Aviation Borescope Market - Global Forecast to 2030

Aviation borescopes are mainly referred to as industrial endoscopes and video scopes. Borescopes are like inspection cameras widely used in aviation and aeronautics industries. To ensure optimal performance standards of internal components, aviation specialists use aircraft borescopes as a visual inspection tool for helicopters, fixed-wing aircraft, and aircraft engines. It's a device used to monitor a structure's interiors. In addition, borescope also helps to provide safety surveillance in aircraft engines, especially gas turbines, industrial gas turbines, steam turbines, and fuel systems.

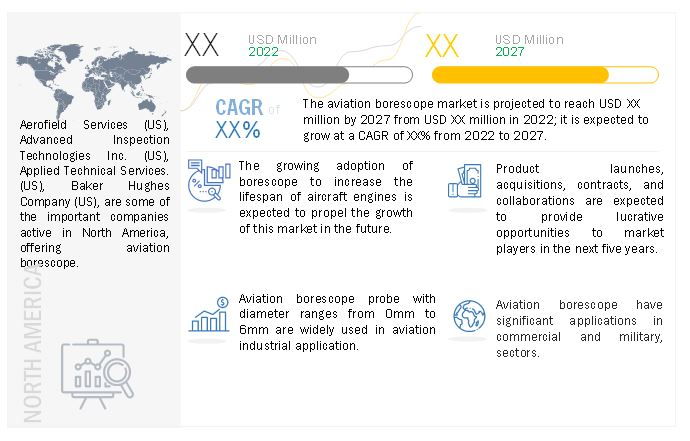

The global aviation borescope market size is expected to grow from USD XX million in 2024 to USD XX million by 2030, at a CAGR of XX%. The key factors boosting market growth are the rising need and demand for advanced equipment for different inspections in the aviation industry and stringent safety regulations in this sector.

To know about the assumptions considered for the study, Request for Free Sample Report

Drivers:High efficiency and time savings in the inspection process

With the help of a borescope, the maintenance crew in the aviation industry can easily conduct thorough inspections of an aircraft without disassembling the entire engine. In case of any defect, the aircraft crew can perform a targeted repair with the help of a borescope, which saves their time and operational costs. In addition, an engine borescope can also be used to perform routine aircraft cleaning procedures in a short time and with less expense.

Improvement in aircraft engines’ lifespan

Any incident or damage to an aircraft engine can lead to a decrease in its lifespan. Also, extensive repairs that require rebuilding and disassembling the engine may reduce an aircraft’s lifespan. Hence, it is necessary to conduct a routine borescope inspection to spot minor problems early. Performing small, targeted, and timely repairs using a borescope could improve the aircraft’s lifespan. Hence, the adoption of aviation borescopes is rising in the aviation sector.

Challenges: Limited motion and viewing capability

One of the most critical challenges with the borescope is its limited motion and viewing capability in tight spaces. Due to its limited maneuverability, some rigid borescopes may not be able to efficiently inspect all the places. Hence, these borescopes can only be used where only the subject's linear and straight viewing access is available.

Key players in the market

Aerofield Services (US), Advanced Inspection Technologies Inc. (US), Applied Technical Services. (US), Baker Hughes Company (US), Fluke Corporation (US), General Electric Company (US), Gradient Lens Corporation. (US), JME Technologies (US), and KARL STORZ (Germany) are some of the global aviation borescope players.

Recent Developments

- In March 2022, Applied Technical Services deployed a premium borescope that helps to measure indications precisely with high resolution vessel/push cameras and robotics capable of delivering a payload.

- In February 2022, Waygate Technologies, which is a Baker Hughes Company business, upgraded its high-end Everest Mentor Visual iQ (MViQ) VideoProbe for visual inspection remotely. The software upgrade offers some of the most advanced video borescopes with built-in artificial intelligence (AI) features.

- In July 2021, Waygate Technologies, a Baker Hughes Company business considered a world leader in industrial nondestructive testing (NDT) solutions, launched the new Everest Mentor Flex VideoProbe.

