Asia-Pacific Gesture Recognition & Touchless Sensing Market (2013 - 2018): Technology (2D, 3D, Ultrasonic, IR, Capacitive); Product (Biometric, Sanitary); Application (Healthcare, Electronics, Automotive); Country (India, China, Japan, South Korea)

The report on Asia-Pacific gesture recognition and touchless sensing market deals with the in-depth analysis of the technologies, applications, products, and countries of the broad markets for the period from 2013 till 2018. The touchless sensing market has covered through two broad markets, namely, touchless sanitary equipment and touchless biometrics. All the applications, technologies and the major countries in APAC that hold potential for the future in the gesture recognition market have been identified and articulated in the report.

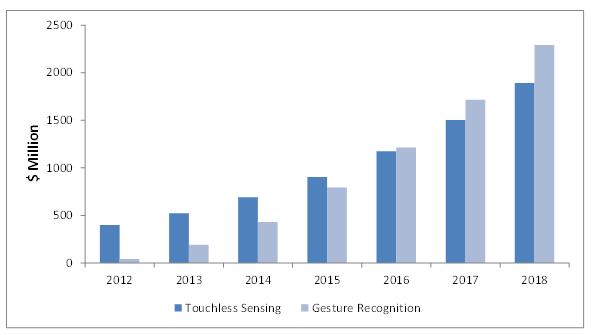

The total Asia-Pacific touchless sensing and gesture recognition market is expected to reach $4.18 billion by 2018 at a double digit CAGR from 2013 till 2018. The market value in 2012 was approximately $442.65 million.

The report focuses on the in-depth segmentation of all these markets by the different technologies, products, and applications. For instance, the touchless biometric market has been segmented by the different types like face, iris, voice, and touchless fingerprint biometrics. Similarly, the touchless sanitary equipment is segmented by the major products like faucets, soap dispensers, trash cans, hand dryers, paper towel dispenser, and flushes. The gesture recognition market has been segmented by technologies like 2D camera based, 3D camera based, ultrasonic, infrared arrays, and capacitive technology. These major technologies and products have been mapped against each other and also against the major countries.

The market dynamics, i.e. drivers, restraints, and opportunities of each of the markets have been identified and explained in the report. The market estimation and forecasts have been done using market dynamics. The report has identified the major companies active in the current market and also those who have potential to emerge as prominent players. In addition to the company profiles, the report does provide a Competitive landscape (CL) of the key players for each of the markets. The CL covers market share analysis, mergers and acquisitions, collaborations, partnerships, new product developments, and the key growth strategies of each player.

The report also provides detailed about porters five force analysis for Touchless sanitary, touchless biometrics and gesture recognition markets. All the five major factors in these markets have been quantified using internal key parameters governing each of them.

The touchless sensing and gesture recognition is also mapped against major individual countries. The market by geography is segmented by India, China, Japan, South Korea, Taiwan, Oceania and others, which gives a detailed insight of regional profit pockets and potential emerging markets. Apart from market segmentation, the report includes critical market data showing the price trend analysis, emerging trends and value chain analysis.

KEY TAKE-AWAYS

- The Asia-Pacific touchless sensing and gesture recognition market is estimated to grow at a healthy CAGR from 2013 till 2018 and to cross $4 billion by the end of these five years.

- Detailed segmentation of global touchless sensing and gesture recognition market by technology and products with a focus on markets of high growth and emerging technologies.

- The major drivers for the gesture recognition market are the user experience offered and the increasing focus of OEMs in the APAC market.

- India is the fastest growing region for touchless Biometric Market, while China leads in the touchless sanitary equipment market.

- Currently, consumer electronics application contributes more than 99% of the Asia-Pacific gesture recognition market.

- The factors such as evolving technology and increasing adoption by OEMs are rapidly changing the market ecosystem.

- Of all the major technologies, 2D camera-based technology is expected to have higher adoption rates for mass markets like smartphones. The 3D time-of-flight cameras are expected to see considerable shipments by late 2014 and early 2015.

- Gesture recognition in healthcare is mainly used for rehabilitation applications and will soon witness high demand for operating room applications.

- The automotive application for gesture recognition is expected to be commercialized in 2015.

- Porters analysis in detail, value chain analysis along with technology & market roadmaps, and evolution of each of the markets is given.

