Application Platform Market by Software (Application Platform & Transaction Processing Monitor), Service (Deployment & Integration, Support & Maintenance, & Managed), Deployment (aPaaS & On-Premises), Organization Size, & Region - Global Forecast to 2023

[129 Pages Report] The global application platform market was valued at USD 8.48 Billion in 2017 and is expected to reach USD 11.69 Billion by 2023, at a Compound Annual Growth Rate (CAGR) of 5.4% during the forecast period. The base year considered for this study is 2017, and the forecast period is 20182023.

Objectives of the Study:

The key objective of the report is to define, describe, and forecast the application platform market size by component (software and services), deployment, organization size, and region. The report provides detailed information on the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market. The report attempts to forecast the market size with respect to 5 major regions, namely, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America. It strategically profiles the key market players and comprehensively analyzes their core competencies. The report also tracks and analyzes competitive developments, such as partnerships, agreements, and collaborations; mergers and acquisitions; and new product developments, in the market.

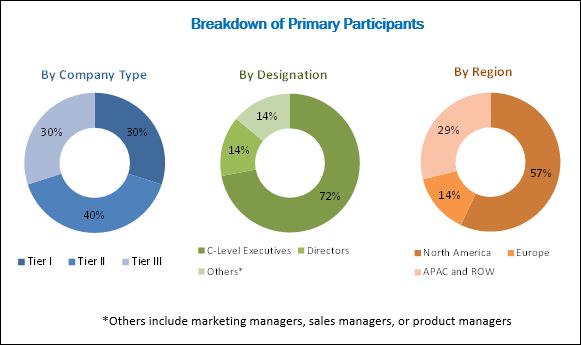

The research methodology used to estimate and forecast the application platform market size begins with the collection and analysis of the data on key vendor revenues through secondary sources, including annual reports and press releases; investor presentations of companies; conferences and associations (Mobile + Web Devcon 2018, App Promotion Summit London 2018, MobileTech Conference 2018, and Mobile World Congress [MWC] 2018); technology journals and certified publications; and articles from recognized authors, directories, and databases. The vendor offerings have also been taken into consideration to determine the market segmentations. The bottom-up procedure was employed to arrive at the overall market size of the market from the revenue of the key players and their market shares. The application platform market expenditures across all regions, along with the geographic split in various segments was considered to arrive at the overall market size. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key people, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of profiles of primary participants is depicted in the below figure:

To know about the assumptions considered for the study, download the pdf brochure

The application platform market consists of vendors providing software such as application platform software and transaction processing monitor software. In addition, they offer various associated services, such as deployment and integration, support and maintenance, and managed services, to commercial clients across the globe.

The major players in the application platform market include IBM (US), Oracle (US), SAP (Germany), NEC (Japan), Microsoft (US), Micro Focus (UK), Fujitsu (Japan), Hitachi (Japan), Adobe (US), HPE (US), Huawei (China), and Red Hat (US). The other players include Akamai (US), GigaSpaces (US), Caucho (US), Apache Tomcat, TmaxSoft (US), Nastel Technologies (US), Navisite (US), Rogue Wave Software (US), 4D Technologies (France), NGINX (US), Mendix (US), Kony (US), and Betty Blocks (Netherlands) who have adopted new product launches and partnerships, agreements, and collaborations as the key strategies to improve their services and provide better software and associated services to enterprises and to expand their market reach.

Key Target Audience

- Application developers

- Cloud service providers

- Managed security service providers

- Third-party system integrators

- Monitoring-as-a-service providers

- Application Lifecycle Management (ALM) specialists

- ALM solutions and services providers

- Regulatory agencies

- Government

- Quality Assurance (QA)/test engineers

The study answers several questions for the stakeholders, primarily, which market segments focus in the next 2 to 5 years for prioritizing efforts and investments.

