Balance Shaft Market by Engine Type (Inline-3 Cylinder, Inline-4 Cylinder, Inline-5 Cylinder, and V-6 Cylinder), Manufacturing Process (Forged and Cast Balance Shaft), & by Region - Industry Trends & Forecast to 2020

[149 Pages Report] A balance shaft is designed to rotate and vibrate in a way that reduces the vibration produced by an engine. Balance shafts are commonly used for engine refinement. Four cylinder engines use a tow shaft, which turns in opposite directions on either side of engines crankshaft. A single balance shaft is used in three cylinder and V6 engines.

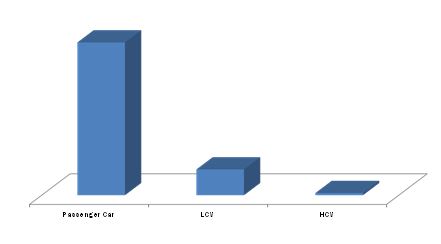

A balance shaft is manufactured through either forging or casting. Balance shafts can be forged from a steel bar, usually through roll forging. Forged balance shafts are widely adopted, due to their lightness, compact dimensions, and effective inherent damping. In this research study, the automotive balance shaft market has been categorized into the following major segments:, by manufacturing process (cast balance shaft and forged balance shaft), by engine type (inline 3 cylinder engine, inline 4 cylinder engine, inline 5 cylinder engine, and V 6 engine), by vehicle type (passenger car, LCV, and HCV), and by region (Asia-Oceania, North America, Europe, and RoW).

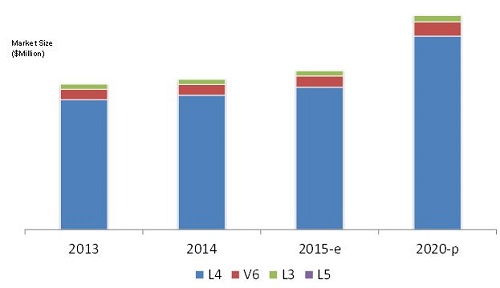

The global market size, in terms of value, of automotive balance shafts is estimated to grow at a promising CAGR of 6.15% from 2015 to 2020. Market growth is propelled by the increasing demand for vehicles equipped with inline-4 cylinder engines and the growing trends of fuel efficiency, reduced CO2 emissions, and weight reduction. However, the shifting focus towards electric vehicles and the increasing demand for SUVs and luxury cars with high-performance engines restrain the growth of the market.

The Asia-Oceania region, comprising markets such as China, India, and Japan, was estimated to be the largest market, in terms of volume, for automotive balance shafts in 2014. The Asia-Oceania region has emerged as significant market for the global automotive industry.The primary reason behind this trend is the Chinese market, which has evolved into the largest producer and consumer of automobiles across the globe. The other major country-level markets in the region include India, Japan, and South Korea. While India is slowly emerging as a credible force in the automotive industry, Japan and South Korea are already well-established names. The North American market, along with the European market, is estimated to spearhead the automotive industry in terms advancements.

This report classifies and defines the global automotive balance shaft market size, in terms of volume and value. Market size, in terms of volume, is provided in thousand units (000 units) from 2013 to 2020, whereas the market size, by value, has been provided in ($Million). The automotive balance shaft market is dominated by a few global players and several regional players. Key players include SKF Group (U.S), SHW Ag (Germany), Musashi Seimitsu Industry Co. Ltd (Japan), OTICS Co. (Japan), and Metaldyne (U.S.) among others. The report also provides qualitative and competitive intelligence regarding market drivers, restraints, opportunities, and challenges, burning issue and porters five forces analysis prevailing in the automotive balance shaft market.

Global Automotive Balance Shaft System Material Market, 2015-E ($Million)

Source: MarketsandMarkets Analysis

The automotive balance shaft market size is projected to grow at a CAGR of 6.15 % from 2015 to 2020 to reach $9,854.7 Million in 2015.

The balance shaft is a vital component of an internal combustion (IC) engine, and is used to suppress secondary vibrations. Balance shafts are primarily installed in inline-3, inline-4, inline-5, and 90° V6 cylinder IC engines. The application of a balance shaft in an IC engine ensures that uneven forces cannot move the engine in a particular direction.