Customer Interested in this report also can view

-

Gesture Recognition & Touchless Sensing Market (2013 - 2018): By Technology (2D, 3D, Ultrasonic, IR, Capacitive); Product (Biometric, Sanitary Equipment); Application (Healthcare, Consumer Electronics, Automotive); Geography (Americas, EMEA, & APAC)

-

Europe Gesture Recognition & Touchless Sensing Market(2013 - 2018) Technology (2D, 3D, Ultrasonic, IR, Capacitive); Product (Biometric, Sanitary); Application (Healthcare, Electronics, Automotive); Region (Germany, U.K., France, Italy, MEA)

-

Americas Gesture Recognition & Touchless Sensing Market (2013 - 2018) Technology (2D, 3D, Ultrasonic, IR, Capacitive); Product (Biometric, Sanitary); Application (Healthcare, Electronics, Automotive); Country (U.S., Canada, Mexico, Brazil, Argentina)

The increasing security concerns in the major countries of the region have pushed for the need of accurate and reliable biometric systems. The e-passport program has picked up pace in many countries and the Aadhaar number initiative by the Indian government have created huge demand for the touchless biometrics. The touchless sanitary market that includes products like touchless faucets, touchless soap dispensers, touchless hand dryers and so on, will witness growth in their shipments as the governments increase their focus on hygiene in the region.

The demand for touchless biometrics is on the rise owing to the accuracy on the part of the system. The contact-less biometric solutions are more hygienic as compared to the touch-based biometric systems. The touch-less sensing market is expected to reach $1.89 billion by the end of 2018 at a CAGR of 29.30%. The key players in the touch-less sanitary equipment market are iTouchless (U.S.), simplehuman LLC (U.S.). The key players in touchless biometric solutions include NEC Corporation (Japan), Fujitsu Limited (Japan), TST Biometrics (Germany), Touchless Biometric Systems (Germany), and IrisGuard (Switzerland). Majority of the global players have strong presence in the Asia-Pacific market.

The huge demand for Smartphones and Tablets is a definite driver for the gesture recognition market in the APAC region. This is evident with the number of product launched, from the OEMs in the last two years. A number of OEMs, who have their footprint globally and in local markets, have launched products ranging from smartphones to smart TVs. The figure below shows the trend of the Asia-Pacific gesture recognition and touchless sensing market from 2012 till 2018.

Source: MarketsandMarkets Analysis

The Asia-Pacific gesture recognition market is expected to reach $2.29 billion in 2018 from $43.32 million in 2012 at a CAGR of 83.18% from 2013 to 2018.

Gesture recognition is still in the emerging phase but has proved to be the next generation technology that has the potential to revolutionize the way humans interact with machines. The technology is currently being integrated majorly into consumer electronics. This would help to push the technology towards maturity and in turn the decrease in price. Slowly, automotive application and healthcare would emerge as potential applications for the gesture recognition market in the near future.

