Automotive Bushing Market by Application (Engine, Suspension, Chassis, Interior, Exhaust, Transmission), Vehicle Type (Passenger Car, Light Commercial Vehicle, Heavy Commercial Vehicle), EV Type, and Region - Global Forecast to 2025

[120 Pages Report] The global automotive bushing market was valued at USD 127.53 billion in 2017 and is projected to reach USD 175.31 billion by 2025, at a CAGR of 4.11% during the forecast period. The base year for the report is 2017 and the forecast period is 2018 to 2025.

Objectives of the report

- To define, describe, and provide a detailed analysis of the overall market for automotive bushings and determine the contribution of each segment to the total market

- To analyze and forecast the global automotive bushing market, in terms of value (USD billion) and volume (billion units), from 2018 to 2025

- To analyze and forecast the market, by volume and value, on the basis of application, vehicle type, electric vehicle type, and region

- To analyze regional markets for growth trends, prospects, and their contribution towards the overall market

- To provide a detailed analysis of factors influencing the market (drivers, restraints, opportunities, and challenges)

- To analyze the opportunities offered by various segments of the market to its stakeholders

- To profile key players and analyze their market shares and core competencies

- To track and analyze competitive developments such as joint ventures, mergers & acquisitions, new product launches, expansions, and other industrial activities carried out by key industry participants

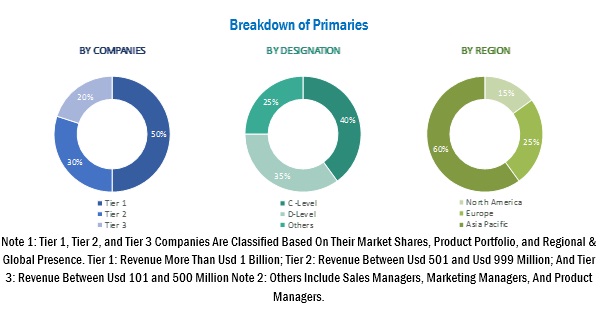

The research methodology used in the report involves primary and secondary sources and follows a bottom-up approach for data triangulation. The study involves the country-level and characteristics-wise analysis of automotive bushing market. This analysis involves historical trends as well as existing market penetrations by country as well as by vehicle type and application. The analysis is projected based on numerous factors such as growth trends in vehicle production and global development trends in bushing industry. The analysis has been discussed and validated by primary respondents, which include experts from the core and related industries, suppliers, manufacturers, distributors, technology developers, and organizations related to various segments of this industry’s value chain. Secondary sources include associations such as China Association of Automobile Manufacturers (CAAM), International Organization of Motor Vehicle Manufacturers (OICA), European Automobile Manufacturers Association (ACEA), Society of Indian Automotive Manufacturers (SIAM), and paid databases and directories such as D&B Hoovers, Bloomberg, and Factiva.

The figure below illustrates the break-up of the profile of industry experts who participated in primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the automotive bushing market consists of established bushing manufacturers such as Continental AG (Germany), ZF Group (Germany), Sumitomo Riko Company Limited (Japan), DuPont (US), and Mahle GmbH (Germany). It also comprises a few other players such as Tenneco Inc (US), Federal-Mogul (US), Oiles Corporation (Japan), Cooper Standard Holdings Inc (US), Vibracoustic GMBH (Germany), BOGE Rubber & Plastics (Germany), Hyundai Polytech India (India), Nolathane (Australia and New Zealand), Paulstra SNC (France), and Benara Udyog Limited (India).

Target Audience

- Manufacturers of automotive bushings

- Automotive OEMs

- Electric vehicle manufacturers

- Industry associations and experts

- Traders, distributors, and suppliers of automotive bushings

Scope of the Report

Market, By Application

- Engine

- Suspension

- Chassis

- Interior

- Exhaust

- Transmission

Market, By Vehicle Type

- Passenger car (PC)

- Light commercial vehicle (LCV)

- Heavy commercial vehicle (HCV)

Market, By Electric Vehicle Type

- Battery electric vehicle (BEV)

- Hybrid electric vehicle (HEV)

- Plug-in-hybrid electric vehicle (PHEV)

Market, By Region

- Asia Pacific

- Europe

- North America

- Rest of the World

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis:

- Further breakdown of the Rest of Asia Pacific, Rest of North America, Rest of Europe, and Rest of World automotive bushings markets

Company Information:

- Detailed analysis and profiles of additional market players (up to three companies)

The global automotive bushing market is projected to grow from an estimated USD 132.20 billion in 2018 to USD 175.31 billion by 2025, at a CAGR of 4.11% from 2018 to 2025. The market is anticipated to grow due to several factors such as the growing vehicle production, shifting focus toward lightweight vehicles, and increasing demand for electric vehicles in the market.

