Automotive Catalyst Market by Type (Platinum, Palladium and Rhodium), Vehicle Type (Light-Duty Vehicles, Heavy-Duty Vehicles), and region (North America, APAC, Europe, South America, and Middle East & Africa) - Global Forecast to 2023

Automotive Catalyst Market Size And Forecast

The automotive catalyst market was valued at USD 11.78 billion in 2017 and is projected to reach USD 15.73 billion by 2023, at a CAGR of 5.0% during the forecast period. This growth can be attributed to the increasingly stringent global emission standards. In addition, greater stress on improving vehicle efficiency and reducing toxic emissions is a major factor driving the automotive catalyst market.

The base year considered for the study is 2017 and the forecast period is from 2018 to 2023.

Market Dynamics

Drivers

- Growth driven by tighter legislation on automotive emission

Restraints

- Growth of electric vehicles

Opportunities

- Increased focus on emission standards in developing nations

Growth driven by tighter legislation on automotive emission

To reduce air pollution and safeguard public health, governments all over the world have pledge to make motor vehicle fuel and emission standards more stringent.

Light-duty vehicles and heavy-duty vehicles are the two main consumers of automotive catalyst. Typically, light duty vehicles are regulated by comparatively less stringent emission standards. Each region has their own set of standards. In the US, the emission standards are regulated by the Environmental Protection Agency (EPA). In Europe, the emission standards are termed as Euro standards. China and India set their own standards which typically mirror Euro emission standards.

The newer light- and heavy-duty vehicles require fuel with minimal sulphur content for optimal performance. The sulfur content of gasoline and diesel fuels in Europe are strictly controlled to satisfy the stringent fuel-quality standards. These standards are driving the demand for automotive catalysts.

Objective Of The Report:

The report aims at estimating the market size and future growth potential of the automotive catalyst market which has been segmented on the basis of vehicle type, type, and region. The report provides detailed information regarding the major factors influencing the growth of the automotive catalyst market. It also analyzes opportunities in the market for stakeholders and delineates a competitive landscape for market leaders. Additionally, the report profiles key players and comprehensively analyzes their core competencies.

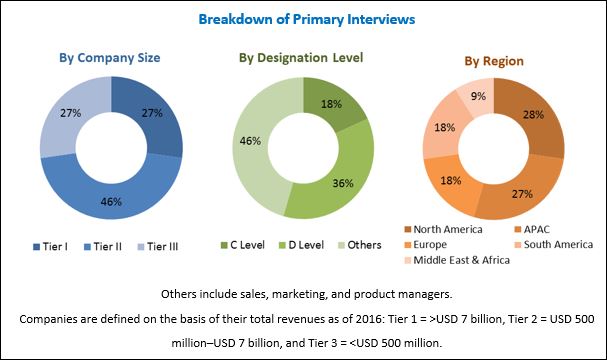

The top-down and bottom-up approaches were used to estimate and forecast the size of the automotive catalyst market and estimate the size of various other dependent submarkets. This research study involved the use of extensive secondary sources, directories, and databases, such as Bloomberg BusinessWeek and Factiva, to collect information useful for this technical, market-oriented, and commercial study of the automotive catalyst market. In-depth interviews with various primary respondents were conducted to verify critical qualitative and quantitative information as well as to assess growth prospects.

To know about the assumptions considered for the study, download the pdf brochure

The value chain of the automotive catalyst market includes manufacturers, such as BASF(Germany), Johnson Matthey (UK), Umicore (Belgium), Cataler (Japan), Cummins (US), Heraeus (Germany), INTERKAT (Germany), and Tenneco (US).

Major Market Developments

- In December 2017, BASF expanded its mobile emission catalysts production site in ?roda ?l¹ska, Poland. This expansion increased the manufacturing site by 14,000 square meters and involve the addition of new production lines.

- In September 2016, Umicore increased its manufacturing capacity in the newly commissioned plant in Poland. The introduction of new emission regulations in Europe requires a broader range of ever more technologically advanced products such as selective catalytic reduction (SCR) and advanced three-way catalysts (TWC).

- In June 2018, Clariant expanded its range of Envicat catalyst to incorporate high-performance solution for selective catalytic reduction (SCR). The catalyst comprises of a honeycomb structure block made of a vanadium based composite which is designed to catalyze NOx reduction reactions.

