AR VR Software Market by Technology Type (AR Software and VR Software), Software Type (Software Development Kit, Game Engine), Vertical (Media & Entertainment, Retail & eCommerce, Manufacturing, Healthcare) and Region - Global Forecast to 2028

AR VR Software Market Overview

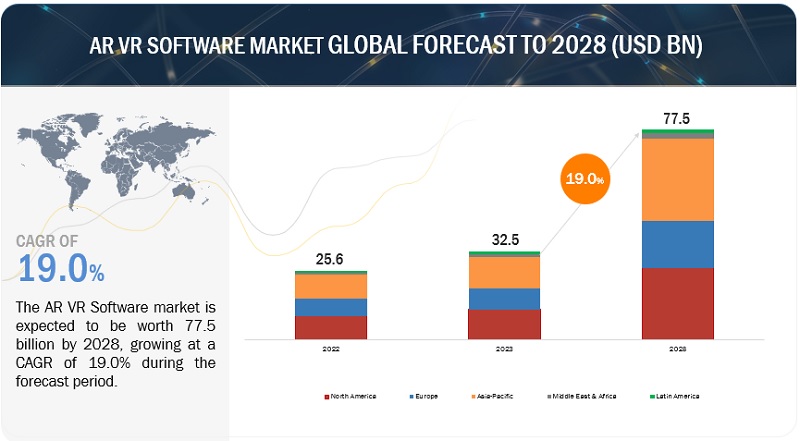

The global AR VR Software Market size was estimated at $32.5 billion in 2023 and is projected to reach $77.5 billion by 2028, growing at a CAGR of 19.0% from 2023 to 2028. The base year considered for estimation is 2022 and the historical data span ranges from 2023 to 2028.

AR VR Software, In the aviation and aerospace sectors, AR and VR technologies are instrumental for pilot training, aircraft maintenance, and cockpit design. These immersive technologies provide trainee pilots with true-to-life flight simulations, improving their skills and decision-making abilities. Additionally, maintenance procedures are streamlined as technicians can access augmented repair instructions and visualize complex systems in 3D, reducing downtime. Furthermore, AR and VR facilitate cockpit design by allowing engineers to test and refine layouts virtually, optimizing ergonomics and enhancing safety. Consequently, the development of specialized software solutions for these industries is driven by the practicality and efficiency that AR and VR bring to aviation and aerospace operations.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

AR VR Software Market Growth Dynamics

Driver: Growing popularity of gaming

The gaming sector's enthusiasm for immersive experiences, its thirst for authenticity, and its welcoming stance towards innovation are propelling the acceptance of AR/VR software. Gamers, renowned for their early adoption of tech, actively pursue immersive gameplay and inventive features, rendering AR/VR software exceptionally appealing. Leading gaming companies are seamlessly integrating AR/VR software with their existing gaming ecosystems. Furthermore, multiplayer, and social gaming experiences, as well as heightened developer involvement, are flourishing within the AR/VR software realm. Gaming communities magnify the positive impact of AR/VR software, while esports amplify spectator engagement. Collectively, gamers play a pivotal role in expanding the influence of AR/VR software in the realm of entertainment and gaming.

Restraint: Diverse use cases of AR VR in multiple industries

AR/VR software serves as a driving force in various industries, including aviation, healthcare, and military training, by offering realistic simulations for safe skill development. It enables remote collaboration in fields like architecture and engineering, fosters therapy and rehabilitation in healthcare, enhances education through interactive learning experiences, and transforms marketing campaigns by engaging customers with virtual try-ons and product visualizations. In real estate, it facilitates virtual property tours, saving time for both buyers and sellers. Additionally, AR/VR software promotes tourism and cultural preservation by providing immersive virtual tours of historical and cultural sites, thereby driving innovation and growth in the AR/VR industry.

Opportunity: Enhancing remote work and collaboration through AR/VR software

The ascent of remote work and collaboration has propelled AR/VR software into a transformative role in redefining the way teams interact and collaborate. AR/VR-enabled virtual meetings transcend the limitations of traditional video conferencing, allowing colleagues to gather in lifelike virtual environments, fostering a stronger sense of presence and connection. Design collaboration takes on a new dimension, as teams can visualize and interact with 3D models in real time, enhancing creativity and productivity. Moreover, AR/VR facilitates immersive team-building experiences, enabling remote teams to engage in team-building activities and training exercises as if they were physically present, ultimately strengthening bonds and collaboration.

Challenge: Limited amount of content available for AR/VR

Content development is a pivotal challenge in the AR/VR ecosystem due to the relatively limited availability of diverse and compelling experiences. Attracting users and sustaining their interest hinges on having a rich array of content. Insufficient content diversity can deter users from adopting AR/VR technology, as they seek engaging applications and experiences that cater to their diverse preferences. This scarcity necessitates a concerted effort from developers to create innovative, high-quality content across various genres, from gaming and entertainment to education and training, to drive user adoption and establish AR/VR as a mainstream platform.

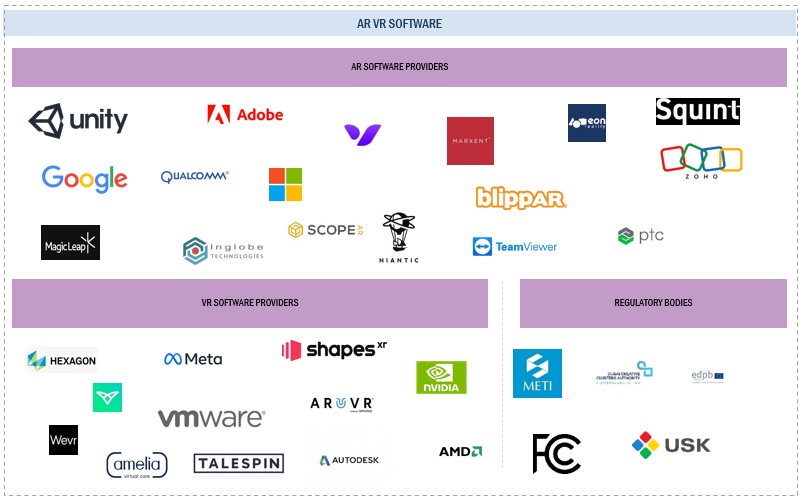

AR VR Software Market Ecosystem

Prominent players in this market include well-established, financially stable AR and VR Software solutions, services providers, and regulatory bodies. These companies have been operating in the market for several years and possess a diversified product portfolio and state-of-the-art technologies. Prominent companies in this market include Microsoft (US), Google (US), and Unity Technologies (US) and so on.

