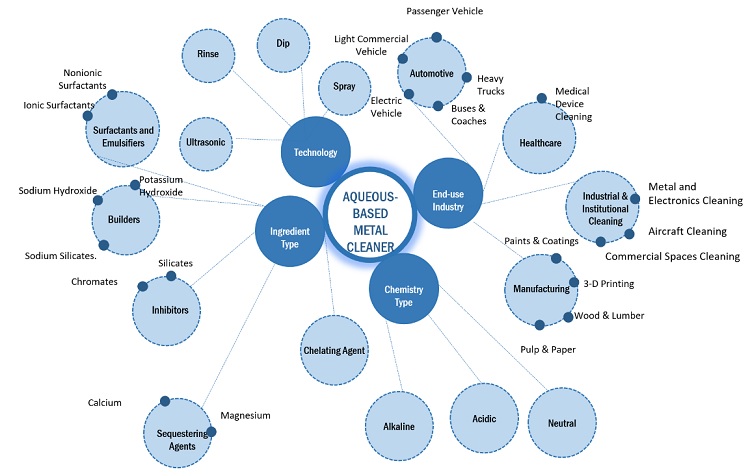

Aqueous-based Metal Cleaners Market by Cleaning Chemicals (Builders, Sequestrants & Inhibitors, Surfactants), End-use Industries (Manufacturing, Automotive & Aerospace, Healthcare), Chemistry Type, Technology and Region- Global Forecast to 2027

Updated on : August 06, 2024

Aqueous-based Metal Cleaners Market

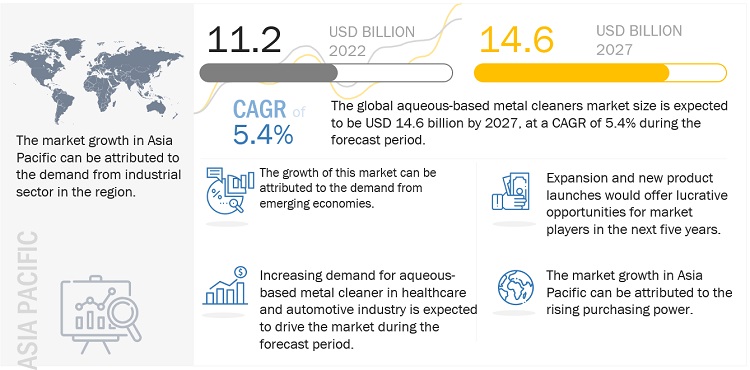

The global aqueous-based metal cleaners market was valued at USD 11.2 billion in 2022 and is projected to reach USD 14.6 billion by 2027, growing at 5.4% cagr from 2022 to 2027. The use of trichloroethylene and other solvents results in health and environmental risks and is, therefore, not the preferred choice. Companies operating in the market have also realized the advantages of using safe and sustainable operating practices. There has been an increase in demand for green alternatives. The growing preference for aqueous-based metal cleaning, the rapidly growing automotive and manufacturing industry, and the transition to safer alternatives for solvent-degreasing applications are the major factors driving the market. The major restraints of this market are the impact of these chemicals on the environment and the high energy needed compared to solvent cleaners

Attractive Opportunities in the Aqueous-Based Metal Cleaners Market

e-estimated, p-projected

To know about the assumptions considered for the study, Request for Free Sample Report

Aqueous-based Metal Cleaners Market Dynamics

Driver: Rapidly growing automotive and manufacturing industries

Automotive and manufacturing are the key end-use industries of aqueous-based metal cleaners. The use of aqueous-based metal cleaners in the manufacturing of body parts is essential. Aqueous-based metal cleaners clean metal body parts of vehicles. There is increased production of vehicles globally. This leads to an increase in the usage of aqueous-based metal cleaners in the industry. Aqueous-based metal cleaners are also widely used in the manufacturing industry as they are used for the removal of metallic scale and corrosion products.

Restraint: Factors pertaining to environmental responsibility

Certain aqueous-based metal cleaners are classified as more dangerous than specific solvent metal cleaners based on toxicity. Thus lies the importance of proper wastewater treatment. Even when the aqueous-based cleaners are classified as biodegradable, the soil generated should not be. Thus, the treatment and disposal of wastewater are of great importance. In aqueous-based metal cleaning, as soils and contaminants are emulsified and removed from the water, the quality of cleaning will depend on the number and quality of the rinsing baths with demineralized water. The higher the quality of cleaning, the investment and space requirements for aqueous-based cleaning will increase accordingly.

Opportunity: Green and biobased alternatives to traditional metal cleaners

Biobased cleaners have plant and/or animal materials as their main ingredients. They are made from renewable resources, and with some exceptions, they generally do not contain synthetics, toxins, or environmentally damaging substances. These chemicals are witnessing increasing demand in European and North American regions as a result of government regulations and initiatives promoting the use of biobased materials. Companies are now innovating and offering biobased alternatives in the market. The use of biobased alternatives helps to avoid any hazardous conditions as they do not react with other chemicals and prevents the use of any special personal protective equipment (PPE), which saves costs and aids worker safety. It can also be stored indefinitely and is safe to use and dispose of. These factors can drive the aqueous cleaning chemical market.

Aqueous-based Metal Cleaners Market Ecosystem

“Ultrasonic was the largest technology of aqueous-based metal cleaners market industry, in terms of value, in 2021”

In ultrasonic cleaning, a sound wave is created in the water, similar to an audio speaker, when it creates sound in the air by vibrating a diaphragm. When the sound wave passes across the water, alternating areas of high and low pressures are generated. This technology is more suitable for small and intricate components, mostly in the healthcare, precision optics, jewelry, and electronics industry where a high level of cleanliness is required. Ultrasonic cleaning eliminates foreign contaminates from equipment surfaces which reduces maintenance-related problems. This can reduce maintenance which can lead to continued production.

“Acidic was the second-fastest growing chemistry type of aqueous-based metal cleaners market industry, in terms of value, in 2021”

After alkaline cleaners, acidic cleaners are the second-most widely used globally. Acidic metal cleaners are aqueous-based mixtures with a pH level of less than 7. They are used in the removal of scale, rust, and oxides from metals. Surface treatments, including phosphating and brightening, use acidic chemistry types of aqueous solutions. Use of eye protection equipment and gloves is required to protect from fumes while using acidic cleaners.

“Sequestrants and inhibitors is the second fastest-growing cleaning chemicals of aqueous-based metal cleaners market, in terms of value, in 2021”

Sequestrants are water conditioners that prevent the precipitation and deposit of metal ions in alkaline media. They help in the removal of oxide layers without attacking the base metal and to control water hardness. Their function is to form soluble complexes with calcium and magnesium or metals from dissolved oxides. Such sequestrants include tripolyphosphates, organic phosphates, and polycarbonic acid salts such as sodium gluconates. Inhibitors are used in aqueous-based metal cleaning solutions again corrosion. The corrosion of metal parts during cleaning is of lesser importance with alkaline cleaners and ferrous metals. In alkaline solutions, iron and steel are relatively stable. The case is different for acid systems or for non-ferrous metals. Various substances can be used depending on the builder system, the pH value, and the workpiece metal.

“Healthcare was the fastest growing end-use industry of aqueous-based metal cleaners market, in terms of value, in 2021”

Using aqueous-based metal cleaners in the healthcare industry is paving the way to several benefits in terms of effectiveness, fewer surface residues, and easier cleaning. Aqueous-based cleaning is done in two steps depending on the types of residues involved. First, an alkaline cleaner removes all oily residues, followed by a rinse to prevent drag out. Second, this is followed by an acid cleaner and thorough rinse to remove alkaline-insoluble inorganic materials.

