Automated Feeding Systems Market by Livestock (Ruminants, Swine, Poultry), Function (Controlling, Mixing, Filling and Screening), Offering, Technology, Integration, Type, and Region (North America, Europe, Asia Pacific, Row) - Global Forecast to 2023

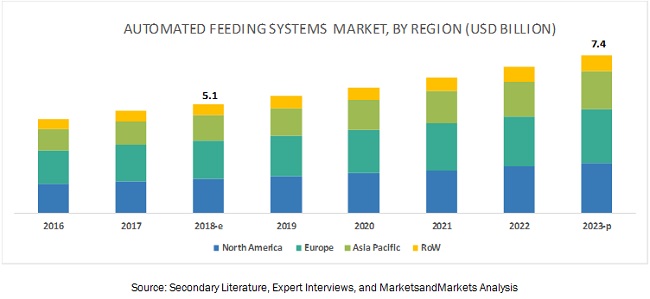

[149 Pages Report] The automated feeding systems market is estimated to account for about USD 5.1 billion in 2018 and is projected to reach a value of about USD 7.4 billion by 2023, at a CAGR of 7.6%. The growing size of dairy farms, the increasing focus of major companies on technological advancements as well as product launches and developments, and substantial cost savings associated with automated feeding systems are the major driving factors for the market. On the other hand, the high upfront cost is a restraining factor for the automated feeding systems market.

The ruminants segment is estimated to dominate the global automated feeding systems market in 2018

By livestock, the ruminant segment is estimated to dominate the global market for automated feeding systems in 2018. Hardware and software solutions enable automatic feeding, resulting in accurate and rapid livestock feeding management. The labor cost associated with feeding management reduces drastically due to higher automation and fewer labor requirements. Due to these advantages, the market for automated feeding systems for ruminants is projected to grow significantly during the forecast period.

The filling & screening segment is estimated to account for the largest share in the automated feeding systems market in 2018.

By function, the filling & screening segment is estimated to account for the largest share in the market for automated feeding systems in 2018. The belt feeders combine a conveyor belt and sliding scraper. This allows the distribution of small amounts of raw feed at short intervals to various groups of animals. This automated filling & screening process in feeding offers consistently high reliability and a reduced daily workload.

The services segment is estimated to grow at the highest CAGR during the forecast period in the automated feeding systems market.

Various services are used to integrate hardware and software in automated feeding systems. Service providers are engaged in handling a majority of operations related to hardware installation, software functioning, and output analysis pertaining to precision farming solutions.

The Asia Pacific market is projected to grow at the highest CAGR during the forecast period.

The growth of the Asia Pacific automated feeding systems market is attributed to the increasing awareness among consumers regarding the importance of automated feeding systems. Further, with rapid economic growth in the region, the demand for meat is rising particularly in China, India, Japan, and Australia. This increased demand for meat products has driven the meat production in this region, which in turn, has contributed to the market growth.

Key Market Players

The key players in this market include GEA (Germany), DeLaval (Sweden), Trioliet (Netherlands), Fullwood Packo (UK), AfiMilk (Israel), Lely Holding (Netherlands), VDL Agrotech (Netherlands), Sum-it Computer (UK), Boumatic LLC (US), Pellon Group Oy (Finland), Davisway (Australia), and Dairymaster (US). These players are focusing on improving their presence through undertaking acquisitions, expansions, and developing products specific to the requirements of consumers and their preferences in these regions. These companies have a strong presence in Europe and North America. They have also set up manufacturing facilities in various regions and have strong distribution networks.

Recent Developments:

- In September 2018, Trioliet launched a new addition of mixer feeder, Solomix 3, for large livestock. With the launch of new feeding equipment, the company is focusing on capturing large European cattle farms to expand their business.

- In November 2018, VDL Agrotech acquired Siemens Hengelo (Netherlands), which helps in expanding VDL Agrotech’s business and product offerings.

- In November 2018, DeLaval Corp. announced a partnership with CEJA (European Council of Young Farmers Home) to help farmers in the European Union for better sustainability in the long-term process of farming.