The Media & Entertainment segment to hold the largest market size during the forecast period

Virtual cinemas revolutionize movie-watching by transporting viewers into virtual theaters. Within these immersive environments, users can enjoy films on a virtual big screen, complete with theater ambiance and seating, all from the comfort of their own space. This innovative cinematic experience not only adds novelty to movie consumption but also opens new possibilities for social interactions, allowing friends and family to watch movies together in a shared virtual space, regardless of physical distance. The growth of virtual cinemas propels the advancement of software solutions tailored to this unique form of cinematic entertainment, enriching the overall landscape of modern film experiences.

The VR Software segment is expected to register the second fastest growth rate during the forecast period.

In the real estate sector, VR has ushered in a transformative era by providing virtual property tours, immersive 3D property visualizations, and augmented property information. These innovations have significantly elevated the property marketing and sales landscape, offering prospective buyers an unparalleled opportunity to explore and evaluate properties from the comfort of their own spaces. This immersive experience not only saves time and resources but also enhances decision-making by allowing buyers to interact with properties as if they were physically present. As a result, the adoption of VR software in property marketing and sales has surged, becoming an integral tool for real estate professionals, and redefining the way properties are showcased and sold in the market.

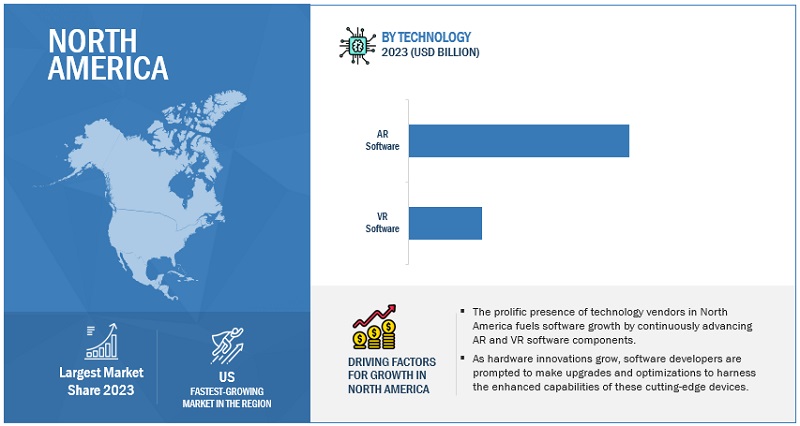

North America is expected to hold the second largest market size during the forecast period

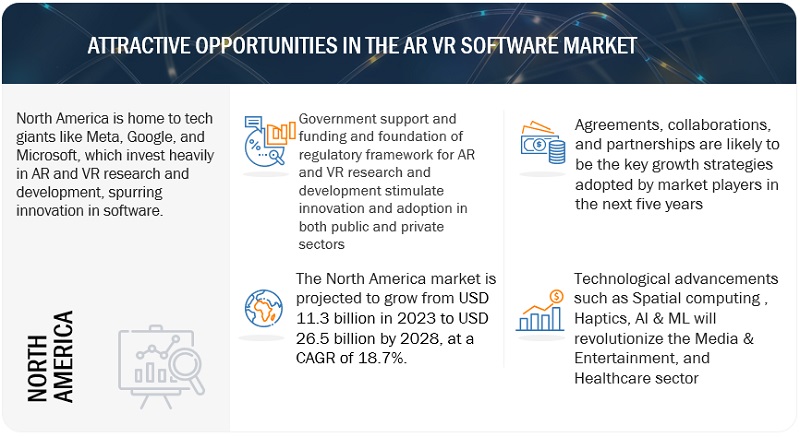

Prominent North American technology giants, such as Meta, Google, and Microsoft, allocate substantial resources to AR and VR research and development initiatives. These investments drive forward groundbreaking innovations in AR and VR software. By pushing the boundaries of what's possible in terms of hardware capabilities, user experiences, and immersive content, these industry leaders set the pace for the entire AR and VR ecosystem. Their contributions range from cutting-edge VR headsets and AR glasses to software development kits (SDKs) that empower developers worldwide to create the next generation of immersive applications and experiences. This commitment to advancing AR and VR technologies continues to shape the industry's trajectory, propelling it into new frontiers of possibility.

AR VR Software Companies:

The major companies in the AR VR Software market are include Microsoft (US), Google (US), Unity Technologies (US), Adobe (US), Autodesk (US), Meta (US), PTC (US), TeamViewer (Germany), NVIDIA Corporation (US), Advanced Micro Devices (US), Qualcomm (US), Zoho Corporation (India), Hexagon AB (Sweden), Magic Leap (US), VMware (US), Blippar (UK), Augment (France), ShapesXR (US), ARuVR (UK), Scope AR (US), Vectary (US), Eon Reality (US), Wevr (US), Talespin Reality Labs (US), Squint (US), Niantic (US), Marxent Labs (US), Inglobe Technologies (Italy), Ultraleap (US), Amelia (US). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches and enhancements, and acquisitions to expand their AR VR Software market footprint.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2017-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD) Billion |

|

Segments covered |

Technology Type (AR Software and VR Software), Software Type, Vertical, and Region |

|

Region covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. |

|

Companies covered |

Microsoft (US), Google (US), Unity Technologies (US), Adobe (US), Autodesk (US), Meta (US), PTC (US), TeamViewer (Germany), NVIDIA Corporation (US), Advanced Micro Devices (US), Qualcomm (US), Zoho Corporation (India), Hexagon AB (Sweden), Magic Leap (US), VMware (US), Blippar (UK), Augment (France), ShapesXR (US), ARuVR (UK), Scope AR (US), Vectary (US), Eon Reality (US), Wevr (US), Talespin Reality Labs (US), Squint (US), Niantic (US), Marxent Labs (US), Inglobe Technologies (Italy), Ultraleap (US), Amelia (US) |

This research report categorizes the AR VR Software market to forecast revenues and analyze trends in each of the following submarkets:

Based on Technology Type:

- AR Software

- VR Software

Based on Software Type:

- Software Development Kit

- Game Engine

- Modeling & Visualization Software

- Content Management System

- Training Simulation Software

- Other Software (remote collaboration, geospatial mapping, and industrial platforms)

Based on Vertical:

- Media & Entertainment

- Retail & E-commerce

- Training & Education

- Travel & Hospitality

- Aerospace & Defense

- Real Estate

- Manufacturing

- Healthcare

- Aerospace & Defense

- Automotive

- Other Verticals (IT & Telecom, Transportation & Logistics, and Energy & Utilities)

By Region:

-

North America

- United States (US)

- Canada

-

Europe

- United Kingdom (UK)

- Germany

- France

- Italy

- Spain

- Nordics

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia & New Zealand

- Southeast Asia

- Rest of Asia Pacific

-

Middle East & Africa

- Middle East

- Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In February 2023, Samsung, Google, and Qualcomm collaborated to deliver a mixed-reality platform. This collaboration will enable the companies to deliver the next-gen technology through cutting-edge advanced hardware and software.