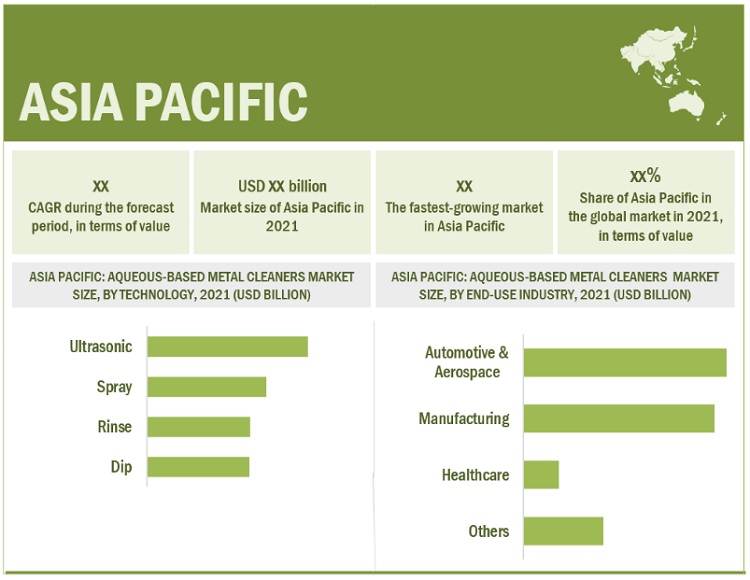

“Asia Pacific to account for the largest share of the global aqueous-based metal cleaners market, in terms of value, in 2021”

Asia Pacific is projected to be the largest, as well as the fastest-growing aqueous-based metal cleaners industry, in terms of both value and volume, during the forecast period. The region is a global manufacturing hub and has one of the largest numbers of on-road vehicles in the world. The growth of the aqueous-based metal cleaners market in the region is supported by rising incomes, the standard of living, population, and exports. The high economic growth in developing countries and increasing disposable incomes have made Asia Pacific an attractive market for aqueous-based metal cleaners. The tremendous growth of industrial production increased trade, and the rise in the demand for vehicles is primarily responsible for the high consumption of aqueous-based metal cleaners in the region. China, Japan, India, and South Korea are the major markets for aqueous-based metal cleaners in Asia Pacific .

Source: Secondary Research, Expert Interviews, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Aqueous-based Metal Cleaners Market Players

The key market players profiled in the report include BASF SE (Germany), Dow Inc. (US), Stepan Company (US), Evonik Industries AG (Germany), Eastman Chemical Company (US), Nouryon (Netherlands), Clariant AG (Switzerland), The Chemours Company (US), Indorama Ventures Public Company Limited (Thailand), Ashland Global Holdings Inc. (US) and others.

Aqueous-based Metal Cleaners Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2017-2027 |

|

Base Year Considered |

2021 |

|

Forecast period |

2022–2027 |

|

Units considered |

Value (USD Billion), Volume (Kiloton) |

|

Segments covered |

Technology, Chemistry Type, Cleaning Chemicals, End-Use Industry, and Region |

|

Regions covered |

Europe, North America, Asia Pacific, Middle East & Africa, and South America |

|

Companies profiled |

BASF SE (Germany), Dow Inc. (US), Stepan Company (US), Evonik Industries AG (Germany), Eastman Chemical Company (US), Nouryon (Netherlands), Clariant AG (Switzerland), The Chemours Company (US), Indorama Ventures Public Company Limited (Thailand), Ashland Global Holdings Inc. (US), and others |

This report categorizes the global aqueous-based metal cleaners market based on technology, chemistry type, cleaning chemicals, end-use industry, and region.

On the basis of technology, the aqueous-based metal cleaners market has been segmented as follows:

- Ultrasonic

- Rinse

- Dip

- Spray

On the basis of chemistry type, the aqueous-based metal cleaners market has been segmented as follows:

- Alkaline

- Acidic

- Neutral

On the basis of cleaning chemicals, the aqueous-based metal cleaners market has been segmented as follows:

- Builders

- Sequestrants and inhibitors

-

Surfactants

-

Ionic

- -Anionic

- -Cationic

- Non-ionic

-

Ionic

- Others

On the basis of end-use industries, the aqueous-based metal cleaners market has been segmented as follows:

- Manufacturing

- Automotive & Aerospace

- Healthcare

- Others

On the basis of region, the aqueous-based metal cleaners market has been segmented as follows:

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- South America

Recent Developments:

- In October 2022, The surface treatment global business unit of BASF’s coatings division, operating under the Chemetall brand, opened its first regional innovation and technology center for applied surface treatment technology in Shanghai, China..

- In September 2022, Stepan Company announced the completion of its acquisition of the surfactant business and associated assets of PerformanX Specialty Chemicals, LLC. The acquisition includes intellectual property, commercial relationships, and inventory.

- In April 2019, Chemetall (BASF SE) came into a conclusive agreement with Polymer Ventures to acquire its automotive paint detackification business and shares of Galaxy Chemical Corporation.

Frequently Asked Questions (FAQ):

What is the current size and CAGR of the global aqueous-based metal cleaners market?

The global aqueous-based metal cleaners market will grow to USD 14.6 billion by 2027, at a CAGR of 5.4% from USD 11.2 billion in 2022

What are the major factors impacting market growth during the forecast period?

The growing preference for aqueous-based metal cleaning, the rapidly growing automotive and manufacturing industry, and the transition to safer alternatives for solvent-degreasing applications are the major factors driving the aqueous-based metal cleaners market. The major restraints of this market are the impact of these chemicals on the environment and the high energy needed compared to solvent cleaners.

What is the main opportunity the market has during the forecast period?

Biobased products are given preference over traditional products through various government initiatives, which is expected to drive the demand for biobased alternatives in metal cleaning. According to the United States Department of Agriculture (USDA), the Office of Contracting & Procurement (OCP) serves the secretary and USDA agencies with policy, advice, and coordination of contracting.

Which are the significant players operating in the aqueous-based metal cleaners market?

BASF SE (Germany), Dow Inc. (US), Stepan Company (US), Evonik Industries AG (Germany), Eastman Chemical Company (US), Nouryon (Netherlands), Clariant AG (Switzerland), The Chemours Company (US), Indorama Ventures Public Company Limited (Thailand), Ashland Global Holdings Inc. (US) and among others

Which region will lead the market during the forecast period?

Asia Pacific is expected to lead the market during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rapidly growing automotive and manufacturing industries- Increasing demand for aqueous-based metal cleaners over solvent-based cleaners- Transition to safer alternatives for solvent degreasing applicationsRESTRAINTS- Factors pertaining to environmental responsibility- Higher energy demand compared to solvent cleanersOPPORTUNITIES- Green and biobased alternatives to traditional metal cleaners- Increased demand for aqueous metal cleaners from 3D printing industryCHALLENGES- Potential for re-use and recycling in solvent cleaning

-

5.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.4 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.5 MACROECONOMIC INDICATORSGDP TRENDS AND FORECAST FOR MAJOR ECONOMIES

-

6.1 SUPPLY CHAIN ANALYSISRAW MATERIALSMETAL CLEANING CHEMICAL MANUFACTURERS FOR AQUEOUS FORMULATIONSFINISHED AQUEOUS-BASED METAL CLEANER MANUFACTURERSDISTRIBUTION NETWORKEND-USE INDUSTRIES

-

6.2 AQUEOUS-BASED METAL CLEANERS MARKET: REALISTIC, PESSIMISTIC, OPTIMISTIC, AND NON-COVID-19 SCENARIOSNON-COVID-19 SCENARIOOPTIMISTIC SCENARIOPESSIMISTIC SCENARIOREALISTIC SCENARIO