Table Of Contents

1 Introduction (Page No. - 25)

1.1 Key Take-Aways

1.2 Report Description

1.3 Markets Covered

1.4 Stakeholders

1.5 Research Methodology

1.5.1 Market Size

1.5.2 Key Data Points Taken From Secondary Sources

1.5.3 Key Data Points Taken From Primary Sources

1.5.4 Assumptions Made For This Report

2 Executive Summary (Page No. - 33)

3 Cover-Page Interviews (Page No. - 36)

3.1 Qualcomm, Inc.

3.2 Cognivue Corporation

4 Asia-Pacific Market Overview (Page No. - 42)

4.1 Market Definition

4.2 Market Evolution

4.2.1 Touchless Sensing

4.2.2 Gesture Recognition

4.3 Market Segmentation

4.3.1 Touchless Sensing

4.3.2 Gesture Recognition

4.4 Value Chain Analysis

4.4.1 Touchless Sensing

4.4.2 Gesture Recognition

4.4.2.1 Semiconductor Vendors

4.4.2.1.1 Key Technology Providers

4.4.2.1.2 Component Manufacturers

4.4.2.2 Software Solution Providers

4.4.2.3 Oems

4.5 Porter’s Five Forces Analysis

4.5.1 Touchless Biometrics

4.5.1.1 Threat Of New Entrants

4.5.1.2 Threat Of Substitutes

4.5.1.3 Degree Of Competition

4.5.1.4 Bargaining Power Of Buyer

4.5.1.5 Bargaining Power Of Supplier

4.5.2 Touchless Sanitary Equipment

4.5.2.1 Threat Of New Entrants

4.5.2.2 Threat Of Substitutes

4.5.2.3 Degree Of Competition

4.5.2.4 Bargaining Power Of Buyer

4.5.2.5 Bargaining Power Of Supplier

4.5.3 Gesture Recognition

4.5.3.1 Threat Of New Entrants

4.5.3.2 Threat Of Substitutes

4.5.3.3 Degree Of Competition

4.5.3.4 Bargaining Power Of Buyer

4.5.3.5 Bargaining Power Of Supplier

4.6 Market Dynamics

4.6.1 Touchless Sensing-Biometrics Market

4.6.1.1 Overview

4.6.1.2 Drivers

4.6.1.2.1 Demand From Banking And Finance Sector

4.6.1.2.2 Aadhaar Number Initiative

4.6.1.2.3 Embracing The E-Passport Program

4.6.1.3 Restraints

4.6.1.3.1 Privacy Intrusion

4.6.1.4 Opportunities

4.6.1.4.1 Scope In Automotive And Consumer Electronics Applications

4.6.1.5 Burning Issue

4.6.1.5.1 High Product/Replacement Cost

4.6.1.6 Winning Imperatives

4.6.2 Touchless Sensing-Sanitary Equipment Market

4.6.2.1 Overview

4.6.2.2 Drivers

4.6.2.2.1 Push By Local Government Bodies

4.6.2.2.2 Emerging Travel And Healthcare Applications

4.6.2.3 Restraints

4.6.2.3.1 Dominance Of White-Box Products Due To High Cost Of Branded Products

4.6.2.4 Opportunities

4.6.2.4.1 Touchless Sanitary Equipment For Residential Use

4.6.2.5 Burning Issue

4.6.2.5.1 Choice Of Touch Based Sanitary Equipment

4.6.3 Gesture Recognition Market

4.6.3.1 Overview

4.6.3.2 Drivers

4.6.3.2.1 Convenient And Easy Interface

4.6.3.2.2 Intelligent Product Pricing Strategy

4.6.3.2.3 Huge Addressable Demand

4.6.3.2.4 Presence Of Oems

4.6.3.3 Restraints

4.6.3.3.1 Lack Of Content

4.6.3.3.2 Increased Battery Use

4.6.3.3.3 Lack Of Accuracy

4.6.3.4 Opportunities

4.6.3.4.1 Huge Potential In The Automotive Sector

4.6.3.4.2 Integration Of Multiple Technologies

4.6.3.5 Burning Issues

4.6.3.5.1 Lack Of Technology Awareness & Product Marketing

4.6.3.6 Winning Imperatives

4.6.3.6.1 Increasing The Frequency Of Product Launches

4.6.3.6.2 Robust Products

4.7 Emerging Trends In Gesture Recognition Market

4.7.1 Increase In The Number Of Product Launches Embracing The Technology

4.7.2 Streamlining Of Technologies For Specific Applications

4.7.3 A Technology And Not Just A Feature

5 Asia-Pacific Touch-Less Sensing Market (Page No. - 92)

5.1 Introduction

5.2 Touchless Sensing – Technology Analysis

5.2.1 Infrared Sensors

5.2.2 Capacitive Sensors

5.3 Touchless Sensing - Product Market

5.3.1 Sanitary Equipment Market

5.3.1.1 Touch-Less Faucets

5.3.1.2 Touch-Less Soap Dispenser

5.3.1.3 Touch-Less Paper Towel Dispensers

5.3.1.4 Touch-Less Trash Cans

5.3.1.5 Touch-Less Flushes

5.3.1.6 Hand Dryers

5.3.2 Touch-Less Biometrics Market

5.3.2.1 Geographic Distribution

5.3.2.2 Touch-Less Fingerprint Recognition

5.3.2.3 Iris Recognition

5.3.2.4 Face Recognition System

5.3.2.4.1 Methods Of Face Recognition

5.3.2.4.1.1 Traditional Method

5.3.2.4.1.1.1 Face Recognition Using Eigen Faces

5.3.2.4.1.1.2 Face Recognition Using Line Edge Map

5.3.2.4.1.2 3d Face Recognition

