Artificial Neural Network Market by Component (Solutions, Platform/API and Services), Application (Image Recognition, Signal Recognition, and Data Mining), Deployment Mode, Organization Size, Industry Vertical, and Region - Global Forecast to 2024

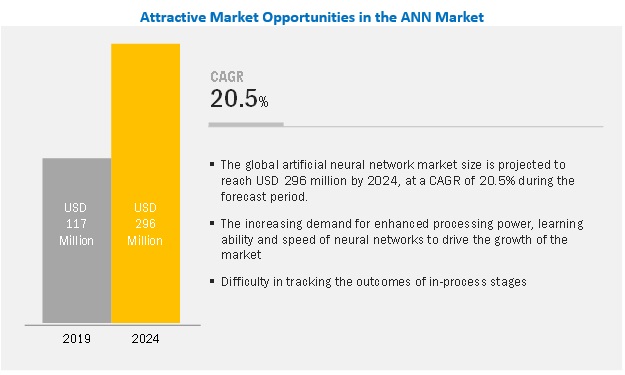

[153 Pages Report] MarketsandMarkets forecasts the global Artificial Neural Network Market size to grow from USD 117 million in 2019 to USD 296 million by 2024, at a Compound Annual Growth Rate (CAGR) of 20.5% during the forecast period. The major growth drivers of the market include the increasing use of emerging technologies to detect complex nonlinear relationships between variables and pattern.

Among applications, the data mining segment to grow at the higher CAGR during the forecast period

ANN is segmented based on applications. The verticals include image recognition, signal recognition, data mining and others (recommender system and drug discovery). The data mining segment is the fastest-growing segment in the Artificial Neural Network Market due to the growing demand for active data mining to turn raw data into useful information.

Deployment via the cloud to grow at a rapid pace during the forecast period

Most of the vendors in the Artificial Neural Network Market offer cloud-based maintenance solutions to gain maximum profits and effectively automate the equipment maintenance process. The adoption of cloud-based ANN solutions is expected to grow, mainly due to their benefits, such as easy maintenance of generated data, cost-effectiveness, scalability, and effective management.

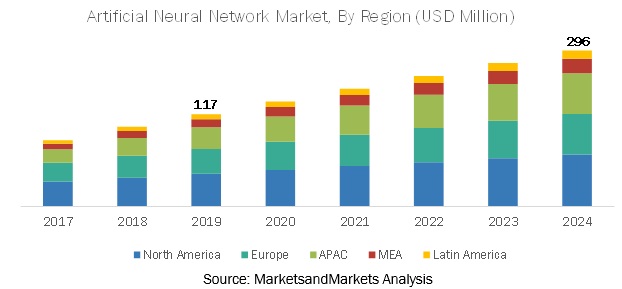

North America to hold the largest market size during the forecast period

North America is expected to hold the largest market size in the global ANN market, while Asia Pacific (APAC) is expected to grow at the highest CAGR during the forecast period. In APAC, the highest growth rate can be attributed to the massive investments made by private and public sectors for enhancing their business solutions, resulting in an increased demand for ANN solutions used to train large volume of data sets with low supervision.

North America is the most significant revenue contributor to the global Artificial Neural Network Market. The region is witnessing significant developments in the ANN market. Many ANN solution providers in North America are experimenting in the ANN market by integrating AI, and deep learning functionalities with their existing ANN solutions. They are also adopting various growth strategies to strengthen their positions in the market

Key Artificial Neural Network Market Players

Major vendors in the global ANN market include Google (US), IBM (US), Oracle (US), Microsoft (US), Intel (US), Qualcomm (US), Alyuda (US), Ward Systems (US), GMDH, LLC (US), Starmind (Switzerland), NeuralWare (US), Neurala (US), and Clarifai (US). These vendors have adopted various organic and inorganic growth strategies, such as new product launches, partnerships and collaborations, and mergers and acquisitions, to expand their presence in the global ANN market further.