-

6.3 PRICING ANALYSISAVERAGE SELLING PRICE FOR END-USE INDUSTRY, BY KEY PLAYERSAVERAGE SELLING PRICE, BY REGION

-

6.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSREVENUE SHIFTS & REVENUE POCKETS FOR AQUEOUS-BASED METAL CLEANERS MARKET

-

6.5 CONNECTED MARKETS: ECOSYSTEM

-

6.6 TECHNOLOGY ANALYSISCYCLIC NUCLEATION PROCESS TECHNOLOGY FOR CLEANING METALSBIO-REMEDIATION

-

6.7 CASE STUDY ANALYSISCASE STUDY ON AEROSOL SERVICE SP. Z O.O.CASE STUDY ON LIGHTOLIER

-

6.8 TRADE DATA STATISTICSIMPORT SCENARIO OF SURFACTANTSEXPORT SCENARIO OF SURFACTANTS

-

6.9 REGULATORY LANDSCAPEREGULATIONS RELATED TO AQUEOUS-BASED METAL CLEANERS

- 6.10 KEY CONFERENCES & EVENTS, 2022–2023

-

6.11 PATENT ANALYSISAPPROACHDOCUMENT TYPEJURISDICTION ANALYSISTOP APPLICANTS

- 7.1 INTRODUCTION

-

7.2 ULTRASONIC TECHNOLOGYHIGH LEVEL OF CLEANLINESS TO FUEL MARKET GROWTH

-

7.3 RINSE TECHNOLOGYAPPLICATION IN VARIOUS CLEANING PROCESSES TO FUEL DEMAND

-

7.4 DIP TECHNOLOGY (IMMERSION)EFFECTIVENESS IN CLEANING DELICATE OBJECTS TO DRIVE DEMAND

-

7.5 SPRAY TECHNOLOGYCOST-EFFECTIVE CLEANING METHOD TO FUEL DEMAND

- 8.1 INTRODUCTION

-

8.2 ALKALINEGROWING AWARENESS AND EXCELLENT PROPERTIES TO DRIVE MARKET

-

8.3 ACIDICUNIQUE COMBINATION OF EXCELLENT PROPERTIES TO DRIVE DEMAND FOR ACIDIC CLEANERS

-

8.4 NEUTRALINCREASING DEMAND FOR ENVIRONMENT-FRIENDLY SOLUTIONS TO DRIVE MARKET

- 9.1 INTRODUCTION

-

9.2 BUILDERSENHANCED CLEANING EFFICIENCY TO PROPEL DEMAND

-

9.3 SEQUESTRANTS & INHIBITORSHIGH PERFORMANCE IN CLEANING OXIDE LAYERS TO DRIVE MARKET

-

9.4 SURFACTANTSWIDE USE IN GENERAL CLEANERS TO DRIVE MARKET

- 9.5 OTHERS

- 10.1 INTRODUCTION

-

10.2 MANUFACTURINGDEMAND FOR SAFER ALTERNATIVE AND PRECISE CLEANING TO BOOST MARKET

-

10.3 AUTOMOTIVE & AEROSPACEGREEN TECHNOLOGIES TO PROPEL DEMAND FOR AQUEOUS-BASED CLEANERS IN AUTOMOTIVE & AEROSPACE

-

10.4 HEALTHCAREINCREASING HEALTHCARE EXPENDITURE TO CREATE FAVORABLE CONDITIONS FOR MARKET GROWTH

-

10.5 OTHERSINCREASED DEMAND FROM SEMICONDUCTOR INDUSTRY TO DRIVE MARKET

- 11.1 INTRODUCTION

- 11.2 IMPACT OF RECESSION

-

11.3 ASIA PACIFICASIA PACIFIC: AQUEOUS-BASED METAL CLEANERS MARKET, BY TECHNOLOGYASIA PACIFIC: AQUEOUS-BASED METAL CLEANERS MARKET, BY CHEMISTRY TYPEASIA PACIFIC: AQUEOUS-BASED METAL CLEANERS MARKET, BY CLEANING CHEMICALSASIA PACIFIC: AQUEOUS-BASED METAL CLEANERS MARKET, BY END-USE INDUSTRYASIA PACIFIC: AQUEOUS-BASED METAL CLEANERS MARKET, BY COUNTRY- China- Japan- India- South Korea

-

11.4 NORTH AMERICANORTH AMERICA: AQUEOUS-BASED METAL CLEANERS MARKET, BY TECHNOLOGYNORTH AMERICA: AQUEOUS-BASED METAL CLEANERS MARKET, BY CHEMISTRY TYPENORTH AMERICA: AQUEOUS-BASED METAL CLEANERS MARKET, BY CLEANING CHEMICALSNORTH AMERICA: AQUEOUS-BASED METAL CLEANERS MARKET, BY END-USE INDUSTRYNORTH AMERICA: AQUEOUS-BASED METAL CLEANERS MARKET, BY COUNTRY- US- Canada- Mexico

-

11.5 EUROPEEUROPE: AQUEOUS-BASED METAL CLEANERS MARKET, BY TECHNOLOGYEUROPE: AQUEOUS-BASED METAL CLEANERS MARKET, BY CHEMISTRY TYPEEUROPE: AQUEOUS-BASED METAL CLEANERS MARKET, BY CLEANING CHEMICALSEUROPE: AQUEOUS-BASED METAL CLEANERS MARKET, BY END-USE INDUSTRYEUROPE: AQUEOUS-BASED METAL CLEANERS MARKET, BY COUNTRY- Germany- UK- France- Italy- Russia- Spain

-

11.6 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: AQUEOUS-BASED METAL CLEANERS MARKET, BY TECHNOLOGYMIDDLE EAST & AFRICA: AQUEOUS-BASED METAL CLEANERS MARKET, BY CHEMISTRY TYPEMIDDLE EAST & AFRICA: AQUEOUS-BASED METAL CLEANERS MARKET, BY CLEANING CHEMICALSMIDDLE EAST & AFRICA: AQUEOUS-BASED METAL CLEANERS MARKET, BY END-USE INDUSTRYMIDDLE EAST & AFRICA: AQUEOUS-BASED METAL CLEANERS MARKET, BY COUNTRY- Saudi Arabia- UAE

-

11.7 SOUTH AMERICASOUTH AMERICA: AQUEOUS-BASED METAL CLEANERS MARKET, BY TECHNOLOGYSOUTH AMERICA: AQUEOUS-BASED METAL CLEANERS MARKET, BY CHEMISTRY TYPESOUTH AMERICA: AQUEOUS-BASED METAL CLEANERS MARKET, BY CLEANING CHEMICALSSOUTH AMERICA: AQUEOUS-BASED METAL CLEANERS MARKET, BY END-USE INDUSTRYSOUTH AMERICA: AQUEOUS-BASED METAL CLEANERS MARKET, BY COUNTRY- Brazil- Argentina

- 12.1 INTRODUCTION

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS

-

12.3 MARKET SHARE ANALYSISRANKING OF KEY MARKET PLAYERS, 2021MARKET SHARE OF KEY PLAYERS- BASF SE- Dow Inc.- Stepan Company- Evonik Industries AG- Eastman Chemical CompanyREVENUE ANALYSIS OF TOP FIVE PLAYERS

