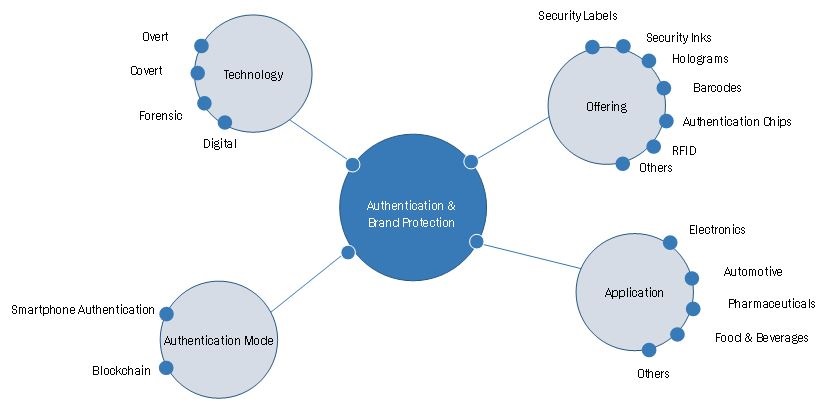

Authentication and Brand Protection Market by Technology (Overt, Covert, Digital, Forensic), Offering (Security Labels, Holograms, RFID/NFC, Barcodes, QR Codes), Authentication Mode (Smartphone, Blockchain), Application, Region - Global Forecast to 2028

Updated on : October 22, 2024

Authentication and Brand Protection Market Size

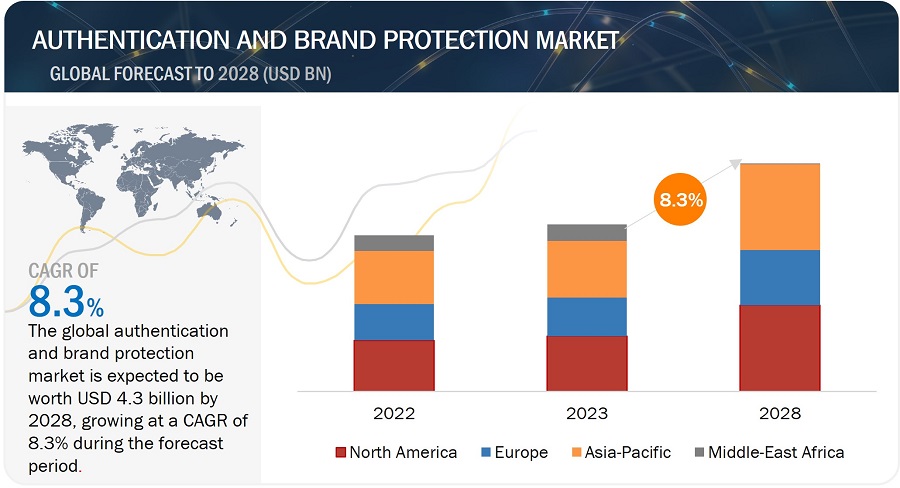

[216 Pages Report] The global authentication and brand protection market size is estimated to be worth USD 2.9 billion in 2023 and is projected to reach USD 4.3 billion by 2028, at a CAGR of 8.3% during the forecast period 2023 to 2028. Increasing need for preserving brand reputation, ensuring consumer safety, maintaining legal compliance, and safeguarding intellectual property rights as well as rising cases of counterfeiting and piracy of products in various applications such as pharmaceutical, food & beverage and electronics are some of the major factors driving the authentication and brand protection market growth globally.

Authentication and Brand Protection Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Authentication and Brand Protection Market Dynamics

Driver: Emergence of Trace and Track Technologies

Various emerging technologies, such as blockchain, are used for traceability in the supply chain. Blockchain functions like a database, holding information in a digital ledger consisting of individual blocks, with each new transaction added to the chain. Traceability technologies allow users to get the entire detailed data of the supply chain, which offers valuable and actionable insights, which, in turn, influences a company’s efficiency, transparency, and profitability. Apart from the authentication of the product, blockchain also helps trace the origin of the product and track it through the entire logistical chain. It helps manufacturers maintain an efficient supply chain and check whether the product has been delivered to the right location within the required time. The data obtained from track & trace technologies also helps companies analyze their best functioning depots, distributors, and identify efficient supply routes.

Restraint: Limitations of Existing Technologies

The conventional technologies employed for authentication, such as RFID, barcodes, and holograms, have inherent limitations that can be exploited by counterfeiters. For example, 2D codes, including QR codes, can be easily copied. A simple replication of a QR code duplicates its full functionality, making it difficult for QR code readers to differentiate between the original and copied codes.

Holograms, which are integrated into many security-sensitive products like credit cards and banknotes, possess intricate details, structures, and reflective characteristics that are challenging to replicate. Despite advancements in hologram technology, their primary function remains cosmetics. Counterfeiters, through careful study, can deceive non-experts, as they can order branded and customized holograms of any shape, size, and design, making it nearly impossible to detect a counterfeit hologram.

Opportunity: Development of Remote Authentication Solutions

As reported by the OECD and the European Union's Intellectual Property Office, the trade in counterfeit and pirated goods has reached approximately 3.3% of global trade. Based on customs seizure data, the estimated value of globally imported counterfeit goods in 2019 was around USD 509 billion. Several companies are offering remote authentication solutions to combat counterfeiters in response to this issue. With remote authentication, users can scan product images and upload them to a company's website to determine the authenticity of the product. This technology, developed by AlpVision, aims to reduce counterfeiting in the market.

Challenge: Constant evolution of counterfeiting and fraudulent practices

As counterfeiters become more sophisticated in their methods, it becomes increasingly challenging for businesses to develop effective and foolproof authentication solutions. The rapid growth of online marketplaces and digital platforms also presents a challenge, as it provides a convenient avenue for counterfeiters to distribute their fake products globally. Additionally, the global nature of supply chains and the prevalence of cross-border trade make it difficult to track and control the movement of counterfeit goods. Businesses operating in the authentication and brand protection market size must continuously innovate and adapt their solutions to stay ahead of counterfeiters while also collaborating with regulatory bodies, industry associations, and technology providers to tackle this ongoing challenge.