Google (US) is one of the global technology leaders, and its primary areas include advertising, search, operating systems and platforms, and enterprise and hardware products. The company is a conglomerate, and its most significant part of revenue comes from Google. All non-Google businesses are collectively called Other Bets. Its Google segment comprises revenues from Ads, Android, Chrome, Google Maps, Google Play, Google Cloud, Search, YouTube, and hardware. The company has an integrated research organization called Google Brain Team for conducting DNN and machine learning research. Google has been making certain developments in the field of the neural network to augment its product offerings and bring about higher technological innovations. In November 2015, Google introduced TensorFlow, an open-source AI engine that deploys deep-learning technology for its computational operations.

Scope of the Artificial Neural Network Market Report

|

Report Metrics |

Details |

|

Market size available for years |

20172024 |

|

Base year considered |

2018 |

|

Forecast period |

20192024 |

|

Forecast units |

Million (USD) |

|

Segments covered |

Component (Solutions {[Software and SDK], Platform/ API} Services { Managed Services, Professional Services [Consulting, Support and Maintenance, and Deployment and Integration]}), Applications, Deployment Modes, Organization Sizes, Industry Verticals, and Regions |

|

Geographies covered |

North America, Europe, APAC, Latin America, and MEA |

|

Companies covered |

Google (US), IBM (US), Oracle (US), Microsoft (US), Intel (US), Qualcomm (US), Alyuda (US), Ward Systems (US), GMDH, LLC (US), Starmind (Switzerland), NeuralWare (US), Neurala (US), and Clarifai (US) |

This research report categorizes the ANN market based on component, applications, deployment modes, organization sizes, industry verticals, and regions.

By Component, the Artificial Neural Network Market is divided into the following segments:

- Solutions

- Platform/API

- Services

- Managed Services

- Professional Services

- Consulting Services

- Deployment and Integration

- Support and Maintenance Services

By Application, the ANN market is divided into the following segments:

- Image Recognition

- Signal Recognition

- Data Mining

- Others ( Recommender System and Drug Discovery)

By Deployment Mode, the Artificial Neural Network Market is divided into the following segments:

- On-premises

- Cloud

By Industry Vertical, the ANN market is divided into the following segments:

- Banking, Financial Services, and Insurance (BFSI)

- Retail and eCommerce

- Telecommunication and Information Technology (IT)

- Healthcare and Life Sciences

- Manufacturing

- Government and Defense

- Transportation and Logistics

- Others (Media and Entertainment, Travel and Hospitality, and Education)

By Region, the Artificial Neural Network Market is divided into the following segments:

- North America

- US

- Canada

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Rest of Europe

- Asia Pacific (APAC)

- China

- India

- South Korea

- ANZ

- Japan

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa (MEA)

- Middle East

- Africa

Recent Developments

- In August 2019, IBM announced the first release of Python SDK and Node.js SDK for interacting with IBMs Cloud Security Advisor service findings Application Program Interface (API) to accelerate the customers platform integration with the service.

- In May 2018, Microsoft released the new Microsoft Translator custom feature, which enables users to apply customizations to both text and speech translation workflows.

- In June 2017, Google launched MultiModel, a neural network architecture that draws from the success of vision, language, and audio networks to simultaneously solve a number of problems spanning multiple domains, including image recognition, translation, and speech recognition.

Critical Questions the Report Answers

- What are the current trends that are driving the Artificial Neural Network Market?

- In which vertical most of the industrial companies are deploying ANN solutions?

- Where will all these developments take the industry in the mid- to long-term?

- Who are the top vendors in the ANN market, and what is their competitive analysis?

- What are the drivers and challenges of the ANN market?

Frequently Asked Questions (FAQ):

What is Artificial Neural Network?

Artificial Neural Networks or ANN is an information processing paradigm that is inspired by the way the biological nervous system such as brain process information. It is composed of large number of highly interconnected processing elements(neurons) working in unison to solve a specific problem.

What are the top vendors in Artificial Neural Network market?

Major vendors offering Artificial Neural Network software and services includes Google, IBM, Oracle, Microsoft, Intel, Qualcomm, Alyuda, Ward Systems, GMDH, LLC, and Starmind. These vendors have adopted different types of organic and inorganic growth strategies such as new product launches, partnerships and collaborations, and mergers and acquisitions to expand their offerings in the market.

What are the applications of Artificial Neural Network?