- 12.4 COMPANY PRODUCT FOOTPRINT ANALYSIS

-

12.5 COMPANY EVALUATION QUADRANT (TIER 1)STARSEMERGING LEADERSPERVASIVE COMPANIESPARTICIPANTS

- 12.6 COMPETITIVE BENCHMARKING

-

12.7 START-UPS/SMES EVALUATION QUADRANTRESPONSIVE COMPANIESPROGRESSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

12.8 COMPETITIVE SCENARIOSDEALSPRODUCT LAUNCHESOTHER DEVELOPMENTS

-

13.1 MAJOR PLAYERSBASF SE- Business overview- Products offered- Recent developments- MnM viewEVONIK INDUSTRIES AG- Business overview- Products offered- MnM viewSTEPAN COMPANY- Business overview- Products offered- Recent developments- MnM viewEASTMAN CHEMICAL COMPANY- Business overview- Products offered- MnM viewDOW INC.- Business overview- Products offered- MnM viewTHE CHEMOURS COMPANY- Business overview- Products offered- MnM viewNOURYON- Business overview- Products offered- Recent developments- MnM viewCLARIANT AG- Business overview- Products offered- Recent developments- MnM viewINDORAMA VENTURES PUBLIC COMPANY LIMITED- Business overview- Products offered- Recent developments- MnM viewASHLAND GLOBAL HOLDINGS INC.- Business overview- Products offered- MnM view

-

13.2 OTHER KEY MARKET PLAYERSKYZEN CORPORATIONADEKA CORPORATIONAARTI INDUSTRIES LIMITEDCOLONIAL CHEMICALGALAXY SURFACTANTSINNOSPECLANKEM LTDDST-CHEMICALSPCC GROUPPILOT CHEMICAL COMPANYSASOLUNGER FABRIKKER ASELLES OBERFLÄCHEN SYSTEME GMBHENVIROSERVE CHEMICALS INC.TOKYO CHEMICAL INDUSTRY CO.

- 14.1 INTRODUCTION

- 14.2 LIMITATIONS

-

14.3 INDUSTRIAL CLEANING CHEMICALS MARKETMARKET DEFINITIONMARKET OVERVIEWINDUSTRIAL CLEANING CHEMICALS, BY REGION- Asia Pacific- North America- Western Europe- Central & Eastern Europe- South America- Middle East & Africa

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 VAPORIZATION HEAT FOR DRYING PROPERTIES

- TABLE 2 AQUEOUS-BASED METAL CLEANERS MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 3 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE CLEANING CHEMICALS (%)

- TABLE 4 KEY BUYING CRITERIA FOR TOP THREE CLEANING CHEMICALS

- TABLE 5 GDP TRENDS AND FORECAST OF MAJOR ECONOMIES, 2019–2027 (USD BILLION)

- TABLE 6 AQUEOUS-BASED METAL CLEANERS MARKET FORECAST SCENARIO, 2019–2027 (USD MILLION)

- TABLE 7 AVERAGE SELLING PRICE FOR TOP THREE END-USE INDUSTRIES, BY KEY PLAYERS (USD/KG)

- TABLE 8 AVERAGE SELLING PRICE OF AQUEOUS-BASED METAL CLEANERS, BY REGION (USD/KG)

- TABLE 9 AQUEOUS-BASED METAL CLEANERS MARKET: ECOSYSTEM

- TABLE 10 IMPORTS OF SURFACTANTS, BY REGION, 2012–2021 (USD MILLION)

- TABLE 11 EXPORTS OF SURFACTANTS, BY REGION, 2012–2021 (USD MILLION)

- TABLE 12 AQUEOUS-BASED METAL CLEANERS MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- TABLE 13 TOTAL NUMBER OF PATENTS IN LAST 11 YEARS (2011–2021)

- TABLE 14 PATENTS BY PROCTER & GAMBLE

- TABLE 15 LIST OF PATENTS BY ECOLAB INC.

- TABLE 16 TOP 10 PATENT OWNERS IN US, 2011–2021

- TABLE 17 AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY TECHNOLOGY, 2017–2020 (KILOTON)

- TABLE 18 AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY TECHNOLOGY, 2021–2027 (KILOTON)

- TABLE 19 AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

- TABLE 20 AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY TECHNOLOGY, 2021–2027 (USD MILLION)

- TABLE 21 AQUEOUS-BASED METAL CLEANERS MARKET SIZE IN ULTRASONIC TECHNOLOGY, BY REGION, 2017–2020 (KILOTON)

- TABLE 22 AQUEOUS-BASED METAL CLEANERS MARKET SIZE IN ULTRASONIC TECHNOLOGY, BY REGION, 2021–2027 (KILOTON)

- TABLE 23 AQUEOUS-BASED METAL CLEANERS MARKET SIZE IN ULTRASONIC TECHNOLOGY, BY REGION, 2017–2020 (USD MILLION)

- TABLE 24 AQUEOUS-BASED METAL CLEANERS MARKET SIZE IN ULTRASONIC TECHNOLOGY, BY REGION, 2021–2027 (USD MILLION)

- TABLE 25 RINSE TECHNOLOGY: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

- TABLE 26 RINSE TECHNOLOGY: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY REGION, 2021–2027 (KILOTON)

- TABLE 27 RINSE TECHNOLOGY: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

- TABLE 28 RINSE TECHNOLOGY: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

- TABLE 29 DIP TECHNOLOGY: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

- TABLE 30 DIP TECHNOLOGY: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY REGION, 2021–2027 (KILOTON)

- TABLE 31 DIP TECHNOLOGY: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

- TABLE 32 DIP TECHNOLOGY: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

- TABLE 33 SPRAY TECHNOLOGY: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

- TABLE 34 SPRAY TECHNOLOGY: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY REGION, 2021–2027 (KILOTON)

- TABLE 35 SPRAY TECHNOLOGY: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

- TABLE 36 SPRAY TECHNOLOGY: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

- TABLE 37 AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY CHEMISTRY TYPE, 2017–2020 (KILOTON)

- TABLE 38 AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY CHEMISTRY TYPE, 2021–2027 (KILOTON)

- TABLE 39 AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY CHEMISTRY TYPE, 2017–2020 (USD MILLION)

- TABLE 40 AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY CHEMISTRY TYPE, 2021–2027 (USD MILLION)

- TABLE 41 ALKALINE: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

- TABLE 42 ALKALINE: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY REGION, 2021–2027 (KILOTON)

- TABLE 43 ALKALINE: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

- TABLE 44 ALKALINE: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

- TABLE 45 ACIDIC: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

- TABLE 46 ACIDIC: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY REGION, 2021–2027 (KILOTON)

- TABLE 47 ACIDIC: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

- TABLE 48 ACIDIC: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

- TABLE 49 NEUTRAL: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

- TABLE 50 NEUTRAL: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY REGION, 2021–2027 (KILOTON)

- TABLE 51 NEUTRAL: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

- TABLE 52 NEUTRAL: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

- TABLE 53 AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY CLEANING CHEMICALS, 2017–2020 (KILOTON)

- TABLE 54 AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY CLEANING CHEMICALS, 2021–2027 (KILOTON)

- TABLE 55 AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY CLEANING CHEMICALS, 2017–2020 (USD MILLION)

- TABLE 56 AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY CLEANING CHEMICALS, 2021–2027 (USD MILLION)

- TABLE 57 BUILDERS: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

- TABLE 58 BUILDERS: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY REGION, 2021–2027 (KILOTON)

- TABLE 59 BUILDERS: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

- TABLE 60 BUILDERS: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

- TABLE 61 SEQUESTRANTS & INHIBITORS: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

- TABLE 62 SEQUESTRANTS & INHIBITORS: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY REGION, 2021–2027 (KILOTON)

- TABLE 63 SEQUESTRANTS & INHIBITORS: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

- TABLE 64 SEQUESTRANTS & INHIBITORS: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

- TABLE 65 SURFACTANTS: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

- TABLE 66 SURFACTANTS: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY REGION, 2021–2027 (KILOTON)

- TABLE 67 SURFACTANTS: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

- TABLE 68 SURFACTANTS: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

- TABLE 69 OTHERS: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

- TABLE 70 OTHERS: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY REGION, 2021–2027 (KILOTON)

