Artificial Cornea and Corneal Implant Market by Type (Human Cornea, Artificial Cornea), Transplant Type (Penetrating Keratoplasty, Endothelial Keratoplasty), Disease Indication, End Users (Hospitals, Specialty Clinics & ASCs) - Global Forecast to 2026

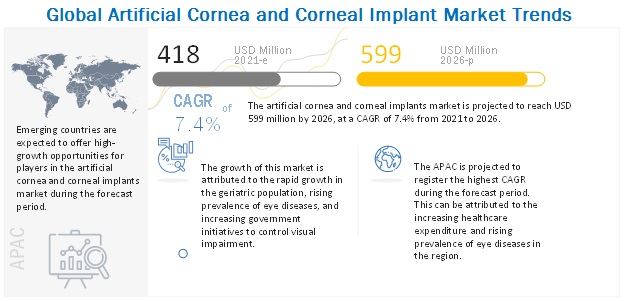

The global artificial cornea and corneal implant market in terms of revenue was estimated to be worth $418 million in 2021 and is poised to reach $599 million by 2026, growing at a CAGR of 7.4% from 2021 to 2026. Market growth is largely driven by the The growing geriatric population and the rising prevalence of eye diseases are the major drivers for the artificial cornea and corneal implants market. The increasing prevalence of eye disorders and government initiatives to control visual impairment are further boosting the market growth.

However, the high cost of ophthalmology devices and surgical procedures is expected to restrain the growth of this market during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

Artificial Cornea Market

Drivers: Rising prevalence of eye diseases

The number of people with major eye diseases is increasing across the globe, and vision loss is becoming a major public health concern. The growth in the aging population and increasing prevalence of chronic disorders such as diabetes and hypertension have increased the prevalence of eye diseases such as diabetic retinopathy and ocular hypertension (glaucoma). The number of blind individuals or those affected with low vision is also expected to increase substantially. According to the Royal National Institute of Blind People (RNIB), in 2013, around 2 million people in the UK were living with vision loss, and this figure is expected to increase to 4.1 million by 2050. Currently, there are 146 million people across the globe with trachoma, of which 10 million suffer from trichiasis and need surgery to prevent corneal blindness and 4.9 million individuals are completely blind from trachomatous corneal scarring (Source: WHO). Furthermore, as per the “World Report on Vision 2019” by WHO, nearly 2.2 people across the globe have vision impairment or blindness. This figure comprises several eye conditions that include moderate to severe distance vision impairment or blindness due to unaddressed refractive errors (123.7 million) and presbyopia (1.8 billion, including both addressed and unaddressed presbyopia), age-related macular degeneration (10.4 million), cataract (65.2 million), corneal opacities (4.2 million), glaucoma (6.9 million), trachoma (2 million), diabetic retinopathy (3 million), and other causes (37.1 million), and people with mild vision impairment with unknown causes (188.5 million).

According to a study by the NCBI, in India, the number of individuals with unilateral corneal blindness will rise to 10.6 million by the end of 2020. As per the same study, it was observed that 30.5% of the blindness was due to corneal diseases. Corneal blindness has substantially increased in the geriatric population, from 3% in 1997 to 14.7% in 2001. Major reasons for corneal disorders in the elderly population include corneal degenerations, trauma-induced infectious keratitis, and trachomatous keratopathy. In order to prevent corneal blindness, constant assessment of the burden of corneal blindness with a periodic review is necessary. Such a scenario will result in the demand for corneal implants, including artificial implants, in order to treat corneal diseases.

Restraints: High cost of ophthalmology devices and surgical procedures

Technological advancements in ophthalmic lasers, such as the development of femtosecond lasers, have reduced surgery times and improved procedural outcomes and convenience. However, the high cost of these instruments is expected to restrain their growth. According to a study conducted by the Singapore Eye Research Institute (SERI), the cost of a femtosecond laser was USD 400,000–USD 550,000. This affects their adoption among end users, as it is difficult to estimate the number of patients choosing femtosecond laser therapy over conventional methods and whether the number of patients choosing the therapy will cover the installation cost of the laser. Similarly, the cost of an OCT ranges from USD 70,000 to USD 120,000, and the cost of new fundus machines range from USD 15,000 to USD 60,000.

The cost of laser eye surgeries depends on various factors, such as the amount of correction needed, the type of technology used, and the experience and reputation of the surgeon. LASIK prices increased slightly in 2019 due to advancements in laser technologies. The average price ranges between USD 1,000 and USD 3,000 per eye. In 2019, the average cost of a LASIK procedure using the blade method was USD 1,500 per eye, whereas the average cost of bladeless custom wavefront LASIK procedures was USD 2,000 per eye. Moreover, the cost of laser eye surgery varies from region to region. For instance, in the US, the average cost of these surgeries ranged from USD 1,500–2,300 per eye; in the UK, the average cost ranged from USD 1,280–3,800 per eye; and in Australia, the cost ranged from USD 1,500–4,300 per eye.