- In March 2017, Trioliet launched a heavy-duty mixer feeder, Solomix P3 4000L ZKX-TR, with a straw blower. This mixer feeder has three vertical mixing augers and helps in increasing farm productivity.

- In November 2018, Afimilk launched AfiFarm 5.3—a new market-leading product line of dairy management software, and Afi2Go Pro—a mobile app designed to provide the management teams with flexibility for optimization of herds and their productivity.

- In September 2018, Afimilk and Fullwood Packo Group (UK), entered into a long-term strategic partnership agreement for the development and manufacturing of industrial automated dairy farming systems.

Key Questions addressed by the report:

- What are the new trending technologies, which the automated feeding systems companies are exploring?

- Which are the key players in the market and how intense is the competition?

- What are the upcoming growth trends, which the automated feeding systems manufacturers are focusing on in the future?

- What are the high growth opportunities in the automated feeding systems market in each segment?

- What are the key growth strategies adopted by major market players in the automated feeding systems market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.4 Periodization Considered

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Key Industry Insights

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Research Assumptions & Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 34)

4.1 Attractive Growth Opportunities in the Automated Feeding Systems Market

4.2 Europe: Automated Feeding Systems Market, By Livestock and Country

4.3 Automated Feeding Systems Market, By Integration, 2018 vs 2023

4.4 Automated Feeding Systems Market, By Type

4.5 Automated Feeding Systems Market, By Region

5 Market Overview (Page No. - 38)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Size of Dairy Farms

5.2.1.2 Increasing Focus of Major Companies on Technological Advancements and New Product Launches and Developments for Livestock Management

5.2.1.3 Increasing Consumption of Meat and Dairy Products

5.2.2 Restraints

5.2.2.1 Affordability of High Setup Cost By Dairy Farmers

5.2.3 Opportunities

5.2.3.1 Significant Growth Opportunities for Automated Feeding Systems in Developing Countries

5.2.3.2 Rising Demand for Livestock Monitoring Services in Automated Feeding Systems

5.2.4 Challenges

5.2.4.1 Lack of Standardization of Automated Feeding Systems

6 Automated Feeding System Market, By Function (Page No. - 42)

6.1 Introduction

6.2 Controlling

6.2.1 Controllers Witness an Increasing Use as They Accurately Weigh the Feed and Maintain Proper Feed Intake

6.3 Mixing

6.3.1 Automated Feed Mixing Equipment Helps in the Proper Mixing of Feed to Meet the Nutritional Requirements of the Livestock

6.4 Filling and Screening

6.4.1 The Filling & Screening Segment Dominated the Automated Feeding System Market During the Forecast Period

6.5 Others

7 Automated Feeding Systems Market, By Livestock (Page No. - 48)

7.1 Introduction

7.2 Ruminants

7.2.1 The Ruminants Segment is Projected to Dominate the Automated Feeding Systems Market, Registering the Highest Growth Rate During the Forecast Period

7.3 Swine

7.3.1 The Adoption of Measures to Ensure the Production of Superior-Quality Pork in the Asia Pacific Region is to Drive the Market

7.4 Poultry

7.4.1 Growth in Demand for Poultry Feeding Systems has Increased, as They are Equipped With Innovative Technologies for Reducing Labor Costs

7.5 Others

8 Automated Feeding Systems Market, By Offering (Page No. - 55)

8.1 Introduction

8.2 Hardware

8.2.1 Hardware Systems Dominated the Automated Feeding Systems Market

8.3 Software

8.3.1 Software Systems Reduce Operational Errors, Resulting in A Higher Production Rate

8.4 Services

8.4.1 The Services Segment is Estimated to Grow at the Highest CAGR During the Projected

9 Automated Feeding Systems Market, By Technology (Page No. - 60)

9.1 Introduction

9.2 Guidance and Remote Sensing Technology

9.2.1 Guidance and Remote-Sensing Technology is Widely Preferred as One of the Important Tools in Feeding Systems, as It Helps in Livestock Diet Optimization

