Artificial Intelligence in Genomics Market by Offering (Software & Services), Technology (Machine Learning), Functionality (Gene Sequencing, Gene Editing), Application (Diagnostics, Drug discovery), End User (Pharma, Hospitals) - Global Forecast to 2028

Market Growth Outlook Summary

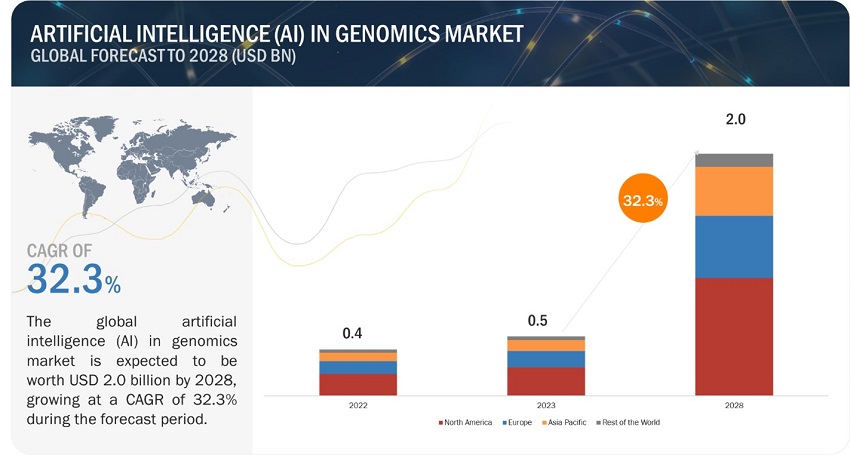

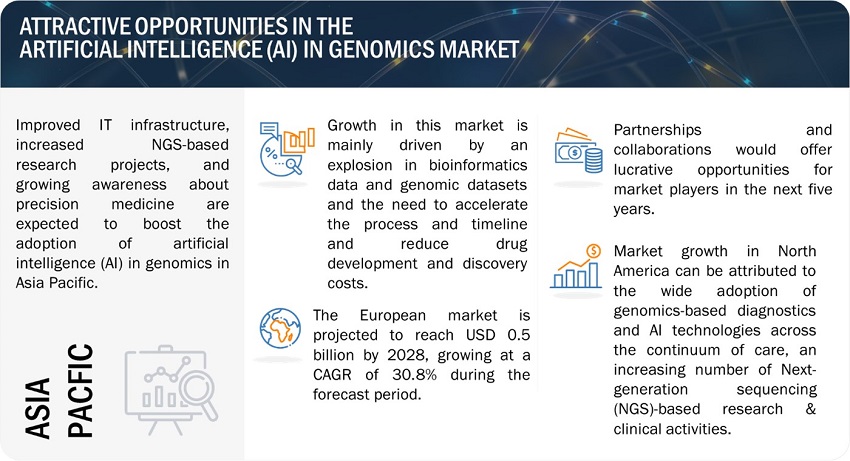

The global artificial intelligence in genomics market, valued at US$0.4 billion in 2022, stood at US$0.5 billion in 2024 and is projected to advance at a resilient CAGR of 32.3% from 2024 to 2028, culminating in a forecasted valuation of US$2.0 billion by the end of the period. The growth of this market is primarily driven by the need to accelerate processes and timelines, reduce drug development and discovery costs, increase partnerships and collaborations among key players, and grow investments in AI in genomics. However, the lack of a skilled AI workforce and ambiguous regulatory guidelines for medical software are expected to restrain market growth during the forecast period.

Artificial Intelligence in Genomics Market – Global Forecast and Growth Insights to 2028

To know about the assumptions considered for the study, download the pdf brochure

Artificial Intelligence in Genomics Market – Global Forecast and Key Opportunities to 2028

Artificial Intelligence in Genomics Market Dynamics to 2028

Driver: Need to accelerate processes and timeline and reduce drug development and discovery costs

Drug discovery is an expensive and lengthy process, which creates a need for alternative tools to discover new drugs. Drug discovery and development are commonly conducted through in vivo and in vitro methods, which are costly and time-consuming. Furthermore, it takes ~10 years on average for a new drug to enter the market and costs ~USD 2.6 billion.

Only one out of 5,000–10,000 compounds is approved as a potential drug for a particular condition. Most drug candidates selected in the discovery phase fail in the late stages of development due to toxicity or other pharmacokinetic characteristics. Machine learning technology can help at this stage by predicting the outcome of a drug compound in the discovery phase and eliminating compounds without potential in the early discovery phase itself. This will significantly cut downtime and expenses in identifying potential drug candidates.

The potential for time and cost reductions in this process has drawn significant stakeholder attention and resulted in numerous investigative projects. For instance, in November 2020, Deep Genomics and BioMarin announced a collaboration to discover and develop oligonucleotide drug candidates for four rare diseases, combining BioMarin’s extensive rare disease expertise with Deep Genomics’ AI Workbench platform. With that, AI in genomics for drug discovery has the potential to significantly accelerate the drug development process, reduce costs, and improve patient outcomes by enabling the development of more targeted and effective drugs.

Restraint: Lack of skilled AI workforce and ambiguous regulatory guidelines for medical software

An AI is a complex system; to develop, manage, and implement AI systems, companies require a workforce with certain skill sets. Personnel working with AI systems, for instance, should be knowledgeable about image recognition, deep learning, cognitive computing, and ML and machine intelligence. In order to emulate human brain behavior, integrating AI technologies into current systems is a difficult operation that necessitates substantial data processing. Even a minor error can result in system failure or adversely affect the desired result. Additionally, the development of AI is being constrained by the lack of professional standards and certifications in AI/ML technologies. Because of a lack of technological understanding and a shortage of AI professionals, service providers encounter difficulties when delivering and maintaining their solutions at the locations of their clients.

Moreover, government or regulatory agencies must keep up regularly with advancements and guide AI system deployment, especially in healthcare. The accuracy, reliability, security, and clinical use of medical AI technologies are ensured by subjecting them to various standards and regulations. However, medical software regulation is still dynamic and dependent on changing guidelines and subjective interpretation by regulatory authorities. In the US, the FDA has regulatory authority over medical devices. To receive FDA approval, AI or machine learning tools that have healthcare applications must pass a series of tests to show that they can produce results at least as accurately as humans.