OCT angiography is also a costly prospect for end users, making OCT diagnostic tests correspondingly expensive for patients. According to the Ophthalmology Magazine, in a typical general ophthalmology practice, OCT tests are used in around 3–12% of total visits. The machine maintenance cost, staffing, and training cost and the costs involved in securing spatial requirements are also high. All these factors affect the purchase decision for such high-cost equipment at clinics and small-sized diagnostic centers and are expected to restrain the market growth.

Opportunities: Shortage of corneal donors

There is a significant requirement of corneal donors across the globe, as approximately 10 million people are in need of corneal transplants. Densely populated counties such as India suffer from a significant shortage of donor corneas, and there is a waiting period of more than six months for corneal transplants among patients suffering from corneal blindness. Approximately 6.8 million people in the country have poor vision in one eye, and nearly one million people have poor vision in both eyes due to corneal disorders. It was estimated that by the end of 2020, India would suffer from 10.6 million cases of unilateral corneal blindness. In 2019, around 120,000 people were affected by corneal blindness. Around 250,000 corneas are needed annually in the country; however, the total number of corneas donated each year is around 25,000. The high burden of corneal blindness, coupled with a shortage of corneal donors, is expected to offer high-growth opportunities to manufacturers of corneal implants.

Challenges: Shortage of ophthalmologists

Although the demand for ophthalmologists has increased significantly-proportional to the growth in population, globally-their number has not. This is particularly evident in developing countries. India, for example, has one ophthalmologist for every 107,000 people, while the US has a ratio of 1:15,800. While there are regions that have a ratio of 1:9,000 (largely urban centers), some regions have ratios as low as 1:608,000.

The average number of ophthalmologists per million people varies with the level of economic development, ranging from an average of nine per million in low-income countries to an average of 79 per million in high-income countries. Only 18 countries had more than 100 ophthalmologists per million people (Source: World Bank).

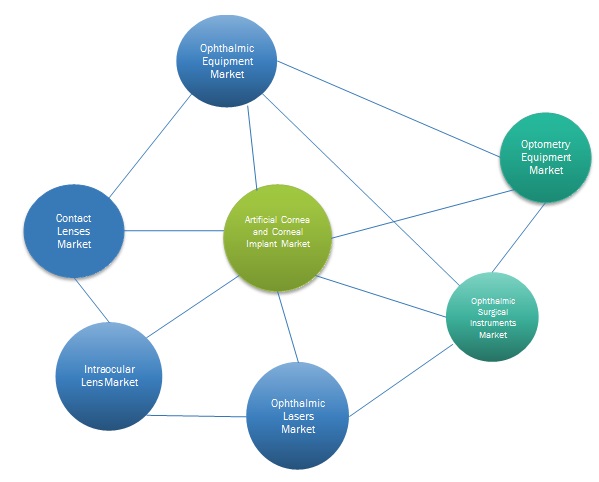

Global Artificial cornea and corneal implant market Interconnections

Human cornea segment accounted for the largest share of artificial cornea and corneal implant market in 2020.

On the basis of type, the artificial cornea and corneal implants market is segmented into human cornea and artificial cornea. In 2020, the human cornea segment accounted for the largest share of the artificial cornea and corneal implants market. The large share of this segment can be attributed to the rising awareness regarding corneal transplantation and eye tissue donations, especially in developing economies.

Penetrating keratoplasty segment accounted for the largest share of artificial cornea and corneal implant market in 2020.

On the basis of transplant type, the artificial cornea and corneal implants market is segmented into penetrating keratoplasty, endothelial keratoplasty, and other transplants (including anterior lamellar keratoplasty (ALK) and keratoprosthesis). In 2020, the penetrating keratoplasty segment accounted for the largest share of the global artificial cornea and corneal implants market. The large share of this segment can be attributed to the rising number of people suffering from eye disorders such as infectious keratitis and injury of the eyeball.

Fuchs’ dystrophy segment is projected to witness fastet growth during the forecast period

On the basis of disease indication, the artificial cornea and corneal implants market is segmented into fungal keratitis, Fuchs’ dystrophy, keratoconus, and other diseases. Fuchs’ dystrophy segment is projected to witness fastet growth during the forecast period. The rising incidence of the disease and the growing awareness among people regarding early disease diagnosis are the key factors driving the growth of this segment.

Specialty clinics and ASCs segment is expected to register the highest CAGR during the forecast period

Based on end users, the artificial cornea and corneal implants market is segmented into hospitals and specialty clinics and ambulatory surgery centers (ASCs). The specialty clinics and ASCs segment is expected to register the highest CAGR during the forecast period. Growth in this segment can be attributed to the reluctance of in-patient surgeries and the rising demand for minimally invasive procedures. Patient preference towards effective treatment and concerns regarding hospital-acquired infections are further supporting the growth of this segment.