9.3 Robotics and Telemetry

9.3.1 The Reduction in Labor Demand and an Increase in Cows’ Feeding Activity Due to Automation are the Key Driving Factors for the Rise in Demand for Robotic & Telemetry Technologies in the Market

9.4 Rfid Technology

9.4.1 The Technology Provides Alternatives to Barcode Identification for Better and Effective Feeding of Livestock and is Responsible for the Rise in Demand in the European Region

9.5 Others

10 Automated Feeding Systems Market, By Type (Page No. - 66)

10.1 Introduction

10.2 Rail-Guided Feeding Systems

10.2.1 Rail-Guided Feeding Systems Dominated the Automated Feeding Systems Market

10.3 Conveyor Feeding Systems

10.3.1 Conveyor Feeding Systems are Inexpensive and Require Less Maintenance

10.3.2 Belt Feeding Systems

10.3.3 Pan Feeding Systems

10.3.4 Chain Feeding Systems

10.4 Self-Propelled Feeding Systems

10.4.1 The Market for Self-Propelled Feeding Systems is Projected to Grow at the Highest CAGR During the Forecast Period

11 Automated Feeding Systems Market, By Integration (Page No. - 71)

11.1 Introduction

11.2 Integrated Automated Feeding Systems

11.2.1 With the Rising Demand for Dairy Products, Globally, Dairy Farms are Adopting Integrated Automated Feeding Systems to Maximize Their Productivity

11.3 Non-Integrated Automated Feeding Systems

11.3.1 The Non-Integrated Systems Particularly Function as Independent System, Thereby Reducing the Cost of the Overall Automation of the Feeding Systems for Smaller Farms

12 Automated Feeding Systems Market, By Region (Page No. - 75)

12.1 Introduction

12.2 North America

12.2.1 US

12.2.1.1 High Awareness Related to the Efficient Use of Controlling Feeding Systems Drives the Market in the Us

12.2.2 Canada

12.2.2.1 The Increase in Large Farms, Along With Food Safety of Meat Products in the Country, is Driving the Growth of the Automated Feeding Systems Market

12.2.3 Mexico

12.2.3.1 The Key Factor Responsible for Market Growth in Mexico is the Increasing Awareness Among Farmers About Various Advantages Associated With the Automation of Feeding on Livestock Farms

12.3 Europe

12.3.1 Germany

12.3.1.1 Significant Growth in the Feed Industry is Expected in This Region, as the Private Sector is Proving to Be More Efficient Than the Public Sector, in Terms of Providing Automated Feeding Systems Among Farmers

12.3.2 UK

12.3.2.1 Presence of Major Players in the Region is A Key Driving Factor for Automated Feeding Systems in the Uk

12.3.3 Italy

12.3.3.1 Italian Automated Feeding Systems Market is A High-Growth-Potential Market, as the Livestock Production in the Country is Also Growing With the Increasing Demand for Meat

12.3.4 France

12.3.4.1 Developments in Automated Feed Technology, Marketing Innovations, and Export of Innovative Feeding Systems Have Contributed to the Country’s Increasing Demand for Automated Feeding Systems

12.3.5 Spain

12.3.5.1 Spain is an Emerging Market for Automated Feeding Systems, With the Increasing Preference for Meat & Dairy Products Boosting the Feed Market in the Country

12.3.6 Rest of Europe

12.4 Asia Pacific

12.4.1 China

12.4.1.1 Urbanization has Increased the Demand for Livestock, Leading to an Increase in Automated Feeding Among Farm Owners and Farmers in the Market

12.4.2 India

12.4.2.1 The Increasing Investment in the Indian Market on Automated Feeding Systems is Because It Helps to Provide Feed to Animals on Time and in Precise Intervals and Quantities

12.4.3 Japan

12.4.3.1 The Japanese Market for Automated Feeding Systems is Witnessing A Tremendous Surge Due to Extensive Demand for Meat and Poultry Products in the Domestic Market

12.4.4 Australia & New Zealand

12.4.4.1 The Demand for Pork, Beef, and Poultry Products has Gained Rapid Momentum in Australia & New Zealand, Encouraging Farmers to Use Automated Feeding Systems