- In November 2022, Microsoft and Microsoft partnered to integrate Microsoft 365, Teams, Intune, and Azure Active Directory into Meta Quest devices.

- In March 2022, Autodesk acquired The Wild cloud-connected Metaverse and virtual reality platform technology firm.

Frequently Asked Questions (FAQ):

What is mean by AR VR Software?

AR and VR software refers to computer programs and applications that create immersive digital environments or enhance real-world experiences. AR overlays digital information onto the physical world, enhancing it with interactive elements, while VR immerses users in entirely computer-generated environments. These software types are used across various industries, including gaming, education, healthcare, and more, to provide interactive and immersive experiences.

What is the future for AR VR Software market?

The AR VR Software Market is anticipated to be valued at USD 32.5 billion in 2023 and poised to reach USD 77.5 billion by 2028, at a Compound Annual Growth Rate (CAGR) of 19.0% during anticipated period from 2023 to 2028.

What are the major drivers in the AR VR Software market?

The major drivers in the AR VR Software market are the growing popularity of gaming and diverse use cases of AR VR in multiple industries.

Which are the leading AR VR Software companies included in the report?

The leading AR VR Software companies included in this report are Microsoft (US), Google (US), Unity Technologies (US), Adobe (US), Autodesk (US), Meta (US), PTC (US), TeamViewer (Germany), NVIDIA Corporation (US), Advanced Micro Devices (US), Qualcomm (US), Zoho Corporation (India), Hexagon AB (Sweden), Magic Leap (US), VMware (US), Blippar (UK), Augment (France), ShapesXR (US), ARuVR (UK), Scope AR (US), Vectary (US), Eon Reality (US), Wevr (US), Talespin Reality Labs (US), Squint (US), Niantic (US), Marxent Labs (US), Inglobe Technologies (Italy), Ultraleap (US), Amelia (US).

What is the total CAGR expected to be recorded for the wireless charging market for electric vehicles during 2023-2030?

The key technology trends in AR VR Software include Spatial Computing, Haptics, and AI & ML.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing popularity of gaming- Diverse use cases of AR/VR across multiple industries- Advancements in real-time rendering enginesRESTRAINTS- Diversity of AR/VR platforms and complex development landscape- High initial costs and limited hardware optionsOPPORTUNITIES- Increase in remote working and collaboration through AR/VR software- Increasing role of AR/VR software in healthcare transformationCHALLENGES- Requirement for optimized performance in AR/VR- Limited availability of content for AR/VR

-

5.3 INDUSTRY TRENDSBRIEF HISTORY OF AR/VR SOFTWARE- 1950–1970- 1970–2000- 2000–2010- 2011–2023CASE STUDY ANALYSIS- Case study 1: Magna supercharges its quality control and training processes with AR- Case study 2: STERIS helps customers reduce critical mistakes with AR- Case study 3: Revolutionizing technical training in VR- Case study 4: Streamlining enterprise VR training developmentECOSYSTEM ANALYSIS- AR software providers- VR software providersVALUE CHAIN ANALYSISREGULATORY LANDSCAPE- Regulatory bodies, government agencies, and other organizations- North America- Europe- Asia Pacific- Middle East & Africa- Latin AmericaPRICING ANALYSIS- Average selling price trend of key players, by VR software- Indicative pricing analysis of key players, by AR softwareTECHNOLOGY ANALYSIS- Key technologies- Complementary technologies- Adjacent technologiesPATENT ANALYSIS- Methodology- Types of patents- Innovations and patent applicationsKEY STAKEHOLDERS AND BUYING CRITERIA- Key stakeholders in buying process- Buying criteriaKEY CONFERENCES AND EVENTS, 2023–2024PORTER’S FIVE FORCES ANALYSIS- Threat of new entrants- Threat of substitutes- Bargaining power of buyers- Bargaining power of suppliers- Intensity of competitive rivalryTRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESSBEST PRACTICES OF AR VR SOFTWARE MARKET- User-centered design- Cross-platform compatibility- Interactivity and immersion- Accessibility- Content creationCURRENT AND EMERGING BUSINESS MODELS- Subscription services model- Freemium- Pay-per-use or pay-per-session- Enterprise licensing- Content marketplaceAR VR SOFTWARE TOOLS, FRAMEWORKS, AND TECHNIQUES- AR VR software tools- AR VR software frameworks- AR VR software techniquesFUTURE LANDSCAPE OF AR VR SOFTWARE MARKET- AR VR software technology roadmap till 2030

-

6.1 INTRODUCTIONTECHNOLOGY TYPE: AR VR SOFTWARE MARKET DRIVERS

-

6.2 AR SOFTWAREENHANCES REAL-WORLD EXPERIENCES BY ADDING LAYERS OF IMMERSION AND INTERACTION USING ARMARKER-BASED AR TECHNOLOGYMARKERLESS AR TECHNOLOGY

-

6.3 VR SOFTWARECRAFTS HYPER-REALISTIC WORLDS FOR UNPARALLELED IMMERSIVE EXPLORATION AND INNOVATION

-

7.1 INTRODUCTIONSOFTWARE TYPE: AR VR SOFTWARE MARKET DRIVERS

-

7.2 SOFTWARE DEVELOPMENT KIT (SDK)TOOLS AND KITS TO ENGINEER MORE AR/VR EXPERIENCES AND APPLICATIONS

-

7.3 GAME ENGINEBUILDS VIRTUAL WORLDS AND IMMERSIVE GAMING ADVENTURES

-

7.4 MODELING & VISUALIZATION SOFTWAREHELPS DESIGN INTERACTIVE VISUAL EXPERIENCES WITH EXTREME PRECISION AND DETAIL

-

7.5 CONTENT MANAGEMENT SYSTEMMANAGES AR AND VR MULTIMEDIA CONTENT ACROSS MULTIPLE PLATFORMS

-

7.6 TRAINING SIMULATION SOFTWARESIMULATES REALISTIC TRAINING MODULES TO SAVE TIME AND COST

- 7.7 OTHER SOFTWARE

-

8.1 INTRODUCTIONVERTICAL: AR VR SOFTWARE MARKET DRIVERS

-

8.2 MEDIA & ENTERTAINMENTINCREASING POPULARITY OF AR/VR-BASED GAMING TO DRIVE MARKETUSE CASES- Immersive gaming experiences- Enhanced sports viewing