- TABLE 71 OTHERS: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

- TABLE 72 OTHERS: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

- TABLE 73 AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

- TABLE 74 AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

- TABLE 75 AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 76 AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

- TABLE 77 AQUEOUS-BASED METAL CLEANERS MARKET IN MANUFACTURING, BY REGION, 2017–2020 (KILOTON)

- TABLE 78 AQUEOUS-BASED METAL CLEANERS MARKET IN MANUFACTURING, BY REGION, 2021–2027 (KILOTON)

- TABLE 79 AQUEOUS-BASED METAL CLEANERS MARKET IN MANUFACTURING, BY REGION, 2017–2020 (USD MILLION)

- TABLE 80 AQUEOUS-BASED METAL CLEANERS MARKET IN MANUFACTURING, BY REGION, 2021–2027 (USD MILLION)

- TABLE 81 AQUEOUS-BASED METAL CLEANERS MARKET IN AUTOMOTIVE & AEROSPACE, BY REGION, 2017–2020 (KILOTON)

- TABLE 82 AQUEOUS-BASED METAL CLEANERS MARKET IN AUTOMOTIVE & AEROSPACE, BY REGION, 2021–2027 (KILOTON)

- TABLE 83 AQUEOUS-BASED METAL CLEANERS MARKET IN AUTOMOTIVE & AEROSPACE, BY REGION, 2017–2020 (USD MILLION)

- TABLE 84 AQUEOUS-BASED METAL CLEANERS MARKET IN AUTOMOTIVE & AEROSPACE, BY REGION, 2021–2027 (USD MILLION)

- TABLE 85 AQUEOUS-BASED METAL CLEANERS MARKET IN HEALTHCARE, BY REGION, 2017–2020 (KILOTON)

- TABLE 86 AQUEOUS-BASED METAL CLEANERS MARKET IN HEALTHCARE, BY REGION, 2021–2027 (KILOTON)

- TABLE 87 AQUEOUS-BASED METAL CLEANERS MARKET IN HEALTHCARE, BY REGION, 2017–2020 (USD MILLION)

- TABLE 88 AQUEOUS-BASED METAL CLEANERS MARKET IN HEALTHCARE, BY REGION, 2021–2027 (USD MILLION)

- TABLE 89 AQUEOUS-BASED METAL CLEANERS MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2017–2020 (KILOTON)

- TABLE 90 AQUEOUS-BASED METAL CLEANERS MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2021–2027 (KILOTON)

- TABLE 91 AQUEOUS-BASED METAL CLEANERS MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2017–2020 (USD MILLION)

- TABLE 92 AQUEOUS-BASED METAL CLEANERS MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2021–2027 (USD MILLION)

- TABLE 93 AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

- TABLE 94 AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY REGION, 2021–2027 (KILOTON)

- TABLE 95 AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

- TABLE 96 AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

- TABLE 97 ASIA PACIFIC: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY TECHNOLOGY, 2017–2020 (KILOTON)

- TABLE 98 ASIA PACIFIC: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY TECHNOLOGY, 2021–2027 (KILOTON)

- TABLE 99 ASIA PACIFIC: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

- TABLE 100 ASIA PACIFIC: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY TECHNOLOGY, 2021–2027 (USD MILLION)

- TABLE 101 ASIA PACIFIC: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY CHEMISTRY TYPE, 2017–2020 (KILOTON)

- TABLE 102 ASIA PACIFIC: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY CHEMISTRY TYPE, 2021–2027 (KILOTON)

- TABLE 103 ASIA PACIFIC: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY CHEMISTRY TYPE, 2017–2020 (USD MILLION)

- TABLE 104 ASIA PACIFIC: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY CHEMISTRY TYPE, 2021–2027 (USD MILLION)

- TABLE 105 ASIA PACIFIC: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY CLEANING CHEMICALS, 2017–2020 (KILOTON)

- TABLE 106 ASIA PACIFIC: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY CLEANING CHEMICALS, 2021–2027 (KILOTON)

- TABLE 107 ASIA PACIFIC: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY CLEANING CHEMICALS, 2017–2020 (USD MILLION)

- TABLE 108 ASIA PACIFIC: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY CLEANING CHEMICALS, 2021–2027 (USD MILLION)

- TABLE 109 ASIA PACIFIC: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

- TABLE 110 ASIA PACIFIC: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

- TABLE 111 ASIA PACIFIC: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 112 ASIA PACIFIC: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

- TABLE 113 ASIA PACIFIC: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

- TABLE 114 ASIA PACIFIC: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY COUNTRY, 2021–2027 (KILOTON)

- TABLE 115 ASIA PACIFIC: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

- TABLE 116 ASIA PACIFIC: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

- TABLE 117 CHINA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

- TABLE 118 CHINA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

- TABLE 119 CHINA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 120 CHINA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

- TABLE 121 JAPAN: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

- TABLE 122 JAPAN: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

- TABLE 123 JAPAN: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 124 JAPAN: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

- TABLE 125 INDIA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

- TABLE 126 INDIA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

- TABLE 127 INDIA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 128 INDIA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

- TABLE 129 SOUTH KOREA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

- TABLE 130 SOUTH KOREA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

- TABLE 131 SOUTH KOREA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 132 SOUTH KOREA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

- TABLE 133 NORTH AMERICA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY TECHNOLOGY, 2017–2020 (KILOTON)

- TABLE 134 NORTH AMERICA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY TECHNOLOGY, 2021–2027 (KILOTON)

- TABLE 135 NORTH AMERICA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

- TABLE 136 NORTH AMERICA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY TECHNOLOGY, 2021–2027 (USD MILLION)

- TABLE 137 NORTH AMERICA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY CHEMISTRY TYPE, 2017–2020 (KILOTON)

- TABLE 138 NORTH AMERICA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY CHEMISTRY TYPE, 2021–2027 (KILOTON)

- TABLE 139 NORTH AMERICA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY CHEMISTRY TYPE, 2017–2020 (USD MILLION)

- TABLE 140 NORTH AMERICA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY CHEMISTRY TYPE, 2021–2027 (USD MILLION)

- TABLE 141 NORTH AMERICA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY CLEANING CHEMICALS, 2017–2020 (KILOTON)

- TABLE 142 NORTH AMERICA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY CLEANING CHEMICALS, 2021–2027 (KILOTON)

- TABLE 143 NORTH AMERICA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY CLEANING CHEMICALS, 2017–2020 (USD MILLION)

- TABLE 144 NORTH AMERICA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY CLEANING CHEMICALS, 2021–2027 (USD MILLION)

- TABLE 145 NORTH AMERICA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

- TABLE 146 NORTH AMERICA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

- TABLE 147 NORTH AMERICA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 148 NORTH AMERICA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

- TABLE 149 NORTH AMERICA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

- TABLE 150 NORTH AMERICA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY COUNTRY, 2021–2027 (KILOTON)

- TABLE 151 NORTH AMERICA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

- TABLE 152 NORTH AMERICA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

- TABLE 153 US: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

- TABLE 154 US: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

- TABLE 155 US: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 156 US: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

- TABLE 157 CANADA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

- TABLE 158 CANADA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

- TABLE 159 CANADA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 160 CANADA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

- TABLE 161 MEXICO: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

- TABLE 162 MEXICO: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

- TABLE 163 MEXICO: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 164 MEXICO: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

- TABLE 165 EUROPE: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY TECHNOLOGY, 2017–2020 (KILOTON)

- TABLE 166 EUROPE: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY TECHNOLOGY, 2021–2027 (KILOTON)

- TABLE 167 EUROPE: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

- TABLE 168 EUROPE: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY TECHNOLOGY, 2021–2027 (USD MILLION)

