APAC In Situ Hybridization Market by Products (Consumables, Instruments, Software), Technology (DNA FISH, RNA FISH, PNA FISH, CISH), Application (Cancer, Immunology, Neuroscience, Cytology), End User (Hospital, Pharma, Biotech, CROs) & Region - Global Forecast to 2027

Updated on : September 24, 2024

Overview of the APAC In Situ Hybridization Market

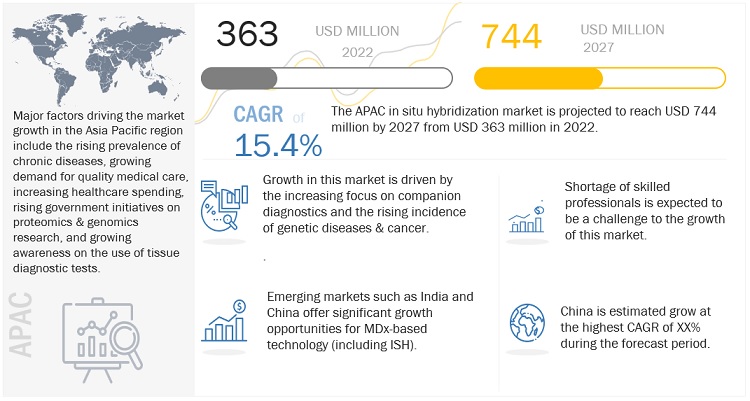

APAC In Situ Hybridization market forecasted to transform from $363 million in 2022 to $744 million by 2027, driven by a CAGR of 15.4%. The research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

In developed countries, high-quality molecular diagnostic tests are readily available. However, in developing countries, the cost of these diagnostic technologies is very high, which often makes them unaffordable for a large part of the population. Moreover, the lack of a commercial market for diagnostic procedures has resulted in the availability of a small number of diagnostic tests in developing countries. As a result, emerging markets such as India, China, and South Korea offer significant growth opportunities for MDx-based technologies (including ISH) owing to the rising geriatric population, the growing prevalence of infectious diseases and various types of cancers, the improving healthcare infrastructure, and increasing investments by respective government bodies and leading players in these countries.

Attractive Opportunities in the APAC in Situ Hybridization Market

To know about the assumptions considered for the study, Request for Free Sample Report

APAC In Situ Hybridization Market Dynamics

Driver: Rising incidence of genetic disorders and cancer

Clinical trials pertaining to genetic disorders increased most significantly in the Asia Pacific region. The number of trials conducted increased by 184% between 2010 and 2020. Japan accounted for the largest share, with 28.4% of all trials in the region taking place in Japan in 2020. Australia (25%) and China (21.6%) accounted for the second- and third-largest shares of the overall number of ongoing trials in the region. Moreover, Southeast Asians are more likely to have genetic disorders, according to a study led by co-senior authors Dr. Kumaraswamy Thangaraj of the CSIR-Centre for Cellular and Molecular Biology (CCMB) and Dr. David Reich of the Broad Institute of MIT and Harvard, Cambridge, US, in collaboration with other institutes.

Challenge: Shortage of skilled professionals

In Situ hybridization requires high technical know-how. For instance, understanding of the molecular information of a chromosome or a gene is crucial for conducting ISH tests. Moreover, there is a reluctcance to move from tradional approaches to IT-based approaches such as in situ hybridization. Thus, the shortage of skilled professionals for conducting in situ hybridization tests will hinder the market growth over the forecast period.

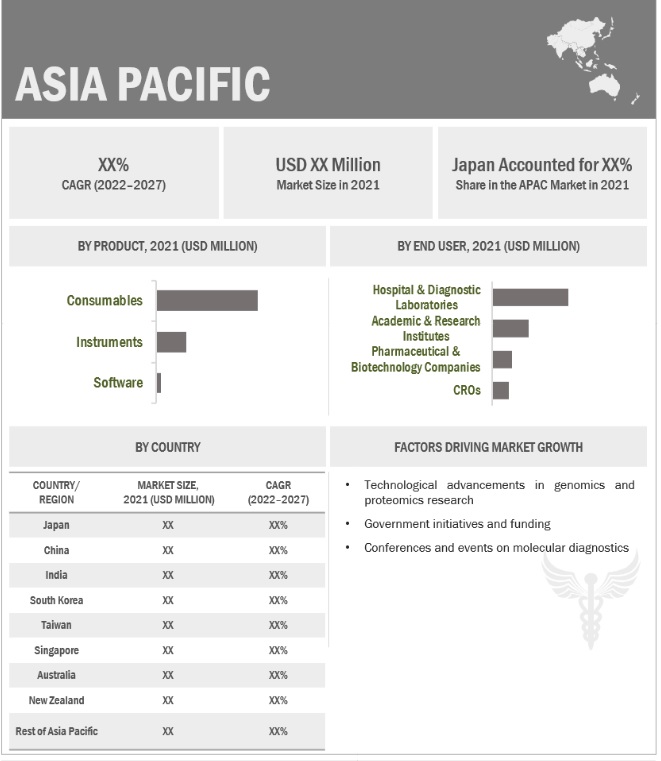

The consumables accounted for the largest share of the APAC in situ hybridization industry

The APAC in situ hybridization market is segmented into consumables, instruments, and software based on product. In 2021, the ISH consumables segment accounted for the largest share of this market. The growing government and private funding in life sciences and cancer research, the increasing number of reagent rental agreements, and the application of innovative technologies and methodologies in the fields of tissue and in vitro diagnostics are expected to drive the growth of the consumables market during the forecast period.

