Automotive NVH Materials Market by Material Type (Thermoplastic Polymer, Engineering Resin), Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles), Application (Absorption, Insulation), & Region- Global Forecast to 2027

Updated on : October 25, 2024

Automotive NVH Materials Market

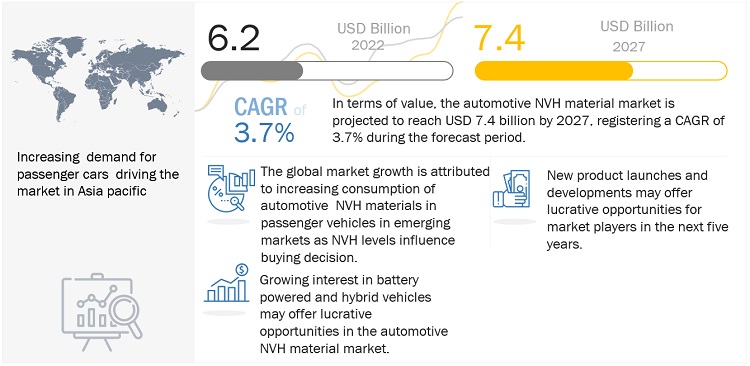

The global automotive NVH materials market was valued at USD 6.2 billion in 2022 and is projected to reach USD 7.4 billion by 2027, growing at 3.7% cagr from 2022 to 2027. The automobile industry incorporates automotive NVH materials to improve a vehicle’s overall drivability and ride comfort. The automotive industry makes considerable investments in the development of technology and methods that lower NVH levels in vehicles, which contributes to boost overall sales. The demand for fuel efficient and lightweight vehicles as well as the growing preference for battery powered and hybrid vehicles are key causes impacting the global market. This is expected that the emerging economies of Asia-Pacific provide high growth opportunities to the market due to rapid urbanization and modernization. The use of automotive NVH material may significantly encouraged by the growing demand for Luxury vehicles.

Attractive Opportunities in the Automotive NVH Material Market

To know about the assumptions considered for the study, Request for Free Sample Report

Automotive NVH Materials Market Dynamics

Driver: Increased demand for cars in emerging markets

China, South Korea, Japan, and India are the major automobile manufacturing hubs in Asia Pacific. Brazil in South America and Turkey in Eastern Europe are the fastest-growing markets for automobiles. A significant share of the automobiles manufactured in these countries is exported to Europe, North America, and the Middle East & Africa. The domestic demand for automobiles is also increasing in China, India, Turkey, and Brazil. Due to the increase in demand for cars in emerging markets, automobile manufacturers are focusing more on incorporating safety and comfort measures in their vehicles. In order to improve ride quality and passenger comfort while reducing noise, vibration, and harshness, automotive NVH materials are utilized in automobiles. Increased demand for luxury cars may moderately help in the usage of automotive NVH materials in them.

Restraints: Installation of active noise control systems

Lowering the NVH levels of a vehicle leads to an increase in its overall vehicle weight. This has led manufacturers, such as GM, Ford, BMW, and Toyota to develop new and radical methods to reduce NVH levels in their automobiles. Active noise control system is one such technology that allows automotive manufacturers to achieve better noise control without using more NVH materials in vehicles. This technology uses the vehicle’s audio system to cancel low-frequency unwanted noise by emitting sound waves with the same amplitude, but with an inverted phase to the original sound. As this technology can limit only low-frequency noise, the high-frequency noise would still require NVH materials for adequate noise insulation. However, active noise control systems cannot counter the vibrations transferred throughout the vehicle body, as they focus on noise cancellation only. However, the development of such technology may substitute NVH control materials in the coming years, thus reducing their demand.

Opportunities: Growing interest in battery powered and hybrid vehicles

The NVH requirements for hybrid and battery-powered cars are different from those for regular cars with IC engines. The battery-powered vehicles produce almost no noise, in contrast to internal-combustion engines. Therefore, the need for NVH control materials is minimal in hybrid and battery-powered cars. Therefore, as these vehicles become more prevalent on the market, demand for NVH control materials may subsequently fall. On the other hand, in conventional cars, the noise of the IC engine typically drowns out a number of low decibel (dB) noises, including wind noise, tire noise, squeaks, and rattles from suspensions. As a result, NVH control materials are not necessary to reduce such noises. The various squeaks, rattles, tire and wind noises, however, are audible to the passengers of the car because the engines of battery-powered and hybrid vehicles are quieter than traditional engines. Consequently, to get rid of these noises, both traditional and contemporary types of NVH control materials are needed. The market for NVH control materials in future battery- and hybrid-powered vehicles may be accelerated by this trend.

Challenges: NVH materials increases overall vehicle weight

Additional NVH control materials add to the overall vehicle weight. The rising cost of automotive fuels and greater awareness about automotive emissions that add to greenhouse gases has led automobile manufacturers to develop more fuel-efficient vehicles. A few years ago, the sedans sold by leading Japanese, European, and American manufacturers had 2000 cc engines. The same sedans today use 1000 to 1500 cc engines, which are as powerful as the 2000 cc engines and almost 1.5 times more fuel efficient. The new generation of engines creates less pollution. The CO2 released per kilometer of travel by the new engine is almost 1/5th of the older 2000 cc engines. Manufacturers employ different techniques, such as more-efficient fuel injection systems and turbochargers to make the smaller powertrains develop power equal to the older aspirated engines. The new engines run on a large number of mechanical parts and generate more noise. Thus, more NVH control materials are required to meet the NVH regulations, which is a challenge for automotive manufacturers. The additional weight of NVH control materials counters the weight advantage gained by the use of lighter and smaller engines. Thus, the challenge for automotive manufacturers is to establish optimum terms between vehicle weight and NVH levels in their automobiles.

Automotive NVH Material Market Ecosystem

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

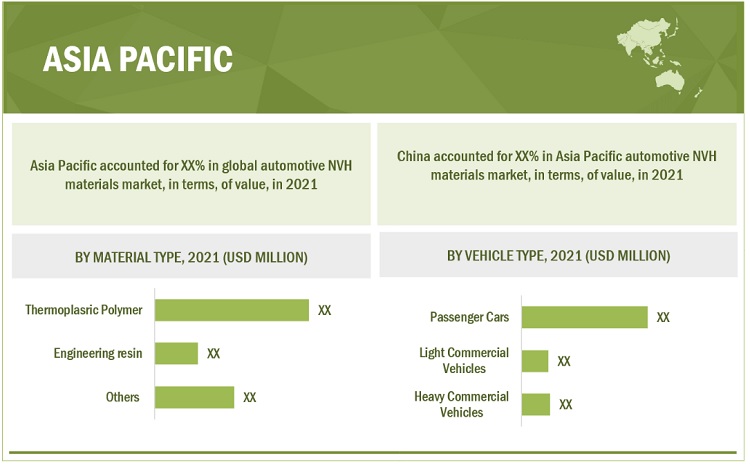

“Thermoplastic polymer was the largest material type of automotive NVH materials market in 2021, in terms of volume”

Thermoplastic polymer material accounted for the largest share of the global automotive NVH materials market, in terms of volume, in 2021. The demand for Thermoplastic polymer is primarily driven by its unique features and properties, such as excellent chemical, electrical, and high temperature resistance, and mechanical properties. It is used as an NVH materials to manufacture lightweight automotive parts, reducing the overall vehicle weight which derives its application for ride comfort in the automobiles and are mainly used in the interiors and exteriors of passenger cars, LCV, and HCV.