In 2020, North America accounted for the largest share of the global artificial cornea and corneal implants market

Geographically, the artificial cornea and corneal implant market is segmented into North America, Europe, the Asia Pacific, Latin America, and Middle East & Africa. In 2020, North America accounted for the largest share of the global artificial cornea and corneal implants market. The market is well-established in North America, with the US dominating the market in this region. The large share of North America is mainly attributed to the established healthcare infrastructure, higher adoption of sophisticated healthcare technologies, higher budget among end users of ophthalmic devices, and a large number of manufacturers for corneal implants in the region.

Key Market Players

Some of the key players operating in the artificial cornea and corneal implant market include AJL Ophthalmic (Spain), CorneaGen Inc. (US), Addition Technology, Inc. (US), LinkoCare Life Sciences AB (Sweden), Presbia plc (Ireland), Mediphacos (Brazil), Aurolab (India), Cornea Biosciences (US), DIOPTEX GmbH (Austria), EyeYon Medical (Israel), Massachusetts Eye and Ear (US), Florida Lions Eye Bank (US), SightLife (US), Advancing Sight Network (US), San Diego Eye Bank (US), L V Prasad Eye Institute (LVPEI, India).

Scope of the report

|

Report Metric |

Details |

|

Market Size Available for Years |

2019–2026 |

|

Base Year Considered |

2020 |

|

Forecast Period |

2021–2026 |

|

Forecast Unit |

Value (USD Million) |

|

Segments Covered |

Type, Transplant Type, Disease Indication and End User |

|

Geographies Covered |

|

The research report ?categorizes the artificial cornea and corneal implant market into the following segments and sub-segments:

By Type

- Human Cornea

- Artificial Cornea

By Transplant Type

- Penetrating Keratoplasty

- Endothelial Keratoplasty

- Others

By Disease Indication

- Fuchs’ Dystrophy

- Keratoconus

- Fungal Keratitis

- Others

By End User

- Hospitals

- Specialty Clinics & ASCs

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Rest of Europe

-

Asia-Pacific

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Middle East and Africa

Recent Developments

- In June 2020, AJL Ophthalmic (Spain) received CE Mark approval for ENDO-K PRO. Product approval will enable company to provide its portfolio to end users.

- In January 2020, Mediphacos (Brazil) launched Keraring Intrastromal Corneal Ring. Product launch will enable company to capture market share.

- In April 2018, CorneaGen (US) acquired AcuFocus (US). This acquisition aimed at expanding the company’s presence in the artificial cornea and corneal implants market.

- In December 2020, L V Prasad Eye Institute (India) inaugurated its 200th Vision Centre in Telangana, India.

Frequently Asked Questions (FAQs):

What is the size of Artificial Cornea Market ?

The global artificial cornea and corneal implant market in terms of revenue was estimated to be worth $418 million in 2021 and is poised to reach $599 million by 2026, growing at a CAGR of 7.4% from 2021 to 2026.

Why is Artificial Cornea Market Growing ?

Market growth is largely driven by the The growing geriatric population and the rising prevalence of eye diseases are the major drivers for the artificial cornea and corneal implants market. The increasing prevalence of eye disorders and government initiatives to control visual impairment are further boosting the market growth.

Who all are the prominent players of Artificial Cornea Market ?

Some of the key players operating in the artificial cornea and corneal implant market include AJL Ophthalmic (Spain), CorneaGen Inc. (US), Addition Technology, Inc. (US), LinkoCare Life Sciences AB (Sweden), Presbia plc (Ireland), Mediphacos (Brazil), Aurolab (India), Cornea Biosciences (US), DIOPTEX GmbH (Austria), EyeYon Medical (Israel), Massachusetts Eye and Ear (US), Florida Lions Eye Bank (US), SightLife (US), Advancing Sight Network (US), San Diego Eye Bank (US), L V Prasad Eye Institute (LVPEI, India). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 23)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 26)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 2 PRIMARY SOURCES

2.1.2.1 Key data from primary sources

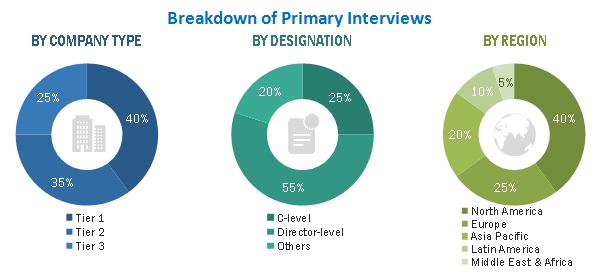

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 4 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS OF THE ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET (2020)

FIGURE 5 CAGR PROJECTIONS FROM THE ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET (2021–2026)

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS FOR THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 35)

FIGURE 7 ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 8 ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY TRANSPLANT TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 9 ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY DISEASE INDICATION, 2021 VS. 2026 (USD MILLION)