TABLE OF CONTENTS

1 INTRODUCTION

1.1. Study Objectives

1.2. Market Definition

1.3. Study Scope

1.3.1. Markets Covered

1.3.2. Geographic Scope

1.3.3. Years Considered for the Study

1.4. Currency

1.5. Limitations

1.6. Stakeholders

2 RESEARCH METHODOLOGY

2.1. Research Data

2.1.1. Secondary Data

2.1.2. Primary Data

2.2. Market Size Estimation

2.2.1. Bottom-Up Approach

2.2.2. Top-Down Approach

2.3. Market Breakdown and Data Triangulation

2.4. Research Assumptions

2.5. Risk Assessments

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.2.4. Challenges

5.3. Value Chain Analysis

5.4. Ecosystem Analysis

5.5. Revenue Shift and New Revenue Pockets for Aviation Borescope Market

5.6. Porter’s Five Forces Analysis

5.7. Case Study Analysis

5.8. Technology Analysis

5.9. Pricing Analysis

5.10. Key Stakeholders & Buying Criteria

5.11. Trade Analysis

5.12. Patent Analysis

5.13. Key Conferences & Events

5.14. Regulatory Bodies, Government Agencies, And Other Organizations

5.14.1. Standards

6 AVIATION BORESCOPE MARKET, BY AVIATION TYPE

6.1. Introduction

6.2. Commercial Aviation

6.3. Military Aviation

6.4. Business & General Aviation

7 AVIATION BORESCOPE MARKET, BY TYPE

7.1. Introduction

7.2. Video Borescopes

7.3. Flexible Borescopes

7.4. Semi-rigid Borescopes

7.5. Rigid Borescopes

8 AVIATION BORESCOPE MARKET, BY DIAMETER

8.1. Introduction

8.2. 0mm to 3mm

8.3. 3mm to 6mm

8.4. Above 6mm

9 AVIATION BORESCOPE MARKET, BY ANGLE

9.1. Introduction

9.2. 0° to 90°

9.3. 90° to 180°

9.4. 180° to 360°

10 AVIATION BORESCOPE MARKET, BY GEOGRAPHY

10.1. Introduction

10.2. North America

10.2.1. US

10.2.2. Canada

10.2.3. Mexico

10.3. Europe

10.3.1. Germany

10.3.2. UK

10.3.3. France

10.3.4. Rest of Europe

10.4. Asia Pacific

10.4.1. China

10.4.2. Japan

10.4.3. India

10.4.4. South Korea

10.4.5. Rest of Asia Pacific

10.5. Rest of the World (RoW)

10.5.1. South America

10.5.2. Middle East

10.5.3. Africa

11 COMPETITIVE LANDSCAPE

11.1. Introduction

11.2. Top Company Revenue Analysis

11.3. Market Share/Rank Analysis

11.4. Company Evaluation Quadrant, 2021

11.4.1. Star

11.4.2. Emerging Leader

11.4.3. Pervasive

11.4.4. Participants

11.5. Small and Medium Enterprises (SMEs) Evaluation Quadrant, 2021

11.5.1. Progressive Companies

11.5.2. Responsive Companies

11.5.3. Dynamic Companies

11.5.4. Starting Blocks

11.6. Competitive Benchmarking

11.7. Aviation Borescope Market: Company Footprint

11.8. Competitive Situation and Trends

11.8.1. Product Launches

11.8.2. Deals

12 COMPANY PROFILES

12.1. Key Players

12.1.1. Aerofieldservices

12.1.2. AIT (Advanced Inspection Technologies)

12.1.3. ATSlab

12.1.4. Baker Hughes

12.1.5. Fluke

12.1.6. GE

12.1.7. Gradient Lens

12.1.8. JME Technologies

12.1.9. Karlstorz

12.1.10. Lenox

12.2. Other Key Players

12.2.1. Mitcorp

12.2.2. Moritex

12.2.3. Nexxis

12.2.4. Oasis Scientific

12.2.5. Olympus

12.2.6. Ome-Top Systems

12.2.7. PCE Instruments

12.2.8. RVI Ltd

12.2.9. SKF

12.2.10. Sofema

12.2.11. SPI Borescopes

12.2.12. USABorescopes

12.2.13. ViewTech

12.2.14. Vizaar

12.2.15. Yateks

13 Adjacent and Related Markets

14 Appendix

14.1. Insights of Industry Experts

14.2. Discussion Guide

14.3. Knowledge Store: MarketsandMarkets’ Subscription Portal

14.4. Available Customizations

14.5. Related Reports

14.6. Author Details

Note: This ToC is tentative and minor changes are possible as the study progresses.

Growth opportunities and latent adjacency in Aviation Borescope Market