“Passenger car was the largest vehicle type for automotive NVH materials market in 2021, in terms of value”

Passenger vehicles accounted for the largest market share in the global automotive NVH materials market, in terms of value, in 2021. The segment is projected to grow at highest CAGR, in terms of value, during the forecast period as there is rising demand for cars in emerging vehicles. Increasing living standards in emerging economies and growing production facilities of various automotive manufacturers project the high demand for the use of automotive NVH materials in the passenger vehicles segment.

“Asia Pacific was the largest market for automotive NVH materials in 2021, in terms of volume.”

Asia Pacific was the largest market for global automotive NVH material market, in terms of volume, in 2021. The market in Asia Pacific is driven by rising modernization and urbanization which leads to the new innovations for the automotive industry. China is the key market in Asia-Pacific. It is estimated to witness high growth during the forecast period because of rising population, modernization, and rapid urbanization which results in growing manufacturing sector and expanding production facilities of automotive industries.

To know about the assumptions considered for the study, download the pdf brochure

Automotive NVH Materials Market Players

The key players in this market DuPont De Nemours, Inc. (US), BASF SE (Germany), Sumitomo Riko Company Limited (Japan), Dow Inc. (US), Covestro AG (Germany). Continuous developments in the market—including new product launches, mergers & acquisitions, agreements, and expansions—are expected to help the market grow. Leading manufacturers of automotive NVH materials have opted for new product launches to sustain their market position.

Automotive NVH Materials Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2017-2027 |

|

Base Year |

2021 |

|

Forecast period |

2022–2027 |

|

Units considered |

Volume (Kiloton); Value (USD Million/USD Billion) |

|

Segments |

Material Type, Vehicle Type, Application, and Region |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa and South America |

|

Companies |

The key players in this market are as DuPont (U.S.), BASF SE (Germany), Sumitomo Riko Company Limited (Japan), Dow Inc. (U.S.) and Covestro AG (Germany). |

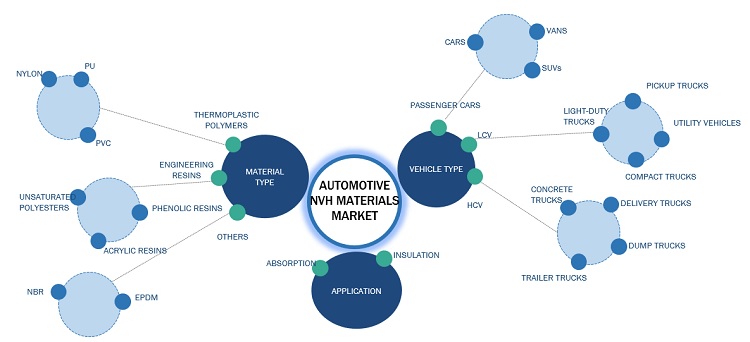

This report categorizes the global automotive NVH materials market based on material type, vehicle type, and region.

On the basis of application, the automotive NVH materials market has been segmented as follows:

- Absorption

- Insulation

On the basis of material type, the automotive NVH materials market has been segmented as follows:

- Thermoplastic Polymers

- Engineering Resins

- Others

On the basis of vehicle type, the automotive NVH materials market has been segmented as follows:

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

On the basis of region, the automotive NVH materials market has been segmented as follows:

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- South America

Recent Developments

- In November 2020 BASF SE launched product based on engineering resin under the Ultracure brand that include Ultracure 3D which provides high stiffness to the material with the flexibility and used in automotive parts.

- In February 2022, Dupont and Celanese Corporation entered into an agreement to divest mobility and materials segment including the engineering polymers business, performance resins and advanced solutions.

Frequently Asked Questions (FAQ):

What is the expected growth rate of automotive NVH materials market?

The forecast period for automotive NVH materials market in this study is 2022-2027. The automotive NVH material market is expected to grow at CAGR of 3.7%, in terms of value, during the forecast period.

Who are the major key players in automotive NVH materials market?

DuPont De Nemours, Inc. (US), BASF SE (Germany), Sumitomo Riko Company Limited (Japan), Dow Inc. (US), Covestro AG (Germany) are the leading manufacturers of automotive NVH material.

Who are the major regulations the automotive NVH materials market in various countries?

In Australia, ADR 21-ADR defines a head impact area of the dashboard as any area contactable by a 165mm diameter sphere, with the exception of any area within 127mm of the left-hand A-pillar (the forward-most pillar that typically supports the windscreen), areas to the right of the left-hand edge of that part of the dashboard protected from contact by the sphere by the left-hand side of the steering wheel, and areas below the rearmost face of the dashboard. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 42)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 AUTOMOTIVE NVH MATERIALS MARKET: INCLUSIONS AND EXCLUSIONS

1.2.2 AUTOMOTIVE NVH MATERIALS MARKET DEFINITION AND INCLUSIONS, BY MATERIAL TYPE

1.2.3 AUTOMOTIVE NVH MATERIALS MARKET DEFINITION AND INCLUSIONS, BY VEHICLE TYPE

1.3 STUDY SCOPE

FIGURE 1 AUTOMOTIVE NVH MATERIALS MARKET SEGMENTATION

1.3.1 REGIONS COVERED

1.3.2 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 47)

2.1 RESEARCH DATA

FIGURE 2 AUTOMOTIVE NVH MATERIALS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews – demand and supply sides

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

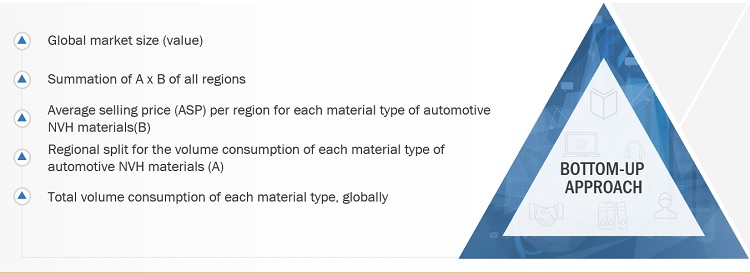

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): COLLECTIVE REVENUE OF COMPANIES

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL PRODUCTS

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 – BOTTOM-UP (DEMAND SIDE): PRODUCTS SOLD

2.2.2 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 – TOP-DOWN

2.3 DATA TRIANGULATION

FIGURE 7 AUTOMOTIVE NVH MATERIALS MARKET: DATA TRIANGULATION

2.4 GROWTH RATE ASSUMPTIONS/GROWTH FORECASTS

2.4.1 SUPPLY SIDE

FIGURE 8 MARKET CAGR PROJECTIONS FROM SUPPLY SIDE

2.4.2 DEMAND SIDE

FIGURE 9 MARKET GROWTH PROJECTIONS FROM DEMAND SIDE DRIVERS AND OPPORTUNITIES

2.5 FACTOR ANALYSIS

2.6 LIMITATIONS

2.7 RISK ASSESSMENT

TABLE 1 AUTOMOTIVE NVH MATERIALS MARKET: RISK ASSESSMENT

2.8 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 57)