FIGURE 10 ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY END USER, 2021 VS. 2026 (USD MILLION)

FIGURE 11 GEOGRAPHICAL SNAPSHOT OF THE ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET

4 PREMIUM INSIGHTS (Page No. - 39)

4.1 ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET OVERVIEW

FIGURE 12 RISING PREFERENCE OF EYE DISEASES TO DRIVE MARKET GROWTH

4.2 ASIA PACIFIC: ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY TYPE AND END USER (2020)

FIGURE 13 HUMAN CORNEA SEGMENT ACCOUNTED FOR THE LARGEST SHARE OF THE APAC MARKET IN 2020

4.3 ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY REGION, 2021−2026

FIGURE 14 NORTH AMERICA WILL CONTINUE TO DOMINATE THE ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET IN THE FORECAST PERIOD

4.4 ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET: DEVELOPING VS. DEVELOPED MARKETS

FIGURE 15 DEVELOPING MARKETS TO REGISTER HIGHER GROWTH DURING THE FORECAST PERIOD

4.5 ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 16 CHINA TO REGISTER THE HIGHEST GROWTH RATE DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 43)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

TABLE 1 MARKET DYNAMICS: IMPACT ANALYSIS

5.2.1 MARKET DRIVERS

5.2.1.1 Rapid growth in the geriatric population

FIGURE 17 GERIATRIC POPULATION AS A PERCENTAGE OF THE TOTAL POPULATION, BY REGION, 2017 VS. 2050

5.2.1.2 Rising prevalence of eye diseases

5.2.1.2.1 Corneal blindness

5.2.1.2.2 Cataracts

TABLE 2 TOTAL NUMBER OF CATARACT SURGICAL PROCEDURES PERFORMED, BY COUNTRY, 2017 VS. 2018

5.2.1.2.3 Glaucoma

TABLE 3 NUMBER OF GLAUCOMA PATIENTS, BY REGION AND TYPE, 2013 VS. 2020 VS. 2040 (MILLION)

5.2.1.2.4 Obesity and diabetes

TABLE 4 NUMBER OF PEOPLE WITH DIABETES, BY REGION, 2019 VS. 2030 VS. 2045 (MILLION)

5.2.1.3 Increasing government initiatives to control visual impairment

5.2.2 RESTRAINTS

5.2.2.1 High cost of ophthalmology devices and surgical procedures

5.2.3 OPPORTUNITIES

5.2.3.1 Shortage of corneal donors

5.2.3.2 Untapped potential of emerging markets

5.2.4 CHALLENGES

5.2.4.1 Lack of awareness and low access to eye care in low-income economies

5.2.4.2 Shortage of ophthalmologists

6 INDUSTRY INSIGHTS (Page No. - 51)

6.1 INTRODUCTION

6.2 INDUSTRY TRENDS

6.2.1 3D-PRINTED HUMAN CORNEAS

6.2.2 OCT ANGIOGRAPHY DEVICES

6.2.3 ADVANCES IN REFRACTIVE SURGERY

6.3 IMPACT OF COVID-19 ON THE ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET

6.4 VALUE CHAIN ANALYSIS

FIGURE 18 ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET: VALUE CHAIN ANALYSIS

6.5 ECOSYSTEM

FIGURE 19 ECOSYSTEM: ARTIFICIAL CORNEAL IMPLANTS MARKET (2019)

6.6 REGULATORY ANALYSIS

TABLE 5 STRINGENCY OF REGULATIONS FOR OPHTHALMIC EQUIPMENT, BY REGION

6.6.1 NORTH AMERICA

6.6.1.1 US

TABLE 6 US: CLASSIFICATION OF OPHTHALMIC EQUIPMENT

TABLE 7 US: TIME, COST, AND COMPLEXITY OF THE REGISTRATION PROCESS

6.6.1.2 Canada

TABLE 8 CANADA: LEVEL OF RISK, TIME, COST, AND COMPLEXITY OF THE REGISTRATION PROCESS

6.6.2 EUROPE

TABLE 9 EUROPE: LEVEL OF RISK, TIME, COST, AND COMPLEXITY OF THE REGISTRATION PROCESS

TABLE 10 EUROPE: CLASSIFICATION OF ARTIFICIAL CORNEAL IMPLANTS ALONG WITH OTHER OPHTHALMIC EQUIPMENT

6.6.3 ASIA PACIFIC

6.6.3.1 Japan

TABLE 11 JAPAN: TIME, COST, AND COMPLEXITY OF THE REGISTRATION PROCESS

6.6.3.2 China

TABLE 12 CHINA: TIME, COST, AND COMPLEXITY OF THE REGISTRATION PROCESS

7 ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY TYPE (Page No. - 60)