The global automotive balance shaft market size is projected to reach $13,281.2 Million by 2020. Asia-Oceania is estimated to dominate the market, accounting for a market share of about 57% in 2015. China is the key contributor to the balance shaft market in the Asia-Oceania region. The global demand for automotive balance shafts is propelled by the increasing demand for vehicles equipped with inline-4 cylinder engines and the growing trends of fuel efficiency, reduced CO2 emissions, and weight reduction. Europe is estimated to hold the second position in the market, with a market share, by value, of 19% in 2015. The major contributors to this market are Germany, the U.K., France, and Spain, which all have high vehicle production levels.

The regions covered in the report are Asia-Oceania, Europe, North America, and the rest of the world (RoW), with emphasis on key countries. With regard to the manufacturing process for balance shafts, the market is segmented into forged and cast balance shafts. The automotive balance shaft market is also segmented by vehicle type into passenger car, LCV, and HCV. The global automotive balance shaft market is dominated by major players such as Musashi Seimitsu Industry Co. Ltd (Japan), SKF Group (U.S.), SHW Ag (Germany), OTICS Co. (Japan), and Metaldyne (U.S.)

Automotive Balance Shaft Market Size, by Vehicle Type, 2015 ($Million)

Source: MarketsandMarkets Analysis

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered in the Report

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.3 Data From Secondary Sources

2.4 Primary Data

2.4.1 Sampling Techniques & Data Collection Methods

2.4.2 Primary Participants

2.5 Factor Analysis

2.5.1 Introduction

2.5.2 Demand Side Analysis

2.5.2.1 Impact of Gross Domestic Product (GDP) on Commercial Vehicle Production (CVP)

2.5.2.2 Urbanization vs. Passenger Cars Per 1,000 People

2.5.2.3 Infrastructure: Roadways

2.5.3 Supply Side Analysis

2.5.3.1 Increasing Vehicle Production in Developing Countries

2.5.4 Influence of Other Factors

2.6 Market Size Estimation

2.7 Data Triangualtion

2.8 Assumptions

3 Executive Summary (Page No. - 32)

4 Premium Insights (Page No. - 37)

4.1 Inline-4 Cylinder Engine & Asia-Oceania to Dominate the Balance Shaft Market in 2015

4.2 China & India are Expected to Register the Highest CAGR During the Forecast Period

4.3 Balance Shaft Equipped in Passenger Car Segment Estimated to Dominate L4 Cylinder Engine in 2015

4.4 in 2015, the Forged Balance Shaft Market in Asia-Oceania is Estimated to Account for the Largest Share in the Global Balance Shaft Market

4.5 Attractive Market Opportunities in the Automotive Balance Shaft Market

4.6 Forged Balance Shaft Gaining Popularity in the Balance Shaft Market

4.7 Top 4 Countries to Contribute Around 71.6% of the Automotive Balance Shaft Market Size, in Terms of Value, 20152020

5 Market Overview (Page No. - 43)

5.1 Introduction

5.2 Market Segmentation

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Demand for Vehicles Equipped With Inline-4 Cylinder Engines