-

8.3 RETAIL & ECOMMERCERESHAPING VIRTUAL SHOPPING EXPERIENCES WITH AR AND VRUSE CASE- Virtual try-on- Furniture and decor visualization

-

8.4 TRAINING & EDUCATIONELEVATING EDUCATION THROUGH IMMERSIVE TRAINING EXPERIENCESUSE CASES- Employee training- Historical reconstruction

-

8.5 TRAVEL & HOSPITALITYAR AND VR TECHNOLOGIES HELP TRAVELERS RESEARCH, PLAN, AND EXPERIENCE JOURNEYSUSE CASE- Virtual destination tours- Language translation and navigation

-

8.6 REAL ESTATEAR-BASED INSIGHTS AND PROPERTY TOURSUSE CASE- Interactive 3D floor plans- Architectural visualization

-

8.7 MANUFACTURINGAR AND VR ASSIST IN MANUFACTURING TO MAINTAIN RISK-FREE ENVIRONMENTSUSE CASE- Design and prototyping- Quality control

-

8.8 HEALTHCAREAR AND VR TECHNOLOGIES ENHANCE PATIENT CARE, MEDICAL TRAINING, AND THERAPEUTIC INTERVENTIONSUSE CASE- Phobia and PTSD treatment- Surgical planning

-

8.9 AEROSPACE & DEFENSEIMPROVING SITUATIONAL AWARENESS AND PLANNING EFFECTIVE RESPONSE WITH AR AND VR-BASED SIMULATIONUSE CASE- Flight simulation and training- Military training simulation

-

8.10 AUTOMOTIVEAR AND VR TECHNOLOGIES ENHANCE PROTOTYPING PROCESSES BY BUILDING MORE INTERACTIVE 3D MODELSUSE CASE- Vehicle customization- Autonomous vehicle development

-

8.11 OTHER VERTICALSUSE CASE- Remote technical support- Inventory management- Infrastructure design

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICANORTH AMERICA: AR VR SOFTWARE MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTUS- Extensive research in AR and VR to drive marketCANADA- Rising implementation of AR/VR software by enterprises to drive market

-

9.3 EUROPEEUROPE: AR VR SOFTWARE MARKET DRIVERSEUROPE: RECESSION IMPACTUK- Funding initiatives, grants, and tax incentives for tech companies to drive marketGERMANY- Focus on integrating AR and VR within industries and film making to drive marketFRANCE- Favorable government policies and rising adoption of immersive technologies in automobile and fashion industries to drive marketITALY- Increasing demand for AR/VR-based tourism to drive marketSPAIN- Increasing use of AR/VR in building interactive and engaging infrastructure to drive marketNORDICS- Tech-savvy population and robust investment in technology companies to drive marketREST OF EUROPE

-

9.4 ASIA PACIFICASIA PACIFIC: AR VR SOFTWARE MARKET DRIVERSASIA PACIFIC: RECESSION IMPACTCHINA- Robust tech ecosystem to drive marketINDIA- Investments, partnerships, and government support to drive marketJAPAN- Introduction of AR and VR-friendly policies and regulations to drive marketAUSTRALIA & NEW ZEALAND- Increasing application of AR and VR in defense and farming to drive marketSOUTH KOREA- Thriving gaming ecosystem to drive marketSOUTHEAST ASIA- Increasing adoption of AR and VR in tourism to drive marketREST OF ASIA PACIFIC

-

9.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: AR VR SOFTWARE MARKET DRIVERSMIDDLE EAST & AFRICA: RECESSION IMPACTMIDDLE EAST- Growing adoption of AR VR technologies to enhance healthcare and tourism to drive market- Kingdom of Saudi Arabia- United Arab Emirates- Bahrain- Kuwait- Rest of Middle EastAFRICA- Strong initiatives from governments and companies to drive market

-

9.6 LATIN AMERICALATIN AMERICA: AR VR SOFTWARE MARKET DRIVERSLATIN AMERICA: RECESSION IMPACTBRAZIL- Increasing adoption of AR/VR in education and healthcare to drive marketMEXICO- Government initiatives and adoption of AR/VR across diverse sectors to drive marketREST OF LATIN AMERICA

- 10.1 INTRODUCTION

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 10.3 HISTORICAL REVENUE ANALYSIS

- 10.4 MARKET SHARE ANALYSIS OF KEY PLAYERS

-

10.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT

-

10.6 STARTUP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

-

10.7 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHESDEALSOTHERS

-

10.8 AR VR PRODUCT BENCHMARKINGPROMINENT AR SOFTWARE SOLUTIONS- Unity AR Engine- Microsoft Mesh- ARCore- Frontline AR- Zoho Corporation LensPROMINENT VR SOFTWARE SOLUTIONS- Unity VR tools- Oculus Platform SDK- NVIDIA Corporation Omniverse- myVR Software- Wevr Virtual Studio

- 10.9 VALUATION AND FINANCIAL METRICS OF KEY AR VR SOFTWARE VENDORS

-

11.1 KEY PLAYERSMETA- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMICROSOFT- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewGOOGLE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewUNITY TECHNOLOGIES- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewQUALCOMM- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewADOBE- Business overview- Products/Solutions/Services offered- Recent developmentsAUTODESK- Business overview- Products/Solutions/Services offered- Recent developmentsPTC- Business overview- Products/Solutions/Services offered- Recent developmentsTEAMVIEWER- Business overview- Products/Solutions/Services offered- Recent developmentsNVIDIA CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsADVANCED MICRO DEVICES- Business overview- Products/Solutions/Services offered- Recent developmentsZOHO CORPORATIONVMWAREHEXAGON ABMAGIC LEAP

-

11.2 OTHER PLAYERSTAQTILE- Business overview- Products/Solutions/Services offered- Recent developmentsBLIPPARAUGMENTSHAPESXRARUVRSCOPE ARVECTARYEON REALITYWEVRTALESPIN REALITY LABSSQUINTNIANTICMARXENT LABSINGLOBE TECHNOLOGIESULTRALEAPAMELIA VIRTUAL CARE

