Automotive Charge Air Cooler Market by Type (Air-cooled, Liquid-cooled), Position(Integrated, Standalone), Design(Tube & Fin, Bar & Plate), Fuel Type(Gasoline, Diesel), Vehicle(PC, LCV, Truck, Bus), Material, Sales Channel & Region-Global Forecast to 2026

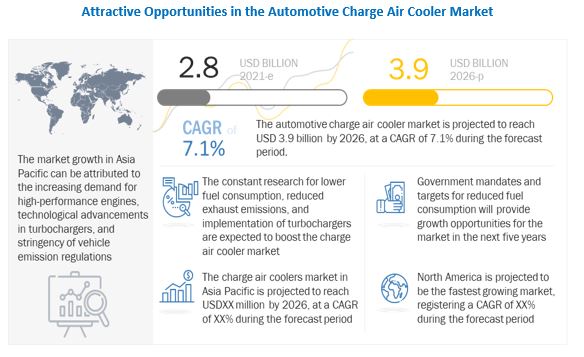

[189 Pages Report] The global automotive charge air cooler market is expected to grow from USD 2.8 billion in 2021 to USD 3.9 billion by 2026, at a compound annual growth rate (CAGR) of 7.1%. MAHLE GmbH (Germany), T. RAD Co. Ltd. (Japan), Dana Incorporated (US), Valeo (France), and Modine Manufacturing Company (US) are the major players dominating the global automotive charge air cooler market. during the forecast period. Today, the automotive industry is taking significant steps toward more stringent emission regulations and fuel consumption, which has resulted in increased demand for components and modules to control the intake air temperature in conventional vehicles. This factor is expected to drive the demand for charge air coolers significantly during the forecast period.

The North American region is estimated to be the fastest-growing market for automotive charge air coolers. The North American automotive charge air cooler market is governed by some of the key players such as Dana Incorporated and Modine Manufacturing Company. The region is dominated by gasoline-fueled premium cars, SUVs, and pickup trucks. These vehicle segments require higher consumption of thermal components to offer effective heat dissipation and engine cooling. As a result, the big players are partnering with thermal component manufacturers to develop enhanced components. For instance, in May 2017, Dana developed a technologically advanced heat exchanger for the induction-air system on FCA’s 2018 Dodge Challenger SRT Demon model. This is the first model of FCA that comes with a factory-fitted refrigerated liquid-to-air charge air cooling system. Such developments and partnerships between OEMs and component providers are expected to drive the sales of charge air coolers in the North American region.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on automotive charge air cooler Market:

The overall automotive industry faced significant production and sales decline of vehicles from 2019 to 2020. With lockdowns being administered by most countries to prevent the spread of the virus, OEMs and other component suppliers across North America, Europe, and Asia Pacific suspended operations at a number of their production locations. This heavily impacted the overall declining performance of automotive.

As per the Economic Times review, vehicle sales in China significantly declined by -9.7%, from 25.7 million units in 2019 to 23.2 million units in 2020. Similarly, in the US and Europe, vehicle sales decline by -17.0% and -12.6% from 2019 to 2020, respectively. The situation of sales in RoW countries was no good either; approximately a decline of -5.3% was noticed from 2019 to 2020.

COVID-19 has resulted in a decline in vehicle production, which is directly proportionate to the decline in the overall automotive charge air cooler market. On the other hand, it is expected that the pandemic effect will help the gasoline segment to grow over diesel as diesel engines are expensive, and implementation of new emission regulations further adds to the cost of diesel engines, especially in light-duty vehicles. In addition to that, the impact of COVID-19 would limit the purchasing power of buyers, which might result in the purchase of gasoline vehicles over diesel vehicles. Therefore, a shift toward gasoline engines or GDI could be observed. This, in turn, will create a better chance for the growth of the automotive charge air cooler market.

The global automotive charge air cooler market has been hard hit by the spread of coronavirus in 2020. Lockdowns imposed in most of the major economies led to a decrease in vehicle production, resulting in reduced sales of charge air coolers significantly. Halt in automotive production, supply chain disruptions, and lowered demand from aftermarket services resulted in a decline in the market till 2020. Considering the ongoing second wave in some of the European and Asia countries coupled with challenges from chip shortage, automotive production may witness a further slowdown in 2021. This may further impact adjacent automotive component markets such as charge air coolers.

Driver: Growing penetration of turbochargers in passenger cars

Turbochargers help in reducing vehicular emissions. Using a turbocharger reduces the displacement volume of the cylinder, which reduces the volume of the fuel required for the same output, and thereby reducing the exhaust emissions of the vehicle. It also increases fuel efficiency. It is because of these reasons the push for the adoption of turbocharger technology has intensified mostly in passenger cars. Passenger cars with conventional fuel include diesel and gasoline engines. Diesel engines have emerged as the dominant fuel type for carmakers, as diesel engines emit low CO2. Although, the diesel proportion of new vehicle registrations has been falling gradually as modern petrol-powered cars are more convenient, popular, and are better at delivering similar benefits. The use of turbochargers for diesel engines was to improve fuel efficiency and engine performance, but the market for diesel turbochargers has been slowly shifting toward petrol superchargers.

As per Valeo’s survey, over 80 million vehicles in Europe are equipped with turbocharged systems and charge air coolers. While the charge air coolers help reduce the fuel consumption while increasing the engine power and efficiency, the turbocharger increases the power and torque and also the compressed air temperature sent to the engine. The charge air cooler’s task is to reduce the temperature of the inlet gas and thus, densify the air required, which optimizes the combustion. Thus, charge air coolers lower the temperature of the inlet gas from 130° C to 60°C and removes the negative effects of the turbo and increases the power by around 20%.

Restraint: Rising demand for electric vehicles

With increasing concerns raised over the environmental impact of conventional vehicles, governments around the world are encouraging the adoption of vehicles using alternative sources of fuel. EVs are zero-emission vehicles and are gaining preference for clean public transport across countries. Several national governments offer financial incentives, such as tax exemptions and rebates, subsidies, reduced parking/toll fees, and free charging, to encourage the adoption of EVs. On the other hand, the decline in sales of diesel vehicles signifies a huge obstacle for the growth of the charge air cooler market. As per the Society of Indian Automobile Manufacturers (SIAM), in 2020, diesel passenger cars formed just 17% of total sales, down by half compared to the same in 2019 (33%). The overall sales share of diesel PCs reduced from 40% in both 2017 and 2018 to 36% in 2019 and 29% in 2020. As per the analysis, this was bound to happen due to the decreasing fuel price gap between diesel and petrol. OEMs in India are pulling out diesel models with the shift to BS6 emission norms from April 2020 onward.

A charge air cooler is not installed in hybrid electric vehicles (HEVs), plug-in hybrid electric vehicles (PHEVs), and battery electric vehicles (BEVs). This is a major hurdle for the global charge air cooler market. EVs have been gaining traction in the automobile industry as these vehicles provide zero emissions and high fuel efficiency. Many OEMs globally are focused on R&D to develop new EV designs.