The major applications of Artificial Neural Network are image recognition, signal recognition, data mining, and others (recommender system and drug discovery). Among which, the data mining segment is the fastest-growing segment in the Artificial Neural Network Market due to the growing demand for active data mining to turn raw data into useful information.

Which industry verticals are adopting Artificial Neural Network solution, platform/API and services?

The top industry verticals adopting social media management solutions and services include BFSI, retail and eCommerce, telecom and IT, healthcare and life sciences, and manufacturing. The increasing demand for enhanced processing power, learning ability, and speed of neural networks to drive the adoption of Artificial Neural Network solutions and services across industry verticals.

What is the market size of Artificial Neural Network?

The global Artificial Neural Network Market size to grow from USD 117 million in 2019 to USD 296 million by 2024, at a Compound Annual Growth Rate (CAGR) of 20.5% during the forecast period. The major growth drivers of the market include the increasing use of emerging technologies to detect complex nonlinear relationships between variables and pattern. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 22)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakup of Primary Profiles

2.1.2.2 Key Industry Insights

2.2 Market Breakup and Data Triangulation

2.3 Market Size Estimation

2.3.1 Top-Down Approach

2.3.2 Bottom-Up Approach

2.4 Market Forecast

2.5 Competitive Leadership Mapping Research Methodology

2.5.1 Vendor Inclusion Criteria

2.6 Assumptions for the Study

2.7 Limitations of the Study

3 Executive Summary (Page No. - 30)

4 Premium Insights (Page No. - 34)

4.1 Attractive Opportunities in the Artificial Neural Network Market

4.2 Market Share By Region

4.3 Market By Industry Vertical and Region

4.4 Best Market to Invest, By Region, 2019

5 Market Overview and Industry Trends (Page No. - 37)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Enhanced Processing Power, Learning Ability, and Speed of Neural Networks to Drive the Growth of the Market

5.2.1.2 Increasing Demand to Detect Complex Nonlinear Relationships Between Variables and Recognize Patterns in Big Data

5.2.1.3 Demand to Train Large Volumes of Data Sets With Low Supervision to Drive the Market

5.2.2 Restraints

5.2.2.1 Difficulty in Tracking the Outcomes of In-Process Stages

5.2.3 Opportunities

5.2.3.1 Increasing Use of Ann in IoT and Data Analytics

5.2.4 Challenges

5.2.4.1 Extrapolation Issues in Ann Being A Drawback to the Market

5.3 Regulatory Implications

5.3.1 General Data Protection Regulation

5.3.2 Health Insurance Portability and Accountability Act

5.4 Expected Applications of Ann-Integrated Systems

5.4.1 Data Mining and Archiving

5.4.2 Analytical Software

5.4.3 Optimization Software

5.4.4 Visualization Software

5.5 Ecosystem of Artificial Neural Network

5.6 Types of Artificial Neural Network

5.6.1 Recurrent Neural Network

5.6.2 Convolutional Neural Network

5.6.3 Feedforward Neural Network

6 Artificial Neural Network Market By Component (Page No. - 44)

6.1 Introduction

6.2 Solution

6.2.1 Open-Source Software Solution to Drive the Adoption of Artificial Neural Network in Research, Forecasting/Prediction, and Visualizations Areas

6.3 Platform/API

6.3.1 Availability of Flexible Apis to Drive the Adoption of Artificial Neural Network in Different Industries

6.4 Services

6.4.1 Managed Services

6.4.1.1 Increasing Need for Monitoring and Maintaining Tool Operations and Reducing Overhead Costs to Drive the Growth of Managed Services in the Market

6.4.2 Professional Services

6.4.2.1 Consulting

6.4.2.1.1 Technicalities Involved in Implementing Artificial Neural Network Tools and Services to Boost the Growth of Consulting Services

6.4.2.2 Deployment and Integration

6.4.2.2.1 Growing Need to Overcome System-Related Issues Effectively to Drive the Growth of Deployment and Integration Services

6.4.2.3 Support and Maintenance

6.4.2.3.1 Growing Deployment of Artificial Neural Network Software to Drive the Demand for Support and Maintenance Services

7 Artificial Neural Network Market By Application (Page No. - 53)

7.1 Introduction

7.2 Image Recognition

7.2.1 Rising Need for Efficient Techniques to Process and Categorize Objects in Variety of Fields to Drive the Growth of the Image Recognition Segment