The DNA FISH technology segment dominated the fluorescent APAC in situ hybridization industry

Based on the technology, the APAC in situ hybridization market is FISH (fluorescent in situ hybridization) and CISH (chromogenic in situ hybridization). The FISH segment is further categorized into DNA FISH, RNA FISH, and PNA FISH. In 2021, the FISH segment dominated the market with the highest revenue share as FISH is better for data analysis as FISh offers better visuals on software.

In 2021, hospitals & diagnostic laboratories generated the highest revenue in the APAC in situ hybridization industry.

Based on the end user, the APAC in situ hybridization market is segmented into hospital & diagnostic laboratories, academic and research institutes, CROs, and pharmaceutical & biotechnology companies. In 2021, the hospital & diagnostic laboratories generated the second highest revenue in the market.The growing patient population, increase in Medicare reimbursements for clinical tests performed in hospitals, and the emergence of advanced diagnostic tests are some of the key factors driving the growth of this end-user segment.

Japan was the largest market for Asia Pacific in situ hybridization industry in 2021.

Companies in Japan are increasingly focusing on revolutionizing the field of precision oncology and personalized medicine with the integration of genetics and proteomics diagnosis. Several collaborations have been observed in the country, which support the research industry in Japan. This trend is expected to continue in the coming years and contribute to market growth in Japan.

To curb the growing incidence of chronic diseases, the Japanese government has been taking initiatives for targeted treatments & personalized therapies, such as the establishment of the Center for Cancer Genomics and Advanced Therapeutics. This initiative is the focal point through which the government aims to aggregate and manage public information on genomic medicine. Efforts like these will also favor market growth in the country.

To know about the assumptions considered for the study, download the pdf brochure

Prominent players in the APAC in situ hybridization market include Abbott Laboratories (US), Thermo Fisher Scientific (US), Danaher Corporation (US), Merck (Germany), F. Hoffmann-La Roche (Switzerland), BioView (Israel), Agilent Technologies (US), Biocare Medical (US), Bio-Techne Corporation (US), QIAGEN (Germany), PerkinElmer (US), Enzo Biochem (US), Bio-Rad Laboratories (US), Abnova Corporation (Taiwan), BioGenex Laboratories (US), OpGen (US), Bio SB (US), Abcam (UK), Zytomed (Germany), 10x Genomics Inc. (US), and NeoGenomics Laboratories (US).

Scope of the APAC In Situ Hybridization Industry

|

Report Metric |

Details |

|

Market Revenue in 2022 |

$363 million |

|

Projected Revenue by 2027 |

$744 million |

|

Revenue Rate |

Poised to Grow at a CAGR of 15.4% |

|

Market Driver |

Rising incidence of genetic disorders and cancer |

|

Market Opportunity |

Untapped markets in developing countries |

This report categorizes the APAC in situ hybridization market to forecast revenue and analyze trends in each of the following submarkets:

By Product

- Consumables

- Kits & Reagents

- Probes

- Accessories

- Instruments

- Software

By Technology

- FISH

- DNA FISH

- RNA FISH

- PNA FISH

- CISH

By Application

- Cancer Diagnostics

- Cytology

- Infectious Disease Diagnostics

- Neuroscience

- Immunology

By End User

- Hospitals and Diagnostic Laboratories

- Academic and Research Institutes

- CROs

- Pharmaceutical and Biotechnology Companies

By Region

- Japan

- China

- India

- South Korea

- Taiwan

- Singapore

- Australia

- New Zealand

- Rest of Asia Pacific (RoAPAC)

Recent Developments of APAC In Situ Hybridization Industry

- In 2022, RNAscope ISH Detection Kit manufactured by Bio-Techne received CE-IVD approval for the BOND-III platform (Leica Biosystems).

- In 2021, Applied Spectral Imaging (ASI) and KromaTiD, Inc. entered a strategic commercial partnership granting ASI worldwide rights to market KromaTiD’s proprietary Pinpoint FISH (PPF) probes and assay services.

- In 2020, Creative Bioarray introduced an advanced FISH probe to detect the 2019 Novel Coronavirus.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global APAC in situ hybridization market?

The global APAC in situ hybridization market boasts a total revenue value of USD 744 million by 2027.

What is the estimated growth rate (CAGR) of the global APAC in situ hybridization market?