12.4.5 Rest of Asia Pacific

12.5 Rest of the World (RoW)

12.5.1 South America

12.5.1.1 The Increasing Demand for High Quality Dairy Products and Meat in the Region has Resulted in Promoting the Growth of Automated Feeding Systems in the Region

12.5.2 The Middle East

12.5.2.1 The Increase in the Number of Livestock and Dairy Farms is Propelling the Demand for the Automated Feeding Systems in the Middle East

12.5.3 Africa

12.5.3.1 The Farmers in Africa Have Been Adopting Automated Feeding Systems in Order to Meet the Consumer Demand for Meat Products

13 Competitive Landscape (Page No. - 110)

13.1 Overview

13.2 Market Ranking

13.2.1 Key Market Strategies

13.3 Competitive Scenario

13.3.1 Expansions

13.3.2 Acquisitions

13.3.3 New Product Launches

13.3.4 Partnerships & Mergers

14 Company Profiles (Page No. - 117)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

14.1 GEA

14.2 Delaval

14.3 Boumatic LLC

14.4 Fullwood Packo

14.5 Trioliet

14.6 Afimilk

14.7 Lely Holding

14.8 Sum-It Computer Systems

14.9 VDL Agrotech

14.10 Pellon Group Oy

14.11 Dairy Master

14.12 Davisway

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 143)

15.1 Discussion Guide

15.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

15.3 Available Customizations

15.4 Related Reports

15.5 Author Details

List of Tables (79 Tables)

Table 1 Automated Feeding Systems Market Snapshot (Value), 2018 vs 2023

Table 2 Automated Feeding Systems Market Size, By Function, 2016–2023 (USD Million)

Table 3 Controlling Market Size, By Region, 2016–2023 (USD Million)

Table 4 Mixing System Market Size, By Region, 2016–2023 (USD Million)

Table 5 Filling and Screening System Market Size, By Region, 2016–2023 (USD Million)

Table 6 Others Market Size, By Region, 2016–2023 (USD Million)

Table 7 Automated Feeding Systems Market Size, By Livestock, 2016–2023 (USD Million)

Table 8 Automated Feeding Systems Market Size, for Ruminants, 2016–2023 (USD Million)

Table 9 Automated Feeding Systems Market Size, for Swine, 2016–2023 (USD Million)

Table 10 Automated Feeding Systems Market Size, for Poultry, 2016–2023 (USD Million)

Table 11 Automated Feeding Systems Market Size, By Others, 2016–2023 (USD Million)

Table 12 Automated Feeding Systems Market Size, By Offering, 2016–2023 (USD Million)

Table 13 Automated Feeding Systems Market Size for Hardware, By Region, 2016–2023 (USD Million)

Table 14 Automated Feeding Systems Market Size for Software, By Region, 2016–2023 (USD Million)

Table 15 Automated Feeding Systems Market Size for Services, By Region, 2016–2023 (USD Million)

Table 16 Automated Feeding Systems Market Size, By Technology, 2016–2023 (USD Million)

Table 17 Automated Feeding Systems: Guidance and Remote Sensing Technology Market Size, By Region, 2016–2023 (USD Million)

Table 18 Automated Feeding Systems: Robotics and Telemetry Technology Market Size, By Region, 2016–2023 (USD Million)

Table 19 Automated Feeding Systems: Rfid Technology Market Size, By Region, 2016–2023 (USD Million)

Table 20 Automated Feeding Systems: Others Market Size, By Region, 2016–2023 (USD Million)

Table 21 Automated Feeding Systems Market Size, By Type, 2016–2023 (USD Million)

Table 22 Automated Feeding Systems Market: Rail-Guided Feeding Systems Market Size, By Region, 2016–2023 (USD Million)

Table 23 Automated Feeding Systems Market: Conveyor Feeding Systems Market Size, By Region, 2016–2023 (USD Million)

Table 24 Automated Feeding Systems Market: Self-Propelled Feeding Systems Market Size, By Region, 2016–2023 (USD Million)

Table 25 Automated Feeding Systems Market Size, By Integration, 2016–2023 (USD Million)