Ecosystem Of Authentication and Brand Protection Market

Authentication and Brand Protection Market: Key Trends

The prominent players in the authentication and brand protection market size are Authentix, Brady, DE LA RUE, Avery Dennison, WiseKey, Infineon, Centro Grafico and Sunchemicals and so on. These authentication and brand protection companies boast anti-counterfeiting and tracking and tracing trends with a comprehensive product portfolio and geographic solid footprint.

Authentication and Brand Protection Market Share

Overt technology to account for the largest share of the authentication and brand protection market in 2028.

Usage of authentication solutions has resulted in the emergence of multiple authentication and brand protection technologies. Among these, overt technology has established itself as a prominent technology in the authentication and brand protection market. Overt is expected to dominate during the forecast period as they are typically more affordable compared to covert (hidden) or forensic measures. Authentication and brand protection offerings with covert technology can be integrated into product packaging or labels without significant additional production costs. This cost-effectiveness makes overt measures a practical choice for many brands, leading to their higher market share. All these factors are expected to surge the market growth for overt authentication and brand protection technology during the forecast period.

QR Code segment to contribute largest market share in the authentication and brand protection market during forecast period.

In 2023, QR Codes is expected to grow at the fastest rate during the forecast period as it offers a convenient and versatile solution for product authentication, enabling consumers to quickly verify the genuineness of a product using their smartphones. QR codes effectively track and trace products throughout the supply chain, helping brands monitor and prevent counterfeiting or gray market activities. Also, advancements in technology have made QR code scanning accessible to a wide range of users, contributing to their rapid adoption, and making them a cost-effective and scalable option for brand protection. All these factors are expected to provide a significant surge for QR Codes in in the authentication and brand protection market.

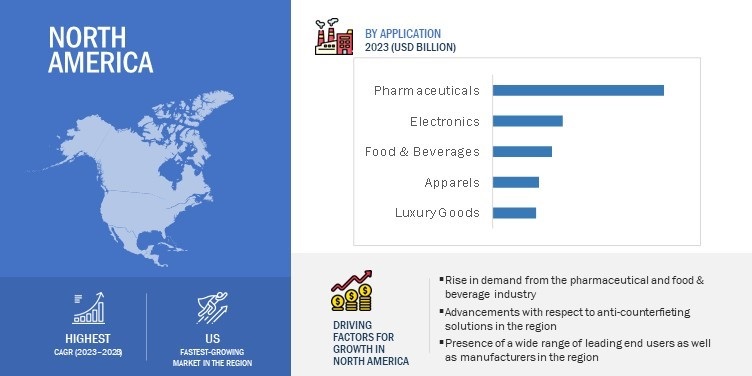

The pharmaceutical application to register highest CAGR as well as market size in the authentication and brand protection market during the forecast period.

The pharmaceutical application is expected to dominate the authentication and brand protection industry size with the highest market size in 2028 and is expected to grow at a significant CAGR during the forecast period. In pharmaceutical applications, authentication and brand protection is crucial as counterfeit pharmaceutical products not only jeopardize patients health but also tarnish the reputation of pharmaceutical companies. Robust brand protection measures are necessary to safeguard intellectual property, comply with regulations, prevent revenue loss, and combat the distribution of counterfeit drugs. By preserving the authenticity and quality of their products, pharmaceutical companies can instill confidence in healthcare professionals and patients, and ultimately contribute to the well-being and trustworthiness of the entire pharmaceutical industry. All these factors is expected to escalate the demand for authentication and brand protection offerings in pharmaceuticals in the authentication and brand protection market.

Furthermore, pharmaceuticals are subject to stringent regulations to ensure drug safety, efficacy, and quality. Brand protection measures help companies comply with regulatory requirements and demonstrate their commitment to patient safety and regulatory compliance. These factors are fueling the authentication and brand protection market growth.

Authentication and Brand Protection Market Regional Analysis

North America held the largest market share of the authentication and brand protection market in 2028

North America accounted for the largest market share of the authentication and brand protection market in 2028. North America is one of the prominent regions for pharmaceutical and food & beverage applications. Various companies in North America are investing and focusing on the development novel authnetication and brand protection techonology. The presence of key players in this region, along with a large customer base, is among the major factors driving the authentication and brand protection market share in North America. Additionally, rules and regulations implemented in the countries of the region to check counterfeiting activities have been fostering market growth in the region. All these factors are driving the growth of the authentication and brand protection market in the region.

Authentication and Brand Protection Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Authentication and Brand Protection Companies: Key players

The major authentication and brand protection equipment providers in the authentication and brand protection market include

- Authentix, Brady,

- DE LA RUE,

- Avery Dennison,

- WiseKey,

- Infineon,

- Centro

- Grafico and Sunchemicals and so on.

These authentication and brand protection companies have used both organic and inorganic growth strategies such as product launches, acquisitions, and partnerships to strengthen their position in the authentication and brand protection companies.

Authentication and Brand Protection Report Scope :

|

Report Metric |

Details |

| Estimated Market Size | USD 2.9 billion in 2023 |

| Projected Market Size | USD 4.3 billion by 2028 |

| Growth Rate | At CAGR of 8.3% |

|

Market size available for years |

2019–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million/Billion), Volume (Thousand Units) |

|

Segments covered |

|

|

Geographies covered |

North America, Europe, Asia Pacific, and Rest of World |

|

Companies covered |

The major players in the authentication and brand protection market are Authentix, Brady, DE LA RUE, Avery Dennison, WiseKey, Infineon, Centro Grafico and Sunchemicals and so on |

Authentication and Brand Protection Market Size & Highlights

The study of segments in authentication and brand protection market based on By Technology, by Offering, By Mode, Application and region at the regional and global level.

|

Segment |

Subsegment |

|

Authentication and Brand Protection Market Size, By Technological |

|

|

By Authentication Mode |

|

|

By Offering |

|

|

Authentication and Brand Protection Market Size, By Application |

|

|

By Region |

|

Recent Developments in Authentication and Brand Protection Industry

- In April 2023, Authentix, announced its acquisition of Royal Joh. Enschedé, a prominent specialty printing and security solutions provider based in the Netherlands. Koninklijke (Royal) Joh. Enschedé has evolved from a humble book printer to an esteemed security printing company recognized for its production of security documents, postage stamps, banknotes, and brand protection solutions.

