Assured PNT Market by Platform (Fighter Aircraft, Military helicopters, unmanned Vehicles, Combat Vehicles, Soldiers, Submarines, Corvettes, Destroyers, and Frigates), End User (Defense, Homeland Security), Component and Region - Global forecast to 2027

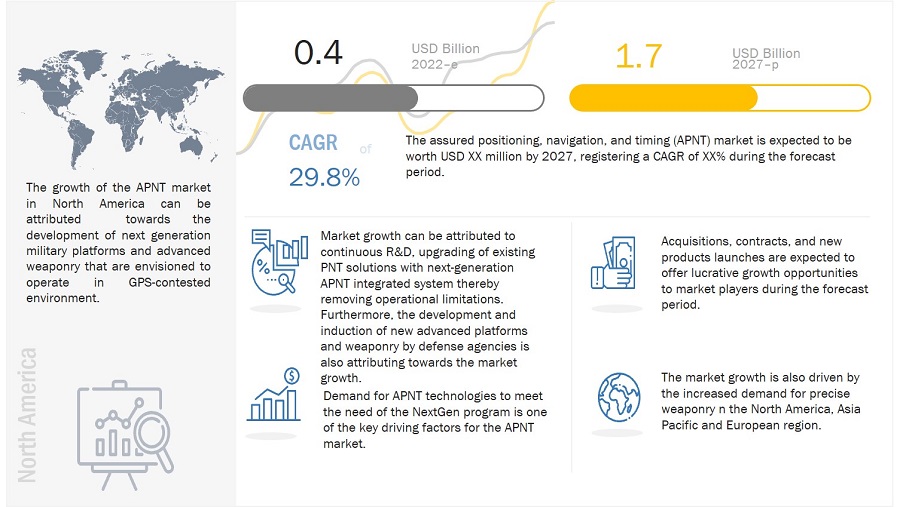

[204 Pages Report] The Assured PNT market is expected to grow from USD 0.4 billion in 2022 to USD 1.7 billion by 2027, at a CAGR of 29.8%. The evolving need for advanced PNT technologies to support upcoming military platforms and weapon technologies is expected to drive the demand for APNT systems. At the same time, the lack of a regulatory framework and established operational parameters will hinder the market growth.

Assured PNT systems play an important role in precise modern military warfare and enhance the functions of airborne, land, and naval platforms in navigation, positioning, and survivability. The increasing focus on enhancing advanced navigating capabilities to reduce casualties, the rising need for modernization programs, and increasing incidences of asymmetric warfare drive the assured PNT industry. Countries worldwide are investing in developing missile systems, such as ballistic missiles and cruise missiles, which require assured positioning systems for guidance. Thus, the increasing implementation of assured PNT systems in missiles is contributing to the growth of the assured PNT market. Militaries use smart weapons with advanced tactical-grade military navigation for greater accuracy and lower circular error probability (CEP) to neutralize terrorists and reduce collateral damage.

Assured PNT Market Forecast to 2027

To know about the assumptions considered for the study, Request for Free Sample Report

Assured PNT Market Dynamics:

Driver: Availability of miniaturized components at affordable prices

Assured PNT uses gyroscopes and accelerometers to track the position and location of an object relative to its starting point. Earlier, gyroscopes and accelerometers used in inertial navigation systems required special manufacturing and assembly skills. The cost of these components was significantly high due to the complexity involved in their fabrication and assembly. Advances in navigational technology, such as micro-electro-mechanical systems (MEMS), have improved fabrication and assembly techniques, reducing components' size and design complexity. Furthermore, various component manufacturers are trying to reduce the cost of components, which, in turn, would reduce the overall cost of inertial navigation systems. Thus, the availability of miniaturized components at affordable prices is expected to propel the growth of the assured PNT market.

Restraint: Absence of established operational parameters

APNT technologies are still evolving, there is no parity in the standard operating parameters of such technologies. For instance, while all current generation aircraft are equipped with DDI MOPS/TSO standard components, MOPS Changes will be needed to enable RNP accuracy, monitoring & alerting. Besides, the performance of APNT systems may be limited to area navigation (RNAV) at 0.6 at best. APNT technologies also do not fulfill Automatic Dependent Surveillance-Broadcast (ADS-B) positioning requirements, and aircraft operations would still require secondary surveillance radars (SSRs) for operation, especially for general aviation. Besides, APNT requires additional spectrum bandwidth that narrows the bandwidth availability of the L and VHF bands' aeronautical radio-navigation service (ARNS) portions.

Moreover, creating a new signal optimized for APNT requires extensive R&D to demonstrate operational capabilities in the targeted spectrum already dominated by several other transmissions. Meanwhile, some modification would also be required by the existing ground-based assets to support APNT signal transmissions, which reduces the attractiveness of the technology by operators and service providers alike and may restrain the growth of the APNT market in the near future.

Opportunity: Increasing application to mitigate the effects of threats

When adopting resilience approaches, assured PNT systems can respond in various ways when threats and other abnormalities are detected. One suitable reaction is stopping depending on any output from the hacked PNT source. If the assured PNT system contains additional PNT sources, it can use them to offer the system PNT solution to the user while the PNT source with the detected threat is still compromised. When it is safe to do so, the PNT user equipment (UE) system can contain control logic to restore the performance of the compromised PNT source automatically. Another option to respond to threat detection is to reduce the danger's effects and restore real PNT data. When a GNSS receiver is spoofed, the PNT UE system can employ various approaches to differentiate the genuine GNSS signals from fraudulent ones and continue monitoring the true signals to provide a PNT solution. When constructing robust PNT UE systems, mitigation approaches must be aware of their limits. Attackers working together may be able to replicate the features of the real signals better. True signals may exist but may not be noticed or identified appropriately. Because of these constraints, PNT UE systems should not rely entirely on resilience approaches to limit the untrusted external inputs to provide robust behaviors. System designers should instead integrate mitigations with different resilience approaches to produce overall resilient PNT UE systems.