Scope of the Report

The research report segments the application platform market into the following submarkets:

By Component:

- Software

- Services

By Software:

- Application platform software

- Transaction processing monitor software

By Service:

- Deployment and integration

- Support and maintenance

- Managed services

By Deployment:

- On-premises

- Application Platform-as-a-Service (aPaaS)

By Organization Size:

- Large enterprises

- Small and medium-sized enterprises

By Region:

- North America

- Europe

- APAC

- MEA

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the US and Canada by component, software, service, deployment, and organization size

- Further breakdown of the UK and Germany by component, software, service, deployment, and organization size

Company Information

- Detailed analysis and profiling of additional market players

MarketsandMarkets forecasts the global application platform market size to grow from USD 8.99 Billion in 2018 to USD 11.69 Billion by 2023, at a Compound Annual Growth Rate (CAGR) of 5.4% during the forecast period.

The application platform market is segmented on the basis of components (software and services), deployment, organization size, and regions. This market is expected to gain traction, as vendors and open-source communities offer user-friendly, reliable, innovative, and specialized platforms to support the modern and real-time application requirements. Application platforms are instrumental in simplifying the deployment of application codes, automating the application release processes, and proactively monitoring applications and associated infrastructure performances. In addition, these platforms empower the rapid development and deployment of application logic, enable faster application iteration, and provide an unified experience to developers. Vendors are offering paid, as well as free open-source software to their commercial customers in the market. Hence, both paid and open-source software play a significant role in the growth of the market. The software segment of the application platform market includes application platform software and transaction processing monitor software. Among these subsegments, the application platform software subsegment is expected to play a vital role in the growth of the market. This subsegment is estimated to account for the larger market share and projected to be a faster-growing subsegment as well. Services are evolving as an important aspect, as application platform vendors offer integrated services packages, along with application software packages to their commercial customers. The services segment of the market comprises various services, such as deployment and integration, support and maintenance, and managed services. The deployment and integration subsegment is expected to account for the largest market size during the forecast period. This subsegment plays a vital role in the growth of the market, as in this service the application platform, along with the monitoring software are deployed at the customers premises. The deployment segment consists of 2 types, namely, Application Platform-as-Service (aPaaS) and on-premises. The organization size segment is categorized into Small and Medium-sized Enterprises (SMEs) and large enterprises.

The application platform market offers a reliable platform for developers and enterprises, and helps them develop and host mission-critical business applications. Application platforms provide a multitude of features, such as load balancers, auto-scaling orchestrators, automated deployment tools, and In-Memory Data Grids (IMDGs). aPaaS is offered as cloud services and provides managed platforms for designing, building, deploying and managing customized business applications. Furthermore, aPaaS provides a cloud-based foundation for app creation and establishes stability during the app development phase.

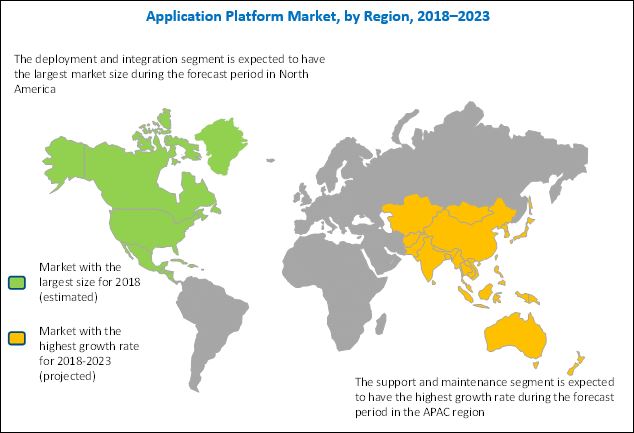

North America is expected to account for the largest market share and dominate the application platform market during the forecast period. This region is witnessing emerging trends, such as Bring Your Own Application (BYOA) initiatives, mobility, and DevOps, which have made enterprises realize the significance of application platform software. This software proactively deploys, monitors, manages, and visualizes applications, in turn boosting the growth of the overall market in North America. Asia Pacific (APAC) has witnessed an advanced and dynamic adoption of new technologies and has always been a lucrative region. The application platform market in APAC is expected to grow at the highest CAGR during the forecast period. The growth in this region is primarily driven by the strong positive outlook of regional enterprises. Owing to the rapid growth of web and mobile applications in this region, the need to deploy, monitor, protect, and manage these applications against vulnerabilities is a major concern. This concern has given rise to the demand for application platform software, as this software provides a reliable platform to develop, deploy, and manage enterprise applications.