FIGURE 10 THERMOPLASTIC POLYMERS SEGMENT LED AUTOMOTIVE NVH MATERIALS MARKET IN 2021

FIGURE 11 HEAVY COMMERCIAL VEHICLES TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

FIGURE 12 ASIA PACIFIC ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

4 PREMIUM INSIGHTS (Page No. - 60)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AUTOMOTIVE NVH MATERIALS MARKET

FIGURE 13 GLOBAL MARKET TO WITNESS HIGH GROWTH DURING FORECAST PERIOD

4.2 AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY REGION

FIGURE 14 ASIA PACIFIC TO BE LARGEST MARKET DURING FORECAST PERIOD

4.3 ASIA PACIFIC: AUTOMOTIVE NVH MATERIALS MARKET, BY MATERIAL TYPE AND COUNTRY, 2021

FIGURE 15 CHINA AND THERMOPLASTIC POLYMERS MATERIAL TYPE ACCOUNTED FOR LARGEST SHARES

4.4 AUTOMOTIVE NVH MATERIALS MARKET SIZE, VEHICLE TYPE VS. REGION, 2021

FIGURE 16 PASSENGER CARS SEGMENT MAJORLY LED MARKET IN 2021

4.5 AUTOMOTIVE NVH MATERIALS MARKET, BY KEY COUNTRIES

FIGURE 17 MARKET IN INDONESIA TO GROW AT HIGHEST CAGR BETWEEN 2022 AND 2027

5 MARKET OVERVIEW (Page No. - 63)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN AUTOMOTIVE NVH MARKET

5.2.1 DRIVERS

5.2.1.1 Increased demand for cars in emerging markets

5.2.1.2 Stringent government regulations to make cars safer and quieter

5.2.1.3 NVH and vehicle refinement levels influence buying decisions

5.2.1.4 Increasing demand from electric vehicle industry

5.2.2 RESTRAINTS

5.2.2.1 Installation of active noise control systems

5.2.2.2 Use of metals and alloys to reduce NVH levels

5.2.2.3 Rising demand for lighter vehicles to improve fuel efficiency restricts market growth

5.2.3 OPPORTUNITIES

5.2.3.1 Growing demand for battery-powered and hybrid vehicles

5.2.4 CHALLENGES

5.2.4.1 NVH materials increase overall vehicle weight

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 19 AUTOMOTIVE NVH MATERIALS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT OF SUBSTITUTES

5.3.2 BARGAINING POWER OF BUYERS

5.3.3 THREAT OF NEW ENTRANTS

5.3.4 BARGAINING POWER OF SUPPLIERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

TABLE 2 AUTOMOTIVE NVH MATERIALS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.4 MACROECONOMIC INDICATORS

5.4.1 GDP TRENDS AND FORECAST FOR MAJOR ECONOMIES

TABLE 3 GDP TRENDS AND FORECAST, BY MAJOR ECONOMIES, 2020–2027 (USD BILLION)

6 INDUSTRY TRENDS (Page No. - 71)

6.1 SUPPLY CHAIN ANALYSIS

FIGURE 20 AUTOMOTIVE NVH MATERIALS MARKET: SUPPLY CHAIN

6.1.1 AUTOMOTIVE NVH RAW MATERIALS

6.1.2 AUTOMOTIVE NVH OEMS

6.1.3 AUTOMOTIVE NVH OEM SUPPLIERS AND DISTRIBUTORS

6.1.4 AUTOMOTIVE NVH MATERIAL END USERS

6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

6.2.1 REVENUE SHIFT & REVENUE POCKETS FOR AUTOMOTIVE NVH MATERIALS

FIGURE 21 AUTOMOTIVE NVH MATERIALS MARKET: CHANGING REVENUE MIX

6.3 CONNECTED MARKETS: ECOSYSTEM

FIGURE 22 AUTOMOTIVE NVH MATERIALS MARKET: ECOSYSTEM

TABLE 4 AUTOMOTIVE NVH MATERIALS MARKET: ECOSYSTEM

6.4 KEY STAKEHOLDERS AND BUYING CRITERIA

6.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 23 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE MATERIAL TYPES

TABLE 5 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE MATERIAL TYPES (%)

6.4.2 BUYING CRITERIA

FIGURE 24 KEY BUYING CRITERIA FOR TOP THREE MATERIAL TYPES

TABLE 6 KEY BUYING CRITERIA FOR TOP THREE MATERIAL TYPES

6.5 AUTOMOTIVE NVH MATERIALS MARKET: REALISTIC, PESSIMISTIC, OPTIMISTIC, AND NON-COVID-19 SCENARIOS

FIGURE 25 MARKET SIZE UNDER REALISTIC, PESSIMISTIC, OPTIMISTIC, AND NON-COVID-19 SCENARIOS

TABLE 7 AUTOMOTIVE NVH MATERIALS MARKET FORECAST SCENARIO, 2019–2027 (USD MILLION)

6.5.1 NON-COVID-19 SCENARIO

6.5.2 OPTIMISTIC SCENARIO

6.5.3 PESSIMISTIC SCENARIO

6.5.4 REALISTIC SCENARIO

6.6 PRICING ANALYSIS

6.6.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY MATERIAL TYPE

FIGURE 26 AVERAGE SELLING PRICES OF KEY PLAYERS FOR TOP THREE MATERIAL TYPES

TABLE 8 AVERAGE SELLING PRICES OF KEY PLAYERS FOR TOP THREE MATERIAL TYPES (USD/KG)

6.6.2 AVERAGE SELLING PRICE TREND

FIGURE 27 AVERAGE SELLING PRICE OF AUTOMOTIVE NVH MATERIALS, BY REGION, 2020–2027

TABLE 9 AVERAGE SELLING PRICE OF AUTOMOTIVE NVH MATERIALS, BY REGION, 2020–2027 (USD/KG)

6.7 REGULATORY LANDSCAPE

6.7.1 REGULATIONS FOR AUTOMOTIVE NVH MATERIALS MARKET

TABLE 10 REGULATIONS FOR PASSENGER CAR SEATS

6.8 PATENT ANALYSIS

6.8.1 APPROACH

6.8.2 PATENT STATUS

TABLE 11 GRANTED PATENTS ARE 11% OF TOTAL COUNT

FIGURE 28 PATENT PUBLICATION TRENDS FOR AUTOMOTIVE NVH MATERIALS MARKET, 2011–2021

FIGURE 29 LEGAL STATUS OF PATENTS

6.8.3 JURISDICTION ANALYSIS

FIGURE 30 MAXIMUM PATENTS FILED BY COMPANIES IN CHINA

6.8.4 TOP APPLICANTS

FIGURE 31 STATE GRID CORPORATION OF CHINA COMPANY REGISTERED MAXIMUM NUMBER OF PATENTS BETWEEN 2011 AND 2021

TABLE 12 TOP 10 PATENT OWNERS IN US, 2011–2021

6.9 TECHNOLOGY ANALYSIS

6.10 CASE STUDY ANALYSIS

6.10.1 CASE STUDY ON REDUCING HIGH-FREQUENCY NOISE IN ELECTRIC VEHICLES

6.11 TRADE DATA STATISTICS

6.11.1 IMPORT SCENARIO OF AUTOMOTIVE NVH MATERIALS

FIGURE 32 IMPORTS OF AUTOMOTIVE NVH MATERIALS, BY KEY COUNTRIES

TABLE 13 IMPORTS OF AUTOMOTIVE NVH MATERIALS, BY REGION, 2013–2021 (USD MILLION)

