AI in Oil & Gas Market by Type (Hardware, Software, Services), Application (Upstream, Midstream, Downstream), Function (Predictive Maintenance, Production Planning, Field Service, Material Movement, Quality Control), and Region - Global Forecast to 2022

[140 Pages Report] AI in Oil & Gas Market was USD 1.42 Billion in 2016 and is expected to grow at a CAGR of 12.66% from 2017 to 2022 to reach a market size of USD 2.85 Billion by 2022.

The years considered for the study are as follows:

- Base Year: 2016

- Estimated Year: 2017

- Projected Year: 2022

- Forecast Period: 2017 to 2022

The base year considered for company profiles is 2016. Whenever information was unavailable for the base year, the prior year has been considered.

Objectives of the Study

- To define, describe, and segment the global market on the basis of type, function, application, and region

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and industry-specific challenges)

- To estimate the size of the global market in terms of value

- To study the individual growth trends of the providers of market, their future expansions, and analyze their contributions to the market

- To forecast the revenue of market segments with respect to regions, namely, North America, Europe, South America, Asia Pacific, and the Middle East and Africa

- To strategically analyze micro-markets with respect to individual growth trends, future prospects, and contribution to the total market, covered by market and various regions

- To track and analyze competitive developments such as joint ventures, mergers & acquisitions, and new product launches, in market

- To strategically profile key market players and comprehensively analyze their market position and core competencies

Research Methodology

This research study involved the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of Market. Primary sources are mainly industry experts from the core and related industries, preferred suppliers, manufacturers, distributors, service providers, technology developers, standards and certification organizations of companies, and organizations related to all the segments of this industrys value chain. The research methodology has been explained below.

- Study of annual revenues and market developments of major players that offer artificial intelligence

- Assessment of future trends of Market

- Assessment of Market with respect to the type of AI used in various applications

- Study of the market trends in various regions or countries supported by the type of Market

- Study of contracts and developments related to Market by key players across different regions

- Finalization of the overall market sizes by triangulating the supply-side data, which includes product developments, supply chain, and annual revenues of companies manufacturing Market across the globe

To know about the assumptions considered for the study, download the pdf brochure

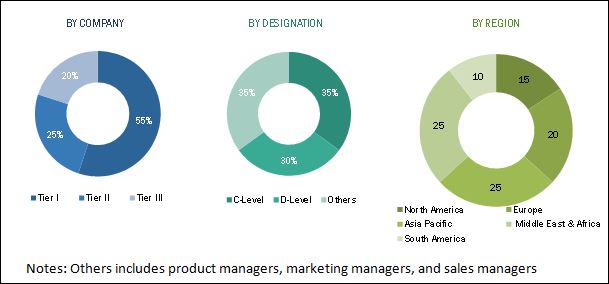

After arriving at the overall market size, the total market has been split into segments and sub-segments. The figure given above illustrates the breakdown of primaries conducted during the research study on the basis of company type, designation, and region.

AI in oil & gas ecosystem comprises service providers such as IBM (US), Intel (US), Microsoft (US), Accenture (Republic of Ireland), Google (US), Microsoft (US), Oracle (US), Numenta (US), Sentient technologies (US), Inbenta (US), General Vision (US), Cisco (US), FuGenX Technologies (US), Infosys (India), Hortonworks (US), and Royal Dutch Shell (Netherlands).

Target Audience:

The reports target audience includes:

- AI manufacturers and suppliers

- AI system providers

- Environmental research institutes

- Government and research organizations

- Institutional investors

- National and local government organizations

- Research organizations and consulting companies

- Technology providers

Scope of the Report:

The Market has been segmented as follows.