Key Target Audience:

- Manufacturers of Automotive Catalysts

- Traders, Distributors, and Suppliers of Automotive Component Parts

- Regional Manufacturers’ Associations and General Automotive Associations

- Government and Regional Agencies and Research Organizations

- Investment Research Firms

The study answers several questions for stakeholders, primarily, which market segments they need to focus upon during the next 2 to 5 years to prioritize their efforts and investments.

Scope of the report:

This research report categorizes the automotive catalyst market based on vehicle type, type, and region.

Based on Vehicle Type:

- Light-duty Vehicles

- Heavy-duty Vehicles

Based on Type:

- Platinum

- Palladium

- Rhodium

Based on Region:

- North America

- Asia Pacific

- Europe

- South America

- Middle East & Africa

The market has been further analyzed on the basis of key countries in each of these regions.

Critical questions which the report answers

- What is the market size of automotive catalysts in different regions and countries?

- Which are the key players in the market and how intense is the competition?

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific needs of companies. The following customization options are available for the report:

Regional Analysis:

- Country-level analysis of the automotive catalyst market

Company Information:

- Detailed analysis and profiles of additional market players

The automotive catalyst market is estimated to be USD 12.35 billion in 2018 and is projected to reach USD 15.73 billion by 2023, at a CAGR of 5.0% from 2018 to 2023. Growth of this market can be attributed to the rising use of automotive catalysts in emerging economies. In addition, increasing disposable income in emerging economies is also anticipated to fuel the growth of the automotive catalyst market.

Automotive catalysts are used in vehicles, such as light-duty vehicles and heavy-duty vehicles. The light-duty vehicle segment is the largest type application segment of the automotive catalyst market. There has been considerable rise in the fuel economy standards implemented for light-duty vehicles during the past 10 years. This factor has led to greater use of automotive catalysts in this segment.

Based on type, the palladium segment is estimated to account for the largest share of the automotive catalyst market in 2018. Other factors driving the light-duty vehicles segment include the increasing demand for automotive vehicles in emerging economies. The use of palladium as an automotive catalyst has grown in importance in recent years driven by factors, such as increase in automotive sales and growing regulations for emissions.

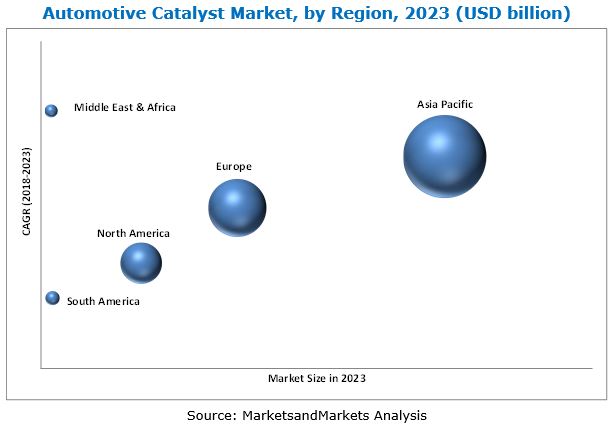

APAC, North America, Europe, South America, and the Middle East & Africa are the key regions considered for market analysis in the report. APAC is estimated to be the largest market for automotive catalysts in 2018 in terms of volume. It is also expected to continue to be the largest market by 2023, as growing awareness about automotive catalysts is expected to drive the automotive catalyst market during the forecast period. The automotive catalyst market in the APAC region is projected to grow at the highest CAGR between 2018 and 2023, in terms of value and volume. The increasing demand for vehicles in the Asia Pacific region is anticipated to drive the automotive catalyst market. Greater stress on low vehicle emissions as well as a rise in disposable incomes of consumers are expected to drive the automotive catalyst market during the forecast period.

Increasing use of electric vehicles is a key challenge for the growth of the automotive catalyst market. Rising number of electric vehicles which do not require the use of automotive catalysts are expected to dampen the demand for automotive catalysts during the forecast period.

The automotive catalyst market is segmented on the basis of vehicle type as heavy-duty vehicle and light-duty vehicle. The demand for automotive catalysts is increasing as emission standards set by governments across the globe are becoming more stringent.

Light-Duty Vehicle

Light duty vehicles have typically contributed the most to emissions from mobile sources. This is partly due to the large number of light-duty vehicles present.

Considerable developments have taken place in fuel economy standards for light-duty vehicles in the past 10 years. Most of the fuel economy standards permit certain leeway to the manufacturers to meet their targets. Some of the methods to create flexibilities include setting corporate average fuel economy targets, providing off-credits to reduce carbon-dioxide emissions.