Similarly, there is no general exclusion for software in the European Union, and software may be regulated as a medical device if it has a medical purpose. Generally, a case-by-case assessment is required, considering the product characteristics, mode of use, and claims. However, the assessment is particularly complex because, unlike the classification of general medical devices, it is not immediately apparent how these parameters apply to software, given that software does not act on the human body to restore, correct, or modify bodily functions. As a result, the software used in healthcare settings is not necessarily a medical device. Such ambiguous regulatory guidelines sometimes create major barriers for market players.

Opportunity: Focus on developing human-aware AI systems

The aim of developing AI technologies was to make them human-aware or capable of human thinking patterns. However, creating interactive and scalable machines remains a challenge for the developers of AI machines. Additionally, increasing human interference with AI techniques has introduced new research challenges—interpretation and presentation challenges such as interaction issues with automating parts and intelligent control of crowdsourcing parts. Interpretation challenges include challenges faced by AI machines in understanding human input, such as knowledge and specific directives. Presentation challenges include issues related to delivering the AI system’s output and feedback. Thus, the development of human-aware AI systems remains the foremost opportunity for AI developers.

Challenge: Lack of curated genomic data

Data is a vital source to train and develop a complete and robust AI system. Earlier, datasets were mostly structured and entered manually. However, the growing digital footprint and technology adoption, such as IoT in healthcare and life science, has resulted in large data volumes that are unstructured (and in the form of text, voice, or images).

To train machine learning tools, developers require high-quality labeled data, along with skilled human trainers. Extracting and labeling unstructured data requires a large, skilled workforce and time. Moreover, patient information is extremely sensitive and subject to stringent privacy norms. For instance, legislations such as the HIPAA (implemented in the US in 1996) and the HITECH Act (implemented in the US in 2003) require entities responsible for sensitive health information to implement certain measures to ensure its privacy and security; these entities are also required to inform patients of instances when the privacy and security of their information have been compromised. This makes curated data hard to access due to privacy concerns, record identification concerns, and security requirements.

Thus, structured data plays a pivotal role in developing an efficient AI system. Companies are now practicing developing insights from semi-structured data (a combination of structured and unstructured data) that enables information from groupings and hierarchies. However, analytics tools and solutions for semi-structured data are still in the nascent stage.

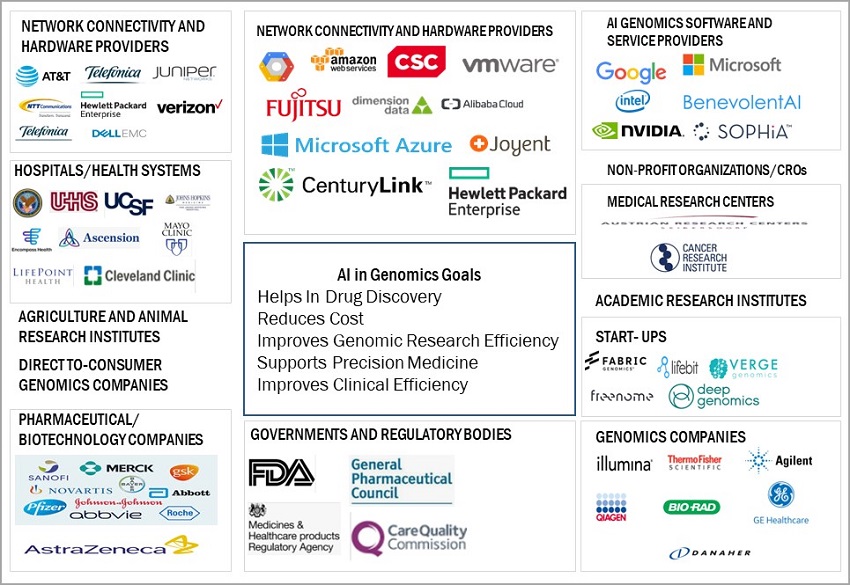

Artificial Intelligence in Genomics Market Map & Ecosystem Overview

Well-known, financially secure producers of AI in genomics systems and platforms are prominent players in this market. These companies have been in operation for a while and have a broad range of products, cutting-edge technologies, and robust international sales and marketing networks.

Machine learning acquires largest size of AI in genomics market, by technology.

Based on technology, the market is segmented into machine learning and other technologies. The machine learning segment dominated this market in 2022, as pharmaceutical companies, CROs, and biotechnology companies have widely adopted machine learning for drug genomics applications. This is because machine learning can extract insights from data sets, accelerating genomic research.

Based on application, diagnostics segment is anticipated to dominate the AI in genomics market.

Based on application, the market is segmented into diagnostics, drug discovery & development, precision medicine, agriculture & animal research, and other applications. Diagnostics was the largest application segment in the market, in 2022. The large share of this segment can be attributed to the increasing research on diseases and the decreasing cost of sequencing.

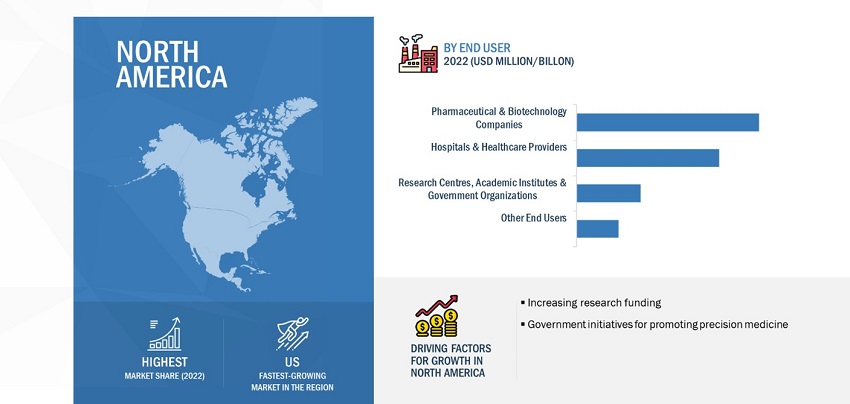

Based on the end user, hospitals & healthcare providers accounted for the second largest share of AI in genomics market.

