Asia-Pacific Cold Insulation Material Market by Type (Fiber Glass, Polyurethane Foam, Polystyrene Foam, Phenolic Foam & Others) & Application (HVAC, Oil & Gas, Refrigeration, Chemicals and Others) - Trends & Forecasts to 2019

[111 Pages Report] The Asia-Pacific cold insulation material market is expected to grow at a CAGR of 8.0% during the next five years to reach $1,585.5 million by 2019. Asia-Pacific, with its flourishing economy and rapidly expanding industrial sectors, is an emerging market and is expected to experience a huge growth in demand from 2014 to 2019.

The major driving factors of this market are the continuously growing cold chain market in Asia-Pacific on account of growing food and healthcare industry. The other growth driver is industrial development in the major economies. Emerging markets such as China, India, Japan, Australia & New Zealand, and South Korea are in the process of rapid growth and industrialization. Due to rapid industrialization, economic development, and changing lifestyles, the level of production and consumption in the Asia-Pacific region has rapidly increased, which is a major driver of cold insulation material in the region. Increasing demand for cooling equipment in Asia-Pacific and the rising demand of cryogenic insulation in oil & gas is also driving the demand for cold insulation material.

Upcoming opportunities such as development of eco-friendly cold insulation products show a promising growth in the Asia-Pacific cold insulation material market. Many cold insulation products are hazardous and cause severe health problems. So, the companies are coming up with plant-based or bio-based cold insulation products. They are also coming up with fiber glass insulation made from 35% recyclable content, thus saving energy costs in manufacturing entirely new products. These products have almost zero Volatile Organic Compounds. These innovations will result in an increase in demand for cold insulation materials in Asia-Pacific.

Cold insulation material is used in the wide end-user industries such as construction, automobile, and electronics. Cold insulation material has a number of applications in HVAC, chemicals, oil & gas, refrigerant, and others. Oil & gas and chemicals are the most important applications of cold insulation material. Cryogenic conditions are required for the transportation of LNG and Asia-Pacific is a major importer of oil & gas, so the demand for cold insulation material is growing in the region. The demand for cold insulation material in Asia-Pacific region is anticipated to grow at a CAGR of 8.0% in the next five years.

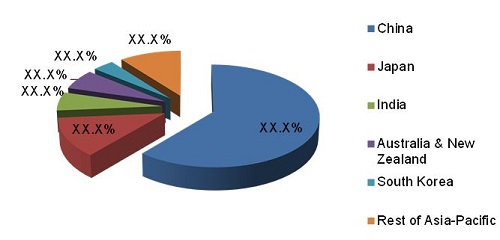

The Asia-Pacific cold insulation material market is analyzed in terms of value ($Million) application-wise, on the basis of type, for all major countries in Asia-Pacific, namely, China, India, Japan, Australia & New Zealand, South Korea, and Rest of the Asia-Pacific. Fiber glass, PU/PIS foam, polystyrene foam, phenolic foam, and others are the major types of cold insulation material.

For this report, various secondary sources such as directories, technical handbooks, company annual reports, industry association publications, chemical magazine articles, Asia-Pacific economic outlook, trade websites, and databases have been referred to identify and collect information useful for this extensive commercial study of the Asia-Pacific cold insulation material market. The primary sources - experts from related industries and suppliers have been interviewed to obtain and verify critical information as well as to assess the prospects and market estimations.

This report analyzes various marketing trends and establishes the most effective growth strategy in the market. It identifies market dynamics such as drivers, restraints, opportunities, burning issues, and winning imperatives. Major companies such as BASF (Germany), Huntsman Corporation (U.S.), ITW Insulation Systems (U.S.), Kingspan Group Plc (Ireland), Rockwool International A/S (Denmark), Armacell International Holding Inc. (Luxembourg), Bayer MaterialScience (Germany), Nichias Corporation (Japan), The Dow Chemical Company (U.S.) and Dongsung Finetc Corporation (Korea) have also been profiled in this report.