Challenge: Limited development of feasible technologies

Since PNT technologies are heavily utilized by critical infrastructure, including telecom, energy, finance, and transportation, these are strategic from a commercial and societal perspective. It is estimated that PNT services contribute to around 10% of the European GDP, and if GNSS is disabled, it will result in potential losses of USD 1.07 billion daily. Despite several ongoing APNT R&D programs globally, the results have been less than promising. The technology is favored primarily in the military sector and limited penetration in other sectors. Data is still limited on how APNT systems perform and how they can significantly improve the operations of assets in GPS-contested environments.

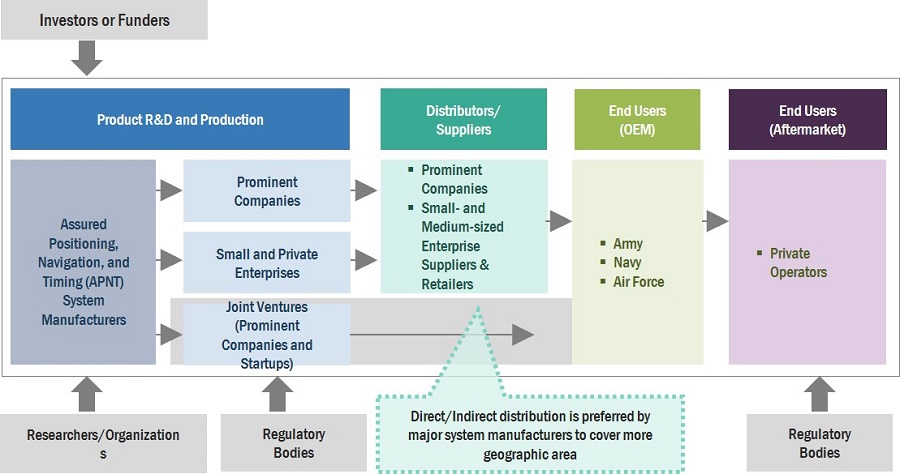

Assured Positioning, Navigation, and Timing (Apnt) Market Ecosystem

Prominent companies that provide APNT systems, private and small enterprises, distributors/suppliers/retailers, and end customers (defense forces) are the key stakeholders in the APNT market ecosystem. Investors, funders, academic researchers, distributors, service providers, and defense procurement authorities are the major influencers in the avionics market.

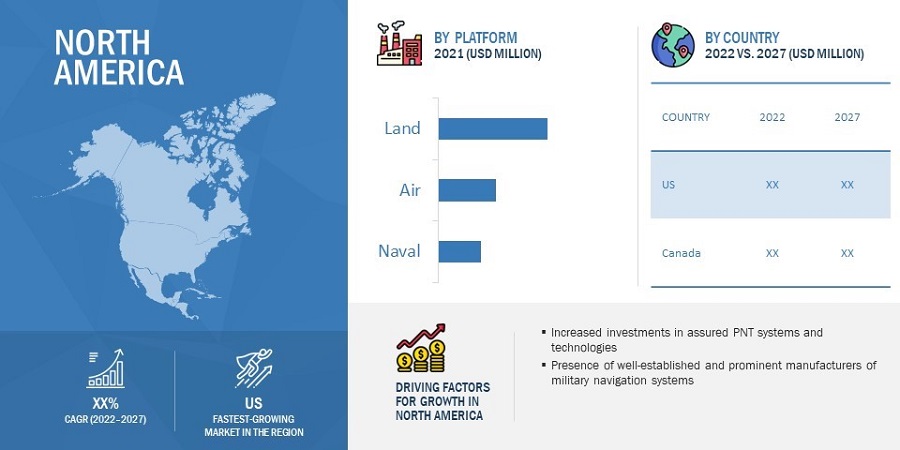

Based on the platform, the assured PNT market is segmented into land, air, and naval. An increase in defense budgets of military powers such as the US, China, and Russia, is expected to lead to increased demand for modernizing vehicles with digital navigation systems. These systems help in providing resilient capabilities and assured positioning of vehicles.

Based on the end user, the assured PNT market has been segmented into defense and homeland security. The defense segment is expected to lead due to technological advancements in obtaining mission-critical data. The increasing R&D and spending on precision positioning, navigation, and timing systems drive the defense segment in the assured PNT market.

Assured PNT Marketby Region

To know about the assumptions considered for the study, download the pdf brochure

The North American region is projected to lead the market during the forecast period

North America is expected to lead the assured PNT market during the forecasted period. It is projected to grow at the highest CAGR, with the US being the largest market in the region. The region is witnessing increased investments in developing and deploying new and advanced navigation systems to achieve improved interoperability between various units and platforms of defense forces. North America can be considered a maturing market for assured PNT because the developments in this region are focused on advancements in existing infrastructure.

Government organizations across all regions are acquiring improved and technologically advanced military navigation solutions; thus, the market size of these solutions is expected to increase worldwide rapidly. The increase in demand for security equipment and solutions across industries, such as aviation, maritime, and border security, is anticipated to drive market growth over the forecast period. The industry is highly competitive, and manufacturers invest heavily in R&D activities to offer innovative products.

Top Assured PNT Companies - Key Market Players:

The assured PNT companies are dominated by globally established players such as Bae Systems PLC (UK), L3Harris Technologies, Inc. (US), Northrop Grumman (US), General Dynamics Corporation (US), Leonardo DRS (US), Honeywell International (US), and Raytheon Technologies (US). This is also supported by their growth rates, which are remarkably close to the market.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2019-2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Million/ Billion) |

|

Segments Covered |

By component, platform, end-user, and region |

|

Geographies Covered |

North America, Asia Pacific, Europe, the Middle East & Africa, and Latin America |

|

Companies Covered |

Bae Systems PLC (UK), L3Harris Technologies (US), Northrop Grumman (US), Lockheed Martin Corporation (US), Leonardo DRS (US), General Dynamics (US), Raytheon Technologies (US), and others |

Assured PNT Market Highlights

This research report categorizes the assured PNT market based on component platform, end-user, and region

|

Segment |

Subsegment |

|

Assured PNT Market, By Platform |

|

|

Assured PNT Market, By End User |

|

|

Assured PNT Market, By Component |

|

|

Assured PNT Market, By Region |

|

Recent Developments

- In September 2022, The United States Army awarded Raytheon Technologies' Collins Aerospace company a prospective five-year contract to develop the current generation of positioning, navigation, and timing systems for the service's uncrewed and manned ground vehicles.

