Automotive Wrap Market by Product Type (Cast Film, Calendered Films, Window Films), Vehicle (Passenger Cars - Hatchback, Sedan, SUV/MPV; LCV, Bus, Truck), Electric Vehicles, Application (Advertisement, Protection, Sports) and Region - Global Forecast 2027

The automotive wrap is a plastic film made of polyvinyl material applied to a vehicle either partially or completely for different applications such as advertisement, body paint protection, or aesthetic purposes. Automotive wraps are low in cost compared to paint jobs and highly flexible and customizable, which increases their attractiveness when compared to paint jobs.

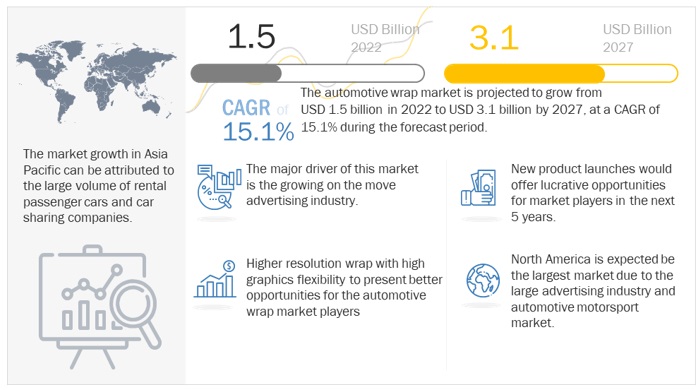

The automotive wrap market is expected to grow from USD 1.5 billion in 2022 and is poised to reach USD 3.1 billion in 2027, at a CAGR of 15.1% during the forecast period. Rising advertisement spending, growing preference for better-looking aesthetics, and motorsport applications drive the demand for the automotive wrap market.

Driver: On-the-go advertising to drive demand for automotive wrap

On-the-go advertising involves a company buying space on automotive vehicles to display their products or service offerings to prospective customers to increase the reach of their brand to improve sales. Car rental fleets, buses, and coaches in the tourism and sports industry rent the space on their vehicles to such companies and have an additional source of income. The advertising budget for companies has risen globally. According to the Outdoor Advertising Association of America, or OAAA, over 95% of US people respond to vehicle advertising. Hence as advertisement on vehicles grows, the demand for the automotive wrap will grow.

Restraint: Transportation regulations can restrain the market

Some countries, such as India, which is a large market for the automotive sector, have stringent regulations on the level of customization allowed for vehicles. As per The Supreme Court Of India ruling, car window tinting is prohibited in India. Using window tint of any VLT (Visual Light Transmission) rating on the windscreen (front and rear) and side windows is illegal. Tinted windows straight from the car manufacturer are allowed with certain conditions applied. Violation of such regulations can incur penalties. Thus, such regulations can restrain the automotive wrap market growth in a key region of Asia Pacific.

Opportunity: High-resolution graphics with better flexibility

Companies trying to attract customers quickly or private vehicle owners' preference for a particular design demand a high level of graphic resolution and a higher degree of flexibility. Avery Dennison offers digitally printed wraps as a part of their product portfolio where one can get any image digitally printed on the wrap. Automotive wrap companies have an opportunity to adapt to a higher resolution digitally printed products to gain market share in the rapidly evolving market.

Challenge: Maintaining the low cost of the wrap.

Wraps are primarily made of plastic materials, and global price fluctuations may increase the price of wrap material. Depending on the material flexibility, the wrap can be an expensive prospect for customers in the event of damage. Hence the market is posed with a challenge to keep the costs down to maintain the product's attractiveness.

Key Players

Avery Dennison (US), Arlon Graphics, LLC(US), 3M (US), Kay Premium Marking Films (KPMF) (UK), Ritrama S.p.A. Vvivid Vinyl (Canada), Orafol Group (Germany), Hexis S.A. (France), Guangzhou Carbins Film Co., LTD (China), Madico, Inc. (US), Nexfil Co, Ltd. (South Korea).

|

Report Metrics |

Details |

| Base year for estimation | 2021 |

| Forecast period | 2022 – 2027 |

| Market Growth forecast | USD 3.1 Mn by 2027 at a CAGR of 15.1% |

| Top Players | Avery Dennison (US), Arlon Graphics, LLC(US), 3M(US), Kay Premium Marking Films (KPMF) (UK), Ritrama S.p.A. Vvivid Vinyl (Canada), Orafol Group (Germany), Hexis S.A. (France), Guangzhou Carbins Film Co., LTD (China), Madico, Inc. (US), Nexfil Co, Ltd. (South Korea). |

| Fastest Growing Market | Asia-Pacific |

| Largest Market | Asia-Pacific |

| Segments covered | |

| By Vehicle Type | Light Duty Vehicles, Buses, Trucks |

| By Application | Advertisement, Protection, Sports |

| By Product Type | Cast films, Calendered films, Window films, Others |

| Passenger Cars By Segment Type | Hatchbacks, Sedans, SUVs/MPVs |

| By Region | North America – US, Canada |

| Europe – France, Germany, Spain, UK, Poland, Italy, Turkey | |

| Asia Oceania – China, India, Japan, South Korea, Australia | |

| Rest of the World – Brazil, Argentina, South Africa | |

| Additional Customization to be offered |

|

Recent Developments

- In 2021, 3M witnessed a large demand for the textured wrap. These textured wraps can be of leather or even snake-skin, providing a futuristic and unique look to the vehicle.