Heavy-Duty Vehicle

Heavy duty vehicles are governed by stricter emission standards compared to light duty vehicles. These vehicles also require ultra-low sulfur fuel. Most of the heavy vehicles consume diesel to power their engines, resulting in emission of high level of particulates and nitrogen oxides. While regulations on heavy-duty vehicle exhaust emissions such as nitrogen oxides (NOx) and particulate matter (PM) in the developed countries are already strictly enforced, developing economies are catching up fast to their emission standards.

Critical questions the report answers:

- What are the upcoming hot bets for automotive catalyst market?

- How market dynamics is changing across the globe for automotive catalysts?

Key players in the automotive catalyst market include BASF (Germany), Johnson Matthey (UK), Umicore (Belgium), Cataler (Japan), Cummins (US), Heraeus (Germany), INTERKAT (Germany), CDTi Advanced Materials (US), Tenneco (US), and IBIDEN (Japan). These companies are expected to venture into new markets to widen their customer base and strengthen their market presence. Other manufacturers of automotive catalysts include N.E. Chemcat (Japan), Sinocat (China), and Ecocat (India).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Units Considered

1.6 Stakeholders

1.7 Limitations

2 Research Methodology (Page No. - 15)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 27)

4.1 Automotive Catalyst Market Overview, 2018 vs 2023

4.2 Automotive Catalyst Market, By Vehicle Type

4.3 Automotive Catalyst Market, By Region

4.4 Automotive Catalyst Market Share, By Type and Country

4.5 Automotive Catalyst Market Attractiveness

5 Market Overview (Page No. - 30)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growth Driven By Tighter Legislation on Automotive Emission

5.2.2 Restraints

5.2.2.1 Growth of Electric Vehicles

5.2.3 Opportunities

5.2.3.1 Increased Focus on Emission Standards in Developing Nations

5.3 Porter’s Five Force Analysis

5.3.1 Bargaining Power of Suppliers

5.3.2 Bargaining Power of Buyers

5.3.3 Threat of New Entrants

5.3.4 Threat of Substitutes

5.3.5 Intensity of Competitive Rivalry

6 Automotive Catalyst Market, By Type (Page No. - 35)

6.1 Introduction

6.2 Platinum Catalysts

6.3 Palladium Catalysts

6.4 Rhodium Catalysts

7 Automotive Catalyst Market, By Vehicle Type (Page No. - 38)

7.1 Introduction

7.2 Light-Duty Vehicle

7.3 Heavy-Duty Vehicle

8 Automotive Catalyst Market, By Region (Page No. - 41)

8.1 Introduction

8.2 North America

8.2.1 US

8.2.2 Canada

8.2.3 Mexico

8.3 APAC

8.3.1 China

8.3.2 South Korea

8.3.3 Japan

8.3.4 India

8.3.5 Rest of APAC

8.4 Europe

8.4.1 UK

8.4.2 Germany

8.4.3 France

8.4.4 Italy

8.4.5 Spain

8.4.6 Rest of Europe

8.5 South America

8.5.1 Brazil

8.5.2 Argentina

8.5.3 Rest of South America

8.6 Middle East & Africa

8.6.1 Iran

8.6.2 South Africa

8.6.3 Rest of Middle East & Africa

9 Competitive Landscape (Page No. - 69)

9.1 Overview

9.2 Market Ranking of Key Players

9.3 Competitive Situation & Trends

9.4 Expansions & Agreements

9.5 Partnerships & Acquisitions

9.6 New Product Launches

10 Company Profiles (Page No. - 73)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis & MnM View)*

10.1 Umicore

10.2 BASF

10.3 Johnson Matthey

10.4 Cataler

10.5 Clariant

10.6 CDTI Advanced Materials

10.7 Cummins

10.8 Heraeus

10.9 Interkat

10.10 Tenneco

10.11 Other Companies

10.11.1 Ibiden

10.11.2 Ne Chemcat

10.11.3 Sinocat

10.11.4 Magnetti Marelli

10.11.5 Bosal

10.11.6 NG Clark

10.11.7 CRI Catalyst

10.11.8 Ecocat

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis & MnM View Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 92)

11.1 Insights From Industry Experts

11.2 Discussion Guide

11.3 Knowledge Store: Marketsandmarkets Subscription Portal

11.4 Available Customizations

11.5 Related Reports

11.6 Author Details

List of Tables (69 Tables)

