Ashwagandha Supplements Market

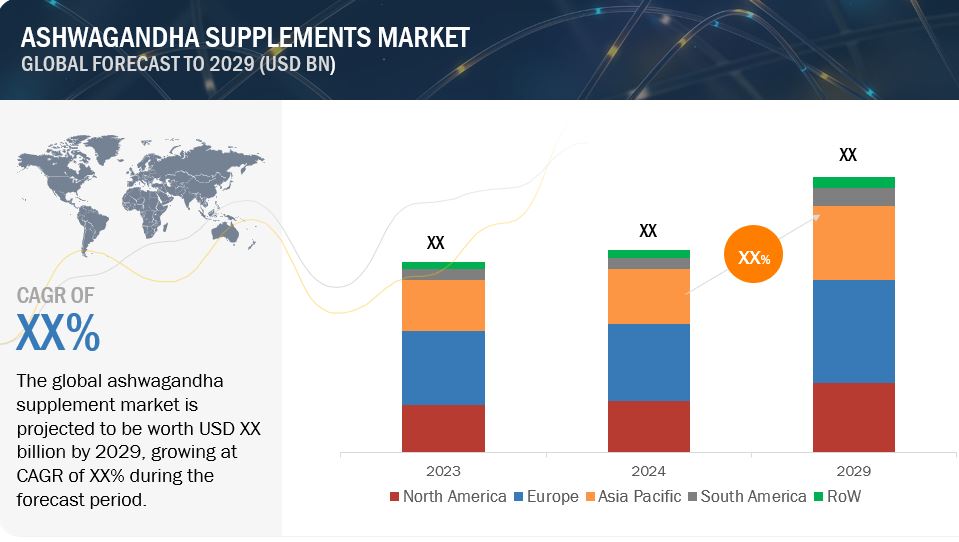

The global market for ashwagandha supplements has been estimated to be USD XX billion in 2024 and is projected to grow at XX% between 2024 and 2029.

The Ashwagandha supplements market is experiencing strong growth, driven by an increasing awareness among consumers of natural and herbal remedies for stress management, immune support, and overall well-being. Ashwagandha (Withania somnifera), a traditional Ayurvedic herb, has gained global popularity due to its adaptogenic properties, which help the body manage stress and anxiety, improve cognitive function, and enhance physical endurance. The market is segmented by product type, including powders, capsules, tablets, and liquid extracts, catering to a wide range of consumer preferences. Additionally, the applications of Ashwagandha supplements span various industries, such as dietary supplements, pharmaceuticals, functional beverages, cosmetics, and personal care. This diverse usage highlights the herb's versatility as both a wellness supplement and a functional ingredient in personal care products.

Driven by the rising demand for natural health solutions and plant-based alternatives, the market is seeing a surge in research and development. Manufacturers are focusing on creating innovative formulations, including organic and high-potency extracts. Regionally, North America and Europe dominate the market due to increasing consumer interest in alternative medicine and herbal therapies, while the Asia-Pacific region continues to expand, supported by the herb's traditional roots in Ayurveda.

Overall, the Ashwagandha supplements market presents significant opportunities for companies that offer a wide range of products targeting health-conscious and wellness-oriented consumers. With ongoing scientific research validating its health benefits, the market is well-positioned for sustained growth in the coming years.

Global Ashwagandha Supplements Market Trends

Market Dynamics

Drivers: Health and Wellness Trend

The global health and wellness trend has become a significant driver of demand for natural and herbal supplements like Ashwagandha. As consumers increasingly prioritize preventive healthcare and adopt holistic lifestyles, there is a growing preference for natural remedies to enhance well-being. This trend is particularly noticeable in regions like North America, where healthy eating has gained momentum. According to a recent article by BusinessDasher released in September 2024, 50% of Americans actively strive to eat healthily, and 62% consider healthfulness a critical factor when making food and beverage purchasing decisions. Furthermore, 63% of Americans evaluate whether food is processed before making a purchase, reflecting a rising preference for clean and organic products. Additionally, 56% of those prioritizing healthy eating choose organic foods, underscoring the shift toward natural, unprocessed ingredients. The heightened focus on mental health also drives this trend, as more individuals seek products that promote relaxation, stress relief, and overall mental wellness. Consequently, Ashwagandha, known for its benefits in stress reduction and cognitive function, aligns well with the growing demand for products supporting both physical and mental health, positioning itself as a key player in the health and wellness sector.