5.3.2.4.1.3 Skin Texture Analysis

5.3.2.4.1.4 Facial Thermo Gram

5.3.2.4.1.5 Smile Recognition

5.3.2.5 Voice Recognition

5.4 Touch-Less Sensing – Applications Market

5.4.1 Touchless Biometrics Grows Across All Applications

5.4.2 Travel

5.4.3 Government

5.4.4 Finance & Banking

5.4.5 Consumer Electronics

5.4.6 Healthcare

5.4.7 Others

6 Asia-Pacific Gesture Recognition Market (Page No. - 158)

6.1 Introduction

6.2 Pricing Analysis

6.3 Gesture Recognition – Technology Analysis

6.3.1 How Gesture Recognition Works?

6.3.1.1 Software Is The Key Inside A Gesture Recognition Device

6.3.2 Gesture Detection Technologies

6.3.2.1 Touch/Device Based Gesture Recognition

6.3.2.1.1 Accelerometers

6.3.2.1.2 Gyroscopes

6.3.2.2 Touchless Gesture Recognition Technologies

6.3.2.2.1 Capacitive/Electric Near Field

6.3.2.2.2 Infrared Array

6.3.2.2.3 Ultrasonic Technology

6.3.2.2.4 2D Camera Based

6.3.2.2.5 3D Vision Technologies

6.3.2.2.5.1 Stereoscopic

6.3.2.2.5.2 Structured Lighting

6.3.2.2.5.3 Time-Of-Flight Cameras

6.3.2.2.5.4 Gesture Cameras

6.3.2.3 2D Vs. 3D

6.3.2.3.1 3D Gesture Recognition Technology Will Emerge As The Winner

6.3.2.4 Technology Comparison

6.3.2.4.1 Look Out For The Ultrasonic Technology Based Gesture Recognition

6.4 Gesture Recognition – Application Market

6.4.1 Introduction

6.4.2 Consumer Electronics

6.4.2.1 Smartphones

6.4.2.2 Laptops

6.4.2.3 Gaming Consoles

6.4.2.4 Media Tablets

6.4.2.5 Smart Tvs

6.4.2.6 Set-Top Boxes

6.4.3 Healthcare

6.4.4 Automotive

6.4.5 Retail

6.4.6 Others

7 Asia-Pacific Market By Country (Page No. - 216)

7.1 Introduction

7.2 Pest Analysis

7.2.1 Political Factors

7.2.2 Economic Factors

7.2.3 Social Factors

7.2.4 Technological Factors

7.3 India

7.4 China

7.5 South Korea

7.6 Japan

7.7 Taiwan

7.8 Oceania

8 Competitive Landscape (Page No. - 256)

8.1 Introduction

8.2 Market Players Analysis

8.2.1 Gesture Recognition Market

8.3 Key Growth Strategies

8.4 Analysis Of Acquisitions

8.5 Analysis Of New Product Launches

8.6 Competitive Landscape: New Product Launch Gesture Recognition

8.7 Analysis Of Partnership, Agreements And Collaborations

8.8 Analysis Of Other Developments

9 Company Profiles (Page No. - 281)

9.1 Cognitec Systems Gmbh

9.2 Cognivue Corporation

9.3 Cross Match Technologies

9.4 Elliptic Labs

9.5 Espros Photonics Corporation

9.6 Eyesight Tech

9.7 Gestsure Technologies

9.8 Irisguard, Inc.

9.9 Microchip Technology Inc.

9.10 Microsoft Corporation

9.11 Morphotrak

9.12 Movea Sa

9.13 Omek Interactive

9.14 Omron Corporation

9.15 Pebbles Limited

9.16 Pmdtechnologies Gmbh

9.17 Pointgrab Limited

9.18 Primesense Limited

9.19 Pyreos Limited

9.20 Qualcomm, Inc.

9.21 Samsung Electronics

9.22 Softkinetic

9.23 Sony Corporation

9.24 Thalmic Labs Inc.

9.25 XYZ Interactive Technologies, Inc.

List Of Tables ( 150 Tables)

Table 1 General Assumptions, Terminology & Application Key Notes

Table 2 APAC Touchless Sensing Market Revenue, 2012 – 2018 ($Million)

Table 3 APAC Gesture Recognition Market Overview, 2012 – 2018

Table 4 APAC Touch-Less Sanitary Equipment Market, By Types, 2012 - 2018 ($Million)

Table 5 Touch-Less Faucet Market, By Geography, 2012 - 2018 ($Million)

Table 6 Touch-Less Faucet Shipments, By Geography, 2012 - 2018 (Million Units)

Table 7 APAC Touch-Less Faucet Market, By Country, 2012 - 2018 ($Million)

Table 8 APAC Touch-Less Faucet Shipments, By Country, 2012 - 2018 (Thousand Units)

Table 9 Touch-Less Soap Dispenser Market, By Geography, 2012 - 2018 ($Million)

Table 10 Touch-Less Soap Dispenser Shipments, By Geography, 2012 - 2018 (Million Units)

Table 11 APAC Touch-Less Soap Dispenser Market, By Country, 2012 - 2018 ($Million)

Table 12 APAC Touch-Less Soap Dispenser Shipments, By Country, 2012 - 2018 (Thousand Units)

Table 13 Touch-Less Towel Dispensers And Flushes Market, 2012 - 2018 ($Million)

Table 14 Touch-Less Towel Dispensers And Flushes Shipment, By Geography, 2012 - 2018 (Million Units)

Table 15 APAC Touch-Less Towel Dispensers And Flushes Market, 2012 - 2018 ($Million)

