Automotive Hydraulics System Market by Application (Brake, Clutch, Suspension & Tappet), OE Component (Master Cylinder, Slave Cylinder, Reservoir & Hose), Aftermarket Component, On-Highway Vehicle, Off-Highway Vehicle, and Region - Global Forecast to 2025

The global automotive hydraulics system market size was valued at USD 30.57 Billion in 2016 and is projected to grow at a CAGR of 6.04% from 2017 to reach USD 51.37 Billion by 2025. In this study, 2016 has been considered the base year, and 2017–2025 the forecast period, for estimating the size of the market. The report analyzes and forecasts the market size, by value (USD million), of the automotive hydraulics system market. The report segments the market and forecasts its size, by region, application, OE component, on-highway vehicle, off-highway vehicle, and aftermarket component. The report also provides a detailed analysis of various forces acting in the market including drivers, restraints, opportunities, and challenges. It strategically profiles key players and comprehensively analyzes their market shares and core competencies. It also tracks and analyzes competitive developments such as joint ventures, mergers & acquisitions, new product launches, expansions, and other activities carried out by key industry participants.

The research methodology used in the report involves various secondary sources such as National Highway Traffic Safety Administration (NHTSA), GENIVI Alliance, Japan Automobile Manufacturers Association (JAMA), European Automobile Manufacturers Association (EAMA), Canadian Automobile Association (CAA), and Korea Automobile Manufacturers Association (KAMA). Experts from related industries, automotive hydraulics system suppliers and manufacturers have been interviewed to understand the future trends in the automotive hydraulics system market. The market size of the individual segments was determined through various secondary sources: industry associations; white papers; and journals. The vendor offerings were also taken into consideration to determine the market segmentation. The bottom-up approach has been used to estimate and validate the size of the global market. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments.

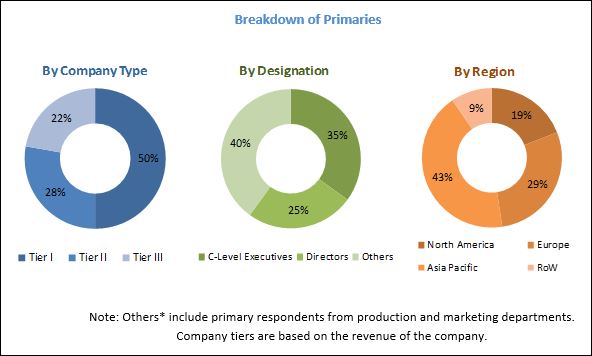

The figure given below illustrates the break-up of the profile of industry experts who participated in primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the automotive hydraulics system market consists of manufacturers such as Aisin Seiki (Japan), Bosch (Germany), ZF (Germany), BorgWarner (US) and JTEKT (Japan) and research institutes such as Colorado Off-highway Vehicle Coalition (COHVCO), Japan Automobile Manufacturers Association (JAMA), European Automobile Manufacturers Association (EAMA), Canadian Automobile Association (CAA), and Korea Automobile Manufacturers Association (KAMA).

Target Audience

- Automotive hydraulics system manufacturers

- Infrastructure Development Companies

- Automobile organizations/associations

- Compliance regulatory authorities

- Government agencies

- Information Technology (IT) companies & System integrators

- Investors and Venture Capitalists (VCs)

- Raw material suppliers for automotive hydraulics system

- Traders, distributors, and suppliers of automotive hydraulics system

Scope of the Report

Market, By Region

Market, By Application

Market, By OE Component

Market, By On-Highway Vehicles

Market, By Off-Highway Vehicles

Market, By Aftermarket Component

-

- North America

- Europe

- Asia Pacific

- Rest of the World (RoW)

- Hydraulic Brakes

- Hydraulic Clutch

- Hydraulic Suspension

- Hydraulic Tappets

- Master Cylinder

- Slave Cylinder

- Reservoir

- Hose

- Passenger Cars (PCs)

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Construction Vehicles

- Agricultural Vehicles

- Master Cylinder

- Slave Cylinder

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Detailed analysis and profiling of additional market players (up to 3)

- Detailed analysis of automotive hydraulic application for off-highway vehicle market

- Detailed analysis of automotive hydraulic aftermarket

The global automotive hydraulics system market is estimated to be USD 32.13 Billion in 2017 and is projected to grow at a CAGR of 6.04% to reach USD 51.37 Billion by the end of 2025. Some of the major drivers identified are the increasing sales of off-highway vehicles and increasing vehicle production. Innovations in electro-hydraulic automotive applications can create new revenue generation opportunities for automotive hydraulics system manufacturers. Whereas, user concerns regarding the noise, uptime, and reliability of hydraulic systems and contamination of hydraulic fluids are creating challenges for automotive hydraulics system manufacturers.