- In September 2022, BAE Systems received a USD 13 million contract for advanced GPS technology to protect US F-15E aircraft from GPS signal jamming and spoofing. The company's Digital GPS Anti-jam Receiver (DIGAR) will ensure the reliability of military GPS systems for aircraft operating in challenging signal environments.

- In July 2022, Under a contract with the US Space Systems Command, BAE Systems was slated to deliver its Miniature Precision Lightweight GPS Receiver Engine – M-Code (MPE-M) to German military forces.

Key Benefits of the Report/Reason to Buy:

Target Audience:

Frequently Asked Questions (FAQ):

What is the current size of the assured PNT market?

The assured PNT market is projected to grow from USD 0.4 billion in 2022 and reach USD 1.7 billion by 2027, at a CAGR of 29.8% during the forecast period.

Who are the winners in the assured PNT market?

Bae Systems PLC (UK), L3Harris Technologies, Inc. (US), Northrop Grumman (US), General Dynamics. (US) Leonardo DRS (US), Honeywell International (US), and Raytheon Technologies (US).

What are some of the technological advancements in the market?

Micro-electro-mechanical systems (MEMS) comprise miniaturized mechanical and electromechanical elements manufactured using microfabrication techniques. The MEMS INS is small; however, its broad functionalities have led to its increasing adoption in military and space applications. It is lightweight and consumes low power. Other advantages MEMS INS offers include ease of installation and modification, small thermal constant, high resistance to vibrations and shocks, reduced cost of fabrication, and real-time environment control. MEMS INS is easily integrated with UAVs and small aircraft. Key players providing MEMS INS include VectorNav Technologies (US), Gladiator Technologies (US), Sparton Navigation and Exploration (US), and Honeywell International (US).

A high-end INS is a high-precision tactical grade system that uses Fiber Optics Gyro (FOG) technology or Ring Laser Gyro (RLG) technology. FOG and RLG technologies sense the difference in propagation time between two counterpropagating light beams traveling along a closed path using the Sagnac effect. High-end INS are used in aerospace (ballistic missiles, fighter aircraft, and tactical UAVs) and marine (military vessels, aircraft carriers, warships, submarines, and UUVs) applications.

What are the factors driving the growth of the market?

The high demand in the assured PNT market can be attributed to the growing regional tensions across the globe and increasing incidences of armed conflicts, violence, and terrorism. For instance, the Middle East, North Africa, and South Asian regions have been identified as high-potential markets for smart weapons owing to the increasing demand for smart weapons from these regions in recent years.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- High demand for assured global positioning system (GPS) in military applications- Increasing demand for accuracy in navigation- Availability of miniaturized components at affordable prices- Increasing preference for use of UAVs in modern warfare- Use of UAVs as loitering munition by defense forces- Advent of next-generation military platforms and weapon technologiesRESTRAINTS- Absence of established operational parametersOPPORTUNITIES- Ongoing R&D programs- Increasing application to mitigate effects of threats- Increasing demand for new-generation air and missile defense systems- Integration of anti-jamming capabilities with navigation systemsCHALLENGES- Limited development of feasible technologies- High cost of development of military navigation equipment

- 5.3 VALUE CHAIN ANALYSIS

-

5.4 PRICING ANALYSISCOST OF INERTIAL NAVIGATION SYSTEMS USED FOR VARIOUS GRADES AND MANUFACTURERS OF INS

- 5.5 TRADE ANALYSIS

-

5.6 DISRUPTIONS IMPACTING CUSTOMER BUSINESSREVENUE SHIFT AND NEW REVENUE POCKETS FOR ASSURED PNT MARKET

-

5.7 MARKET ECOSYSTEMPROMINENT COMPANIESPRIVATE AND SMALL ENTERPRISESEND USERS

-

5.8 RECESSION IMPACT ANALYSISUNCERTAINTY ANALYSISFACTORS IMPACTING ASSURED PNT MARKET, 2022–2023PROBABLE SCENARIO IMPACT OF ASSURED PNT MARKET

-

5.9 TECHNOLOGY ANALYSISGNSS AND INTERNET OF THINGS5G AND GNSSGNSS AND MACHINE LEARNING/ARTIFICIAL INTELLIGENCECOMPACT GPS ANTI-JAM SYSTEMSALTERNATIVE TO GPS ANTI-JAM TECHNOLOGY

-

5.10 CASE STUDY ANALYSISGPS ANTI-JAMMING TECH BY NOVATEL AND JUNCTION BOX BY FORSBERG SELECTED TO PROTECT ROYAL NAVY T26 FRIGATENOVATEL'S ANTI-JAM ANTENNA SELECTED FOR CANADIAN ARMY OBSERVATION POST VEHICLESPASSIVE ANTI-JAM ANTENNA USED TO COMBAT GNSS INTERFERENCE

-

5.11 PORTER'S FIVE FORCESTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 5.12 OPERATIONAL DATA

-

5.13 TARIFF AND REGULATORY LANDSCAPEEUROPEAN UNION REGULATION NO. 1285/2013 – IMPLEMENTATION AND EXPLOITATION OF EUROPEAN SATELLITE NAVIGATION SYSTEMSEUROPEAN UNION REGULATION NO. 2015/758 – ECALL IN-VEHICLE SYSTEMUS SPACE-BASED POSITIONING, NAVIGATION, AND TIMING POLICYGDPRICAO POLICY ON GNSSREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14 KEY CONFERENCES & EVENTS IN 2023