5.3.1.2 Need for Reduction in Engine Nvh Levels

5.3.1.3 Growing Trend of Fuel Efficiency, Reduced Co2 Emissions, and Weight

5.3.2 Restraint

5.3.2.1 Shifting Focus Towards Electric Vehicles

5.3.3 Opportunity

5.3.3.1 Sizeable Demand of Automotive Balance Shaft From Brics Nations

5.3.4 Challenges

5.3.4.1 Tedious Replacement Procedure of Balance Shaft

5.3.4.2 Manufacturing Cost-Effective & Long-Lasting Balance Shafts

5.4 Burning Issue

5.4.1 Need for Lightweight Balance Shaft

5.5 Value Chain Analysis

5.6 Porters Five Forces Analysis

5.6.1 Threat of New Entrants

5.6.2 Threat of Substitutes

5.6.3 Bargaining Power of Buyers

5.6.4 Bargaining Power of Suppliers

5.6.5 Intensity of Competitive Rivalry

6 Technology Overview (Page No. - 55)

6.1 Introduction

6.2 Technology Roadmap

6.3 Balance Shaft Drive-Belt, Chain, Gear

6.4 Technological Trends

6.4.1 Light Weight Balance Shaft

6.4.1.1 Use of Roller Bearing: Eliminating the Need for Oil Pump Pressure

6.5 Changing V-Angle in V-6 Engines Eliminate the Need for Balance Shaft

7 Automotive Balance Shaft Market, By Manufacturing Process Type (Page No. - 58)

7.1 Introduction

7.2 Forged Balance Shaft

7.3 Cast Balance Shaft

8 Automotive Balance Shaft Market, By Engine Type (Page No. - 65)

8.1 Introduction

8.2 Automotive Balance Shaft Market, By Engine and Vehicle Type

8.3 Inline-3 Cylinder (L3) Engine

8.4 Inline- 4 Cylinder (L4) Engine

8.5 Inline- 5 Cylinder Engine

8.6 V-6 Engine

9 Regional Analysis (Page No. - 100)

9.1 Introduction

9.2 Pest Analysis

9.2.1 Political Factors

9.2.1.1 Asia-Oceania

9.2.1.2 North America

9.2.1.3 Europe

9.2.1.4 Rest of the World

9.2.2 Economic Factors

9.2.2.1 Asia-Oceania

9.2.2.2 North America

9.2.2.3 Europe

9.2.2.4 Rest of the World

9.2.3 Social Factors

9.2.3.1 Asia-Oceania

9.2.3.2 North America

9.2.3.3 Europe

9.2.3.4 Rest of the World

9.2.4 Technological Factors

9.2.4.1 Asia-Oceania

9.2.4.2 North America

9.2.4.3 Europe

9.2.4.4 Rest of the World

9.3 Automotive Balance Shaft Market, By Region

9.4 Asia-Oceania

9.5 Europe

9.6 North America

9.7 RoW

10 Competitive Landscape (Page No. - 116)

10.1 Overview

10.2 Market Share Analysis, Automotive Balance Shaft Market

10.3 Competitive Situation & Trends

10.4 Battle for Market Share: Expansion the Key Strategy

10.5 Expansions

10.6 Agreements, Partnerships, Collaborations, & Joint Ventures

10.7 Mergers & Acquisitions

10.8 New Product Launches & Developments

11 Company Profiles (Page No. - 124)

11.1 Introduction

11.2 Metaldyne LLC

11.2.1 Business Overview

11.2.2 Product Portfolio

11.2.3 Strategy

11.2.4 Recent Developments

11.2.5 SWOT Analysis

11.2.6 MnM View

11.3 Musashi Seimitsu Industry Co., Ltd.

11.3.1 Business Overview

11.3.2 Product Portfolio

11.3.3 Strategy

11.3.4 Recent Developments

11.3.5 SWOT Analysis

11.3.6 MnM View

11.4 SKF Group

11.4.1 Business Overview

11.4.2 Product Portfolio

11.4.3 Strategy

11.4.4 Recent Developments

11.4.5 SWOT Analysis

11.4.6 MnM View

11.5 Otics Corporation

11.5.1 Business Overview

11.5.2 Product Portfolio

11.5.3 Strategy

11.5.4 SWOT Analysis

11.5.5 MnM View

11.6 SHW AG

11.6.1 Business Overview

11.6.2 Product Portfolio

11.6.3 Strategy

11.6.4 Recent Developments

11.6.5 SWOT Analysis

11.6.6 MnM View

11.7 Sansera Engineering

11.7.1 Business Overview

11.7.2 Product Portfolio

11.7.3 Strategy

11.7.4 Recent Developments

11.8 Mitec-Jebsen Automotive Systems (Dalian) Co. Ltd.

11.8.1 Business Overview

11.8.2 Product Portfolio

11.8.3 Strategy

11.8.4 Recent Developments

11.9 Ningbo Jingda Hardware Manufacture Co., Ltd.

11.9.1 Business Overview

11.9.2 Product Portfolio

11.9.3 Strategy

11.10 Tfo Corporation

11.10.1 Business Overview

11.10.2 Product Portfolio

11.10.3 Strategy

11.11 Engine Power Components, Inc.

11.11.1 Business Overview

11.11.2 Product Portfolio

11.11.3 Strategy

12 Appendix (Page No. - 145)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Introducing RT: Real Time Market Intelligence

12.4 Available Customizations

12.4.1 Regional Analysis

12.4.2 Company Information

12.4.3 Balance Shaft Material Market,By Type

12.5 Related Reports

List of Tables (74 Tables)

Table 1 Noise Limits for Motor Vehicles

Table 2 Increasing Inline-4 Cylinder Engines Production Propelling the Growth of the Balance Shaft Markets