The automotive bushing market has been segmented based on application, vehicle type, electric vehicle type, and region. The suspension bushing market is expected to hold the largest market share, by value and volume. Automotive bushings are made of rubber or polyurethane. Rubber bushings are commonly used for automotive applications as they are relatively softer and provide better cushioning. Bushings used for heavy-duty applications have multiple layers of rubber rather than a single, solid bushing.

The passenger car segment is expected to dominate the automotive bushing market with an estimated market size of USD 74.35 billion in 2018, while the light commercial vehicle segment is estimated to account for a market size of USD 47.73 billion in the same year. North America is estimated to be the largest market for the light commercial vehicle segment. Driven by the growth of emerging markets such as China and India, the Asia Pacific market for passenger cars and light commercial vehicles is projected to grow at the highest CAGR during the forecast period. For heavy commercial vehicles, the North American market is expected to grow at the highest CAGR during the forecast period. A large customer base in the European and North American regions and high disposable income of end-users have fueled the demand for vehicles, which, in turn, has resulted in increased manufacturing activities by local automotive OEMs.

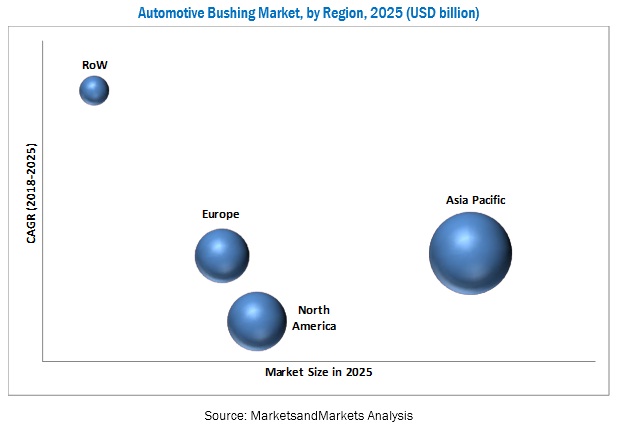

North America is estimated to be the largest market for automotive bushings during the forecast period. The North American automotive bushing market is estimated to be USD 43.79 billion in 2018 and is projected to reach USD 57.52 billion by 2025. Europe is expected to be the second-largest market for automotive bushings with an estimated market size of USD 37.45 billion in 2018. The Asia Pacific market is expected to grow at the highest CAGR of 4.53% during the forecast period because of increased vehicle production in China, Japan, and India and the rising demand for ride quality, vehicle lightweighting, and vehicle safety.

Some of the major market players operating in the automotive bushing market are Federal-Mogul (US), Oiles Corporation (Japan), Freudenberg Group (Germany), Cooper Standard Holdings Inc. (US), ZF Friedrichshafen AG (Germany), Tenneco Inc. (US), Continental AG (Germany), CRRC Corporation Limited (China), and Benara Udyog Limited (India).

Sumitomo, Continental AG, and ZF are the dominant players in the automotive bushing market. The extensive competition in the automotive industry has compelled these companies to upgrade their existing systems and processes. These players have adopted various strategies to diversify their global presence and increase their market shares.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Covered

1.3.2 Years Considered During the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.2.2 Key Output Parameters From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.5 Data Trangulation

2.6 Assumptions

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 29)

4.1 Attractive Opportunities in the Automotive Bushing Market

4.2 Market, By Region

4.3 Market, By Application

4.4 Market, By Vehicle

4.5 Market, By Electric Vehicle Type

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Significant Growth in Global Automotive Production

5.2.1.2 Significant Growth in Global Vehicle Parc

5.2.1.3 Rising Demand for Comfort, Safety, and Ride Quality

5.2.2 Restraints

5.2.2.1 Lack of Standardization for Automotive Bushing System

5.2.3 Opportunities

5.2.3.1 Increase in Demand for Bushings With High Load Carrying Capacity for Heavy-Duty Applications

5.2.3.2 Use of Lightweight Materials to Improve the Efficiency of Vehicles

5.2.4 Challenges

5.2.4.1 Rising Price of Natural Rubber

5.2.4.2 Rising Demand for Pure Electric Vehicles in the Market

6 Automotive Bushing Market, By Application (Page No. - 38)

6.1 Introduction

6.2 Engine

6.2.1 Asia Pacific is Expected to Witness the Highest Growth in Terms on Volume During the Forecast Year 2018-2025

6.3 Suspension

6.3.1 Suspension System Contributes to Around 43% of the Total Bushings Required in Automotive

6.4 Chassis

6.4.1 Market for Chassis Application is Estimated to Be the Largest Market in Terms of Volume in Asia Pacific Region During the 42