7.3 Signal Recognition

7.3.1 Classification and Feature Extraction Algorithm to Fuel the Growth of the Signal Recognition Application in the Market

7.4 Data Mining

7.4.1 Demand for Predictive Analytics to Fuel the Growth of Data Mining Application in the Market

7.5 Others

8 Artificial Neural Network Market By Deployment Mode (Page No. - 59)

8.1 Introduction

8.2 Cloud

8.2.1 Cost-Effectiveness and Scalability of Cloud Deployment Mode to Boost the Growth of This Segment

8.3 On-Premises

8.3.1 Data-Sensitive Organizations Prefer the On-Premises Deployment Mode for Artificial Neural Network Software

9 Artificial Neural Network Market By Organization Size (Page No. - 63)

9.1 Introduction

9.2 Small and Medium-Sized Enterprises

9.2.1 Need for Viable Cloud-Based Cost-Effective Solutions to Drive the Adoption of Artificial Neural Network in Small and Medium-Sized Enterprises

9.3 Large Enterprises

9.3.1 Increasing Adoption of Advanced Technologies to Drive the Adoption of Artificial Neural Network in Large Enterprises

10 Artificial Neural Network Market By Industry Vertical (Page No. - 67)

10.1 Introduction

10.2 Banking, Financial Services and Insurance

10.2.1 Growing Focus on Financial Standards and Compliance With Regulations to Drive the Market

10.3 Retail and eCommerce

10.3.1 Growing Demand to Identify Customer Behavior in Real Time to Fuel the Growth of the Retail and eCommerce Industry Vertical

10.4 Telecommunications and It

10.4.1 Increasing Demand to Provide Improved Services for A Growing Customer Base to Boost the Adoption of the Market

10.5 Healthcare and Life Sciences

10.5.1 Growing Demand to Achieve Better Patient Experience and Personalized Treatment in Real Time to Fuel the Growth of the Healthcare and Life Sciences Industry Vertical

10.6 Manufacturing

10.6.1 Growing Need to Extend the Lifespan of Factory Equipment and Reduce the Risk of Production Delays to Fuel the Growth of the Artificial Neural Network Application in the Manufacturing Industry Vertical

10.7 Transportation and Logistics

10.7.1 Demand to Reduce Cost and Management of the Overall Supply Chain Flow to Drive the Growth of the Market

10.8 Government and Defense

10.8.1 Growing Demand for Enhanced Data Security and Advanced Intelligence to Drive the Market

10.9 Others

11 Artificial Neural Network Market By Region (Page No. - 77)

11.1 Introduction

11.2 North America

11.2.1 United States

11.2.1.1 Governments Focus on Innovation and Research to Fuel the Adoption of Artificial Neural Network Software in the United States

11.2.2 Canada

11.2.2.1 Increase in Investments and Research Activities to Drive Artificial Neural Network Software and Services Adoption in Canada

11.3 Europe

11.3.1 United Kingdom

11.3.1.1 Government Focus on Innovation and Research to Fuel the Adoption of Artificial Neural Network Software in the United Kingdom

11.3.2 Germany

11.3.2.1 Growing Investments By Tech-Giants to Provide Opportunities for the Development of Artificial Neural Network Software

11.3.3 France

11.3.3.1 Focus on R&D and Heavy Inflow of Capital From Global Players and Investors to Drive the Market Growth in France

11.3.4 Italy

11.3.4.1 Government Initiatives to Increase the Adoption of Artificial Neural Network in Manufacturing and Finance Sector to Help Market Growth

11.3.5 Spain

11.3.5.1 Government Smart City Initiatives Contributing to the Growth of the Market in Spain

11.3.6 Rest of Europe

11.4 Asia Pacific

11.4.1 China

11.4.1.1 Increasing Focus on Integrating Artificial Intelligence and Deep Learning Technologies to Drive the Adoption of Artificial Neural Network Software in China

