Automotive Control Panel Market by Components (Rotary Switch, Roof Control, Roof Light, Touch Pad, Smart Roof and others), Vehicle Type (Passenger Cars, LCV & HCV), and by Region (Asia-Pacific, North America, Europe & Row) - Global Forecast to 2021

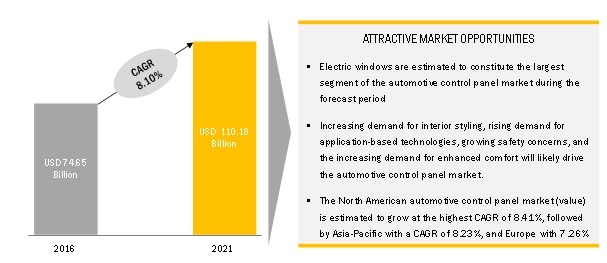

[125 Pages Report] The automotive control panel market is projected to grow from USD 74.65 Billion in 2016 to USD 110.18 Billion by 2021, at a CAGR of 8.10%. Market growth is primarily driven by innovations and technological advancements in the automotive industry. The rising demand for electric vehicles also boosts the demand for automotive electronic components and control panels. The control panel provides easy access to various comfort and convenience features in the vehicle.

The objective of the study is to define and segment the global market for passenger cars, light commercial vehicles (LCVs), and heavy commercial vehicles (HCVs). This report also segments the global market by component into rotary switch, roof control, roof light, touchpad, smart roof, electric window, locking function, side mirror, door panel light, and driver monitoring camera. The electric window segment is estimated to hold the largest market share. The growing inclination of consumers towards enhanced interior styling has boosted the electric window market.

Years considered for the study:

- 2015-base year

- 2016-estimated year

- 2021-projected year

Market Dynamics

Drivers

- Increasing demand for application-based technologies

- Rising demand for cabin comfort & convenience features

- Growing global demand for electric vehicles

Restraints

- Recycling of plastic components used in automotive interiors

Opportunities

- Rising demand for interior styling

- Development of solar sunroofs in cars

- Partnership between major OEMs & domestic players

Challenges

- Providing luxurious interiors at low price

The major objectives of the study are as follows:

- To provide a detailed analysis of various forces acting in the automotive control panel market (drivers, restraints, opportunities, and challenges)

- To analyze the regional markets for growth trends, future prospects, and their contribution to the overall market

- To analyze and forecast (2016 to 2021) the market size, in terms of volume (thousand/million units) and value (USD million/billion), of the global automotive control panel market

- To segment the market and forecast its size, by volume and value, on the basis of regions namely, Asia-Pacific, Europe, North America, and the Rest of the World (RoW)

- To segment the market and forecast the market size, by volume and value, based on vehicle type (passenger cars, light commercial vehicles (LCVs), and heavy commercial vehicles (HCVs))

- To segment the market and forecast its size, in terms of volume and value, on the basis of component (Rotary Switch, Roof Control, Roof Light, Touchpad, Smart Roof, Electric Window, Locking Function, Side Mirror, Door Panel Light, Driver Monitoring Camera)

- To track and analyze competitive developments such as joint ventures, mergers & acquisitions, new product launches, expansions, and other activities carried out by key industry participants

Research Methodology:

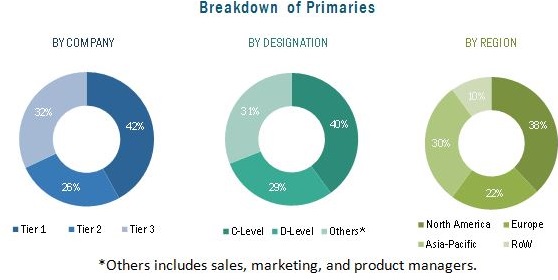

The research methodology used in the report involves primary and secondary sources. Secondary sources include paid databases and directories. In the primary research stage, experts from related industries and suppliers have been interviewed to understand the future trends of the automotive control panel market. The market size, in terms of volume (thousand units) and value (USD million), for various regions and product applications has been derived using forecasting techniques based on automobile demand and production trends. The OEM prices of automotive control panel components have been verified through primary sources. The bottom-up and top-down approaches have been followed to derive the market size, in terms of volume and value.

