Automotive MLCC Market by EV Application, Voltage Range, Vehicle Type, Dielectric Type, Type, Application (Powertrain, Steering System, Infotainment, Lighting, Body Control Module and ADAS & Safety) and Region - Global Forecast to 2027

Automotive Multilayer Ceramic Capacitor (MLCC) is widely used in on-board electrical and electronic circuits. These are not only used in automotive industry but all applications where reliability is priority. They are essential components that are responsible for smooth execution of the various electrical and electronic circuits utilized in cars. High voltage MLCCs are used in onboard inverter, onboard AC/DC Convertor, BMS circuits and onboard charger in a BEV. They are made of alternating layers of metallic electrodes and dielectric ceramic. Additionally, automotive MLCCs must offer a small size and high capacitance like those found in smartphones. MLCC integrated in automotives are linked to a higher degree of quality and are entirely different from the MLCCs used in consumer electronics.

The global automotive MLCC market size is expected to grow from USD xx million in 2022 to USD xx million in 2027, at a CAGR of xx%. The increase in integration of electronic devices in automobiles, such as engines, powertrains and infotainment systems, is accelerating the demand for automotive MLCC.

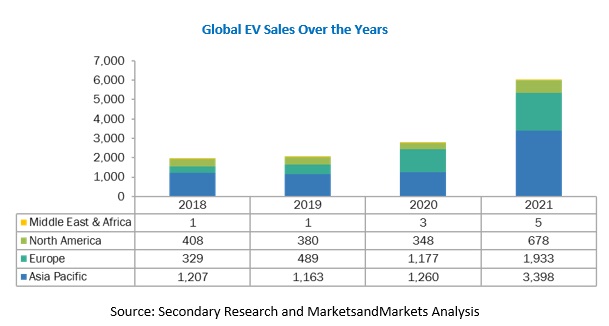

Drivers: Increase in use of MLCC in BEV vehicles is expected to drive the market

According to world’s largest MLCC manufacturers Murata and Taiyo Yuden, Tesla Model S and Model X both have over 10,000 MLCCs, whereas the Tesla Model 3 has over 9,000 MLCCs. By 2025, this number is anticipated to rise to an average of 16,000 MLCC per BEV. Modern EVs, HEVs, and PHEVs are bringing a revolution in capacitor technology targeting subsystem electronics. On the other hand, in ICE vehicles, around 3,000-5,000 MLCCs are present. The use of ceramic MLCCs in EV subsystems is growing because traditional plastic film capacitors are no longer appropriate for all applications due to the increased temperatures inside the control circuits. The advancement in EVs is also increasing the complimenting the development of self-driving cars. Subsequently, integration of MLCC will increase with integration of ADAS system in EVs.

Opportunities: Integration of IoT, AI and cloud in automobiles is offering growth opportunities for MLCC

The integration of IoT and AI require more advanced electrical and electronic systems which is likely to increase technical requirements of MLCCs. The demand for miniature, high capacitance and low inductance MLCC will increase in the coming future as these MLCC are suitable for integration in automation and connectivity. Electronic control units (ECUs) are increasingly needed to meet the demands of automation and connectivity in vehicles. As a result, automobile manufacturers must fit more components into a given space. Accordingly, the demand for compact capacitors with high capacitance values is the main trend in the automobile industry. This is likely to drive Automotive MLCC market in near future.

Challenge: Increasing prices of Palladium and Nickel due to uncertainties in global situation is expected to impact the growth of market

Palladium and Nickel are both obtained in significant quantities from a single mining operation in Siberia, tensions in eastern Europe have influenced their prices. In MLCC electrodes, palladium and nickel are utilised. All printed circuit boards use MLCCs, which are the workhorse of the passive components sector. Consumer and business electronic sub-assemblies use MLCCs with nickel electrodes, whereas high reliability electronics use MLCCs with palladium electrodes. Given that nickel and palladium are main components for manufacturing of Automotive MLCC, the high cost of these metals are affecting the market, In March 2022 nickel jumped a whopping 90% to over $55,000 per metric ton now with sudden spike in their prices is expected to impact the market growth.