- TABLE 169 EUROPE: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY CHEMISTRY TYPE, 2017–2020 (KILOTON)

- TABLE 170 EUROPE: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY CHEMISTRY TYPE, 2021–2027 (KILOTON)

- TABLE 171 EUROPE: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY CHEMISTRY TYPE, 2017–2020 (USD MILLION)

- TABLE 172 EUROPE: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY CHEMISTRY TYPE, 2021–2027 (USD MILLION)

- TABLE 173 EUROPE: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY CLEANING CHEMICALS, 2017–2020 (KILOTON)

- TABLE 174 EUROPE: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY CLEANING CHEMICALS, 2021–2027 (KILOTON)

- TABLE 175 EUROPE: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY CLEANING CHEMICALS, 2017–2020 (USD MILLION)

- TABLE 176 EUROPE: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY CLEANING CHEMICALS, 2021–2027 (USD MILLION)

- TABLE 177 EUROPE: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

- TABLE 178 EUROPE: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

- TABLE 179 EUROPE: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 180 EUROPE: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

- TABLE 181 EUROPE: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

- TABLE 182 EUROPE: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY COUNTRY, 2021–2027 (KILOTON)

- TABLE 183 EUROPE: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

- TABLE 184 EUROPE: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

- TABLE 185 GERMANY: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

- TABLE 186 GERMANY: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

- TABLE 187 GERMANY: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 188 GERMANY: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

- TABLE 189 UK: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

- TABLE 190 UK: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

- TABLE 191 UK: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 192 UK: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

- TABLE 193 FRANCE: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

- TABLE 194 FRANCE: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

- TABLE 195 FRANCE: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 196 FRANCE: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

- TABLE 197 ITALY: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

- TABLE 198 ITALY: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

- TABLE 199 ITALY: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 200 ITALY: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

- TABLE 201 RUSSIA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

- TABLE 202 RUSSIA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

- TABLE 203 RUSSIA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 204 RUSSIA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

- TABLE 205 SPAIN: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

- TABLE 206 SPAIN: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

- TABLE 207 SPAIN: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 208 SPAIN: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

- TABLE 209 MIDDLE EAST & AFRICA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY TECHNOLOGY, 2017–2020 (KILOTON)

- TABLE 210 MIDDLE EAST & AFRICA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY TECHNOLOGY, 2021–2027 (KILOTON)

- TABLE 211 MIDDLE EAST & AFRICA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

- TABLE 212 MIDDLE EAST & AFRICA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY TECHNOLOGY, 2021–2027 (USD MILLION)

- TABLE 213 MIDDLE EAST & AFRICA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY CHEMISTRY TYPE, 2017–2020 (KILOTON)

- TABLE 214 MIDDLE EAST & AFRICA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY CHEMISTRY TYPE, 2021–2027 (KILOTON)

- TABLE 215 MIDDLE EAST & AFRICA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY CHEMISTRY TYPE, 2017–2020 (USD MILLION)

- TABLE 216 MIDDLE EAST & AFRICA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY CHEMISTRY TYPE, 2021–2027 (USD MILLION)

- TABLE 217 MIDDLE EAST & AFRICA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY CLEANING CHEMICALS, 2017–2020 (KILOTON)

- TABLE 218 MIDDLE EAST & AFRICA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY CLEANING CHEMICALS, 2021–2027 (KILOTON)

- TABLE 219 MIDDLE EAST & AFRICA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY CLEANING CHEMICALS, 2017–2020 (USD MILLION)

- TABLE 220 MIDDLE EAST & AFRICA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY CLEANING CHEMICALS, 2021–2027 (USD MILLION)

- TABLE 221 MIDDLE EAST & AFRICA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

- TABLE 222 MIDDLE EAST & AFRICA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

- TABLE 223 MIDDLE EAST & AFRICA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 224 MIDDLE EAST & AFRICA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

- TABLE 225 MIDDLE EAST & AFRICA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

- TABLE 226 MIDDLE EAST & AFRICA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY COUNTRY, 2021–2027 (KILOTON)

- TABLE 227 MIDDLE EAST & AFRICA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

- TABLE 228 MIDDLE EAST & AFRICA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

- TABLE 229 SAUDI ARABIA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

- TABLE 230 SAUDI ARABIA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

- TABLE 231 SAUDI ARABIA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 232 SAUDI ARABIA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

- TABLE 233 UAE: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

- TABLE 234 UAE: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

- TABLE 235 UAE: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 236 UAE: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

- TABLE 237 SOUTH AMERICA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY TECHNOLOGY, 2017–2020 (KILOTON)

- TABLE 238 SOUTH AMERICA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY TECHNOLOGY, 2021–2027 (KILOTON)

- TABLE 239 SOUTH AMERICA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

- TABLE 240 SOUTH AMERICA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY TECHNOLOGY, 2021–2027 (USD MILLION)

- TABLE 241 SOUTH AMERICA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY CHEMISTRY TYPE, 2017–2020 (KILOTON)

- TABLE 242 SOUTH AMERICA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY CHEMISTRY TYPE, 2021–2027 (KILOTON)

- TABLE 243 SOUTH AMERICA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY CHEMISTRY TYPE, 2017–2020 (USD MILLION)

- TABLE 244 SOUTH AMERICA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY CHEMISTRY TYPE, 2021–2027 (USD MILLION)

- TABLE 245 SOUTH AMERICA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY CLEANING CHEMICALS, 2017–2020 (KILOTON)

- TABLE 246 SOUTH AMERICA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY CLEANING CHEMICALS, 2021–2027 (KILOTON)

- TABLE 247 SOUTH AMERICA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY CLEANING CHEMICALS, 2017–2020 (USD MILLION)

- TABLE 248 SOUTH AMERICA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY CLEANING CHEMICALS, 2021–2027 (USD MILLION)

- TABLE 249 SOUTH AMERICA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

- TABLE 250 SOUTH AMERICA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

- TABLE 251 SOUTH AMERICA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 252 SOUTH AMERICA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

- TABLE 253 SOUTH AMERICA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

- TABLE 254 SOUTH AMERICA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY COUNTRY, 2021–2027 (KILOTON)

- TABLE 255 SOUTH AMERICA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

- TABLE 256 SOUTH AMERICA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

- TABLE 257 BRAZIL: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

- TABLE 258 BRAZIL: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

- TABLE 259 BRAZIL: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 260 BRAZIL: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

- TABLE 261 ARGENTINA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

- TABLE 262 ARGENTINA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

- TABLE 263 ARGENTINA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 264 ARGENTINA: AQUEOUS-BASED METAL CLEANERS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

- TABLE 265 OVERVIEW OF STRATEGIES ADOPTED BY KEY MANUFACTURERS

- TABLE 266 AQUEOUS-BASED METAL CLEANERS MARKET: DEGREE OF COMPETITION

- TABLE 267 AQUEOUS-BASED METAL CLEANERS MARKET: CLEANING CHEMICALS FOOTPRINT

- TABLE 268 AQUEOUS-BASED METAL CLEANERS MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 269 AQUEOUS-BASED METAL CLEANERS MARKET: COMPANY REGIONAL FOOTPRINT

- TABLE 270 AQUEOUS-BASED METAL CLEANERS MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 271 AQUEOUS-BASED METAL CLEANERS MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- TABLE 272 AQUEOUS-BASED METAL CLEANERS MARKET: DEALS (2018–2022)

- TABLE 273 AQUEOUS-BASED METAL CLEANERS MARKET: PRODUCT LAUNCHES (2018–2022)

- TABLE 274 AQUEOUS-BASED METAL CLEANERS MARKET: EXPANSIONS, INVESTMENTS, AND INNOVATIONS (2018–2022)