To know about the assumptions considered for the study, download the pdf brochure

The automotive control panel market ecosystem comprises various control panel component manufacturers such as Continental AG (Germany), Johnson Controls, Inc. (U.S.), Magna International Inc. (Canada), and Faurecia S.A. (France). These manufacturers supply components to numerous vehicle manufacturers, which include BMW AG (Germany), Daimler AG, (Germany), Fiat Chrysler Automobiles (Italy), Ford Motor Company (U.S.), and Toyota (Japan). The ecosystem also includes regional automotive associations such as the International Organization of Motor Vehicle Manufacturers (OICA), Society of Indian Automotive Manufacturers (SIAM), China Association of Automobile Manufacturers (CAAM), Japan Automotive Manufacturers Association (JAMA), and European Automobile Manufacturers Association (ACEA).

Critical Questions which the report answers:

- Which region will lead automotive control panel market in future?

- Which are key market players of market?

- What are the major drivers and opportunities of market?

Target Audience:

- Automotive component manufacturers

- Raw material suppliers

- Automotive manufacturers

- Distributors and suppliers of automotive components/parts

- Industry associations and experts

Scope of the Report:

The scope of the automotive control panel market is as follows:

-

By Vehicle Type

- Passenger Cars

- LCVs

- HCVs

-

By Region

- Asia-Pacific

- North America

- Europe

- Rest of the World

-

By Component

- Rotary Switch

- Roof Control

- Roof Light

- Touchpad

- Smart Roof

- Electric Window

- Locking Function

- Side Mirror

- Door Panel Light

- Driver Monitoring Camera

- The regional segmentation has been considered based on market trends in each of the above-mentioned segments.

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs.

- Profiling of additional market players (Up to 3 players)

- Automotive Control Panel Component Market, By Vehicle Type*

- *Only two vehicle types will be covered under this segment: passenger cars and commercial vehicles.

The automotive control panel market is projected to grow at a CAGR of 8.10%, from USD 74.65 Billion in 2016 to USD 110.18 Billion by 2021. It is driven by the increasing demand for application-based technologies and the growing demand for enhanced interior styling.

Driver monitoring cameras are estimated to dominate the market in terms of growth rate in 2016, followed by touchpads. Increasing vehicle electrification and the rising demand for enhanced cabin comfort and safety are driving the market for automotive control panels. The growing demand for safety features and application-based technologies represents a promising opportunity for automotive control panel manufacturers.

Electric windows are estimated to constitute the largest application market (by value), followed by rotary switches. Electric windows, rotary gear knobs, and various other features are generally found in the premium and luxury car segments. However, the passenger car segment is also expected to have high growth potential. Innovations and technological advancements in regions such as North America and Europe have resulted in the development of advanced technologies, and have consequently been driving the global market.

Other types of control panels considered in the study are roof control, roof light, smart roof, locking function, side mirror, and door light. These control panels represent an attractive market, especially in Asia-Pacific and North America, which are the fastest-growing regional markets for automotive control panels.

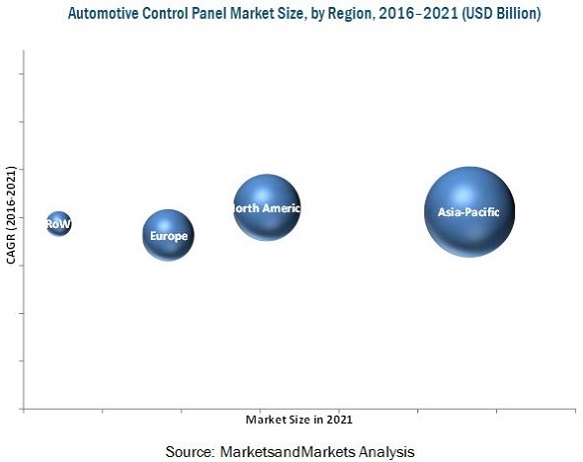

Asia-Pacific is estimated to account for the largest share of the global market. The region comprises emerging economies such as China, Japan, South Korea, and India. China, the largest vehicle producer in the world, is estimated to be one of the largest markets for automotive control panels. The increasing vehicle production, coupled with the growing demand for comfort and convenience, will likely drive the market in Asia-Pacific.