Scope of the report

- On the basis of country:

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- On the basis of application:

- HVAC

- Chemical

- Refrigeration

- Oil & Gas

- On the basis of user type:

- Fiber Glass

- Polyurethane/Polyisocyanurate Foam

- Polystyrene Foam

- Phenolic Foam

The Asia-Pacific cold insulation material market is anticipated to increase by 8.0% annually to reach $1585.0 million by 2019. Cold insulation material is primarily used for to prevent the loss of chill or heat gain to maintain the temperature to conserve energy. The report covers the cold insulation material market and its trends concerning five countries in Asia-Pacific, namely, China, India, Japan, South Korea, and Australia & New Zealand. Cold insulation material applications such as, HVAC, refrigeration, oil & gas, chemicals, and others are included along with their estimated market sizes in terms of value and consumption trends. Various types of cold insulation materials such as fiber glass, polyurethane/polyisocyanurate foam, polystyrene foam, phenolic foam have also been identified.

China is the largest market for cold insulation material due to early industrialization. Polyurethane/Polyisocyanurate foam is the most widely used cold insulation material type in the region. The flourishing oil & gas industry demand is contributing to the heavy demand in the region. However, the region is also facing stringent regulations for the use of some hazardous cold insulation material. The manufacturers in this region are coming up with new bio-based cold insulation materials, which are expected to increase the demand of cold insulation material in the region.

Cold Insulation Material Market Share, by Region, 2013

Source: MarketsandMarkets Analysis

India has been identified as the upcoming market for cold insulation material due to rapid industrialization and increasing demand for cryogenic conditions for the import of LNG. The increasing demand for cooling equipment and rising cold chain market in emerging economies in Asia-Pacific such as Japan and India are contributing heavily to the demand. Japan is another region which will have a high growth rate for cold insulation materials.

In the cold insulation material market, the industry comprises several players which are engaged in this business. The major companies identified include BASF SE (Germany), Huntsman Corporation (U.S.), Kingspan plc (Ireland), Rockwool International A/S (Denmark), and Armacell International Holding (Luxembourg), and others.

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Scope

1.2.1 Market Definition

1.2.2 Markets Covered

1.2.2.1 Type

1.2.2.2 Application

1.2.2.3 Country

1.2.3 Currency

1.2.4 Limitations

1.3 Stakeholders

2 Research Methodology (Page No. - 15)

2.1 Market Size Estimation

2.2 Market Crackdown & Data Triangulation

2.3 Market Share Estimation

2.4 Assumptions

3 Executive Summary (Page No. - 21)

4 Premium Insights (Page No. - 23)

4.1 Asia-Pacific is an Attractive Market for Cold Insulation Material

4.2 Asia-Pacific Cold Insulation Material Market Growing At A Steady Rate

4.3 Asia-Pacific Cold Insulation Material Market Share (Value), By Type, 2013

4.4 Asia-Pacific Cold Insulation Material Market Size, By Country ($Million) , 20142019

4.5 Market Attractiveness, By Country

5 Market Overview (Page No. - 28)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Cold Insulation Material Market, By Type

5.2.2 Cold Insulation Market, By Application

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Growing Asia-Pacific Cold Chain Market