Table 3 Increasing Trend for Electric Vehicles & High-Performance Engines Restraining Growth of the Balance Shaft Market

Table 4 Significant Balance Shaft Demand From BRICS Nations Act as Opportunity for Market Growth

Table 5 Manufacturing of Cost-Effective & Long-Lasting Balance Shafts: A Challenge in the Balance Shaft Market

Table 6 Balance Shaft Requirement for Different Engines

Table 7 Global: Automotive Balance Shaft Market Size, By Manufacturing Process Type, 20132020 (000 Units)

Table 8 Global: Automotive Balance Shaft Market Size, By Manufacturing Process Type, 20132020 ($Million)

Table 9 Automotive Forged Balance Shaft Market Size, By Region, 20132020 (000 Units)

Table 10 Automotive Forged Balance Shaft Market Size, By Region, 20132020 ($Million)

Table 11 Automotive Cast Balance Shaft Market Size, By Region,20132020 (000 Units)

Table 12 Automotive Cast Balance Shaft Market Size, By Region,20132020 ($Million)

Table 13 Global Automotive Balance Shaft Market, By Engine Type, 20132020 (000 Units)

Table 14 Global Automotive Balance Shaft Market, By Engine Type, 20132020 ($Million)

Table 15 Global: Inline-3 Cylinder Engine Balance Shaft Market, By Vehicle Type, 20132020 (000 Units)

Table 16 Global: Inline-3 Cylinder Engine Balance Shaft Market, By Vehicle Type, 20132020 ($Million)

Table 17 Asia-Oceania: Inline-3 Cylinder Engine Balance Shaft Market, By Country & Vehicle Type, 20132020 (000 Units)

Table 18 Asia-Oceania: Inline-3 Cylinder Engine Balance Shaft Market, By Country & Vehicle Type, 20132020 ($ Million)

Table 19 Europe: Inline-3 Cylinder Engine Balance Shaft Market, By Country & Vehicle Type, 20132020 (000 Units)

Table 20 Europe: Inline-3 Cylinder Engine Balance Shaft Market, By Country & Vehicle Type, 20132020 ($ Million)

Table 21 North America: Inline-3 Cylinder Engine Balance Shaft Market, By Country & Vehicle Type, 20132020 (000 Units)

Table 22 North America: Inline-3 Cylinder Engine Balance Shaft Market, By Country & Vehicle Type, 20132020 ($ Million)

Table 23 RoW: Inline-3 Cylinder Engine Balance Shaft Market, By Country& Vehicle Type, 20132020 (000 Units)

Table 24 RoW: Inline-3 Cylinder Engine Balance Shaft Market, By Country& Vehicle Type, 20132020 ($ Million)

Table 25 Global: Inline-4 Cylinder Engine Balance Shaft Market, By Vehicle Type, 20132020 (000 Units)

Table 26 Global: Inline-4 Cylinder Engine Balance Shaft Market, By Vehicle Type, 20132020 ($Million)

Table 27 Asia-Oceania: Inline-4 Cylinder Engine Balance Shaft Market, By Country & Vehicle Type, 20132020 (000 Units)

Table 28 Asia-Oceania: Inline-4 Cylinder Engine Balance Shaft Market, By Country & Vehicle Type, 20132020 ($ Million)

Table 29 Europe: Inline-4 Cylinder Engine Balance Shaft Market, By Country & Vehicle Type, 20132020 (000 Units)

Table 30 Europe: Inline-4 Cylinder Engine Balance Shaft Market, By Country & Vehicle Type, 20132020 ($ Million)

Table 31 North America: Inline-4 Cylinder Engine Balance Shaft Market, By Country & Vehicle Type, 20132020 (000 Units)

Table 32 North America: Inline-4 Cylinder Engine Balance Shaft Market, By Country & Vehicle Type, 20132020 ($ Million)

Table 33 RoW: Inline-4 Cylinder Engine Balance Shaft Market, By Country & Vehicle Type, 20132020 (000 Units)

Table 34 RoW: Inline-4 Cylinder Engine Balance Shaft Market, By Country & Vehicle Type, 20132020 ($ Million)

Table 35 Global: Inline-5 Cylinder Engine Balance Shaft Market, By Vehicle Type, 20132020 (000 Units)

Table 36 Global: Inline-5 Cylinder Engine Balance Shaft Market, By Vehicle Type, 20132020 ($Million)