Restraints: High Cost of Standardized Extracts

The high cost of producing standardized Ashwagandha extracts presents significant challenges for the market. Achieving consistent potency, purity, and quality requires advanced processing techniques, rigorous testing, and strict adherence to quality control standards. These processes are essential for ensuring that the extract meets therapeutic efficacy benchmarks, especially in markets where consumers and regulatory bodies demand scientifically validated products. However, these necessary steps contribute to increased production costs, which are often passed on to consumers in the form of higher prices.

In price-sensitive markets, this can hinder the widespread adoption of Ashwagandha supplements, as consumers may choose more affordable alternatives that lack the same level of standardization or quality assurance. This issue is particularly relevant in developing regions, where disposable income is lower and the cost of premium health products can be prohibitive. Consequently, companies operating in these markets must find a balance between maintaining product quality and offering competitive pricing in order to expand their customer base and capitalize on growth opportunities.

Opportunities: New Product Development

The increasing demand for natural health supplements has opened new opportunities for product diversification, particularly in the Ashwagandha supplements market. Companies are actively exploring innovative ways to incorporate Ashwagandha into functional foods, beverages, and even personal care products. This approach not only appeals to health-conscious consumers but also offers new consumption formats that fit seamlessly into everyday lifestyles. For instance, Organic India is expanding its product range with the launch of Organic Fiber Gummies and Ashwagandha Organic Gummies in August 2024. Known for their supplements in capsule and powder forms, the introduction of gummies signifies Organic India’s entry into this new format. The Ashwagandha Gummies, flavored with lemon-lime, contain 300mg of KSM-66® Ashwagandha root extract per serving, a potent adaptogen recognized for its stress-reducing and immunity-supporting properties. This product is certified organic and has a low sugar content, making it appealing to health-conscious consumers looking for convenient and flavorful supplement options.

Another example is Heritage Foods, which introduced its Ashwagandha Milk in December 2020. This ready-to-drink product combines the herbal extract Withania Somnifera (Ashwagandha) with milk, drawing on traditional Ayurvedic remedies to boost immunity and vitality. Positioned as an immunity booster—a key trend in the post-pandemic world—it offers a shelf-stable solution that can be enjoyed warm or chilled. This launch follows their successful herbal milk variants, including Ginger, Tulsi, and Turmeric.

Additionally, the UK market has welcomed ‘Tranquilo,’ a 500mg Ashwagandha Root drink that was launched in April 2024. Designed as a relaxation supplement, this product caters to health-conscious individuals seeking natural stress relief solutions. These innovative launches underscore the growing opportunities for product development in the Ashwagandha market, as brands increasingly diversify their portfolios by incorporating Ashwagandha into a variety of formats and applications. This trend aligns with consumer preferences for functional products that support holistic wellness in convenient and enjoyable forms.

Challenges: Quality Control and Standardization

Quality control and standardization pose significant challenges in the Ashwagandha supplements market. The natural variability of herbal products makes it difficult to ensure consistent quality across different manufacturers. Ashwagandha, like many botanical ingredients, can experience fluctuations in potency due to factors such as the source of the plant, growing conditions, and harvesting methods. These variations complicate efforts to maintain standardized levels of active ingredients, such as withanolides, across different product batches. Without rigorous quality control protocols, there is a risk of inconsistent product efficacy, which can damage consumer trust in both the brand and the supplement. Manufacturers must invest in advanced testing procedures and certification processes to ensure that each batch meets high standards for purity, potency, and safety. However, implementing these quality assurance measures can be costly, particularly for smaller or newly established market entrants, potentially impacting price competitiveness and market accessibility in certain regions.