7.1 INTRODUCTION

TABLE 13 ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

7.2 HUMAN CORNEA

7.2.1 INCREASING PREVALENCE OF CORNEAL BLINDNESS TO DRIVE MARKET GROWTH

TABLE 14 US: TOTAL DONATIONS AND DISTRIBUTION OF TISSUE, 2019

FIGURE 20 US: CORNEAL TRANSPLANT SUPPLIED BY EYE BANKS, 2010−2019

TABLE 15 ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET FOR HUMAN CORNEA, BY COUNTRY, 2019–2026 (USD MILLION)

7.3 ARTIFICIAL CORNEA

7.3.1 SCARCITY OF HUMAN EYE DONORS HAS PROPELLED MARKET GROWTH

TABLE 16 ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET FOR ARTIFICIAL CORNEA, BY COUNTRY, 2019–2026 (USD MILLION)

8 ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY TRANSPLANT TYPE (Page No. - 65)

8.1 INTRODUCTION

TABLE 17 ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY TRANSPLANT TYPE, 2019–2026 (USD MILLION)

FIGURE 21 US: SURGERY TRENDS, 2010−2019

8.2 PENETRATING KERATOPLASTY

8.2.1 PK ENABLES THE ABILITY TO TREAT KERATITIS AND INJURY OF THE EYEBALL

TABLE 18 ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET FOR PENETRATING KERATOPLASTY, BY COUNTRY, 2019–2026 (USD MILLION)

8.3 ENDOTHELIAL KERATOPLASTY

8.3.1 ADVANTAGES SUCH AS FASTER VISUAL RECOVERY AND LESS PRONE TO INJURY ARE SUPPORTING THE GROWTH OF THIS SEGMENT

TABLE 19 ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET FOR ENDOTHELIAL KERATOPLASTY, BY COUNTRY, 2019–2026 (USD MILLION)

8.4 OTHER TRANSPLANTS

TABLE 20 ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET FOR OTHER TRANSPLANTS, BY COUNTRY, 2019–2026 (USD MILLION)

9 ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY DISEASE INDICATION (Page No. - 70)

9.1 INTRODUCTION

TABLE 21 ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY DISEASE INDICATION, 2019–2026 (USD MILLION)

9.2 FUCHS’ DYSTROPHY

9.2.1 RISING PREVALENCE OF FUCHS’ DYSTROPHY IS THE KEY FACTOR DRIVING MARKET GROWTH

TABLE 22 ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET FOR FUCHS’ DYSTROPHY, BY COUNTRY, 2019–2026 (USD MILLION)

9.3 FUNGAL KERATITIS

9.3.1 LARGE PATIENT POPULATION SUFFERING FROM FUNGUS KERATITIS TO DRIVE MARKET GROWTH

TABLE 23 ESTIMATED ANNUAL INCIDENCE OF FUNGAL KERATITIS, BY REGION (2019)

TABLE 24 ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET FOR FUNGAL KERATITIS, BY COUNTRY, 2019–2026 (USD MILLION)

9.4 KERATOCONUS

9.4.1 INCREASING RESEARCH ON KERATOCONUS TREATMENT TO SUPPORT MARKET GROWTH

TABLE 25 ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET FOR KERATOCONUS, BY COUNTRY, 2019–2026 (USD MILLION)

9.5 OTHER DISEASES

TABLE 26 ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET FOR OTHER DISEASES, BY COUNTRY, 2019–2026 (USD MILLION)

10 ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY END USER (Page No. - 76)

10.1 INTRODUCTION

TABLE 27 ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY END USER, 2019–2026 (USD MILLION)

10.2 IMPACT OF COVID-19 ON THE END-USER MARKET

10.3 HOSPITALS

10.3.1 LARGE PATIENT POOL AND HIGH PURCHASING POWER OF HOSPITALS ARE THE KEY FACTORS DRIVING MARKET GROWTH

TABLE 28 ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET FOR HOSPITALS, BY COUNTRY, 2019–2026 (USD MILLION)

10.4 SPECIALTY CLINICS & AMBULATORY SURGERY CENTERS

10.4.1 COST-EFFECTIVENESS OF AMBULATORY CARE HAS RESULTED IN GROWING END-USER INTEREST TOWARDS ASCS

TABLE 29 ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET FOR SPECIALTY CLINICS & AMBULATORY SURGERY CENTERS, BY COUNTRY, 2019–2026 (USD MILLION)

11 ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY REGION (Page No. - 80)

11.1 INTRODUCTION

TABLE 30 ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 31 ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

11.2 NORTH AMERICA

TABLE 32 EYE BANKING STATISTICS IN NORTH AMERICA REPORTED BY EBAA MEMBERS: COUNTRIES OF DESTINATION (2019)

FIGURE 22 NORTH AMERICA: ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET SNAPSHOT

TABLE 33 NORTH AMERICA: ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 34 NORTH AMERICA: ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 35 NORTH AMERICA: ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY TRANSPLANT TYPE, 2019–2026 (USD MILLION)

