE 48 EUROPE: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 49 EUROPE: MARKET, BY DEVICE TYPE, 2020–2027 (USD MILLION)

TABLE 50 EUROPE: MINIMALLY INVASIVE BARIATRIC SURGICAL DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 51 EUROPE: MARKET, BY PROCEDURE, 2020–2027 (USD MILLION)

8.3.1 GERMANY

8.3.1.1 Growing healthcare expenditure to increase uptake of bariatric surgery devices

TABLE 52 GERMANY: PREVALENCE OF ADULT OBESITY BY 2030

TABLE 53 GERMANY: BARIATRIC SURGERY DEVICES MARKET, BY DEVICE TYPE, 2020–2027 (USD MILLION)

TABLE 54 GERMANY: MINIMALLY INVASIVE BARIATRIC SURGICAL DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 55 GERMANY: MARKET, BY PROCEDURE, 2020–2027 (USD MILLION)

8.3.2 UK

8.3.2.1 Growing incidence of obesity and lifestyle diseases to drive market

TABLE 56 UK: MARKET, BY DEVICE TYPE, 2020–2027 (USD MILLION)

TABLE 57 UK: MINIMALLY INVASIVE BARIATRIC SURGICAL DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 58 UK: MARKET, BY PROCEDURE, 2020–2027 (USD MILLION)

8.3.3 FRANCE

8.3.3.1 Rising government support for surgical device manufacturers to drive market

TABLE 59 FRANCE: MARKET, BY DEVICE TYPE, 2020–2027 (USD MILLION)

TABLE 60 FRANCE: MINIMALLY INVASIVE BARIATRIC SURGICAL DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 61 FRANCE: MARKET, BY PROCEDURE, 2020–2027 (USD MILLION)

8.3.4 ITALY

8.3.4.1 Rising technological advancements to support market uptake for bariatric surgery devices

TABLE 62 ITALY: PREVALENCE OF ADULT OBESITY BY 2030

TABLE 63 ITALY: BARIATRIC SURGERY DEVICES MARKET, BY DEVICE TYPE, 2020–2027 (USD MILLION)

TABLE 64 ITALY: MINIMALLY INVASIVE BARIATRIC SURGICAL DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 65 ITALY: MARKET, BY PROCEDURE, 2020–2027 (USD MILLION)

8.3.5 SPAIN

8.3.5.1 High incidence of diabetes to drive demand for MIS bariatric devices

TABLE 66 SPAIN: MARKET, BY DEVICE TYPE, 2020–2027 (USD MILLION)

TABLE 67 SPAIN: MINIMALLY INVASIVE BARIATRIC SURGICAL DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 68 SPAIN: MARKET, BY PROCEDURE, 2020–2027 (USD MILLION)

8.3.6 REST OF EUROPE

TABLE 69 REST OF EUROPE: BARIATRIC SURGERY DEVICES MARKET, BY DEVICE TYPE, 2020–2027 (USD MILLION)

TABLE 70 REST OF EUROPE: MINIMALLY INVASIVE BARIATRIC SURGICAL DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 71 REST OF EUROPE: MARKET, BY PROCEDURE, 2020–2027 (USD MILLION)

8.4 ASIA PACIFIC

FIGURE 23 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 72 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 73 ASIA PACIFIC: MARKET, BY DEVICE TYPE, 2020–2027 (USD MILLION)

TABLE 74 ASIA PACIFIC: MINIMALLY INVASIVE BARIATRIC SURGICAL DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 75 ASIA PACIFIC: MARKET, BY PROCEDURE, 2020–2027 (USD MILLION)

8.4.1 CHINA

8.4.1.1 High incidence of obesity in children and adults to propel market growth

TABLE 76 CHINA: BARIATRIC SURGERY DEVICES MARKET, BY DEVICE TYPE, 2020–2027 (USD MILLION)

