Automotive Supercharger Market by Components, Technology (Centrifugal, Twin-Screw, Roots), Vehicle Type (PC, CV, Motorcycle), Fuel Type (Gasoline, Diesel), Power Source (Engine Driven, Electric Motor Driven), and Region - Global Forecast to 2025

[147 Pages Report] The automotive supercharger market was valued at USD 6.83 Billion in 2016 and is projected to grow at a CAGR of 5.27% during the forecast period, to reach USD 10.95 Billion by 2025.

Years considered for the study are

- Base year – 2016

- Forecast period – 2017–2025

Objectives of the Report

- To define, segment, and forecast the automotive supercharger market (2017–2025) in terms of volume (thousand units) and value (USD million)

- To provide detailed analysis of the various forces acting in the market (drivers, restraints, opportunities, and challenges)

- To segment and forecast its size, by volume and value, based on component, fuel type, technology, power source, vehicle type, and region (Asia Pacific, Europe, and North America)

- To segment and forecast the market size, by value, based on components-Harmonic Balancers, Pulleys/ Belts, Compressors, Intercoolers, Blowers, Tensioners, Valves, and Head Units

- To segment and forecast the market size, by volume and value, based on fuel type- Gasoline and Diesel

- To segment and forecast the market size, by volume and value, based on technology-Centrifugal, Roots, and Twin-Screw

- To segment and forecast the market size, by volume and value, based on power source-Engine Driven and Electric Motor Driven

- To segment and forecast the market size, by volume and value, based on vehicle type-Passenger Cars, Commercial Vehicles, and Motorcycles

- To track and analyze competitive developments such as joint ventures, mergers & acquisitions, new product launches, expansions, and other activities carried out by key industry participants

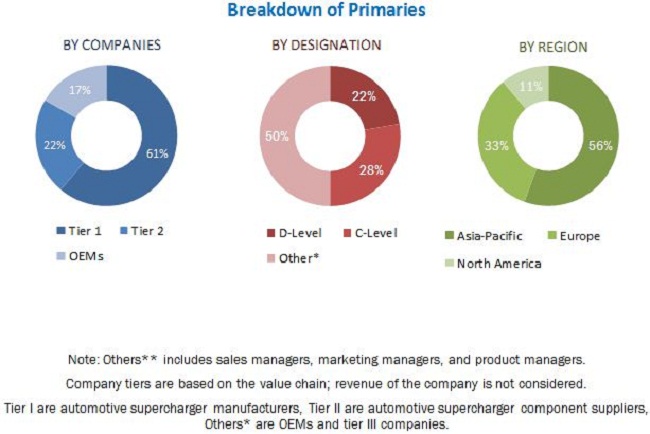

The research methodology used in the report involves primary and secondary sources and follows a bottom-up approach for the purpose of data triangulation. The study involves the country-level OEM and model-wise analysis of automotive supercharger market. This analysis involves historical trends as well as existing market penetrations by country as well as vehicle type. The analysis is projected based on various factors such as growth trends in vehicle production and adoption rate by OEMs. The analysis has been discussed with and validated by primary respondents, including experts from the automotive industry, manufacturers, and suppliers. Secondary sources include associations such as China Association of Automobile Manufacturers (CAAM), International Organization of Motor Vehicle Manufacturers (OICA), European Automobile Manufacturers Association (ACEA), Environmental Protection Agency (EPA), Society of Indian Automotive Manufacturers, SAE International, and paid databases and directories such as Factiva.

The figure given below illustrates the break-up of the profile of industry experts who participated in primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the automotive supercharger market consists of manufacturers such as Honeywell (US), Eaton (Ireland), and Valeo (France) and research institutes such as the Japan Automobile Manufacturers Association (JAMA), European Automobile Manufacturers Association (ACEA), Canadian Automobile Association (CAA), and Korea Automobile Manufacturers Association (KAMA).