- 12.1 INTRODUCTION

-

12.2 EXTENDED REALITY MARKETMARKET DEFINITIONMARKET OVERVIEWEXTENDED REALITY MARKET, BY TECHNOLOGYEXTENDED REALITY MARKET, BY VR TECHNOLOGYEXTENDED REALITY MARKET, BY OFFERINGEXTENDED REALITY MARKET, DEVICE TYPEEXTENDED REALITY MARKET, BY REGION

-

12.3 IMMERSIVE ANALYTICS MARKETMARKET DEFINITIONMARKET OVERVIEWIMMERSIVE ANALYTICS MARKET, BY OFFERINGIMMERSIVE ANALYTICS MARKET, BY END-USE INDUSTRYIMMERSIVE ANALYTICS MARKET, BY REGION

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2020–2022

- TABLE 2 RISK ANALYSIS

- TABLE 3 RESEARCH ASSUMPTIONS

- TABLE 4 AR VR SOFTWARE MARKET: ECOSYSTEM

- TABLE 5 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 AVERAGE SELLING PRICE OF KEY PLAYERS, BY VR SOFTWARE (USD)

- TABLE 10 INDICATIVE PRICING ANALYSIS, BY AR SOFTWARE (USD)

- TABLE 11 PATENTS FILED, 2021–2023

- TABLE 12 PATENTS GRANTED IN AR VR SOFTWARE MARKET, 2021–2023

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 VERTICALS (%)

- TABLE 14 KEY BUYING CRITERIA FOR TOP 3 VERTICALS

- TABLE 15 DETAILED LIST OF CONFERENCES AND EVENTS, 2023–2024

- TABLE 16 MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 17 MARKET, BY TECHNOLOGY TYPE, 2017–2022 (USD MILLION)

- TABLE 18 MARKET, BY TECHNOLOGY TYPE, 2023–2028 (USD MILLION)

- TABLE 19 AR SOFTWARE: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 20 AR SOFTWARE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 21 VR SOFTWARE: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 22 VR SOFTWARE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 23 AR VR SOFTWARE MARKET, BY SOFTWARE TYPE, 2017–2022 (USD MILLION)

- TABLE 24 MARKET, BY SOFTWARE TYPE, 2023–2028 (USD MILLION)

- TABLE 25 SOFTWARE DEVELOPMENT KIT: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 26 SOFTWARE DEVELOPMENT KIT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 27 GAME ENGINE: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 28 GAME ENGINE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 29 MODELING & VISUALIZATION SOFTWARE: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 30 MODELING & VISUALIZATION SOFTWARE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 CONTENT MANAGEMENT SYSTEM: AR VR SOFTWARE MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 32 CONTENT MANAGEMENT SYSTEM: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 33 TRAINING SIMULATION SOFTWARE: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 34 TRAINING SIMULATION SOFTWARE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 OTHER SOFTWARE: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 36 OTHER SOFTWARE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 37 MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 38 MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 39 MEDIA & ENTERTAINMENT: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 40 MEDIA & ENTERTAINMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 41 RETAIL & ECOMMERCE: AR VR SOFTWARE MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 42 RETAIL & ECOMMERCE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 TRAINING & EDUCATION: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 44 TRAINING & EDUCATION: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 45 TRAVEL & HOSPITALITY: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 46 TRAVEL & HOSPITALITY: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 47 REAL ESTATE: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 48 REAL ESTATE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 MANUFACTURING: AR VR SOFTWARE MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 50 MANUFACTURING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 51 HEALTHCARE: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 52 HEALTHCARE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 53 AEROSPACE & DEFENSE: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 54 AEROSPACE & DEFENSE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 55 AUTOMOTIVE: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 56 AUTOMOTIVE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 57 OTHER VERTICALS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 58 OTHER VERTICALS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 59 MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 60 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 61 NORTH AMERICA: AR VR SOFTWARE MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 62 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 63 NORTH AMERICA: MARKET, BY TECHNOLOGY TYPE, 2017–2022 (USD MILLION)

- TABLE 64 NORTH AMERICA: MARKET, BY TECHNOLOGY TYPE, 2023–2028 (USD MILLION)

- TABLE 65 NORTH AMERICA: MARKET, BY SOFTWARE TYPE, 2017–2022 (USD MILLION)

- TABLE 66 NORTH AMERICA: MARKET, BY SOFTWARE TYPE, 2023–2028 (USD MILLION)

- TABLE 67 NORTH AMERICA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 68 NORTH AMERICA: AR VR SOFTWARE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 69 US: MARKET, BY TECHNOLOGY TYPE, 2017–2022 (USD MILLION)

- TABLE 70 US: MARKET, BY TECHNOLOGY TYPE, 2023–2028 (USD MILLION)

- TABLE 71 US: MARKET, BY SOFTWARE TYPE, 2017–2022 (USD MILLION)

- TABLE 72 US: MARKET, BY SOFTWARE TYPE, 2023–2028 (USD MILLION)

- TABLE 73 US: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 74 US: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 75 CANADA: MARKET, BY TECHNOLOGY TYPE, 2017–2022 (USD MILLION)

- TABLE 76 CANADA: MARKET, BY TECHNOLOGY TYPE, 2023–2028 (USD MILLION)

- TABLE 77 CANADA: AR VR SOFTWARE MARKET, BY SOFTWARE TYPE, 2017–2022 (USD MILLION)

- TABLE 78 CANADA MARKET, BY SOFTWARE TYPE, 2023–2028 (USD MILLION)

- TABLE 79 CANADA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 80 CANADA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 81 EUROPE: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 82 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 83 EUROPE: MARKET, BY TECHNOLOGY TYPE, 2017–2022 (USD MILLION)

- TABLE 84 EUROPE: MARKET, BY TECHNOLOGY TYPE, 2023–2028 (USD MILLION)

- TABLE 85 EUROPE: MARKET, BY SOFTWARE TYPE, 2017–2022 (USD MILLION)

- TABLE 86 EUROPE: MARKET, BY SOFTWARE TYPE, 2023–2028 (USD MILLION)

- TABLE 87 EUROPE: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 88 EUROPE: AR VR SOFTWARE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 89 UK: MARKET, BY TECHNOLOGY TYPE, 2017–2022 (USD MILLION)