- In May 2022, Avery Dennison aimed at expanding its manufacturing capacity and improving factory efficiency in Europe to meet growing demand for its label and packaging materials.

- In March 2021, Wisekey expanded its products and services portfolio for brand protection with the combination of Artificial Intelligence (AI) and NanoSeal secure Near Field Communication (secure NFC) technology. The nanoseal ecosystem includes a complete product authentication server and database management.

Frequently Asked Questions (FAQ):

What is the current size of the global authentication and brand protection market?

The authentication and brand protection market is estimated to be worth USD 2.9 billion in 2023 and is projected to reach USD 4.3 billion by 2028, at a CAGR of 8.3% during the forecast period. Rising need for anti-counterfeiting solutions to protect from piracy and duplicacy in several applications such pharmaceutical, electronics, food & beverage, automobile and so on are the major factors driving the authentication and brand protection marketgrowth.

Who are the winners in the global authentication and brand protection market?

Authentication and brand protection equipment companies such as Authentix, Brady, DE LA RUE, Avery Dennison, WiseKey, Infineon, Centro Grafico and Sunchemicals and so on fall under the winners category.

Which region is expected to hold the highest share in the authentication and brand protection market?

North America is expected to dominate the authentication and brand protection market in 2028. Growth and demand for pharmaceutical and food & beverage applications, which are proposed to be the main applications for authentication and brand protection.

What are the major drivers and opportunities related to the authentication and brand protection market?

Increasing emphasis on safeguarding product and brand integrity as well as emergence of track & trace technologies are some of the major drivers and opportunities for authentication and brand protection companies as well as for the authentication and brand protection market.

What are the major strategies adopted by market players?

The authentication and brand protection companies have adopted product launches, acquisitions, and contracts to strengthen their position in the authentication and brand protection market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- High emphasis on safeguarding product and brand integrity- Increased use of track and trace technologies in supply chain- Enforcement of anti-counterfeiting laws and regulations by governments- Heightened focus on consumer safety and satisfactionRESTRAINTS- Requirement for significant initial capital investments- Limitations of existing authentication technologiesOPPORTUNITIES- Increased textile and apparel production in Asia Pacific- Reliance on remote authentication technologies- Collaborations between businesses to combat counterfeitingCHALLENGES- Lack of awareness about benefits of authentication technologies- Developing foolproof anti-counterfeiting solutions

- 5.3 VALUE CHAIN ANALYSIS

-

5.4 ECOSYSTEM MAPPING

-

5.5 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYTHREAT OF NEW ENTRANTSBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTES

-

5.6 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

5.8 CASE STUDY ANALYSISOPSEC’S BRAND PROTECTION TOOLS HELP TONINO LAMBORGHINI SECURE SUPPLY CHAINNABCORE’S BRAND PROTECTION SOLUTIONS HELP ELECTRONICS COMPANY IMPROVE SECURITYAUSNFC’S AUTHENTICATION SERVICES HELP OLD KEMPTON DISTILLERY SAFEGUARD PRODUCTSCOLLABORATION BETWEEN SYSTECH AND ALCOHOLIC BEVERAGE COMPANY TO DEVELOP E-FINGERPRINT PRODUCT LABELS

-

5.9 TECHNOLOGY ANALYSISARTIFICIAL INTELLIGENCE AND MACHINE LEARNINGGEOLOCATION AND GEO-BLOCKINGAUGMENTED REALITYWATERMARKING AND DIGITAL FINGERPRINTING

-

5.10 AVERAGE SELLING PRICE ANALYSISAVERAGE SELLING PRICES OF AUTHENTICATION AND BRAND PROTECTION PRODUCTS, BY APPLICATION (USD)AVERAGE SELLING PRICE TRENDS

-

5.11 PATENT ANALYSIS

-

5.12 TRADE ANALYSISIMPORT SCENARIOEXPORT SCENARIO

- 5.13 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.14 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSSTANDARDS FOR AUTHENTICATION AND BRAND PROTECTION SOLUTIONS

- 6.1 INTRODUCTION

-

6.2 EMERGING TECHNOLOGY TRENDS IN AUTHENTICATION AND BRAND PROTECTION MARKETBLOCKCHAIN TECHNOLOGYINTERNET OF THINGS AND ARTIFICIAL INTELLIGENCESMART PACKAGINGBIOMETRICSINTEGRATION OF DATA ANALYTICS

- 7.1 INTRODUCTION

-

7.2 SMARTPHONE AUTHENTICATIONINTEGRATION OF PRODUCT AUTHENTICATION APPS IN ANDROID AND IOS SMARTPHONES TO VERIFY PRODUCT AUTHENTICITY

-

7.3 BLOCKCHAIN AUTHENTICATIONDEPLOYMENT OF BLOCKCHAIN AUTHENTICATION TECHNOLOGY TO ENABLE SUPPLY CHAIN TRACEABILITY

- 8.1 INTRODUCTION

-

8.2 OVERTDEVELOPMENT OF OVERT SOLUTIONS TO HELP CUSTOMERS IDENTIFY GENUINE PRODUCTS

-

8.3 COVERTRELIANCE ON COVERT AUTHENTICATION TECHNOLOGY TO PROVIDE SECOND LEVEL OF SECURITY

-

8.4 DIGITALIMPLEMENTATION OF DIGITAL TECHNOLOGIES TO DEVELOP TRACK-AND-TRACE SYSTEMS

-

8.5 FORENSICUSE OF FORENSIC ANTI-COUNTERFEIT SOLUTIONS TO ENHANCE PRODUCT AND PACKAGE SECURITY

- 9.1 INTRODUCTION

-

9.2 SECURITY LABELS AND INKSUTILIZATION OF TEMPER-EVIDENT SECURITY LABELS FOR BRAND PROTECTION

-

9.3 HOLOGRAMSRELIANCE ON HOLOGRAMS TO PROVIDE QUICK PRODUCT AUTHENTICATION AND VALIDATION

-

9.4 BARCODESAPPLICATION OF BARCODES IN PRODUCT CHECK-OUT, INVENTORY MANAGEMENT, AND TRACKING

-

9.5 RFID/NFC TAGSUSE OF RFID/NFC TAGS IN REAL-TIME TRACKING AND AUTOMATED AUTHENTICATION

-

9.6 AUTHENTICATION CHIPSINCORPORATION OF AUTHENTICATION CHIPS FOR ITEM TRACKING THROUGHOUT SUPPLY CHAIN

-

9.7 QR CODESAVAILABILITY OF LOW-COST QR CODES FOR PRODUCT AUTHENTICATION

- 10.1 INTRODUCTION

-

10.2 ELECTRONICSINVESTMENTS IN TRACK & TRACE TECHNOLOGIES BY ELECTRONIC MANUFACTURERS TO DRIVE MARKET

-

10.3 PHARMACEUTICALSENFORCEMENT OF MANDATES REGARDING USE OF AUTHENTICATION TECHNOLOGIES TO COMBAT COUNTERFEIT DRUGS TO BOOST SEGMENTAL GROWTH