The global automotive hydraulics system market is segmented by application, OE component, on-highway vehicle, off-highway vehicle, aftermarket component, and region. The report discusses four automotive hydraulics system applications, namely, hydraulic brakes, clutch, suspension, and tappets. Hydraulic brakes segment accounted for the largest market shares in the market by application and is estimated to grow with the highest CAGR during the forecast period following its wide applications in several types of vehicles.

The hydraulic tappets segment is estimated to be the fastest growing market for automotive hydraulics systems by application, followed by hydraulic brakes, hydraulic clutch, and hydraulic suspension. This segment is estimated to experience a stable growth due to engine upsizing by the various automaker in their vehicles.

The slave cylinder segment for automotive hydraulics system OE market by the component is expected to grow at the highest CAGR followed by the reservoir, hose and master cylinder segment. The slave cylinder segment is estimated to account for the highest share in the automotive hydraulics system market, following its wide applications in automotive hydraulics system.

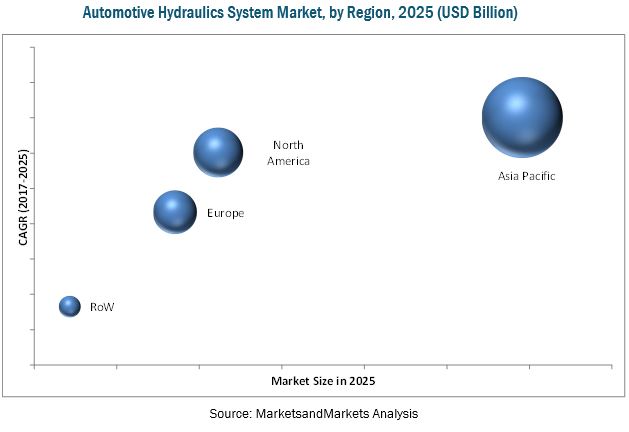

The extensive study has been done on four key regions, namely, Asia Pacific, Europe, North America, and the Rest of the World (RoW).

Asia Pacific is forecasted to have the largest market share growing at the highest CAGR followed by North America region. This growth is majorly fueled by the growth vehicle production and government mandates regarding the active and passive safety of vehicles. Increasing investment in infrastructure, construction activities and increasing vehicle sales are projected to drive the growth in this region.

Some of the major restraint identified in the global automotive hydraulics system market is the replacement of hydraulic applications with fully electrical systems and high maintenance cost of hydraulic systems. Advantages of electro-mechanical systems over hydraulic systems help offer friendly operations and make the systems cost-effective for the end user.

Some of the major players in the global automotive hydraulics system market are Aisin Seiki (Japan), Bosch (Germany), ZF (Germany), BorgWarner (US) and JTEKT(Japan). The last chapter of this report covers a comprehensive study of the key vendors operating in the market. The evaluation of market players is done by taking several factors into accounts, such as new product development, R&D expenditure, business strategies, product revenue, and organic and inorganic growth.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency Exchange Rates

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.2.2 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Factor Analysis

2.4.1 Demand-Side Analysis

2.4.1.1 Expanding Infrastructure Development Sector in Emerging Economies

2.4.1.2 Infrastructure: Road Network

2.4.1.3 Technological Advancements

2.5 Market Size Estimation

2.5.1 Bottom-Up Approach

2.6 Market Breakdown and Data Triangulation

2.7 Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities for the Automotive Hydraulics System Market

4.2 Market Share, By Region

4.3 Market, By Vehicle Type

4.4 Market, By Application

4.5 Market, By Component

4.6 Market, By Off-Highway Vehicle Type

4.7 Automotive Hydraulics System Aftermarket, By Component Type

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Sales of Off-Highway Vehicles