-

5.15 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSKEY BUYING CRITERIA

- 6.1 INTRODUCTION

-

6.2 TECHNOLOGY TRENDSERROR-FREE DIGITAL OUTPUT THROUGH AIR DATA COMPUTERSSIMULATION AND DEBRIEFING THROUGH WEAPONS-INTEGRATED BATTLEFIELD MANAGEMENT SYSTEMSWIRELESS INERTIAL MEASUREMENT UNITS – FOR USE IN ROBOTICS AND UAVSMICRO-ELECTRO-MECHANICAL SYSTEMS – FOR REAL-TIME CONTROLHIGH-END INS – WIDELY USED IN MARINE APPLICATIONS- Ring laser gyro inertial navigation sensors- Fiber optic gyro inertial navigation sensorsGPS-AIDED INS – OFFERS ENHANCED DATAAIR DATA INERTIAL REFERENCE UNIT ELIMINATES NEED FOR EXTRA COMPONENTSMULTI-SENSOR DATA FUSION FOR UAV NAVIGATION- Use of sense & avoid technologyADVANCED INERTIAL NAVIGATION SYSTEMS FOR UUVS

- 6.3 SUPPLY CHAIN ANALYSIS

-

6.4 IMPACT OF MEGATRENDSARTIFICIAL INTELLIGENCE

- 6.5 INNOVATIONS AND PATENT REGISTRATIONS

- 7.1 INTRODUCTION

- 7.2 ATOMIC CLOCKS

- 7.3 ANTENNAS

- 7.4 TRANSPONDERS

- 7.5 SENSORS

- 7.6 POWER AMPLIFIERS

- 7.7 RECEIVERS

- 7.8 OTHERS

- 8.1 INTRODUCTION

-

8.2 LANDCOMBAT VEHICLES- Increasing integration of new PNT systems in modernized vehicle platformsUNMANNED GROUND VEHICLES- Demand driven by need for protection and rescue dutiesSOLDIERS- Replace GPS receivers and single source of positioning & navigation

-

8.3 AIRMILITARY AIRCRAFT- Increasing demand for new aircraft with advanced capabilitiesMILITARY HELICOPTERS- Increasing use in combat search & rescue operationsUNMANNED AERIAL VEHICLES- Increasing proliferation of drones for ISR missions

-

8.4 NAVALDESTROYERS- Increasing procurement by US and ChinaFRIGATES- Rising construction and maintenance of frigates drive demandCORVETTES- Growing focus of China on induction of advanced corvettes by 2030SUBMARINES- Increasing efforts of US, China, and India to develop advanced submarines

- 9.1 INTRODUCTION

-

9.2 DEFENSEEXPANSION OF OPERATIONAL AWARENESS AND NEW CAPABILITIES TO DRIVE SEGMENT

-

9.3 HOMELAND SECURITYINCREASING R&D ACTIVITIES FOR RESILIENT PNT TO FUEL GROWTH

- 10.1 INTRODUCTION

- 10.2 RECESSION IMPACT ANALYSIS

-

10.3 NORTH AMERICARECESSION IMPACT ANALYSIS: NORTH AMERICAPESTLE ANALYSIS: NORTH AMERICAUS- Presence of leading manufacturers in countryCANADA- High investments in development and upgrade of weapons

-

10.4 EUROPERECESSION IMPACT ANALYSIS: EUROPEPESTLE ANALYSIS: EUROPERUSSIA- Increasing investments in AI as part of modernizationUK- Need for secure guidance systems by Royal Armed ForcesFRANCE- Focus on internal security and interoperability of defense forcesGERMANY- High demand from government agencies to maintain law & orderITALY- Focus on battlefield readiness technologies that employ PNT systemsREST OF EUROPE- Geopolitical rifts to encourage adoption of modern vehicle platforms

-

10.5 ASIA PACIFICRECESSION IMPACT ANALYSIS: ASIA PACIFICPESTLE ANALYSIS: ASIA PACIFICCHINA- Increasing defense spending and conflicts with other countriesINDIA- Rising military expenditure and ongoing modernization programsJAPAN- Use of military navigation systems in defense on the riseSOUTH KOREA- Installation of GPS anti-jammers due to ongoing disputes with North KoreaAUSTRALIA- Demand for modern digital technologies in military equipmentREST OF ASIA PACIFIC- Increased technological advancements in navigation systems

-

10.6 MIDDLE EAST & AFRICARECESSION IMPACT ANALYSIS: MIDDLE EAST & AFRICAPESTLE ANALYSIS: MIDDLE EAST & AFRICASAUDI ARABIA- Growing need for cyber defenseISRAEL- Military modernization programs and development of defense capabilities in focusSOUTH AFRICA- Need for advanced systems to mitigate spoofing and jamming threatsREST OF MIDDLE EAST & AFRICA

-

10.7 LATIN AMERICARECESSION IMPACT ANALYSIS: LATIN AMERICABRAZIL- Focus on strengthening border monitoring capabilitiesMEXICO- Increasing defense spending to fight organized crime

- 11.1 INTRODUCTION

- 11.2 REVENUE ANALYSIS OF KEY MARKET PLAYERS, 2021

- 11.3 MARKET SHARE ANALYSIS

-

11.4 COMPANY EVALUATION MATRIXASSURED PNT MARKET COMPETITIVE LEADERSHIP MAPPINGSTARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTSCOMPETITIVE BENCHMARKING

-

11.5 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHES/DEVELOPMENTSDEALS

- 12.1 INTRODUCTION

-

12.2 KEY PLAYERSBAE SYSTEMS PLC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewGENERAL DYNAMICS CORPORATION- Business overview- Products/Solutions/Services offered- MnM viewLEONARDO DRS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewLOCKHEED MARTIN CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewNORTHROP GRUMMAN CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewRAYTHEON TECHNOLOGIES CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTHALES GROUP- Business overview- Products/Solutions/Services offeredL3HARRIS TECHNOLOGIES- Business overview- Products/Solutions/Services offered- Recent developmentsHEXAGON AB- Business overview- Products/Solutions/Services offered- Recent developmentsISRAEL AEROSPACE INDUSTRIES- Business overview- Products/Services/Solutions offeredSPIRENT COMMUNICATIONS- Business overview- Products/Services/Solutions Offered- Recent developmentsRHEINMETALL AG- Business overview- Products/Services/Solutions Offered- Recent developmentsCOBHAM LTD.- Business overview- Products/Services/Solutions Offered- Recent developmentsCURTISS-WRIGHT CORPORATION- Business overview- Products/Services/Solutions OfferedOROLIA- Business overview- Products/Services/Solutions Offered- Recent developmentsHONEYWELL INTERNATIONAL, INC.- Business overview- Products/Solutions/Services offered