11.4.2 Japan

11.4.2.1 Existing Market and Already Adopted Technology to Boost the Market in Japan

11.4.3 South Korea

11.4.3.1 Government Initiatives and Support Toward the Adoption of Artificial Intelligence to Drive the Market Growth

11.4.4 India

11.4.4.1 Advent of Neural Network Startups in India to Drive the Growth of the Market

11.4.5 Australia and New Zealand

11.4.5.1 Growth in Infrastructure Developments and the Adoption of Connected Devices to Drive the Artificial Neural Network Market

11.4.6 Rest of Asia Pacific

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Advanced Analytics Coupled With AI Adoption to Drive the Market in the United Arab Emirates

11.5.2 Africa

11.5.2.1 Transformation in the Overall Infrastructure Industry to Boost the Adoption of Artificial Neural Network Tools in South Africa

11.6 Latin America

11.6.1 Brazil

11.6.1.1 Investments By Multinational Companies to Drive the Market Growth in Brazil

11.6.2 Mexico

11.6.2.1 Government Initiatives and Increasing Demand for Artificial Neural Network Software and Services to Trigger the Market Growth in Mexico

11.6.3 Rest of Latin America

12 Competitive Landscape (Page No. - 115)

12.1 Competitive Leadership Mapping Overview

12.1.1 Visionary Leaders

12.1.2 Innovators

12.1.3 Dynamic Differentiators

12.1.4 Emerging Companies

12.2 Competitive Benchmarking

12.2.1 Business Strategy Excellence of Major Players in the Artificial Neural Network Market

12.2.2 Strength of Solution Offerings of Major Players in the Market

12.3 Ranking of Players, 2019

13 Company Profiles (Page No. - 119)

13.1 Introduction

(Business Overview, Products & Solutions, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

13.2 Google

13.3 IBM

13.4 Microsoft

13.5 Oracle

13.6 Intel

13.7 Qualcomm

13.8 Alyuda

13.9 Ward Systems

13.10 GMDH, LLC

13.11 Starmind

13.12 Neuralware

13.13 Neurala

13.14 Clarifai

*Details on Business Overview, Products & Solutions, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 145)

14.1 Knowledge Store: Marketsandmarkets Subscription Portal

14.2 Available Customizations

14.3 Related Reports

14.4 Author Details

List of Tables (100 Tables)

Table 1 Inclusions and Exclusions

Table 2 Major Secondary Sources

Table 3 Factor Analysis

Table 4 Evaluation Criteria

Table 5 Artificial Neural Network Market Size and Growth Rate, 20172024 (USD Thousand, Y-O-Y %)

Table 6 Worldwide Data Volume Growth (In Zettabytes)

Table 7 IoT Installed Base (In Billion Units)

Table 8 Market: Different Component Providers

Table 9 Market Size By Component, 20172024 (USD Thousand)

Table 10 Solution: Artificial Neural Network Market Size, By Region, 20172024 (USD Thousand)

Table 11 Platform/API: Market Size By Region, 20172024 (USD Thousand)

Table 12 Services: Market Size By Type, 20172024 (USD Thousand)

Table 13 Managed Services: Market Size By Region, 20172024 (USD Thousand)

Table 14 Professional Services: Market Size By Type, 20172024 (USD Thousand)

Table 15 Consulting: Market Size By Region, 20172024 (USD Thousand)

Table 16 Deployment and Integration: Market Size By Region, 20172024 (USD Thousand)

Table 17 Support and Maintenance: Market Size By Region, 20172024 (USD Thousand)

Table 18 Artificial Neural Network Market Size, By Application, 20172024 (USD Thousand)

Table 19 Image Recognition: Market Size By Region, 20172024 (USD Thousand)

Table 20 Signal Recognition: Market Size By Region, 20172024 (USD Thousand)

Table 21 Data Mining: Market Size By Region, 20172024 (USD Thousand)

Table 22 Other Applications: Market Size By Region, 20172024 (USD Thousand)

Table 23 Artificial Neural Network Market Size, By Deployment Mode, 20172024 (USD Thousand)

Table 24 Cloud: Market Size By Region, 20172024 (USD Thousand)

Table 25 On-Premises: Market Size By Region, 20172024 (USD Thousand)

Table 26 Market Size By Organization Size, 20172024 (USD Thousand)

Table 27 Small and Medium-Sized Enterprises: Market Size By Region, 20172024 (USD Thousand)