- TABLE 275 BASF SE: BUSINESS OVERVIEW

- TABLE 276 EVONIK INDUSTRIES AG: BUSINESS OVERVIEW

- TABLE 277 STEPAN COMPANY: BUSINESS OVERVIEW

- TABLE 278 EASTMAN CHEMICAL COMPANY: BUSINESS OVERVIEW

- TABLE 279 DOW INC.: BUSINESS OVERVIEW

- TABLE 280 THE CHEMOURS COMPANY: BUSINESS OVERVIEW

- TABLE 281 NOURYON: BUSINESS OVERVIEW

- TABLE 282 CLARIANT AG: COMPANY OVERVIEW

- TABLE 283 INDORAMA VENTURES PUBLIC COMPANY LIMITED: COMPANY OVERVIEW

- TABLE 284 ASHLAND GLOBAL HOLDINGS INC.: COMPANY OVERVIEW

- TABLE 285 KYZEN CORPORATION: BUSINESS OVERVIEW

- TABLE 286 ADEKA CORPORATION: BUSINESS OVERVIEW

- TABLE 287 AARTI INDUSTRIES LIMITED: BUSINESS OVERVIEW

- TABLE 288 COLONIAL CHEMICAL: BUSINESS OVERVIEW

- TABLE 289 GALAXY SURFACTANTS: BUSINESS OVERVIEW

- TABLE 290 INNOSPEC: BUSINESS OVERVIEW

- TABLE 291 LANKEM LTD: BUSINESS OVERVIEW

- TABLE 292 DST-CHEMICALS: BUSINESS OVERVIEW

- TABLE 293 PCC GROUP: BUSINESS OVERVIEW

- TABLE 294 PILOT CHEMICAL COMPANY: BUSINESS OVERVIEW

- TABLE 295 SASOL: BUSINESS OVERVIEW

- TABLE 296 UNGER FABRIKKER AS: BUSINESS OVERVIEW

- TABLE 297 ELLES OBERFLÄCHEN SYSTEME GMBH: BUSINESS OVERVIEW

- TABLE 298 ENVIROSERVE CHEMICALS INC.: BUSINESS OVERVIEW

- TABLE 299 TOKYO CHEMICAL INDUSTRY CO., LTD.: BUSINESS OVERVIEW

- TABLE 300 INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

- TABLE 301 INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

- TABLE 302 INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY REGION, 2017–2019 (KILOTON)

- TABLE 303 INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY REGION, 2020–2026 (KILOTON)

- TABLE 304 ASIA PACIFIC: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY COUNTRY, 2017–2019 (USD MILLION)

- TABLE 305 ASIA PACIFIC: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

- TABLE 306 ASIA PACIFIC: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY COUNTRY, 2017–2019 (KILOTON)

- TABLE 307 ASIA PACIFIC: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY COUNTRY, 2020–2026 (KILOTON)

- TABLE 308 NORTH AMERICA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY COUNTRY, 2017–2019 (USD MILLION)

- TABLE 309 NORTH AMERICA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

- TABLE 310 NORTH AMERICA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY COUNTRY, 2017–2019 (KILOTON)

- TABLE 311 NORTH AMERICA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY COUNTRY, 2020–2026 (KILOTON)

- TABLE 312 WESTERN EUROPE: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY COUNTRY, 2017–2019 (USD MILLION)

- TABLE 313 WESTERN EUROPE: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE,BY COUNTRY, 2020–2026 (USD MILLION)

- TABLE 314 WESTERN EUROPE: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY COUNTRY, 2017–2019 (KILOTON)

- TABLE 315 WESTERN EUROPE: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY COUNTRY, 2020–2026 (KILOTON)

- TABLE 316 CENTRAL & EASTERN EUROPE: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY COUNTRY, 2017–2019 (USD MILLION)

- TABLE 317 CENTRAL & EASTERN EUROPE: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

- TABLE 318 CENTRAL & EASTERN EUROPE: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY COUNTRY, 2017–2019 (KILOTON)

- TABLE 319 CENTRAL & EASTERN EUROPE: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY COUNTRY, 2020–2026 (KILOTON)

- TABLE 320 SOUTH AMERICA: SOUTH AMERICA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY COUNTRY, 2017–2019 (USD MILLION)

- TABLE 321 SOUTH AMERICA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

- TABLE 322 SOUTH AMERICA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY COUNTRY, 2017–2019 (KILOTON)

- TABLE 323 SOUTH AMERICA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY COUNTRY, 2020–2026 (KILOTON)

- TABLE 324 MIDDLE EAST & AFRICA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY COUNTRY, 2017–2019 (USD MILLION)

- TABLE 325 MIDDLE EAST & AFRICA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

- TABLE 326 MIDDLE EAST & AFRICA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY COUNTRY, 2017–2019 (KILOTON)

- TABLE 327 MIDDLE EAST & AFRICA: INDUSTRIAL CLEANING CHEMICALS MARKET SIZE, BY COUNTRY, 2020–2026 (KILOTON)

- FIGURE 1 AQUEOUS-BASED METAL CLEANERS MARKET: RESEARCH DESIGN

- FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 - BOTTOM-UP (SUPPLY SIDE): COLLECTIVE SHARE OF TOP PLAYERS

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 - BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL PRODUCTS

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (DEMAND SIDE)

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 –TOP-DOWN

- FIGURE 6 AQUEOUS-BASED METAL CLEANERS MARKET: DATA TRIANGULATION

- FIGURE 7 MARKET CAGR PROJECTIONS FROM SUPPLY SIDE

- FIGURE 8 MARKET GROWTH PROJECTIONS FROM DEMAND SIDE: DRIVERS AND OPPORTUNITIES

- FIGURE 9 MANUFACTURING WAS LARGEST END-USE INDUSTRY OF AQUEOUS-BASED METAL CLEANERS IN 2021

- FIGURE 10 ULTRASONIC TECHNOLOGY TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 11 ALKALINE TO BE LARGEST CHEMISTRY TYPE IN AQUEOUS-BASED METAL CLEANERS MARKET

- FIGURE 12 SURFACTANTS TO BE LARGEST CLEANING CHEMICALS IN AQUEOUS-BASED METAL CLEANERS MARKET DURING FORECAST PERIOD

- FIGURE 13 ASIA PACIFIC ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

- FIGURE 14 MANUFACTURING INDUSTRY TO DRIVE MARKET DURING FORECAST PERIOD

- FIGURE 15 ASIA PACIFIC TO BE LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 16 AQUEOUS CLEANERS SEGMENT AND CHINA ACCOUNTED FOR LARGEST SHARES IN 2021

- FIGURE 17 ULTRASONIC LED AQUEOUS-BASED METAL CLEANERS MARKET

- FIGURE 18 INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 19 DRIVERS, RESTRAINTS, CHALLENGES, AND OPPORTUNITIES IN AQUEOUS-BASED METAL CLEANERS MARKET

- FIGURE 20 WORLD MOTOR VEHICLE PRODUCTION, 2017–2021

- FIGURE 21 AQUEOUS-BASED METAL CLEANERS MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE CLEANING CHEMICALS

- FIGURE 23 KEY BUYING CRITERIA FOR TOP THREE CLEANING CHEMICALS

- FIGURE 24 AQUEOUS-BASED METAL CLEANERS MARKET: SUPPLY CHAIN

- FIGURE 25 MARKET SIZE UNDER REALISTIC, PESSIMISTIC, OPTIMISTIC, AND NON-COVID-19 SCENARIOS

- FIGURE 26 AVERAGE SELLING PRICE FOR TOP THREE END-USE INDUSTRIES, BY KEY PLAYERS

- FIGURE 27 AVERAGE SELLING PRICE OF AQUEOUS-BASED METAL CLEANERS, BY REGION

- FIGURE 28 REVENUE SHIFT FOR AQUEOUS-BASED METAL CLEANERS MARKET

- FIGURE 29 AQUEOUS-BASED METAL CLEANERS MARKET: ECOSYSTEM

- FIGURE 30 IMPORTS OF SURFACTANTS, BY KEY COUNTRY (2012–2021)