TABLE 77 CHINA: MINIMALLY INVASIVE BARIATRIC SURGICAL DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 78 CHINA: MARKET, BY PROCEDURE, 2020–2027 (USD MILLION)

8.4.2 JAPAN

8.4.2.1 Accessibility to affordable healthcare facilities to support market growth

TABLE 79 JAPAN: MARKET, BY DEVICE TYPE, 2020–2027 (USD MILLION)

TABLE 80 JAPAN: MINIMALLY INVASIVE BARIATRIC SURGICAL DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 81 JAPAN: MARKET, BY PROCEDURE, 2020–2027 (USD MILLION)

8.4.3 INDIA

8.4.3.1 Rising government initiatives on obesity awareness to support market growth

TABLE 82 INDIA: BARIATRIC SURGERY DEVICES MARKET, BY DEVICE TYPE, 2020–2027 (USD MILLION)

TABLE 83 INDIA: MINIMALLY INVASIVE BARIATRIC SURGICAL DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 84 INDIA: MARKET, BY PROCEDURE, 2020–2027 (USD MILLION)

8.4.4 AUSTRALIA

8.4.4.1 Increasing initiatives to spread awareness on effective bariatric surgical care to support market growth

TABLE 85 AUSTRALIA: MARKET, BY DEVICE TYPE, 2020–2027 (USD MILLION)

TABLE 86 AUSTRALIA: MINIMALLY INVASIVE BARIATRIC SURGICAL DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 87 AUSTRALIA: MARKET, BY PROCEDURE, 2020–2027 (USD MILLION)

8.4.5 REST OF ASIA PACIFIC

TABLE 88 REST OF ASIA PACIFIC: BARIATRIC SURGERY DEVICES MARKET, BY DEVICE TYPE, 2020–2027 (USD MILLION)

TABLE 89 REST OF ASIA PACIFIC: MINIMALLY INVASIVE BARIATRIC SURGICAL DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 90 REST OF ASIA PACIFIC: MARKET, BY PROCEDURE, 2020–2027 (USD MILLION)

8.5 LATIN AMERICA

8.5.1 GROWING EFFORTS TO ENSURE UNIVERSAL HEALTHCARE COVERAGE TO SUPPORT MARKET GROWTH

TABLE 91 LATIN AMERICA: MARKET, BY DEVICE TYPE, 2020–2027 (USD MILLION)

TABLE 92 LATIN AMERICA: MINIMALLY INVASIVE BARIATRIC SURGICAL DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 93 LATIN AMERICA: MARKET, BY PROCEDURE, 2020–2027 (USD MILLION)

8.6 MIDDLE EAST & AFRICA

8.6.1 IMPROVING HEALTHCARE INFRASTRUCTURE TO SUPPORT MARKET GROWTH

TABLE 94 MIDDLE EAST & AFRICA: BARIATRIC SURGERY DEVICES MARKET, BY DEVICE TYPE, 2020–2027 (USD MILLION)

TABLE 95 MIDDLE EAST & AFRICA: MINIMALLY INVASIVE BARIATRIC SURGICAL DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 96 MIDDLE EAST & AFRICA: MARKET, BY PROCEDURE, 2020–2027 (USD MILLION)

9 COMPETITIVE LANDSCAPE (Page No. - 132)

9.1 OVERVIEW

9.2 STRATEGIES ADOPTED BY KEY PLAYERS/RIGHT TO WIN

9.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY COMPANIES

TABLE 97 OVERVIEW OF STRATEGIES DEPLOYED BY KEY COMPANIES

9.3 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 24 REVENUE SHARE ANALYSIS OF TOP PLAYERS

9.4 MARKET SHARE ANALYSIS

9.4.1 BARIATRIC SURGERY DEVICES MARKET

FIGURE 25 GLOBAL MARKET SHARE BY KEY PLAYER (2021)