-

10.4 AUTOMOBILESSTRONG FOCUS ON PREVENTING SALES OF FAKE AUTOMOTIVE COMPONENTS TO BOOST DEMAND

-

10.5 FOOD & BEVERAGESADOPTION OF BRAND PROTECTION SOLUTIONS TO LIMIT CIRCULATION OF FAKE FOODS & BEVERAGES TO DRIVE MARKET

-

10.6 APPARELSUSE OF AUTHENTICATION SOLUTIONS TO PREVENT PREMIUM APPAREL COUNTERFEITING TO CONTRIBUTE TO MARKET GROWTH

-

10.7 LUXURY GOODSINVESTMENTS IN SOPHISTICATED TECH SOLUTIONS TO AUTHENTICATE PRODUCTS TO SUPPORT MARKET GROWTH

-

10.8 COSMETICSINCREASED USE OF AUTHENTICATION AND BRAND PROTECTION SOLUTIONS TO CURB COUNTERFEIT COSMETICS TRADING TO DRIVE MARKET

- 10.9 OTHERS

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICAIMPACT OF RECESSION ON MARKET IN NORTH AMERICAUS- Implementation of anti-counterfeiting regulations to restrict inauthentic product salesCANADA- Imposition of government initiatives to curb trading of illegal healthcare productsMEXICO- Enforcement of rules and regulations to fight against counterfeit products

-

11.3 EUROPEIMPACT OF RECESSION ON MARKET IN EUROPEGERMANY- Use of authentication solutions to support active pharmaceutical ingredient exportUK- Adoption of authentication and brand protection solutions to fix fake product tradingFRANCE- Employment of authentication solutions to avoid manufacturing substandard pharma productsREST OF EUROPE

-

11.4 ASIA PACIFICIMPACT OF RECESSION ON MARKET IN ASIA PACIFICCHINA- Utilization of authentication products to limit intellectual property infringementINDIA- Execution of stringent policies to prevent counterfeitingJAPAN- Use of brand protection solutions to ensure import of authentic productsSOUTH KOREA- Adoption of brand authentication solutions to reduce luxury brand counterfeitingREST OF ASIA PACIFIC

-

11.5 ROWIMPACT OF RECESSION ON MARKET IN ROWMIDDLE EAST & AFRICA- Introduction of intellectual property conservation laws to fight against brand imitationSOUTH AMERICA- Reliance on authentication solutions to protect e-retail and manufacturing businesses

- 12.1 OVERVIEW

- 12.2 KEY DEVELOPMENTS IN AUTHENTICATION AND BRAND PROTECTION MARKET

- 12.3 REVENUE ANALYSIS OF TOP COMPANIES

- 12.4 MARKET SHARE ANALYSIS

-

12.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

12.6 EVALUATION MATRIX OF STARTUPS/SMES, 2022PROGRESSIVE PLAYERSRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 12.7 AUTHENTICATION AND BRAND PROTECTION MARKET: COMPANY FOOTPRINT

- 12.8 AUTHENTICATION AND BRAND PROTECTION MARKET: SME MATRIX

-

12.9 COMPETITIVE SCENARIOOTHER STRATEGIES

-

13.1 KEY PLAYERSAUTHENTIX- Business overview- Products offered- Recent developments- MnM viewAVERY DENNISON CORPORATION- Business overview- Products offered- Recent developments- MnM viewBRADY WORLDWIDE, INC.- Business overview- Products offered- MnM viewDE LA RUE PLC- Business overview- Products offered- Recent developments- MnM viewWISEKEY- Business overview- Products offered- Recent developments- MnM viewINFINEON TECHNOLOGIES AG- Business overview- Product offered- Recent developmentsMERCK KGAA- Business overview- Products offeredHID GLOBAL CORPORATION- Business overview- Products offered- Recent developmentsCENTRO GRAFICO DG- Business overview- Products offeredSUN CHEMICAL- Business overview- Products offered

-

13.2 OTHER PLAYERSAUTHENTIC VISIONALPVISIONAPPLIED DNA SCIENCESCILS INTERNATIONALBLUE BITE LLCNOSCO, INC.ULTIMATE SOLUTIONSQLIK SOFTWARE PVT. LTD.DSS, INC.VISUALEADSYSTECHDIGIMARC CORPORATIONU-NICA SOLUTIONS AGTRACEPACKNABCORE PTE LTDEDGYN

- 14.1 INTRODUCTION

-

14.2 RFID MARKET, BY OFFERINGTAGS- Use of tags to identify assets or personREADERSSOFTWARE & SERVICES- Adoption of data storage software & services to maintain administrative records

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 AVAILABLE CUSTOMIZATIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 RECESSION IMPACT ANALYSIS

- TABLE 2 ROLE OF COMPANIES IN VALUE CHAIN

- TABLE 3 IMPACT OF PORTER’S FIVE FORCES ON AUTHENTICATION AND BRAND PROTECTION MARKET

- TABLE 4 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END USERS (%)

- TABLE 5 KEY BUYING CRITERIA FOR TOP 3 END USERS

- TABLE 6 AVERAGE SELLING PRICES OF AUTHENTICATION AND BRAND PROTECTION PRODUCTS, BY APPLICATION (USD)