By Type:

- Hardware

- Software

- Hybrid

By Function:

- Predictive maintenance and machinery inspection

- Material movement

- Production planning

- Field services

- Quality control

- Reclamation

By Application:

- Upstream

- Downstream

- Midstream

By Region:

- North America

- Asia Pacific

- Europe

- South America

- Middle East and Africa

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the clients specific needs. The following customization options are available for this report:

Regional Analysis

Further breakdown of region-/country-specific analyses

Company Information

Detailed analyses and profiling of additional market players (up to five)

The global AI in Oil & Gas market is expected to grow at a CAGR of 12.66%, from 2017 to 2022, to reach a projected USD 2.85 Billion by 2022. The growth will be mainly driven by the rise in adoption of the big data technology, digitalization of the Oil & Gas industry, investments in AI-related start-ups, and rising pressure to reduce production costs and increase efficiency.

The report segments Artificial Intelligence in Oil and Gas market, on the basis of type, into hardware, software, and services. The software segment led market in 2016. Software in market are applicable in upstream Oil & Gas exploration and production activities. The hardware segment in market is expected to grow swiftly during the forecast period (2017 to 2022), mainly due to the increasing requirement for sophisticated hardware system configurations and components capable of handling massive data, including, but not limited to Tensor Processor Unit (TPU), Graphic Processing Unit (GPU), Resistive Processing Unit (RPU), Field Programmable Gate Array (FPGA), and Visual Processing Unit (VPU) to install software-based AI capabilities.

Artificial Intelligence in Oil and Gas market, by function, is segmented into predictive maintenance and machinery inspection, material movement, production planning, field services, quality control, and reclamation. Preventive maintenance is the largest and one of the fastest growing segment in market. Predictive maintenance aids in addressing costly downturn, by predicting maintenance schedules for equipment to prevent the possibility of equipment failures and, thus, save millions of dollars.

The report further segments Artificial Intelligence in Oil and Gas market, by application into upstream, midstream, and downstream. The upstream segment of market is expected to account for the largest market size and grow at the highest CAGR during the forecast period.

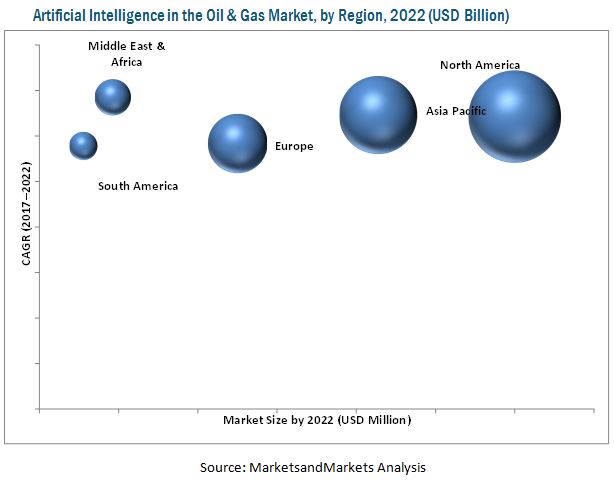

North America is projected to be the largest market for Artificial Intelligence in Oil and Gas market due to increasing adoption of AI technologies by oilfield operators and service providers and the strong presence of prominent AI software and system suppliers, especially in the US and Canada. The Middle East and Africa is the fastest growing market due to increasing investments in start-ups for AI implementation, which would further raise the demand for AI in the near future.

The major factor restraining the growth of market is the ambiguous regulatory guidelines for market.

Some of the global players in this AI in Oil & Gas market include IBM (US), Accenture (Republic of Ireland), Google (US), Microsoft Corporation (US), and Oracle (US). Together they hold a strong share of the global market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Geographical Scope

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities in the AI in Oil & Gas Market