Market Ecosystem

The Ashwagandha supplement market operates within a dynamic ecosystem involving both demand and supply sides. On the demand side, the growing consumer focus on health, wellness, stress relief, and mental wellness drives significant consumption across retail platforms, online marketplaces, and through health and wellness influencers. On the supply side, manufacturers such as Nutriventia, Himalaya Wellness, and KSM-66 Ashwagandha are at the forefront, providing high-quality extracts and formulations. The industry is regulated by bodies like the FDA and EFSA, ensuring the quality and safety of these herbal products. Associations like the Council for Responsible Nutrition play a vital role in shaping industry standards and promoting consumer awareness.

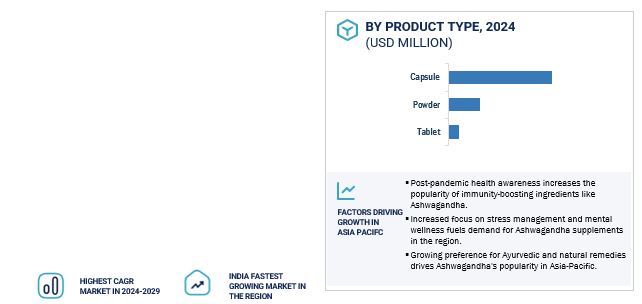

The Ashwagandha supplement capsule in the product type segment accounted the largest during the forecast period.

Among the various product types in the Ashwagandha supplements market, capsules hold the largest market share. This dominance is largely due to their convenience in terms of dosage accuracy, portability, and ease of consumption, making them the preferred choice for consumers. Capsules also have a longer shelf life compared to powders or liquid extracts, which enhances their appeal, particularly in developed markets. Furthermore, capsule formulations often include standardized extract concentrations, allowing consumers to trust the efficacy and consistency of the product. Consequently, capsules remain the top-selling product type in the global Ashwagandha supplements market.

In terms of application, dietary supplements account for the largest share of the Ashwagandha supplements market

This segment is gaining traction due to the increasing consumer emphasis on natural, plant-based solutions for managing stress, boosting immunity, and promoting overall health. Ashwagandha, known for its adaptogenic properties, has become a popular ingredient in dietary supplements aimed at stress relief, cognitive health, and physical performance. The growing trend of holistic wellness, along with the rising demand for herbal and organic products, has further strengthened the position of dietary supplements as the leading application segment in this market.

The Asia-Pacific region is emerging as the fastest-growing market for Ashwagandha supplements market during the forecast period.

The Asia-Pacific region is emerging as the fastest-growing market for Ashwagandha supplements, driven by increasing consumer awareness of the herb's health benefits and its longstanding use in traditional Ayurvedic medicine. In countries like India, where Ashwagandha has been utilized for centuries, there is a significant rise in demand as modern consumers increasingly turn to herbal remedies for stress management, immunity boosting, and overall wellness. The growing interest in natural and organic products across Asia-Pacific, along with an expanding middle class, is further contributing to this rapid growth. Additionally, the rise of e-commerce platforms and improved accessibility to dietary supplements are key factors driving market expansion in the region. Ongoing research and development in herbal supplements, along with supportive government initiatives to promote traditional medicine, are also accelerating the adoption of Ashwagandha-based products across various applications. Consequently, the Asia-Pacific region is positioned as a crucial growth driver in the global Ashwagandha supplements market.

Key Market Players

The key players in this market include NOW Foods, Organic India, Nutritox Life Sciences, Swanson Health Products, KSM66 Ashwagandha, Himalaya Herbal Healthcare, NutraScience Labs, Dabur, Gaia Herbs, Jarrow Formulas, Herbal Hills, Patanjali Ayurved, GNC Holdings, BulkSupplements, and Toniiq .