- TABLE 90 UK: MARKET, BY TECHNOLOGY TYPE, 2023–2028 (USD MILLION)

- TABLE 91 UK: MARKET, BY SOFTWARE TYPE, 2017–2022 (USD MILLION)

- TABLE 92 UK: MARKET, BY SOFTWARE TYPE, 2023–2028 (USD MILLION)

- TABLE 93 UK: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 94 UK: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 95 ASIA PACIFIC: AR VR SOFTWARE MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 96 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 97 ASIA PACIFIC: MARKET, BY TECHNOLOGY TYPE, 2017–2022 (USD MILLION)

- TABLE 98 ASIA PACIFIC: MARKET, BY TECHNOLOGY TYPE, 2023–2028 (USD MILLION)

- TABLE 99 ASIA PACIFIC: MARKET, BY SOFTWARE TYPE, 2017–2022 (USD MILLION)

- TABLE 100 ASIA PACIFIC: MARKET, BY SOFTWARE TYPE, 2023–2028 (USD MILLION)

- TABLE 101 ASIA PACIFIC: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 102 ASIA PACIFIC: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 103 CHINA: AR VR SOFTWARE MARKET, BY TECHNOLOGY TYPE, 2017–2022 (USD MILLION)

- TABLE 104 CHINA: MARKET, BY TECHNOLOGY TYPE, 2023–2028 (USD MILLION)

- TABLE 105 CHINA: MARKET, BY SOFTWARE TYPE, 2017–2022 (USD MILLION)

- TABLE 106 CHINA: MARKET, BY SOFTWARE TYPE, 2023–2028 (USD MILLION)

- TABLE 107 CHINA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 108 CHINA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 109 MIDDLE EAST & AFRICA: AR VR SOFTWARE MARKET, BY TECHNOLOGY TYPE, 2017–2022 (USD MILLION)

- TABLE 110 MIDDLE EAST & AFRICA: MARKET, BY TECHNOLOGY TYPE, 2023–2028 (USD MILLION)

- TABLE 111 MIDDLE EAST & AFRICA: MARKET, BY SOFTWARE TYPE, 2017–2022 (USD MILLION)

- TABLE 112 MIDDLE EAST & AFRICA: MARKET, BY SOFTWARE TYPE, 2023–2028 (USD MILLION)

- TABLE 113 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 114 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 115 MIDDLE EAST & AFRICA: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 116 MIDDLE EAST & AFRICA: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 117 MIDDLE EAST: AR VR SOFTWARE MARKET, BY TECHNOLOGY TYPE, 2017–2022 (USD MILLION)

- TABLE 118 MIDDLE EAST: MARKET, BY TECHNOLOGY TYPE, 2023–2028 (USD MILLION)

- TABLE 119 MIDDLE EAST: MARKET, BY SOFTWARE TYPE, 2017–2022 (USD MILLION)

- TABLE 120 MIDDLE EAST: MARKET, BY SOFTWARE TYPE, 2023–2028 (USD MILLION)

- TABLE 121 MIDDLE EAST: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 122 MIDDLE EAST: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 123 MIDDLE EAST: MARKET, BY COUNTRY/REGION, 2017–2022 (USD MILLION)

- TABLE 124 MIDDLE EAST: MARKET, BY COUNTRY/REGION, 2023–2028 (USD MILLION)

- TABLE 125 KINGDOM OF SAUDI ARABIA: AR VR SOFTWARE MARKET, BY TECHNOLOGY TYPE, 2017–2022 (USD MILLION)

- TABLE 126 KINGDOM OF SAUDI ARABIA: MARKET, BY TECHNOLOGY TYPE, 2023–2028 (USD MILLION)

- TABLE 127 KINGDOM OF SAUDI ARABIA: MARKET, BY SOFTWARE TYPE, 2017–2022 (USD MILLION)

- TABLE 128 KINGDOM OF SAUDI ARABIA: MARKET, BY SOFTWARE TYPE, 2023–2028 (USD MILLION)

- TABLE 129 LATIN AMERICA: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 130 LATIN AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 131 LATIN AMERICA: MARKET, BY TECHNOLOGY TYPE, 2017–2022 (USD MILLION)

- TABLE 132 LATIN AMERICA: MARKET, BY TECHNOLOGY TYPE, 2023–2028 (USD MILLION)

- TABLE 133 LATIN AMERICA: MARKET, BY SOFTWARE TYPE, 2017–2022 (USD MILLION)

- TABLE 134 LATIN AMERICA: MARKET, BY SOFTWARE TYPE, 2023–2028 (USD MILLION)

- TABLE 135 LATIN AMERICA: AR VR SOFTWARE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 136 LATIN AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 137 BRAZIL: MARKET, BY TECHNOLOGY TYPE, 2017–2022 (USD MILLION)

- TABLE 138 BRAZIL: MARKET, BY TECHNOLOGY TYPE, 2023–2028 (USD MILLION)

- TABLE 139 BRAZIL: MARKET, BY SOFTWARE TYPE, 2017–2022 (USD MILLION)

- TABLE 140 BRAZIL: MARKET, BY SOFTWARE TYPE, 2023–2028 (USD MILLION)

- TABLE 141 BRAZIL: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 142 BRAZIL: AR VR SOFTWARE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 143 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 144 MARKET: DEGREE OF COMPETITION

- TABLE 145 COMPANY FOOTPRINT

- TABLE 146 TECHNOLOGY FOOTPRINT

- TABLE 147 SOFTWARE FOOTPRINT

- TABLE 148 REGIONAL FOOTPRINT

- TABLE 149 DETAILED LIST OF STARTUPS/SMES

- TABLE 150 COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 151 COMPETITIVE BENCHMARKING OF KEY PLAYERS

- TABLE 152 MARKET: PRODUCT LAUNCHES, JANUARY 2021–SEPTEMBER 2023

- TABLE 153 MARKET: DEALS, JANUARY 2021–SEPTEMBER 2023

- TABLE 154 AR VR SOFTWARE MARKET: OTHERS

- TABLE 155 COMPARATIVE ANALYSIS OF PROMINENT AR SOFTWARE

- TABLE 156 COMPARATIVE ANALYSIS OF PROMINENT VR SOFTWARE

- TABLE 157 META: COMPANY OVERVIEW

- TABLE 158 META: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 159 META: DEALS

- TABLE 160 MICROSOFT: COMPANY OVERVIEW

- TABLE 161 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 162 MICROSOFT: DEALS