Table 37 Asia-Oceania: Inline-5 Cylinder Engine Balance Shaft Market, By Country & Vehicle Type, 20132020 (000 Units)

Table 38 Asia-Oceania: Inline-5 Cylinder Engine Balance Shaft Market, By Country & Vehicle Type, 20132020 ($ Million)

Table 39 North America: Inline-5 Cylinder Engine Balance Shaft Market, By Country & Vehicle Type, 20132020 (000 Units)

Table 40 North America: Inline-5 Cylinder Engine Balance Shaft Market, By Country & Vehicle Type, 20132020 ($ Million)

Table 41 RoW: Inline-5 Cylinder Engine Balance Shaft Market, By Country & Vehicle Type, 20132020 (000 Units)

Table 42 RoW: Inline-5 Cylinder Engine Balance Shaft Market, By Country & Vehicle Type, 20132020 ($ Million)

Table 43 Global: V-6 Engine Balance Shaft Market, By Vehicle Type, 20132020 (000 Units)

Table 44 Global: V-6engine Balance Shaft Market, By Vehicle Type, 20132020 ($Million)

Table 45 Asia-Oceania: V-6 Engine Balance Shaft Market, By Country &Vehicle Type, 20132020 (000 Units)

Table 46 Asia-Oceania: V-6 Engine Balance Shaft Market, By Country & Vehicle Type, 20132020 ($ Million)

Table 47 Europe: V-6 Engine Balance Shaft Market, By Country & Vehicle Type, 20132020 (000 Units)

Table 48 Europe: V-6 Engine Balance Shaft Market, By Country & Vehicle Type, 20132020 ($ Million)

Table 49 North America: V-6 Engine Balance Shaft Market, By Country &Vehicle Type, 20132020 (000 Units)

Table 50 North America: V-6 Engine Balance Shaft Market, By Country & Vehicle Type, 20132020 ($ Million)

Table 51 RoW: V-6 Engine Balance Shaft Market, By Country & Vehicle Type, 20132020 (000 Units)

Table 52 RoW: V-6 Engine Balance Shaft Market, By Country & Vehicle Type, 20132020 ($ Million)

Table 53 Global: Automotive Balance Shaft Market, By Region,20132020 (000 Units)

Table 54 Global: Automotive Balance Shaft Market, By Region,20132020 ($ Million)

Table 55 Asia-Oceania: Automotive Balance Shaft Market, By Country, 20132020 (000 Units)

Table 56 Asia-Oceania: Automotive Balance Shaft Market, By Country, 20132020 ($ Million)

Table 57 Asia-0ceania: Automotive Balance Shaft Market, By Vehicle Type, 20132020 (000 Units)

Table 58 Asia-0ceania: Automotive Balance Shaft Market, By Vehicle Type, 20132020 ($Million)

Table 59 Europe: Automotive Balance Shaft Market, By Country,20132020 (000 Units)

Table 60 Europe: Automotive Balance Shaft Market, By Country,20132020 ($ Million)

Table 61 Europe: Automotive Balance Shaft Market, By Vehicle Type, 20132020 (000 Units)

Table 62 Europe: Automotive Balance Shaft Market, By Vehicle Type, 20132020 ($Million)

Table 63 North America: Automotive Balance Shaft Market, By Country, 20132020 (000 Units)

Table 64 North America: Automotive Balance Shaft Market, By Country, 20132020 ($ Million)

Table 65 North America: Automotive Balance Shaft Market, By Vehicle Type, 20132020 (000 Units)

Table 66 North America: Automotive Balance Shaft Market, By Vehicle Type, 20132020 ($Million)

Table 67 RoW: Automotive Balance Shaft Market, By Country,20132020 (000 Units)

Table 68 RoW: Automotive Balance Shaft Market, By Country,20132020 ($ Million)

Table 69 RoW: Automotive Balance Shaft Market, By Vehicle Type, 20132020 (000 Units)

Table 70 RoW: Automotive Balance Shaft Market, By Vehicle Type,20132020 ($Million)

Table 71 Expansions, 2013-2015

Table 72 Agreements, Partnerships, Collaborations, & Joint Ventures,20132014

Table 73 Mergers and Acquisitions, 20112014

Table 74 New Product Launches and Developments, 20132014

List of Figures (54 Figures)

