Automotive Fascia Market by Position (Front Fascia, Rear Fascia), Vehicle Type (Passenger Vehicles, Commercial Vehicles), Material (Metals, Polypropylene, ABS, Rubber, Polycarbonate, Others), Sales Channel (OEM and Aftermarket) and Region - Global Forecast to 2027

Automotive Fascia refers to the bumper component installed in the front and rear of the vehicle. The component is generally made of Acrylonitrile Butadiene Styrene, Thermoplastic olefin elastomers, or Polypropylene. With the evolution of composite plastics, a wider range of materials have become useable for bumper fascia. Bumpers act as crucial crumple zones during collisions by absorbing impact, thereby bringing down the cost of repair of the vehicle and providing safety to the passengers. Vehicle manufacturers cover the bumper components with lightweight fascias to match the aesthetics of the vehicle and provide better aerodynamics, hence increasing the overall fuel efficiency. The constant focus of governments on a fuel-efficient and safer automobile while not compromising on aesthetics is the primary reason for the growth of this market.

There is a growing need for automotive fascias in the lightweight vehicle category over the past several years due to the end-user sectors' desire for lightweight automobiles, which has put pressure on bumper producers to boost output. Additionally, the governments of emerging nations have made steps to restrict pollution rates, which has increased demand for automotive fascia in the segment of lightweight cars. Thus, fascia is constructed in a flexible way that is sufficient to reduce the danger of damage to passengers and also ensure reduced weight for cars.

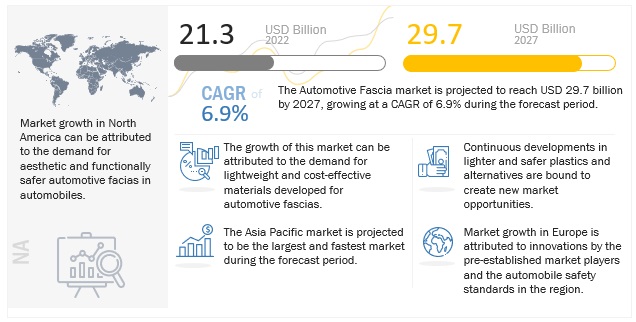

The global Automotive Fascia market size is expected to grow from USD 21.3 billion in 2022 to USD 29.7 billion by 2027, at a CAGR of 6.9%. The increasing safety standards for pedestrians and passengers and the increasing complexity of vehicles leading to higher repairs post-impact damage is the primary driver of automotive fascias both in the OEM and aftermarket segments boosting the growth of the market. Consistent vehicle production worldwide would further ensure robust demand for automotive fascia over the forecast period.

Drivers: Demand for lightweight and cost-effective automotive fascias contributes to market growth.

The growing trend of vehicle light-weighting, premium vehicle design, and consistent vehicle production drives the automotive fascia market. The market for automotive fascia is expected to benefit further from the increase in demand for electric and fuel-efficient automobiles since the fascia plays a crucial role in the safety and aesthetics of the vehicle.

The adoption of strict pollution regulations throughout the world is pushing automakers to create lightweight vehicles, which is projected to raise demand for lightweight fascia in cars. To increase vehicle range, major electric vehicle (EV) manufacturers are using lightweight materials, which is also anticipated to drive the growth of the automotive fascia market.

It is projected that the global small- and medium-scale manufacturing sectors would boost the market for automobile fascias. The increasing mergers and acquisitions between automakers and manufacturers of auto parts are one of the key drivers for the global growth of automobile fascias.

Opportunities: Aftermarket visual modification of vehicles is a key opportunity for the automotive fascia market.

The urge for visually appealing cars among consumers is driving the general evolution and improvement of the automobile market. Consequently, the worldwide auto modification industry is flourishing, increasing the demand for aesthetically pleasing and aerodynamic automotive fascia. A rising consumer preference for modern, attractive automobiles over older versions may also contribute to the expansion of the automotive fascia industry. Additionally, people's changing lifestyles and increasing income levels cause automobiles to eventually undergo changes; during the projection period, these factors are also anticipated to significantly increase the market's growth rate.