6.11.2 EXPORT SCENARIO OF AUTOMOTIVE NVH MATERIALS

FIGURE 33 EXPORTS OF AUTOMOTIVE NVH MATERIALS, BY KEY COUNTRIES

TABLE 14 EXPORTS OF AUTOMOTIVE NVH MATERIALS, BY REGION, 2013–2021 (USD MILLION)

6.12 KEY CONFERENCES & EVENTS IN 2022–2023

TABLE 15 AUTOMOTIVE NVH MATERIALS MARKET: DETAILED LIST OF CONFERENCES & EVENTS

7 AUTOMOTIVE NVH MATERIALS MARKET, BY APPLICATION (Page No. - 90)

7.1 INTRODUCTION

7.2 ABSORPTION

7.3 INSULATION

8 AUTOMOTIVE NVH MATERIALS MARKET, BY MATERIAL TYPE (Page No. - 92)

8.1 INTRODUCTION

FIGURE 34 THERMOPLASTIC POLYMERS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

TABLE 16 AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2017–2020 (KILOTON)

TABLE 17 AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2021–2027 (KILOTON)

TABLE 18 AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2017–2020 (USD MILLION)

TABLE 19 AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2021–2027 (USD MILLION)

8.2 THERMOPLASTIC POLYMERS

8.2.1 DEMAND FOR LIGHTWEIGHT VEHICLES TO DRIVE MARKET

8.2.2 PU

8.2.3 PVC

TABLE 20 THERMOPLASTIC POLYMERS: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 21 THERMOPLASTIC POLYMERS: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY REGION, 2021–2027 (KILOTON)

TABLE 22 THERMOPLASTIC POLYMERS: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 23 THERMOPLASTIC POLYMERS: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

8.3 ENGINEERING RESINS

8.3.1 GROWING E-VEHICLE MARKET TO PROPEL MARKET

8.3.2 ABS

8.3.3 POLYCARBONATES

8.3.4 NYLON

TABLE 24 ENGINEERING RESINS: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 25 ENGINEERING RESINS: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY REGION, 2021–2027 (KILOTON)

TABLE 26 ENGINEERING RESINS: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 27 ENGINEERING RESINS: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

8.4 OTHERS

8.4.1 RESTORATION OF VINTAGE AUTOMOTIVES TO DRIVE MARKET

TABLE 28 OTHERS: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 29 OTHERS: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY REGION, 2021–2027 (KILOTON)

TABLE 30 OTHERS: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 31 OTHERS: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

9 AUTOMOTIVE NVH MATERIALS MARKET, BY VEHICLE TYPE (Page No. - 101)

9.1 INTRODUCTION

FIGURE 35 PASSENGER CARS SEGMENT TO DOMINATE DURING FORECAST PERIOD

TABLE 32 AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2017–2020 (KILOTON)

TABLE 33 AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2021–2027 (KILOTON)

TABLE 34 AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2017–2020 (USD MILLION)

TABLE 35 AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

9.2 PASSENGER CARS

9.2.1 INCREASING AUTOMOTIVE PRODUCTION HUBS IN ASIA PACIFIC

TABLE 36 AUTOMOTIVE NVH MATERIALS MARKET SIZE IN PASSENGER CARS, BY REGION, 2017–2020 (KILOTON)

TABLE 37 AUTOMOTIVE NVH MATERIALS MARKET SIZE IN PASSENGER CARS, BY REGION, 2021–2027 (KILOTON)

TABLE 38 AUTOMOTIVE NVH MATERIALS MARKET SIZE IN PASSENGER CARS, BY REGION, 2017–2020 (USD MILLION)

TABLE 39 AUTOMOTIVE NVH MATERIALS MARKET SIZE IN PASSENGER CARS, BY REGION, 2021–2027 (USD MILLION)

9.3 LIGHT COMMERCIAL VEHICLES (LCVS)

9.3.1 AWARENESS OF SAFETY FEATURES TO DRIVE MARKET

TABLE 40 AUTOMOTIVE NVH MATERIALS MARKET SIZE IN LIGHT COMMERCIAL VEHICLES, BY REGION, 2017–2020 (KILOTON)

TABLE 41 AUTOMOTIVE NVH MATERIALS MARKET SIZE IN LIGHT COMMERCIAL VEHICLES, BY REGION, 2021–2027 (KILOTON)

TABLE 42 AUTOMOTIVE NVH MATERIALS MARKET SIZE IN LIGHT COMMERCIAL VEHICLES, BY REGION, 2017–2020 (USD MILLION)

TABLE 43 AUTOMOTIVE NVH MATERIALS MARKET SIZE IN LIGHT COMMERCIAL VEHICLES, BY REGION, 2021–2027 (USD MILLION)

9.4 HEAVY COMMERCIAL VEHICLES (HCV)

9.4.1 GROWING INFRASTRUCTURE PROJECTS TO DRIVE MARKET

TABLE 44 AUTOMOTIVE NVH MATERIALS MARKET SIZE IN HEAVY COMMERCIAL VEHICLES, BY REGION, 2017–2020 (KILOTON)

TABLE 45 AUTOMOTIVE NVH MATERIALS MARKET SIZE IN HEAVY COMMERCIAL VEHICLES, BY REGION, 2021–2027 (KILOTON)

TABLE 46 AUTOMOTIVE NVH MATERIALS MARKET SIZE IN HEAVY COMMERCIAL VEHICLES, BY REGION, 2017–2020 (USD MILLION)

TABLE 47 AUTOMOTIVE NVH MATERIALS MARKET SIZE IN HEAVY COMMERCIAL VEHICLES, BY REGION, 2021–2027 (USD MILLION)

10 AUTOMOTIVE NVH MATERIALS MARKET, BY REGION (Page No. - 109)

10.1 INTRODUCTION

FIGURE 36 ASIA PACIFIC MARKET PROJECTED TO GROW AT HIGHEST CAGR

TABLE 48 AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 49 AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY REGION, 2021–2027 (KILOTON)

TABLE 50 AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 51 AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

10.2 ASIA PACIFIC

FIGURE 37 ASIA PACIFIC AUTOMOTIVE NVH MATERIALS MARKET SNAPSHOT

10.2.1 ASIA PACIFIC AUTOMOTIVE NVH MATERIALS MARKET, BY MATERIAL TYPE

TABLE 52 ASIA PACIFIC: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2017–2020 (KILOTON)

TABLE 53 ASIA PACIFIC: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2021–2027 (KILOTON)

TABLE 54 ASIA PACIFIC: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2017–2020 (USD MILLION)

TABLE 55 ASIA PACIFIC: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2021–2027 (USD MILLION)

10.2.2 ASIA PACIFIC AUTOMOTIVE NVH MATERIALS MARKET, BY VEHICLE TYPE

TABLE 56 ASIA PACIFIC: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2017–2020 (KILOTON)

TABLE 57 ASIA PACIFIC: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2021–2027 (KILOTON)

TABLE 58 ASIA PACIFIC: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2017–2020 (USD MILLION)