- TABLE 7 AVERAGE SELLING PRICE OF AUTHENTICATION AND BRAND PROTECTION PRODUCTS, BY REGION

- TABLE 8 TOP 20 PATENT OWNERS IN US FROM 2013 TO 2023

- TABLE 9 LIST OF PATENTS GRANTED IN AUTHENTICATION AND BRAND PROTECTION MARKET, 2021–2022

- TABLE 10 AUTHENTICATION AND BRAND PROTECTION MARKET: LIST OF CONFERENCES & EVENTS

- TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 AUTHENTICATION AND BRAND PROTECTION MARKET, BY AUTHENTICATION MODE, 2019–2022 (USD MILLION)

- TABLE 16 AUTHENTICATION AND BRAND PROTECTION MARKET, BY AUTHENTICATION MODE, 2023–2028 (USD MILLION)

- TABLE 17 AUTHENTICATION AND BRAND PROTECTION MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 18 AUTHENTICATION AND BRAND PROTECTION MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 19 OVERT: AUTHENTICATION AND BRAND PROTECTION MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 20 OVERT: AUTHENTICATION AND BRAND PROTECTION MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 21 OVERT: AUTHENTICATION AND BRAND PROTECTION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 22 OVERT: AUTHENTICATION AND BRAND PROTECTION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 23 COVERT: AUTHENTICATION AND BRAND PROTECTION MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 24 COVERT: AUTHENTICATION AND BRAND PROTECTION MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 25 COVERT: AUTHENTICATION AND BRAND PROTECTION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 26 COVERT: AUTHENTICATION AND BRAND PROTECTION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 27 DIGITAL: AUTHENTICATION AND BRAND PROTECTION MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 28 DIGITAL: AUTHENTICATION AND BRAND PROTECTION MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 29 DIGITAL: AUTHENTICATION AND BRAND PROTECTION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 30 DIGITAL: AUTHENTICATION AND BRAND PROTECTION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 31 FORENSIC: AUTHENTICATION AND BRAND PROTECTION MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 32 FORENSIC: AUTHENTICATION AND BRAND PROTECTION MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 33 FORENSIC: AUTHENTICATION AND BRAND PROTECTION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 34 FORENSIC: AUTHENTICATION AND BRAND PROTECTION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 35 AUTHENTICATION AND BRAND PROTECTION MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 36 AUTHENTICATION AND BRAND PROTECTION MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 37 SECURITY LABELS AND INKS: AUTHENTICATION AND BRAND PROTECTION MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 38 SECURITY LABELS AND INKS: AUTHENTICATION AND BRAND PROTECTION MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 39 HOLOGRAMS: AUTHENTICATION AND BRAND PROTECTION MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 40 HOLOGRAMS: AUTHENTICATION AND BRAND PROTECTION MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 41 BARCODES: AUTHENTICATION AND BRAND PROTECTION MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 42 BARCODES: AUTHENTICATION AND BRAND PROTECTION MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 43 RFID/NFC TAGS: AUTHENTICATION AND BRAND PROTECTION MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 44 RFID/NFC TAGS: AUTHENTICATION AND BRAND PROTECTION MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 45 AUTHENTICATION CHIPS: AUTHENTICATION AND BRAND PROTECTION MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 46 AUTHENTICATION CHIPS: AUTHENTICATION AND BRAND PROTECTION MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 47 QR CODES: AUTHENTICATION AND BRAND PROTECTION MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 48 QR CODES: AUTHENTICATION AND BRAND PROTECTION MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 49 AUTHENTICATION AND BRAND PROTECTION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 50 AUTHENTICATION AND BRAND PROTECTION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 51 ELECTRONICS: AUTHENTICATION AND BRAND PROTECTION MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 52 ELECTRONICS: AUTHENTICATION AND BRAND PROTECTION MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 53 ELECTRONICS: AUTHENTICATION AND BRAND PROTECTION MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 54 ELECTRONICS: AUTHENTICATION AND BRAND PROTECTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 55 PHARMACEUTICALS: AUTHENTICATION AND BRAND PROTECTION MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 56 PHARMACEUTICALS: AUTHENTICATION AND BRAND PROTECTION MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 57 PHARMACEUTICALS: AUTHENTICATION AND BRAND PROTECTION MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 58 PHARMACEUTICALS: AUTHENTICATION AND BRAND PROTECTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 59 AUTOMOBILES: AUTHENTICATION AND BRAND PROTECTION MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 60 AUTOMOBILES: AUTHENTICATION AND BRAND PROTECTION MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 61 AUTOMOBILES: AUTHENTICATION AND BRAND PROTECTION MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 62 AUTOMOBILES: AUTHENTICATION AND BRAND PROTECTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 63 FOOD & BEVERAGES: AUTHENTICATION AND BRAND PROTECTION MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 64 FOOD & BEVERAGES: AUTHENTICATION AND BRAND PROTECTION MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 65 FOOD & BEVERAGES: AUTHENTICATION AND BRAND PROTECTION MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 66 FOOD & BEVERAGES: AUTHENTICATION AND BRAND PROTECTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 67 APPARELS: AUTHENTICATION AND BRAND PROTECTION MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 68 APPARELS: AUTHENTICATION AND BRAND PROTECTION MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 69 APPARELS: AUTHENTICATION AND BRAND PROTECTION MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 70 APPARELS: AUTHENTICATION AND BRAND PROTECTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 71 LUXURY GOODS: AUTHENTICATION AND BRAND PROTECTION MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 72 LUXURY GOODS: AUTHENTICATION AND BRAND PROTECTION MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 73 LUXURY GOODS: AUTHENTICATION AND BRAND PROTECTION MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 74 LUXURY GOODS: AUTHENTICATION AND BRAND PROTECTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 75 COSMETICS: AUTHENTICATION AND BRAND PROTECTION MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 76 COSMETICS: AUTHENTICATION AND BRAND PROTECTION MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 77 COSMETICS: AUTHENTICATION AND BRAND PROTECTION MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 78 COSMETICS: AUTHENTICATION AND BRAND PROTECTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 79 OTHERS: AUTHENTICATION AND BRAND PROTECTION MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 80 OTHERS: AUTHENTICATION AND BRAND PROTECTION MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 81 OTHERS: AUTHENTICATION AND BRAND PROTECTION MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 82 OTHERS: AUTHENTICATION AND BRAND PROTECTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 83 AUTHENTICATION AND BRAND PROTECTION MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 84 AUTHENTICATION AND BRAND PROTECTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 85 NORTH AMERICA: AUTHENTICATION AND BRAND PROTECTION MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 86 NORTH AMERICA: AUTHENTICATION AND BRAND PROTECTION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 87 NORTH AMERICA: AUTHENTICATION AND BRAND PROTECTION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 88 NORTH AMERICA: AUTHENTICATION AND BRAND PROTECTION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 89 EUROPE: AUTHENTICATION AND BRAND PROTECTION MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 90 EUROPE: AUTHENTICATION AND BRAND PROTECTION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 91 EUROPE: AUTHENTICATION AND BRAND PROTECTION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 92 EUROPE: AUTHENTICATION AND BRAND PROTECTION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 93 ASIA PACIFIC: AUTHENTICATION AND BRAND PROTECTION MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 94 ASIA PACIFIC: AUTHENTICATION AND BRAND PROTECTION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 95 ASIA PACIFIC: AUTHENTICATION AND BRAND PROTECTION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 96 ASIA PACIFIC: AUTHENTICATION AND BRAND PROTECTION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 97 ROW: AUTHENTICATION AND BRAND PROTECTION MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 98 ROW: AUTHENTICATION AND BRAND PROTECTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 99 ROW: AUTHENTICATION AND BRAND PROTECTION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 100 ROW: AUTHENTICATION AND BRAND PROTECTION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 101 MIDDLE EAST & AFRICA: AUTHENTICATION AND BRAND PROTECTION MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 102 MIDDLE EAST & AFRICA: AUTHENTICATION AND BRAND PROTECTION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 103 SOUTH AMERICA: AUTHENTICATION AND BRAND PROTECTION MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 104 SOUTH AMERICA: AUTHENTICATION AND BRAND PROTECTION MARKET, BY COUNTRY 2023–2028 (USD MILLION)