Based on the end user, the market is broadly segmented into pharmaceutical & biotechnology companies; hospitals & healthcare providers; research centers, academic institutes, & government organizations; and other end users. Hospitals & healthcare providers accounted for the second largest share of the market in 2022. Factors such as rising demand for solutions to cut the time and costs of drug development drive the market growth.

Artificial Intelligence in Genomics Market by Region – Forecast to 2028

North America is expected to account for the largest share in AI in genomics market.

Based on region, the market has been segmented into North America, Europe, Asia Pacific, and the Rest of the World. In 2022, North America accounted for the largest market share followed by Europe. The large share of North America can be attributed to the increasing research funding and government initiatives for promoting precision medicine in the US.

The AI in genomics market is dominated by a few globally established players such as NVIDIA Corporation (US), Microsoft Corporation (US), Google LLC (US), Intel Corporation (US), BenevolentAI (UK), SOPHiA GENETICS (Switzerland), Illumina, Inc. (US), among others.

Artificial Intelligence in Genomics Market Report Scope and Insights

| Report Metric | Details |

|---|---|

| Market Size in 2023 | US$ 0.5 billion |

| Forecasted Size by 2028 | US$ 2.0 billion |

| Market Growth Rate | Poised to Grow at a CAGR of 32.3% |

| Market Driver | Need to accelerate processes and timeline and reduce drug development and discovery costs |

| Market Opportunity | Focus on developing human-aware AI systems |

Artificial Intelligence in Genomics Market Segmentation and Analysis

By Offering

- Software

- Services

By Technology

-

Machine Learning

- Deep Learning

- Supervised Learning

- Reinforcement Learning

- Unsupervised Learning

- Other Machine Learning Technologies

- Other Technologies

By Functionality

- Genome Sequencing

- Gene Editing

- Clinical Workflows

- Predictive Genetic Testing & Preventive Medicine

By Application

- Diagnostics

- Drug Discovery & Development

- Precision Medicine

- Agriculture & animal Research

- Other Applications

By End User

- Pharmaceutical & Biotech Companies

- Healthcare Providers

- Research Centers, Academic Institutes, & Government Organizations

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Rest of Europe

- Asia Pacific

- Rest of the World

Artificial Intelligence in Genomics Market Recent Developments and Insights

- In December 2022, Intel Labs and the Perelman School of Medicine at the University of Pennsylvania (Penn Medicine) completed of a joint research study using distributed machine learning (ML) and artificial intelligence (AI) approaches to help international healthcare and research institutions identify malignant brain tumors.

- In September 20222, NVIDIA Corporation partnered with the Broad Institute of MIT and Harvard to accelerate Genome analysis workflows and help teams to co-develop large language models for the discovery and development of targeted therapies. The collaboration connects NVIDIA’s AI expertise and healthcare computing platforms with the Broad Institute’s researchers, scientists, and open platforms with a focus on Making NVIDIA Clara Parabricks available in the Terra platform, building large language models, and providing improved deep learning to Genome Analysis Toolkit (GATK).

- In August 2021, Illumina, Inc. acquired GRAIL to provide patients with access to a potentially life-saving multi-cancer early-detection test.

- In March 2021, SOPHiA GENETICS collaborated with Hitachi. This collaboration agreement offered clinical, genomic, and real-world insights to healthcare practitioners and pharmaceutical and biotechnology firms and to further democratize Data-Driven Precision Medicine internationally for the benefit of patients.

Frequently Asked Questions (FAQ):

What is the projected growth and market value of the global artificial intelligence (AI) in genomics market?

The global artificial intelligence (AI) in genomics market is projected to grow from US$ 0.5 billion in 2023 to US$ 2.0 billion by 2028, demonstrating a robust CAGR of 32.3%.

What are the key factors driving the growth of the AI in genomics market?

Key factors driving the AI in genomics market include the increasing need to accelerate genomics processes, reduce drug development costs, advancements in computing power, and the growing integration of AI into healthcare systems, which enables more personalized medicine.

How is AI in genomics improving drug development and disease treatment?

AI in genomics accelerates drug development by processing vast amounts of genomic data, helping identify disease-causing variants, and facilitating the design of targeted therapies. This enables faster clinical analysis and more efficient drug discovery processes.

What challenges are faced by the AI in genomics market?

The market faces challenges such as the shortage of skilled AI professionals, ambiguous regulatory guidelines for medical software, and the difficulty in acquiring curated genomic data. These challenges may hinder the widespread adoption and growth of AI technologies in genomics.

How is AI in genomics impacting precision medicine?

AI in genomics plays a crucial role in precision medicine by enabling the identification of chromosomal disorders, genetic mutations, and other relevant patterns in genomic data, which helps in tailoring treatments and therapies to individual patients' needs.

Which technologies are driving growth in the AI in genomics market?

Machine learning (ML) and other AI technologies such as deep learning and natural language processing are driving growth in the AI in genomics market. These technologies are enabling the analysis of large genomic datasets and speeding up the drug discovery process.

How are leading companies advancing the AI in genomics market?

Companies like NVIDIA, Microsoft, and BenevolentAI are driving the AI in genomics market by launching new products, forming partnerships, and investing heavily in research and development. Their efforts are focused on accelerating genomics workflows, improving the accuracy of diagnostics, and expanding AI applications in precision medicine.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Need to accelerate processes and timeline and reduce drug development & discovery costs- Increased partnerships and collaborations among players and growing investments in AI in genomics- Rising adoption of AI in precision medicine- Explosion in bioinformatics data and genomic datasets- Improving computing power and declining hardware costRESTRAINTS- Lack of skilled AI workforce and ambiguous regulatory guidelines for medical softwareOPPORTUNITIES- Focus on developing human-aware AI systemsCHALLENGES- Lack of curated genomic data- Data privacy concerns