Figure 1 Automotive Balance Shaft Market: Markets Covered

Figure 2 Research Design

Figure 3 Research Methodology Model

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 5 Gross Domestic Product (GDP) vs. Commercial Vehicle Production (CVP)

Figure 6 Urbanization vs. Passenger Cars Per 1,000 People

Figure 7 Impact of Growing Road Network on Passenger Car Sales

Figure 8 Significant Growth in Vehicle Production Across the Globe. 2009-2013

Figure 9 Industry Specific Factor Analysis

Figure 10 Market Size Estimation Methodology (By Engine Type): Bottom-Up Approach

Figure 11 Market Size Estimation Methodology By Manufacturing Process: Bottom-Up Approach

Figure 12 Asia-Oceania: Largest Market for Automotive Balance Shaft Market, 2015

Figure 13 Country-Level Market Snapshot of Asia-Oceania

Figure 14 Passenger Car Segment Dominates the Automotive Balance Shaft Market, 2015 - 2020

Figure 15 Penetration of Balance Shaft Used in Inline-4 Cylinder Engine is Projected to Rise By 2020

Figure 16 Forged Balance Shafts to Account for Over 90% of the European Automotive Balance Shaft Market Size By Volume in 2015

Figure 17 Automotive Balance Shaft Market By Engine Type & Region

Figure 18 Country Wise CAGR of Automotive Balance Shaft Market

Figure 19 Automotive Balance Shaft Market By Vehicle Type

Figure 20 Regional Level Balance Shaft Market, By Manufacturing Process, 2015

Figure 21 China, Russia, India, and Brazil to Offer Lucrative Opportunities

Figure 22 Forged Balance Shaft : to Dominate During the Forecast Period

Figure 23 Automotive Balance Shaft Market By Key Countries, 20152020

Figure 24 Market Segmentation

Figure 25 Automotive Balance Shaft Market Dynamics

Figure 26 Increasing Demand for Inline-4 Cylinder Engines Across the Globe (2015 vs. 2020)

Figure 27 Growth in Electric Vehicle Sales, By Region, 20122014 (000 Units)

Figure 28 BRICS Nations: Vehicle Production (Million Units) vs. GDP ($Trillion), 20092013

Figure 29 Automotive Balance Shaft: Value Chain

Figure 30 Porters Five Forces Analysis

Figure 31 Balance Shaft: Technology Road Map

Figure 32 Global Automotive Balance Shaft Market Snapshot

Figure 33 Asia-Oceania Forged Balance Shaft Market is Expected to Grow at the Highest CAGR From 2015 to 2020

Figure 34 Asia-Oceania to Contribute the Major Market Share in Automotive Cast Balance Shaft Market Across the Globe From 2015 to 2020

Figure 35 Automotive Balance Shaft Market Size in Terms of Value, By Engine Type, 2015

Figure 36 Passenger Car Segment Estimated to Dominate the L4 Engine Balance Shaft Market in 2015

Figure 37 LCV Estimated to Be Fastest Growing Segment in V6 Engine Balance Shaft Market in 2015

Figure 38 Region-Wise Snapshot: China Emerging as A Hotspot for the Automotive Balance Shaft Market (20152020)

Figure 39 Asia-Oceania Market Snapshot (2015): Largest Market for Automotive Balance Shaft

Figure 40 North America Market Snapshot (2015): Rapidly Growing Market for Automotive Balance Shaft

Figure 41 Companies Adopted Expansions as A Key Growth Strategy During the Past Four Years

Figure 42 SHW AG Grew at the Fastest Rate, 20102013

Figure 43 Automotive Balance Shaft Market Share, By Key Player, 2014

Figure 44 Market Evolution Framework

Figure 45 Region-Wise Revenue Mix of Top 3 Market Players

Figure 46 Competitive Benchmarking of Key Market Players (20102013)

Figure 47 Metaldyne LLC: SWOT Analysis

Figure 48 Musashi Seimitsu Industry Co., Ltd.: Company Snapshot

Figure 49 Musashi Seimitsu Industry Co., Ltd.: SWOT Analysis

Figure 50 SKF Group: Company Snapshot

Figure 51 SKF Group: SWOT Analysis

Figure 52 Otics Corporation: SWOT Analysis

Figure 53 SHW AG : Company Snapshot

Figure 54 SHW AG: SWOT Analysis

Growth opportunities and latent adjacency in Balance Shaft Market