5.3.1.2 Industrialization of Emerging Economies

5.3.1.3 Increase in Demand of Cooling Equipment in Asia-Pacific

5.3.1.4 Growing Cryogenic Insulation Demand in Oil & Gas

5.3.2 Restraints

5.3.2.1 Government Regulations Due to Health Hazards Caused By Cold Insulation Material

5.3.2.2 High Prices of Some Insulation Materials

5.3.3 Opportunities

5.3.3.1 Development of Eco-Friendly Products At Competitive Prices

5.3.3.2 Targets on Energy Savings

5.3.4 Challenges

5.3.4.1 Price & Performance Issues of Bio-Based Products

5.3.5 Winning Imperatives

5.3.5.1 Catering to Various Segments

6 Industry Trends (Page No. - 37)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porters Five forces Analysis

6.3.1 Threat From New Entrants

6.3.2 Threat From Substitutes

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Competitive Rivalry

6.4 Strategic Benchmarking

6.4.1 Expansion

6.4.2 New Product Launch

7 Cold Insulation Material Market, By Type (Page No. - 42)

7.1 Introduction

7.1.1 Fiber Glass

7.1.2 Polyurethane Foam/Polyisocyanurate Foam

7.1.3 Polystyrene Foam

7.1.4 Phenolic Foam

8 Asia-Pacific Cold Insulation Material Market, By Application (Page No. - 54)

8.1 Introduction

8.2 HVAC (Heating, Ventilation & Air Conditioning)

8.3 Refrigeration

8.4 Oil & Gas

8.5 Chemicals

8.6 Other Applications

9 Country Analysis (Page No. - 65)

9.1 Introduction

9.2 China

9.3 Japan

9.4 India

9.5 Australia & New Zealand

9.6 South Korea

10 Competitive Landscape (Page No. - 73)

10.1 Overview

10.2 Major Active Companies

10.3 Expansion: the Most Popular Growth Strategy

10.4 Maximum Developments in 2012

10.5 BASF SE and Huntsman Corporation: the Most Active Participants

10.6 Competitive Situation & Trends

10.6.1 Expansions

10.6.2 New Product Launch

10.6.3 Supply Contracts

10.6.4 Other

11 Company Profiles (Page No. - 81)

11.1 Basf S.E.

11.1.1 Overview

11.1.2 Products

11.1.3 Key Strategy

11.1.4 Developments

11.1.5 SWOT Analysis

11.1.6 MNM View

11.2 Huntsman Corporation

11.2.1 Overview

11.2.2 Products

11.2.3 Key Strategy

11.2.4 Developments

11.2.5 SWOT Analysis

11.2.6 MNM View

11.3 ITW Insulation Systems

11.3.1 Overview

11.3.2 Products

11.3.3 Key Strategy

11.3.4 Developments

11.3.5 SWOT Analysis

11.3.6 MNM View

11.4 Kingspan Group PLC

11.4.1 Overview

11.4.2 Products

11.4.3 Strategy & Insights

11.4.4 Developments

11.4.5 SWOT Analysis

11.4.6 MNM View

11.5 Rockwool International A/S

11.5.1 Overview

11.5.2 Products

11.5.3 Strategy & Insights

11.5.4 Developments

11.5.5 SWOT Analysis

11.5.6 MNM View

11.6 Armacell International Holding Inc.

11.6.1 Overview

11.6.2 Products

11.6.3 Strategy & Insights

11.6.4 Developments

11.7 Bayer Material Science

11.7.1 Overview

11.7.2 Products

11.7.3 Strategy & Insights

11.7.4 Developments

11.8 Nichias Corporation

11.8.1 Overview

11.8.2 Products

11.8.3 Strategy & Insights

11.9 Dongsung Finetec Corporation

11.9.1 Overview

11.9.2 Products

11.9.3 Strategy & Insights

11.10 The Dow Chemical Company

11.10.1 Overview

11.10.2 Products

11.10.3 Strategy & Insights

11.10.4 Developments

12 Appendix (Page No. - 106)

12.1 Discussion Guide

12.2 Introducing RT: Real Time Market Intelligence

12.3 Available Customizations

12.4 Related Reports

List of Tables (43 Tables)

Table 1 Asia-Pacific: Cold Insulation Material Market Size, By Type, 2012-2019 ($Million)

Table 2 Asia-Pacific: Cold Insulation Material Market Size, By Type, 2012-2019 (Kilotons)

Table 3 Asia-Pacific: Fiber Glass Cold Insulation Market Size ($Million) & (Kilotons), 2012 2019

Table 4 Asia Pacific: Fiber Glass Cold Insulation Market Size, By Country, ($Million), 2012-2019

Table 5 Asia-Pacific: Fiber Glass Cold Insulation Market Size, By Country (Kilotons), 2012-2019

Table 6 Asia-Pacific: Polyurethane Foam/Polyisocyanurate Foam Cold Insulation Market Size: ($Million) & (Kilotons), 2012 2019

Table 7 Asia-Pacific: Polyurethane /Polyisocyanurate Foam Cold Insulation Market Size, By Country ($ Million), 2012-2019