TABLE 59 ASIA PACIFIC: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

10.2.3 ASIA PACIFIC AUTOMOTIVE NVH MATERIALS MARKET, BY COUNTRY

TABLE 60 ASIA PACIFIC: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 61 ASIA PACIFIC: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY COUNTRY, 2021–2027 (KILOTON)

TABLE 62 ASIA PACIFIC: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 63 ASIA PACIFIC: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

10.2.3.1 China

10.2.3.1.1 Large consumer base to fuel market demand

TABLE 64 CHINA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2017–2020 (KILOTON)

TABLE 65 CHINA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2021–2027 (KILOTON)

TABLE 66 CHINA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2017–2020 (USD MILLION)

TABLE 67 CHINA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2021–2027 (USD MILLION)

TABLE 68 CHINA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2017–2020 (KILOTON)

TABLE 69 CHINA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2021–2027 (KILOTON)

TABLE 70 CHINA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2017–2020 (USD MILLION)

TABLE 71 CHINA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

10.2.3.2 Japan

10.2.3.2.1 Electric passenger cars to drive market demand

TABLE 72 JAPAN: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2017–2020 (KILOTON)

TABLE 73 JAPAN: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2021–2027 (KILOTON)

TABLE 74 JAPAN: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2017–2020 (USD MILLION)

TABLE 75 JAPAN: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2021–2027 (USD MILLION)

TABLE 76 JAPAN: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2017–2020 (KILOTON)

TABLE 77 JAPAN: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2021–2027 (KILOTON)

TABLE 78 JAPAN: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2017–2020 (USD MILLION)

TABLE 79 JAPAN: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

10.2.3.3 India

10.2.3.3.1 Strategic government initiatives to drive market

TABLE 80 INDIA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2017–2020 (KILOTON)

TABLE 81 INDIA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2021–2027 (KILOTON)

TABLE 82 INDIA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2017–2020 (USD MILLION)

TABLE 83 INDIA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2021–2027 (USD MILLION)

TABLE 84 INDIA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2017–2020 (KILOTON)

TABLE 85 INDIA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2021–2027 (KILOTON)

TABLE 86 INDIA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2017–2020 (USD MILLION)

TABLE 87 INDIA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

10.2.3.4 South Korea

10.2.3.4.1 Government policies and investments to drive demand

TABLE 88 SOUTH KOREA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2017–2020 (KILOTON)

TABLE 89 SOUTH KOREA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2021–2027 (KILOTON)

TABLE 90 SOUTH KOREA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2017–2020 (USD MILLION)

TABLE 91 SOUTH KOREA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2021–2027 (USD MILLION)

TABLE 92 SOUTH KOREA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2017–2020 (KILOTON)

TABLE 93 SOUTH KOREA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2021–2027 (KILOTON)

TABLE 94 SOUTH KOREA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2017–2020 (USD MILLION)

TABLE 95 SOUTH KOREA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

10.2.3.5 Indonesia

10.2.3.5.1 Expansion of global car manufacturers to drive market

TABLE 96 INDONESIA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2017–2020 (KILOTON)

TABLE 97 INDONESIA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2021–2027 (KILOTON)

TABLE 98 INDONESIA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2017–2020 (USD MILLION)

TABLE 99 INDONESIA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2021–2027 (USD MILLION)

TABLE 100 INDONESIA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2017–2020 (KILOTON)

TABLE 101 INDONESIA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2021–2027 (KILOTON)

TABLE 102 INDONESIA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2017–2020 (USD MILLION)

TABLE 103 INDONESIA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

10.3 NORTH AMERICA

FIGURE 38 NORTH AMERICA AUTOMOTIVE NVH MATERIALS MARKET SNAPSHOT

10.3.1 NORTH AMERICA AUTOMOTIVE NVH MATERIALS MARKET, BY MATERIAL TYPE

TABLE 104 NORTH AMERICA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2017–2020 (KILOTON)

TABLE 105 NORTH AMERICA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2021–2027 (KILOTON)

TABLE 106 NORTH AMERICA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2017–2020 (USD MILLION)

TABLE 107 NORTH AMERICA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2021–2027 (USD MILLION)

10.3.2 NORTH AMERICA AUTOMOTIVE NVH MATERIALS MARKET, BY VEHICLE TYPE

TABLE 108 NORTH AMERICA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2017–2020 (KILOTON)

TABLE 109 NORTH AMERICA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2021–2027 (KILOTON)

TABLE 110 NORTH AMERICA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2017–2020 (USD MILLION)

TABLE 111 NORTH AMERICA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

10.3.3 NORTH AMERICA AUTOMOTIVE NVH MATERIALS MARKET, BY COUNTRY

TABLE 112 NORTH AMERICA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 113 NORTH AMERICA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY COUNTRY, 2021–2027 (KILOTON)

TABLE 114 NORTH AMERICA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 115 NORTH AMERICA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

10.3.3.1 US

10.3.3.1.1 LCVs segment to drive market

TABLE 116 US: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2017–2020 (KILOTON)

TABLE 117 US: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2021–2027 (KILOTON)

TABLE 118 US: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2017–2020 (USD MILLION)

TABLE 119 US: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2021–2027 (USD MILLION)

TABLE 120 US: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2017–2020 (KILOTON)

TABLE 121 US: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2021–2027 (KILOTON)

TABLE 122 US: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2017–2020 (USD MILLION)

TABLE 123 US: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

10.3.3.2 Canada

10.3.3.2.1 Rising demand for electric vehicles to boost market

TABLE 124 CANADA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2017–2020 (KILOTON)

TABLE 125 CANADA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2021–2027 (KILOTON)

TABLE 126 CANADA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2017–2020 (USD MILLION)

TABLE 127 CANADA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2021–2027 (USD MILLION)

TABLE 128 CANADA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2017–2020 (KILOTON)

TABLE 129 CANADA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2021–2027 (KILOTON)

TABLE 130 CANADA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2017–2020 (USD MILLION)

TABLE 131 CANADA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

10.3.3.3 Mexico

10.3.3.3.1 Manufacturing plants of leading players to drive market

TABLE 132 MEXICO: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2017–2020 (KILOTON)

TABLE 133 MEXICO: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2021–2027 (KILOTON)

TABLE 134 MEXICO: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2017–2020 (USD MILLION)

TABLE 135 MEXICO: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2021–2027 (USD MILLION)

TABLE 136 MEXICO: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2017–2020 (KILOTON)

TABLE 137 MEXICO: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2021–2027 (KILOTON)

TABLE 138 MEXICO: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2017–2020 (USD MILLION)

TABLE 139 MEXICO: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

10.4 EUROPE

FIGURE 39 EUROPE AUTOMOTIVE NVH MATERIALS MARKET SNAPSHOT

10.4.1 EUROPE AUTOMOTIVE NVH MATERIALS MARKET, BY MATERIAL TYPE

TABLE 140 EUROPE: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2017–2020 (KILOTON)

TABLE 141 EUROPE: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2021–2027 (KILOTON)

TABLE 142 EUROPE: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2017–2020 (USD MILLION)

TABLE 143 EUROPE: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2021–2027 (USD MILLION)

10.4.2 EUROPE AUTOMOTIVE NVH MATERIALS MARKET, BY VEHICLE TYPE

TABLE 144 EUROPE: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2017–2020 (KILOTON)