Target Audience

- Automotive supercharger manufacturers for passenger cars, commercial vehicles, and motorcycles

- Automobile manufacturers

- Automotive supercharger design companies

- Automobile organizations/associations

- Automotive supercharger suppliers

- Raw material suppliers for automotive superchargers

- Traders and distributors of automotive superchargers

- Automotive parts manufacturers

- Tier 1, Tier 2, and Tier 3 suppliers

- Distributors and suppliers of automotive components/parts

Scope of the Report

By Component

By Power Source

By Vehicle Type

By Technology

By Fuel Type

By Region

-

- Harmonic Balancers

- Pulleys/ Belts

- Compressors

- Intercoolers

- Blowers

- Tensioners

- Valves

- Head Units

- Engine Driven

- Electric Motor Driven

- Passenger Cars (PC)

- Commercial Vehicles (CV)

- Motorcycles

- Centrifugal

- Roots

- Twin-Screw

- Gasoline

- Diesel

- Asia Pacific

- Europe

- North America

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Detailed analysis of component segment by country

- Detailed analysis and profiling of additional market players (up to 3)

- Detailed analysis and profiling of additional regions (up to 3)

The higher performance expectations from smaller engines to drive the global automotive supercharger market close to USD 11 billion by 2025

Automotive superchargers are advanced devices that pressurize air into the engine which helps to increase the net power supplied to the vehicle. The power of superchargers is achieved from a belt, which is connected to the engine. Superchargers also increase the rotations per minute of an engine by up to 50,000. There are mainly three different types of superchargers, namely, roots type, twin screw, and centrifugal.

The rising production of gasoline engine vehicles due to strict air emission standards and higher sales of high-end vehicles due to increased disposable incomes worldwide are some of the major factors driving the growth of the automotive supercharger market.

The centrifugal supercharging technology is the latest technology in the market. Hence, the market for this technology is currently low. However, the adoption of centrifugal superchargers by OEMs is increasing at a rapid pace because of the obvious benefits of this technology such as easy installation, smaller size, high efficiency, and low maintenance. Major automotive supercharger players such as Mitsubishi Heavy Industries and Vortech Engineering are now offering several products based on centrifugal supercharging technology.

Automotive Supercharger Market Dynamics

Drivers

- Advantage over a turbocharger as lag diminishes

- Increased demand for high end vehicles

Restraints

- Decline in enthusiast segment – Millennial Effect

- Growing inclination of OEMs towards Electric & Hybrid vehicles

Opportunities

- Electric Superchargers can be a game changer

- Development of Diesel Superchargers

Automotive Supercharger Market Challenges

- Lack of scalability – Economies of scale

- Weight Constraint is one of the biggest challenge for OEMs

Critical Questions:

- How will the automotive supercharger market cope with the rise in electric vehicle sales?

- How are OEMs planning to increase penetration of automotive superchargers in economic vehicles without having a significant effect on their price?

- Will the 48-volt electric supercharger be a success in the electric and ICE vehicles? If not, what alternatives the industry will explore?

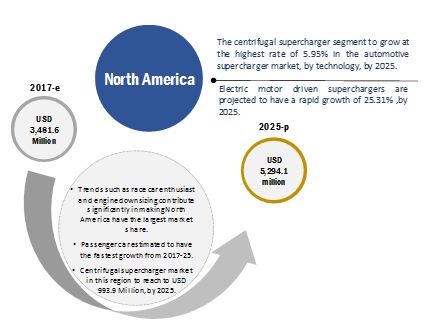

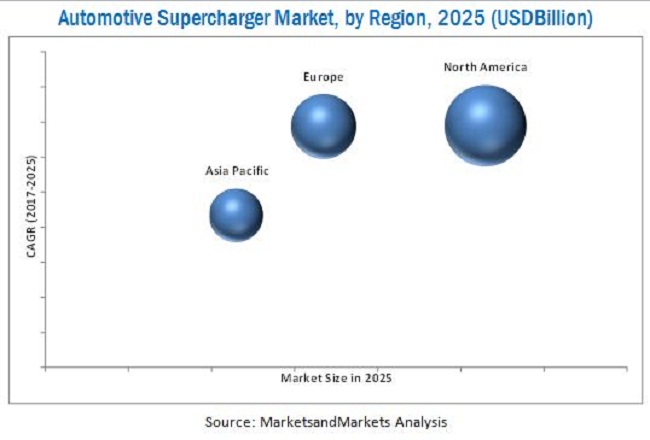

The supercharger market for automotive is projected to grow at a CAGR of 5.27% from 2017 to 2025. The supercharger market market for automotive superchargers is estimated to be USD 7.26 Billion in 2017 and is projected to reach USD 10.95 Billion by 2025. The key growth drivers of this market are the global measures by OEMs in the direction of engine downsizing, increased demand for high-end vehicles, and increasing norms on fuel efficiency.