Table 26 Integrated Automated Feeding Systems Market Size, By Region, 2016–2023 (USD Million)

Table 27 Non-Integrated Automated Feeding Systems Market Size, By Region, 2016–2023 (USD Million)

Table 28 Automated Feeding Systems Market Size, By Region, 2016–2023 (USD Million)

Table 29 North America: Automated Feeding Systems Market Size, 2016–2023 (USD Million)

Table 30 North America: Automated Feeding Systems Market Size, By Function, 2016–2023 (USD Million)

Table 31 North America: Automated Feeding Systems Market Size, By Livestock, 2016–2023 (USD Million)

Table 32 North America: Automated Feeding Systems Market Size, By Offering, 2016–2023 (USD Million)

Table 33 North America: Automated Feeding Systems Market Size, By Technology, 2016–2023 (USD Million)

Table 34 North America: Automated Feeding Systems Market Size, By Integration, 2016–2023 (USD Million)

Table 35 North America: Automated Feeding Systems Market Size, By System, 2016–2023 (USD Million)

Table 36 US: Automated Feeding Systems Market Size, By Function , 2016–2023 (USD Million)

Table 37 Canada: Automated Feeding Systems Market Size, By Function, 2016–2023 (USD Million)

Table 38 Mexico: Automated Feeding Systems Market Size, By Function, 2016–2023 (USD Million)

Table 39 Europe: Automated Feeding Systems Market Size, 2016–2023 (USD Million)

Table 40 Europe: Automated Feeding Systems Market Size, By Function, 2016–2023 (USD Million)

Table 41 Europe: Automated Feeding Systems Market Size, By Livestock, 2016–2023 (USD Million)

Table 42 Europe: Automated Feeding Systems Market Size, By Offering, 2016–2023 (USD Million)

Table 43 Europe: Automated Feeding Systems Market Size, By Technology, 2016–2023 (USD Million)

Table 44 Europe: Automated Feeding Systems Market Size, By Type, 2016–2023 (USD Million)

Table 45 Europe: Automated Feeding Systems Market Size, By Integration, 2016–2023 (USD Million)

Table 46 Germany: Automated Feeding Systems Market Size, By Function, 2016–2023 (USD Million)

Table 47 UK: Number of Dairy Farms and Cattle, 2012–2016

Table 48 UK: Automated Feeding Systems Market Size, By Function, 2016–2023 (USD Million)

Table 49 Italy: Automated Feeding Systems Market Size, By Function, 2016–2023 (USD Million)

Table 50 France: Automated Feeding Systems Market Size, By Function, 2016–2023 (USD Million)

Table 51 Spain: Automated Feeding Systems Market Size, By Function, 2016–2023 (USD Million)

Table 52 Rest of Europe: Automated Feeding Systems Market Size, By Function, 2016–2023 (USD Million)

Table 53 Asia Pacific: Automated Feeding Systems Market Size, By Country/Region, 2016–2023 (USD Million)

Table 54 Asia Pacific: Automated Feeding Systems Market Size, By Function, 2016–2023 (USD Million)

Table 55 Asia Pacific: Automated Feeding Systems Market Size, By Livestock, 2016–2023 (USD Million)

Table 56 Asia Pacific: Automated Feeding Systems Market Size, By Offering, 2016–2023 (USD Million)

Table 57 Asia Pacific: Automated Feeding Systems Market Size, By Technology, 2016–2023 (USD Million)

Table 58 Asia Pacific: Automated Feeding Systems Market Size, By Type, 2016–2023 (USD Million)

Table 59 Asia Pacific: Automated Feeding Systems Market Size, By Integration, 2016–2023 (USD Million)

Table 60 China: Automated Feeding Systems Market Size, By Function, 2016–2023 (USD Million)

Table 61 India: Automated Feeding Systems Market Size, By Function, 2016–2023 (USD Million)

Table 62 Japan: Automated Feeding Systems Market Size, By Function, 2016–2023 (USD Million)

Table 63 Australia & New Zealand: Automated Feeding Systems Market Size, By Function, 2016–2023 (USD Million)