Table 8 Asia-Pacific: Polyurethane /Polyisocyanurate Foam Cold Insulation Market Size, By Country (Kilotons), 2012-2019

Table 9 Asia-Pacific: Polystyrene Foam Cold Insulation Market Size ($Million) & (Tons), 2012 2019

Table 10 Asia-Pacific: Polystyrene Foam: Cold Insulation Market Size, By Country ($Million), 2012-2019

Table 11 Asia-Pacific: Polystyrene Foam Cold Insulation Market Size, By Country (Kilotons), 2012-2019

Table 12 Asia-Pacific: Phenolic Foam Cold Insulation Market Size, ($Million) & (Tons), 2012 2019

Table 13 Asia-Pacific: Phenolic Foam Cold Insulation Market Size, By Country ($Million), 2012 2019

Table 14 Asia-Pacific: Phenolic Foam Cold Insulation Market Size, By Country (Kilotons), 2012-2019

Table 15 Cold Insulation Material: Application & End-User Industries

Table 16 Asia-Pacific: Cold Insulation Material Market Size, By Application, 2012-2019 (Kilotons)

Table 17 Asia-Pacific: Cold Insulation Material Market Size, By Application, 2012-2019 ($Million)

Table 18 HVAC: Cold Insulation Material Market Size, By Country 20122019 ($Million)

Table 19 HVAC: Cold Insulation Material Market Size, By Country 20122019 (Kilotons)

Table 20 Refrigeration: Cold Insulation Material Market Size, By Country 20122019 ($Million)

Table 21 Cold Insulation Material Market Size in Refrigeration, By Country, 20122019 (Kilotons)

Table 22 Oil & Gas: Cold Insulation Material Market Size, By Country, 20122019 ($Million)

Table 23 Oil & Gas: Cold Insulation Material Market Size, By Country, 20122019 (Kilotons)

Table 24 Chemicals: Cold Insulation Material Market Size, By Country, 20122019 ($Million)

Table 25 Chemicals: Cold Insulation Material Market Size, By Country, 20122019 (Kilotons)

Table 26 Other Applications: Cold Insulation Material Market Size, By Country 20122019 ($Million)

Table 27 Other Applications: Cold Insulation Material Market Size, By Country, 20122019 (Kilotons)

Table 28 Asia-Pacific Cold Insulation Material Market Size, By Country, 20122019 ($Million)

Table 29 Asia-Pacific Cold Insulation Material Market Size, By Country, 20122019 (KT)

Table 30 China: Cold Insulation Material Market Size, By Application, 20122019 ($Million)

Table 31 China: Cold Insulation Material Market Size, By Application, 20122019 (KT)

Table 32 Japan: Cold Insulation Material Market Size, By Application, 20122019 ($Million)

Table 33 Japan: Cold Insulation Material Market Size, By Application, 20122019 (KT)

Table 34 India: Cold Insulation Material Market Size, By Application, 20122019 ($Million)

Table 35 India: Cold Insulation Material Market Size, By Application, 20122019 (KT)

Table 36 Australia & New Zealand: Cold Insulation Material Market Size, By Application, 20122019 ($Million)

Table 37 Australia & New Zealand: Cold Insulation Material Market Size, By Application, 20122019 (KT)

Table 38 South Korea: Cold Insulation Material Market Size, By Application, 20122019 ($Million)

Table 39 South Korea: Cold Insulation Material Market Size, By Application, 20122019 (KT)

Table 40 Expansion, 2010-2014

Table 41 New Product Launch, 2010-2014

Table 42 Supply Contracts, 2010-2014

Table 43 Others, 2010-2014

List of Figures (52 Figures)

Figure 1 Asia-Pacific Cold Insulation Material Market, Research Methodology

Figure 2 Market Size Estimation: Bottom Up Approach

Figure 3 Market Size Estimation: Top-Down Approach

Figure 4 Breakdown of Primary Interviews, By Company Type, Designation & Region

Figure 5 Key Data Taken From Secondary Sources

Figure 6 Key Data Taken From Primary Sources

Figure 7 Cold Insulation Material Market Snapshot (2014 vs 2019): Market for Refrigeration Segment Growing At the Fastest Rate