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES

- TABLE 2 ASSURED PNT MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 3 COUNTRIES THAT USE LOITERING MUNITION

- TABLE 4 IMPORT VALUE OF RADAR APPARATUS, RADIO NAVIGATIONAL AID APPARATUS, AND RADIO REMOTE CONTROL APPARATUS [PRODUCT HARMONIZED SYSTEM CODE: 8526, USD MILLION (2017–2021)]

- TABLE 5 EXPORTED VALUE OF RADAR APPARATUS, RADIO NAVIGATIONAL AID APPARATUS, AND RADIO REMOTE CONTROL APPARATUS [(PRODUCT HARMONIZED SYSTEM CODE: 8526, USD MILLION (2017–2021)]

- TABLE 6 ASSURED PNT MARKET ECOSYSTEM

- TABLE 7 ASSURED PNT MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 8 MAIN BATTLE TANKS VOLUME ANALYSIS, BY COUNTRY, 2018–2021

- TABLE 9 INFANTRY FIGHTING VEHICLES VOLUME ANALYSIS, BY COUNTRY, 2018–2021

- TABLE 10 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASSURED PNT MARKET: CONFERENCES & EVENTS, 2023

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE PLATFORMS (%)

- TABLE 13 KEY BUYING CRITERIA FOR TOP THREE PLATFORMS

- TABLE 14 ASSURED PNT: KEY PATENTS (2020—2022)

- TABLE 15 ASSURED PNT MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

- TABLE 16 ASSURED PNT MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 17 ASSURED PNT MARKET, BY END USER, 2019–2021 (USD MILLION)

- TABLE 18 ASSURED PNT MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 19 RECESSION IMPACT ANALYSIS

- TABLE 20 ASSURED PNT MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 21 ASSURED PNT MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 22 NORTH AMERICA: ASSURED PNT MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

- TABLE 23 NORTH AMERICA: ASSURED PNT MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 24 NORTH AMERICA: ASSURED PNT MARKET, BY END USER, 2019–2021 (USD MILLION)

- TABLE 25 NORTH AMERICA: ASSURED PNT MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 26 NORTH AMERICA: ASSURED PNT MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 27 NORTH AMERICA: ASSURED PNT MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 28 US: ASSURED PNT MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

- TABLE 29 US: ASSURED PNT MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 30 US: ASSURED PNT MARKET, BY END USER, 2019–2021 (USD MILLION)

- TABLE 31 US: ASSURED PNT MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 32 CANADA: ASSURED PNT MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

- TABLE 33 CANADA: ASSURED PNT MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 34 CANADA: ASSURED PNT MARKET, BY END USER, 2019–2021 (USD MILLION)

- TABLE 35 CANADA: ASSURED PNT MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 36 EUROPE: ASSURED PNT MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

- TABLE 37 EUROPE: ASSURED PNT MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 38 EUROPE: ASSURED PNT MARKET, BY END USER, 2019–2021 (USD MILLION)

- TABLE 39 EUROPE: ASSURED PNT MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 40 EUROPE: ASSURED PNT MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 41 EUROPE: ASSURED PNT MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 42 RUSSIA: ASSURED PNT MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

- TABLE 43 RUSSIA: ASSURED PNT MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 44 RUSSIA: ASSURED PNT MARKET, BY END USER, 2019–2021 (USD MILLION)

- TABLE 45 RUSSIA: ASSURED PNT MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 46 UK: ASSURED PNT MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

- TABLE 47 UK: ASSURED PNT MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 48 UK: ASSURED PNT MARKET, BY END USER, 2019–2021 (USD MILLION)

- TABLE 49 UK: ASSURED PNT MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 50 FRANCE: ASSURED PNT MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

- TABLE 51 FRANCE: ASSURED PNT MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 52 FRANCE: ASSURED PNT MARKET, BY END USER, 2019–2021 (USD MILLION)

- TABLE 53 FRANCE: ASSURED PNT MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 54 GERMANY: ASSURED PNT MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

- TABLE 55 GERMANY: ASSURED PNT MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 56 GERMANY: ASSURED PNT MARKET, BY END USER, 2019–2021 (USD MILLION)

- TABLE 57 GERMANY: ASSURED PNT MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 58 ITALY: ASSURED PNT MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

- TABLE 59 ITALY: ASSURED PNT MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 60 ITALY: ASSURED PNT MARKET, BY END USER, 2019–2021 (USD MILLION)

- TABLE 61 ITALY: ASSURED PNT MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 62 REST OF EUROPE: ASSURED PNT MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

- TABLE 63 REST OF EUROPE: ASSURED PNT MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 64 REST OF EUROPE: ASSURED PNT MARKET, BY END USER, 2019–2021 (USD MILLION)

- TABLE 65 REST OF EUROPE: ASSURED PNT MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 66 ASIA PACIFIC: ASSURED PNT MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

- TABLE 67 ASIA PACIFIC: ASSURED PNT MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 68 ASIA PACIFIC: ASSURED PNT MARKET, BY END USER, 2019–2021 (USD MILLION)

- TABLE 69 ASIA PACIFIC: ASSURED PNT MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 70 ASIA PACIFIC: ASSURED PNT MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 71 ASIA PACIFIC: ASSURED PNT MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 72 CHINA: ASSURED PNT MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

- TABLE 73 CHINA: ASSURED PNT MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 74 CHINA: ASSURED PNT MARKET, BY END USER, 2019–2021 (USD MILLION)