Table 16 APAC Touch-Less Towel Dispensers And Flushes Shipment, By Country, 2012 - 2018 (Thousand Units)

Table 17 Touch-Less Trash Can Market, By Geography, 2012 - 2018 ($Million)

Table 18 Touch-Less Trash Can Shipment, By Geography, 2012 - 2018 (Million Units)

Table 19 APAC Touch-Less Trash Can Market, By Country, 2012 - 2018 ($Million)

Table 20 APAC Touch-Less Trash Can Shipments, By Country, 2012 - 2018 (Thousand Units)

Table 21 Touch-Less Hand Dryer Market Revenue, 2012 - 2018 ($Million)

Table 22 Touch-Less Hand Dryer Shipment, By Geography, 2012 - 2018 (Million Units)

Table 23 APAC Touch-Less Hand Dryer Market, By Country, 2012 - 2018 ($Million)

Table 24 APAC Touch-Less Hand Dryer Shipments, By Country, 2012 - 2018 (Thousand Units)

Table 25 IR Sensors Shipment In Touch-Less Faucets, By Geography, 2012 - 2018 (Million Units)

Table 26 IR Sensors In Touch-Less Faucets Market, By Geography, 2012 - 2018 ($Million)

Table 27 IR Sensors In Touch-Less Hand Dryers Shipments, By Geography, 2012 - 2018 (Million Units)

Table 28 IR Sensors In Touch-Less Hand Dryer Market, By Geography, 2012 - 2018 ($Million)

Table 29 IR Sensors In Touch-Less Soap Dispenser Shipments, By Geography, 2012 - 2018 (Million Units)

Table 30 IR Sensors In Touch-Less Soap Dispensers, Market, By Geography, 2012 - 2018 ($Million)

Table 31 IR Sensors In Touch-Less Trash Cans, Shipments, By Geography, 2012 - 2018 (Million Units)

Table 32 IR Sensors In Touch-Less Trash Can Market, By Geography, 2012 - 2018 ($Million)

Table 33 IR Sensors In Towel Dispensers And Flushes Shipments, By Geography, 2012 - 2018 (Million Units)

Table 34 IR Sensors In Towel Dispensers And Flushes Market, By Geography, 2012 - 2018 ($Million)

Table 35 Global Touch-Less Biometrics Market, By Types, 2012 - 2018 ($Million)

Table 36 Touch-Less Biometric Market, By Geography, 2012 - 2018 ($Million)

Table 37 APAC Touch-Less Biometric Market, By Country, 2012 - 2018 ($Million)

Table 38 Product Segments Of Companies Providing Touch-Less Biometric Solutions

Table 39 Touch-Less Fingerprint Recognition Market, By Applications, 2012 - 2018 ($Million)

Table 40 Touch-Less Fingerprint Market, By Geography, 2012 - 2018 ($Million)

Table 41 APAC Touch-Less Fingerprint Market, By Country, 2012 - 2018 ($Million)

Table 42 Touch-Less Versus Touch Fingerprinting

Table 43 Touch-Less Iris Recognition Market, By Applications, 2012 - 2018 ($Million)

Table 44 Touch-Less Iris Recognition Market, By Geography, 2012 - 2018 ($Million)

Table 45 APAC Touch-Less Iris Recognition Market, By Country, 2012 - 2018 ($Million)

Table 46 Touch-Less Face Recognition Market ,By Applications, 2012 - 2018 ($Million)

Table 47 Touch-Less Face Recognition Market, By Geography, 2012 - 2018 ($Million)

Table 48 APAC Touch-Less Face Recognition Market, By Country, 2012 - 2018 ($Million)

Table 49 Comparison Between 2D & 3D Facial Recognition

Table 50 Touch-Less Voice Recognition Market, By Applications, 2012 - 2018 ($Million)

Table 51 Touch-Less Voice Recognition Market, By Geography, 2012 - 2018 ($Million)

Table 52 APAC Touch-Less Voice Recognition Market, By Country, 2012 - 2018 ($Million)

Table 53 GR Technology Component Pricing Analysis, 2012 – 2018 ($)

Table 54 APAC Gesture Recognition Market Revenue, By Technology, 2012 – 2018 ($Million)

Table 55 APAC Gesture Recognition Market Shipments, By Technology, 2012 – 2018 (Million Units)

Table 56 APAC Capacitive Based Gesture Recognition Market Revenue, By Devices, 2012 – 2018 ($Million)

Table 57 APAC Capacitive Based Gesture Recognition Market Shipments, By Devices, 2012 – 2018 (Million Units)

Table 58 APAC Infrared Arrays Based Gesture Recognition Market Revenue, By Applications, 2012 – 2018 ($Million)