Challenges: Higher maintenance and replacement costs of the automotive bumper fascia may hamper the growth of the market

Car crashes cause extensive vehicle damage that requires expensive repairs. Modern vehicles are safer, lighter, and have better gas mileage. However, the cost of body repairs has increased due to the newest production techniques and vehicle designs. Since a bumper fascia for an automobile is primarily made of plastic, replacement costs are significant. The replacement of the bumper fascia is necessary since it appears to have cracks. For instance, the price to replace an automobile fascia might range from USD 50 to USD 500. Therefore, changing this vehicle component may result in an increase in operating expenses, which is predicted to impede market expansion throughout the projection period.

Key players in the market

Magna International (Canada), Plastic Omnium (France), Gestamp (Spain), Flex-N-Gate (Germany), Dongfeng Electronic Technology Co., Ltd. (China), Chiyoda Manufacturing (Japan), Giken (Japan), Guardian Industries (US), MRC Manufacturing (US), SANKO GOSEI (US), Hyundai Mobis Co. (South Korea) and Sai Auto Industries (India) are few key players in the software-defined vehicles market globally.

Scope of the Report

|

Report Metrics |

Details |

| Base year of estimation | 2022 |

| Forecast period | 2022-2027 |

| Market Growth and Revenue forecast | USD 21.4 billion in 2022 to USD 30.6 billion by 2027, at a CAGR of 6.9% |

| Top Players | Magna International (Canada), Plastic Omnium (France), Gestamp (Spain), Flex-N-Gate (Germany), Dongfeng Electronic Technology Co., Ltd. (China), Chiyoda Manufacturing (Japan), Giken (Japan), Guardian Industries (US), MRC Manufacturing (US), SANKO GOSEI (US), Hyundai Mobis Co. (South Korea), Sai Auto Industries (India) |

| Fastest growing market | Asia Pacific |

| Largest Market | Asia Pacific |

|

SEGMENTS COVERED | |

| By Position | Front Fascia, Rear Fascia |

| By Vehicle Type | Passenger Vehicles, Commercial Vehicles |

| By Material | Metals, Polypropylene, ABS, Rubber, Polycarbonate, and Others |

| By Sales Channel | OEM and Aftermarket |

| By Region | Asia Pacific (China, Japan, India, South Korea), Europe (Germany, France, Italy, Spain, UK), North America (US, Canada), ROW (Brazil, South Africa and Others) |

Along with the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs.

Recent Developments

- In December 2021, one of the seven supermajor France-based companies of oil & gas 'Total Energies', signed a strategic partnership with Plastic Omnium to design and develop new plastic materials made from recycled polypropylene, which would minimize waste as well as enhance performance.

- In July 2021, Revere Plastics Systems announced the acquisition of Ferguson Production Inc., a U.S.-based plastic material manufacturing company. The acquisition has enabled the company to expand its reach to 9 locations in North America.

TABLE OF CONTENTS

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 YEARS CONSIDERED FOR STUDY

1.4 PACKAGE SIZE

1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key secondary sources for Automotive Fascia

2.1.1.2 Key data from other secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Sampling techniques & data collection methods

2.1.3 PRIMARY PARTICIPANTS

2.2 MARKET ESTIMATION METHODOLOGY

2.3 MARKET SIZE ESTIMATION

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

2.5 FACTOR ANALYSIS

2.6 ASSUMPTIONS & ASSOCIATED RISKS

2.7 LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.2 RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.4 CHALLENGES

5.2.5 IMPACT OF MARKET DYNAMICS

5.3 SUPPLY CHAIN ANALYSIS

5.4 PORTER FIVE FORCES ANALYSIS

5.5 TECHNOLOGY ANALYSIS

5.6 ECOSYSTEM ANALYSIS

5.7 TRENDS AND DISRUPTIONS

5.8 PATENT ANALYSIS

5.9 CASE STUDY

5.10 TARIFF AND REGULATORY OVERVIEW (WITH DETAILED LIST OF REGULATORY BODIES)

5.11 KEY CONFERENCES AND EVENTS

5.12 AUTOMOTIVE FASCIA MARKET, SCENARIOS (2022–2027)

5.12.1 MOST LIKELY SCENARIO

5.12.2 OPTIMISTIC SCENARIO

5.12.3 PESSIMISTIC SCENARIO

6 AUTOMOTIVE FASCIA MARKET, BY POSITION

6.1 INTRODUCTION

6.2 OPERATIONAL DATA

6.2.1 ASSUMPTIONS

6.2.2 RESEARCH METHODOLOGY

6.3 FRONT FASCIA

6.4 REAR FASCIA

6.5 KEY INDUSTRY INSIGHTS

(*Note: Market Size would be provided at regional level and in terms of Volume (Units) & Value (USD Million))