Opportunity: Implementation of high-performance engines

The constant research for lower fuel consumption and reduced exhaust emissions has constantly resulted in engine development. Particularly, the trend of engine downsizing with high-performance has led to a continuously increasing specific component load. With the substitution of high-volume engines with small, turbocharged engines, the requirement for thermal management has also evolved. Thus, an increasingly important position in the development process of high-performance engines has fueled the demand for charge air coolers as well.

High-performance engine cars are vehicles with great speed and power along with emission standards. In the UK, passenger car buyers prefer downsized petrol engines that emit nearly 100 g/km CO2 as a feasible, efficient alternative to diesel engines. Currently, big players like Ford, Opel, Volkswagen, and Hyundai, offer downsized high-performance engines that allow emitting around 100 g/km of CO2.

Challenge: Condensation within a charge air cooler

Manufacturers of charge air coolers had been facing the challenge of reducing the accumulation of condensed water in intercoolers. This can disrupt the operation of the engine when the water has aspired in large quantities. Today, intercoolers’ efficiency is increasing, and the outlet temperature of the compressed gases is lower, which create a greater danger of reaching dew temperature. To overcome the cost factor and facilitate the manufacturing process, carmakers often choose to use the same intercooler body in different cars. Thus, the appropriate dimensioning of an intercooler for higher displacement engines at high power regimes leads to overcooling of the intercooler in smaller engines. These cases especially occur in situations where the engine operates at low power. Even in the same car model, the intercooler sized for maximum power can cause condensation when the engine runs at low power.

Liquid-cooled automotive charge air cooler segment by type is expected to be the fastest-growing segment during the forecast period

Liquid-cooled charge air coolers are efficient air coolers based on liquid cooling (such as water), which facilitate diesel and gasoline engine manufacturers to meet stringent emissions regulations and improve engine power and fuel efficiency. Similar to air-cooled coolers, liquid-cooled charge air coolers are generally used after the turbocharger. They help in cooling the hot charge air to increase the air density of the manifold intake before it enters the engine. Liquid-cooled charge air coolers are a more efficient alternative to air-cooled charge systems. Liquid-cooled charge air coolers offer higher stability in charged air temperature, which further helps in improving the fuel efficiency in transient driving conditions. In addition, liquid-cooled charge air coolers offer greater flexibility in terms of the position of installation in the vehicle. These coolers can also be installed/integrated into the intake manifold, further improving its efficiency.

Asia Pacific is the largest market for liquid-cooled charge air coolers, followed by Europe. In 2021, the liquid-cooled charge air cooler segment in Asia Pacific stood at 5,256 thousand units and is expected to reach 8,602 by 2026. Over the forecast period, the liquid-cooled segment is expected to register a higher CAGR of 10% due to the growing focus on engine and fuel efficiency. Some of the major concerns of liquid-cooled charge air coolers are higher cost, oil leakage issues, and overall complex assembly and functioning. Nevertheless, liquid-cooled charge air coolers are now increasingly being installed as integrated systems directly into the intake manifold. This significantly simplifies the functioning and reduces issues such as oil leakage. With such developments, the liquid-cooled segment is expected to prosper during the forecast period.

Asia Pacific market is projected to hold the largest share, in terms of volume, by 2026

Asia Pacific is estimated to have the largest market for charge air coolers, backed by strong demand and production of passenger vehicles and emission regulations in various countries. The growth of fuel-efficient vehicles has positively influenced the Asia Pacific automotive charge air cooler market. Also, the region has the presence of leading charge air cooler manufacturers like Hanon Systems, T.RAD Co. Ltd., Marelli, and Denso Corporation, thus creating growth opportunities for the market in the region. These companies have been developing and expanding their business in the region. For instance, in March 2021, Hanon Systems announced that it had begun construction on its fifth plant in Korea. This new plant will be built on a site that offers approximately 33,000 square meters (approximately 335,000 square feet) of land.

Key Market Players

The key players considered in the analysis of the Automotive charge air cooler market are MAHLE GmbH (Germany), T. RAD Co. Ltd. (Japan), Dana Incorporated (US), Valeo (France), and Modine Manufacturing Company (US). These companies offer extensive products for the automotive charge air cooler industry and have strong distribution networks, and they invest heavily in R&D to develop new products.

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2018–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021-2026 |

|

Forecast Market Size |

Value (USD Million) and Volume (‘000 Units) |

|

Segments covered |

Type (air-cooled charge air cooler and liquid-cooled charge air cooler), fuel type (gasoline and diesel), design (fin & tube and bar & plate), vehicle type (passenger cars, light commercial vehicles, trucks, and buses), position (standalone and integrated), material [aluminum, stainless steel, copper, others (plastic, reinforced fiber, etc.), sales channel (OEM and aftermarket) and region |

|

Countries covered |

India, China, Japan, South Korea, Rest of Asia Pacific, France, Germany, Spain, Italy, Rest of Europe, US, Canada, Mexico, Brazil, Russia, South Africa, and Others |

|

Companies Covered |

MAHLE GmbH (Germany), T. RAD Co. Ltd. (Japan), Dana Incorporated (US), Valeo (France), and Modine Manufacturing Company (US). |

This research report categorizes the automotive charge air cooler market based on train type, application, component, cable type, voltage, material type, wire length, end use, and region

By Type

- Air-Cooled Charge Air Cooler

- Liquid-Cooled Charge Air Cooler

By Position

- Standalone

- Integrated

By Design

- Fin & Tube

- Bar & Plate

By Fuel Type

- Gasoline

- Diesel

By Vehicle Type

- Passenger Cars

- LCV

- Trucks

- Buses

By Material

- Aluminum

- Stainless Steel

- Copper

- Others

By Sales Channel

- OEM

- Aftermarket

By Region

-

Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

-

North America

- US

- Canada

- Mexico

-

Europe

- France

- Germany

- Spain

- UK

- Italy

- Rest of Europe

-

RoW

- Brazil

- Russia

- South Africa

- Others

Recent Developments

- In July 2020, MAHLE GmbH completed the acquisition of Behr Hella Service. The acquisition was undertaken to complement the company’s Aftermarket product range. MAHLE is expected to continue managing the thermal management business of Behr Hella Service on its own in the future. As a result, the company is expected to align its Aftermarket business consistently with strong original equipment competencies, particularly in lighting and electronics.

- In November 2020, Dana Incorporated announced that it has entered into a definitive agreement to purchase a division of the thermal management business of Modine Manufacturing Company's automotive segment. The agreed purchase price is USD 1 with the assumption of certain financial liabilities. The transaction is expected to be completed during the first half of 2021 and be consolidated within Dana's Power Technologies segment. The acquisition balances Dana’s current product portfolio by extending its offerings in chillers and water-charged air coolers, adding exhaust-gas recirculation, and expanding its manufacturing process capabilities. This acquisition includes eight major facilities in China, Germany, Hungary, Italy, the Netherlands, and the US.

- In May 2019, Calsonic Kansei, a Japanese company, merged with Marelli. Both companies are striving towards integrated energy management by taking advantage of their power electronics technologies, providing world-leading inverter production and a wide range of technologies and products covering air conditioning, heat exchangers, exhaust, and other heat-related areas.

- In March 2021, Hanon Systems announced that it had begun the construction of its fifth plant in Korea. This new plant is expected to be built on a site that offers an approximately 33,000 square meters (approximately 335,000 square feet) facility.