- In 2021, BMW created an AI-based wrap design software where several picture inputs of a theme were fed into the AI system, and the system gave a unique output. This allows for a highly unique wrap design system that will be popular amongst customers.

TABLE OF CONTENTS

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

2.1 SECONDARY DATA

2.2 PRIMARY DATA

2.3 FACTOR ANALYSIS

2.3.1 INTRODUCTION

2.3.2 DEMAND SIDE ANALYSIS

2.3.3 SUPPLY SIDE ANALYSIS

2.4 MARKET SIZE ESTIMATION

2.5 MARKET BREAKDOWN AND DATA TRIANGULATION

2.6 ASSUMPTIONS

2.7 RISK ASSESSMENT & RANGES

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.2 RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.4 CHALLENGES

5.3 TECHNOLOGY ANALYSIS

5.4 PORTER’S FIVE FORCES MODEL

5.5 ECOSYSTEM ANALYSIS

5.6 SUPPLY CHAIN ANALYSIS

5.7 CASE STUDY ANALYSIS

5.8 PATENT ANALYSIS

5.9 TRADE ANALYSIS

5.10 KEY CONFERENCE (2022-2023)

5.11 ASP ANALYSIS

5.12 CUSTOMER BUYING BEHAVIOUR

5.12 REGULATORY ANALYSIS

6 AUTOMOTIVE WRAP MARKET, BY VEHICLE TYPE

6.1 INTRODUCTION

6.2 PASSENGER CARS

6.2.1 SEDAN

6.2.2 HATCHBACK

6.2.3 SUV/MPV

6.2 LCV

6.3 TRUCKS

6.4 BUSES

*MNM will provide regional level market in terms of volume (units) and value (USD million)

7 AUTOMOTIVE WRAP MARKET, BY PRODUCT TYPE

7.1 INTRODUCTION

7.2 CAST FILM

7.3 CALENDERED FILMS

7.4 WINDOW FILMS

7.5 OTHERS

*MNM will provide regional level market in terms of volume (units) and value (USD million)

8 AUTOMOTIVE WRAP MARKET, BY APPLICATION

8.1 INTRODUCTION

8.2 ADVERTISEMENT

8.3 PROTECTION

8.4 SPORTS

*MNM will provide regional -level market in terms of volume (units) and value (USD million)

9 ELECTRIC VEHICLE WRAP MARKET, BY VEHICLE TYPE

9.1 INTRODUCTION

9.2 BEV

9.3 PHEV

*MNM will provide regional -level market in terms of volume (units) and value (USD million)

10 AUTOMOTIVE WRAP MARKET, BY END USE INDUSTRY

10.1 INTRODUCTION

10.2 OE

10.3 AFTERMARKET

*MNM will provide regional -level market in terms of volume (units) and value (USD million)

11 AUTOMOTIVE WRAP MARKET, BY REGION

11.1 INTRODUCTION

11.2 ASIA PACIFIC

11.2.1 CHINA

11.2.2 INDIA

11.2.3 JAPAN

11.2.4 SOUTH KOREA

11.2.5 AUSTRALIA

11.3 NORTH AMERICA

11.3.1 CANADA

11.3.2 US

11.4 EUROPE

11.4.1 FRANCE

11.4.2 GERMANY

11.4.3 ITALY

11.4.4 UK

11.4.5 SPAIN

11.4.6 POLAND

11.4.7 TURKEY

11.5 REST OF THE WORLD

11.5.1 BRAZIL

11.5.2 ARGENTINA

11.5.3 SOUTH AFRICA

12 COMPETITIVE LANDSCAPE

12.1 OVERVIEW

12.2 MARKET SHARE/RANKING ANALYSIS, 2021

12.3 COMPETITIVE SCENARIO

12.3.1 NEW PRODUCT DEVELOPMENTS

12.3.2 ACQUISITIONS

12.3.3 JOINT VENTURES AND AGREEMENTS

12.3.4 EXPANSIONS

12.4 COMPANY EVALUATION QUADRANT

12.4.1 STARS

12.4.2 EMERGING LEADERS

12.4.3 PERVASISVE

12.4.4 PARTICIPANTS

12.5 STARTUP/SME EVALUATION QUADRANT

12.6 RIGHT TO WIN

13 COMPANY PROFILES

(Company overview, Strength of product portfolio, Product offerings, Business strategy excellence, Recent developments) *

13.1 KEY PLAYERS

13.1.1 AVERY DENNISON CORPORATION

13.1.2 ARLON GRAPHICS, LLC

13.1.3 3M COMPANY

13.1.4 KAY PREMIUM MARKING FILMS LTD.

13.1.5 HEXIS S.A.S.

13.1.6 FEDRIGONI S.P.A. (RITRAMA S.P.A.)

13.1.7 VVIVID VINYL

13.1.8 ORAFOL EUROPE GMBH

13.1.9 GUANGZHOU CARBINS FILM CO., LTD.

13.1.10 JMR GRAPHICS

13.2 OTHER KEY PLAYERS

13.2.1 KPMF

13.2.2 MADICO, INC.

13.2.3 NEXFIL CO, LTD.

13.2.4 PRESTIGE FILM TECHNOLOGIES

13.2.5 FOLIATEC BOHM GMBH & CO. VERTRIEBS KG

*Details on Company overview, Strength of product portfolio, Product offerings, Business strategy excellence, Recent developments might not be captured in case of unlisted companies.

14 RECOMMENDATIONS

15 APPENDIX

Growth opportunities and latent adjacency in Automotive Wrap Market