7 AUTOMOTIVE FASCIA MARKET, BY VEHICLE TYPE

7.1 INTRODUCTION

7.2 OPERATIONAL DATA

7.2.1 ASSUMPTIONS

7.2.2 RESEARCH METHODOLOGY

7.3 PASSENGER VEHICLES

7.4 COMMERCIAL VEHICLES

7.5 KEY INDUSTRY INSIGHTS

(*Note: Market Size would be provided at regional level and in terms of Volume (Units) & Value (USD Million))

8 AUTOMOTIVE FASCIA MARKET, BY MATERIAL

8.1 INTRODUCTION

8.2 OPERATIONAL DATA

8.2.1 ASSUMPTIONS

8.2.2 RESEARCH METHODOLOGY

8.3 METALS

8.4 POLYPROPYLENE

8.5 ABS

8.6 RUBBER

8.7 POLYCARBONATE

8.8 OTHERS

8.9 KEY INDUSTRY INSIGHTS

(*Note: Market Size would be provided at regional level and in terms of Volume (Units) & Value (USD Million))

9 AUTOMOTIVE FASCIA MARKET, BY SALES CHANNEL

9.1 INTRODUCTION

9.2 OPERATIONAL DATA

9.2.1 ASSUMPTIONS

9.2.2 RESEARCH METHODOLOGY

9.3 OEM

9.4 AFTERMARKET

9.5 KEY INDUSTRY INSIGHTS

(*Note: Market Size would be provided at regional level and in terms of Volume (Units) & Value (USD Million))

10 AUTOMOTIVE FASCIA MARKET, BY REGION

10.1 INTRODUCTION

10.2 ASIA PACIFIC

10.2.1 CHINA

10.2.2 JAPAN

10.2.3 INDIA

10.2.4 SOUTH KOREA

10.3 EUROPE

10.3.1 GERMANY

10.3.2 FRANCE

10.3.3 ITALY

10.3.4 SPAIN

10.3.5 UK

10.4 NORTH AMERICA

10.4.1 US

10.4.2 CANADA

10.5 REST OF THE WORLD (ROW)

10.5.1 BRAZIL

10.5.2 SOUTH AFRICA

10.5.3 OTHERS

(*Note: Market Size would be provided in terms of Volume (Units) & Value (USD Million))

11 COMPETITIVE LANDSCAPE

11.1 OVERVIEW

11.2 MARKET SHARE/RANKING ANALYSIS

11.3 TOP 5 PLAYERS REVENUE ANALYSIS

11.4 COMPETITIVE SCENARIO

11.4.1 NEW PRODUCT LAUNCHES

11.4.2 DEALS

11.4.3 OTHERS

11.5 COMPETITIVE EVALUATION QUADRANT

11.5.1 STARS

11.5.2 EMERGING LEADERS

11.5.3 PERVASISVE

11.5.4 PARTICIPANTS

11.6 SME PLAYERS EVALUATION MATRIX

11.6.1 PROGRESSIVE COMPANIES

11.6.2 RESPONSIVE COMPANIES

11.6.3 DYNAMIC COMPANIES

11.6.4 STARTING BLOCKS

11.7 WINNERS VS. TAIL-ENDERS

12 COMPANY PROFILES

12.1 KEY PLAYERS

12.1.1 MAGNA INTERNATIONAL

12.1.2 PLASTIC OMNIUM

12.1.3 GESTAMP

12.1.4 FLEX-N-GATE

12.1.5 DONGFENG ELECTRONIC TECHNOLOGY CO. LTD.

12.1.6 CHIYODA MANUFACTURING

12.1.7 GIKEN

12.1.8 GUARDIAN INDUSTRIES

12.1.9 MRC MANUFACTURING

12.1.10 SANKO GOSEI

12.1.11 HYUNDAI MOBIS CO.

12.1.12 SAI AUTO INDUSTRIES

(*Company profile would cover Business overview, Products offered, Deals, MNM view) *Details on Business overview, Products offered, Deals, MNM view might not be captured in case of unlisted companies.

12.2

(*Qualitative write up would be provided for other players)

(*Company name may vary according to report progress or upon client request)

13 RECOMMENDATIONS BY MARKETSANDMARKETS

14 APPENDIX

Growth opportunities and latent adjacency in Automotive Fascia Market