Table 64 Rest of Asia Pacific: Automated Feeding Systems Market Size, By Function, 2016–2023 (USD Million)

Table 65 RoW: Automated Feeding Systems Market Size, By Region, 2016–2023 (USD Million)

Table 66 RoW: Automated Feeding Systems Market Size, By Function, 2016–2023 (USD Million)

Table 67 RoW: Automated Feeding Systems Market Size, By Livestock, 2016–2023 (USD Million)

Table 68 RoW: Automated Feeding Systems Market Size, By Offering, 2016–2023 (USD Million)

Table 69 RoW: Automated Feeding Systems Market Size, By Technology, 2016–2023 (USD Million)

Table 70 RoW: Automated Feeding Systems Market Size, By Integration, 2016–2023 (USD Million)

Table 71 RoW: Automated Feeding Systems Market Size, By Type, 2016–2023 (USD Million)

Table 72 South America: Automated Feeding Systems Market Size, By Function, 2016–2023 (USD Million)

Table 73 The Middle East: Automated Feeding Systems Market Size, By Function, 2016–2023 (USD Million)

Table 74 Africa: Automated Feeding Systems Market Size, By Function, 2016–2023 (USD Million)

Table 75 Top Five Companies in the Automated Feeding System Market, 2017

Table 76 Expansions, 2014–2018

Table 77 Acquisitions, 2014–2018

Table 78 New Product Launches, 2014–2018

Table 79 Partnerships & Mergers, 2014–2018

List of Figures (33 Figures)

Figure 1 Automated Feeding Systems Market Segmentation

Figure 2 Automated Feeding Systems Market: Regional Scope

Figure 3 Automated Feeding Systems Market: Research Design

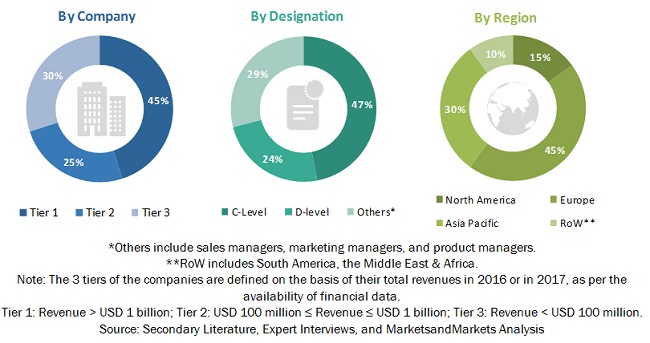

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 5 Market Size Estimation: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Data Triangulation

Figure 8 Automated Feeding Systems Market Size, By Livestock, 2018 vs 2023 (USD Million)

Figure 9 Automated Feeding Systems Market Size, By Type, 2018 vs 2023 (USD Million)

Figure 10 Automated Feeding Systems Market Size, By Offering, 2018 vs 2023 (USD Million)

Figure 11 Automated Feeding Systems Market Share (Value), By Function, 2018

Figure 12 Automated Feeding Systems Market Share (Value), By Region, 2017

Figure 13 Emerging Economies Offer Attractive Opportunities in the Automated Feeding Systems Market, Globally

Figure 14 Ruminants Segment Was Dominant, in Terms of Livestock, in the European Automated Feeding Systems Market

Figure 15 Non-Integrated Segment to Dominate the Market During the Forecast Period

Figure 16 Rail-Guided Feeding Systems Segment to Dominate the Market From 2018 to 2023

Figure 17 US Accounted for the Largest Share of the Global Automated Feeding Systems Market in 2017

Figure 18 Automated Feeding Systems Market Dynamics

Figure 19 World Cattle Production, 2008–2016 (Million)

Figure 20 Production of Meat (Chicken): Top 10 Producers, 2016 (Million Tonnes)

Figure 21 Filling and Screening Segment is Projected to Dominate the Market Throughout 2023

Figure 22 Ruminants Segment is Projected to Dominate the Market Throughout the Forecast Period

Figure 23 Automated Feeding Systems Market Size, By Offering, 2018 vs 2023 (USD Million)