The roots supercharger technology is estimated to have the largest market size in the global supercharger industry as it is an old and tested technology. However, the centrifugal supercharger technology is gaining momentum in the market due to its high efficiency, low maintenance, and smaller size.

The electric motor driven segment of the market is estimated to be the fastest growing segment. The 48-volt electric motor driven superchargers are gaining popularity among OEMs as these superchargers do not consume any power from the vehicle’s engine.

Gasoline engine vehicles segment is estimated to be the largest segment of the automotive supercharger market, by fuel type. Superchargers can boost a vehicle as soon as the vehicle starts moving. Also, superchargers are suitable for a gasoline engine that does not emit a large amount of exhaust gases. With the measures taken worldwide to curb air pollution, the production of diesel engine vehicles is expected to decrease. The resultant increase in gasoline vehicles will further drive the market of automotive superchargers in gasoline engine vehicles.

The automotive supercharger market for passenger cars segment is estimated to be the largest and fastest growing market. This is because superchargers are commonly used in racing cars and sports vehicles that require instantaneous boost as soon as the engine is started. Hence, superchargers are the perfect choice for such vehicles. The growing inclination of consumers towards high-end cars is also contributing to the growth of this segment.

North America is estimated to dominate the market, by volume as well as value. The growth of this market is due to the high enthusiasm for racing cars in this region. Other factors contributing to the growth of the automotive supercharger market in this region are the growing trend of engine downsizing, increasing fuel efficiency norms, and high disposable incomes that have increased the demand for high-end cars. The US is estimated to be the largest and fastest growing market in this region.

A key factor restraining the growth of the automotive supercharger market is the increasing number of air emission norms around the world. These norms are pushing the OEMs to invest in electric vehicles. As electric vehicles do not have a combustion engines, any kind of forced induction technology cannot be utilized in such vehicles. As the production and sales of electric vehicles continue to increase, the market for automotive superchargers is expected to decline. Some of the key market players are Honeywell (US), Eaton (Ireland), Valeo (France), Mitsubishi Heavy Industries (Japan), and Federal-Mogul (US).

Leading automotive supercharger manufacturers and OEMs are catering to the increasing demand for high-speed vehicles, to drive the industry forward

Centrifugal supercharger

The centrifugal superchargers compress the air which is to be supplied to the engine with the help of an impeller. This type of supercharger is similar to that of a turbocharger, except that in a turbocharging it uses the engine exhaust gases, whereas in a centrifugal supercharger it uses a belt driven by the crank pulley to spin the impeller. The major advantage of a centrifugal supercharging is that a considerable quantity of air can be delivered by a relatively small size. However, unlike roots and screw superchargers, centrifugal superchargers are good for high rpm range.

Centrifugal superchargers find highest application in sports cars or supercars due to their compact size, less maintenance and placement with respect to the engine.

Roots supercharger

The roots type supercharging technology is the oldest technology amongst the other supercharging technologies. Roots superchargers are similar to that of an air pump. Thus, unlike centrifugal and screw superchargers which act as a compressor, roots superchargers act more like an air displacer. These superchargers are placed on the top of the engine and they look attractive when seen hanging from the hood. Roots superchargers promise a drastic increase in power at lower RPMs.

Major supercharger manufacturers such as Eaton solely offer roots superchargers.