Recent Developments

- August 2024, Organic India, USA, introduced Organic Fiber Gummies and Ashwagandha Organic Gummies, their first venture into the gummy supplement market. This launch indicates the growing consumer demand for convenient, low-sugar supplements in innovative formats, reflecting the broader trend of incorporating Ashwagandha into functional foods and supplements. This product diversification could accelerate growth in the Ashwagandha supplement market, particularly in wellness-focused segments like dietary supplements and functional beverages.

- April 2024, The "Tranquilo" 500mg Root Ashwagandha Drink was launched in the UK, targeting health-conscious consumers seeking natural relaxation supplements. This product taps into the growing demand for stress-relief beverages, aligning with the rising interest in holistic wellness.

- September 2022, Nutriventia, an India-based company, launched Prolanza, a sustained-release Ashwagandha supplement, offering superior absorption and longer-lasting therapeutic effects. Backed by a clinical study, Prolanza was shown to have higher bioavailability and a longer elimination half-life compared to traditional Ashwagandha extracts. The study demonstrated that Prolanza's sustained-release formulation resulted in a 12x higher bioavailability of key phytoactives like withanolides. This new development positions Prolanza as a more effective option for consumers seeking long-lasting stress relief and other health benefits from Ashwagandha.

- December 2021, Nidra Nutrition, part of Supercluster Pi (House of Brands), launched the world's first stress relief gummies containing 175 mg of Ashwagandha in India. Pre-sales for these gummies, aimed at managing stress and promoting wellness. This product targets the growing number of individuals experiencing stress, with studies highlighting Ashwagandha's ability to reduce stress markers, including cortisol levels. As stress continues to rise globally, Nidra Nutrition's focus on health and sustainability aligns with consumer demand for natural stress management solutions.

- December 2020, Heritage Foods launched its immunity-boosting Ashwagandha Milk, following successful releases of its Ginger, Tulsi, and Turmeric milk variants. This ready-to-drink product combines Withania Somnifera (Ashwagandha) with milk, drawing on centuries-old Ayurvedic remedies. Known for its stress-relief and immunity-boosting properties, this product caters to the growing consumer focus on natural health solutions. With a 90-day shelf life and no refrigeration needed until opened, it offers convenience, positioning the brand to tap into the rising demand for functional beverages. This launch further underscores the integration of Ayurvedic ingredients into mainstream wellness products.

Frequently Asked Questions (FAQ):

Which region is projected to account for the largest share in the ashwagandha supplements market?

North America dominated the ashwagandha supplements market, worth USD XX billion in 2024, and is projected to reach USD XX billion by 2029, at a CAGR of XX% during the forecast period.

What is the current size of the global ashwagandha supplements market?

The global ashwagandha supplements market was valued at USD XX billion in 2024. It is projected to reach USD XX billion by 2029, recording a CAGR of XX% during the forecast period.

Who are the key players in the market?

The key players in this market NOW Foods, Organic India, Nutritox Life Sciences, Swanson Health Products, KSM66 Ashwagandha, Himalaya Herbal Healthcare, NutraScience Labs, Dabur, Gaia Herbs, Jarrow Formulas, Herbal Hills, Patanjali Ayurved, GNC Holdings, BulkSupplements, and Toniiq.

What are the factors driving the ashwagandha supplements market?

- Growing Consumer Awareness: Increasing awareness about Ashwagandha's health benefits, particularly for stress management and mental well-being.

- Rising Demand for Natural Supplements: Shift towards plant-based, natural, and organic products in the wellness and dietary supplement sectors.

- Health and Wellness Trend: The global focus on holistic health and preventive care fuels the demand for herbal supplements like Ashwagandha.

- Ayurvedic Popularity: Growing acceptance and use of traditional Ayurvedic ingredients in mainstream wellness products.

- Increased Mental Health Concerns: Rising stress levels and mental health issues have led to higher adoption of Ashwagandha-based products for relaxation and anxiety relief.

Which segment accounted for the largest ashwagandha supplements market share?

Ashwagandha supplement capsules accounted for the largest market share in the product type in the forecast period.

Growth opportunities and latent adjacency in Ashwagandha Supplements Market