Competition from open-source alternatives is expected to be one of the restraining factors for the growth of application platform market. However, recent developments, new product launches, and mergers and acquisitions undertaken by the major market players are expected to boost the market growth.

The study measures and evaluates key offerings and strategies of the major market vendors, including IBM (US), Oracle (US), SAP (Germany), NEC (Japan), Microsoft (US), Micro Focus (UK), Fujitsu (Japan), Hitachi (Japan), Adobe (US), HPE (US), Huawei (China), and Red Hat (US). The other players include Akamai (US), GigaSpaces (US), Caucho (US), Apache Tomcat, TmaxSoft (US), Nastel Technologies (US), Navisite (US), Rogue Wave Software (US), 4D Technologies (France), NGINX (US), Mendix (US), Kony (US), and Betty Blocks (Netherlands). These companies offer reliable application platform software and associated services to commercial clients across regions.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Research Assumptions

2.4 Limitations

3 Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 26)

4.1 Attractive Market Opportunities in the Application Platform Market

4.2 Market By Service and Region, 2018

4.3 Market Investment Scenario, 20182023

4.4 Market By Organization Size, 2018

4.5 Market By Region, 2018 vs 2023

5 Market Overview (Page No. - 29)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Demand for Collaborative Application Development

5.2.1.2 Importance of Devops

5.2.1.3 Emergence of No-Code Application Platforms

5.2.1.4 Rise of Apaas

5.2.2 Restraints

5.2.2.1 Competition From Open-Source Alternatives

5.2.3 Opportunities

5.2.3.1 Advancements in Application Delivery and the Evolution of Software-Defined Age

5.2.4 Challenges

5.2.4.1 Lack of Pro-Active and Real-Time Application Visibility

5.2.4.2 Lack of Skill Set and Expertise

5.3 Application Platform-As-A-Service: Types

5.3.1 High-Productivity Application Platform-As-A-Service

5.3.2 High-Control Application Platform-As-A-Service

6 Application Platform Market, By Component (Page No. - 33)

6.1 Introduction

6.2 Software

6.3 Services

7 Market By Software (Page No. - 37)

7.1 Introduction

7.2 Application Platform Software

7.3 Transaction Processing Monitor Software

8 Market By Service (Page No. - 41)

8.1 Introduction

8.2 Deployment and Integration

8.3 Support and Maintenance

8.4 Managed Services

9 Application Platform Market, By Deployment (Page No. - 46)

9.1 Introduction

9.2 On-Premises

9.3 Application Platform-As-A-Service

10 Market By Organization Size (Page No. - 50)

10.1 Introduction

10.2 Small and Medium-Sized Enterprises

10.3 Large Enterprises

11 Application Platform Market, By Region (Page No. - 54)

11.1 Introduction

11.2 North America

11.3 Europe

11.4 Asia Pacific

11.5 Middle East and Africa

11.6 Latin America

12 Competitive Landscape (Page No. - 72)

12.1 Overview

12.2 Market Ranking Analysis

12.3 Competitive Scenario

12.3.1 New Product Launches

12.3.2 Mergers and Acquisitions

12.3.3 Agreements and Partnerships

13 Company Profiles (Page No. - 75)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

13.1 IBM

13.2 SAP

13.3 NEC

13.4 Micro Focus

13.5 Oracle

13.6 Fujitsu

13.7 Microsoft

13.8 Hitachi

13.9 Adobe Systems

13.10 HPE

13.11 Huawei

13.12 Red Hat

13.13 Akamai

13.14 Gigaspaces

13.15 Caucho Technology

13.16 APAChe Tomcat

13.17 Tmaxsoft

13.18 Nastel Technologies

13.19 Navisite

13.20 Rogue Wave Software

13.21 4D Technologies

13.22 Nginx

13.23 Mendix

13.24 Kony

13.25 Betty Blocks

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 121)