Twin-screw supercharger

The twin-screw type superchargers are advanced versions of roots superchargers and thus look identical to them from the outside. But, from inside there is a twin-screw design which helps to compress the air flow. The twin screw has a fill side and a discharge side. Thus, when air is moved from the fill side to the discharge end, the air pockets decrease and get squeezed by the rotor lobes and are compressed into the engine. With this technology, the twin-screw superchargers become more efficient, and are a bit expensive than the roots superchargers, because the screw-type rotors require more precision in the manufacturing process.

- Since superchargers are mainly seen in high end or racing vehicles? Would targeting of the economic or low-end vehicles a success or a challenge?

- Will the suppliers continue to explore new avenues for automotive superchargers effectiveness?

- Which geographical markets are unexplored in the automotive supercharger market where there is a good growth potential?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Automotive Supercharger Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.2 Secondary Data

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Data Triangulation

2.5 Factor Analysis

2.5.1 Introduction

2.5.2 Demand-Side Analysis

2.5.2.1 Increased Demand By Consumers for High-End Vehicles Or Sport Variants

2.5.2.2 Engine Downsizing Also Led to Increased Use of Superchargers

2.5.3 Supply-Side Analysis

2.5.3.1 Legislations and Increasing Public Awareness for Global Warming, Emission Norms

2.6 Market Size Estimation

2.7 Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 32)