Table 59 APAC Infrared Arrays Based Gesture Recognition Market Shipments, By Applications, 2012 – 2018 (Million Units)

Table 60 APAC Consumer Electronics Devices’ Revenue From Infrared Array Technology, 2012 – 2018 ($Million)

Table 61 APAC Consumer Electronics Devices’ Shipments, Infrared Array Technology, 2012 – 2018 (Million Units)

Table 62 APAC Ultrasound Technology Based Gesture Recognition Market Revenue, By Devices, 2012 – 2018 ($Million)

Table 63 APAC Ultrasound Technology Based Gesture Recognition Market Shipments, By Device, 2012 – 2018 (Million Units)

Table 64 APAC 2D Camera Based Gesture Recognition Market Revenue,By Devices, 2012 – 2018 ($Million)

Table 65 APAC 2D Camera Based Gesture Recognition Market Shipments, By Devices, 2012 – 2018 (Million Units)

Table 66 APAC 3D Technologies Based Gesture Recognition Market Revenue, By Applications, 2012 – 2018 ($Million)

Table 67 APAC 3D Technologies Based Gesture Recognition Market Shipments, By Applications, 2012 – 2018 (Million Units)

Table 68 APAC 3D Technologies Based Gesture Recognition Market Revenue, Devices, 2012 – 2018 ($Million)

Table 69 APAC 3D Technologies Based Gesture Recognition Market Shipments, By Devices, 2012 – 2018 (Million Units)

Table 70 Gesture Recognition: Technology Comparison

Table 71 APAC Gesture Recognition Market Revenues, By Applications, 2012 – 2018 ($Million)

Table 72 APAC Gesture Recognition Market Shipments, By Applications, 2012 – 2018 (Million Units)

Table 73 APAC Consumer Electronics Gesture Recognition Market Revenue, By Devices, 2012 – 2018 ($Million)

Table 74 APAC Consumer Electronics Gesture Recognition Market Shipments, By Devices, 2012 – 2018 (Million Units)

Table 75 APAC Gesture Recognition Smartphones Market, 2012 – 2018

Table 76 APAC Gesture Recognition Smartphones Market Revenue, By Technology, 2012 – 2018 ($Million)

Table 77 APAC Gesture Recognition Smartphones Market Shipments, By Technology, 2012 – 2018 (Million Units)

Table 78 APAC Gesture Recognition Laptop Pcs Market, 2012 – 2018

Table 79 APAC Gesture Recognition Laptop Pcs Market Revenue, By Technology, 2012 – 2018 ($Million)

Table 80 APAC Gesture Recognition Laptop Pcs Market Shipments, By Technology, 2012 – 2018 (Million Units)

Table 81 APAC Gesture Recognition Gaming Consoles Market, 2012 – 2018

Table 82 APAC Gesture Recognition Media Tablets Market, 2012 – 2018

Table 83 APAC Gesture Recognition Media Tablets Market Revenue, By Technology, 2012 – 2018 ($Million)

Table 84 APAC Gesture Recognition Media Tablets Market Shipments, By Technology, 2012 – 2018 (Million Units)

Table 85 APAC Gesture Recognition Smart Tvs Market, 2012 – 2018

Table 86 APAC Gesture Recognition Smart Tvs Market Revenue, By Technology, 2012 – 2018 ($Million)

Table 87 APAC Gesture Recognition Smart Tvs Market Shipments, By Technology, 2012 – 2018 (Million Units)

Table 88 APAC Gesture Recognition Set-Top Box Market, 2012 – 2018

Table 89 APAC Gesture Recognition Set-Top Box Market Revenue, By Technology, 2012 – 2018 ($Million)

Table 90 APAC Gesture Recognition Set-Top Box Market Shipments, By Technology, 2012 – 2018 (Million Units)

Table 91 APAC Gesture Recognition Market, By Automotive Applications, 2012 – 2018

Table 92 APAC Gesture Recognition Market, By Retail Applications, 2012 – 2018

Table 93 APAC Gesture Recognition Market, By Others Application, 2012 – 2018

Table 94 APAC: Touchless Biometric Technology Market Revenue, By Type, 2012 - 2018 ($Million)

Table 95 APAC: Touchless Sanitary Equipment Market Revenue, By Types, 2012 - 2018 ($Million)

Table 96 APAC: Sanitary Equipmentmarket Shipments, By Types, 2012 - 2018 (Million Units)

Table 97 India: Gesture Recognition Market Overview, 2012 – 2018

Table 98 India: Gesture Recognition Market Revenue, By Applications, 2012 – 2018 ($Million)

Table 99 India: Gesture Recognition Market Shipments, By Applications, 2012 – 2018 (Million Units)