- TABLE 105 STRATEGIES ADOPTED BY KEY PLAYERS IN AUTHENTICATION AND BRAND PROTECTION MARKET

- TABLE 106 MARKET SHARE OF TOP PLAYERS IN AUTHENTICATION AND BRAND PROTECTION MARKET IN 2022

- TABLE 107 OVERALL COMPANY FOOTPRINT

- TABLE 108 COMPANY OFFERING FOOTPRINT

- TABLE 109 COMPANY APPLICATION FOOTPRINT

- TABLE 110 COMPANY REGIONAL FOOTPRINT

- TABLE 111 AUTHENTICATION AND BRAND PROTECTION MARKET: LIST OF KEYS SMES

- TABLE 112 AUTHENTICATION AND BRAND PROTECTION MARKET: COMPETITIVE BENCHMARKING OF SMES

- TABLE 113 AUTHENTICATION AND BRAND PROTECTION MARKET: PRODUCT LAUNCHES, 2019−2021

- TABLE 114 AUTHENTICATION AND BRAND PROTECTION MARKET: DEALS, 2019–2023

- TABLE 115 AUTHENTICATION AND BRAND PROTECTION MARKET: OTHER STRATEGIES, 2022

- TABLE 116 AUTHENTIX: COMPANY OVERVIEW

- TABLE 117 AUTHENTIX: PRODUCTS OFFERED

- TABLE 118 AUTHENTIX: DEALS

- TABLE 119 AVERY DENNISON CORPORATION: COMPANY OVERVIEW

- TABLE 120 AVERY DENNISON CORPORATION: PRODUCTS OFFERED

- TABLE 121 AVERY DENNISON CORPORATION: PRODUCT LAUNCHES

- TABLE 122 AVERY DENNISON CORPORATION: DEALS

- TABLE 123 AVERY DENNISON CORPORATION: OTHERS

- TABLE 124 BRADY WORLDWIDE, INC.: COMPANY OVERVIEW

- TABLE 125 BRADY WORLDWIDE, INC.: PRODUCTS OFFERED

- TABLE 126 DE LA RUE PLC: COMPANY OVERVIEW

- TABLE 127 DE LA RUE PLC: PRODUCTS OFFERED

- TABLE 128 DE LA RUE PLC: PRODUCT LAUNCHES

- TABLE 129 DE LA RUE: DEALS

- TABLE 130 WISEKEY: COMPANY OVERVIEW

- TABLE 131 WISEKEY: PRODUCTS OFFERED

- TABLE 132 WISEKEY: PRODUCT DEVELOPMENTS

- TABLE 133 INFINEON TECHNOLOGIES AG: COMPANY OVERVIEW

- TABLE 134 INFINEON TECHNOLOGIES AG: PRODUCTS OFFERED

- TABLE 135 INFINEON TECHNOLOGIES AG: PRODUCT LAUNCHES

- TABLE 136 INFINEON TECHNOLOGIES AG: DEALS

- TABLE 137 MERCK KGAA: COMPANY OVERVIEW

- TABLE 138 MERCK KGAA: PRODUCTS OFFERED

- TABLE 139 HID GLOBAL CORPORATION: COMPANY OVERVIEW

- TABLE 140 HID GLOBAL CORPORATION: PRODUCTS OFFERED

- TABLE 141 HID GLOBAL CORPORATION: PRODUCT LAUNCHES

- TABLE 142 CENTRO GRAFICO DG: COMPANY OVERVIEW

- TABLE 143 CENTRO GRAFICO DG: PRODUCTS OFFERED

- TABLE 144 SUN CHEMICAL: COMPANY OVERVIEW

- TABLE 145 SUN CHEMICAL: PRODUCTS OFFERED

- TABLE 146 AUTHENTIC VISION: COMPANY OVERVIEW

- TABLE 147 ALPVISION: COMPANY OVERVIEW

- TABLE 148 APPLIED DNA SCIENCES: COMPANY OVERVIEW

- TABLE 149 CILS INTERNATIONAL: COMPANY OVERVIEW

- TABLE 150 BLUE BIET LLC: COMPANY OVERVIEW

- TABLE 151 NOSCO, INC.: COMPANY OVERVIEW

- TABLE 152 ULTIMATE SOLUTIONS: COMPANY OVERVIEW

- TABLE 153 QLIK SOFTWARE PVT. LTD.: COMPANY OVERVIEW

- TABLE 154 DSS, INC.: COMPANY OVERVIEW

- TABLE 155 VISUALEAD: COMPANY OVERVIEW

- TABLE 156 SYSTECH: COMPANY OVERVIEW

- TABLE 157 DIGIMARC CORPORATION: COMPANY OVERVIEW

- TABLE 158 U-NICA SOLUTIONS AG: COMPANY OVERVIEW

- TABLE 159 TRACEPACK: COMPANY OVERVIEW

- TABLE 160 NABCORE PTE LTD: COMPANY OVERVIEW

- TABLE 161 EDGYN: COMPANY OVERVIEW

- TABLE 162 RFID MARKET, BY OFFERING, 2018–2021 (USD MILLION)