4.1 Market, 2017 vs. 2025 (USD Billion)

4.2 By Region, 2017 vs. 2025 (USD Million)

4.3 By Technology,

4.4 By Vehicle Type,

4.5 By Components,

4.6 By Fuel Type, 2017 vs. 2025 (USD Million)

4.7 By Power Source,

5 Market Overview (Page No. - 39)

5.1 Market Dynamics

5.1.1 Drivers

5.1.1.1 Advantage Over Turbocharger as Lag Diminishes

5.1.1.2 Increased Demand for High-End Vehicles

5.1.2 Restraints

5.1.2.1 Decline in Enthusiast Segment – Millennial Effect

5.1.2.2 Growing Inclination of Oems Towards Electric and Hybrid Vehicles

5.1.3 Opportunities

5.1.3.1 Electric Superchargers Can Be A Game Changer

5.1.3.2 Development of Diesel Superchargers

5.1.4 Challenges

5.1.4.1 Lack of Scalability – Economies of Scale

5.1.4.2 Weight Constraint

6 Technological Overview (Page No. - 44)

6.1 Introduction

6.2 Market: Segmentation

6.2.1 Roots Supercharger

6.2.2 Twin-Screw Supercharger

6.2.3 Centrifugal Supercharger

7 Automotive Supercharger Market, By Component (Page No. - 47)

7.1 Introduction

7.2 Harmonic Balancers

7.3 Pulleys/Belts

7.4 Compressors

7.5 Intercoolers

7.6 Blowers

7.7 Tensioners

7.8 Valves

7.9 Head Units

8 By Technology (Page No. - 65)

8.1 Introduction

8.2 Centrifugal Supercharger

8.3 Roots Superchargers

8.4 Twin-Screw Superchargers

9 By Fuel Type (Page No. - 73)

9.1 Introduction

9.2 Gasoline

9.3 Diesel

10 By Power Source (Page No. - 79)

10.1 Introduction

10.2 Engine Driven

10.3 Electric Motor Driven

11 Automotive Supercharger Market, By Region (Page No. - 85)

11.1 Introduction

11.2 North America

11.2.1 Canada

11.2.2 Mexico

11.2.3 US

11.3 Europe

11.3.1 France

11.3.2 Germany

11.3.3 Italy

11.3.4 Spain

11.3.5 UK

11.4 Asia Pacific

11.4.1 China

11.4.2 India

11.4.3 Japan

11.4.4 South Korea

12 Competitive Landscape (Page No. - 108)

12.1 Overview

12.2 Automotive Supercharger Market Ranking Analysis

12.3 Competitive Situation & Trends

12.3.1 New Product Developments

12.3.2 Expansions

12.3.3 Mergers & Acquisitions

12.3.4 Supply Contracts/Partnerships/Collaborations

13 Company Profile (Page No. - 113)

13.1 Honeywell

13.2 Eaton

13.3 Valeo

13.4 Mitsubishi Heavy Industries

13.5 Federal-Mogul

13.6 Ihi Corporation

13.7 Paxton Automotive

13.8 Vortech Engineering

13.9 A&A Corvette

13.10 Rotrex A/S

13.11 Aeristech

13.12 Duryea Technologies

14 Appendix (Page No. - 138)

14.1 Insights of Industry Experts

14.2 Discussion Guide

14.4 Introducing RT: Real Time Market Intelligence

14.5 Available Customizations - Automotive Supercharger Market

14.5.1 Detailed Analysis of Component Segment, By Country

14.5.2 Detailed Analysis and Profiling of Additional Market Players

14.6 Related Reports

14.7 Author Details

List of Tables (77 Tables)

Table 1 Currency Exchange Rates (Wrt USD)

Table 2 Automotive Supercharger Market Size, By Component, 2015–2025 (USD Million)

Table 3 Harmonic Balancers: Automotive Superchargers Market Size, By Region, 2015–2025 (USD Million)

Table 4 Harmonic Balancers: Market Size, By Vehicle Type, 2015–2025 (USD Million)

Table 5 Pulleys/Belts: Automotive Superchargers Market Size, By Region, 2015–2025 (USD Million)

Table 6 Pulleys/Belts: Market Size, By Vehicle Type, 2015–2025 (USD Million)

Table 7 Compressors: Automotive Superchargers Market Size, By Region, 2015–2025 (USD Million)

Table 8 Compressors: Market Size, By Vehicle Type, 2015–2025 (USD Million)

Table 9 Intercoolers: Automotive Superchargers Market Size, By Region, 2015–2025 (USD Million)

Table 10 Intercoolers: Market Size, By Vehicle Type, 2015–2025 (USD Million)

Table 11 Blowers: Automotive Superchargers Market Size, By Region, 2015–2025 (USD Million)

Table 12 Blowers: Automotive Supercharger Market Size, By Vehicle Type, 2015–2025 (USD Million)

Table 13 Tensioners: Automotive Superchargers Market Size, By Region, 2015–2025 (USD Million)

Table 14 Tensioners: Market Size, By Vehicle Type, 2015–2025 (USD Million)

Table 15 Valves: Automotive Superchargers Market Size, By Region, 2015–2025 (USD Million)

Table 16 Valves: Market Size, By Vehicle Type, 2015–2025 (USD Million)

Table 17 Head Units: Automotive Superchargers Market Size, By Region, 2015–2025 (USD Million)

Table 18 Head Units: Market Size, By Vehicle Type, 2015–2025 (USD Million)

Table 19 Automotive Superchargers Market, By Technology, 2015–2025 (Thousand Units)

Table 20 Automotive Supercharger Market, By Technology, 2015–2025 (USD Million)

Table 21 Centrifugal Supercharger: Market, By Region, 2015–2025 (Thousand Units)

Table 22 Centrifugal Supercharger: Market, By Region, 2015–2025 (USD Million)

Table 23 Roots Supercharger: Market, By Region, 2015–2025 (Thousand Units)

Table 24 Roots Supercharger: Market, By Region, 2015–2025 (USD Million)

Table 25 Twin-Screw Supercharger: Market, By Region, 2015–2025 (Thousand Units)

Table 26 Twin-Screw Supercharger: Market, By Region, 2015–2025 (USD Million)

Table 27 Market, By Fuel Type, 2015–2025 (Thousand Units)

Table 28 Market, By Fuel Type, 2015–2025 (USD Million)

Table 29 Gasoline: Market, By Region, 2015–2025 (Thousand Units)

Table 30 Gasoline: Market, By Region, 2015–2025 (USD Million)

Table 31 Diesel: Market, By Region,2015–2025 (Thousand Units)

Table 32 Diesel: Market, By Region, 2015–2025 (USD Million)

Table 33 Market, By Power Source, 2015–2025 (Thousand Units)

Table 34 Market, By Power Source, 2015–2025 (USD Million)

Table 35 Engine Driven: Market, By Region, 2015–2025 (Thousand Units)

Table 36 Engine Driven: Market, By Region, 2015–2025 (USD Million)