TABLE 36 NORTH AMERICA: ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY DISEASE INDICATION, 2019–2026 (USD MILLION)

TABLE 37 NORTH AMERICA: ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY END USER, 2019–2026 (USD MILLION)

11.2.1 US

11.2.1.1 The US dominates the artificial cornea and corneal implants market

FIGURE 23 EYE BANKING STATISTICS IN THE US: AVERAGE CORNEAS RECOVERED FOR TRANSPLANT (2011-2019)

TABLE 38 US: KEY MACROINDICATORS

TABLE 39 US: ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 40 US: ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY TRANSPLANT TYPE, 2019–2026 (USD MILLION)

TABLE 41 US: ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY DISEASE INDICATION, 2019–2026 (USD MILLION)

TABLE 42 US: ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY END USER, 2019–2026 (USD MILLION)

11.2.2 CANADA

11.2.2.1 Growing number of cataract and diabetic retinopathy cases to propel market growth

TABLE 43 CANADA: KEY MACROINDICATORS

TABLE 44 CANADA: ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 45 CANADA: ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY TRANSPLANT TYPE, 2019–2026 (USD MILLION)

TABLE 46 CANADA: ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY DISEASE INDICATION, 2019–2026 (USD MILLION)

TABLE 47 CANADA: ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY END USER, 2019–2026 (USD MILLION)

11.3 EUROPE

TABLE 48 EYE BANKING STATISTICS IN EUROPE REPORTED BY EBAA MEMBERS: COUNTRIES OF DESTINATION (2019)

TABLE 49 EUROPE: ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 50 EUROPE: ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 51 EUROPE: ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY TRANSPLANT TYPE, 2019–2026 (USD MILLION)

TABLE 52 EUROPE: ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY DISEASE INDICATION, 2019–2026 (USD MILLION)

TABLE 53 EUROPE: ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY END USER, 2019–2026 (USD MILLION)

11.3.1 GERMANY

11.3.1.1 Established healthcare infrastructure and higher healthcare spending to drive the market growth

TABLE 54 GERMANY: KEY MACROINDICATORS

TABLE 55 GERMANY: ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 56 GERMANY: ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY TRANSPLANT TYPE, 2019–2026 (USD MILLION)

TABLE 57 GERMANY: ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY DISEASE INDICATION, 2019–2026 (USD MILLION)

TABLE 58 GERMANY: ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY END USER, 2019–2026 (USD MILLION)

11.3.2 UK

11.3.2.1 Rising prevalence of diabetes and related eye diseases to support market growth

FIGURE 24 UK: NUMBER OF CORNEAS RETRIEVED TO NHSBT EYE BANKS AND CORNEAS GRAFTED

FIGURE 25 UK: NUMBER OF CORNEAL TRANSPLANTS, BY INDICATION, 2010−2020

TABLE 59 UK: KEY MACROINDICATORS

TABLE 60 UK: ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 61 UK: ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY TRANSPLANT TYPE, 2019–2026 (USD MILLION)

TABLE 62 UK: ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY DISEASE INDICATION, 2019–2026 (USD MILLION)

TABLE 63 UK: ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY END USER, 2019–2026 (USD MILLION)

11.3.3 FRANCE

11.3.3.1 Growing awareness of eye health to drive the market growth in France

TABLE 64 FRANCE: KEY MACROINDICATORS

TABLE 65 FRANCE: ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 66 FRANCE: ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY TRANSPLANT TYPE, 2019–2026 (USD MILLION)

TABLE 67 FRANCE: ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY DISEASE INDICATION, 2019–2026 (USD MILLION)

TABLE 68 FRANCE: ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY END USER, 2019–2026 (USD MILLION)

11.3.4 REST OF EUROPE

FIGURE 26 ITALY: NUMBER OF CORNEA DONATIONS, 2014-2019

TABLE 69 ROE: ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 70 ROE: ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY TRANSPLANT TYPE, 2019–2026 (USD MILLION)

TABLE 71 ROE: ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY DISEASE INDICATION, 2019–2026 (USD MILLION)

TABLE 72 ROE: ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY END USER, 2019–2026 (USD MILLION)

11.4 ASIA PACIFIC

TABLE 73 EYE BANKING STATISTICS IN THE ASIA PACIFIC REPORTED BY EBAA MEMBERS: COUNTRIES OF DESTINATION (2019)

FIGURE 27 ASIA PACIFIC: ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET SNAPSHOT

TABLE 74 ASIA PACIFIC: ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 75 ASIA PACIFIC: ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 76 ASIA PACIFIC: ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY TRANSPLANT TYPE, 2019–2026 (USD MILLION)

TABLE 77 ASIA PACIFIC: ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY DISEASE INDICATION, 2019–2026 (USD MILLION)