6.5 Interior

6.5.1 Interior Bushing Segment is Estimated to Be the Fastest Growing Segment During the Forecast Year 2018-2025

6.6 Exhaust

6.6.1 Market for Exhaust Application is Estimated to Be the Fastest Growing Market in Terms of Volume in Asia Pacific Period 2018 - 45

6.7 Transmission

6.7.1 Market for Transmission Application is Estimated to Be the Slowest Growing Market in During the Forecast Period 2018-2025

7 Automotive Bushing Market, By Vehicle Type (Page No. - 48)

7.1 Introduction

7.2 Passenger Car

7.2.1 Passenger Car Market is Expected to Dominate the Market

7.3 LCV

7.3.1 North America is Estimated to Be the Largest Market for Light Commercial Vehicle Segment

7.4 HCV

7.4.1 North America is Estimated to Be the Fastest Growing Market for Heavy Commercial Vehicle Segment

8 Automotive Oe Bushing Market, By Electric Vehicle Type (Page No. - 54)

8.1 Introduction

8.2 BEV

8.2.1 APAC is Estimated to Be the Largest Market for BEV Segment

8.3 HEV

8.3.1 HEV Segment is Expected to Dominate the Market

8.4 PHEV

8.4.1 This Segment is Estimated to Be the Lowest Market and Slowest Growing Market for Automotive Bushings

9 Automotive Bushing Market, By Region (Page No. - 60)

9.1 Introduction

9.2 Asia Pacific

9.2.1 APAC is Estimated to Be the Fastest Growing Market for Automotive Bushing

9.2.2 China

9.2.3 Japan

9.2.4 India

9.2.5 South Korea

9.2.6 Roa (Countries Covered: Thailand, Indonesia, Malaysia, Pakistan, and Taiwan)

9.3 Europe

9.3.1 Europe is Estimated to Contribute Around 28% of the Market in 2018

9.3.2 Germany

9.3.3 France

9.3.4 Spain

9.3.5 UK

9.3.6 Italy

9.3.7 Roe (Countries Covered: Czech Republic, Belgium, Sweden, Hungary, Poland, Romania, and Slovakia)

9.4 North America

9.4.1 North America is Estimated to Contribute Around 33% of the Market in 2018 and is the 3rd Largest Growing Market for Bushings

9.4.2 United States

9.4.3 Mexico

9.4.4 Canada

9.5 Rest of the World

9.5.1 Brazilian Market is Estimated to Be the Fastest Growing Market During the Forecast Year 2018 - 2025

9.5.2 Russia

9.5.3 Brazil

9.5.4 Other Countries

10 Competitive Landscape (Page No. - 89)

10.1 Overview

10.2 Automotive Bushing Market: Market Ranking Analysis

10.3 Competitive Scenario

10.3.1 New Product Developments

10.3.2 Expansions

10.3.3 Mergers & Acquisitions

11 Company Profiles (Page No. - 92)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis)*

11.1 Continental AG

11.2 ZF

11.3 Sumitomo Riko Company Limited

11.4 Dupont

11.5 Mahle GmbH

11.6 Tenneco Inc.

11.7 Federal-Mogul

11.8 Oiles Corporation

11.9 Cooper Standard Holdings Inc.

11.10 Vibracoustic GmbH

11.11 Boge Rubber & Plastics

11.12 Hyundai Polytech India Pvt Ltd.

11.13 Nolathane

11.14 Paulstra Snc

11.15 Benara Udyog Limited

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 115)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Available Customizations

12.3.1 Additional Company Profiles

12.3.1.1 Business Overview

12.3.1.2 SWOT Analysis

12.3.1.3 Recent Developments

12.3.1.4 MnM View

12.3.1.5 Who–Supplies–Whom Data

12.3.2 Region and Country Specific Automotive Bushing Market

12.4 Author Details

List of Tables (79 Tables)

Table 1 Currency Exchange Rates (W.R.T USD)

Table 2 Automotive Bushing Market, By Application, 2016–2025 (USD Billion)

Table 3 Market, By Application, 2016–2025 (Billion Units)

Table 4 Engine: Market, By Region, 2016–2025 (USD Billion)

Table 5 Engine: Market, By Region, 2016–2025 (Billion Units)