- TABLE 163 GOOGLE: COMPANY OVERVIEW

- TABLE 164 GOOGLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 165 GOOGLE: PRODUCT LAUNCHES

- TABLE 166 GOOGLE: DEALS

- TABLE 167 UNITY TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 168 UNITY TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 169 UNITY TECHNOLOGIES: DEALS

- TABLE 170 QUALCOMM: COMPANY OVERVIEW

- TABLE 171 QUALCOMM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 172 QUALCOMM: DEALS

- TABLE 173 QUALCOMM: OTHERS

- TABLE 174 ADOBE: COMPANY OVERVIEW

- TABLE 175 ADOBE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 176 ADOBE: DEALS

- TABLE 177 AUTODESK: COMPANY OVERVIEW

- TABLE 178 AUTODESK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 179 AUTODESK: DEALS

- TABLE 180 PTC: COMPANY OVERVIEW

- TABLE 181 PTC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 182 PTC: PRODUCT LAUNCHES

- TABLE 183 PTC: DEALS

- TABLE 184 TEAMVIEWER: COMPANY OVERVIEW

- TABLE 185 TEAMVIEWER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 186 TEAMVIEWER: PRODUCT LAUNCHES

- TABLE 187 TEAMVIEWER: DEALS

- TABLE 188 NVIDIA CORPORATION: COMPANY OVERVIEW

- TABLE 189 NVIDIA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 190 NVIDIA CORPORATION: PRODUCT LAUNCHES

- TABLE 191 NVIDIA CORPORATION: DEALS

- TABLE 192 ADVANCED MICRO DEVICES: COMPANY OVERVIEW

- TABLE 193 ADVANCED MICRO DEVICES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 194 ADVANCED MICRO DEVICES: DEALS

- TABLE 195 TAQTILE: COMPANY OVERVIEW

- TABLE 196 TAQTILE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 197 TAQTILE: PRODUCT LAUNCHES

- TABLE 198 TAQTILE: DEALS

- TABLE 199 EXTENDED REALITY MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 200 EXTENDED REALITY MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 201 VR TECHNOLOGY: EXTENDED REALITY MARKET, BY TECHNOLOGY TYPE, 2019–2022 (USD MILLION)

- TABLE 202 VR TECHNOLOGY: EXTENDED REALITY MARKET, BY TECHNOLOGY TYPE, 2023–2028 (USD MILLION)

- TABLE 203 EXTENDED REALITY MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 204 EXTENDED REALITY MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 205 HARDWARE: EXTENDED REALITY MARKET, BY COMPONENT, 2019–2022 (USD MILLION)

- TABLE 206 HARDWARE: EXTENDED REALITY MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 207 AR SOFTWARE: EXTENDED REALITY MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 208 AR SOFTWARE: EXTENDED REALITY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 209 VR SOFTWARE: EXTENDED REALITY MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 210 VR SOFTWARE: EXTENDED REALITY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 211 MR SOFTWARE: EXTENDED REALITY MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 212 MR SOFTWARE: EXTENDED REALITY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 213 EXTENDED REALITY MARKET, BY DEVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 214 EXTENDED REALITY MARKET, BY DEVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 215 EXTENDED REALITY MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 216 EXTENDED REALITY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 217 IMMERSIVE ANALYTICS MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 218 IMMERSIVE ANALYTICS MARKET, BY HARDWARE, 2023–2028 (USD MILLION)

- TABLE 219 AR/VR/MR HEADSETS: IMMERSIVE ANALYTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 220 DISPLAYS: IMMERSIVE ANALYTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 221 SENSORS & CONTROLLERS: IMMERSIVE ANALYTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 222 OTHER HARDWARE: IMMERSIVE ANALYTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 223 IMMERSIVE ANALYTICS MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 224 PROFESSIONAL SERVICES: IMMERSIVE ANALYTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 225 MANAGED SERVICES: IMMERSIVE ANALYTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 226 IMMERSIVE ANALYTICS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 227 MEDIA & ENTERTAINMENT: IMMERSIVE ANALYTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 228 HEALTHCARE: IMMERSIVE ANALYTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 229 AUTOMOTIVE & TRANSPORTATION: IMMERSIVE ANALYTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 230 CONSTRUCTION: IMMERSIVE ANALYTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 231 GOVERNMENT & DEFENSE: IMMERSIVE ANALYTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 232 OTHER END-USE INDUSTRIES: IMMERSIVE ANALYTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 233 IMMERSIVE ANALYTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- FIGURE 1 AR VR SOFTWARE MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

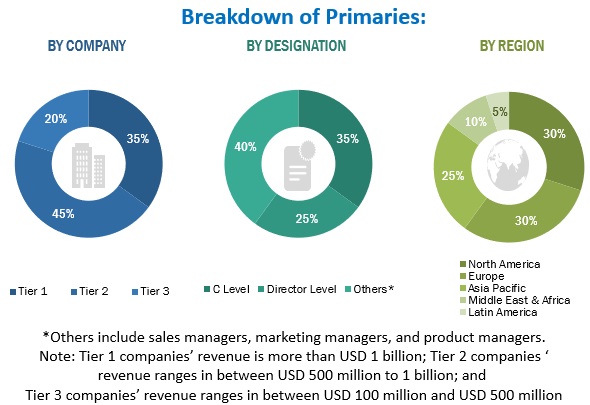

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 1 (SUPPLY SIDE): REVENUE OF OFFERINGS IN MARKET

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 2 (DEMAND SIDE): MARKET

- FIGURE 6 BOTTOM-UP APPROACH

- FIGURE 7 AR VR SOFTWARE MARKET SIZE ESTIMATION METHODOLOGY USING BOTTOM-UP APPROACH

- FIGURE 8 TOP-DOWN APPROACH

- FIGURE 9 DATA TRIANGULATION

- FIGURE 10 MARKET TO WITNESS SIGNIFICANT GROWTH DURING FORECAST PERIOD

- FIGURE 11 AR VR SOFTWARE MARKET: REGIONAL SNAPSHOT

- FIGURE 12 GOVERNMENT INITIATIVES AND STRONG REGULATORY FRAMEWORK TO DRIVE MARKET

- FIGURE 13 AR SOFTWARE SEGMENT TO REGISTER HIGHER GROWTH RATE DURING FORECAST PERIOD

- FIGURE 14 SOFTWARE DEVELOPMENT KIT SEGMENT ESTIMATED TO LEAD MARKET IN 2023

- FIGURE 15 MEDIA & ENTERTAINMENT SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 16 AR SOFTWARE AND MEDIA & ENTERTAINMENT SEGMENTS ESTIMATED TO HOLD LARGEST MARKET SHARES IN 2023