TABLE 98 GLOBAL MARKET: DEGREE OF COMPETITION

9.5 COMPANY EVALUATION QUADRANT

9.5.1 LIST OF EVALUATED VENDORS

9.5.2 STARS

9.5.3 EMERGING LEADERS

9.5.4 PERVASIVE PLAYERS

9.5.5 PARTICIPANTS

FIGURE 26 GLOBAL MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

9.6 COMPETITIVE LEADERSHIP MAPPING FOR START-UPS/SMES (2021)

9.6.1 PROGRESSIVE COMPANIES

9.6.2 STARTING BLOCKS

9.6.3 RESPONSIVE COMPANIES

9.6.4 DYNAMIC COMPANIES

FIGURE 27 GLOBAL MARKET: COMPETITIVE LEADERSHIP MAPPING FOR START-UPS/SMES, 2021

9.7 COMPETITIVE BENCHMARKING

9.7.1 PRODUCT & GEOGRAPHIC FOOTPRINT ANALYSIS

FIGURE 28 PRODUCT AND GEOGRAPHIC FOOTPRINT ANALYSIS OF LEADING PLAYERS

TABLE 99 GLOBAL MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

TABLE 100 COMPANY PRODUCT & SERVICE FOOTPRINT

TABLE 101 COMPANY REGIONAL FOOTPRINT

TABLE 102 GLOBAL MARKET: DETAILED LIST OF KEY START-UPS/SMES

9.8 COMPETITIVE SCENARIO

9.8.1 PRODUCT LAUNCHES

TABLE 103 KEY PRODUCT LAUNCHES & REGULATORY APPROVALS

9.8.2 DEALS

TABLE 104 KEY DEALS

9.8.3 OTHER DEVELOPMENTS

TABLE 105 KEY OTHER DEVELOPMENTS

10 COMPANY PROFILES (Page No. - 146)

(Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) *

10.1 KEY PLAYERS

10.1.1 JOHNSON & JOHNSON

TABLE 106 JOHNSON & JOHNSON: BUSINESS OVERVIEW

FIGURE 29 JOHNSON & JOHNSON: COMPANY SNAPSHOT (2021)

10.1.2 MEDTRONIC PLC

TABLE 107 MEDTRONIC PLC: BUSINESS OVERVIEW

FIGURE 30 MEDTRONIC PLC: COMPANY SNAPSHOT (2021)

10.1.3 INTUITIVE SURGICAL, INC.

TABLE 108 INTUITIVE SURGICAL, INC: BUSINESS OVERVIEW

FIGURE 31 INTUITIVE SURGICAL, INC: COMPANY SNAPSHOT (2021)

10.1.4 OLYMPUS CORPORATION

TABLE 109 OLYMPUS CORPORATION: BUSINESS OVERVIEW

FIGURE 32 OLYMPUS CORPORATION: COMPANY SNAPSHOT (2021)

10.1.5 APOLLO ENDOSURGERY, INC.

TABLE 110 APOLLO ENDOSURGERY, INC: BUSINESS OVERVIEW

FIGURE 33 APOLLO ENDOSURGERY, INC: COMPANY SNAPSHOT (2021)

10.1.6 RESHAPE LIFESCIENCES INC.

TABLE 111 RESHAPE LIFESCIENCES INC: BUSINESS OVERVIEW

FIGURE 34 RESHAPE LIFESCIENCES INC: COMPANY SNAPSHOT (2021)

10.1.7 SPATZ MEDICAL

TABLE 112 SPATZ MEDICAL: BUSINESS OVERVIEW

10.1.8 COUSIN BIOTECH

TABLE 113 COUSIN BIOTECH: BUSINESS OVERVIEW

10.1.9 MEDIFLEX SURGICAL PRODUCTS

TABLE 114 MEDIFLEX SURGICAL PRODUCTS: BUSINESS OVERVIEW

10.1.10 B. BRAUN MELSUNGEN AG

TABLE 115 B. BRAUN MELSUNGEN AG: BUSINESS OVERVIEW

FIGURE 35 B. BRAUN MELSUNGEN AG: COMPANY SNAPSHOT (2021)