Key Players

Murata (Japan), Samsung Electro (South Korea), TDK Corporation (Japan), Kyocera (Japan), Taiyo Yuden (Japan), Darfon Electronics (Taiwan), Holystone (Taiwan), Yageo Corporation (Taiwan), Walsin (Taiwan), Kemet (US), Vishay (US), JDI (Japan). These companies adopted new product launches, partnership, and supply contracts to gain traction in the automotive MLCC market.

TABLE OF CONTENTS

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

2.1 SECONDARY DATA

2.2 PRIMARY DATA

2.3 FACTOR ANALYSIS

2.3.1 INTRODUCTION

2.3.2 DEMAND SIDE ANALYSIS

2.3.3 SUPPLY SIDE ANALYSIS

2.4 MARKET SIZE ESTIMATION

2.5 MARKET BREAKDOWN AND DATA TRIANGULATION

2.6 ASSUMPTIONS

2.7 RISK ASSESSMENT & RANGES

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.2 RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.4 CHALLENGES

5.2.5 IMPACT OF MARKET DYNAMICS

5.3 TECHNOLOGY ANALYSIS

5.4 PRICING ANALYSIS

5.6 PORTER’S FIVE FORCES MODEL

5.7 CASE STUDY ANALYSIS

5.8 ECOSYSTEM ANALYSIS

5.9 SUPPLY CHAIN ANALYSIS

5.10 PATENT ANALYSIS

5.11 REGULATORY LANDSCAPE

5.11.1 LIST OF REGULATORY BODIES, ORGANIZATIONS AND ASSOCIATIONS

5.12 BUYING CRITERIA AND KEY STAKEHOLDERS

5.12.1 BUYING CRITERIA

5.12.2 STAKEHOLDERS IN BUYING PROCESS

5.13 TRENDS & DISRUPTIONS IMPACTING THE MARKET

5.14 AUTOMOTIVE MLCC MARKET: SCENARIOS (2022-2027)

5.14.1 MOST LIKELY SCENARIO

5.14.2 OPTIMISTIC SCENARIO

5.14.3 PESSIMISTIC SCENARIO

7 AUTOMOTIVE MLCC MARKET, BY APPLICATION

7.1 INTRODUCTION

7.2 OPERATIONAL DATA

7.3 RESEARCH METHODOLOGY

7.4 ASSUMPTIONS

7.5 POWERTRAIN

7.5.1 ENGINE CONTROL MODULE

7.5.2 TRANSMISSION

7.5.3 MOTORS

7.5.4 BRAKE CONTROL MODULE

7.5.5 FUEL INJECTION

7.6 STEERING SYSTEM

7.7 INFOTAINMENT

7.7.1 NAVIGATION SYSTEM

7.7.2 VEHICLE AUDIO

7.8 LIGHTING

7.9 BODY CONTROL MODULE

7.1 ADAS & SAFETY

8 AUTOMOTIVE MLCC MARKET, BY EV APPLICATION

8.1 INTRODUCTION

8.2 OPERATIONAL DATA

8.3 RESEARCH METHODOLOGY

8.4 ASSUMPTIONS

8.5 CHARGER

8.6 BATTERY MANAGEMENT SYSTEM

8.7 COMPRESSORS

8.8 INVERTER

8.9 CONVERTER

9 AUTOMOTIVE MLCC MARKET, BY VOLTAGE RANGE

9.1 INTRODUCTION

9.2 OPERATIONAL DATA

9.3 RESEARCH METHODOLOGY

9.4 LOW RANGE (UP TO 50V)

9.5 MID RANGE (100 TO 630V)

9.6 HIGH RANGE (1000V AND ABOVE)

*MNM will provide regional level market in terms of volume (units)