- TABLE 163 RFID MARKET, BY OFFERING, 2022–2030 (USD MILLION)

- FIGURE 1 MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 REVENUE GENERATED BY COMPANIES FROM SALES OF AUTHENTICATION AND BRAND PROTECTION PRODUCTS

- FIGURE 4 ILLUSTRATIVE EXAMPLE OF COMPANIES OPERATING IN AUTHENTICATION AND BRAND PROTECTION MARKET

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 TOP-DOWN APPROACH

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 QR CODES SEGMENT TO DEPICT HIGHEST CAGR IN AUTHENTICATION AND BRAND PROTECTION MARKET FROM 2023 TO 2028

- FIGURE 9 OVERT SEGMENT TO ACCOUNT FOR LARGEST SHARE OF AUTHENTICATION AND BRAND PROTECTION MARKET IN 2028

- FIGURE 10 PHARMACEUTICALS SEGMENT TO REGISTER HIGHEST CAGR BETWEEN 2023 AND 2028

- FIGURE 11 ASIA PACIFIC TO HOLD LARGEST SHARE OF AUTHENTICATION AND BRAND PROTECTION MARKET IN 2023

- FIGURE 12 INCREASING PREVALENCE OF BRAND INFRINGEMENT TO FUEL DEMAND FOR AUTHENTICATION AND BRAND PROTECTION PRODUCTS

- FIGURE 13 SMARTPHONE AUTHENTICATION SEGMENT HELD LARGER MARKET SHARE IN 2022

- FIGURE 14 SECURITY LABELS AND INKS SEGMENT TO ACCOUNT FOR LARGEST SHARE OF AUTHENTICATION AND BRAND PROTECTION MARKET IN 2028

- FIGURE 15 PHARMACEUTICAL SEGMENT AND NORTH AMERICA TO REGISTER HIGHEST REVENUE IN AUTHENTICATION AND BRAND PROTECTION MARKET IN 2028

- FIGURE 16 US TO DEPICT HIGHEST CAGR IN AUTHENTICATION AND BRAND PROTECTION MARKET BETWEEN 2023 AND 2028

- FIGURE 17 AUTHENTICATION AND BRAND PROTECTION MARKET DYNAMICS

- FIGURE 18 AUTHENTICATION AND BRAND PROTECTION MARKET DRIVERS: IMPACT ANALYSIS

- FIGURE 19 AUTHENTICATION AND BRAND PROTECTION MARKET RESTRAINTS: IMPACT ANALYSIS

- FIGURE 20 AUTHENTICATION AND BRAND PROTECTION MARKET OPPORTUNITIES: IMPACT ANALYSIS

- FIGURE 21 AUTHENTICATION AND BRAND PROTECTION MARKET CHALLENGES: IMPACT ANALYSIS

- FIGURE 22 AUTHENTICATION AND BRAND PROTECTION MARKET: VALUE CHAIN ANALYSIS

- FIGURE 23 KEY SEGMENTS OF AUTHENTICATION AND BRAND PROTECTION MARKET

- FIGURE 24 IMPACT ANALYSIS: PORTER’S FIVE FORCES

- FIGURE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END USERS

- FIGURE 26 KEY BUYING CRITERIA FOR TOP 3 END USERS

- FIGURE 27 REVENUE SHIFT FOR PLAYERS IN AUTHENTICATION AND BRAND PROTECTION MARKET

- FIGURE 28 AVERAGE SELLING PRICES OF AUTHENTICATION AND BRAND PROTECTION PRODUCTS, BASED ON APPLICATION

- FIGURE 29 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS FROM 2013 TO 2023

- FIGURE 30 PATENTS GRANTED FROM 2013 TO 2023

- FIGURE 31 IMPORT DATA, BY KEY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 32 EXPORT DATA, BY KEY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 33 AUTHENTICATION AND BRAND PROTECTION MARKET, BY AUTHENTICATION MODE

- FIGURE 34 SMARTPHONE AUTHENTICATION SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2028

- FIGURE 35 AUTHENTICATION AND BRAND PROTECTION MARKET, BY TECHNOLOGY

- FIGURE 36 OVERT SEGMENT TO DOMINATE AUTHENTICATION AND BRAND PROTECTION MARKET DURING FORECAST PERIOD

- FIGURE 37 AUTHENTICATION AND BRAND PROTECTION MARKET, BY OFFERING

- FIGURE 38 SECURITY LABELS AND INKS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2028

- FIGURE 39 AUTHENTICATION AND BRAND PROTECTION MARKET, BY APPLICATION

- FIGURE 40 PHARMACEUTICALS SEGMENT TO HOLD LARGEST SHARE OF AUTHENTICATION AND BRAND PROTECTION MARKET IN 2028

- FIGURE 41 OVERT SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2028

- FIGURE 42 NORTH AMERICA TO DEPICT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 43 AUTHENTICATION AND BRAND PROTECTION MARKET IN US TO DEPICT HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 44 NORTH AMERICA: AUTHENTICATION AND BRAND PROTECTION MARKET SNAPSHOT