Table 6 Suspension: Market, By Region, 2016–2025 (USD Billion)

Table 7 Suspension: Market, By Region, 2016–2025 (Billion Units)

Table 8 Chassis: Market, By Region, 2016–2025 (USD Billion)

Table 9 Chassis: Market, By Region, 2016–2025 (Billion Units)

Table 10 Interior: Market, By Region, 2016–2025 (USD Billion)

Table 11 Interior: Market, By Region, 2016–2025 (Billion Units)

Table 12 Exhaust: Market, By Region, 2016–2025 (USD Billion)

Table 13 Exhaust: Market, By Region, 2016–2025 (Billion Units)

Table 14 Transmission: Market, By Region, 2016–2025 (USD Billion)

Table 15 Transmission: Market, By Region, 2016–2025 (Billion Units)

Table 16 Market, By Vehicle Type, 2016–2025 (Billion Units)

Table 17 Market, By Vehicle Type, 2016–2025 (USD Billion)

Table 18 Passenger Car: Market, By Region, 2016–2025 (Billion Units)

Table 19 Passenger Car: Market, By Region, 2016–2025 (USD Billion)

Table 20 LCV: Market, By Region, 2016–2025 (Billion Units)

Table 21 LCV: Market, By Region, 2016–2025 (USD Millions)

Table 22 HCV: Market, By Region, 2016–2025 (Billion Units)

Table 23 HCV: Market, By Region, 2016–2025 (USD Billion)

Table 24 Automotive Oe Bushing Market, By Electric Vehicle, 2016–2025 (Million Units)

Table 25 Automotive Oe Bushing Market, By Electric Vehicle, 2016–2025 (USD Million)

Table 26 BEV: Automotive Oe Bushing Market, By Region, 2016–2025 (Million Units)

Table 27 BEV: Automotive Oe Bushing Market, By Region, 2016–2025 (USD Million)

Table 28 HEV: Market, By Region, 2016–2025 (Million Units)

Table 29 HEV: Market, By Region, 2016–2025 (USD Million)

Table 30 PHEV: Market, By Region, 2016–2025 (Million Units)

Table 31 PHEV: Market, By Region, 2016–2025 (USD Million)

Table 32 Automotive Bushing Market, By Region, 2016–2025 (Billion Units)

Table 33 Market, By Region, 2016–2025 (USD Billion)

Table 34 Asia Pacific: Market, By Country, 2016–2025 (Billion Units)

Table 35 Asia Pacific: Market, By Country, 2016–2025 (USD Billion)

Table 36 China: Market, By Application, 2016 –2025 (Billion Units)

Table 37 China: Market, By Application, 2016–2025 (USD Billion)

Table 38 Japan: Market, By Application, 2016–2025 (Billion Units)

Table 39 Japan: Market, By Application, 2016–2025 (USD Billion)

Table 40 India: Market, By Application, 2016–2025 (Billion Units)

Table 41 India: Market, By Application, 2016–2025 (USD Billion)

Table 42 South Korea: Market, By Application, 2016–2025 (Billion Units)

Table 43 South Korea: Market, By Application, 2016–2025 (USD Billion)

Table 44 Roa: Market, By Application, 2016 –2025 (Billion Units)

Table 45 Roa: Market, By Application, 2016 –2025 (USD Billion)

Table 46 Europe: Market, By Country, 2016 –2025 (Billion Units)

Table 47 Europe: Market, By Country, 2016–2025 (USD Billion)

Table 48 Germany: Market, By Application, 2016–2025 (Billion Units)

Table 49 Germany: Market, By Application, 2016–2025 (USD Billion)

Table 50 France: Market, By Application, 2016–2025 (Billion Units)

Table 51 France: Market, By Application, 2016–2025 (USD Billion)

Table 52 Spain: Market, By Application, 2016 –2025 (Billion Units)

Table 53 Spain: Market, By Application, 2016 –2025 (USD Billion)

Table 54 UK: Market, By Application, 2016–2025 (Billion Units)

Table 55 UK: Market, By Application, 2016 –2025 (USD Billion)

Table 56 Italy: Market, By Application, 2016–2025 (Billion Units)

Table 57 Italy: Market, By Application, 2016–2025 (USD Billion)

Table 58 Roe: Market, By Application, 2016–2025 (Billion Units)

Table 59 Roe: Market, By Application, 2016–2025 (USD Billion)

Table 60 North America: Market, By Country, 2016 –2025 (Billion Units)

Table 61 North America: Market, By Country, 2016 –2025 (USD Billion)