14.1 Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets Subscription Portal

14.4 Introducing RT: Real-Time Market Intelligence

14.5 Available Customizations

14.6 Related Reports

14.7 Author Details

List of Tables (52 Tables)

Table 1 Application Platform Market Size and Growth Rate, 20162023 (USD Million, Y-O-Y %)

Table 2 Application Platform: Market Size By Component, 20162023 (USD Million)

Table 3 Software: Market Size By Region, 20162023 (USD Million)

Table 4 Services: Market Size By Region, 20162023 (USD Million)

Table 5 Application Platform Market Size, By Software, 20162023 (USD Million)

Table 6 Application Platform Software: Market Size By Region, 20162023 (USD Million)

Table 7 Transaction Processing Monitor Software: Market Size By Region, 20162023 (USD Million)

Table 8 Market Size By Service, 20162023 (USD Million)

Table 9 Deployment and Integration: Market Size By Region, 20162023 (USD Million)

Table 10 Support and Maintenance: Market Size By Region, 20162023 (USD Million)

Table 11 Managed Services: Market Size By Region, 20162023 (USD Million)

Table 12 Application Platform Market Size, By Deployment, 20162023 (USD Million)

Table 13 On-Premises: Market Size By Region, 20162023 (USD Million)

Table 14 Application Platform-As-A-Service: Market Size By Region, 20162023 (USD Million)

Table 15 Market Size By Organization Size, 20162023 (USD Million)

Table 16 Small and Medium-Sized Enterprises: Market Size By Region, 20162023 (USD Million)

Table 17 Large Enterprises: Market Size By Region, 20162023 (USD Million)

Table 18 Application Platform Market Size, By Region, 20162023 (USD Million)

Table 19 North America: Market Size By Component, 20162023 (USD Million)

Table 20 North America: Market Size By Software, 20162023 (USD Million)

Table 21 North America: Market Size By Service, 20162023 (USD Million)

Table 22 North America: Market Size By Deployment, 20162023 (USD Million)

Table 23 North America: Market Size By Organization Size, 20162023 (USD Million)

Table 24 North America: Market Size By Country, 20162023 (USD Million)

Table 25 Europe: Application Platform Market Size, By Component, 20162023 (USD Million)

Table 26 Europe: Market Size By Software, 20162023 (USD Million)

Table 27 Europe: Market Size By Service, 20162023 (USD Million)

Table 28 Europe: Market Size By Deployment, 20162023 (USD Million)

Table 29 Europe: Market Size By Organization Size, 20162023 (USD Million)

Table 30 Europe: Market Size By Country, 20162023 (USD Million)

Table 31 Asia Pacific: Application Platform Market Size, By Component, 20162023 (USD Million)

Table 32 Asia Pacific: Market Size, By Software, 20162023 (USD Million)

Table 33 Asia Pacific: Market Size By Service, 20162023 (USD Million)

Table 34 Asia Pacific: Market Size By Deployment, 20162023 (USD Million)

Table 35 Asia Pacific: Market Size By Organization Size, 20162023 (USD Million)

Table 36 Asia Pacific: Market Size By Country, 20162023 (USD Million)

Table 37 Middle East and Africa: Application Platform Market Size, By Component, 20162023 (USD Million)

Table 38 Middle East and Africa: Market Size By Software, 20162023 (USD Million)

Table 39 Middle East and Africa: Market Size By Service, 20162023 (USD Million)

Table 40 Middle East and Africa: Market Size By Deployment, 20162023 (USD Million)

Table 41 Middle East and Africa: Market Size By Organization Size, 20162023 (USD Million)

Table 42 Middle East and Africa: Market Size By Country, 20162023 (USD Million)

Table 43 Latin America: Application Platform Market Size, By Component, 20162023 (USD Million)

Table 44 Latin America: Market Size By Software, 20162023 (USD Million)

Table 45 Latin America: Market Size By Service, 20162023 (USD Million)