Frequently Asked Questions (FAQ):

What is the current size of the Asia Pacific automotive charge air cooler market?

The Asia Pacific automotive charge air cooler market is estimated to be USD 1.3 Billion in 2021 and projected to reach USD 1.8 Billion by 2026, at a CAGR of 7.1%

Who are the STARS in the automotive charge air cooler market?

MAHLE GmbH (Germany), T. RAD Co. Ltd. (Japan), Dana Incorporated (US), Valeo (France), and Modine Manufacturing Company (US). are recognized as stars in the charge air cooler market. They have strong portfolios. These companies maintain strong positions in the overall automotive thermal products segment that helps them gain prominence in the charge air cooler market as well. These companies also have been marking their presence in the charge air cooler market by offering vast product portfolios and advanced and innovative solutions. Their robust business strategies have helped these companies achieve constant growth in the market. Companies categorized as stars have a strong presence across the globe.

What is the Covid-19 impact on automotive charge air cooler manufacturers?

The automotive charge air cooler market is facing challenges because of the COVID-19 pandemic. It has resulted in a decline in demand and investments due to the effect on transportation. The automotive charge air cooler market is struggling due to the abrupt halt in production. Suspension of production and focus on the health and safety of employees and workers have disrupted the supply chain of the Automotive charge air cooler market. A sudden impact on the economy, along with the restrictions on the movement of people and goods, has caused a substantial contraction in GDPs and economic output worldwide. Just like most of the companies in the market, Automotive charge air cooler manufacturers suffered from the outbreak as well.

What are the new market trends impacting the growth of the automotive charge air cooler market?

Automotive charge air coolers are used to reduce fuel consumption and CO2 emissions in combination with turbocharging. These components maintain and improve power output and torque in vehicles. As the degree of turbocharging increases, the necessity of cooling the heated air grows. Thus, charge air coolers play a critical role in cooling the engine. With the trend of engine downsizing in the automotive industry, automakers and manufacturers are focused on reducing fuel consumption and increasing efficiency of vehicles.

Which countries are considered in the Asia Pacific region?

The report covers market sizing for countries such as India, China, Japan, South Korea and Rest of Asia Pacific. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 20)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

TABLE 1 INCLUSIONS & EXCLUSIONS FOR AUTOMOTIVE CHARGE AIR COOLER MARKET

1.3 MARKET SCOPE

FIGURE 1 MARKET SEGMENTATION: MARKET

1.3.1 YEARS CONSIDERED FOR THE STUDY

1.4 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 25)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

FIGURE 3 RESEARCH METHODOLOGY MODEL

2.1.1 SECONDARY DATA

2.1.1.1 List of key secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY, DESIGNATION, & REGION

2.1.2.1 List of primary participants

2.2 MARKET ESTIMATION METHODOLOGY

FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 6 MARKET SIZE: BOTTOM-UP APPROACH

FIGURE 7 MARKET SIZE ESTIMATION APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY FOR MARKET: TOP-DOWN APPROACH

FIGURE 9 MARKET: RESEARCH DESIGN & METHODOLOGY

FIGURE 10 MARKET: RESEARCH METHODOLOGY ILLUSTRATION OF MAHLE REVENUE ESTIMATION

2.3.3 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDE

2.4 DATA TRIANGULATION

FIGURE 11 DATA TRIANGULATION

2.5 FACTOR ANALYSIS

2.6 RESEARCH ASSUMPTIONS

2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 38)

FIGURE 12 AUTOMOTIVE CHARGE AIR COOLER MARKET: MARKET DYNAMICS

FIGURE 13 MARKET, BY REGION

FIGURE 14 PASSENGER CARS SEGMENT ESTIMATED TO HOLD LARGEST MARKET SHARE IN 2021

FIGURE 15 AIR-COOLED CHARGE AIR COOLER SEGMENT ESTIMATED TO HOLD LARGER MARKET SHARE THAN LIQUID-COOLED CHARGE AIR COOLER SEGMENT IN 2021

3.1 COVID-19 IMPACT ON MARKET, 2018–2026

4 PREMIUM INSIGHTS (Page No. - 43)

4.1 ATTRACTIVE OPPORTUNITIES IN AUTOMOTIVE CHARGE AIR COOLER MARKET

FIGURE 16 GROWTH OF TURBOCHARGERS AND INCREASING FOCUS ON ENGINE DOWNSIZING TO DRIVE MARKET IN NEXT FIVE YEARS

4.2 ASIA PACIFIC MARKET, BY COUNTRY & VEHICLE TYPE

FIGURE 17 CHINA ESTIMATED TO BE LARGEST MARKET IN ASIA PACIFIC IN 2021

4.3 MARKET, BY VEHICLE TYPE

FIGURE 18 PASSENGER CARS SEGMENT ESTIMATED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2021

4.4 MARKET, BY DESIGN

FIGURE 19 BAR & PLATE SEGMENT PROJECTED TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

4.5 MARKET, BY TYPE

FIGURE 20 AIR-COOLED SEGMENT EXPECTED TO LEAD THE MARKET FROM 2021 TO 2026

4.6 MARKET, BY FUEL TYPE

FIGURE 21 GASOLINE SEGMENT EXPECTED TO LEAD THE MARKET FROM 2021 TO 2026

4.7 MARKET, BY POSITION

FIGURE 22 INTEGRATED SEGMENT PROJECTED TO RECORD HIGHER CAGR DURING FORECAST PERIOD

4.8 MARKET, BY REGION

FIGURE 23 ASIA PACIFIC ESTIMATED TO ACCOUNT FOR LARGEST SHARE OF MARKET IN 2021

5 MARKET OVERVIEW (Page No. - 48)

5.1 INTRODUCTION

TABLE 2 DIFFERENT TYPES OF CHARGE AIR COOLERS IN PASSENGER CARS

5.2 MARKET DYNAMICS

FIGURE 24 AUTOMOTIVE CHARGE AIR COOLER MARKET: MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Stringent emission and fuel consumption regulations

TABLE 3 EMISSION NORMS SPECIFICATIONS IN KEY COUNTRIES FOR PASSENGER CARS

FIGURE 25 GLOBAL FUEL ECONOMY AND CO2 EMISSION DATA (2016–2025)

5.2.1.2 Growing penetration of turbochargers in passenger cars

TABLE 4 POWER OUTPUT OF VARIOUS TURBOCHARGED PETROL MODELS VS NON-TURBOCHARGED VARIANTS

5.2.2 RESTRAINTS

5.2.2.1 Rising demand for electric vehicles

FIGURE 26 GLOBAL EV SALES, 2017-2020

TABLE 5 GOVERNMENT PROGRAMS FOR PROMOTION OF ELECTRIC COMMERCIAL VEHICLE SALES

5.2.2.2 Decrease in vehicle production in last few years

FIGURE 27 GLOBAL PASSENGER CAR PRODUCTION, 2017-2019 (UNITS)

FIGURE 28 GLOBAL LIGHT COMMERCIAL VEHICLE SALES, 2017 – 2020 (UNITS)