TABLE 145 EUROPE: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2021–2027 (KILOTON)

TABLE 146 EUROPE: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2017–2020 (USD MILLION)

TABLE 147 EUROPE: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

10.4.3 EUROPE AUTOMOTIVE NVH MATERIALS MARKET, BY COUNTRY

TABLE 148 EUROPE: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 149 EUROPE: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY COUNTRY, 2021–2027 (KILOTON)

TABLE 150 EUROPE: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 151 EUROPE: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

10.4.3.1 Germany

10.4.3.1.1 Presence of major players to drive market

TABLE 152 GERMANY: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2017–2020 (KILOTON)

TABLE 153 GERMANY: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2021–2027 (KILOTON)

TABLE 154 GERMANY: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2017–2020 (USD MILLION)

TABLE 155 GERMANY: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2021–2027 (USD MILLION)

TABLE 156 GERMANY: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2017–2020 (KILOTON)

TABLE 157 GERMANY: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2021–2027 (KILOTON)

TABLE 158 GERMANY: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2017–2020 (USD MILLION)

TABLE 159 GERMANY: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

10.4.3.2 France

10.4.3.2.1 Increase in production of commercial vehicles to drive market

TABLE 160 FRANCE: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2017–2020 (KILOTON)

TABLE 161 FRANCE: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2021–2027 (KILOTON)

TABLE 162 FRANCE: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2017–2020 (USD MILLION)

TABLE 163 FRANCE: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2021–2027 (USD MILLION)

TABLE 164 FRANCE: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2017–2020 (KILOTON)

TABLE 165 FRANCE: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2021–2027 (KILOTON)

TABLE 166 FRANCE: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2017–2020 (USD MILLION)

TABLE 167 FRANCE: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

10.4.3.3 UK

10.4.3.3.1 Government policies to promote sales of electric vehicles to drive demand

TABLE 168 UK: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2017–2020 (KILOTON)

TABLE 169 UK: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2021–2027 (KILOTON)

TABLE 170 UK: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2017–2020 (USD MILLION)

TABLE 171 UK: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2021–2027 (USD MILLION)

TABLE 172 UK: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2017–2020 (KILOTON)

TABLE 173 UK: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2021–2027 (KILOTON)

TABLE 174 UK: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2017–2020 (USD MILLION)

TABLE 175 UK: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

10.4.3.4 Russia

10.4.3.4.1 Establishment of facilities and growth in investments to drive market

TABLE 176 RUSSIA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2017–2020 (KILOTON)

TABLE 177 RUSSIA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2021–2027 (KILOTON)

TABLE 178 RUSSIA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2017–2020 (USD MILLION)

TABLE 179 RUSSIA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2021–2027 (USD MILLION)

TABLE 180 RUSSIA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2017–2020 (KILOTON)

TABLE 181 RUSSIA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2021–2027 (KILOTON)

TABLE 182 RUSSIA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2017–2020 (USD MILLION)

TABLE 183 RUSSIA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

10.4.3.5 Italy

10.4.3.5.1 Domestic car manufacturers to drive market

TABLE 184 ITALY: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2017–2020 (KILOTON)

TABLE 185 ITALY: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2021–2027 (KILOTON)

TABLE 186 ITALY: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2017–2020 (USD MILLION)

TABLE 187 ITALY: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2021–2027 (USD MILLION)

TABLE 188 ITALY: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2017–2020 (KILOTON)

TABLE 189 ITALY: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2021–2027 (KILOTON)

TABLE 190 ITALY: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2017–2020 (USD MILLION)

TABLE 191 ITALY: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

10.5 SOUTH AMERICA

10.5.1 SOUTH AMERICA AUTOMOTIVE NVH MATERIALS MARKET, BY MATERIAL TYPE

TABLE 192 SOUTH AMERICA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2017–2020 (KILOTON)

TABLE 193 SOUTH AMERICA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2021–2027 (KILOTON)

TABLE 194 SOUTH AMERICA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2017–2020 (USD MILLION)

TABLE 195 SOUTH AMERICA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2021–2027 (USD MILLION)

10.5.2 SOUTH AMERICA AUTOMOTIVE NVH MATERIALS MARKET, BY VEHICLE TYPE

TABLE 196 SOUTH AMERICA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2017–2020 (KILOTON)

TABLE 197 SOUTH AMERICA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2021–2027 (KILOTON)

TABLE 198 SOUTH AMERICA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2017–2020 (USD MILLION)

TABLE 199 SOUTH AMERICA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

10.5.3 SOUTH AMERICA AUTOMOTIVE NVH MATERIALS MARKET, BY COUNTRY

TABLE 200 SOUTH AMERICA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 201 SOUTH AMERICA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY COUNTRY, 2021–2027 (KILOTON)

TABLE 202 SOUTH AMERICA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 203 SOUTH AMERICA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

10.5.3.1 Brazil

10.5.3.1.1 Facilities of major automobile manufacturers to support market growth

TABLE 204 BRAZIL: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2017–2020 (KILOTON)

TABLE 205 BRAZIL: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2021–2027 (KILOTON)

TABLE 206 BRAZIL: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2017–2020 (USD MILLION)

TABLE 207 BRAZIL: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2021–2027 (USD MILLION)

TABLE 208 BRAZIL: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2017–2020 (KILOTON)

TABLE 209 BRAZIL: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2021–2027 (KILOTON)

TABLE 210 BRAZIL: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2017–2020 (USD MILLION)

TABLE 211 BRAZIL: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

10.5.3.2 Argentina

10.5.3.2.1 Cheap labor and raw materials to boost market

TABLE 212 ARGENTINA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2017–2020 (KILOTON)

TABLE 213 ARGENTINA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2021–2027 (KILOTON)

TABLE 214 ARGENTINA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2017–2020 (USD MILLION)

TABLE 215 ARGENTINA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2021–2027 (USD MILLION)

TABLE 216 ARGENTINA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2017–2020 (KILOTON)

TABLE 217 ARGENTINA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2021–2027 (KILOTON)

TABLE 218 ARGENTINA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2017–2020 (USD MILLION)

TABLE 219 ARGENTINA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

10.6 MIDDLE EAST & AFRICA

10.6.1 MIDDLE EAST & AFRICA AUTOMOTIVE NVH MATERIALS MARKET, BY MATERIAL TYPE

TABLE 220 MIDDLE EAST & AFRICA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2017–2020 (KILOTON)

TABLE 221 MIDDLE EAST & AFRICA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2021–2027 (KILOTON)

TABLE 222 MIDDLE EAST & AFRICA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2017–2020 (USD MILLION)

TABLE 223 MIDDLE EAST & AFRICA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2021–2027 (USD MILLION)

10.6.2 MIDDLE EAST & AFRICA AUTOMOTIVE NVH MATERIALS MARKET, BY VEHICLE TYPE

TABLE 224 MIDDLE EAST & AFRICA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2017–2020 (KILOTON)

TABLE 225 MIDDLE EAST & AFRICA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2021–2027 (KILOTON)

TABLE 226 MIDDLE EAST & AFRICA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2017–2020 (USD MILLION)

TABLE 227 MIDDLE EAST & AFRICA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

10.6.3 MIDDLE EAST & AFRICA AUTOMOTIVE NVH MATERIALS MARKET, BY COUNTRY

TABLE 228 MIDDLE EAST & AFRICA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 229 MIDDLE EAST & AFRICA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY COUNTRY, 2021–2027 (KILOTON)