Table 100 India: Touchless Biometrics’ Market Revenue, By Types, 2012 – 2018 ($Million)

Table 101 India: Touchless Sanitary Equipment Market Revenue, By Types, 2012 - 2018 ($Million)

Table 102 China: Gesture Recognition Market Overview, 2012 – 2018

Table 103 China: Gesture Recognition Market Revenue, By Applications, 2012 – 2018 ($Million)

Table 104 China: Gesture Recognition Market Shipments, By Applications, 2012 – 2018 (Million Units)

Table 105 China: Touchless Biometric Market Revenue, By Types, 2012 – 2018 ($Million)

Table 106 China Touch-Less Sanitary Equipment Market Revenue, By Types, 2012 - 2018 ($Million)

Table 107 South Korea: Gesture Recognition Market Overview, 2012 – 2018

Table 108 South Korea: Gesture Recognition Market Revenue, By Applications, 2012 – 2018 ($Million)

Table 109 South Korea: Gesture Recognition Market Shipments, By Applications, 2012 – 2018 (Million Units)

Table 110 South Korea: Touch-Less Biometric Market Revenue, By Types, 2012 – 2018 ($Million)

Table 111 South Korea: Touchless Sanitary Equipment Market Revenue, By Types, 2012 - 2018 ($Million)

Table 112 Japan: Gesture Recognition Market Overview, 2012 – 2018

Table 113 Japan: Gesture Recognition Market Revenue, By Applications, 2012 – 2018 ($Million)

Table 114 Japan Gesture Recognition Market Shipments, By Applications, 2012 – 2018 (Million Units)

Table 115 Japan: Touchless Biometric Market Revenue, By Types, 2012 – 2018 ($Million)

Table 116 Japan: Touchless Sanitary Equipment Market Revenue, By Types, 2012 - 2018 ($Million)

Table 117 Taiwan: Gesture Recognition Market Overview, 2012 – 2018

Table 118 Taiwan: Gesture Recognition Market Revenue, By Applications, 2012 – 2018 ($Million)

Table 119 Taiwan: Gesture Recognition Market Shipments, By Applications, 2012 – 2018 (Million Units)

Table 120 Taiwan: Touchless Biometric Market Revenue, By Types, 2012 – 2018 ($Million)

Table 121 Taiwan: Touchless Sanitary Equipment Market Revenue, By Types, 2012 - 2018 ($Million)

Table 122 Oceania: Gesture Recognition Market Overview, 2012 – 2018

Table 123 Oceania: Gesture Recognition Market Revenue, By Applications, 2012 – 2018 ($Million)

Table 124 Oceania: Gesture Recognition Market Shipments, By Applications, 2012 – 2018 (Million Units)

Table 125 Oceania & Others: Touchless Biometric Market Revenue, By Types, 2012 – 2018 ($Million)

Table 126 Oceania & Others: Touch-Less Sanitary Equipment Market Revenue, By Types, 2012 - 2018 ($Million)

Table 127 Competitive Landscape: Acquisitionstouchless Sensing

Table 128 Competitive Landscape: Acquisitions Gesture Recognition

Table 129 Competitive Landscape: New Product Launch Touchless Sensing

Table 130 Competitive Landscape: New Product Launch Gesture Recognition

Table 131 Competitive Landscape: Partnership, Agreements And Collaborations – Touchless Sensing

Table 132 Competitive Landscape: Partnership, Agreements And Collaborations – Gesture Recognition

Table 133 Competitive Landscape: Other Developments – Touchless Sensing

Table 134 Competitive Landscape: Other Developments – Gesture Recognition

Table 135 Microchip Technology Inc: Products

Table 136 Microchip Technology, Inc: Overall Revenue, 2011 - 2012 ($Million)

Table 137 Microsoft: Market Revenue, 2010 - 2012 ($Billion)

Table 138 Microsoft: Market Revenue, By Product Segment, 2010 - 2012 ($Billion)

Table 139 Microsoft: Market Revenue, By Geography, 2010 - 2012 ($Billion)

Table 140 Morphotrak Products And Services

Table 141 Omron Corporation: Market Revenue, 2010 - 2011 ($Billion)

Table 142 Pyreos: Products & Services

Table 143 Qualcomm: Overall Revenues, 2010 - 2012 ($Billion)

Table 144 Qualcomm: Revenues By Product/Business Segments, 2010 - 2012 ($Billion)

Table 145 Qualcomm: Revenues By Geography, 2010 - 2012 ($Billion)

Table 146 Samsung: Market Revenue, 2010 - 2011 ($Billion)