-

5.3 ECOSYSTEM ANALYSIS

- 6.1 INTRODUCTION

-

6.2 SOFTWAREINTELLIGENT SOFTWARE TO REDUCE ERRORS CAUSED BY STANDARD STATISTICAL APPROACHES

-

6.3 SERVICESRISING AI TECHNOLOGY ADOPTION IN VARIOUS END-USE INDUSTRIES TO BOOST MARKET

- 7.1 INTRODUCTION

-

7.2 MACHINE LEARNINGDEEP LEARNING- Growing demand for accelerated genome sequencing analysis workflows and improved function of gene editing tools to propel marketSUPERVISED LEARNING- To help create predictive models for population health managementREINFORCEMENT LEARNING- Need to reduce costs associated with collecting labeled training data to drive segmentUNSUPERVISED LEARNING- Ability to perform more complex processing tasks than supervised learning systems to drive marketOTHER MACHINE LEARNING TECHNOLOGIES

- 7.3 OTHER TECHNOLOGIES

- 8.1 INTRODUCTION

-

8.2 GENOME SEQUENCINGINCREASING ADOPTION OF MACHINE AND DEEP LEARNING IN DIAGNOSTICS AND DRUG DISCOVERY PROCESSES TO ENHANCE MARKET GROWTH

-

8.3 GENE EDITINGTO HELP IMPROVE GENE EDITING FUNCTIONS AND REDUCE TIME AND COSTS

-

8.4 CLINICAL WORKFLOWTO HELP INCREASE EFFICIENCY OF CLINICAL WORKFLOWS

-

8.5 PREDICTIVE GENETIC TESTING & PREVENTIVE MEDICINEAI IN GENOMICS TO PREDICT OUTCOMES AND RISKS ASSOCIATED WITH CURING GENETIC DISEASES BASED ON AVAILABLE DATA

- 9.1 INTRODUCTION

-

9.2 DIAGNOSTICSAI IN GENOMICS FOR DIAGNOSTICS TO HELP IDENTIFY CHROMOSOMAL DISORDERS, DYSMORPHIC SYNDROMES, TERATOGENIC DISORDERS, AND SINGLE-GENE DISORDERS

-

9.3 DRUG DISCOVERY & DEVELOPMENTGROWING APPLICATION OF AI IN GENOMICS IN DRUG DISCOVERY & DEVELOPMENT TO PROPEL MARKET

-

9.4 PRECISION MEDICINEFOCUSE ON IDENTIFYING EFFECTIVE MEDICAL TREATMENTS FOR PATIENTS TO DRIVE MARKET

-

9.5 AGRICULTURE & ANIMAL RESEARCHAI IN GENOMICS TO HELP IMPROVE CROP AND LIVESTOCK PRODUCTIVITY

- 9.6 OTHER APPLICATIONS

- 10.1 INTRODUCTION

-

10.2 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIESRISING DEMAND FOR SOLUTIONS TO REDUCE TIME AND COSTS OF DRUG DEVELOPMENT

-

10.3 RESEARCH CENTERS, ACADEMIC INSTITUTES, AND GOVERNMENT ORGANIZATIONSINCREASED RESEARCH ACTIVITIES TO ENCOURAGE USE OF AI IN GENOMICS IN ACADEMIC AND GOVERNMENT INSTITUTES

-

10.4 HOSPITALS & HEALTHCARE PROVIDERSGROWING DEMAND FOR PHARMACOGENOMICS TO PROPEL ACCEPTANCE OF NGS IN HOSPITALS

- 10.5 OTHER END USERS

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACTUS- Initiatives to accelerate genomic research and growing adoption of AI to bolster marketCANADA- Increasing research in genomics to drive market

-

11.3 EUROPEEUROPE: RECESSION IMPACTUK- Adoption of AI in genomics for drug discovery to fuel marketGERMANY- Availability of funding for AI initiatives to boost marketFRANCE- Increasing government investments in NGS to boost marketREST OF EUROPE

-

11.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACT

-

11.5 REST OF THE WORLDREST OF THE WORLD: RECESSION IMPACT

- 12.1 OVERVIEW

- 12.2 KEY MARKET PLAYERS’ STRATEGIES/RIGHT TO WIN

- 12.3 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS, 2022

- 12.4 MARKET RANKING ANALYSIS, 2022

- 12.5 COMPETITIVE BENCHMARKING

-

12.6 COMPANY EVALUATION QUADRANT FOR KEY PLAYERSSTARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTS

-

12.7 COMPANY EVALUATION QUADRANT FOR START-UPS/SMESPROGRESSIVE COMPANIESDYNAMIC COMPANIESRESPONSIVE COMPANIESSTARTING BLOCKS

-

12.8 COMPETITIVE SCENARIOS AND TRENDSPRODUCT LAUNCHES/ENHANCEMENTSDEALSOTHER DEVELOPMENTS

-

13.1 KEY PLAYERSNVIDIA CORPORATION- Business overview- Products/Services offered- Recent developments- MnM viewMICROSOFT CORPORATION- Business overview- Products/Services offered- Recent developments- MnM viewGOOGLE, INC.- Business overview- Products/Services offered- Recent developments- MnM viewINTEL CORPORATION- Business overview- Products/Services offered- Recent developments- MnM viewBENEVOLENTAI- Business overview- Products/Services offered- Recent developments- MnM viewSOPHIA GENETICS- Business overview- Products/Services offered- Recent developmentsILLUMINA, INC.- Business overview- Products/Services offered- Recent developmentsPREDICTIVE ONCOLOGY, INC.- Business overview- Products/Services offered- Recent developmentsINVITAE CORPORATION- Business overview- Products/Services offered- Recent developmentsDEEP GENOMICS, INC.- Business overview- Products/Services offered- Recent developmentsFABRIC GENOMICS, INC.- Business overview- Products/Services offered- Recent developmentsVERGE GENOMICS- Business overview- Products/Services offered- Recent developmentsFREENOME HOLDINGS, INC.- Business overview- Products/Services offered- Recent developmentsMOLECULARMATCH, INC.- Business overview- Products/Services offeredDANTE LABS- Business overview- Products/Services offered- Recent developmentsDATA4CURE- Business overview- Products/Services offeredPRECISIONLIFE LTD- Business overview- Products/Services offered- Recent developmentsGENOOX- Business overview- Products/Services offered- Recent developmentsLIFEBIT- Business overview- Products/Services offered- Recent developments

-

13.2 OTHER EMERGING PLAYERSFDNA, INC.DNANEXUSENGINE BIOSCIENCESTEMPUS LABS, INC.CONGENICA LTDEMEDGENE, INC.SERAGON PHARMACEUTICALS, INC.