- FIGURE 45 EUROPE: AUTHENTICATION AND BRAND PROTECTION MARKET SNAPSHOT

- FIGURE 46 ASIA PACIFIC: AUTHENTICATION AND BRAND PROTECTION MARKET SNAPSHOT

- FIGURE 47 5-YEAR REVENUE ANALYSIS OF TOP PLAYERS IN AUTHENTICATION AND BRAND PROTECTION MARKET

- FIGURE 48 MARKET SHARE OF KEY PLAYERS IN AUTHENTICATION AND BRAND PROTECTION MARKET

- FIGURE 49 COMPANY EVALUATION MATRIX, 2022

- FIGURE 50 EVALUATION MATRIX OF STARTUPS/SMES, 2022

- FIGURE 51 AVERY DENNISON CORPORATION: COMPANY SNAPSHOT

- FIGURE 52 BRADY WORLDWIDE, INC.: COMPANY SNAPSHOT

- FIGURE 53 DE LA RUE PLC: COMPANY SNAPSHOT

- FIGURE 54 INFINEON TECHNOLOGIES AG: COMPANY SNAPSHOT

- FIGURE 55 MERCK KGAA: COMPANY SNAPSHOT

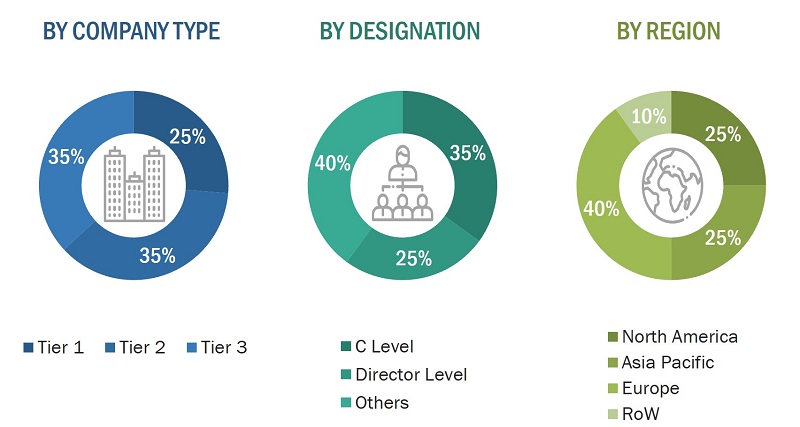

The research study involved 4 major activities in estimating the authentication and brand protection market size. Exhaustive secondary research been done to collect important information about the market and peer markets. The validation of these findings, assumptions, and sizing with the help of primary research with industry experts across the value chain has been the next step. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information required for this study. The secondary sources include annual reports, press releases, and investor presentations of companies, white papers, and articles from recognized authors. Secondary research was mainly done to obtain essential information about the market’s value chain, the pool of key market players, market segmentation according to industry trends, and regional outlook and developments from both market and technology perspectives.

Primary Research

In the primary research, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative insights required for this report. Primary sources from the supply side include experts such as CEOs, vice presidents, marketing directors, equipment manufacturers, technology and innovation directors, end users, and related executives from multiple key companies and organizations operating in the authentication and brand protection market ecosystem.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, both top-down and bottom-up approaches along with data triangulation methods have been used to estimate and validate the size of the authentication and brand protection market and other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

- Initially, MarketsandMarkets focuses on top line investments and spending in the ecosystems. Further, major developments in the key market area have been considered.

- Analyzing major original equipment manufacturers (OEMs) and studying their product portfolios and understanding different applications of the solutions offered by them.

- Analyzing the trends related to the adoption of different types of authentications and brand protection equipment.

- Tracking the recent and upcoming developments in the authentication and brand protection market that include investments, R&D activities, product launches, collaborations, mergers and acquisitions, and partnerships, as well as forecasting the market size based on these developments and other critical parameters.

- Conducting multiple discussions with key opinion leaders to know about different types of authentications and brand protection offerings used and the applications for which they are used to analyze the breakup of the scope of work carried out by major companies.

- Segmenting the market based on technology types with respect to applications wherein the types are to be used and deriving the size of the global application market.

- Segmenting the overall market into various market segments

- Validating the estimates at every level through discussions with key opinion leaders, such as chief executives (CXOs), directors, and operation managers, and finally with the domain experts at MarketsandMarkets

Market Size Estimation Methodology-Bottom-up Approach

Market Size Estimation Methodology-Top-down Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall authentication and brand protection market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments, data triangulation and market breakdown procedures have been used, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The authentication and brand protection market size has been validated using top-down and bottom-up approaches.

Market Definition

Authentication is the process of verifying the genuineness or identity of something or someone. In the context of brand protection, authentication entails confirming the legitimacy of products, services, or other brand assets to ensure they are not counterfeit or fraudulent. Brand protection, on the other hand, encompasses a range of strategies, measures, and practices aimed at safeguarding a brand's identity, reputation, and intellectual property rights. It involves preventing unauthorized use, counterfeiting, infringement, and other risks associated with the brand. Brand protection efforts include implementing security features, monitoring and enforcing intellectual property rights, conducting investigations, taking legal action against infringers, and educating consumers about the authenticity of the brand's offerings. Authentication and brand protection go hand in hand to ensure the credibility, reliability, and value of a brand. Through the implementation of effective authentication measures and robust brand protection strategies, companies can protect their brand's identity, foster consumer trust, combat counterfeiting and piracy, and maintain a competitive edge in the market.

Stakeholders

- Logistics and shipment companies

- Authentication and brand protection providers

- Consumer electronic product distributors, including e-commerce stores.

- Technology investors

- Research organizations

- Analysts and strategic business planners

- Authentication and brand protection Equipment Distributors and Traders

- Government Bodies Such as Regulating Authorities and Policymakers

- Venture Capitalists, Private Equity Firms, and Startup Companies

The main objectives of this study are as follows:

- To describe and forecast the authentication and brand protection market, in terms of value, based on technology type, offering, mode and application.

- To describe and forecast the authentication and brand protection market size, in terms of value, with respect to 4 main regions, namely, North America, Europe, Asia Pacific, and Rest of the World (RoW)

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the authentication and brand protection market

- To provide a detailed overview of the supply chain of the authentication and brand protection market ecosystem

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for various stakeholders by identifying the high-growth segments of the market

- To analyze the probable impact of the recession on the market in future

- To benchmark the market players using the proprietary company evaluation matrix framework, which analyzes the market players on various parameters within the broad categories of market ranking/share and product portfolio.

- To analyze the competitive landscape of the market

- To track and analyze competitive developments, such as partnerships, contracts, acquisitions, expansions, product launches, and other developments in the market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Country-wise Information:

- Analysis for additional countries (up to five)

Company Information:

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Authentication and Brand Protection Market