Rising demand for application based technologies, increasing vehicle production, high demand for luxury vehicles, and growing demand for electric vehicles are creating opportunities for the growth of the automotive control panel market

Passenger Cars

A Passenger Car (PC), as defined by the OICA, is a motor vehicle equipped with at least 4 wheels, comprising not more than 8 seats. The PC segment is the largest, by vehicle type, and includes sedans, hatchbacks, station wagons, Sports Utility Vehicles (SUVs), and Multi-Utility Vehicles (MUVs). This vehicle segment is the most promising market for electric vehicles as it is the largest segment in the automotive industry. The PC segment of the electric vehicle market is growing at a significant rate in emerging economies in the Asia Pacific region. The market growth in the region can be attributed to a rise in the GDP and population, improvement in lifestyle, increased purchasing power of consumers, and development of infrastructure.

Light Commercial Vehicles

Vehicles that have authorized mass between 3.5 tons and 7 tons are called light commercial vehicles. LCVs have come a long way from having bare essential features to full-blown utility vehicles that can be used for passengers as well as commercial purposes.

Heavy Commercial Vehicles

The HCV segment comprises trucks/lorries, buses, and coaches. Vehicles that have authorized mass more than 7 tons are called heavy commercial vehicles. HCVs combine 2 categories of vehicles—heavy trucks and buses and coaches. The nature of these vehicles limits their production volume and growth rates as they are used in specific applications such as logistics, construction, and mining industries.

The automotive control panel market is estimated to be dominated by a few globally established suppliers such as Johnson Controls, Inc. (U.S.), Continental AG (Germany), Magna International Inc. (Canada), Faurecia S.A. (France), and Valeo S.A. (France). These companies have adopted strategies such as new product development, expansion, mergers & acquisitions, and joint ventures, to gain traction in the market.

Critical questions the report answers:

- What are the major trends in automotive control panel market?

- Which vehicle type will lead market?

- What will be the impact of increasing demand of electric vehicles on market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.2.2 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Factor Analysis

2.4.1 Introduction

2.4.2 Demand-Side Analysis

2.4.2.1 Impact of Disposable Income on Total Vehicle Sales

2.4.2.2 Infrastructure: Roadways

2.4.3 Supply-Side Analysis

2.4.3.1 Rising Demand for Hybrid & Electric Vehicles

2.5 Market Size Estimation

2.6 Data Triangulation

2.7 Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 30)

4.1 Opportunities in the Automotive Control Panel Market

4.2 Regional Analysis for the Market, 2016 & 2021

4.3 Market, By Component, 2016 & 2021

4.4 Market, By Vehicle Type, 2016 & 2021

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 Automotive Control Panel Market Segmentation

5.2.1 Market

5.2.1.1 Global Market, By Vehicle Type

5.2.1.2 Global Market, By Region

5.2.1.3 Global Market, By Component

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increased Demand for Application-Based Technologies