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 CURRENCY CONVERSION RATES

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 LIMITATIONS AND ASSOCIATED RISKS

- TABLE 4 ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY OFFERING, 2021–2028 (USD MILLION)

- TABLE 5 SOFTWARE: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 6 SOFTWARE: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 7 SOFTWARE: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET IN EUROPE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 8 SERVICES: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 9 SERVICES: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 10 SERVICES: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET IN EUROPE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 11 ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 12 MACHINE LEARNING: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 13 MACHINE LEARNING: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 14 MACHINE LEARNING: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 15 MACHINE LEARNING: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET IN EUROPE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 16 DEEP LEARNING: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 17 DEEP LEARNING: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 18 DEEP LEARNING: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET IN EUROPE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 19 SUPERVISED LEARNING: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 20 SUPERVISED LEARNING: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 21 SUPERVISED LEARNING: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET IN EUROPE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 22 REINFORCEMENT LEARNING: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 23 REINFORCEMENT LEARNING: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 24 REINFORCEMENT LEARNING: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET IN EUROPE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 25 UNSUPERVISED LEARNING: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 26 UNSUPERVISED LEARNING: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 27 UNSUPERVISED LEARNING: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET IN EUROPE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 28 OTHER MACHINE LEARNING TECHNOLOGIES: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 29 OTHER MACHINE LEARNING TECHNOLOGIES: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 30 OTHER MACHINE LEARNING TECHNOLOGIES: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET IN EUROPE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 31 OTHER TECHNOLOGIES: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 32 OTHER TECHNOLOGIES: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 33 OTHER TECHNOLOGIES: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET IN EUROPE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 34 ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY FUNCTIONALITY, 2021–2028 (USD MILLION)

- TABLE 35 GENOME SEQUENCING: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 36 GENOME SEQUENCING: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 37 GENOME SEQUENCING: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET IN EUROPE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 38 GENE EDITING: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 39 GENE EDITING: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 40 GENE EDITING: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET IN EUROPE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 41 CLINICAL WORKFLOW: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 42 CLINICAL WORKFLOW: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 43 CLINICAL WORKFLOW: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET IN EUROPE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 44 PREDICTIVE GENETIC TESTING & PREVENTIVE MEDICINE: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 45 PREDICTIVE GENETIC TESTING & PREVENTIVE MEDICINE: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 46 PREDICTIVE GENETIC TESTING & PREVENTIVE MEDICINE: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET IN EUROPE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 47 ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 48 INDICATIVE LIST OF DEVELOPMENTS FOR DIAGNOSTICS APPLICATION

- TABLE 49 DIAGNOSTICS: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 50 DIAGNOSTICS: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 51 DIAGNOSTICS: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET IN EUROPE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 52 INDICATIVE LIST OF DEVELOPMENTS FOR DRUG DELIVERY & DISCOVERY APPLICATION

- TABLE 53 DRUG DISCOVERY & DEVELOPMENT: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 54 DRUG DISCOVERY & DEVELOPMENT: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 55 DRUG DISCOVERY & DEVELOPMENT: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET IN EUROPE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 56 INDICATIVE LIST OF DEVELOPMENTS FOR PRECISION MEDICINE APPLICATION

- TABLE 57 PRECISION MEDICINE: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 58 PRECISION MEDICINE: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 59 PRECISION MEDICINE: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET IN EUROPE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 60 AGRICULTURE & ANIMAL RESEARCH: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 61 AGRICULTURE & ANIMAL RESEARCH: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 62 AGRICULTURE & ANIMAL RESEARCH: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET IN EUROPE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 63 OTHER APPLICATIONS: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 64 OTHER APPLICATIONS: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 65 OTHER APPLICATIONS: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET IN EUROPE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 66 ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 67 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES: INDICATIVE DEVELOPMENTS

- TABLE 68 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 69 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 70 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET IN EUROPE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 71 RESEARCH CENTERS, ACADEMIC INSTITUTES, AND GOVERNMENT ORGANIZATIONS: INDICATIVE DEVELOPMENTS

- TABLE 72 RESEARCH CENTERS, ACADEMIC INSTITUTES, AND GOVERNMENT ORGANIZATIONS: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 73 RESEARCH CENTERS, ACADEMIC INSTITUTES, AND GOVERNMENT ORGANIZATIONS: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 74 RESEARCH CENTERS, ACADEMIC INSTITUTES, AND GOVERNMENT ORGANIZATIONS: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET IN EUROPE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 75 HOSPITALS & HEALTHCARE PROVIDERS: INDICATIVE DEVELOPMENTS

- TABLE 76 HOSPITALS & HEALTHCARE PROVIDERS: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 77 HOSPITALS & HEALTHCARE PROVIDERS: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 78 HOSPITALS & HEALTHCARE PROVIDERS: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET IN EUROPE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 79 OTHER END USERS: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 80 OTHER END USERS: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 81 OTHER END USERS: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET IN EUROPE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 82 ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 83 NORTH AMERICA: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 84 NORTH AMERICA: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY OFFERING, 2021–2028 (USD MILLION)

- TABLE 85 NORTH AMERICA: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 86 NORTH AMERICA: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET FOR MACHINE LEARNING, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 87 NORTH AMERICA: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY FUNCTIONALITY, 2021–2028 (USD MILLION)

- TABLE 88 NORTH AMERICA: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 89 NORTH AMERICA: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 90 US: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY OFFERING, 2021–2028 (USD MILLION)

- TABLE 91 US: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 92 US: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET FOR MACHINE LEARNING, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 93 US: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY FUNCTIONALITY, 2021–2028 (USD MILLION)

- TABLE 94 US: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 95 US: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 96 CANADA: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY OFFERING, 2021–2028 (USD MILLION)