Table 37 Electric Motor Driven: Market, By Region, 2015–2025 (Thousand Units)

Table 38 Electric Motor Driven: Market, By Region, 2015–2025 (USD Million)

Table 39 Market, By Region, 2015–2025 (Thousand Units)

Table 40 Market, By Region, 2015–2025 (USD Million)

Table 41 Market, By Vehicle Type, 2015–2025 (Thousand Units)

Table 42 Market, By Vehicle Type, 2015–2025 (USD Million)

Table 43 North America: Market, By Country, 2015–2025 (Thousand Units)

Table 44 North America: Market, By Country, 2015–2025 (USD Million)

Table 45 Canada: Market, By Vehicle Type, 2015–2025 (Thousand Units)

Table 46 Canada: Market, By Vehicle Type, 2015–2025 (USD Million)

Table 47 Mexico: Market, By Vehicle Type, 2015–2025 (Thousand Units)

Table 48 Mexico: Market, By Vehicle Type, 2015–2025 (USD Million)

Table 49 US: Market, By Vehicle Type, 2015–2025 (Thousand Units)

Table 50 US: Market, By Vehicle Type, 2015–2025 (USD Million)

Table 51 Europe: Market, By Country, 2015–2025 (Thousand Units)

Table 52 Europe: Market, By Country, 2015–2025 (USD Million)

Table 53 France: Market, By Vehicle Type, 2015–2025 (Thousand Units)

Table 54 France: Market, By Vehicle Type, 2015–2025 (USD Million)

Table 55 Germany: Market, By Vehicle Type, 2015–2025 (Thousand Units)

Table 56 Germany: Market, By Vehicle Type, 2015–2025 (USD Million)

Table 57 Italy: Market, By Vehicle Type, 2015–2025 (Thousand Units)

Table 58 Italy: Market, By Vehicle Type, 2015–2025 (USD Million)

Table 59 Spain: Market, By Vehicle Type, 2015–2025 (Thousand Units)

Table 60 Spain: Market, By Vehicle Type, 2015–2025 (USD Million)

Table 61 UK: Market, By Vehicle Type, 2015–2025 (Thousand Units)

Table 62 UK: Market, By Vehicle Type, 2015–2025 (USD Million)

Table 63 Asia Pacific: Market, By Country, 2015–2025 (Thousand Units)

Table 64 Asia Pacific: Market, By Country, 2015–2025 (USD Million)

Table 65 China: Market, By Vehicle Type, 2015–2025 (Thousand Units)

Table 66 China: Market, By Vehicle Type, 2015–2025 (USD Million)

Table 67 India: Market, By Vehicle Type, 2015–2025 (Thousand Units)

Table 68 India: Market, By Vehicle Type, 2015–2025 (USD Million)

Table 69 Japan: Market, By Vehicle Type, 2015–2025 (Thousand Units)

Table 70 Japan: Market, By Vehicle Type, 2015–2025 (USD Million)

Table 71 South Korea: Market, By Vehicle Type, 2015–2025 (Thousand Units)

Table 72 South Korea: Market, By Vehicle Type, 2015–2025 (USD Million)

Table 73 Market Ranking: 2016

Table 74 New Product Developments, 2015–2017

Table 75 Expansions, 2015–2017

Table 76 Mergers & Acquisitions, 2017

Table 77 Supply Contracts/Partnerships/Collaborations, 2016–2018

List of Figures (58 Figures)

Figure 1 Automotive Supercharger Market: Segmentations Covered

Figure 2 Research Design

Figure 3 Research Methodology Model

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 5 Luxury Vehicle Y-O-Y Sales Growth (2010–2016)

Figure 6 Market, By End-User: Bottom-Up Approach

Figure 7 Automotive Superchargers Market, By Type: Top-Down Approach

Figure 8 Gasoline Segment to Drive the Growth of Market, 2017 vs. 2025 (USD Million)

Figure 9 Roots Supercharger Segment to Be the Largest Contributor to Automotive Superchargers Market, 2017 vs. 2025 (USD Million)

