Automotive Augmented Reality Market Size, Share & Trends by Function (AR HUD Navigation, AR HUD ACC, AR HUD LDW & Advanced AR HUD), Sensor Technology, Display Technology, Level of Autonomous Driving, Electric Vehicle, Vehicle Type, and Region - Global Forecast to 2030

The global automotive augmented reality market size was valued at USD 5 billion in 2024 and is expected to reach USD 15 billion by 2030 at a CAGR of 20.09 % during the forecast period 2024-2030.

The automotive augmented reality market for augmented reality automotive applications is primarily driven by the increase in adoption of advanced driving assistance systems by OEMs across different vehicle types and consumer demand for in-vehicle safety features that potentially reduce collisions and injuries caused by human-driver errors. Additionally, the market is also influenced by the increasing level of driving automation and progress toward fully autonomous vehicles.

Market Dynamics

Drivers: Enhanced Driving Safety and Assistance

The need for improved driving safety and support systems is a major factor driving the automotive augmented reality market. With the help of AR technology, drivers may see vital information about navigation, dangers, and vehicle performance while keeping their eyes on the road thanks to real-time information overlays on the windscreen or head-up display (HUD). In addition to lowering distractions, this technology offers early alerts of possible crashes, lane changes, and even pedestrian crossings. In order to satisfy consumer demand for more intelligent, interactive driving experiences, manufacturers are investing in augmented reality (AR) systems with an emphasis on enhancing road safety. Thus, by providing features that make driving safer and easier, the integration of AR is revolutionising the automobile industry, which is a major factor propelling the growth of the AR automobile Market.

Restraints: High Implementation Costs

The expensive expense of installing augmented reality (AR) technology in cars is one of the main factors holding back the automotive augmented reality market. Advanced head-up displays and in-car holographic navigation are examples of AR technologies that require complex hardware and software to integrate, which can raise automakers' production costs considerably. Furthermore, these expenses are increased by the requirement for specialised sensors, cameras, and projectors, which makes AR features more practical for luxury and premium car sectors than for mass-market automobiles. Since many customers could be hesitant to pay more for these features, particularly in price-sensitive markets, this cost barrier may prevent AR from being widely adopted in the car sector. As a result, even if AR has many advantages, the high implementation costs provide a major obstacle to the market's expansion in the AR automotive space.

Opportunities: Growing Demand for Connected and Autonomous Vehicles

The growing need for connected and driverless cars is expected to help the automotive augmented reality market since AR technology is essential to improving the performance of these cutting-edge automobiles. By projecting turn-by-turn directions and traffic alerts straight onto the windscreen, augmented reality (AR) can enhance navigation in connected cars, giving drivers a smooth and simple experience. By showing details about the environment, nearby landmarks, and real-time updates on the vehicle's autonomous capabilities, augmented reality (AR) can improve the passenger experience in autonomous vehicles. AR systems have a growing chance to become crucial parts of cars as the automotive industry continues its transition to completely autonomous driving and integrated connection. As automakers look to differentiate their vehicles with cutting-edge, immersive technologies that improve the driving and riding experience, this trend offers the AR automotive market enormous development potential.

Challenges: Limited Infrastructure and Technological Compatibility

The limited infrastructure and technological compatibility needed to support augmented reality (AR) capabilities in vehicles is a major obstacle facing the automotive augmented reality market. High-speed internet, sophisticated GPS, and real-time data streams are frequently necessary for the successful integration of augmented reality in automobiles, but these resources are not always available, particularly in rural or underdeveloped areas. Furthermore, AR systems need to work in unison with other car systems and sensors, which calls for sophisticated hardware and software solutions that might be difficult to create and maintain. Variability in vehicle models and technology standards across different automakers further complicates compatibility. As a result, overcoming infrastructure limitations and ensuring seamless integration across diverse platforms are critical challenges for AR adoption in the automotive industry, potentially slowing the pace of market growth.

Objectives of the Report.

- To define, describe, and project the automotive augmented reality market (2018–2025), in terms of volume (‘000 units) and value (USD million/billion)

- To provide detailed information regarding the major factors such as drivers, restraints, opportunities, and industry-specific challenges influencing the growth of the market

- To analyze and forecast the market and forecast the market size, by volume and value, based on function, sensor technology, display technology, electric vehicle, level of autonomous driving, vehicle type, and region

- To forecast the market size, by volume and value, of the market for four regions, namely, North America, Europe, Asia-Oceania, and the Rest of the World (RoW)

- To track and analyze competitive developments such as joint ventures, mergers & acquisitions, new product development, and expansions in the market

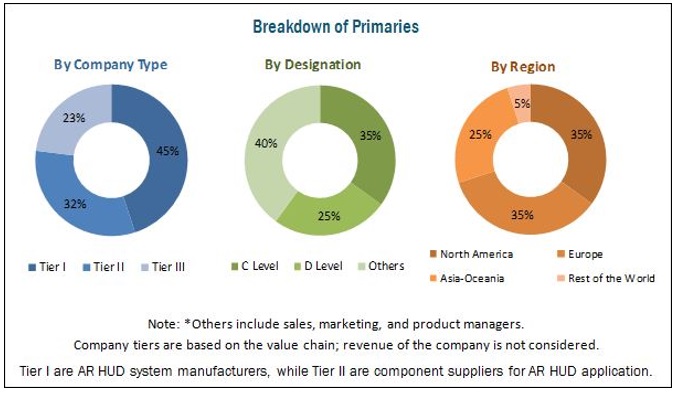

The research methodology used in the report involves primary and secondary sources and follows bottom-up and top-down approaches for data triangulation. The study involves country-level OEM and model-wise analysis of augmented reality automotive head-up displays. This analysis involves historical trends as well as existing penetrations by country as well as vehicle type. The analysis is projected based on various factors such as growth trends in vehicle production and regulations or mandates on the implementation of automotive electronics that drive the augmented reality head-up display (AR HUD) system. The analysis has been discussed and validated by primary respondents, which include experts from the augmented reality automotive industry, manufacturers, and suppliers. Secondary sources include associations such as International Organization of Motor Vehicle Manufacturers (OICA), American Association of Motor Vehicle Administrators (AAMVA), Automotive Component Manufacturers Association of India (ACMA), and paid databases and directories such as Factiva and Bloomberg.