5.2.3 OPPORTUNITIES

5.2.3.1 Implementation of high-performance engines

FIGURE 29 EXHAUST GAS TURBOCHARGING—THE BASIS FOR MODERN, HIGH-PERFORMANCE PASSENGER CAR ENGINES

5.2.3.2 Development of new designs for intercoolers

5.2.4 CHALLENGES

5.2.4.1 Condensation within a charge air cooler

5.2.4.2 Upcoming emission norms

FIGURE 30 ON-ROAD LIGHT AND HEAVY-DUTY VEHICLE EMISSION REGULATION OUTLOOK

5.2.5 IMPACT OF MARKET DYNAMICS

TABLE 6 MARKET: IMPACT OF MARKET DYNAMICS

5.3 MARKET, MARKET SCENARIOS (2018–2026)

FIGURE 31 MARKET: FUTURE TRENDS & SCENARIOS, 2018–2026

5.3.1 MOST LIKELY SCENARIO

TABLE 7 MARKET: MOST LIKELY SCENARIO, BY REGION, 2018–2026 (USD MILLION)

5.3.2 OPTIMISTIC SCENARIO

TABLE 8 MARKET: OPTIMISTIC SCENARIO, BY REGION, 2020–2026 (USD MILLION)

5.3.3 PESSIMISTIC SCENARIO

TABLE 9 MARKET: PESSIMISTIC SCENARIO, BY REGION, 2020–2026 (USD MILLION)

5.4 PORTER’S FIVE FORCES

FIGURE 32 PORTER’S FIVE FORCES: MARKET

TABLE 10 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.4.1 THREAT OF NEW ENTRANTS

5.4.1.1 Entry of new market players

5.4.2 THREAT OF SUBSTITUTES

5.4.2.1 No alternatives for charge air coolers/intercoolers

5.4.3 BARGAINING POWER OF BUYERS

5.4.3.1 Emission norms and turbochargers

5.4.3.2 Increasing phase of EV adoptions

5.4.4 BARGAINING POWER OF SUPPLIERS

5.4.4.1 Low cost and availability of charge air cooler providers

5.4.5 INTENSITY OF COMPETITIVE RIVALRY

5.4.5.1 Pre-established market players

5.5 PRICING ANALYSIS

FIGURE 33 AUTOMOTIVE CHARGE AIR COOLER MARKET: APPROXIMATE PRICE BY YEAR

5.6 SUPPLY CHAIN ANALYSIS

FIGURE 34 MARKET: SUPPLY CHAIN ANALYSIS

5.7 ECOSYSTEM

FIGURE 35 ECOSYSTEM OF MARKET

TABLE 11 CHARGE AIR COOLER MARKET: ECOSYSTEM

5.8 TECHNOLOGY ANALYSIS

5.8.1 INDIRECT CHARGE AIR COOLING

5.8.2 LIQUID-COOLED CHARGE AIR COOLERS

5.9 PATENT ANALYSIS

TABLE 12 IMPORTANT PATENT REGISTRATIONS RELATED TO CHARGE AIR COOLER MARKET

5.10 CASE STUDY

5.10.1 HIETA TECHNOLOGIES LTD: WATER CHARGE AIR COOLER

5.11 TRADE/SALES DATA

5.11.1 INDIA

TABLE 13 INDIA AUTOMOTIVE CHARGE AIR COOLERS EXPORT/IMPORT

5.11.2 US

TABLE 14 US AUTOMOTIVE CHARGE AIR COOLERS EXPORT/IMPORT

5.11.3 KOREA

TABLE 15 KOREA AUTOMOTIVE CHARGE AIR COOLERS EXPORT/IMPORT

5.12 REGULATORY OVERVIEW

TABLE 16 REGULATIONS FOR AUTOMOTIVE CHARGE AIR COOLERS

5.13 MARKET: COVID-19 IMPACT

5.13.1 IMPACT ON CHARGE AIR COOLER SALES

5.13.2 IMPACT ON VEHICLE SALES

5.14 MARKET: REVENUE SHIFT DRIVING MARKET GROWTH

FIGURE 36 TURBOCHARGED GASOLINE CARS AND INNOVATIVE INTERCOOLER DESIGNS TO DRIVE THE REVENUE SHIFT

6 AUTOMOTIVE CHARGE AIR COOLER MARKET, BY TYPE (Page No. - 71)

6.1 INTRODUCTION

FIGURE 37 AIR-COOLED SEGMENT TO DOMINATE DURING THE FORECAST PERIOD

TABLE 17 MARKET, BY TYPE, 2018–2026 (‘000 UNITS)

TABLE 18 MARKET, BY TYPE, 2018–2026 (USD MILLION)

6.2 OPERATIONAL DATA

TABLE 19 AUTOMOTIVE CHARGE AIR COOLER, PRODUCT OFFERINGS BY MAJOR PLAYERS

6.2.1 ASSUMPTIONS

6.2.2 RESEARCH METHODOLOGY

6.2.3 KEY PRIMARY INSIGHTS

6.3 AIR-COOLED CHARGE AIR COOLER

6.3.1 ADVANTAGES OVER LIQUID-COOLED CHARGE AIR COOLERS TO DRIVE THE SEGMENT

TABLE 20 AIR-COOLED CHARGE AIR COOLER: MARKET, BY REGION, 2018–2026 (‘000 UNITS)

TABLE 21 AIR-COOLED CHARGE AIR COOLER: MARKET, BY REGION, 2018–2026 (USD MILLION)

6.4 LIQUID-COOLED CHARGE AIR COOLER

6.4.1 FLEXIBILITY IN TERMS OF POSITION OF INSTALLATION TO DRIVE THE SEGMENT

TABLE 22 LIQUID-COOLED CHARGE AIR COOLER: MARKET, BY REGION, 2018–2026 (‘000 UNITS)

TABLE 23 LIQUID-COOLED CHARGE AIR COOLER: MARKET, BY REGION, 2018–2026 (USD MILLION)

7 AUTOMOTIVE CHARGE AIR COOLER MARKET, BY POSITION (Page No. - 77)

7.1 INTRODUCTION

FIGURE 38 CHARGE AIR COOLER MARKET, BY POSITION, 2021 VS. 2026

TABLE 24 CHARGE AIR COOLER MARKET, BY POSITION, 2018–2026 (‘000 UNITS)

TABLE 25 CHARGE AIR COOLER MARKET, BY POSITION, 2018–2026 (USD MILLION)

7.2 OPERATIONAL DATA

TABLE 26 GLOBAL PASSENGER CARS AND COMMERCIAL VEHICLES PRODUCTION DATA, 2020 (UNITS)

7.2.1 ASSUMPTIONS

7.2.2 RESEARCH METHODOLOGY

7.2.3 KEY PRIMARY INSIGHTS

7.3 STANDALONE

7.3.1 LARGER SHARE OF AIR-COOLED CHARGE AIR COOLERS IN AUTOMOTIVE TO DRIVE THE SEGMENT

TABLE 27 STANDALONE: AUTOMOTIVE CHARGE AIR COOLER MARKET, BY REGION, 2018–2026 (‘000 UNITS)

TABLE 28 STANDALONE: MARKET, BY REGION, 2018–2026 (USD MILLION)