5.2.1.2 Increasing Vehicle Production

5.2.2 Restraints

5.2.2.1 Replacement of Hydraulic Systems With Fully Electrical Systems

5.2.2.2 High Maintenance Cost of Hydraulic Systems

5.2.3 Opportunities

5.2.3.1 Technological Advancements in Vehicle Braking and Suspension Systems

5.2.3.2 Increasing Application Scope of Electro-Hydraulic Systems

5.2.4 Challenges

5.2.4.1 User Concerns Regarding the Noise, Uptime, and Reliability of Hydraulic Systems

5.2.4.2 Contamination of Hydraulic Fluids

5.3 Analysis of Macroindicators

5.3.1 Introduction

5.3.1.1 Construction Vehicle Sales

5.3.1.2 GDP (USD Billion)

5.3.1.3 GNI Per Capita, Atlas Method (USD)

5.3.1.4 GDP Per Capita PPP (USD)

5.3.2 US

5.3.3 China

5.3.4 UK

6 By Application (Page No. - 43)

6.1 Introduction

6.2 Hydraulic Brakes

6.3 Hydraulic Clutch

6.4 Hydraulic Suspension

6.5 Hydraulic Tappets

7 By Component (Page No. - 50)

7.1 Introduction

7.2 Hydraulic Master Cylinder

7.3 Hydraulic Slave Cylinder

7.4 Hydraulic Reservoir

7.5 Hydraulic Hose

8 Automotive Hydraulics System Market for On- Highway Vehicles, By Type (Page No. - 57)

8.1 Introduction

8.2 Passenger Cars

8.3 Light Commercial Vehicles

8.4 Heavy Commercial Vehicles

9 Automotive Hydraulics System Market for Off-Highway Vehicles, By Type (Page No. - 63)

9.1 Introduction

9.2 Agricultural Equipment

9.3 Construction Equipment

10 Automotive Hydraulics System Aftermarket, By Component (Page No. - 67)

10.1 Introduction

10.2 Hydraulic Master Cylinder

10.3 Hydraulic Slave Cylinder

11 By Region (Page No. - 71)

11.1 Introduction

11.2 Asia Pacific

11.2.1 China

11.2.2 Japan

11.2.3 India

11.2.4 South Korea

11.3 Europe

11.3.1 France

11.3.2 Germany

11.3.3 Italy

11.3.4 Spain

11.3.5 UK

11.4 North America

11.4.1 Canada

11.4.2 Mexico

11.4.3 US

11.5 Rest of the World

11.5.1 Brazil

11.5.2 Russia

11.5.3 South Africa

12 Competitive Landscape (Page No. - 93)

12.1 Introduction

12.2 Market Ranking Analysis

12.3 Competitive Situation & Trends

12.3.1 New Product Developments

12.3.2 Partnerships, Supply Contracts, Collaborations, and Joint Ventures

12.3.3 Mergers & Acquisitions

13 Company Profiles (Page No. - 99)

13.1 Aisin Seiki

(Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

13.2 Bosch

13.3 ZF Friedrichshafen

13.4 Borgwarner

13.5 Jtekt

13.6 Continental

13.7 Schaeffler

13.8 Wabco

13.9 GKN

13.10 Fte Automotive

*Details on Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 123)

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.3 Introducing RT: Real Time Market Intelligence

14.4 Available Customizations

14.4.1 Additional Company Profiles

14.4.1.1 Business Overview

14.4.1.2 SWOT Analysis

14.4.1.3 Recent Developments

14.4.1.4 MnM View

14.4.2 Detaled Analysis of Automotive Application

14.4.3 Detaled Analysis of Hydraulic System in Off-Highway Vehicles

14.4.4 Detaled Analysis of Aftermarket

14.5 Related Reports

14.6 Author Details

List of Tables (81 Tables)

Table 1 Automotive Hydraulics System Market, By Application, 2015–2025 (Million Units)

Table 2 Market, By Application, 2015–2025 (USD Million)

Table 3 Hydraulics Brakes Market, By Region, 2015–2025 (Million Units)

Table 4 Hydraulics Brakes Market, By Region, 2015–2025 (USD Million)

Table 5 Hydraulic Clutch Market, By Region, 2015–2025 (Million Units)

Table 6 Hydraulic Clutch Market, By Region, 2015–2025 (USD Million)

Table 7 Hydraulics Suspension Market, By Region, 2015–2025 (Million Units)

Table 8 Hydraulics Suspension Market, By Region, 2015–2025 (USD Million)

Table 9 Hydraulic Tappets Market, By Region, 2015–2025 (Million Units)

Table 10 Hydraulic Tappets Market, By Region, 2015–2025 (USD Million)

Table 11 Market, By Component, 2015–2025 (Million Units)

Table 12 Market, By Component, 2015–2025 (USD Million)

Table 13 Market for Master Cylinders, By Region, 2015–2025 (Million Units)

Table 14 Market for Master Cylinders, By Region, 2015–2025 (USD Million)

Table 15 Market for Slave Cylinders, By Region, 2015–2025 (Million Units)