Table 62 US: Market, By Application, 2016 –2025 (Billion Units)

Table 63 US: Market, By Application, 2016 –2025 (USD Billion)

Table 64 Mexico: Market, By Application, 2016–2025 (Billion Units)

Table 65 Mexico: Market, By Application, 2016 –2025 (USD Billion)

Table 66 Canada: Market, By Application, 2016 –2025 (Billion Units)

Table 67 Canada: Market, By Application, 2016–2025 (USD Billion)

Table 68 Row: Market, By Country, 2016 –2025 (Billion Units)

Table 69 Row: Market, By Country, 2016 –2025 (USD Billion)

Table 70 Russia: Market, By Application, 2016 –2025 (Billion Units)

Table 71 Russia: Market, By Application, 2016–2025 (USD Billion)

Table 72 Brazil: Market, By Application, 2016–2025 (Billion Units)

Table 73 Brazil: Market, By Application, 2016 –2025 (USD Billion)

Table 74 Other Countries: Market, By Application, 2016–2025 (Billion Units)

Table 75 Other Countries: Market, By Application, 2016–2025 (USD Billion)

Table 76 Automotive Bushing Market: Market Ranking Analysis, 2018

Table 77 New Product Developments, 2015–2018

Table 78 Expansions, 2015–2018

Table 79 Mergers & Acquisitions, 2015–2018

List of Figures (39 Figures)

Figure 1 Automotive Bushing Market: Segmentation Covered

Figure 2 Market: Research Design

Figure 3 Research Design Model

Figure 4 Breakdown of Primary Interviews:

Figure 5 Bottom-Up Approach

Figure 6 Market, By Region, 2018 vs. 2025 (USD Billion)

Figure 7 Market, By Application, 2018 vs. 2025 (USD Billion)

Figure 8 Market, By Vehicle Type, 2018 vs. 2025 (USD Billion)

Figure 9 Market, By Electrical Vehicle Type, 2018 vs. 2025 (USD Billion)

Figure 10 Growth of the Asia Pacific Automotive Industry is Expected to Drive the Bushing Market Between 2018 and 2025

Figure 11 Asia Pacific is Estimated to Lead the Market, 2018 (USD Billion)

Figure 12 Suspension Segment is Estimated to Lead the Market, By Application, 2018 & 2025 (USD Billion)

Figure 13 Passenger Car Segment is Estimated to Lead the Market, 2018 & 2025 (USD Billion)

Figure 14 BEV Segment is Estimated to Lead the Market, 2018 & 2025 (USD Million)

Figure 15 Market: Market Dynamics

Figure 16 Global Vehicle Production, 2008–2017 (Million Units)

Figure 17 Global Vehicle Parc, 2013–2017 (Million Units)

Figure 18 Global Heavy Vehicle Production (Heavy Bus and Trucks), 2015–2017 (Million Units)

Figure 19 Annual Average Price of Natural Rubber, 2015–2017 (USD/Kg)

Figure 20 Pure Electric Vehicle Sales and Forecast, 2016–2025 (Million Units)

Figure 21 Market, By Application, 2018 vs. 2025 (USD Billion)

Figure 22 Market, By Vehicle Type, 2018 vs. 2025 (USD Billion)

Figure 23 Automotive Oe Bushing Market, By Electric Vehicle Type, 2018 vs. 2025 (USD Million)

Figure 24 Market, Country Wise Growth By Value

Figure 25 Asia Pacific: Market, By Country, 2018 vs 2025 (USD Billion)

Figure 26 Europe: Market, By Country, 2018 vs 2025 (USD Billion)

Figure 27 North America: Market, By Country, 2018 vs 2025 (USD Billion)

Figure 28 Row: Market, By Country, 2018 vs 2025 (USD Billion)

Figure 29 Companies Adopted A Mix of Both Organic and Inorganic Growth Strategies, 2015–2018

Figure 30 Continental AG: Company Snapshot

Figure 31 ZF: Company Snapshot

Figure 32 Sumitomo Riko Company Limited: Company Snapshot

Figure 33 Dupont: Company Snapshot

Figure 34 Mahle GmbH: Company Snapshot

Figure 35 Tenneco Inc.: Company Snapshot

Figure 36 Federal Mogul: Company Snapshot

Figure 37 Oiles Corporation: Company Snapshot

Figure 38 Cooper Standard Holdings Inc.: Company Snapshot

Figure 39 Vibracoustic GmbH: Company Snapshot

Growth opportunities and latent adjacency in Automotive Bushing Market