TABLE 230 MIDDLE EAST & AFRICA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 231 MIDDLE EAST & AFRICA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

10.6.3.1 Turkey

10.6.3.1.1 Partnerships and expansions of domestic companies to support growth

TABLE 232 TURKEY: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2017–2020 (KILOTON)

TABLE 233 TURKEY: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2021–2027 (KILOTON)

TABLE 234 TURKEY: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2017–2020 (USD MILLION)

TABLE 235 TURKEY: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2021–2027 (USD MILLION)

TABLE 236 TURKEY: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2017–2020 (KILOTON)

TABLE 237 TURKEY: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2021–2027 (KILOTON)

TABLE 238 TURKEY: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2017–2020 (USD MILLION)

TABLE 239 TURKEY: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

10.6.3.2 South Africa

10.6.3.2.1 Growing automotive sector to fuel market growth

TABLE 240 SOUTH AFRICA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2017–2020 (KILOTON)

TABLE 241 SOUTH AFRICA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2021–2027 (KILOTON)

TABLE 242 SOUTH AFRICA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2017–2020 (USD MILLION)

TABLE 243 SOUTH AFRICA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2021–2027 (USD MILLION)

TABLE 244 SOUTH AFRICA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2017–2020 (KILOTON)

TABLE 245 SOUTH AFRICA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2021–2027 (KILOTON)

TABLE 246 SOUTH AFRICA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2017–2020 (USD MILLION)

TABLE 247 SOUTH AFRICA: AUTOMOTIVE NVH MATERIALS MARKET SIZE, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 184)

11.1 INTRODUCTION

11.2 STRATEGIES ADOPTED BY KEY PLAYERS

TABLE 248 OVERVIEW OF STRATEGIES ADOPTED BY KEY AUTOMOTIVE NVH MATERIALS MANUFACTURERS

11.3 MARKET SHARE ANALYSIS

11.3.1 RANKING OF KEY MARKET PLAYERS, 2021

FIGURE 40 RANKING OF TOP FIVE PLAYERS IN AUTOMOTIVE NVH MATERIALS MARKET, 2021

11.3.2 MARKET SHARE OF KEY PLAYERS

TABLE 249 AUTOMOTIVE NVH MATERIALS MARKET: DEGREE OF COMPETITION

FIGURE 41 DUPONT DE NEMOURS, INC. LED AUTOMOTIVE NVH MATERIALS MARKET IN 2021

11.3.2.1 DuPont De Nemours, Inc.

11.3.2.2 BASF SE

11.3.2.3 Sumitomo Riko Company Limited

11.3.2.4 Dow Inc.

11.3.2.5 Covestro AG

FIGURE 42 REVENUE ANALYSIS OF KEY COMPANIES DURING PAST FIVE YEARS

11.4 COMPANY PRODUCT FOOTPRINT ANALYSIS

FIGURE 43 AUTOMOTIVE NVH MATERIALS MARKET: COMPANY FOOTPRINT

TABLE 250 AUTOMOTIVE NVH MATERIALS MARKET: MATERIAL FOOTPRINT

TABLE 251 AUTOMOTIVE NVH MATERIALS MARKET: APPLICATION FOOTPRINT

TABLE 252 AUTOMOTIVE NVH MATERIALS MARKET: COMPANY REGION FOOTPRINT

11.5 COMPANY EVALUATION QUADRANT (TIER 1)

11.5.1 STAR PLAYERS

11.5.2 EMERGING LEADERS

FIGURE 44 COMPANY EVALUATION QUADRANT FOR AUTOMOTIVE NVH MATERIALS MARKET (TIER 1)

11.6 COMPETITIVE BENCHMARKING

TABLE 253 AUTOMOTIVE NVH MATERIALS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 254 AUTOMOTIVE NVH MATERIALS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

11.7 STARTUP/SME EVALUATION QUADRANT

11.7.1 RESPONSIVE COMPANIES

11.7.2 STARTING BLOCKS

FIGURE 45 STARTUP/SME EVALUATION QUADRANT FOR AUTOMOTIVE NVH MATERIALS MARKET

11.8 COMPETITIVE SCENARIOS

11.8.1 NEW PRODUCT LAUNCHES

TABLE 255 AUTOMOTIVE NVH MATERIALS MARKET: NEW PRODUCT LAUNCHES (2019–2022)

11.8.2 DEALS

TABLE 256 AUTOMOTIVE NVH MATERIALS MARKET: DEALS (2019–2022)

11.8.3 OTHER DEVELOPMENTS

TABLE 257 AUTOMOTIVE NVH MATERIALS MARKET: OTHER DEVELOPMENTS (2019–2022)

12 COMPANY PROFILES (Page No. - 201)

(Business Overview, Products/Solutions/Services offered, Recent Developments, Product launches, Deals, Other developments, MnM view, Right to win, Strategic choices, Weaknesses and competitive threats) *