4.2 Artificial Intelligence in Oil & Gas Market, By Country

4.3 AI in Oil & Gas, By Type

4.4 AI in Oil & Gas, By Function

5 Market Overview (Page No. - 33)

5.1 Introduction

5.1.1 Drivers

5.1.1.1 Big Data Technology in the Oil & Gas Industry to Augment E&P Capabilities

5.1.1.2 Significant Increase in Venture Capital Investments

5.1.1.3 Growing Need for Automation is Driving AI in Oil & Gas Industry

5.1.1.4 Tremendous Pressure to Reduce Production Costs

5.1.2 Restraints

5.1.2.1 Lack of Stringent Regulatory Guidelines for AI in Oil & Gas Industry

5.1.2.2 High AI Installation Costs

5.1.3 Opportunities

5.1.3.1 Improving Operational Efficiency in the Oil & Gas Industry

5.1.3.2 Predictive Maintenance to Avoid Costly Downtime

5.1.4 Challenges

5.1.4.1 Concerns Regarding Data Privacy & Increased Cyber Security Risks

6 AI in Oil & Gas, By Type (Page No. - 39)

6.1 Introduction

6.2 Hardware

6.3 Software

6.4 Services

7 AI in Oil & Gas Market, By Function (Page No. - 45)

7.1 Introduction

7.2 Predictive Maintenance & Machine Inspection

7.3 Material Movement

7.4 Production Planning

7.5 Field Services

7.6 Quality Control

7.7 Reclamation

8 AI in Oil & Gas, By Application (Page No. - 52)

8.1 Introduction

8.2 Upstream

8.3 Midstream

8.4 Downstream

9 AI in Oil & Gas, By Region (Page No. - 57)

9.1 Introduction

9.2 North America

9.2.1 By Type

9.2.2 By Function

9.2.3 By Application

9.2.4 By Country

9.2.4.1 US

9.2.4.2 Canada

9.2.4.3 Mexico

9.3 Europe

9.3.1 By Type

9.3.2 By Function

9.3.3 By Application

9.3.4 By Country

9.3.4.1 Norway

9.3.4.2 UK

9.3.4.3 Russia

9.3.4.4 Rest of Europe

9.4 Asia Pacific

9.4.1 By Type

9.4.2 By Function

9.4.3 By Application

9.4.4 By Country

9.4.4.1 China

9.4.4.2 India

9.4.4.3 Australia

9.4.4.4 Malaysia

9.4.4.5 Rest of Asia Pacific

9.5 South America

9.5.1 By Type

9.5.2 By Function

9.5.3 By Application

9.5.4 By Country

9.5.4.1 Brazil

9.5.4.2 Argentina

9.5.4.3 Venezuela

9.5.4.4 Rest of South America

9.6 Middle East & Africa

9.6.1 By Type

9.6.2 By Function

9.6.3 By Application

9.6.4 By Country

9.6.4.1 Saudi Arabia

9.6.4.2 UAE

9.6.4.3 Nigeria

9.6.4.4 Qatar

9.6.4.5 Rest of the Middle & Africa

10 Competitive Landscape (Page No. - 94)

10.1 Introduction

10.2 Market Ranking Analysis

10.3 Competitive Scenario

10.3.1 Partnerships and Collaborations

10.3.2 New Product Launches

10.3.3 Investments and Expansions

10.3.4 Contracts & Agreements

10.3.5 Others

11 Company Profiles (Page No. - 98)

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

11.1 IBM

11.2 Accenture

11.3 Google

11.4 Microsoft

11.5 Oracle

11.6 Intel

11.7 Numenta

11.8 Sentient Technologies

11.9 Inbenta

11.10 General Vision

11.11 Cisco

11.12 Fugenx Technologies

11.13 Infosys

11.14 Hortonworks

11.15 Shell

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 131)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (66 Tables)

Table 1 AI in Oil and Gas Market Snapshot

Table 2 AI in Oil and Gas Industry Size, By Type, 20152022 (USD Million)

Table 3 Hardware: Market, By Region, 20152022 (USD Million)

Table 4 Hardware: Top Countries for Market, 20152022 (USD Million)

Table 5 Software: Market, By Region, 20152022 (USD Million)

Table 6 Services Market, By Region, 20152022 (USD Million)

Table 7 AI in Oil and Gas Industry, By Function, 20152022 (USD Million)