Figure 8 China and India Are the Most Attractive Markets

Figure 9 Attractive Opportunity in the Asia-Pacific Cold Insulation Materials Market From 2014 to 2019

Figure 10 Steady Growth Expected in Cold Insulation Material Market Between 2014 & 2019

Figure 11 Polyurethane is the Most Dominant Segment By Type

Figure 12 China and India Are the Major Countries to Invest in the Next Five Years

Figure 13 China to Witness High Growth From 2014 to 2019 Due to Rapid Industrialization

Figure 14 Cold Insulation Market Segmentation: By Application

Figure 15 Cold Insulation Materials Market Segmentation, By Application

Figure 16 Overview of the Market forces Governing the Cold Insulation Material Market

Figure 17 LNG Storage Capacity, By Country, 2012

Figure 18 Value Chain Analysis for Cold Insulation Material

Figure 19 Porters Five forces Analysis (2013), High Feedstock Prices & Narrow Margins Are Impacting the Industry

Figure 20 Huntsman Corporation & BASF SE Adopted Geographic & Capacity Expansion to Enter Emerging Markets

Figure 21 BASF SE & Kingspan Group PLC Launching New Upgraded Eco-Friendly Products

Figure 22 Asia-Pacific: Cold Insulation Material Market Share (Volume), By Type, 2013 vs 2019

Figure 23 More Than One-Third of the Cold Insulation Materials Market is Dominated By Pu/Pis Foam

Figure 24 China to Dominate the Fiber Glass Insulation Material Market , From 2014 to 2019:

Figure 25 Asia-Pacific: Polyurethane /Polyisocyanurate Foam Cold Insulation Market Size , ($Million) (2014-2019)

Figure 26 China and India to Be the Fastest-Growing Markets of Polystyrene Foam From 2014 to 2019

Figure 27 Rapid Industrialization in Major Economies Will Drive the Phenolic Foam Market, ($Million) 2014-2019

Figure 28 Asia-Pacific Cold Insulation Material Market Share (Volume), By Application, 2013 vs. 2019

Figure 29 Oil & Gas Application Dominates the Cold Insulation Material Market, ($Million), 2014-2019

Figure 30 Cold Insulation Material Market Size in Refrigeration, By Country, ($Million) , 2014-2019

Figure 31 China Leads the Cold Insulation Material Market for Chemical Application, ($Million), 2014-2019

Figure 32 Asia-Pacific: Cold Insulation Material Market Share, (Volume) By Country, 2013 vs. 2019

Figure 33 Companies Adopted Expansion as the Key Growth Strategy, 2010-2014

Figure 34 Developments: Asia-Pacific Cold Insulation Market Share, By Key Player, 2013

Figure 35 Major Growth Strategies in Asia-Pacific Cold Insulation Market, 2009 2013

Figure 36 Developments in Asia-Pacific Cold Insulation Market, 2010 2014

Figure 37 Asia-Pacific Cold Insulation Market: Growth Strategies, By Company, 20102014

Figure 38 BASF SE: Business Overview

Figure 39 BASF SE : SWOT Analysis

Figure 40 Huntsman Corporation: Business Overview

Figure 41 Huntsman Corporation: SWOT Analysis

Figure 42 ITW Insulation Systems: Business Overview

Figure 43 ITW : SWOT Analysis

Figure 44 Kingspan Group PLC: Business Overview

Figure 45 Kingspan Group PLC: SWOT Analysis

Figure 46 Rockwool International A/S: Business Overview

Figure 47 Rockwool International A/S: SWOT Analysis

Figure 48 Armacell International Holding Inc.: Business Overview

Figure 49 Bayer Materialscience: Business Overview

Figure 50 Nichias Corporation: Business Overview

Figure 51 Dongsung Finetec Corporation: Business Overview

Figure 52 The Dow Chemical Company: Business Overview

Growth opportunities and latent adjacency in Asia-Pacific Cold Insulation Material Market

Great post