5.3.1.2 Rising Demand for Cabin Comfort & Convenience Features

5.3.1.3 Growing Global Demand for Electric Vehicles

5.3.2 Restraints

5.3.2.1 Recycling of Plastic Components Used in Automotive Interiors

5.3.3 Opportunities

5.3.3.1 Rising Demand for Interior Styling

5.3.3.2 Development of Solar Sunroofs in Cars

5.3.3.3 Partnerships Between Major Oems & Domestic Players

5.3.4 Challenges

5.3.4.1 Providing Luxurious Interiors at Lower Prices

6 Automotive Control Panel Market, By Component (Page No. - 39)

6.1 Introduction

6.1.1 Rotary Switch

6.1.2 Roof Control

6.1.3 Roof Light

6.1.4 Touch Pad

6.1.5 Smart Roof

6.1.6 Electric Windows

6.1.7 Locking Function

6.1.8 Side Mirror

6.1.9 Door Light

6.1.10 Driver Monitoring Camera

7 Automotive Control Panel Market, By Vehicle Type (Page No. - 52)

7.1 Introduction

7.1.1 Passenger Cars:

7.1.2 LCV

7.1.3 HCV

8 Automotive Control Panel Market, By Region (Page No. - 58)

8.1 Introduction

8.2 Asia-Pacific

8.2.1 China

8.2.2 Japan

8.2.3 South Korea

8.2.4 India

8.3 North America

8.3.1 U.S.

8.3.2 Canada

8.3.3 Mexico

8.4 Europe

8.4.1 Germany

8.4.2 France

8.4.3 U.K.

8.4.4 Italy

8.4.5 Rest of Europe

8.5 Rest of the World

8.5.1 Brazil

8.5.2 Russia

8.5.3 Others

9 Competitive Landscape (Page No. - 88)

9.1 Overview

9.2 Market Ranking Analysis: Automotive Control Panel Market

9.3 Battle for Market Share: Expansion Was the Key Strategy

9.4 Expansion

9.5 Partnerships/Agreements/Joint Ventures/Supply Contracts

9.6 New Product Launch

9.7 Mergers & Acquisitions

10 Company Profiles (Page No. - 93)

10.1 Introduction

(Overview, Financials, Products & Services, Strategy, and Developments)*

10.2 Faurecia S.A.

10.3 Magna International Inc.

10.4 Lear Corporation

10.5 Continental AG

10.6 Johnson Controls, Inc.

10.7 Hyundai Mobis Co., Ltd.

10.8 Toyota Boshoku Corporation

10.9 Calsonic Kansei Corporation

10.10 Delphi Automotive PLC.

10.11 Valeo SA

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 118)

11.1 Insights of Industry Experts

11.2 Discussion Guide

11.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

11.4 Available Customization

11.5 Related Reports

List of Tables (81 Tables)

Table 1 Technological Advancements in Various Control Panel Components Expected to Drive the Automotive Control Panel Market

Table 2 Vehicle Types Considered for the Study

Table 3 Key Regions Considered for the Study

Table 4 Components Considered for the Study

Table 5 Market Size, By Component, 2014–2021 (Million Units)

Table 6 Market Size, By Component, 2014–2021 (USD Million)

Table 7 Rotary Switch: Market Size, By Region, 2014–2021 (Million Units)

Table 8 Rotary Switch: Market Size, By Region, 2014–2021 (USD Million)

Table 9 Roof Control: Market Size, By Region, 2014–2021 (Million Units)

Table 10 Roof Control: Market Size, By Region, 2014–2021 (USD Million)

Table 11 Roof Light: Automotive Control Panel Market Size, By Region, 2014–2021 (Million Units)

Table 12 Roof Light: Market Size, By Region, 2014–2021 (USD Million)

Table 13 Touch Pad: Market Size, By Region, 2014–2021 (Million Units)

Table 14 Touch Pad: Market Size, By Region, 2014–2021 (USD Million)

Table 15 Smart Roof: Market Size, By Region, 2014–2021 (Million Units)

Table 16 Smart Roof: Market Size, By Region, 2014–2021 (USD Million)

Table 17 Electric Windows: Market Size, By Region, 2014–2021 (Million Units)

Table 18 Electric Windows: Market Size, By Region, 2014–2021 (USD Million)

Table 19 Locking Function: Automotive Control Panel Market Size, By Region, 2014–2021 (Million Units)

Table 20 Locking Function: Market Size, By Region, 2014–2021 (USD Million)

Table 21 Side Mirror: Market Size, By Region, 2014–2021 (Million Units)

Table 22 Side Mirror: Market Size, By Region, 2014–2021 (USD Million)

Table 23 Door Light: Market Size, By Region, 2014–2021 (Million Units)

Table 24 Door Light: Market Size, By Region, 2014–2021 (USD Million)