7.4 INTEGRATED

7.4.1 GROWING USAGE OF LIQUID-COOLED CHARGE AIR COOLER TO DRIVE THE SEGMENT

TABLE 29 INTEGRATED: MARKET, BY REGION, 2018–2026 (‘000 UNITS)

TABLE 30 INTEGRATED: MARKET, BY REGION, 2018–2026 (USD MILLION)

8 AUTOMOTIVE CHARGE AIR COOLER MARKET, BY DESIGN (Page No. - 84)

8.1 INTRODUCTION

FIGURE 39 MARKET, BY DESIGN, 2021 VS. 2026

TABLE 31 MARKET, BY DESIGN, 2018–2026 (‘000 UNITS)

TABLE 32 MARKET, BY DESIGN, 2018–2026 (USD MILLION)

8.1.1 ASSUMPTIONS

8.1.2 RESEARCH METHODOLOGY

8.1.3 KEY PRIMARY INSIGHTS

8.2 FIN & TUBE

8.2.1 INCREASING ADOPTION OF HVAC SYSTEMS TO DRIVE THE SEGMENT

TABLE 33 FIN & TUBE: MARKET, BY REGION, 2018–2026 (‘000 UNITS)

TABLE 34 FIN & TUBE: MARKET, BY REGION, 2018–2026 (USD MILLION)

8.3 BAR & PLATE

8.3.1 MORE EFFICIENT HEAT TRANSFER FOR HEAVY VEHICLES TO DRIVE THE SEGMENT

TABLE 35 BAR & PLATE: MARKET, BY REGION, 2018–2026 (‘000 UNITS)

TABLE 36 BAR & PLATE: MARKET, BY REGION, 2018–2026 (USD MILLION)

9 AUTOMOTIVE CHARGE AIR COOLER MARKET, BY FUEL TYPE (Page No. - 90)

9.1 INTRODUCTION

FIGURE 40 MARKET, BY FUEL TYPE, 2021 VS. 2026

TABLE 37 MARKET, BY FUEL TYPE, 2018–2026 (‘000 UNITS)

TABLE 38 MARKET, BY FUEL TYPE, 2018–2026 (USD MILLION)

9.2 OPERATIONAL DATA

TABLE 39 GLOBAL GASOLINE VEHICLE PENETRATION, BY VEHICLE TYPE (%)

TABLE 40 GLOBAL DIESEL VEHICLE PENETRATION, BY VEHICLE TYPE (%)

9.2.1 ASSUMPTIONS

9.2.2 RESEARCH METHODOLOGY

9.2.3 KEY PRIMARY INSIGHTS

9.3 GASOLINE

9.3.1 GOVERNMENT ENCOURAGEMENT TO REDUCE EMISSIONS TO DRIVE THE SEGMENT

TABLE 41 GASOLINE: AUTOMOTIVE CHARGE AIR COOLER MARKET, BY REGION, 2018–2026 (‘000 UNITS)

TABLE 42 GASOLINE: MARKET, BY REGION, 2018–2026 (USD MILLION)

9.4 DIESEL

9.4.1 DECLINING DIESEL VEHICLE PRODUCTION & SALES TO LIMIT SEGMENT GROWTH

TABLE 43 DIESEL: MARKET, BY REGION, 2018–2026 (‘000 UNITS)

TABLE 44 DIESEL: MARKET, BY REGION, 2018–2026 (USD MILLION)

10 AUTOMOTIVE CHARGE AIR COOLER MARKET, BY VEHICLE TYPE (Page No. - 96)

10.1 INTRODUCTION

FIGURE 41 MARKET, BY VEHICLE TYPE, 2021 VS. 2026

TABLE 45 MARKET, BY VEHICLE TYPE, 2018–2026 (‘000 UNITS)

TABLE 46 MARKET, BY VEHICLE TYPE, 2018–2026 (USD MILLION)

10.2 OPERATIONAL DATA

TABLE 47 GLOBAL PASSENGER CARS AND COMMERCIAL VEHICLES PRODUCTION DATA, 2021 (‘000 UNITS)

10.2.1 ASSUMPTIONS

10.2.2 RESEARCH METHODOLOGY

10.2.3 KEY PRIMARY INSIGHTS

10.3 PASSENGER CARS

10.3.1 GROWING PENETRATION OF TURBOCHARGERS IN GASOLINE CARS TO DRIVE THE SEGMENT

TABLE 48 PASSENGER CARS: AUTOMOTIVE CHARGE AIR COOLER MARKET, BY REGION, 2018–2026 (‘000 UNITS)

TABLE 49 PASSENGER CARS: MARKET, BY REGION, 2018–2026 (USD MILLION)

10.4 LCV

10.4.1 HUGE LCV PRODUCTION IN ASIA PACIFIC TO DRIVE THE SEGMENT

TABLE 50 LCV: MARKET, BY REGION, 2018–2026 (‘000 UNITS)

TABLE 51 LCV: MARKET, BY REGION, 2018–2026 (USD MILLION)

10.5 TRUCKS

10.5.1 STRONG ROAD TRANSPORTATION SECTOR ACROSS THE GLOBE TO DRIVE THE SEGMENT

TABLE 52 TRUCKS: MARKET, BY REGION, 2018–2026 (‘000 UNITS)

TABLE 53 TRUCKS: MARKET, BY REGION, 2018–2026 (USD MILLION)

10.6 BUSES

10.6.1 ADOPTION OF ELECTRIC BUSES TO HAMPER THE DEMAND FOR AUTOMOTIVE AIR COOLERS

TABLE 54 BUSES: MARKET, BY REGION, 2018–2026 (‘000 UNITS)

TABLE 55 BUSES: MARKET, BY REGION, 2018–2026 (USD MILLION)

11 AUTOMOTIVE CHARGE AIR COOLER MARKET, BY MATERIAL (Page No. - 105)

11.1 INTRODUCTION

11.2 ALUMINUM

11.3 STAINLESS STEEL

11.4 COPPER

11.5 OTHER

12 AUTOMOTIVE CHARGE AIR COOLER MARKET, BY SALES CHANNEL (Page No. - 107)

12.1 INTRODUCTION

12.1.1 ASSUMPTIONS

12.2 OEM

12.3 AFTERMARKET

13 AUTOMOTIVE CHARGE AIR COOLER MARKET, BY REGION (Page No. - 109)

13.1 INTRODUCTION

FIGURE 42 MARKET, BY REGION, 2021 VS. 2026

TABLE 56 MARKET, BY REGION, 2018–2026 (‘000 UNITS)

TABLE 57 MARKET, BY REGION, 2018–2026 (USD MILLION)

13.2 ASIA PACIFIC

FIGURE 43 ASIA PACIFIC: CHARGE AIR COOLING SYSTEM MARKET SNAPSHOT

TABLE 58 ASIA PACIFIC: CHARGE AIR COOLING SYSTEM MARKET, BY COUNTRY, 2018–2026 (‘000 UNIT)

TABLE 59 ASIA PACIFIC: CHARGE AIR COOLING SYSTEM MARKET, BY COUNTRY, 2018–2026 (USD MILLION)