- TABLE 75 CHINA: ASSURED PNT MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 76 INDIA: ASSURED PNT MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

- TABLE 77 INDIA: ASSURED PNT MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 78 INDIA: ASSURED PNT MARKET, BY END USER, 2019–2021 (USD MILLION)

- TABLE 79 INDIA: ASSURED PNT MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 80 JAPAN: ASSURED PNT MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

- TABLE 81 JAPAN: ASSURED PNT MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 82 JAPAN: ASSURED PNT MARKET, BY END USER, 2019–2021 (USD MILLION)

- TABLE 83 JAPAN: ASSURED PNT MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 84 SOUTH KOREA: ASSURED PNT MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

- TABLE 85 SOUTH KOREA: ASSURED PNT MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 86 SOUTH KOREA: ASSURED PNT MARKET, BY END USER, 2019–2021 (USD MILLION)

- TABLE 87 SOUTH KOREA: ASSURED PNT MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 88 AUSTRALIA: ASSURED PNT MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

- TABLE 89 AUSTRALIA: ASSURED PNT MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 90 AUSTRALIA: ASSURED PNT MARKET, BY END USER, 2019–2021 (USD MILLION)

- TABLE 91 AUSTRALIA: ASSURED PNT MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 92 REST OF ASIA PACIFIC: ASSURED PNT MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

- TABLE 93 REST OF ASIA PACIFIC: ASSURED PNT MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 94 REST OF ASIA PACIFIC: ASSURED PNT MARKET, BY END USER, 2019–2021 (USD MILLION)

- TABLE 95 REST OF ASIA PACIFIC: ASSURED PNT MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 96 MIDDLE EAST & AFRICA: ASSURED PNT MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

- TABLE 97 MIDDLE EAST & AFRICA: ASSURED PNT MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 98 MIDDLE EAST & AFRICA: ASSURED PNT MARKET, BY END USER, 2019–2021 (USD MILLION)

- TABLE 99 MIDDLE EAST & AFRICA: ASSURED PNT MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 100 MIDDLE EAST & AFRICA: ASSURED PNT MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 101 MIDDLE EAST & AFRICA: ASSURED PNT MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 102 SAUDI ARABIA: ASSURED PNT MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

- TABLE 103 SAUDI ARABIA: ASSURED PNT MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 104 SAUDI ARABIA: ASSURED PNT MARKET, BY END USER, 2019–2021 (USD MILLION)

- TABLE 105 SAUDI ARABIA: ASSURED PNT MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 106 ISRAEL: ASSURED PNT MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

- TABLE 107 ISRAEL: ASSURED PNT MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 108 ISRAEL: ASSURED PNT MARKET, BY END USER, 2019–2021 (USD MILLION)

- TABLE 109 ISRAEL: ASSURED PNT MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 110 SOUTH AFRICA: ASSURED PNT MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

- TABLE 111 SOUTH AFRICA: ASSURED PNT MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 112 SOUTH AFRICA: ASSURED PNT MARKET, BY END USER, 2019–2021 (USD MILLION)

- TABLE 113 SOUTH AFRICA: ASSURED PNT MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 114 REST OF MIDDLE EAST & AFRICA: ASSURED PNT MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

- TABLE 115 REST OF MIDDLE EAST & AFRICA: ASSURED PNT MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 116 REST OF MIDDLE EAST & AFRICA: ASSURED PNT MARKET, BY END USER, 2019–2021 (USD MILLION)

- TABLE 117 REST OF MIDDLE EAST & AFRICA: ASSURED PNT MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 118 LATIN AMERICA: ASSURED PNT MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

- TABLE 119 LATIN AMERICA: ASSURED PNT MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 120 LATIN AMERICA: ASSURED PNT MARKET, BY END USER, 2019–2021 (USD MILLION)

- TABLE 121 LATIN AMERICA: ASSURED PNT MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 122 LATIN AMERICA: ASSURED PNT MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 123 LATIN AMERICA: ASSURED PNT MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 124 BRAZIL: ASSURED PNT MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

- TABLE 125 BRAZIL: ASSURED PNT MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 126 BRAZIL: ASSURED PNT MARKET, BY END USER, 2019–2021 (USD MILLION)

- TABLE 127 BRAZIL: ASSURED PNT MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 128 MEXICO: ASSURED PNT MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

- TABLE 129 MEXICO: ASSURED PNT MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 130 MEXICO: ASSURED PNT MARKET, BY END USER, 2019–2021 (USD MILLION)

- TABLE 131 MEXICO: ASSURED PNT MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 132 KEY DEVELOPMENTS BY LEADING MARKET PLAYERS BETWEEN 2018 AND 2022

- TABLE 133 ASSURED PNT MARKET: DEGREE OF COMPETITION

- TABLE 134 COMPANY FOOTPRINT

- TABLE 135 COMPANY END USER FOOTPRINT

- TABLE 136 COMPANY PLATFORM FOOTPRINT

- TABLE 137 COMPANY REGION FOOTPRINT

- TABLE 138 ASSURED PNT MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, APRIL 2019–SEPTEMBER 2021

