Bank Automation Market - Global Forecast to 2027

The Bank Automation is the process of using technology to automate banking process to reduce human participation to minimum, it is a product of technological improvements resulting in a continually developing banking sector. Resulting in a significantly more efficient, dependable, and secure banking service. A number of banks such as Citigroup, Capital One, and JPMorgan Chase are already using technology like artificial intelligence to aid workers or have automated parts of tasks to eliminate jobs.

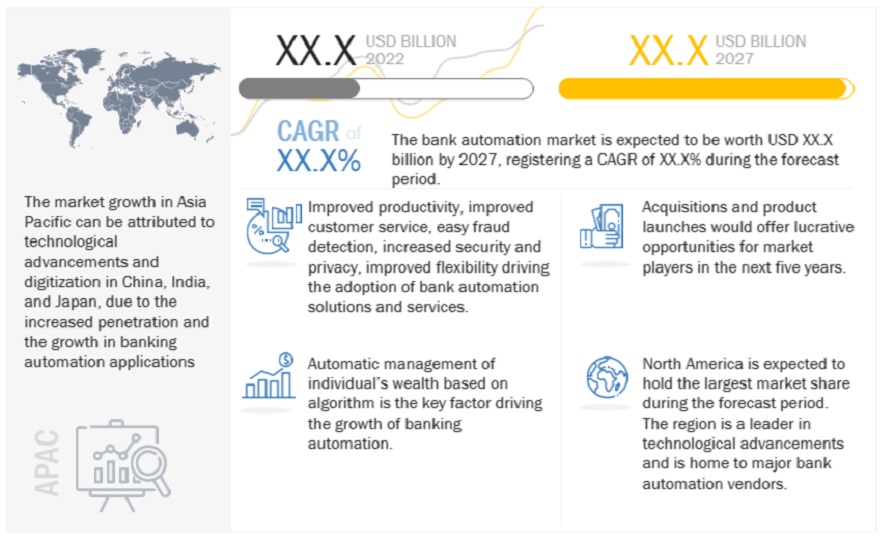

The bank automation market size is projected to grow from USD XX.X billion in 2022 to USD XX.X billion by 2027, at a CAGR of XX.X% during the forecast period.

Market Dynamics

Driver: Exploring robotic process automation (RPA)

The banking industry is eagerly embraced low-code and no-code technologies such as Robotic Process Automation (RPA) as it requires little investment, is adopted with minimal disruption, require no human intervention once deployed, and are beneficial throughout the organization from the C-suite to customer service. RPA utilizes structured data to complete tasks it helps in performing redundant tasks quickly without error. Examples of tasks where RPA technology works well are data entry, data processing and mapping, and client onboarding and new account openings.

Challenge: Outdated Mobile Experiences

Presences of mobile app has become a necessity for banks around the world. According to The Financial Brand, 2018; 42% of consumers report that they now use their banking provider’s mobile app more now than they did 12 months ago. Almost every bank and credit union now have its own mobile application; however, just having a mobile banking doesn’t imply its being used to its full potential. Banks face challenges to keep their clients delighted, and provide a mobile banking experience that’s quick, easy to use, fully featured, secure, and routinely updated.

Key Market Players

Some of the key players operating in the Bank Automation market include Automation Anywhere, Antworks, Onfido, Blackrock, Blue prism, Boston consulting group, Charles Schwab, Nividous, ComplyAdvantage, Uipath, and Wealthfront.

Recent Developments:

- In December 2021, Automation Anywhere Inc, acquired FortressIQ, planning to use its artificial intelligence capabilities to identify opportunities for robots to automate processes traditionally carried out by workers, such as data entry, the sources said.

TABLE OF CONTENTS

1 INTRODUCTION

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

2.4 MARKET FORECAST

2.5 ASSUMPTIONS

2.6 LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 ATTRACTIVE OPPORTUNITIES IN BANK AUTOMATION MARKET

4.2 NORTH AMERICAN MARKET, BY TYPE AND COUNTRY (2022)

4.4 ASIA PACIFIC MARKET, BY TYPE AND COUNTRY (2022)

4.5 MARKET, BY COUNTRY

5 MARKET OVERVIEW AND INDUSTRY TRENDS

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.2 RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.4 CHALLENGES

5.3 INDUSTRY TRENDS

5.3.1 VALUE CHAIN

5.3.2 ECOSYSTEM

5.3.3 PORTER’S FIVE FORCE MODEL

5.3.3.1 THREAT OF NEW ENTRANTS

5.3.3.2 THREAT OF SUBSTITUTES

5.3.3.3 BARGAINING POWER OF BUYERS

5.3.3.4 BARGAINING POWER OF SUPPLIER

5.3.3.5 COMPETITIVE RIVALRY

5.3.4 KEY STAKEHOLDERS AND BUYING CRITERIA

5.3.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

5.3.4.2 BUYING CRITERIA

5.3.5 TECHNOLOGY ANALYSIS

5.3.6 TRENDS AND DISRUPTIONS IMPACTING BUYERS

5.3.7 PATENT ANALYSIS

5.3.8 PRICING ANALYSIS

5.3.8.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TYPE

5.3.9 USE CASES

5.3.10 KEY CONFERENCES & EVENTS IN 2022

5.3.11 TARIFF AND REGULATORY IMPACT

5.3.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES & OTHER ORGANIZATIONS