Table 28 Large Enterprises: Market Size By Region, 20172024 (USD Thousand)

Table 29 Artificial Neural Network Market Size, By Industry Vertical, 20172024 (USD Thousand)

Table 30 Banking, Financial Services and Insurance: Market Size By Region, 20172024 (USD Thousand)

Table 31 Retail and eCommerce: Market Size By Region, 20172024 (USD Thousand)

Table 32 Telecommunications and It: Market Size By Region, 20172024 (USD Thousand)

Table 33 Healthcare and Life Sciences: Market Size By Region, 20172024 (USD Thousand)

Table 34 Manufacturing: Artificial Neural Network Market Size, By Region, 20172024 (USD Thousand)

Table 35 Transportation and Logistics: Market Size, By Region, 20172024 (USD Thousand)

Table 36 Government and Defense: Market Size, By Region, 20172024 (USD Thousand)

Table 37 Other Industry Verticals: Market Size, By Region, 20172024 (USD Thousand)

Table 38 Market Size By Region, 20172024 (USD Thousand)

Table 39 Market Size By Country, 20172024 (USD Thousand)

Table 40 North America: Artificial Neural Network Market Size, By Component, 20172024 (USD Thousand)

Table 41 North America: Market Size By Service, 20172024 (USD Thousand)

Table 42 North America: Market Size By Professional Service, 20172024 (USD Thousand)

Table 43 North America: Market Size By Application, 20172024 (USD Thousand)

Table 44 North America: Market Size By Deployment Mode, 20172024 (USD Thousand)

Table 45 North America: Market Size By Organization Size, 20172024 (USD Thousand)

Table 46 North America: Market Size By Industry Vertical, 20172024 (USD Thousand)

Table 47 North America: Market Size By Country, 20172024 (USD Thousand)

Table 48 United States: Artificial Neural Network Market Size, By Component, 20172024 (USD Thousand)

Table 49 Canada: Market Size By Component, 20172024 (USD Thousand)

Table 50 Europe: Market Size By Component, 20172024 (USD Thousand)

Table 51 Europe: Market Size By Service, 20172024 (USD Thousand)

Table 52 Europe: Market Size By Professional Service, 20172024 (USD Thousand)

Table 53 Europe: Market Size By Application, 20172024 (USD Thousand)

Table 54 Europe: Market Size By Deployment Mode, 20172024 (USD Thousand)

Table 55 Europe: Market Size By Organization Size, 20172024 (USD Thousand)

Table 56 Europe: Market Size By Industry Vertical, 20172024 (USD Thousand)

Table 57 Europe: Market Size By Country, 20172024 (USD Thousand)

Table 58 United Kingdom: Artificial Neural Network Market Size, By Component, 20172024 (USD Thousand)

Table 59 Germany: Market Size By Component, 20172024 (USD Thousand)

Table 60 France: Market Size By Component, 20172024 (USD Thousand)

Table 61 Italy: Market Size By Component, 20172024 (USD Thousand)

Table 62 Spain: Market Size By Component, 20172024 (USD Thousand)

Table 63 Rest of Europe: Artificial Neural Network Market Size, By Component, 20172024 (USD Thousand)

Table 64 Asia Pacific: Market Size By Component, 20172024 (USD Thousand)

Table 65 Asia Pacific: Market Size By Service, 20172024 (USD Thousand)

Table 66 Asia Pacific: Market Size By Professional Service, 20172024 (USD Thousand)

Table 67 Asia Pacific: Market Size By Application, 20172024 (USD Thousand)

Table 68 Asia Pacific: Market Size By Deployment Mode, 20172024 (USD Thousand)

Table 69 Asia Pacific: Market Size By Organization Size, 20172024 (USD Thousand)

Table 70 Asia Pacific: Market Size By Industry Vertical, 20172024 (USD Thousand)

Table 71 Asia Pacific: Market Size By Country, 20172024 (USD Thousand)

Table 72 China: Artificial Neural Network Market Size, By Component, 20172024 (USD Thousand)

Table 73 Japan: Market Size By Component, 20172024 (USD Thousand)

Table 74 South Korea: Market Size By Component, 20172024 (USD Thousand)