Figure 10 Electric Motor Driven Superchargers to Be the Fastest Growth in Cagr of Market, 2017 vs. 2025 (USD Million)

Figure 11 North America to Hold the Largest Share in the Market, By Region, 2017 vs. 2025 (USD Million)

Figure 12 Attractive Opportunities in the Market

Figure 13 North America is Expected to Lead the Automotive Superchargers Market, By Volume and Value, During the Forecast Period

Figure 14 The Roots Supercharger is Expected to Have the Highest Market Share in the Market, By Technology

Figure 15 The Passenger Cars Segment is Expected to Lead the Market, By Vehicle Type

Figure 16 Head Units Component is Expected to Have the Highest Market Share

Figure 17 Gasoline Engine Vehicles are Expected to Lead the Automotive Superchargers Market, By Fuel Type

Figure 18 Engine Driven Supercharges to Be the Highest Market

Figure 19 Market: Market Dynamics

Figure 20 Global Luxury Car Sales

Figure 21 BEV Sales in Major Regions, 2017 vs. 2022

Figure 22 Technological Evolution of Automotive Superchargers

Figure 23 By Technology Type

Figure 24 Market, By Component, 2017 vs 2025 (USD Million)

Figure 25 Harmonic Balancers: Market, By Region, 2017 vs 2025 (USD Million)

Figure 26 Pulleys/Belts: Automotive Superchargers Market, By Region, 2017 vs 2025 (USD Million)

Figure 27 Compressors: Market, By Region, 2017 vs 2025 (USD Million)

Figure 28 Intercoolers: Automotive Superchargers Market, By Region, 2017 vs 2025 (USD Million)

Figure 29 Blowers: Market, By Region, 2017 vs 2025 (USD Million)

Figure 30 Tensioners: Automotive Superchargers Market, By Region, 2017 vs 2025 (USD Million)

Figure 31 Valves: Market, By Region, 2017 vs 2025 (USD Million)

Figure 32 Head Units: Automotive Superchargers Market, By Region, 2017 vs 2025 (USD Million)

Figure 33 Market, By Technology, 2017 vs. 2025 (USD Million)

Figure 34 Centrifugal Supercharger: Automotive Superchargers Market, By Region, 2017 vs. 2025 (USD Million)

Figure 35 Roots Supercharger: Market, By Region, 2017 vs. 2025 (USD Million)

Figure 36 Twin-Screw Supercharger: Automotive Superchargers Market, By Region, 2017 vs. 2025 (USD Million)

Figure 37 Market, By Fuel Type, 2017 vs. 2025 (USD Million)

Figure 38 Gasoline: Market, By Region, 2017 vs. 2025 (USD Million)

Figure 39 Diesel: Automotive Superchargers Market, By Region, 2017 vs. 2025 (USD Million)

Figure 40 Market, By Power Source, 2017 vs. 2025 (USD Million)

Figure 41 Engine Driven: Market, By Region, 2017 vs. 2025 (USD Million)

Figure 42 Electric Motor Driven: Market, By Region, 2017 vs. 2025 (USD Million)

Figure 43 Market, By Region, 2017 vs. 2025 (USD Million)

Figure 44 North America: Automotive Superchargers Market Snapshot

Figure 45 Europe: Market Snapshot

Figure 46 Asia Pacific: Market, By Country, 2017 vs. 2025 (Value)

Figure 47 Key Developments By Leading Players in the Automotive Supercharger Market, 2014–2017

Figure 48 Company Snapshot: Honeywell

Figure 49 SWOT Analysis: Honeywell

Figure 50 Company Snapshot: Eaton

Figure 51 SWOT Analysis: Eaton

Figure 52 Company Snapshot: Valeo

Figure 53 SWOT Analysis: Valeo

Figure 54 Company Snapshot: Mitsubishi Heavy Industries

Figure 55 SWOT Analysis: Mitsubishi Heavy Industries

Figure 56 Company Snapshot: Federal-Mogul

Figure 57 SWOT Analysis: Federal-Mogul

Figure 58 Company Snapshot: Ihi Corporation

Growth opportunities and latent adjacency in Automotive Supercharger Market