TABLE 78 ASIA PACIFIC: ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY END USER, 2019–2026 (USD MILLION)

11.4.1 CHINA

11.4.1.1 China to register the highest growth rate in the artificial cornea and corneal implants market

TABLE 79 CHINA: KEY MACROINDICATORS

TABLE 80 CHINA: ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 81 CHINA: ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY TRANSPLANT TYPE, 2019–2026 (USD MILLION)

TABLE 82 CHINA: ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY DISEASE INDICATION, 2019–2026 (USD MILLION)

TABLE 83 CHINA: ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY END USER, 2019–2026 (USD MILLION)

11.4.2 JAPAN

11.4.2.1 Large geriatric population in the country to support market growth

TABLE 84 JAPAN: KEY MACROINDICATORS

TABLE 85 JAPAN: ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 86 JAPAN: ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY TRANSPLANT TYPE, 2019–2026 (USD MILLION)

TABLE 87 JAPAN: ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY DISEASE INDICATION, 2019–2026 (USD MILLION)

TABLE 88 JAPAN: ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY END USER, 2019–2026 (USD MILLION)

11.4.3 REST OF ASIA PACIFIC

TABLE 89 INDIA: NUMBER OF DONATED EYES FOR CORNEAL TRANSPLANTATION

TABLE 90 ROAPAC: ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 91 ROAPAC: ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY TRANSPLANT TYPE, 2019–2026 (USD MILLION)

TABLE 92 ROAPAC: ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY DISEASE INDICATION, 2019–2026 (USD MILLION)

TABLE 93 ROAPAC: ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY END USER, 2019–2026 (USD MILLION)

11.5 LATIN AMERICA

11.5.1 GOVERNMENT INITIATIVES TO INCREASE AWARENESS ABOUT VISION CARE TO SUPPORT MARKET GROWTH

TABLE 94 ESTIMATED ANNUAL INCIDENCE OF FUNGAL KERATITIS IN LATIN AMERICA

FIGURE 28 NUMBER OF CORNEA TRANSPLANTS PERFORMED IN BRAZIL AND MEXICO FROM 2010 TO 2019 (THOUSAND)

TABLE 95 LATIN AMERICA: ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 96 LATIN AMERICA: ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY TRANSPLANT TYPE, 2019–2026 (USD MILLION)

TABLE 97 LATIN AMERICA: ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY DISEASE INDICATION, 2019–2026 (USD MILLION)

TABLE 98 LATIN AMERICA: ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY END USER, 2019–2026 (USD MILLION)

11.6 MIDDLE EAST & AFRICA

11.6.1 RISING MEDICAL TOURISM IS THE KEY GROWTH DRIVER FOR THE ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET IN THE MEA

TABLE 99 MIDDLE EAST & AFRICA: ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 100 MIDDLE EAST & AFRICA: ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY TRANSPLANT TYPE, 2019–2026 (USD MILLION)

TABLE 101 MIDDLE EAST & AFRICA: ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY DISEASE INDICATION, 2019–2026 (USD MILLION)

TABLE 102 MIDDLE EAST & AFRICA: ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET, BY END USER, 2019–2026 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 118)

12.1 OVERVIEW

FIGURE 29 KEY DEVELOPMENTS IN THE ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET FROM JANUARY 2018 TO DECEMBER 2020

FIGURE 30 MARKET EVALUATION FRAMEWORK: OTHER DEVELOPMENTS WAS THE MOST WIDELY ADOPTED STRATEGY BETWEEN 2018 & 2020

12.2 ARTIFICIAL CORNEA MARKET RANKING

12.3 HUMAN CORNEA MARKET RANKING

12.4 PRODUCT BENCHMARKING

FIGURE 31 PRODUCT PORTFOLIO ANALYSIS: ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET (2020)

12.5 COMPETITIVE SITUATIONS & TRENDS

12.5.1 PRODUCT LAUNCHES & APPROVALS

12.5.2 ACQUISITIONS

12.5.3 EXPANSIONS

12.5.4 OTHER DEVELOPMENTS

13 COMPANY EVALUATION MATRIX DEFINITION & METHODOLOGY AND COMPANY PROFILES (Page No. - 123)

13.1 COMPETITIVE LEADERSHIP MAPPING

13.1.1 STARS

13.1.2 EMERGING LEADERS

13.1.3 PERVASIVE COMPANIES

13.1.4 EMERGING COMPANIES

FIGURE 32 ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET: COMPETITIVE LEADERSHIP MAPPING (2020)

13.2 COMPETITIVE LEADERSHIP MAPPING FOR STARTUPS

13.2.1 PROGRESSIVE COMPANIES

13.2.2 DYNAMIC COMPANIES

13.2.3 STARTING BLOCKS

13.2.4 RESPONSIVE COMPANIES

FIGURE 33 ARTIFICIAL CORNEA AND CORNEAL IMPLANTS MARKET: STARTUP COMPANY EVALUATION MATRIX (2020)