Figure 24 Automated Feeding Systems Market Size, By Type, 2018 vs 2023 (USD Million)

Figure 25 Automated Feeding Systems Market Size, By Integration, 2018 vs 2023 (USD Million)

Figure 26 Automated Feeding Systems Market Size, 2018 vs 2023, By Region, (USD Million)

Figure 27 North America: Market Snapshot

Figure 28 Europe: Market Snapshot

Figure 29 Asia Pacific Regional Snapshot

Figure 30 Key Developments of the Leading Players in the Automated Feeding Systems Market, 2014–2018

Figure 31 Automated Feeding Systems Market Developments, By Growth Strategy, 2014–2018

Figure 32 GEA: Company Snapshot

Figure 33 Delaval: Company Snapshot

The study involves four major activities to estimate the current market size for automated feeding systems. Exhaustive secondary research was done to collect information on the market as well as its peer and parent markets. The findings, assumptions, and market size were validated with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, so as to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, trade directories, and databases.

Primary Research

The automated feeding systems market comprises several stakeholders such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand-side of this market is characterized by the rising demand for automated feeding equipment. The supply-side is characterized by advancements in the feeding equipment technology. Various primary sources from both, the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

The following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both, the top-down and bottom-up approaches were used to estimate and validate the total size of the automated feeding systems market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology was used to estimate the market size, which includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value and volume, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and to arrive at the exact statistics for each market segment and subsegment, data triangulation and market breakdown procedures were employed. The data was triangulated by studying various factors and trends from both, the demand and supply sides in the feed industry.

Report Objectives

- To define, segment, and project the global market size for automated feeding systems products

- To understand the structure of the automated feeding systems market by identifying its various subsegments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the micromarkets; with respect to individual growth trends, future prospects, and their contribution to the total market

- To project the size of the market and its submarkets, in terms of value, with respect to the four regions (along with their respective key countries)

- To profile the key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify the major growth strategies adopted by players across key regions

- To analyze competitive developments such as expansions & investments, new product launches, mergers & acquisitions, joint ventures, and agreements

Scope of the report

|

Report Metric |

Details |

|

Years considered for the study |

2016-2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018-2023 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Type, Function, Livestock, Offering, Technology, System, and Region |

|

Geographies covered |

North America, APAC, Europe, and Rest of the World |

|

Companies covered |

GEA (Germany), DeLaval (Sweden), Boumatic LLC (US), Fullwood Packo (UK), Trioliet (Netherlands), AfiMilk (Israel), Lely Holding (Netherlands), Sum-it Computer Systems (UK), VDL Agrotech (Netherlands), Pellon Group Oy (Finland), Dairy Master (US), and Davisway (Australia). |

This research report categorizes the automated feeding systems market based on, function, livestock, offering, technology, integration, system, and region.

On the basis of function, the automated feeding systems market has been segmented as follows:

- Controlling

- Mixing

- Filling and screening

- Others (conveyors and distributors)

On the basis of livestock, the automated feeding systems market has been segmented as follows

- Ruminants

- Swine

- Poultry

- Others (equine and aquaculture)

On the basis of offering, the automated feeding systems market has been segmented as follows:

- Hardware

- Software

- Services

On the basis of technology, the automated feeding systems market has been segmented as follows:

- Robotic and telemetry

- RFID technology

- Guidance and remote sensing technology

- Others (drone and thermal detectors)

On the basis of integration, the automated feeding systems market has been segmented as follows:

- Integration

- Non-integration

On the basis of system, the automated feeding systems market has been segmented as follows:

- Rail-guided Feeding Systems

-

Conveyor Feeding Systems

- Belt Feeding systems

- Pan Feeding Systems

- Chain Feeding Systems

- Self-propelled Feeding Systems

On the basis of region, the automated feeding systems market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- Rest of the World (South America, the Middle East, and Africa)

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports as per client-specific requirements. The available customization options are as follows:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the Rest of Europe automated feeding systems market

- Further breakdown of the Rest of Asia Pacific automated feeding systems market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Automated Feeding Systems Market