Table 8 Predictive Maintenance & Machine Inspection AI in Oil and Gas, By Region, 20152022 (USD Million)

Table 9 Material Movement: Market, By Region, 20152022 (USD Million)

Table 10 Production Planning: Market, By Region, 20152022 (USD Million)

Table 11 Field Services: Market, By Region, 20152022 (USD Million)

Table 12 Quality Control: Market, By Region, 20152022 (USD Million)

Table 13 Reclamation: Market, By Region, 20152022 (USD Million)

Table 14 AI in Oil and Gas Size, By Application, 20152022 (USD Million)

Table 15 Upstream: Market Size, By Region, 20152022 (USD Million)

Table 16 Midstream: Market Size, By Region, 20152022 (USD Million)

Table 17 Downstream: Market Size, By Region, 20152022 (USD Million)

Table 18 AI in Oil and Gas Size, By Region, 20152022 (USD Million)

Table 19 Top Five Countries: Market Size, 20152022 (USD Million)

Table 20 Top Five Countries With High CAGR: Market, 20152022 (USD Million)

Table 21 North America: Artificial Intelligence in Oil and Gas Market Size, By Country, 20152022 (USD Million)

Table 22 North America: Market Size, By Type, 20152022 (USD Million)

Table 23 North America: Market Size, By Function 20152022 (USD Million)

Table 24 North America: Market Size, By Application, 20152022 (USD Million)

Table 25 US: AI in Oil and Gas Industry Size, By Type, 20152022 (USD Million)

Table 26 Canada: Market Size, By Type, 20152022 (USD Million)

Table 27 Mexico: Market Size, By Type, 20152022 (USD Million)

Table 28 Europe: AI in Oil and Gas Industry Size, By Country, 20152022 (USD Million)

Table 29 Europe: Market Size, By Type, 20152022 (USD Million)

Table 30 Europe: Market Size, By Function, 20152022 (USD Million)

Table 31 Europe: Market Size, By Application, 20152022 (USD Million)

Table 32 Norway: Market Size, By Type, 20152022 (USD Million)

Table 33 UK: Market Size, By Type, 20152022 (USD Million)

Table 34 Russia: Market Size, By Type, 20152022 (USD Million)

Table 35 Rest of Europe: Market Size, By Type, 20152022 (USD Million)

Table 36 Asia Pacific: AI in Oil and Gas Industry Size, By Country, 20152022 (USD Million)

Table 37 Asia Pacific: Market Size, By Type, 20152022 (USD Million)

Table 38 Asia Pacific: Market Size, By Function, 20152022 (USD Million)

Table 39 Asia Pacific: Market Size, By Application, 20152022 (USD Million)

Table 40 China: Market Size, By Type, 20152022 (USD Million)

Table 41 India: Market Size, By Type, 20152022 (USD Million)

Table 42 Australia: Market Size, By Type, 20152022 (USD Million)

Table 43 Malaysia: Market Size, By Type, 20152022 (USD Million)

Table 44 Rest of Asia Pacific: Market Size, By Type, 20152022 (USD Million)

Table 45 South America: AI in Oil and Gas Industry Size, By Country, 20152022 (USD Million)

Table 46 South America: Market Size, By Type, 20152022 (USD Million)

Table 47 South America: Market Size, By Function, 20152022 (USD Million)

Table 48 South America: Market Size, By Application, 20152022 (USD Million)

Table 49 Brazil: Market Size, By Type, 20152022 (USD Million)

Table 50 Argentina: Market Size, By Type, 20152022 (USD Million)

Table 51 Venezuela: Market Size, By Type, 20152022 (USD Million)

Table 52 Rest of South America: Market Size, By Type, 20152022 (USD Million)

Table 53 Middle East & Africa: Market Size, By Country, 20152022 (USD Million)

Table 54 Middle East & Africa: Market Size, By Type, 20152022 (USD Million)

Table 55 Middle East & Africa: Market Size, By Function, 20152022 (USD Million)