Table 46 Latin America: Market Size By Deployment, 20162023 (USD Million)

Table 47 Latin America: Market Size By Organization Size, 20162023 (USD Million)

Table 48 Latin America: Market Size By Country, 20162023 (USD Million)

Table 49 Market Ranking for the Application Platform Market, 2017

Table 50 New Product Launches, 20172018

Table 51 Mergers and Acquisitions, 20152018

Table 52 Partnerships, Agreements, and Collaborations, 20162017

List of Figures (46 Figures)

Figure 1 Application Platform Market Segmentation

Figure 2 Regional Scope

Figure 3 Application Platform Market: Research Design

Figure 4 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 5 Data Triangulation

Figure 6 Market Size Estimation Methodology: Bottom-Up Approach

Figure 7 Market Size Estimation Methodology: Top-Down Approach

Figure 8 Market Assumptions

Figure 9 Market Top 3 Segments, 2018

Figure 10 Market By Component, 2018

Figure 11 Demand for Collaborative Application Development and Importance of Devops are Expected to Drive the Growth of the Application Platform Market

Figure 12 Deployment and Integration Service and North American Region are Estimated to Have the Largest Market Shares in 2018

Figure 13 Asia Pacific is Expected to Emerge as the Best Market for Investment in the Next 5 Years

Figure 14 Large Enterprises Segment is Estimated to Have the Larger Market Share in 2018

Figure 15 North America is Expected to Have the Largest Market Size During the Forecast Period

Figure 16 Application Platform Market: Drivers, Restraints, Opportunities, and Challenges

Figure 17 Software Segment is Expected to Have the Larger Market Size During the Forecast Period

Figure 18 North America is Expected to Have the Largest Market Size in the Services Segment During the Forecast Period

Figure 19 Application Platform Software Segment is Expected to Have the Larger Market Size During the Forecast Period

Figure 20 North America is Expected to Have the Largest Market Size in the Application Platform Software Segment During the Forecast Period

Figure 21 Deployment and Integration Segment is Expected to Have the Largest Market Size During the Forecast Period

Figure 22 Asia Pacific is Expected to Be the Fastest-Growing Region in the Deployment and Integration Segment During the Forecast Period

Figure 23 North America is Expected to Hold the Largest Market Size in the Support and Maintenance Segment During the Forecast Period

Figure 24 Application Platform-As-A-Service Segment is Expected to Have the Larger Market Size During the Forecast Period

Figure 25 North America is Expected to Have the Largest Market Size in the Application Platform-As-A-Service Deployment During the Forecast Period

Figure 26 Large Enterprises Segment is Expected to Hold the Larger Market Size During the Forecast Period

Figure 27 North America is Expected to Have the Largest Market Size in the Large Enterprises Segment During the Forecast Period

Figure 28 North America is Expected to Have the Largest Market Size During the Forecast Period

Figure 29 Asia Pacific is Expected to Be an Attractive Destination to Invest in During the Forecast Period

Figure 30 North America: Market Snapshot

Figure 31 Software Segment is Expected to Have the Larger Market Size in North America During the Forecast Period

Figure 32 Asia Pacific: Market Snapshot

Figure 33 Application Platform Software Segment is Expected to Have the Larger Market Size in Asia Pacific During the Forecast Period

Figure 34 Key Developments By Leading Players in the Application Platform Market During 20152018

Figure 35 IBM: Company Snapshot

Figure 36 SAP: Company Snapshot

Figure 37 NEC: Company Snapshot

Figure 38 Micro Focus: Company Snapshot

Figure 39 Oracle: Company Snapshot

Figure 40 Fujitsu: Company Snapshot

Figure 41 Microsoft: Company Snapshot

Figure 42 Hitachi: Company Snapshot

Figure 43 Adobe Systems: Company Snapshot

Figure 44 HPE: Company Snapshot

Figure 45 Huawei: Company Snapshot

Figure 46 Red Hat: Company Snapshot

Growth opportunities and latent adjacency in Application Platform Market