- TABLE 139 ASSURED PNT MARKET: DEALS, APRIL 2019–SEPTEMBER 2022

- TABLE 140 BAE SYSTEMS PLC: BUSINESS OVERVIEW

- TABLE 141 BAE SYSTEMS PLC: PRODUCT LAUNCHES

- TABLE 142 BAE SYSTEMS PLC: DEALS

- TABLE 143 GENERAL DYNAMICS CORPORATION: BUSINESS OVERVIEW

- TABLE 144 LEONARDO DRS: BUSINESS OVERVIEW

- TABLE 145 LEONARDO DRS: PRODUCT LAUNCHES

- TABLE 146 LOCKHEED MARTIN CORPORATION: BUSINESS OVERVIEW

- TABLE 147 LOCKHEED MARTIN CORPORATION: DEALS

- TABLE 148 NORTHROP GRUMMAN CORPORATION: BUSINESS OVERVIEW

- TABLE 149 NORTHROP GRUMMAN CORPORATION: DEALS

- TABLE 150 RAYTHEON TECHNOLOGIES CORPORATION: BUSINESS OVERVIEW

- TABLE 151 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCT LAUNCHES

- TABLE 152 RAYTHEON TECHNOLOGIES CORPORATION: DEALS

- TABLE 153 THALES GROUP: BUSINESS OVERVIEW

- TABLE 154 L3HARRIS TECHNOLOGIES: BUSINESS OVERVIEW

- TABLE 155 L3HARRIS TECHNOLOGIES: DEALS

- TABLE 156 HEXAGON AB: BUSINESS OVERVIEW

- TABLE 157 HEXAGON AB: PRODUCT LAUNCHES

- TABLE 158 ISRAEL AEROSPACE INDUSTRIES: BUSINESS OVERVIEW

- TABLE 159 SPIRENT COMMUNICATIONS: BUSINESS OVERVIEW

- TABLE 160 SPIRENT COMMUNICATIONS: PRODUCT LAUNCHES

- TABLE 161 SPIRENT COMMUNICATIONS: DEALS

- TABLE 162 RHEINMETALL AG: BUSINESS OVERVIEW

- TABLE 163 RHEINMETALL AG: DEALS

- TABLE 164 COBHAM LTD.: BUSINESS OVERVIEW

- TABLE 165 COBHAM LTD.: DEALS

- TABLE 166 CURTISS-WRIGHT CORPORATION: BUSINESS OVERVIEW

- TABLE 167 OROLIA: BUSINESS OVERVIEW

- TABLE 168 OROLIA: DEALS

- TABLE 169 HONEYWELL INTERNATIONAL, INC.: BUSINESS OVERVIEW

- FIGURE 1 YEARS CONSIDERED

- FIGURE 2 RESEARCH PROCESS FLOW

- FIGURE 3 ASSURED PNT MARKET: RESEARCH DESIGN

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 QUARTERLY REVENUE ANALYSIS OF TOP FIVE KEY PLAYERS

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 8 DATA TRIANGULATION

- FIGURE 9 RESEARCH ASSUMPTIONS

- FIGURE 10 LAND PLATFORMS TO DOMINATE ASSURED PNT MARKET DURING FORECAST PERIOD

- FIGURE 11 DEFENSE TO LEAD END USER SEGMENT DURING FORECAST PERIOD

- FIGURE 12 NORTH AMERICA TO COMMAND LARGEST SHARE OF MARKET

- FIGURE 13 RISING DEMAND FOR MISSILES AND ARTILLERY SYSTEMS TO BOOST ASSURED PNT MARKET FROM 2022 TO 2027

- FIGURE 14 LAND PLATFORMS TO LEAD ASSURED PNT MARKET DURING FORECAST PERIOD

- FIGURE 15 DEFENSE TO BE LARGEST END USER SEGMENT FROM 2022 TO 2027

- FIGURE 16 US MARKET PROJECTED TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

- FIGURE 17 ASSURED PNT MARKET DYNAMICS

- FIGURE 18 VALUE CHAIN ANALYSIS: ASSURED PNT MARKET

- FIGURE 19 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

- FIGURE 20 ASSURED PNT ECOSYSTEM

- FIGURE 21 PORTER'S FIVE FORCES ANALYSIS: ASSURED PNT MARKET

- FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE PLATFORMS

- FIGURE 23 KEY BUYING CRITERIA FOR TOP THREE PLATFORMS

- FIGURE 24 SUPPLY CHAIN ANALYSIS

- FIGURE 25 ASSURED PNT MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- FIGURE 26 ASSURED PNT MARKET, BY END USER, 2022–2027 (USD MILLION)