- TABLE 97 CANADA: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 98 CANADA: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET FOR MACHINE LEARNING, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 99 CANADA: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY FUNCTIONALITY, 2021–2028 (USD MILLION)

- TABLE 100 CANADA: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 101 CANADA: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 102 EUROPE: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 103 EUROPE: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY OFFERING, 2021–2028 (USD MILLION)

- TABLE 104 EUROPE: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 105 EUROPE: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET FOR MACHINE LEARNING, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 106 EUROPE: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY FUNCTIONALITY, 2021–2028 (USD MILLION)

- TABLE 107 EUROPE: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 108 EUROPE: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 109 UK: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY OFFERING, 2021–2028 (USD MILLION)

- TABLE 110 UK: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 111 UK: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET FOR MACHINE LEARNING, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 112 UK: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY FUNCTIONALITY, 2021–2028 (USD MILLION)

- TABLE 113 UK: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 114 UK: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 115 GERMANY: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY OFFERING, 2021–2028 (USD MILLION)

- TABLE 116 GERMANY: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 117 GERMANY: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET FOR MACHINE LEARNING, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 118 GERMANY: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY FUNCTIONALITY, 2021–2028 (USD MILLION)

- TABLE 119 GERMANY: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 120 GERMANY: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 121 FRANCE: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY OFFERING, 2021–2028 (USD MILLION)

- TABLE 122 FRANCE: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 123 FRANCE: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET FOR MACHINE LEARNING, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 124 FRANCE: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY FUNCTIONALITY, 2021–2028 (USD MILLION)

- TABLE 125 FRANCE: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 126 FRANCE: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 127 REST OF EUROPE: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY OFFERING, 2021–2028 (USD MILLION)

- TABLE 128 REST OF EUROPE: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 129 REST OF EUROPE: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET FOR MACHINE LEARNING, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 130 REST OF EUROPE: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY FUNCTIONALITY, 2021–2028 (USD MILLION)

- TABLE 131 REST OF EUROPE: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 132 REST OF EUROPE: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 133 ASIA PACIFIC: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY OFFERING, 2021–2028 (USD MILLION)

- TABLE 134 ASIA PACIFIC: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 135 ASIA PACIFIC: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET FOR MACHINE LEARNING, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 136 ASIA PACIFIC: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY FUNCTIONALITY, 2021–2028 (USD MILLION)

- TABLE 137 ASIA PACIFIC: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 138 ASIA PACIFIC: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 139 REST OF THE WORLD: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY OFFERING, 2021–2028 (USD MILLION)

- TABLE 140 REST OF THE WORLD: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 141 REST OF THE WORLD: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET FOR MACHINE LEARNING, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 142 REST OF THE WORLD: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY FUNCTIONALITY, 2021–2028 (USD MILLION)

- TABLE 143 REST OF THE WORLD: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 144 REST OF THE WORLD: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 145 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET

- TABLE 146 COMPANY FOOTPRINT ANALYSIS

- TABLE 147 PRODUCT FOOTPRINT ANALYSIS (26 COMPANIES)

- TABLE 148 FUNCTIONALITY FOOTPRINT ANALYSIS (26 COMPANIES)

- TABLE 149 REGIONAL FOOTPRINT ANALYSIS (26 COMPANIES)

- TABLE 150 ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET: PRODUCT LAUNCHES/ENHANCEMENTS, 2020–2023

- TABLE 151 ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET: DEALS, 2020–2023

- TABLE 152 ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET: OTHER DEVELOPMENTS, 2020–2023

- TABLE 153 NVIDIA CORPORATION: COMPANY OVERVIEW

- TABLE 154 NVIDIA CORPORATION: PRODUCTS/SERVICES OFFERED

- TABLE 155 NVIDIA CORPORATION: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 156 NVIDIA CORPORATION: DEALS

- TABLE 157 MICROSOFT CORPORATION: COMPANY OVERVIEW

- TABLE 158 MICROSOFT CORPORATION: PRODUCTS/SERVICES OFFERED

- TABLE 159 MICROSOFT CORPORATION: DEALS

- TABLE 160 GOOGLE, INC.: COMPANY OVERVIEW

- TABLE 161 GOOGLE, INC.: PRODUCTS/SERVICES OFFERED

- TABLE 162 GOOGLE, INC.: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 163 GOOGLE, INC.: DEALS

- TABLE 164 INTEL CORPORATION: COMPANY OVERVIEW

- TABLE 165 INTEL CORPORATION: PRODUCTS/SERVICES OFFERED

- TABLE 166 INTEL CORPORATION: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 167 INTEL CORPORATION: DEALS

- TABLE 168 BENEVOLENTAI: COMPANY OVERVIEW

- TABLE 169 BENEVOLENTAI: PRODUCTS/SERVICES OFFERED

- TABLE 170 BENEVOLENTAI: DEALS

- TABLE 171 SOPHIA GENETICS: COMPANY OVERVIEW

- TABLE 172 SOPHIA GENETICS: PRODUCTS/SERVICES OFFERED

- TABLE 173 SOPHIA GENOMICS: DEALS

- TABLE 174 SOPHIA GENETICS: OTHERS

- TABLE 175 ILLUMINA, INC.: COMPANY OVERVIEW

- TABLE 176 ILLUMINA, INC.: PRODUCTS/SERVICES OFFERED

- TABLE 177 ILLUMINA, INC.: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 178 ILLUMINA, INC.: DEALS