Table 56 Middle East & Africa: Market Size, By Application, 20152022 (USD Million)

Table 57 Saudi Arabia: Market Size, By Type, 20152022 (USD Million)

Table 58 UAE: Market Size, By Type, 20152022 (USD Million)

Table 59 Nigeria: Market Size, By Type, 20152022 (USD Million)

Table 60 Qatar: Market Size, By Type, 20152022 (USD Million)

Table 61 Rest of the Middle East & Africa: Market Size, By Type, 20152022 (USD Million)

Table 62 Partnerships and Collaborations, 20142017

Table 63 New Product Launches, 20142017

Table 64 Investments and Expansions, 20152017

Table 65 Contracts & Agreements, 20142017

Table 66 Others, 20142017

List of Figures (42 Figures)

Figure 1 Markets Covered: AI in Oil and Gas

Figure 2 AI in Oil & Gas: Research Design

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation Methodology

Figure 7 The Market in North America Led Artificial Intelligence in Oil and Gas Market in 2016

Figure 8 The Software Segment is Expected to Dominate AI in Oil and Gas Industry During the Forecast Period

Figure 9 The Predictive Maintenance & Machine Inspection Segment is Expected to Lead AI in Oil and Gas Industry During the Forecast Period

Figure 10 The Upstream Segment is Expected to Dominate AI in Oil and Gas Industry During the Forecast Period

Figure 11 Big Data Technology in Oil & Gas Sector to Augment E&P Capabilities is A Driving Factor During the Forecast Period

Figure 12 Saudi Arabia is Expected to Grow at the Fastest Rate During the Forecast Period

Figure 13 The Software Segment is Expected to Dominate AI in Oil and Gas Industry During the Forecast Period

Figure 14 The Predictive Maintenance & Machinery Inspection Segment is Expected to Dominate AI in Oil and Gas Industry in 2017

Figure 15 Artificial Intelligence in Oil and Gas Market: Drivers, Restraints, Opportunities, & Challenges

Figure 16 Cost of Producing A Barrel of Oil & Gas, 2016

Figure 17 The Software Segment is Expected to Dominate the AI in Oil and Gas Industry During the Forecast Period

Figure 18 Predictive Maintenance & Machinery Inspection is the Dominant Segment for AI in Oil and Gas Industry During the Forecast Period

Figure 19 Upstream Segment Led AI in Oil and Gas Industry in 2016

Figure 20 Regional Snapshot: Artificial Intelligence in Oil and Gas Market (2017 & 2022)

Figure 21 The North American Market is Expected to Be the Largest for AI in Oil and Gas Industry During the Forecast Period

Figure 22 North America: Market Snapshot

Figure 23 UK: the Largest Artificial Intelligence in Oil and Gas Market in Europe in 2016

Figure 24 Asia Pacific: Market Snapshot

Figure 25 Brazil: the Expected Largest AI in Oil and Gas Industry in South America in 2017

Figure 26 Saudi Arabia: the Largest AI in Oil and Gas Industry in the Middle East & Africa, 2016

Figure 27 Key Developments in the AI in Oil and Gas Industry, 20142017

Figure 28 Market Ranking Based on Revenue, 2016

Figure 29 IBM: Company Snapshot

Figure 30 IBM: SWOT Analysis

Figure 31 Accenture: Company Snapshot

Figure 32 Accenture: SWOT Analysis

Figure 33 Google: Company Snapshot

Figure 34 Google: SWOT Analysis

Figure 35 Microsoft: Company Snapshot

Figure 36 Microsoft: SWOT Analysis

Figure 37 Oracle: Company Snapshot

Figure 38 Oracle: SWOT Analysis

Figure 39 Intel: Company Snapshot

Figure 40 Cisco: Company Snapshot

Figure 41 Infosys: Company Snapshot

Figure 42 Shell: Company Snapshot

Growth opportunities and latent adjacency in AI in Oil & Gas Market