Key Players

The report analyses all major players in the automotive AR HUD system providers such as Continental AG (Germany), Visteon Corporation (U.S.), and Panasonic Corporation (Japan) among others. The AR HUD systems are supplied to automotive OEMs such as BMW Group (Germany), Daimler AG (Germany), Volkswagen AG (Germany), and others.

Report Details:

|

Report Metrics |

Details |

|

Base year for estimation |

2023 |

|

Forecast period |

2024 – 2030 |

|

Market Growth forecast |

USD 15 billion by 2030 at a CAGR of 20.09 % |

|

Top Players |

Continental AG (Germany), Visteon Corporation (U.S.), and Panasonic Corporation (Japan) among others. The AR HUD systems are supplied to automotive OEMs such as BMW Group (Germany), Daimler AG (Germany), Volkswagen AG (Germany). |

|

Largest Market |

North America |

|

Segments covered |

|

|

Function |

AR HUD Navigation, AR HUD ACC, AR HUD LDW & Advanced AR HUD |

|

Technology |

Sensor Technology, Display Technology, Level of Autonomous Driving, Electric Vehicle |

|

Geographies covered |

North America, Asia Pacific, Europe, and Rest of the World. |

|

Additional Customization to be offered |

Detailed analysis and profiles of additional market players. |

Major Market Developments

- In 2021, BMW unveiled its AR navigation system in the BMW iX, allowing drivers to see real-time navigation instructions overlaid on the vehicle's windshield, enhancing the driving experience with intuitive guidance.

- In 2022, Toyota collaborated with Denso to integrate AR technology into its vehicle maintenance systems, providing technicians with visual instructions and diagnostics directly overlaid on the vehicle's components during servicing.

- In 2023, Volkswagen announced plans to implement AR features in its next-generation vehicles, focusing on driver assistance and safety, which include projected alerts and hazard warnings displayed on the windshield.

Target Audience

- Automotive AR HUD system manufacturers and component suppliers

- Automotive display panel manufacturers

- Automotive OEMs

- Industry associations and other driver assistance systems manufacturers

- The automobile industry and related end-user industries

Report Scope:

By Function

By Sensor Technology

By Display Technology

By Electric Vehicle

By Level of Autonomous Driving

Vehicle Type

By Region

- Standard AR HUD

- AR HUD based Navigation

- AR HUD based Adaptive Cruise Control

- AR HUD based Lane Departure Warning

- Radar

- LiDar

- CCD/CMOS Image Sensor

- Sensor Fusion

- TFT-LCD

- Other Advanced Technologies

- Battery Electric Vehicle

- Others (Hybrid)

- Conventional

- Semi-autonomous

- Passenger Cars

- Commercial Vehicles

- Asia-Oceania (China, Japan, India, and South Korea)

- Europe (Germany, France, Italy, and the U.K.)

- North America (Canada, Mexico, and the U.S.)

- Rest of the World (Brazil, Russia, and South Africa)

Augmented reality (AR) applications in the automotive sector, specifically in primary and secondary processes, are significant drivers of growth in the automotive augmented reality market.

Primary Process

Advanced driver assistance systems (ADAS), virtual maintenance tools, and improved navigation systems are some of the key uses of augmented reality. These augmented reality (AR) solutions increase productivity and decrease errors in vehicle operation and maintenance by improving safety features, enhancing the accuracy of information shown to drivers, and offering immersive experiences for users.

Secondary Process

AR is used for marketing presentations, design visualisation, and training in the secondary application category. These apps improve teamwork, improve the design process, and increase customer involvement by streamlining procedures in the automotive manufacturing and sales industries. It is anticipated that AR technology's contribution to fostering creativity and productivity will increase dramatically as it develops and becomes more integrated into other facets of the automotive sector.

Frequently Asked Questions (FAQ):

What are Augmented Reality Solutions used for?

Augmented reality (AR) solutions in the automotive market are used for applications such as virtual maintenance assistance, advanced driver assistance systems (ADAS), and immersive training simulations, enhancing safety, efficiency, and user experience throughout the vehicle lifecycle.

What is the current size of the automotive augmented reality market?

The current size of the automotive robotics market is estimated at USD 5 billion in 2024

Which region will have the largest market in the automotive augmented reality market?

The North America region is set to be a major player in the augmented reality (AR) automotive market, driven by leading automotive manufacturers and significant investments in AR technology to enhance user experience and safety features.

Who are the winners in the automotive augmented reality market?

Major players in the in the automotive AR HUD system providers such as Continental AG (Germany), Visteon Corporation (U.S.), and Panasonic Corporation (Japan) among others. The AR HUD systems are supplied to automotive OEMs such as BMW Group (Germany), Daimler AG (Germany), Volkswagen AG (Germany), and others.

How is AI impacting augmented reality in automotive?

By enabling more intelligent, context-aware applications that enhance user experience, such personalised navigation and real-time data overlays, artificial intelligence (AI) is boosting augmented reality (AR) in the automotive industry. Furthermore, AI-driven data facilitate improved training initiatives and maintenance solutions, enabling safer and more effective operations. .

Growth opportunities and latent adjacency in Automotive Augmented Reality Market