- FIGURE 27 NORTH AMERICA TO DOMINATE ASSURED PNT MARKET FROM 2022 TO 2027

- FIGURE 28 ASSURED PNT MARKET: NORTH AMERICA SNAPSHOT

- FIGURE 29 ASSURED PNT MARKET: EUROPE SNAPSHOT

- FIGURE 30 ASSURED PNT MARKET: ASIA PACIFIC SNAPSHOT

- FIGURE 31 ASSURED PNT MARKET: MIDDLE EAST & AFRICA SNAPSHOT

- FIGURE 32 ASSURED PNT MARKET: LATIN AMERICA SNAPSHOT

- FIGURE 33 REVENUE ANALYSIS OF KEY COMPANIES IN LAST FIVE YEARS

- FIGURE 34 ASSURED PNT: MARKET SHARE ANALYSIS, 2021

- FIGURE 35 ASSURED PNT MARKET (GLOBAL): COMPANY EVALUATION MATRIX, 2021

- FIGURE 36 BAE SYSTEMS PLC: COMPANY SNAPSHOT

- FIGURE 37 GENERAL DYNAMICS CORPORATION: COMPANY SNAPSHOT

- FIGURE 38 LEONARDO S.P.A.: COMPANY SNAPSHOT

- FIGURE 39 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

- FIGURE 40 NORTHROP GRUMMAN CORPORATION: COMPANY SNAPSHOT

- FIGURE 41 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

- FIGURE 42 THALES GROUP: COMPANY SNAPSHOT

- FIGURE 43 L3HARRIS TECHNOLOGIES: COMPANY SNAPSHOT

- FIGURE 44 HEXAGON AB: COMPANY SNAPSHOT

- FIGURE 45 ISRAEL AEROSPACE INDUSTRIES: COMPANY SNAPSHOT

- FIGURE 46 SPIRENT COMMUNICATIONS: COMPANY SNAPSHOT

- FIGURE 47 RHEINMETALL AG: COMPANY SNAPSHOT

- FIGURE 48 CURTISS-WRIGHT CORPORATION: COMPANY SNAPSHOT

- FIGURE 49 HONEYWELL INTERNATIONAL, INC.: COMPANY SNAPSHOT

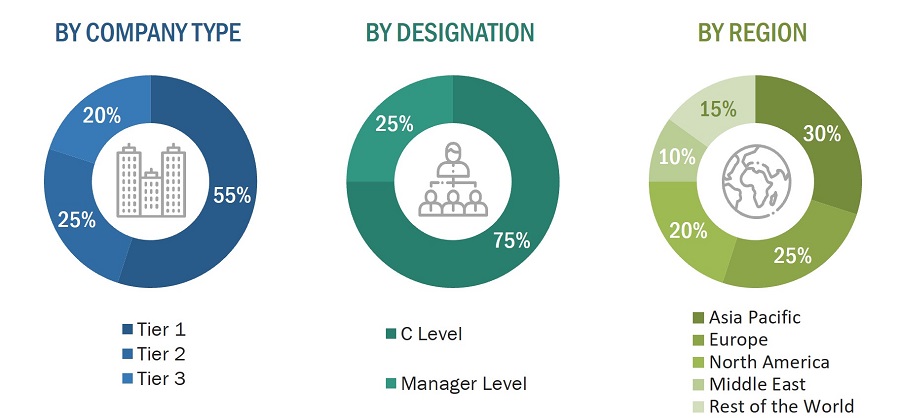

This study on the assured PNT market involved the extensive use of secondary sources, directories, and databases such as D&B Hoovers, Bloomberg BusinessWeek, and Factiva to identify and collect information relevant to the market. The primary sources considered included industry experts, service providers, manufacturers, solution providers, technology developers, alliances, and organizations related to all segments of this industry's value chain. In-depth interviews with primary respondents, including key industry participants, subject matter experts (SMEs), industry consultants, and C-level executives, were conducted to obtain and verify critical qualitative and quantitative information about the market and assess its growth prospects.

Secondary Research

The ranking analysis of companies in the assured PNT market was determined using secondary data from paid and unpaid sources and analyzing major companies' product portfolios and service offerings. These companies were rated based on the performance and quality of their products. Primary sources further validated these data points.

Secondary sources referred for this research study on the assured PNT market included government sources, such as the GPS and the Federal Aviation Administration (FAA); corporate filings, including annual reports, investor presentations, and financial statements of companies offering military navigation; and trade, business, and professional associations.

Primary Research

Extensive primary research was conducted after obtaining information about the assured PNT market's current scenario through secondary research. Several interviews were conducted with market experts from the demand and supply sides across five regions: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. This primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

The top-down and bottom-up approaches were used to estimate and validate the size of the assured PNT market. The research methodology used to estimate the market size includes the following details.

Key players in the assured PNT market were identified through secondary research, and their market share was determined through primary and secondary research. This included a study of the annual and financial reports of the top market players and extensive interviews with leaders such as chief executive officers, directors, and marketing executives of leading companies operating in the assured PNT market.

All percentage shares split and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data on the assured PNT market. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Bottom-Up Approach

The bottom-up approach was employed to arrive at the overall size of the assured PNT market by estimating the revenue and share of key market players. Calculations based on the revenue of key players identified in the market led to the estimation of the overall market size.

The bottom-up approach was also implemented for data extraction from secondary research to validate the market segment revenue. The market share was then estimated for each company to verify the revenue share used earlier in the bottom-up approach. With the data triangulation procedure and data validation through primaries, this study determined and confirmed the overall parent market size and each market size.

Market size Estimation

|

Step 1 |

Segmenting assured PNT market based on platform and end-user |

Various technologies for assured PNT considered in the scope require different platforms. Thus, the penetration of each technology is different. |

|

Step 2 |

Listing existing and upcoming assured PNT contracts |

All the existing and upcoming assured PNT contracts to validate the market. |

|

Step 3 |

Listing existing and upcoming assured PNT R&D projects and related investments |

All the existing and upcoming assured PNT R&D projects and related investments undertaken by various governments were listed and quantified to validate the market. |

|

Step 4 |

Arriving at global market size (2021) |

Global market 2021 = approximation of contract values in 2021 based on platforms |

|

Step 5 |

Arriving at global market size (2022–2027) |

The global market was estimated based on data on existing and upcoming projects announced by OEMs. |

Market Size Estimation methodology: Bottom-Up Approach

Top-Down Approach

In the top-down approach, the size of the assured PNT market was used to estimate the size of individual markets (mentioned in the market segmentation) through percentage splits from secondary and primary research. For the calculation of the sizes of specific market segments, the size of the most appropriate immediate parent market was used to implement the top-down approach.

Different platforms, such as land, naval, and air, were considered for the assured PNT market. The size of each of these platforms was cross-checked and validated to arrive at the overall size. Similar methodologies were adopted to determine the sizes of other segments and subsegments of the assured PNT market.

Data Triangulation

After arriving at the overall size of the assured PNT market from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various segments and sub-segments of the market. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the market size was validated using the top-down and bottom-up approaches.

In the bottom-up approach, the size of the assured PNT market was obtained by calculating country-level data. In the top-down approach, the market size was derived by estimating the revenue of key players operating in the market and validating the data acquired from primary research.

The following figure indicates the data triangulation procedure implemented in the market engineering process to form this report on the assured PNT market.

Report Objectives

- Identify and analyze major drivers, constraints, challenges, and opportunities driving the assured PNT market's growth.

- Analyze the market effect of macro and micro indicators

- To forecast market segment sizes for five regions, including North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America, as well as significant nations within each area.

- To conduct a strategic analysis of micro markets regarding particular technical trends, prospects, and their contribution to the total market.

- To profile key market participants strategically and thoroughly study their market ranking and essential skills

- To give a complete market competitive landscape, as well as an examination of the company and corporate strategies such as contracts, collaborations, partnerships, expansions, and new product developments.

- Identifying comprehensive financial positions, key products, unique selling points, and key developments of industry leaders

Available customizations

MarketsandMarkets provides customizations in addition to market data to meet the individual demands of businesses. The following report customization options are available:

Product Evaluation

- The product matrix provides a thorough comparison of each company's product portfolio.

Regional Examination

- Further segmentation of the market at the national level

Information About the Company

- Additional market participants will be thoroughly examined and profiled (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Assured PNT Market