- FIGURE 17 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 BRIEF HISTORY OF AR/VR SOFTWARE

- FIGURE 19 MARKET ECOSYSTEM MAPPING

- FIGURE 20 AR VR SOFTWARE MARKET: VALUE CHAIN ANALYSIS

- FIGURE 21 NUMBER OF PATENTS GRANTED ANNUALLY, 2021–2023

- FIGURE 22 TOP 10 PATENT APPLICANTS WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2021–2023

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 VERTICALS

- FIGURE 24 KEY BUYING CRITERIA FOR TOP 3 VERTICALS

- FIGURE 25 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 26 AR VR SOFTWARE SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 27 TRAINING SIMULATION SOFTWARE SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 28 TRAVEL & HOSPITALITY SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 29 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 30 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 31 HISTORICAL REVENUE ANALYSIS OF KEY PLAYERS, 2020–2022 (USD MILLION)

- FIGURE 32 MARKET: COMPANY EVALUATION MATRIX, 2023

- FIGURE 33 AR VR SOFTWARE MARKET: STARTUP/SME EVALUATION MATRIX, 2023

- FIGURE 34 VALUATION AND FINANCIAL METRICS OF KEY AR VR SOFTWARE VENDORS

- FIGURE 35 META: COMPANY SNAPSHOT

- FIGURE 36 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 37 GOOGLE: COMPANY SNAPSHOT

- FIGURE 38 UNITY TECHNOLOGIES: COMPANY SNAPSHOT

- FIGURE 39 QUALCOMM: COMPANY SNAPSHOT

- FIGURE 40 ADOBE: COMPANY SNAPSHOT

- FIGURE 41 AUTODESK: COMPANY SNAPSHOT

- FIGURE 42 PTC: COMPANY SNAPSHOT

- FIGURE 43 TEAMVIEWER: COMPANY SNAPSHOT

- FIGURE 44 NVIDIA CORPORATION: COMPANY SNAPSHOT

- FIGURE 45 ADVANCED MICRO DEVICES: COMPANY SNAPSHOT

This research study involved the extensive use of secondary sources, directories, and databases, such as Dun & Bradstreet (D&B) Hoovers and Bloomberg BusinessWeek, to identify and collect information useful for a technical, market-oriented, and commercial study of the AR VR Software market. The primary sources have been mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all segments of the value chain of this market. In-depth interviews have been conducted with various primary respondents, including key industry participants, subject matter experts, C-level executives of key market players, and industry consultants to obtain and verify critical qualitative and quantitative information.

Secondary Research

The market for companies offering AR VR Software solutions and services to different verticals has been estimated and projected based on the secondary data made available through paid and unpaid sources, as well as by analyzing their product portfolios in the ecosystem of the AR VR Software market. It also involved rating company products based on their performance and quality. In the secondary research process, various sources such as the Immersive Technology Alliance (ITA), International Virtual Reality and Healthcare Association (IVHA), VR/AR Association (VRARA), Augmented Reality for Enterprise Alliance (AREA), have been referred to for identifying and collecting information for this study on the AR VR Software market. The secondary sources included annual reports, press releases and investor presentations of companies, white papers, journals, and certified publications and articles by recognized authors, directories, and databases. Secondary research has been mainly used to obtain key information about the supply chain of the market, the total pool of key players, market classification, segmentation according to industry trends to the bottommost level, regional markets, and key developments from both market- and technology-oriented perspectives that have been further validated by primary sources.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from AR VR Software solution vendors, SIs, professional service providers, and industry associations; and key opinion leaders. Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using AR VR Software solutions, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of AR VR Software solutions which would impact the overall AR VR Software market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the size of the AR VR Software market. The first approach involves estimating market size by summing up the revenue generated by companies through the sale of AR and VR Software offerings.

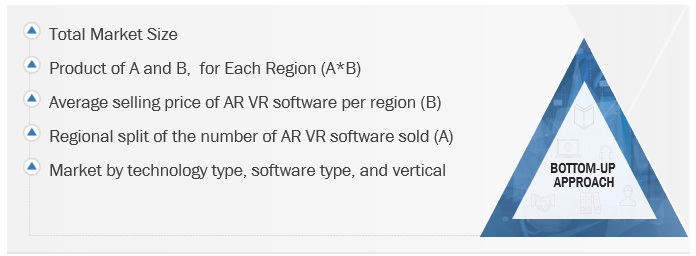

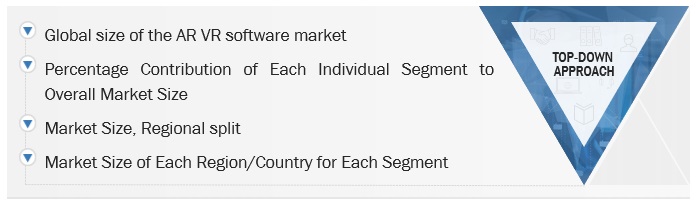

Both top-down and bottom-up approaches were used to estimate and validate the total size of the AR VR Software market. These methods were extensively used to estimate the size of various segments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

AR VR Software Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

AR VR Software Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size, the AR VR Software market was divided into several segments and subsegments. A data triangulation procedure was used to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Market Definition

AR and VR software refer to computer programs and applications designed to create interactive, immersive, and often sensory-rich digital experiences. AR software overlays digital information onto the real world, enhancing it with digital elements, while VR software completely immerses users in a computer-generated environment, typically through headsets or other devices. These software technologies find applications in gaming, education, training, simulations, entertainment, and various industries, transforming how users interact with digital content and their surroundings.

Key Stakeholders

- AR VR Software providers

- Government organizations, forums, alliances, and associations

- Consulting service providers

- Value-added resellers (VARs)

- End users

- System integrators

- Research organizations

- Consulting companies

Report Objectives

- To determine and forecast the global AR VR Software market by technology (AR software, VR software), software type, vertical, and region from 2023 to 2038, and analyze the various macroeconomic and microeconomic factors affecting market growth.

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market.

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall market.

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the AR VR Software market.

- To profile the key market players; provide a comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the market's competitive landscape.

- Track and analyze competitive developments in the market, such as mergers and acquisitions, product developments, partnerships and collaborations, and research and development (R&D) activities.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Country-wise information

- Analysis for additional countries (up to five)

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in AR VR Software Market