10.1.11 STANDARD BARIATRICS, INC.

TABLE 116 STANDARD BARIATRICS, INC: BUSINESS OVERVIEW

10.2 OTHER PLAYERS

10.2.1 RICHARD WOLF GMBH

TABLE 117 RICHARD WOLF GMBH: COMPANY OVERVIEW

10.2.2 MEDSIL

TABLE 118 MEDSIL: COMPANY OVERVIEW

10.2.3 GRENA LTD

TABLE 119 GRENA LTD: COMPANY OVERVIEW

10.2.4 SURGICAL INNOVATIONS GROUP PLC

TABLE 120 SURGICAL INNOVATIONS GROUP PLC: COMPANY OVERVIEW

10.2.5 A.M.I. GMBH

TABLE 121 A.M.I. GMBH: COMPANY OVERVIEW

10.2.6 REACH SURGICAL

TABLE 122 REACH SURGICAL: COMPANY OVERVIEW

10.2.7 SILIMED INDUSTRIA DE IMPLANTES LTDA.

TABLE 123 SILIMED INDUSTRIA DE IMPLANTES LTDA: COMPANY OVERVIEW

10.2.8 COOK MEDICAL LLC

TABLE 124 COOK MEDICAL LLC: COMPANY OVERVIEW

10.2.9 SHANGHAI YISI MEDICAL TECHNOLOGY CO., LTD.

TABLE 125 SHANGHAI YISI MEDICAL TECHNOLOGY CO., LTD: COMPANY OVERVIEW

10.2.10 BOWA-ELECTRONIC GMBH & CO. KG

TABLE 126 BOWA-ELECTRONIC GMBH & CO. KG: COMPANY OVERVIEW

10.2.11 TROKAMED GMBH

TABLE 127 TROKAMED GMBH: COMPANY OVERVIEW

10.2.12 ASPIRE BARIATRICS, INC.

TABLE 128 ASPIRE BARIATRICS, INC: COMPANY OVERVIEW

10.2.13 VICTOR MEDICAL INSTRUMENTS CO., LTD.

TABLE 129 VICTOR MEDICAL INSTRUMENTS CO., LTD: COMPANY OVERVIEW

10.2.14 APPLIED MEDICAL RESOURCES CORPORATION

TABLE 130 APPLIED MEDICAL RESOURCES CORPORATION: COMPANY OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

11 APPENDIX (Page No. - 181)

11.1 DISCUSSION GUIDE

11.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

11.3 CUSTOMIZATION OPTIONS

11.4 RELATED REPORTS

11.5 AUTHOR DETAILS

This study involved four major activities in estimating the current size of the bariatric surgery devices market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate segments and subsegments' market size.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to identify and collect information for this study.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources were mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, technology developers, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify the critical qualitative and quantitative information as well as assess future prospects.

The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the bariatric surgery devices market's total size. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market were identified through secondary research, and their market shares in respective regions were determined through primary and secondary research.

- This entire procedure includes studying the annual and financial reports of the top market players and extensive interviews for key insights with industry leaders such as CEOs, VPs, directors, and marketing executives.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All the possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

- The above-mentioned data was consolidated and added to detailed inputs and analysis from MarketsandMarkets and presented in this report.

Market Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size applying the process mentioned above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, segment, and forecast the global bariatric surgery devices market, by device type, procedure, and region

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments with respect to five regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze company developments such as product launches & approvals, partnerships, acquisitions, and other developments

- To benchmark players within the market using the proprietary Competitive Leadership Mapping framework, which analyzes market players on various parameters within the broad categories of business and product excellence

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Country Information

Bariatric surgery devices market size and growth rate estimates for countries in the Rest of Europe, the Rest of Asia Pacific, Latin America, and Middle East & Africa

Company profiles

Additional five company profiles of players operating in the global market.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Bariatric Surgery Devices Market