Table 1 Automotive Catalyst By Market Size, By Type, 2016–2023 (USD Million)

Table 2 Automotive Catalyst By Market Size, By Type, 2016–2023 (Ton)

Table 3 Automotive Catalyst By Market Size, By Vehicle Type, 2016–2023 (USD Million)

Table 4 Automotive Catalyst By Market Size, By Vehicle Type, 2016–2023 (Ton)

Table 5 Automotive Catalyst By Market Size, By Region, 2016–2023 (USD Million)

Table 6 Automotive Catalyst By Market Size, By Region, 2016–2023 (Ton)

Table 7 North America: By Market Size, By Country, 2016–2023 (USD Million)

Table 8 North America: By Market Size, By Country, 2016–2023 (Ton)

Table 9 North America: By Market Size, By Vehicle Type, 2016–2023 (USD Million)

Table 10 North America: By Market Size, By Vehicle Type, 2016–2023 (Ton)

Table 11 US: By Market Size, By Vehicle Type, 2016–2023 (USD Million)

Table 12 US: By Market Size, By Vehicle Type, 2016–2023 (Ton)

Table 13 Canada: By Market Size, By Vehicle Type, 2016–2023 (USD Million)

Table 14 Canada: By Market Size, By Vehicle Type, 2016–2023 (Ton)

Table 15 Mexico: By Market Size, By Vehicle Type, 2016–2023 (USD Million)

Table 16 Mexico: By Market Size, By Vehicle Type, 2016–2023 (Ton)

Table 17 APAC: By Market Size, By Country, 2016–2023 (USD Million)

Table 18 APAC: By Market Size, By Country, 2016–2023 (Ton)

Table 19 APAC: By Market Size, By Vehicle Type, 2016–2023 (USD Million)

Table 20 APAC: By Market Size, By Vehicle Type, 2016–2023 (Ton)

Table 21 China: By Market Size, By Vehicle Type, 2016–2023 (USD Million)

Table 22 China: By Market Size, By Vehicle, 2016–2023 (Ton)

Table 23 South Korea: By Market Size, By Vehicle Type, 2016–2023 (USD Million)

Table 24 South Korea: By Market Size, By Vehicle Type, 2016–2023 (Ton)

Table 25 Japan: By Market Size, By Vehicle Type, 2016–2023 (USD Million)

Table 26 Japan: By Market Size, By Vehicle Type, 2016–2023 (Ton)

Table 27 India: By Market Size, By Vehicle Type, 2016–2023 (USD Million)

Table 28 India: By Market Size, By Vehicle Type, 2016–2023 (Ton)

Table 29 Rest of APAC: By Market Size, By Vehicle Type, 2016–2023 (USD Million)

Table 30 Rest of APAC: By Market Size, By Vehicle Type, 2016–2023 (Ton)

Table 31 Europe: By Market Size, By Country, 2016–2023 (USD Million)

Table 32 Europe: By Market Size, By Country, 2016–2023 (Ton)

Table 33 Europe: By Market Size, By Vehicle Type, 2016–2023 (USD Million)

Table 34 Europe: By Market Size, By Vehicle Type, 2016–2023 (Ton)

Table 35 UK: By Market Size, By Vehicle Type, 2016–2023 (USD Million)

Table 36 UK: By Market Size, By Vehicle Type, 2016–2023 (Ton)

Table 37 Germany: By Market Size, By Vehicle Type, 2016–2023 (USD Million)

Table 38 Germany: By Market Size, By Vehicle Type, 2016–2023 (Ton)

Table 39 France: By Market Size, By Vehicle Type, 2016–2023 (USD Million)

Table 40 France: By Market Size, By Vehicle Type, 2016–2023 (Ton)

Table 41 Italy: By Market Size, By Vehicle Type, 2016–2023 (USD Million)

Table 42 Italy: By Market Size, By Vehicle Type, 2016–2023 (Ton)

Table 43 Spain: By Market Size, By Vehicle Type, 2016–2023 (USD Million)

Table 44 Spain: By Market Size, By Vehicle Type, 2016–2023 (Ton)

Table 45 Rest of Europe: By Market Size, By Vehicle Type, 2016–2023 (USD Million)

Table 46 Rest of Europe: By Market Size, By Vehicle Type, 2016–2023 (Ton)

Table 47 South America: By Market Size, By Country, 2016–2023 (USD Million)

Table 48 South America: By Market Size, By Country, 2016–2023 (Ton)