12.1 MAJOR PLAYERS

12.1.1 BASF SE

FIGURE 46 BASF SE: COMPANY SNAPSHOT

TABLE 258 BASF SE: COMPANY OVERVIEW

12.1.2 DOW INC.

FIGURE 47 DOW INC.: COMPANY SNAPSHOT

TABLE 259 DOW INC.: COMPANY OVERVIEW

12.1.3 COVESTRO AG

FIGURE 48 COVESTRO AG: COMPANY SNAPSHOT

TABLE 260 COVESTRO AG: COMPANY OVERVIEW

12.1.4 CELANESE CORPORATION

FIGURE 49 CELANESE CORPORATION: COMPANY SNAPSHOT

TABLE 261 CELANESE CORPORATION: COMPANY OVERVIEW

12.1.5 THE 3M COMPANY

FIGURE 50 THE 3M COMPANY: COMPANY SNAPSHOT

TABLE 262 THE 3M COMPANY: COMPANY OVERVIEW

12.1.6 HENKEL AG

FIGURE 51 HENKEL AG: COMPANY SNAPSHOT

TABLE 263 HENKEL AG: COMPANY OVERVIEW

12.1.7 DUPONT DE NEMOURS, INC.

FIGURE 52 DUPONT DE NEMOURS, INC.: COMPANY SNAPSHOT

TABLE 264 DUPONT DE NEMOURS, INC.: COMPANY OVERVIEW

12.1.8 EASTMAN CHEMICAL COMPANY

FIGURE 53 EASTMAN CHEMICAL COMPANY: COMPANY SNAPSHOT

TABLE 265 EASTMAN CHEMICAL COMPANY: COMPANY OVERVIEW

12.1.9 HUNTSMAN CORPORATION

FIGURE 54 HUNTSMAN CORPORATION: COMPANY SNAPSHOT

TABLE 266 HUNTSMAN CORPORATION: COMPANY OVERVIEW

12.1.10 SUMITOMO RIKO COMPANY LIMITED

FIGURE 55 SUMITOMO RIKO COMPANY LIMITED: COMPANY SNAPSHOT

TABLE 267 SUMITOMO RIKO COMPANY LIMITED: COMPANY OVERVIEW

12.1.11 RECTICEL

FIGURE 56 RECTICEL: COMPANY SNAPSHOT

TABLE 268 RECTICEL: COMPANY OVERVIEW

12.2 OTHER KEY MARKET PLAYERS

12.2.1 ARLANXEO

TABLE 269 ARLANXEO: COMPANY OVERVIEW

12.2.2 BORGERS SE & CO. KGAA

TABLE 270 BORGERS SE & CO. KGAA: COMPANY OVERVIEW

12.2.3 EAGLE INDUSTRIES, INC

TABLE 271 EAGLE INDUSTRIES, INC: COMPANY OVERVIEW

12.2.4 JOHNS MANVILLE

TABLE 272 JOHNS MANVILLE: COMPANY OVERVIEW

12.2.5 MITSUI CHEMICALS, INC.

TABLE 273 MITSUI CHEMICALS, INC.: COMPANY OVERVIEW

12.2.6 SOLVAY

TABLE 274 SOLVAY: COMPANY OVERVIEW

12.2.7 ROUSH ENTERPRISES

TABLE 275 ROUSH ENTERPRISES: COMPANY OVERVIEW

12.2.8 NITTO DENKO CORPORATION

TABLE 276 NITTO DENKO CORPORATION: COMPANY OVERVIEW

12.2.9 N.V.H. KOREA CO., LTD.

TABLE 277 N.V.H. KOREA CO., LTD.: COMPANY OVERVIEW

12.2.10 ANAND NVH PRODUCTS

TABLE 278 ANAND NVH PRODUCTS: COMPANY OVERVIEW

12.2.11 TREVES CTA

TABLE 279 TREVES CTA: COMPANY OVERVIEW

12.2.12 LANXESS AG

TABLE 280 LANXESS AG: COMPANY OVERVIEW

12.2.13 JIANGSU WANBEN AUTOMOTIVE PARTS CO., LTD.

TABLE 281 JIANGSU WANBEN AUTOMOTIVE PARTS CO., LTD.: COMPANY OVERVIEW

12.2.14 GUANGZHOU JUNYIHUI AUTOMOBILE TECHNOLOGY CO., LTD

TABLE 282 GUANGZHOU JUNYIHUI AUTOMOBILE TECHNOLOGY CO., LTD: COMPANY OVERVIEW

*Details on Business Overview, Products/Solutions/Services offered, Recent Developments, Product launches, Deals, Other developments, MnM view, Right to win, Strategic choices, Weaknesses and competitive threats might not be captured in case of unlisted companies.

13 ADJACENT & RELATED MARKETS (Page No. - 245)

13.1 INTRODUCTION

13.2 LIMITATIONS

13.3 AUTOMOTIVE PLASTICS MARKET

13.3.1 MARKET DEFINITION

13.3.2 MARKET OVERVIEW

13.4 AUTOMOTIVE PLASTICS MARKET, BY REGION

TABLE 283 AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS, BY REGION, 2019–2026 (KILOTON)

TABLE 284 AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS, BY REGION, 2019–2026 (USD MILLION)

13.4.1 ASIA PACIFIC

TABLE 285 ASIA PACIFIC: AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 286 ASIA PACIFIC: AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 287 ASIA PACIFIC: AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS, BY PRODUCT TYPE, 2019–2026 (KILOTON)

TABLE 288 ASIA PACIFIC: AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 289 ASIA PACIFIC: AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 290 ASIA PACIFIC: AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS, BY APPLICATION, 2019–2026 (USD MILLION)

13.4.2 NORTH AMERICA

TABLE 291 NORTH AMERICA: AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 292 NORTH AMERICA: AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 293 NORTH AMERICA: AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS, BY PRODUCT TYPE, 2019–2026 (KILOTON)

TABLE 294 NORTH AMERICA: AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 295 NORTH AMERICA: AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 296 NORTH AMERICA: AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS, BY APPLICATION, 2019–2026 (USD MILLION)

13.4.3 EUROPE

TABLE 297 EUROPE: AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 298 EUROPE: AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 299 EUROPE: AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS, BY PRODUCT TYPE, 2019–2026 (KILOTON)

TABLE 300 EUROPE: AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 301 EUROPE: AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 302 EUROPE: AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS, BY APPLICATION, 2019–2026 (USD MILLION)

13.4.4 MIDDLE EAST & AFRICA

TABLE 303 MIDDLE EAST & AFRICA: AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 304 MIDDLE EAST & AFRICA: AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 305 MIDDLE EAST & AFRICA: AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS, BY PRODUCT TYPE, 2019–2026 (KILOTON)

TABLE 306 MIDDLE EAST & AFRICA: AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 307 MIDDLE EAST & AFRICA: AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 308 MIDDLE EAST & AFRICA: AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS, BY APPLICATION, 2019–2026 (USD MILLION)

13.4.5 SOUTH AMERICA

TABLE 309 SOUTH AMERICA: AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 310 SOUTH AMERICA: AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 311 SOUTH AMERICA: AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS, BY PRODUCT TYPE, 2019–2026 (KILOTON)

TABLE 312 SOUTH AMERICA: AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 313 SOUTH AMERICA: AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 314 SOUTH AMERICA: AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS, BY APPLICATION, 2019–2026 (USD MILLION)

14 APPENDIX (Page No. - 260)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 CUSTOMIZATION OPTIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

The study involved four major activities to estimate the market size for automotive NVH materials market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, certified publications, articles from recognized authors, gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The automotive NVH materials market comprises several stakeholders in the value chain, which include raw material suppliers, manufacturers, and end users. Various primary sources from the supply and demand sides of the automotive NVH materials market have been interviewed to obtain qualitative and quantitative information.

The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the automotive NVH materials industry.

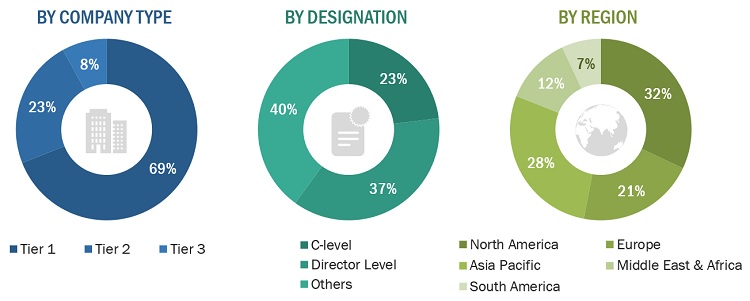

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2021 available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the size of the automotive NVH materials market.

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of the key market players, along with extensive interviews for opinions with leaders such as directors and marketing executives.

Automotive NVH Materials MARKET: BOTTOM-UP APPROACH 1

Source: MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Report Objectives

- To define, describe, and forecast the size of the automotive NVH materials market, in terms of value and volume

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size based on material type, vehicle type, application, and region

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, Middle East & Africa and South America, along with their key countries

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders

- To track and analyze recent developments such as expansions, new product launches, partnerships & agreements, and acquisitions in the market

- To strategically profile key market players and comprehensively analyze their core competencies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

- Regional Analysis

Further breakdown of a region with respect to a particular country or additional application

- Company Information

Detailed analysis and profiles of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Automotive NVH Materials Market

Want to review report on NVH market

Acoustic and reinforcement tapes, foils, and patches market in automotive

Market overview and dynamics.

NVH damping treatments including constrained layer damping.

Market data on global Automotive NVM materials market