13.2.1 CHINA

13.2.1.1 Emission norms and popularity of TGDI to drive the market

TABLE 60 CHINA: CHARGE AIR COOLING SYSTEM MARKET, BY VEHICLE TYPE, 2018–2026 (‘000 UNITS)

TABLE 61 CHINA: CHARGE AIR COOLING SYSTEM MARKET, BY VEHICLE TYPE, 2018–2026 (USD MILLION)

13.2.2 INDIA

13.2.2.1 Increase in turbocharged gasoline vehicles to drive the market

TABLE 62 INDIA: AIR TO AIR CHARGE COOLER MARKET, BY VEHICLE TYPE, 2018–2026 (‘000 UNITS)

TABLE 63 INDIA: AIR TO AIR CHARGE COOLER MARKET, BY VEHICLE TYPE, 2018–2026 (USD MILLION)

13.2.3 JAPAN

13.2.3.1 Emission norms for vehicles to drive the market

TABLE 64 JAPAN: WATER CHARGE AIR COOLER MARKET, BY VEHICLE TYPE, 2018–2026 (‘000 UNITS)

TABLE 65 JAPAN: WATER CHARGE AIR COOLER MARKET, BY VEHICLE TYPE, 2018–2026 (USD MILLION)

13.2.4 SOUTH KOREA

13.2.4.1 Presence of OEMs producing diesel/petrol vehicles to drive the market

TABLE 66 SOUTH KOREA: TURBOCHARGER AIR COOLER MARKET, BY VEHICLE TYPE, 2018–2026 (‘000 UNITS)

TABLE 67 SOUTH KOREA: TURBOCHARGER AIR COOLER MARKET, BY VEHICLE TYPE, 2016–2026 (USD MILLION)

13.2.5 REST OF ASIA PACIFIC

TABLE 68 REST OF ASIA PACIFIC: CHARGE AIR INTERCOOLERMARKET, BY VEHICLE TYPE, 2018–2026 (‘000 UNITS)

TABLE 69 REST OF ASIA PACIFIC: CHARGE AIR INTERCOOLER MARKET, BY VEHICLE TYPE, 2018–2026 (USD MILLION)

13.3 EUROPE

TABLE 70 EUROPE: CO2 EMISSIONS BY VEHICLE MANUFACTURER

FIGURE 44 EUROPE: CHARGE AIR COOLER SNAPSHOT

TABLE 71 EUROPE: CHARGE AIR COOLER TUBEMARKET, BY COUNTRY, 2018–2026 (‘000 UNIT)

TABLE 72 EUROPE: CHARGE AIR COOLER TUBE MARKET, BY COUNTRY, 2018–2026 (USD MILLION)

13.3.1 GERMANY

13.3.1.1 Emission norms and shift toward gasoline vehicles to drive the market

TABLE 73 GERMANY: DIESEL CHARGE AIR COOLER MARKET, BY VEHICLE TYPE, 2018–2026 (‘000 UNITS)

TABLE 74 GERMANY: DIESEL CHARGE AIR COOLER MARKET, BY VEHICLE TYPE, 2018–2026 (USD MILLION)

13.3.2 FRANCE

13.3.2.1 Production of passenger cars and LCVs to drive the market

TABLE 75 FRANCE: TRUCK CHARGE AIR COOLER MARKET, BY VEHICLE TYPE, 2018–2026 (‘000 UNITS)

TABLE 76 FRANCE: TRUCK CHARGE AIR COOLER MARKET, BY VEHICLE TYPE, 2018–2026 (USD MILLION)

13.3.3 UK

13.3.3.1 Lenient gasoline emission norms to drive the market

TABLE 77 UK: INTERCOOLER MARKET, BY VEHICLE TYPE, 2018–2026 (‘000 UNITS)

TABLE 78 UK: INTERCOOLER, BY VEHICLE TYPE, 2018–2026 (USD MILLION)

13.3.4 SPAIN

13.3.4.1 Demand for passenger vehicles to drive the market

TABLE 79 SPAIN: AUTOMOTIVE CHARGE AIR COOLER MARKET, BY VEHICLE TYPE, 2018–2026 (‘000 UNITS)

TABLE 80 SPAIN: MARKET, BY VEHICLE TYPE, 2018–2026 (USD MILLION)

13.3.5 ITALY

13.3.5.1 Government subsidies on fuel-efficient cars to drive the market

TABLE 81 ITALY: MARKET, BY VEHICLE TYPE, 2018–2026 (‘000 UNITS)

TABLE 82 ITALY: MARKET, BY VEHICLE TYPE, 2018–2026 (USD MILLION)

13.3.6 REST OF EUROPE

TABLE 83 REST OF EUROPE: MARKET, BY VEHICLE TYPE, 2018–2026 (‘000 UNITS)

TABLE 84 REST OF EUROPE: MARKET, BY VEHICLE TYPE, 2018–2026 (USD MILLION)

13.4 NORTH AMERICA

TABLE 85 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2026 (‘000 UNIT)

TABLE 86 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2026 (USD MILLION)

13.4.1 US

13.4.1.1 Emission norms and gasoline demand to drive the market

TABLE 87 US: MARKET, BY VEHICLE TYPE, 2018–2026 (‘000 UNITS)

TABLE 88 US: MARKET, BY VEHICLE TYPE, 2018–2026 (USD MILLION)

13.4.2 CANADA

13.4.2.1 Emission regulations to drive the market

TABLE 89 CANADA: MARKET, BY VEHICLE TYPE, 2018–2026 (‘000 UNITS)

TABLE 90 CANADA: MARKET, BY VEHICLE TYPE, 2018–2026 (USD MILLION)

13.4.3 MEXICO

13.4.3.1 Stringent emission norms to drive the market

TABLE 91 MEXICO: MARKET, BY VEHICLE TYPE, 2018–2026 (‘000 UNITS)

TABLE 92 MEXICO: MARKET, BY VEHICLE TYPE, 2018–2026 (USD MILLION)

13.5 REST OF THE WORLD (ROW)

TABLE 93 ROW: MARKET, BY COUNTRY, 2018–2026 (‘000 UNIT)

TABLE 94 ROW: MARKET, BY COUNTRY, 2018–2026 (USD MILLION)

13.5.1 BRAZIL

13.5.1.1 Presence of major automotive companies to drive the market

TABLE 95 BRAZIL: MARKET, BY VEHICLE TYPE, 2018–2026 (‘000 UNITS)

TABLE 96 BRAZIL: MARKET, BY VEHICLE TYPE, 2018–2026 (USD MILLION)

13.5.2 RUSSIA

13.5.2.1 Dominance of diesel and petrol vehicles to drive the market

TABLE 97 RUSSIA: MARKET, BY VEHICLE TYPE, 2018–2026 (‘000 UNITS)

TABLE 98 RUSSIA: MARKET, BY VEHICLE TYPE, 2018–2026 (USD MILLION)

13.5.3 SOUTH AFRICA

13.5.3.1 Presence of key OEMs to drive the market

TABLE 99 SOUTH AFRICA: MARKET, BY VEHICLE TYPE, 2018–2026 (‘000 UNITS)