- TABLE 179 PREDICTIVE ONCOLOGY, INC.: COMPANY OVERVIEW

- TABLE 180 PREDICTIVE ONCOLOGY, INC.: PRODUCTS/SERVICES OFFERED

- TABLE 181 PREDICTIVE ONCOLOGY, INC.: DEALS

- TABLE 182 INVITAE CORPORATION: COMPANY OVERVIEW

- TABLE 183 INVITAE CORPORATION: PRODUCTS/SERVICES OFFERED

- TABLE 184 DEEP GENOMICS, INC.: COMPANY OVERVIEW

- TABLE 185 DEEP GENOMICS, INC.: PRODUCTS/SERVICES OFFERED

- TABLE 186 DEEP GENOMICS, INC.: DEALS

- TABLE 187 DEEP GENOMICS, INC.: OTHERS

- TABLE 188 FABRIC GENOMICS, INC.: COMPANY OVERVIEW

- TABLE 189 FABRIC GENOMICS, INC.: PRODUCTS/SERVICES OFFERED

- TABLE 190 FABRIC GENOMICS, INC.: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 191 FABRIC GENOMICS, INC.: DEALS

- TABLE 192 VERGE GENOMICS: COMPANY OVERVIEW

- TABLE 193 VERGE GENOMICS: PRODUCTS/SERVICES OFFERED

- TABLE 194 VERGE GENOMICS: DEALS

- TABLE 195 FREENOME HOLDINGS, INC.: COMPANY OVERVIEW

- TABLE 196 FREENOME HOLDINGS, INC.: PRODUCTS/SERVICES OFFERED

- TABLE 197 FREENOME HOLDINGS, INC.: DEALS

- TABLE 198 MOLECULARMATCH, INC.: COMPANY OVERVIEW

- TABLE 199 MOLECULARMATCH, INC.: PRODUCTS/SERVICES OFFERED

- TABLE 200 DANTE LABS: COMPANY OVERVIEW

- TABLE 201 DANTE LABS: PRODUCTS/SERVICES OFFERED

- TABLE 202 DANTE LABS: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 203 DANTE LABS: DEALS

- TABLE 204 DATA4CURE: COMPANY OVERVIEW

- TABLE 205 DATA4CURE: PRODUCTS/SERVICES OFFERED

- TABLE 206 PRECISIONLIFE LTD: COMPANY OVERVIEW

- TABLE 207 PRECISIONLIFE LTD: PRODUCTS/SERVICES OFFERED

- TABLE 208 PRECISIONLIFE LTD: DEALS

- TABLE 209 GENOOX: COMPANY OVERVIEW

- TABLE 210 GENOOX: PRODUCTS/SERVICES OFFERED

- TABLE 211 GENOOX: DEALS

- TABLE 212 LIFEBIT: COMPANY OVERVIEW

- TABLE 213 LIFEBIT: PRODUCTS/SERVICES OFFERED

- TABLE 214 LIFEBIT: DEALS

- TABLE 215 LIFEBIT: OTHERS

- FIGURE 1 ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 RESEARCH APPROACH

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

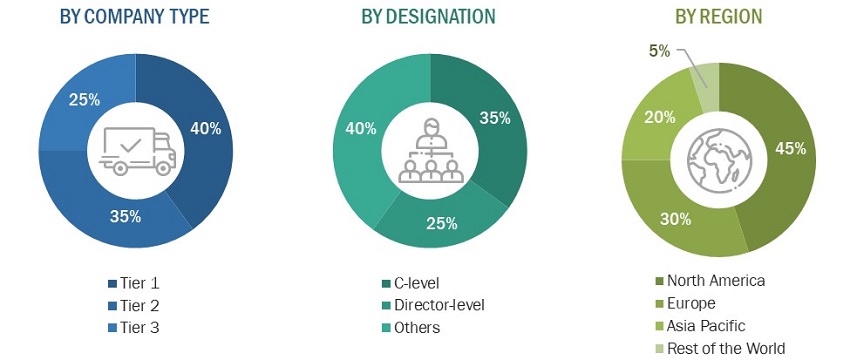

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 6 KEY METRICS FOR ASSESSING SUPPLY OF ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET

- FIGURE 7 REVENUES GENERATED BY COMPANIES FROM SALE OF ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS SOLUTIONS

- FIGURE 8 REVENUE SHARE ANALYSIS ILLUSTRATION

- FIGURE 9 BOTTOM-UP APPROACH

- FIGURE 10 ESTIMATION OF ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET SIZE BASED ON ADOPTION

- FIGURE 11 TOP-DOWN APPROACH

- FIGURE 12 DATA TRIANGULATION METHODOLOGY

- FIGURE 13 ASSUMPTIONS FOR RESEARCH STUDY

- FIGURE 14 SOFTWARE SEGMENT TO LEAD ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY OFFERING

- FIGURE 15 MACHINE LEARNING CONTINUES TO ACQUIRE LARGEST SIZE OF ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY TECHNOLOGY

- FIGURE 16 DEEP LEARNING TO BE FASTEST-GROWING SEGMENT OF ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET FOR MACHINE LEARNING

- FIGURE 17 GENOME SEQUENCING TO REGISTER HIGHEST CAGR IN ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY FUNCTIONALITY

- FIGURE 18 DIAGNOSTICS TO DOMINATE ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY APPLICATION

- FIGURE 19 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES TO SECURE LEADING POSITION IN ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY END USER

- FIGURE 20 ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET, BY REGION

- FIGURE 21 INCREASING ADOPTION OF ARTIFICIAL INTELLIGENCE (AI) SOLUTIONS FOR DRUG DISCOVERY & DEVELOPMENT AND PRECISION MEDICINE TO DRIVE MARKET

- FIGURE 22 NORTH AMERICA TO DOMINATE ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET DURING FORECAST PERIOD

- FIGURE 23 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES AND US DOMINATED MARKET IN NORTH AMERICA IN 2022

- FIGURE 24 SOFTWARE SEGMENT TO HOLD MAJORITY MARKET SHARE IN 2028

- FIGURE 25 MACHINE LEARNING TO SURPASS OTHER TECHNOLOGIES IN 2028

- FIGURE 26 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES TO ACCOUNT FOR LARGEST MARKET SHARE IN 2028

- FIGURE 27 GENOME SEQUENCING TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 28 DIAGNOSTICS TO DOMINATE MARKET IN 2028

- FIGURE 29 COST OF GENOME ANALYSIS VS. LEVELS OF RAW DATA GENERATED, 2003–2023

- FIGURE 30 HEALTHCARE BREACHES REPORTED TO US DEPARTMENT OF HEALTH AND HUMAN SERVICES, 2019–2021

- FIGURE 31 ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 32 SOFTWARE SEGMENT ACCOUNTED FOR LARGER MARKET SHARE IN 2022