Table 16 Market for Slave Cylinders, By Region, 2015–2025 (USD Million)

Table 17 Market for Reservoirs, By Region, 2015–2025 (Million Units)

Table 18 Market for Reservoirs, By Region, 2015–2025 (USD Million)

Table 19 Market for Hoses, By Region, 2015–2025 (Million Units)

Table 20 Market for Hoses, By Region, 2015–2025 (USD Million)

Table 21 Market for On-Highway Vehicles, By Type, 2015-2025 (Million Units)

Table 22 Market for On-Highway Vehicles, By Type, 2015-2025 (USD Million)

Table 23 Passenger Car Hydraulics System Market, By Region, 2015-2025 (Million Units)

Table 24 Passenger Car Hydraulics System Market, By Region, 2015-2025 (USD Million)

Table 25 Light Commercial Vehicle Hydraulics System Market, By Region, 2015-2025 (Million Units)

Table 26 Light Commercial Vehicle Hydraulics System Market, By Region, 2015-2025 (USD Million)

Table 27 Heavy Commercial Vehicle Hydraulics System Market, By Region, 2015-2025 (Million Units)

Table 28 Heavy Commercial Vehicle Hydraulics System Market, By Region, 2015-2025 (USD Million)

Table 29 Market for Off-Highway Vehicles, By Type, 2015–2025 (Million Units)

Table 30 Hydraulics System Market for Agricultural Equipment, By Region, 2015–2025 (‘000 Units)

Table 31 Hydraulics System Market for Construction Equipment, By Region, 2015–2025 (‘000 Units)

Table 32 Automotive Hydraulics System Aftermarket, By Component, 2015–2025 (Million Units)

Table 33 Automotive Hydraulics System Aftermarket, By Component, 2015–2025 (USD Billion)

Table 34 Automotive Hydraulic Master Cylinder Aftermarket, By Region, 2015–2025 (Million Units)

Table 35 Automotive Hydraulic Master Cylinder Aftermarket, By Region, 2015–2025 (USD Billion)

Table 36 Automotive Hydraulic Slave Cylinder Aftermarket, By Region, 2015–2025 (Million Units)

Table 37 Automotive Hydraulic Slave Cylinder Aftermarket, By Region, 2015–2025 (USD Billion)

Table 38 Automotive Hydraulics System Market, By Region, 2015–2025 (Million Units)

Table 39 Market, By Region, 2015–2025 (USD Million)

Table 40 Asia Pacific: Market, By Country, 2015–2025 (Million Units)

Table 41 Asia Pacific: Market, By Country, 2015–2025 (USD Million)

Table 42 China: Market, By Application, 2015–2025 (Million Units)

Table 43 China: Market, By Application, 2015–2025 (USD Million)

Table 44 Japan: Market, By Application, 2015–2025 (USD Million)

Table 45 Japan: Market, By Application, 2015–2025 (USD Million)

Table 46 India: Market, By Application, 2015–2025 (USD Million)

Table 47 India: Market, By Application, 2015–2025 (USD Million)

Table 48 South Korea: Market, By Application, 2015–2025 (Million Units)

Table 49 South Korea: Market, By Application, 2015–2025 (USD Million)

Table 50 Europe: Market, By Country, 2015–2025 (Million Units)

Table 51 Europe: Market, By Country, 2015–2025 (USD Million)

Table 52 France: Market, By Application, 2015–2025 (USD Million)

Table 53 France: Market, By Application, 2015–2025 (USD Million)

Table 54 Germany: Market, By Application, 2015–2025 (USD Million)

Table 55 Germany: Market, By Application, 2015–2025 (USD Million)

Table 56 Italy: Market, By Application, 2015–2025 (USD Million)

Table 57 Italy: Market, By Application, 2015–2025 (USD Million)

Table 58 Spain: Market, By Application, 2015–2025 (USD Million)

Table 59 Spain: Market, By Application, 2015–2025 (USD Million)

Table 60 UK: Market, By Application, 2015–2025 (USD Million)

Table 61 UK: Market, By Application, 2015–2025 (USD Million)

Table 62 North America: Market, By Country, 2015–2025 (Million Units)

Table 63 North America: Market, By Country, 2015–2025 (USD Million)

Table 64 Canada: Market, By Application, 2015–2025 (Million Units)

Table 65 Canada: Market, By Application, 2015–2025 (USD Million)

Table 66 Mexico: Market, By Application, 2015–2025 (USD Million)