- FIGURE 31 EXPORTS OF SURFACTANTS, BY KEY COUNTRY (2012–2021)

- FIGURE 32 PATENTS REGISTERED IN AQUEOUS-BASED METAL CLEANERS MARKET, 2011–2021

- FIGURE 33 PATENT PUBLICATION TRENDS, 2011–2021

- FIGURE 34 LEGAL STATUS OF PATENTS FILED IN AQUEOUS-BASED METAL CLEANERS MARKET

- FIGURE 35 MAXIMUM PATENTS FILED IN JURISDICTION OF US

- FIGURE 36 PROCTER & GAMBLE REGISTERED MAXIMUM NUMBER OF PATENTS BETWEEN 2011 AND 2021

- FIGURE 37 ULTRASONIC TO BE LARGEST TECHNOLOGY DURING FORECAST PERIOD

- FIGURE 38 ASIA PACIFIC TO BE LARGEST AQUEOUS-BASED METAL CLEANERS MARKET IN ULTRASONIC TECHNOLOGY DURING FORECAST PERIOD

- FIGURE 39 NORTH AMERICA TO BE SECOND-LARGEST MARKET IN RINSE TECHNOLOGY DURING FORECAST PERIOD

- FIGURE 40 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR DIP TECHNOLOGY DURING FORECAST PERIOD

- FIGURE 41 ASIA PACIFIC TO BE FASTEST-GROWING MARKET IN SPRAY TECHNOLOGY DURING FORECAST PERIOD

- FIGURE 42 ALKALINE TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 43 ASIA PACIFIC TO BE LARGEST MARKET IN ALKALINE SEGMENT DURING FORECAST PERIOD

- FIGURE 44 NORTH AMERICA TO BE SECOND-LARGEST MARKET IN ACIDIC SEGMENT DURING FORECAST PERIOD

- FIGURE 45 ASIA PACIFIC TO BE LARGEST MARKET IN NEUTRAL SEGMENT DURING FORECAST PERIOD

- FIGURE 46 SURFACTANTS TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 47 ASIA PACIFIC TO BE LARGEST AQUEOUS-BASED METAL CLEANERS MARKET IN BUILDERS SEGMENT

- FIGURE 48 NORTH AMERICA TO BE SECOND-LARGEST MARKET IN SEQUESTRANTS & INHIBITORS SEGMENT DURING FORECAST PERIOD

- FIGURE 49 ASIA PACIFIC TO BE LARGEST MARKET FOR AQUEOUS-BASED METAL CLEANERS IN SURFACTANTS SEGMENT DURING FORECAST PERIOD

- FIGURE 50 ASIA PACIFIC TO BE LARGEST MARKET FOR AQUEOUS-BASED METAL CLEANERS IN OTHERS SEGMENT DURING FORECAST PERIOD

- FIGURE 51 MANUFACTURING TO BE LARGEST END USER OF AQUEOUS-BASED METAL CLEANERS

- FIGURE 52 ASIA PACIFIC TO BE FASTEST-GROWING AQUEOUS-BASED METAL CLEANERS MARKET DURING FORECAST PERIOD

- FIGURE 53 ASIA PACIFIC: AQUEOUS-BASED METAL CLEANERS MARKET SNAPSHOT

- FIGURE 54 NORTH AMERICA: AQUEOUS-BASED METAL CLEANERS MARKET SNAPSHOT

- FIGURE 55 EUROPE: AQUEOUS-BASED METAL CLEANERS MARKET SNAPSHOT

- FIGURE 56 RANKING OF TOP FIVE PLAYERS IN AQUEOUS-BASED METAL CLEANERS MARKET, 2021

- FIGURE 57 BASF SE LED AQUEOUS-BASED METAL CLEANERS MARKET IN 2021

- FIGURE 58 REVENUE ANALYSIS OF KEY COMPANIES IN LAST 5 YEARS

- FIGURE 59 AQUEOUS-BASED METAL CLEANERS MARKET: COMPANY FOOTPRINT

- FIGURE 60 COMPANY EVALUATION QUADRANT FOR AQUEOUS-BASED METAL CLEANERS MARKET (TIER 1)

- FIGURE 61 START-UPS/SME EVALUATION QUADRANT FOR AQUEOUS-BASED METAL CLEANER MARKET

- FIGURE 62 BASF SE: COMPANY SNAPSHOT

- FIGURE 63 EVONIK INDUSTRIES AG: COMPANY SNAPSHOT

- FIGURE 64 STEPAN COMPANY: COMPANY SNAPSHOT

- FIGURE 65 EASTMAN CHEMICAL COMPANY: COMPANY SNAPSHOT

- FIGURE 66 DOW INC.: COMPANY SNAPSHOT

- FIGURE 67 THE CHEMOURS COMPANY: COMPANY SNAPSHOT

- FIGURE 68 CLARIANT AG: COMPANY SNAPSHOT

- FIGURE 69 INDORAMA VENTURES PUBLIC COMPANY LIMITED: COMPANY SNAPSHOT

- FIGURE 70 ASHLAND GLOBAL HOLDINGS INC.: COMPANY SNAPSHOT

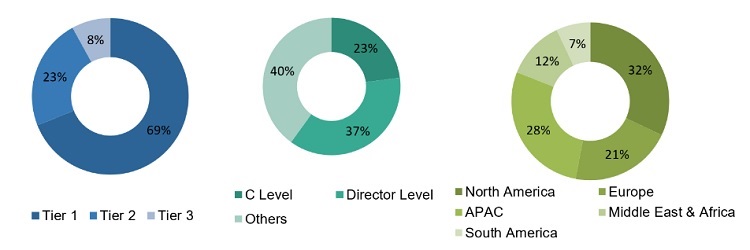

The study involved four major activities in estimating the market size for the aqueous-based metal cleaners market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Post that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. The findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives.

Primary Research

The aqueous-based metal cleaners market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of the automotive and construction industries. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Breakdown of Primary Participants

Notes: Other designations include sales managers, marketing managers, and product managers.

Tier 1: > USD 5 billion; Tier 2: USD 1 billion–USD 5 billion; and Tier 3: < USD 1 billion.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up approach was used to estimate and validate the total size of the aqueous-based metal cleaners market.

- Extensive secondary and primary research has been carried out to understand the global market scenario for various materials of aqueous-based metal cleaners.

- Several primary interviews have been conducted with key opinion leaders related to aqueous-based metal cleaners' manufacturing and development.

- The industry's supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the aqueous-based metal cleaners industry.

Report Objectives

- To analyze and forecast the size of the aqueous-based metal cleaners market in terms of value and volume

- To provide detailed information regarding key factors, such as drivers, restraints, challenges, and opportunities influencing the growth of the market

- To define, describe, and segment the aqueous-based metal cleaners market based on technology, chemistry type, cleaning chemicals, end-use industry, and region.

- To forecast the size of the market segments for regions such as Europe, North America, Asia Pacific, Middle East & Africa, and South America.

- To strategically analyze the segmented markets with respect to individual growth trends, prospects, and contributions to the overall market

- To identify and analyze opportunities for stakeholders in the market

- To strategically profile key players and comprehensively analyze their core competencies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company's specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional type

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Aqueous-based Metal Cleaners Market