Table 49 South America: By Market Size, By Vehicle Type, 2016–2023 (USD Million)

Table 50 South America: By Market Size, By Vehicle Type, 2016–2023 (Ton)

Table 51 Brazil: By Market Size, By Vehicle Type, 2016–2023 (USD Million)

Table 52 Brazil: By Market Size, By Vehicle Type, 2016–2023 (Ton)

Table 53 Argentina: By Market Size, By Vehicle Type, 2016–2023 (USD Million)

Table 54 Argentina: By Market Size, By Vehicle Type, 2016–2023 (Ton)

Table 55 Rest of South America: By Market Size, By Vehicle Type, 2016–2023 (USD Million)

Table 56 Rest of South America: By Market Size, By Vehicle Type, 2016–2023 (Ton)

Table 57 Middle East & Africa: By Market Size, By Country, 2016–2023 (USD Million)

Table 58 Middle East & Africa: By Market Size, By Country, 2016–2023 (Ton)

Table 59 Middle East & Africa: By Market Size, By Vehicle Type, 2016–2023 (USD Million)

Table 60 Middle East & Africa: By Market Size, By Vehicle Type, 2016–2023 (Ton)

Table 61 Iran: By Market Size, By Vehicle Type, 2016–2023 (USD Million)

Table 62 Iran: By Market Size, By Vehicle Type, 2016–2023 (Million)

Table 63 South Africa: By Market Size, By Vehicle Type, 2016–2023 (USD Million)

Table 64 South Africa: By Market Size, By Vehicle Type, 2016–2023 (Ton)

Table 65 Rest of Middle East & Africa: By Market Size, By Vehicle Type, 2016–2023 (USD Million)

Table 66 Rest of Middle East & Africa: By Market Size, By Vehicle Type, 2016–2023 (Ton)

Table 67 Expansions & Agreements, 2015–2018

Table 68 Partnerships & Acquisitions, 2015–2018

Table 69 New Product Launches, 2015–2018

List of Figures (35 Figures)

Figure 1 Automotive Catalyst Market: Research Design

Figure 2 Market Size Estimation: Bottom-Up Approach

Figure 3 Market Size Estimation: Top-Down Approach

Figure 4 Automotive Catalyst Market: Data Triangulation

Figure 5 Palladium Dominates Overall Automotive Catalyst Market

Figure 6 Light-Duty Vehicle Segment to Dominate Overall Automotive Catalyst Market

Figure 7 Middle East & Africa to Be Fastest-Growing Automotive Catalyst Market

Figure 8 APAC is the Largest Automotive Catalyst Market

Figure 9 Automotive Catalyst Market to Witness Strong Growth Between 2018 and 2023

Figure 10 Light-Duty Vehicle to Dominate Automotive Catalysts

Figure 11 APAC to Be the Largest Automotive Catalyst Market

Figure 12 Palladium Was the Largest Type of Automotive Catalyst

Figure 13 Middle East & Africa to Be Fastest-Growing Automotive Catalyst Market

Figure 14 Overview of Factors Governing Automotive Catalyst Market

Figure 15 Porter’s Five Force Analysis

Figure 16 Palladium to Dominate Overall Automotive Catalyst Market

Figure 17 Light-Duty Vehicles to Dominate Overall Automotive Catalyst Market

Figure 18 India to Register Highest CAGR in Automotive Catalyst Market Between 2018 and 2023

Figure 19 APAC: Automotive Catalyst Market Snapshot

Figure 20 Europe: Automotive Catalyst Market Snapshot

Figure 21 Companies Adopted Contracts, Expansions, Agreements, Joint Ventures & Investments as Key Strategies Between 2015 and 2018

Figure 22 Umicore: Company Snapshot

Figure 23 Umicore: SWOT Analysis

Figure 24 BASF: Company Snapshot

Figure 25 BASF: SWOT Analysis

Figure 26 Johnson Matthey: Company Snapshot

Figure 27 Johnson Matthey: SWOT Analysis

Figure 28 Cataler: Company Snapshot

Figure 29 Cataler: SWOT Analysis

Figure 30 Clariant: Company Snapshot

Figure 31 Clariant: SWOT Analysis

Figure 32 CDTI Advanced Materials: Company Snapshot

Figure 33 Cummins: Company Snapshot

Figure 34 Heraeus: Company Snapshot

Figure 35 Tenneco: Company Snapshot

Growth opportunities and latent adjacency in Automotive Catalyst Market