Table 75 India: Market Size By Component, 20172024 (USD Thousand)

Table 76 Australia and New Zealand: Market Size By Component, 20172024 (USD Thousand)

Table 77 Rest of Asia Pacific: Market Size By Component, 20172024 (USD Thousand)

Table 78 Middle East and Africa: Artificial Neural Network Market Size, By Component, 20172024 (USD Thousand)

Table 79 Middle East and Africa: Market Size By Service, 20172024 (USD Thousand)

Table 80 Middle East and Africa: Market Size By Professional Service, 20172024 (USD Thousand)

Table 81 Middle East and Africa: Market Size By Application, 20172024 (USD Thousand)

Table 82 Middle East and Africa: Market Size By Deployment Mode, 20172024 (USD Thousand)

Table 83 Middle East and Africa: Market Size By Organization Size, 20172024 (USD Thousand)

Table 84 Middle East and Africa: Market Size By Industry Vertical, 20172024 (USD Thousand)

Table 85 Middle East and Africa: Market Size By Country, 20172024 (USD Thousand)

Table 86 Middle East: Market Size By Component, 20172024 (USD Thousand)

Table 87 Africa: Market Size By Component, 20172024 (USD Thousand)

Table 88 Latin America: Artificial Neural Network Market Size, By Component, 20172024 (USD Thousand)

Table 89 Latin America: Market Size By Service, 20172024 (USD Thousand)

Table 90 Latin America: Market Size By Professional Service, 20172024 (USD Thousand)

Table 91 Latin America: Market Size By Application, 20172024 (USD Thousand)

Table 92 Latin America: Market Size By Deployment Mode, 20172024 (USD Thousand)

Table 93 Latin America: Market Size By Organization Size, 20172024 (USD Thousand)

Table 94 Latin America: Market Size By Industry Vertical, 20172024 (USD Thousand)

Table 95 Latin America: Market Size By Country, 20172024 (USD Thousand)

Table 96 Brazil: Artificial Neural Network Market Size, By Component, 20172024 (USD Thousand)

Table 97 Mexico: Market Size By Component, 20172024 (USD Thousand)

Table 98 Rest of Latin America: Market Size By Component, 20172024 (USD Thousand)

Table 99 Neurala: Company Snapshot

Table 100 Clarifai: Company Snapshot

List of Figures (45 Figures)

Figure 1 Market Segmentation

Figure 2 Regional Scope

Figure 3 Artificial Neural Network Market: Research Design

Figure 4 Breakup of Primary Interviews: By Company, Designation, and Region

Figure 5 Ann Market: Top-Down and Bottom-Up Approaches

Figure 6 Global Artificial Neural Network Market to Witness Significant Growth During the Forecast Period

Figure 7 Market Snapshot By Component (2019 vs 2024)

Figure 8 Market Snapshot By Service (2019 vs 2024)

Figure 9 Market Snapshot By Deployment Mode (2019 vs 2024)

Figure 10 Market Snapshot By Organization Size (2019 vs 2024)

Figure 11 Artificial Neural Network Market Snapshot, By Industry Vertical (2019 vs 2024)

Figure 12 Learning Ability, and Speed of Neural Network to Drive the Growth of the Artificial Neural Network Market

Figure 13 North America to have the Highest Market Share in 2019

Figure 14 Banking, Financial Services, and Insurance Industry Vertical and North America to have the Highest Market Shares in 2019

Figure 15 Asia Pacific to Be the Best Market to Invest in 2019

Figure 16 Drivers, Restraints, Opportunities, and Challenges: Artificial Neural Network Market

Figure 17 Neural Network Software Ecosystem

Figure 18 Solution Segment to Grow at the Highest CAGR During the Forecast Period

Figure 19 Managed Services Segment to Grow at A Higher CAGR During the Forecast Period

Figure 20 Consulting Segment to Grow at the Highest CAGR During the Forecast Period

Figure 21 Data Mining Segment to Witness the Highest CAGR During the Forecast Period

Figure 22 Cloud Segment to Witness A Higher CAGR During the Forecast Period

Figure 23 Small and Medium-Sized Enterprises Segment to Grow at A Higher CAGR During the Forecast Period