Table 25 Driver Monitoring Camera: Market Size, By Region, 2014–2021 (Million Units)

Table 26 Driver Monitoring Camera: Market Size, By Region, 2014–2021 (USD Million)

Table 27 Automotive Control Panel Market Size, By Vehicle Type, 2014–2021 (Million Units)

Table 28 Market Size, By Vehicle Type, 2014–2021 (USD Million)

Table 29 Passenger Cars: Market Size, By Component, 2014–2021 (Million Units)

Table 30 Passenger Cars: Market Size, By Component, 2014–2021 (USD Million)

Table 31 LCV: nel Market Size, By Component, 2014–2021 (Million Units)

Table 32 LCV: Market Size, By Component, 2014–2021 (USD Million)

Table 33 HCV: Market Size, By Component, 2014–2021 (Million Units)

Table 34 HCV: Market Size, By Component, 2014–2021 (USD Million)

Table 35 Automotive Control Panel Market Size, By Region, 2014–2021 (Million Units)

Table 36 Market Size, By Region, 2014–2021 (USD Million)

Table 37 Asia-Pacific: Market Size, By Component, 2014–2021 (Million Units)

Table 38 Asia-Pacific: Market Size, By Component, 2014–2021 (USD Million)

Table 39 China: Market Size, By Component, 2014–2021 (Million Units)

Table 40 China: Market Size, By Component, 2014–2021 (USD Million)

Table 41 Japan: Market Size, By Component, 2014–2021 (Million Units)

Table 42 Japan: Market Size, By Component, 2014–2021 (USD Million)

Table 43 South Korea: Automotive Control Panel Market Size, By Component, 2014–2021 (Million Units)

Table 44 South Korea: Market Size, By Component, 2014–2021 (USD Million)

Table 45 India: Market Size, By Component, 2014–2021 (Million Units)

Table 46 India: Market Size, By Component, 2014–2021 (USD Million)

Table 47 Rest of Asia-Pacific: Market Size, By Component, 2014–2021 (Million Units)

Table 48 Rest of Asia-Pacific: Market Size, By Component, 2014–2021 (USD Million)

Table 49 North America: Market Size, By Component, 2014–2021 (Million Units)

Table 50 North America: Market Size, By Component, 2014–2021 (USD Million)

Table 51 U.S.: Market Size, By Component, 2014–2021 (Million Units)

Table 52 U.S.: Market Size, By Component, 2014–2021 (USD Million)

Table 53 Canada: Market Size, By Component, 2014–2021 (Million Units)

Table 54 Canada: Market Size, By Component, 2014–2021 (USD Million)

Table 55 Mexico: Market Size, By Vehicle Component, 2014–2021 (Million Units)

Table 56 Mexico: Market Size, By Vehicle Component, 2014–2021 (USD Million)

Table 57 Europe: Market Size, By Component, 2014–2021 (Million Units)

Table 58 Europe: Market Size, By Component, 2014–2021 (USD Million)

Table 59 Germany: Automotive Control Panel Market Size, By Component, 2014–2021 (Million Units)

Table 60 Germany: Market Size, By Component, 2014–2021 (USD Million)

Table 61 France: Market Size, By Component, 2014–2021 (Million Units)

Table 62 France: Market Size, By Component, 2014–2021 (USD Million)

Table 63 U.K.: Market Size, By Component, 2014–2021 (Million Units)

Table 64 U.K.: Market Size, By Component, 2014–2021 (USD Million)

Table 65 Italy: Market Size, By Component, 2014–2021 (Million Units)

Table 66 Italy: Market Size, By Component, 2014–2021 (USD Million)

Table 67 Rest of Europe : Automotive Control Panel Market Size, By Component, 2014–2021 (Million Units)

Table 68 Rest of Europe : Market Size, By Component, 2014–2021 (USD Million)

Table 69 Rest of the World: Market Size, By Component, 2014–2021 (Million Units)

Table 70 Rest of the World: Market Size, By Component, 2014–2021 (USD Million)