TABLE 100 SOUTH AFRICA: MARKET, BY VEHICLE TYPE, 2018–2026 (USD MILLION)

13.5.4 OTHERS

TABLE 101 OTHERS: MARKET, BY VEHICLE TYPE, 2018–2026 (‘000 UNITS)

TABLE 102 OTHERS: MARKET, BY VEHICLE TYPE, 2018–2026 (USD MILLION)

14 COMPETITIVE LANDSCAPE (Page No. - 138)

14.1 OVERVIEW

14.2 MARKET EVALUATION FRAMEWORK

FIGURE 45 KEY DEVELOPMENTS BY LEADING PLAYERS IN CHARGE AIR COOLER MARKET

14.3 REVENUE ANALYSIS OF TOP FIVE PLAYERS

FIGURE 46 TOP PUBLIC/LISTED PLAYERS HAVE DOMINATED THE CHARGE AIR COOLER MARKET DURING THE LAST THREE YEARS

14.4 MARKET SHARE ANALYSIS

FIGURE 47 MARKET SHARE ANALYSIS, 2020

TABLE 103 CHARGE AIR COOLER MARKET: DEGREE OF COMPETITION

14.5 COMPETITIVE SCENARIO

14.5.1 CHARGE AIR COOLER MARKET: PRODUCT LAUNCHES

14.5.2 CHARGE AIR COOLER MARKET: DEALS, 2018–2020

TABLE 104 CHARGE AIR COOLER MARKET: DEALS, 2018–2020

14.5.3 CHARGE AIR COOLER MARKET: OTHERS, 2018–2020

TABLE 105 CHARGE AIR COOLER MARKET: OTHERS, 2018–2020

14.6 COMPETITIVE LEADERSHIP MAPPING FOR THE CHARGE AIR COOLER MARKET

14.6.1 STARS

14.6.2 EMERGING LEADERS

14.6.3 PERVASIVE

14.6.4 PARTICIPANT

FIGURE 48 CHARGE AIR COOLER MARKET: COMPETITIVE LEADERSHIP MAPPING, 2020

14.7 COMPANY EVALUATION QUADRANT - PRODUCT FOOTPRINT

TABLE 106 COMPANY PRODUCT FOOTPRINT

TABLE 107 COMPANY INDUSTRY FOOTPRINT

TABLE 108 COMPANY APPLICATION FOOTPRINT

TABLE 109 COMPANY REGIONAL FOOTPRINT

14.8 START-UP/SME EVALUATION MATRIX, 2020

FIGURE 49 CHARGE AIR COOLER MARKET: SME MATRIX, 2020

14.9 WINNERS VS. TAIL-ENDERS

TABLE 110 WINNERS VS. TAIL-ENDERS

15 COMPANY PROFILES (Page No. - 150)

(Business overview, Products offered, Recent developments & MnM View)*

15.1 KEY PLAYERS

15.1.1 MAHLE GMBH

FIGURE 50 DUAL STRATEGY FOLLOWED BY MAHLE GMBH

TABLE 111 MAHLE GMBH: BUSINESS OVERVIEW

FIGURE 51 MAHLE GMBH: COMPANY SNAPSHOT

TABLE 112 MAHLE GMBH: PRODUCTS OFFERED

TABLE 113 MAHLE GMBH: DEALS

15.1.2 T. RAD CO. LTD.

FIGURE 52 T. RAD CO. LTD.: SALES BY PRODUCT TYPE

TABLE 114 T. RAD CO. LTD.: BUSINESS OVERVIEW

FIGURE 53 T. RAD CO. LTD.: COMPANY SNAPSHOT

TABLE 115 T. RAD CO. LTD.: PRODUCTS OFFERED

TABLE 116 T. RAD CO. LTD.: DEALS

15.1.3 MODINE MANUFACTURING COMPANY

FIGURE 54 MODINE PROVIDES THERMAL MANAGEMENT SOLUTIONS FOCUSING ON INDUSTRIAL MARKETS WITH STRONG MACRO TRENDS

TABLE 117 MODINE MANUFACTURING COMPANY: BUSINESS OVERVIEW

FIGURE 55 MODINE MANUFACTURING COMPANY: COMPANY SNAPSHOT

TABLE 118 MODINE MANUFACTURING COMPANY: PRODUCTS OFFERED

TABLE 119 MODINE MANUFACTURING COMPANY: DEALS

TABLE 120 MODINE MANUFACTURING COMPANY: OTHERS

15.1.4 DANA INCORPORATED

TABLE 121 DANA INCORPORATED: BUSINESS OVERVIEW

FIGURE 56 DANA INCORPORATED: COMPANY SNAPSHOT

TABLE 122 DANA INCORPORATED: PRODUCTS OFFERED

TABLE 123 DANA INCORPORATED: DEALS

15.1.5 VALEO

TABLE 124 APPLICATIONS OF VALEO INTERCOOLERS

TABLE 125 VALEO: BUSINESS OVERVIEW

FIGURE 57 VALEO: COMPANY SNAPSHOT

TABLE 126 VALEO: PRODUCTS OFFERED

15.1.6 MARELLI

TABLE 127 MARELLI: BUSINESS OVERVIEW

TABLE 128 MARELLI: PRODUCTS OFFERED

TABLE 129 MARELLI: DEALS

15.1.7 DENSO CORPORATION

TABLE 130 DENSO CORPORATION: BUSINESS OVERVIEW

FIGURE 58 DENSO CORPORATION: COMPANY SNAPSHOT

TABLE 131 DENSO CORPORATION: PRODUCTS OFFERED

15.1.8 HANON SYSTEMS

TABLE 132 HANON SYSTEMS: BUSINESS OVERVIEW

FIGURE 59 HANON SYSTEMS: COMPANY SNAPSHOT

TABLE 133 HANON SYSTEMS: PRODUCTS OFFERED

TABLE 134 HANON SYSTEMS: OTHERS

TABLE 135 HANON SYSTEMS: DEALS

15.1.9 VESTAS AIRCOIL

TABLE 136 VESTAS AIRCOIL: BUSINESS OVERVIEW

TABLE 137 VESTAS AIRCOIL: PRODUCTS OFFERED

15.1.10 DELPHI TECHNOLOGIES AFTERMARKET

TABLE 138 DELPHI TECHNOLOGIES AFTERMARKET: BUSINESS OVERVIEW

TABLE 139 DELPHI TECHNOLOGIES AFTERMARKET: PRODUCTS OFFERED

TABLE 140 DELPHI TECHNOLOGIES AFTERMARKET: DEALS

*Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

15.2 OTHER KEY PLAYERS

15.2.1 SANDEN HOLDINGS CORPORATION

TABLE 141 SANDEN HOLDINGS CORPORATION: BUSINESS OVERVIEW

15.2.2 AKG GROUP

TABLE 142 AKG GROUP: BUSINESS OVERVIEW

15.2.3 BOYD CORPORATION

TABLE 143 BOYD CORPORATION: BUSINESS OVERVIEW

15.2.4 MISHIMOTO

TABLE 144 MISHIMOTO: BUSINESS OVERVIEW

15.2.5 BANCO PRODUCTS (INDIA) LTD.

TABLE 145 BANCO PRODUCTS (INDIA) LTD.: BUSINESS OVERVIEW

15.2.6 STERLING THERMAL TECHNOLOGY

TABLE 146 STERLING THERMAL TECHNOLOGY: BUSINESS OVERVIEW

15.2.7 COOPER STANDARD

TABLE 147 COOPER STANDARD: BUSINESS OVERVIEW

15.2.8 C, G, & J INC

TABLE 148 C, G, & J INC: BUSINESS OVERVIEW

15.2.9 AMI EXCHANGERS LTD.

TABLE 149 AMI EXCHANGERS LTD.: BUSINESS OVERVIEW

15.2.10 APPLIED COOLING TECHNOLOGY LLC

TABLE 150 APPLIED COOLING TECHNOLOGY LLC: BUSINESS OVERVIEW

15.2.11 EJ BOWMAN

TABLE 151 EJ BOWMAN: BUSINESS OVERVIEW

15.2.12 KELVION HOLDING GMBH

TABLE 152 KELVION HOLDING GMBH: BUSINESS OVERVIEW

16 RECOMMENDATIONS BY MARKETSANDMARKETS (Page No. - 181)

16.1 INCREASING ELECTRIC VEHICLE SALES TO HAMPER MARKET GROWTH; GASOLINE CARS TO EMERGE AS THE MOST PROMISING SEGMENT

16.2 ASIA PACIFIC WILL BE DRIVING THE CHARGE AIR COOLER MARKET

16.3 CONCLUSION

17 APPENDIX (Page No. - 183)

17.1 KEY INSIGHTS OF INDUSTRY EXPERTS

17.2 DISCUSSION GUIDE

17.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

17.4 AVAILABLE CUSTOMIZATIONS

17.5 RELATED REPORTS

17.6 AUTHOR DETAILS

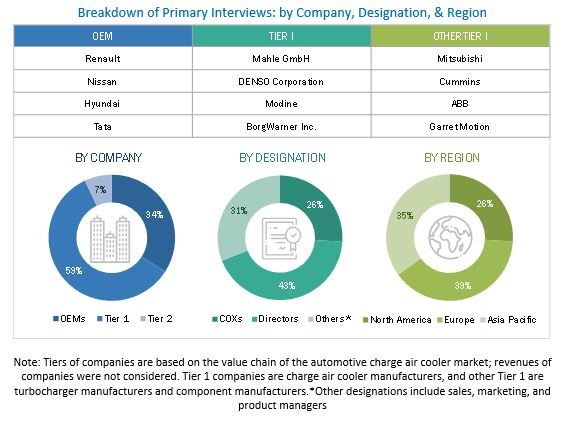

The study involved four major activities in estimating the current size of the automotive charge air cooler market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as company annual reports/presentations, press releases, industry association publications [for example, publications of automotive charge air cooler OEMs, State & National Regulatory Authorities, Testing Companies, Government & Research Organizations, country-level associations and trade organizations, and Traders & Distributors of Electric Vehicles, charge air cooler manufacturers magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, government organizations websites, and technical articles have been used to identify and collect information useful for an extensive commercial study of the global automotive charge air cooler market.