Figure 24 Manufacturing Industry Vertical to Witness the Highest CAGR During the Forecast Period

Figure 25 North America to Account for the Largest Market Size During the Forecast Period

Figure 26 Asia Pacific to Account for the Highest CAGR During the Forecast Period

Figure 27 North America: Market Snapshot

Figure 28 Image Recognition Segment to Consolidate the Largest Market Size During the Forecast Period

Figure 29 Data Mining Segment to Grow at the Highest CAGR During the Forecast Period in Europe

Figure 30 Asia Pacific: Market Snapshot

Figure 31 Data Mining Segment to Grow at the Highest CAGR During the Forecast Period in Asia Pacific

Figure 32 Data Mining Segment to Grow at the Highest CAGR During the Forecast Period in the Middle East and Africa

Figure 33 Data Mining Segment to Grow at the Highest CAGR During Forecast Period in Latin America

Figure 34 Artificial Neural Network Market (Global) Competitive Leadership Mapping, 2019

Figure 35 Ranking of Key Players in the Artificial Neural Network Market, 2019

Figure 36 Google: Company Snapshot

Figure 37 SWOT Analysis: Google

Figure 38 IBM: Company Snapshot

Figure 39 SWOT Analysis: IBM

Figure 40 Microsoft: Company Snapshot

Figure 41 SWOT Analysis: Microsoft

Figure 42 Oracle: Company Snapshot

Figure 43 SWOT Analysis: Oracle

Figure 44 Intel: Company Snapshot

Figure 45 Qualcomm: Company Snapshot

The study involved 4 major activities in estimating the current market size of the Artificial Neural Network Market. An exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the ANN market.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers and Bloomberg BusinessWeek, Dun Bradstreet, and Factiva have been referred to for identifying and collecting information for this study. Secondary sources included annual reports; press releases and investor presentations of companies; whitepapers, certified publications such as American Journal of Neural Networks and Applications (Science Publication Group) and a view of Artificial Neural Network (IEEE), and articles by recognized authors; gold standard and silver standard websites; Research and Development (R&D) organizations; regulatory bodies; and databases.

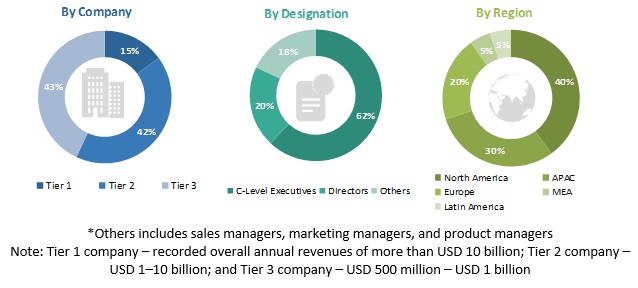

Primary Research

Various primary sources from both the supply and demand sides of the Artificial Neural Network Market were interviewed to obtain qualitative and quantitative information for this study. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), technology and innovation directors, and related key executives from various vendors offering ANN solutions, associated service providers, and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Artificial Neural Network Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the ANN market. The top-down procedure was used to derive the revenue contribution of top vendors and their offerings in the ANN market. The bottom-up process was used to arrive at the overall market size of the global ANN market using key companies revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market were identified through extensive secondary research.

- The market size, in terms of value, was determined through primary and secondary research processes.

- All percentage shares split, and breakups were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, segment, and project the global market size for ANN

- To understand the structure of the Artificial Neural Network Market by identifying its various subsegments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the micro-markets concerning individual growth trends, prospects, and their contribution to the overall market

- To project the size of the market and its submarkets, in terms of value, for the five regions (along with their respective key countries)

- To profile key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify significant growth strategies adopted by players across key regions

- To analyze the competitive developments, such as expansions and fundings, new product launches, mergers and acquisitions, strategic partnerships and agreements in the ANN market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Product analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the North American Artificial Neural Network Market

- Further breakup of the European ANN market

- Further breakup of the APAC ANN market

- Further breakup of the Latin American ANN market

- Further breakup of the MEA ANN market

Company Information

- Detailed analysis and profiling of additional market players up to 5

Growth opportunities and latent adjacency in Artificial Neural Network Market