Table 71 Brazil: Market Size, By Component, 2014–2021 (Million Units)

Table 72 Brazil: Market Size, By Component, 2014–2021 (USD Million)

Table 73 Russia: Market Size, By Component, 2014–2021 (Million Units)

Table 74 Russia: Market Size, By Component, 2014–2021 (USD Million)

Table 75 Others: Market Size, By Component, 2014–2021 (Thousand Units)

Table 76 Others: Market Size, By Component, 2014–2021 (USD Million)

Table 77 Automotive Control Panel Market Ranking, By Key Players, 2015

Table 78 Expansions, 2013–2015

Table 79 Partnerships/Agreements/Joint Ventures/Supply Contracts, 2011–2014

Table 80 New Product Launches, 2014–2016

Table 81 Mergers & Acquisitions, 2014–2015

List of Figures (39 Figures)

Figure 1 Automotive Control Panel Market Segmentation

Figure 2 Market: Research Design

Figure 3 Research Methodology Model

Figure 4 Breakdown of Primary Interviews: By Companyt YPE, Designation, & Region

Figure 5 Impact of Disposable Income on Vehicle Sales, 2014

Figure 6 Roadways Infrastructure: Road Network (Km), By Country, 2011

Figure 7 Market Size Estimation Methodology: Bottom-Up Approach

Figure 8 Automotive Control Panel Market, By Component, 2016 vs 2021

Figure 9 Passenger Cars to Constitute the Largest Vehicle Segment of the Market in 2016

Figure 10 North American Market Estimated to Grow at the Highest CAGR From 2016 to 2021

Figure 11 Rising Demand for Cabin Comfort to Drive the Market for Automotive Control Panels

Figure 12 Market Size, By Component, 2016 & 2021 (USD Billion)

Figure 13 Rotary Switch Market: Asia-Pacific is Projected to Account for the Largest Market Size in 2021 (USD Billion)

Figure 14 Asia-Pacific is Expected to Dominate the Roof Light Market in 2016

Figure 15 Asia-Pacific is Projected to Grow at the Highest CAGR From 2016 to 2021

Figure 16 Passenger Cars Segment is Expected to Dominated the Market During the Forecast Period

Figure 17 Regional Snapshot of the Automotive Control Panel Market: Market Size By Volume (2016–2021)

Figure 18 China is Estimated to Be the Largest Market for Automotive Control Panel (2016)

Figure 19 U.S. is Estimated to Be the Fastest Growing Market for Automotive Control Panel in North America From 2016 to 2021

Figure 20 In 2016 Germany to Be the Largest Market for Automotive Control Panels in the European Region (USD Billion)

Figure 21 Brazil is Estimated to Be the Largest Market for Automotive Control Panel in the Rest of the World Region By 2021

Figure 22 Companies Adopted Expansion as the Key Growth Strategy From 2011 to 2016

Figure 23 Market Evaluation Framework: Expansions Fuelled Market Growth From 2014 to 2016

Figure 24 Region-Wise Revenue Mix of 5 Major Players

Figure 25 Faurecia S.A.: Company Snapshot

Figure 26 Faurecia S.A.: SWOT Analysis

Figure 27 Magna International Inc.: Company Snapshot

Figure 28 Magna International Inc.: SWOT Analysis

Figure 29 Lear Corporation:C Ompany Snapshot

Figure 30 Lear Corporation: SWOT Analysis

Figure 31 Continental AG: Company Snapshot

Figure 32 Continental AG: SWOT Analysis

Figure 33 Johnson Controls, Inc.: Company Snapshot

Figure 34 Johnson Controls, Inc.: SWOT Analysis

Figure 35 Hyundai Mobis Co., Ltd.: Company Snapshot

Figure 36 Toyota Boshoku Corporation: Company Snapshot

Figure 37 Calsonic Kansei Corporation: Company Snapshot

Figure 38 Delphi Automotive PLC.: Company Snapshot

Figure 39 Valeo SA: Company Snapshot

Growth opportunities and latent adjacency in Automotive Control Panel Market