13.3 COMPANY PROFILES

(Business overview, Products offered, Recent developments)*

13.3.1 AJL OPHTHALMIC S.A.

13.3.2 CORNEAGEN, INC.

13.3.3 ADDITION TECHNOLOGY, INC.

13.3.4 LINKOCARE LIFE SCIENCES AB

13.3.5 PRESBIA PLC

FIGURE 34 PRESBIA PLC: COMPANY SNAPSHOT (2018)

13.3.6 MEDIPHACOS

13.3.7 AUROLAB

13.3.8 CORNEA BIOSCIENCES, INC.

13.3.9 DIOPTEX MEDIZINPRODUKTE FORSCHUNGS-, ENTWICKLUNGS- UND VERTRIEBS GMBH (DIOPTEX GMBH)

13.3.10 EYEYON MEDICAL

13.3.11 MASSACHUSETTS EYE AND EAR

FIGURE 35 MASSACHUSETTS EYE AND EAR: COMPANY SNAPSHOT (2020)

13.3.12 FLORIDA LIONS EYE BANK

FIGURE 36 FLORIDA LIONS EYE BANK: COMPANY SNAPSHOT (2019)

13.3.13 SIGHTLIFE

FIGURE 37 SIGHTLIFE: COMPANY SNAPSHOT (2019)

13.3.14 ADVANCING SIGHT NETWORK

13.3.15 SAN DIEGO EYE BANK

13.3.16 L V PRASAD EYE INSTITUTE

13.3.17 NEW MEXICO LIONS EYE BANK

13.3.18 SAN ANTONIO EYE BANK

13.3.19 KANSAS EYE BANK & CORNEA RESEARCH CENTER

13.3.20 ROCKY MOUNTAIN LIONS EYE BANK

13.3.21 CORNEAT VISION

13.3.22 KERAMED, INC.

*Business overview, Products offered, Recent developments might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 149)

14.1 INSIGHTS OF INDUSTRY EXPERTS

14.2 DISCUSSION GUIDE

14.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.4 AVAILABLE CUSTOMIZATIONS

14.5 AUTHOR DETAILS

This study involved four major activities in estimating the current artificial cornea and corneal implant market size. Exhaustive research was conducted to collect information on the market as well as its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the number of corneal transplantation procedures and the value market. After that, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

This research study involved the usage of widespread secondary sources; directories; databases such as Bloomberg Business, Factiva, and Dun & Bradstreet; white papers; annual reports; company house documents; investor presentations; and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the market. It was also used to obtain important information about the key players, market classification and segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives.

Primary Research

The artificial cornea and corneal implant market comprises several stakeholders, such as raw material suppliers, manufacturers of artificial corneas, and regulatory organizations in the supply chain. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include professionals such as company vice presidents, company’s C-level executives, managers, product managers, department heads, professors, and research scientists. The primary sources from the supply side include key CEOs, VPs and managing directors, marketing heads/directors and sales directors, marketing managers, regional/area sales managers, export/import, heads/managers, and product managers/technology experts.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up approach was used to estimate and validate the total size of the artificial cornea and corneal implant market (value and volume). These approaches were also used extensively to estimate the size of various subsegments in the market. After arriving at the overall market size-using the market size estimation processes explained above-the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides of the artificial cornea and corneal implant industry.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both, the demand and supply sides.

Approach to calculate the revenue of different players in the artificial cornea and corneal implant market

The size of the global artificial cornea and corneal implant market was obtained from annual reports, SEC filings, online publications, and extensive primary interviews. A percentage split was applied to arrive at the size of market segments. Further splits were applied to arrive at the size for each sub-segment. Primary participants validated these percentage splits. The country-level market sizes obtained from the annual reports, SEC filings, online publications, and extensive primary interviews were added up to reach the total market size for regions. By adding up the market sizes for all the regions, the global artificial cornea and corneal implant market was derived.

Approach to derive the market size and estimate market growth

The market size and market growth were estimated through primary interviews on a regional and global level. All responses were collated, and a weighted average was taken to derive a probabilistic estimate of the market size and growth rate.

Objectives of the Study

- To define, describe, analyze, and forecast the artificial cornea and corneal implant market by therapy, type, route of administration, end user and region

- To provide detailed information about the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall artificial cornea and corneal implant market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of market segments in North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile key players and comprehensively analyze their market ranking and core competencies in the artificial cornea and corneal implant market

- To track and analyze competitive developments such as acquisitions, product launches, and expansions in the artificial cornea and corneal implant market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top companies

Geographic Analysis

- Further breakdown of the RoAPAC market into South Korea, New Zealand, and other countries Further breakdown of the RoE market into Belgium, Russia, the Netherlands, Switzerland, and other countries

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Artificial Cornea and Corneal Implant Market