6 BANK AUTOMATION MARKET, BY TYPE

6.1 INTRODUCTION

6.1.1 MARKET, BY TYPE: DRIVERS

6.2 ROBOTICS PROCESS AUTOMATION

6.3 ROBOADVISORS

6.4 CUSTOMER SERVICE CHATBOTS

6.5 AI FOR LOAN UNDERWRITING

7 BANK AUTOMATION MARKET, BY APPLICATION

7.1 INTRODUCTION

7.1.1 MARKET, BY APPLICATION: DRIVERS

7.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

7.3 GOVERNMENT/PUBLIC SECTOR

7.4 OTHERS

8 BANK AUTOMATION MARKET, BY REGION

8.1 INTRODUCTION

8.2 NORTH AMERICA

8.2.1 NORTH AMERICA: PESTLE ANALYSIS

8.2.2 UNITED STATES

8.2.3 CANADA

8.3 EUROPE

8.3.1 EUROPE: PESTLE ANALYSIS

8.3.2 UNITED KINGDOM

8.3.3 GERMANY

8.3.4 FRANCE

8.3.5 SPAIN

8.3.6 ITALY

8.3.6 NORDICS

8.3.8 REST OF EUROPE

8.4 ASIA PACIFIC

8.4.1 ASIA PACIFIC: PESTLE ANALYSIS

8.4.2 CHINA

8.4.3 JAPAN

8.4.4 INDIA

8.4.5 ANZ

8.4.6 SE ASIA

8.4.7 REST OF ASIA PACIFIC

8.5 MIDDLE EAST AND AFRICA

8.5.1 MIDDLE EAST AND AFRICA: PESTLE ANALYSIS

8.5.2 UAE

8.5.3 KSA

8.5.3 REST OF MIDDLE EAST AND AFRICA

8.6 LATIN AMERICA

8.5.1 LATIN AMERICA: PESTLE ANALYSIS

8.5.2 BRAZIL

8.5.3 MEXICO

8.5.4 REST OF LATIN AMERICA

9 COMPETITIVE LANDSCAPE

9.1 OVERVIEW

9.2 MARKET EVALUATION FRAMEWORK

9.3 COMPETITIVE SCENARIO AND TRENDS

9.3.1 PRODUCT LAUNCHES

9.3.2 DEALS

9.3.3 OTHERS

9.4 MARKET SHARE ANALYSIS OF TOP PLAYERS

9.5 HISTORICAL REVENUE ANALYSIS

9.6 COMPANY EVALUATION MATRIX OVERVIEW

9.7 COMPANY EVALUATION QUADRANT

9.7.1 STARS

9.7.2 EMERGING LEADERS

9.7.3 PERVASIVE PLAYERS

9.7.4 PARTICIPANTS

9.8 PRODUCT FOOTPRINT ANALYSIS OF COMPANIES

9.9 MARKET RANKING ANALYSIS OF COMPANIES

9.10 STARTUP/SME EVALUATION QUADRANT

9.10.1 PROGRESSIVE COMPANIES

9.10.2 RESPONSIVE COMPANIES

9.10.3 DYNAMIC COMPANIES

9.10.4 STARTING BLOCKS

9.11 COMPETITIVE BENCHMARKING FOR SMES/STARTUPS

10 COMPANY PROFILES

10.1 KEY PLAYERS

10.1.1 AUTOMATION ANYWHERE

10.1.2 ANTWORKS

10.1.3 ONFIDO

10.1.4 BLACKROCK

10.1.5 BLUE PRISM

10.1.6 BOSTON CONSULTING GROUP

10.1.7 CHARLES SCHWAB

10.1.8 NIVIDOUS

10.1.9 COMPLYADVANTANGE

10.1.10 UIPATH

10.1.11 WEALTHFRONT

11 APPENDIX AND ADJACENT MARKETS

11.1 ADJACENT/RELATED MARKETS

11.1.1 INTRODUCTION

11.1.2 LIMITATIONS

11.2 RPA AND HYPERAUTOMATION MARKET

11.3 DIGITAL BANKING PLATFORMS MARKET

11.4 DISCUSSION GUIDE

11.5 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

11.6 AVAILABLE CUSTOMIZATIONS

11.7 RELATED REPORTS

11.8 AUTHOR DETAILS

Growth opportunities and latent adjacency in Bank Automation Market