10 AUTOMOTIVE MLCC MARKET, BY DIELECTRIC TYPE

10.1 INTRODUCTION

10.2 OPERATIONAL DATA

10.3 RESEARCH METHODOLOGY

10.4 X8R

10.5 X7R

10.6 X5R

10.7 C0G

10.8 OTHERS

*MNM will provide regional level market in terms of volume (units)

11 AUTOMOTIVE MLCC MARKET, BY TYPE

11.1 INTRODUCTION

11.2 OPERATIONAL DATA

11.3 RESEARCH METHODOLOGY

11.4 GENERAL CAPACITOR

11.5 SERIAL DESIGN

11.6 ARRAY

11.7 MEGA CAP

11.8 OTHERS

*MNM will provide regional level market in terms of volume (units)

12 AUTOMOTIVE MLCC MARKET, BY VEHICLE TYPE

12.1 INTRODUCTION

12.2 OPERATIONAL DATA

12.3 RESEARCH METHODOLOGY

12.4 PASSENGER CARS

12.5 COMMERCIAL VEHICLES

*MNM will provide country-level market in terms of volume (units) and value (USD million)

13 AUTOMOTIVE MLCC MARKET, BY REGION

13.1 INTRODUCTION

13.2 EUROPE AUTOMOTIVE MLCC MARKET, BY COUNTRY

13.2.1 GERMANY

13.2.2 FRANCE

13.2.3 U.K.

13.2.4 SPAIN

13.2.5 ITALY

13.2.6 REST OF EUROPE

13.3 NORTH AMERICA AUTOMOTIVE MLCC MARKET, BY COUNTRY

13.3.1 U.S.

13.3.2 MEXICO

13.3.3 CANADA

13.4 ASIA-PACIFIC AUTOMOTIVE MLCC MARKET, BY COUNTRY

13.4.1 CHINA

13.4.2 JAPAN

13.4.3 INDIA

13.4.4 SOUTH KOREA

13.4.5 REST OF ASIA PACIFIC

13.5 REST OF THE WORLD AUTOMOTIVE MLCC MARKET, BY COUNTRY

13.5.1 BRAZIL

13.5.2 SOUTH AFRICA

13.5.3 REST OF ROW

*MNM will provide country-level market in terms of volume (units) and value (USD million); country-level segmentation will be provided only for vehicle type segment

14 COMPETITIVE LANDSCAPE

14.1 OVERVIEW

14.2 MARKET SHARE AND MARKET RANKING ANALYSIS

14.3 COMPANY EVALUATION QUADRANT

14.3.1 STARS

14.3.2 EMERGING LEADERS

14.3.3 PERVASIVE PLAYERS

14.3.4 PARTICIPANTS

14.4 COMPETITIVE SCENARIO

14.4.1 NEW PRODUCT DEVELOPMENTS

14.4.2 ACQUISITIONS

14.4.3 JOINT VENTURES AND AGREEMENTS

14.4.4 EXPANSIONS

14.5 SME/STARTUP MATRIX

14.6 RIGHT TO WIN

15 COMPANY PROFILES

(Company overview, Strength of product portfolio, Product offerings, Business strategy excellence, Recent developments) *

15.1 MURATA

15.2 SAMSUNG ELECTRO-MECHANICS

15.3 TAIYO YUDEN

15.4 YAGEO

15.5 TDK CORPORATION

15.6 AVX CORPORATION (KYOCERA GROUP)

15.7 VISHAY INTERTECHNOLOGY, INC.

15.8 NIC COMPONENTS

15.9 HOLYSTONE

15.10 EYANG

15.11 WALSIN

15.12 NIPPON CHEMI-CON

*Details on Company overview, Strength of product portfolio, Product offerings, Business strategy excellence, Recent developments might not be captured in case of unlisted companies.

16 APPENDIX

Growth opportunities and latent adjacency in Automotive MLCC Market