Table 67 Mexico: Market, By Application, 2015–2025 (USD Million)

Table 68 US: Market, By Application, 2015–2025 (USD Million)

Table 69 US: Market, By Application, 2015–2025 (USD Million)

Table 70 RoW: Market, By Country, 2015–2025 (Million Units)

Table 71 RoW: Market, By Country, 2015–2025 (USD Million)

Table 72 Brazil: Market, By Application, 2015–2025 (‘000 Units)

Table 73 Brazil: Market, By Application, 2015–2025 (USD Million)

Table 74 Russia: Market, By Application, 2015–2025 (‘000 Units)

Table 75 Russia: Market, By Application, 2015–2025 (USD Million)

Table 76 South Africa: Market, By Application, 2015–2025 (‘000 Units)

Table 77 South Africa: Market, By Application, 2015–2025 (USD Million)

Table 78 New Product Development

Table 79 Expansions

Table 80 Partnerships, Supply Contracts, Collaborations, and Joint Ventures

Table 81 Mergers & Acquisitions

List of Figures (45 Figures)

Figure 1 Automotive Hydraulics System Market: Market Segmentation

Figure 2 Market: Research Design

Figure 3 Research Design Model

Figure 4 Breakdown of Primary Interviews

Figure 5 Market: Bottom-Up Approach

Figure 6 Data Triangulation

Figure 7 Market Share (2025): Asia Pacific is Projected to Be the Fastest Growing Market

Figure 8 Hydraulic Brakes to Lead the Market Globally, 2017 vs 2025

Figure 9 Automotive Hydraulics System OE Market Size, By Component, 2017 vs 2025

Figure 10 Market Size, By On–Highway Vehicles, 2017 vs 2025

Figure 11 Growing Demand of Passenger Car is Likely to Drive the Hydraulics System Market, 2017–2025

Figure 12 Asia Pacific is Expected to Hold the Largest Share of the Hydraulics System Market, By Value, 2017–2025

Figure 13 The Passenger Car Segment is Estimated to Be the Fastest Growing Segment of the Hydraulics System Market, By Value, 2017 vs 2025 (USD Million)

Figure 14 Hydraulic Suspension is Estimated to Be the Fastest Growing Market in By Component, 2017 vs 2025 (USD Billion)

Figure 15 Slave Cylinder is Estimated to Be the Fastest Growing Market in By Application, 2017 vs 2025 (USD Million)

Figure 16 Construction Equipment Segment is Estimated to Be the Fastest Growing Market for Hydraulics Systems, By Off-Highway Vehicle Type, 2017 vs 2025 (Million Units)

Figure 17 Master Cylinder Segment is Estimated to Be the Fastest Growing Market for Hydraulics Systems, 2017 vs 2025 (USD Billion)

Figure 18 Market: Market Dynamics

Figure 19 Vehicle Production, 2012–2016 (Thousand)

Figure 20 Macroindicators Affecting Market in the US

Figure 21 Macroindicators Affecting Market in China

Figure 22 Macroindicators Affecting Market in the UK

Figure 23 Market: Hydraulic Brakes to Account for the Largest Market Size in 2017

Figure 24 Market: Slave Cylinder Segment is Expected to Dominate the Market in 2017

Figure 25 Market: Passenger Cars Segment to Account for the Largest Market Share During the Forecast Period

Figure 26 Market: Agricultural Equipment to Account for the Largest Market Size in 2017

Figure 27 Automotive Hydraulics System Aftermarket: Slave Cylinder Segment to Dominate the Market in 2017

Figure 28 China & India to Register High Growth Rates in the Market During the Forecast Period

Figure 29 Asia Pacific: Market Snapshot

Figure 30 North America: Market Snapshot

Figure 31 Market Ranking: 2017

Figure 32 Aisin Seiki: Company Snapshot

Figure 33 Aisin Seiki: SWOT Analysis

Figure 34 Bosch: Company Snapshot

Figure 35 Bosch: SWOT Analysis

Figure 36 ZF: Company Snapshot

Figure 37 ZF: SWOT Analysis

Figure 38 Borgwarner: Company Snapshot

Figure 39 Borgwarner: SWOT Analysis

Figure 40 Jtekt: Company Snapshot

Figure 41 Jtekt: SWOT Analysis

Figure 42 Continental: Company Snapshot

Figure 43 Schaeffler: Company Snapshot

Figure 44 Wabco: Company Snapshot

Figure 45 GKN: Company Snapshot

Growth opportunities and latent adjacency in Automotive Hydraulics System Market