- FIGURE 33 MACHINE LEARNING SEGMENT ACCOUNTED FOR LARGER MARKET SHARE IN 2022

- FIGURE 34 DEEP LEARNING SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 35 GENOME SEQUENCING SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 36 DIAGNOSTICS SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 37 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 38 ASIA PACIFIC TO EMERGE AS NEW HOTSPOT DURING FORECAST PERIOD

- FIGURE 39 NORTH AMERICA ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 40 NORTH AMERICA: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET SNAPSHOT

- FIGURE 41 ASIA PACIFIC: ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET SNAPSHOT

- FIGURE 42 KEY DEVELOPMENTS BY MAJOR MARKET PLAYERS BETWEEN JANUARY 2020 AND MARCH 2023

- FIGURE 43 REVENUE SHARE ANALYSIS OF KEY MARKET PLAYERS, 2022

- FIGURE 44 ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET SHARE ANALYSIS, 2022

- FIGURE 45 ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET: COMPANY EVALUATION QUADRANT FOR KEY PLAYERS, 2022

- FIGURE 46 ARTIFICIAL INTELLIGENCE (AI) IN GENOMICS MARKET: COMPANY EVALUATION QUADRANT FOR START-UPS/SMES, 2022

- FIGURE 47 NVIDIA CORPORATION: COMPANY SNAPSHOT

- FIGURE 48 MICROSOFT CORPORATION: COMPANY SNAPSHOT

- FIGURE 49 GOOGLE, INC.: COMPANY SNAPSHOT, 2022

- FIGURE 50 INTEL CORPORATION: COMPANY SNAPSHOT

- FIGURE 51 BENEVOLENTAI: COMPANY SNAPSHOT

- FIGURE 52 SOPHIA GENETICS: COMPANY SNAPSHOT

- FIGURE 53 ILLUMINA, INC.: COMPANY SNAPSHOT

- FIGURE 54 PREDICTIVE ONCOLOGY, INC.: COMPANY SNAPSHOT

- FIGURE 55 INVITAE CORPORATION: COMPANY SNAPSHOT, 2022

The study involved major activities in estimating the current size of the global artificial intelligence (AI) in genomics market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study involved the use of widespread secondary sources; directories; databases, such as D&B, Bloomberg Business, and Factiva; white papers; government sources; corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and professional associations; and company house documents. Secondary research was used to identify and collect information for this extensive, technical, market-oriented, and commercial study of the artificial intelligence (AI) in genomics market. It was also used to obtain important information about the top players, market classification and segmentation according to industry trends to the bottom-most level, geographic markets, technology perspectives, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the artificial intelligence (AI) in genomics market. The primary sources from the demand side include key executives from pharmaceutical & biotechnology companies, research centers, academic institutes, & government organizations, hospitals, healthcare providers, contract research organizations, non-profit organizations (NPOs), agri-genomics organizations, and direct-to-consumer genetic companies. After the complete market engineering process (which includes calculations for the market statistics, market breakdown, market size estimation, market forecasts, and data triangulation), extensive primary research has been conducted to gather information and verify and validate the critical numbers obtained.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to offering, technology, application, functionality, end user, and region.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down (segmental analysis of major segments) and bottom-up approaches (assessment of utilization/adoption/penetration trends, by product & service, end user, and region) were used to estimate and validate the total size of the artificial intelligence (AI) in genomics market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions have been determined through both primary and secondary research.

- The industry’s value chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Market Size: Top-Down Approach --Image--

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, the data triangulation and market breakdown processes have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand- and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Market Definition

AI refers to the theory and development of computer systems capable of performing tasks that usually require human intelligence. AI is being used to combine data generated from genomic analyses with relationships identified from literature to find potential clinically relevant genes. It also helps identify patterns within high-volume genetic data sets. These patterns are then translated to computer models that may help predict an individual’s probability of developing certain diseases or inform potential therapy design. DNA sequencing and other biological techniques have increased the number and complexity of such data sets. AI/ML-based computational tools have gained traction due to their capability to handle, extract, and interpret valuable information hidden within large datasets.

Key Stakeholders

- Artificial intelligence (AI) in genomics solution providers

- Platform providers

- Technology providers

- AI system providers

- Medical research and biotechnology companies

- Pharmaceutical companies and CROs

- Hospitals and clinics

- Universities and research organizations

- Forums, alliances, and associations

- Academic research institutes

- Healthcare institutions

- Laboratories

- Distributors

- Venture capitalists

- Government organizations

- Institutional investors and investment banks

- Investors/Shareholders

- Consulting companies in the genomics sector

- Raw material & component manufacturers

- Non-profit organizations (NPOs)

- Agri-genomics organizations

- Direct-to-consumer genetic companies

Report Objectives

- To define, describe, and forecast the artificial intelligence (AI) in genomics market in terms of value by offering, technology, functionality, application, end user, and region.

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges).

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall artificial intelligence (AI) in genomics market.

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players.

- To forecast the size of the artificial intelligence (AI) in genomics market in four main regions (along with their respective key countries), namely, North America, Europe, Asia Pacific, and the Rest of the World.

- To profile the key players in the artificial intelligence (AI) in genomics market and comprehensively analyze their core competencies.

- To track competitive developments, such as acquisitions, product launches, expansions, collaborations, agreements, partnerships, investments, joint ventures, and R&D activities, of the leading players in the artificial intelligence (AI) in genomics market.

- To benchmark players within the artificial intelligence (AI) in genomics market using the competitive leadership mapping framework, which analyzes market players on various parameters within the broad categories of business strategy, market share, and product offering.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographical Analysis

- Further breakdown of the rest of the world the AI in genomics market in Latin America, and the Middle East & Africa.

- Further breakdown of Latin American the AI in genomics market into Brazil, Mexico, and the rest of Latin America.

- Further breakdown of the Middle East & Africa the AI in genomics market into the UAE, Saudi Arabia, South Africa, and the rest of MEA countries.

Company information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Artificial Intelligence in Genomics Market