Table 147 Samsung: Market Revenue, By Product Segment, 2010 - 2011 ($Billion)

Table 148 Samsung: Market Revenue, By Geography, 2010 - 2011 ($Billion)

Table 149 Sony: Products Offered

Table 150 Sony: Overall Revenue, 2010 – 2012 ($Billion)

List Of Figures ( 56 Figures)

Figure 1 Market Research Methodology

Figure 2 Evolution Of Touchless Sensing Market

Figure 3 Evolution Of Gesture Recognition Market

Figure 4 Touchless Sensing Market Segmentation

Figure 5 Gesture Recognition Market Segmentation

Figure 6 Value Chain Analysis: Touchless Biometrics

Figure 7 Complete Value Chain Of Gesture Recognition Market

Figure 8 Porter’s Five Forces Analysis: Touchless Biometrics

Figure 9 Porter’s Threat Of New Entrants: Touchless Biometrics

Figure 10 Porter’s Threat Of Substitutes: Touchless Biometrics

Figure 11 Porter’s Degree Of Competition: Touchless Biometrics

Figure 12 Porter’s Bargaining Power Of Buyer: Touch-Less Biometrics

Figure 13 Porter’s Bargaining Power Of Supplier: Touch-Less Biometrics

Figure 14 Porter’s Five Forces Analysis: Touch-Less Sanitary Equipment

Figure 15 Porter’s Threat Of New Entrants: Touchless Sanitary Equipment

Figure 16 Porter’s Threat Of Substitutes: Touch-Less Sanitary Equipment

Figure 17 Porter’s Degree Of Competition: Touchless Sanitary Equipment

Figure 18 Porter’s Bargaining Power Of Buyer: Touchless Sanitary Equipment

Figure 19 Porter’s Bargaining Power Of Supplier: Touchless Sanitary Equipment

Figure 20 Porter’s Five Forces Analysis: Gesture Recognition Market

Figure 21 Porter’s Threat Of New Entrants: Gesture Recognition Market

Figure 22 Porter’s Threat Of Substitutes: Gesture Recognition Market

Figure 23 Porter’s Degree Of Competition: Gesture Recognition Market

Figure 24 Porter’s Bargaining Power Of Buyer: Gesture Recognition Market

Figure 25 Porter’s Bargaining Power Of Supplier: Gesture Recognition Market

Figure 26 Impact Analysis - Touchless Biometrics Drivers

Figure 27 Impact Analysis - Touchless Biometric Restraints

Figure 28 Impact Analysis - Touchless Sanitary Equipment Drivers

Figure 29 Impact Analysis - Touchless Sanitary Equipment Restraints

Figure 30 Impact Analysis - Drivers

Figure 31 Impact Analysis - Restraints

Figure 32 Global Standalone Devices For Gesture Recognition Revenue, 2012 – 2018 ($Million)

Figure 33 Types Of Infrared Sensors

Figure 34 Major Players: Touch-Less Biometric Solutions

Figure 35 Major Players: Touch-Less Fingerprint Solutions

Figure 36 Major Players: Touch-Less Iris Scan Solutions

Figure 37 Major Players: Touch-Less Face Recognition Solutions

Figure 38 Flow Diagram Of Face Recognition Process

Figure 39 Major Players: Touch-Less Voice Recognition Solutions

Figure 40 Gesture Recognition Applications

Figure 41 Global Smartphone Shipments And Technology Penetration, 2012 – 2018

Figure 42 Global Laptop Shipments And Technology Penetration, 2012 – 2018

Figure 43 Global Media Tablet Shipments And Technology Penetration, 2012 – 2018

Figure 44 Global Smart Tvs Shipments And Technology Penetration, 2012 – 2018

Figure 45 Global Set-Tob Box Shipments And Technology Penetration, 2012 – 2018

Figure 46 APAC Gesture Recognition Market, By Healthcare Application, 2012 - 2018

Figure 47 Global Gesture Recognition Market Shipments, By Geography, 2012 - 2018 (Million Units)

Figure 48 APAC: Gesture Recogniton Market Shipments, 2012 - 2018 (Million Units)

Figure 49 Pest Analysis

Figure 50 APAC Gesture Recognition Market Players

Figure 51 Analysis Of Key Growth Strategies: Touchless Sensing

Figure 52 Analysis Of Key Growth Strategies: Gesture Recognition

Figure 53 Cognivue Understands Vision: Total Solution

Figure 54 Product Line Of Safran Morphotrak

Figure 55 Solutions Offered By Pointgrab

Figure 56 XYZ Interactive: Products And Markets

Growth opportunities and latent adjacency in Asia-Pacific Gesture Recognition & Touchless Sensing Market