Primary Research

Extensive primary research was conducted after acquiring an understanding of the global automotive charge air cooler market scenarios through secondary research. Several primary interviews were conducted with market experts from both the demand (country-level government associations, trade associations, institutes, R&D centers, and OEMs/vehicle manufacturers) and supply (charge air cooler manufacturers, heat exchanger manufacturers, and raw material suppliers) side across three major regions, namely, North America, Europe, and Asia Pacific. 21% of the experts involved in primary interviews were from the demand side, and 79% were from the supply side of the industry. Primary data was collected through questionnaires, emails, and telephonic interviews. Several primary interviews were conducted from various departments within organizations, such as sales, operations, administration, and so on, to provide a holistic viewpoint in the report.

After interacting with industry participants, some brief sessions were conducted with experienced independent consultants to reinforce the findings from the primaries. This, along with the in-house subject matter experts’ opinions, led to the findings delineated in the rest of this report.

To know about the assumptions considered for the study, download the pdf brochure

List of primary participants

In-depth interviews were conducted with a target group to collect industry-related data, technology-related information, and validation of the analysis. Participants in primary interviews include:

- Automotive Charge Air Cooler Manufacturers

- Automotive Experts

- Automotive Heat Exchanger Manufacturers

- Automotive OEMs

- Automotive Service Centers

- Country-level Government Associations

- Industry Associations and Experts

- Other Automotive Components Manufacturers

- Other Automotive Industry Experts

- Raw Material Suppliers

Market Size Estimation

A detailed market estimation approach was followed to estimate and validate the value of the automotive charge air cooler market and other dependent submarkets, as mentioned below:

- Key players in the automotive charge air cooler market were identified through secondary research, and their global market share was determined through primary and secondary research.

- The research methodology included the understanding of charge air cooler and its correlation with ICE vehicles based on fuel type and vehicle type.

- All major penetration rates, percentage shares, splits, and breakdowns for different charge air cooler segments were based on product mapping for different companies.

- Penetration rates, percentage shares, splits, and breakdowns for different charge air cooler segments were further validated using secondary and primary sources.

- The methodology also included the study of the annual and quarterly financial reports & regulatory filings of major market players, as well as interviews with industry experts for detailed market insights.

- All key macro indicators affecting the revenue growth of the market segments and subsegments were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative & qualitative data.

- The gathered market data was consolidated and added with detailed inputs, analyzed, and presented in this report

Data Triangulation

After arriving at the overall market size of the global market through the abovementioned methodology, this market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact market value data for the key segments and subsegments. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both the demand- and supply-side participants.

Report Objectives

- There are a limited number of industry experts available in developing markets. In such cases, the regional market size was derived based on weightage assigned to these markets, based on qualitative insights from global industry experts.

- Quantitative information for some of the market segments was kept confidential by industry players. Hence, qualitative insights gathered during the study were used to arrive at the market size of such subsegments.

-

Key countries with significant growth in all regions were considered while calculating the

market size. - The scope of the market is only limited to charge air coolers/intercoolers. The report scope does not cover other heat exchangers.

- The market size for HEVs and alternate fuel vehicles is not included in the report.

- The market numbers in this report were rounded off. Hence country, regional, or other segment totals may vary in this report.

- Off-road vehicles, off-highway vehicles, agricultural equipment, industrial vehicles, and cargo equipment were not considered under the scope of this study.

- The report does not cover the market size of the aftermarket segment of the market as the segment is quite unorganized, with significant participation from the car modification segment.

- The report does not cover market size and forecast for Sales Channel and Material segments; these segments have been covered qualitatively.

Certain company figures, such as the number of plants and revenue, were inaccessible because of restrictions by concerned companies. In such cases, figures were estimated based on regional trends, company product portfolios, and secondary and primary sources.

Available Customizations

With the given market data, MarketsandMarkets offers customizations in line with company-specific needs.

- Automotive charge air cooler market, by vehicle type at country-level (for countries covered in the report)

- Automotive charge air cooler market, by type at country-level (for countries covered in the report)

Company Information

- Profiling of additional market players (Up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Automotive Charge Air Cooler Market