The global APAC in situ hybridization market has an estimated compound annual growth rate (CAGR) of 15.4% and a revenue size in the region of USD 363 million in 2022.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing incidence of genetic disorders and cancer- Growing awareness about companion diagnosticsOPPORTUNITIES- Untapped markets in developing countriesCHALLENGES- Shortage of skilled professionals

-

5.3 PORTER’S FIVE FORCES ANALYSISTHREAT FROM NEW ENTRANTSTHREAT FROM SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRY

- 5.4 SUPPLY CHAIN ANALYSIS

- 5.5 VALUE CHAIN ANALYSIS

-

5.6 ECOSYSTEM ANALYSIS

- 5.7 KEY CONFERENCES & EVENTS IN 2022–2023

-

5.8 REGULATORY ANALYSISFDA APPROVALSREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

5.9 PRICING ANALYSISAPAC IN SITU HYBRIDIZATION MARKET: AVERAGE SELLING PRICE TRENDS

-

5.10 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA FOR IN SITU HYBRIDIZATION MARKET IN ASIA PACIFIC

- 6.1 INTRODUCTION

-

6.2 CONSUMABLESPROBES- Growing preference for direct localization of DNA/RNA sequences using probes to drive marketKITS & REAGENTS- Growing focus on companion diagnostics to boost demandACCESSORIES- Use of accessories for optimal performance of FISH and CISH probes to propel adoption

-

6.3 INSTRUMENTSRISING NEED FOR AUTOMATED SYSTEMS TO SUPPORT MARKET

-

6.4 SOFTWAREGROWING DEMAND FOR HIGH-SPEED SAMPLE DATA ANALYSIS TO DRIVE MARKET

- 7.1 INTRODUCTION

-

7.2 CANCER DIAGNOSTICSGROWING IMPORTANCE OF COMPANION DIAGNOSTICS TO DRIVE MARKET

-

7.3 CYTOLOGYGROWING DEMAND FOR FISH FOR DETECTION OF CHROMOSOMAL ABNORMALITIES TO SUPPORT MARKET

-

7.4 INFECTIOUS DISEASE DIAGNOSTICSNEED FOR HIGH SENSITIVITY AND SPECIFICITY IN INFECTIOUS DISEASE DIAGNOSIS TO AID GROWTH

-

7.5 NEUROSCIENCERISING BURDEN OF NEUROLOGICAL DISORDERS TO BOOST R&D ACTIVITIES

-

7.6 IMMUNOLOGYRISING INCIDENCE OF AUTOIMMUNE DISEASES TO DRIVE GROWTH

- 8.1 INTRODUCTION

-

8.2 FLUORESCENCE IN SITU HYBRIDIZATION (FISH)DNA FLUORESCENCE IN SITU HYBRIDIZATION- Need to ensure stability of genetic material to drive marketRNA FLUORESCENCE IN SITU HYBRIDIZATION- Increasing biomedical research to support market growthPNA FLUORESCENCE IN SITU HYBRIDIZATION- Increased applications in infectious disease diagnosis to boost market

-

8.3 CHROMOGENIC IN SITU HYBRIDIZATION (CISH)COST-EFFECTIVENESS OF CISH OVER FISH TO BOOST MARKET GROWTH

- 9.1 INTRODUCTION

-

9.2 HOSPITAL & DIAGNOSTIC LABORATORIESGROWING VOLUME OF MOLECULAR TESTS TO DRIVE MARKET

-

9.3 ACADEMIC & RESEARCH INSTITUTESGROWING RESEARCH ON CHROMOSOMAL ABNORMALITIES TO SUPPORT MARKET

-

9.4 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIESNEED TO DEVELOP PRECISION TREATMENTS TO DRIVE DEMAND FOR ISH

-

9.5 CONTRACT RESEARCH ORGANIZATIONSINCREASING OUTSOURCING OF RESEARCH ACTIVITIES TO BOOST MARKET

-

10.1 INTRODUCTIONJAPAN- Growing focus on personalized diagnostics to support market growthCHINA- China to register highest CAGR during forecast periodINDIA- Collaborations between hospitals and diagnostic labs to propel market growth in IndiaSOUTH KOREA- Robust healthcare infrastructure to boost growthTAIWAN- Improving cancer research and care to propel demand for ISHSINGAPORE- Government initiatives to make cancer treatment more affordable to contribute to growthAUSTRALIA- Increasing public-private investments in cancer research to boost demandNEW ZEALAND- Rising cases of cancer to propel growthREST OF ASIA PACIFIC

- 11.1 INTRODUCTION

- 11.2 RIGHT-TO-WIN STRATEGIES ADOPTED BY KEY PLAYERS

- 11.3 MARKET SHARE ANALYSIS

- 11.4 REVENUE SHARE ANALYSIS

-

11.5 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.6 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHESDEALS

-

12.1 KEY COMPANIESABBOTT LABORATORIES- Business overview- Products offered- MnM viewF. HOFFMANN-LA ROCHE AG- Business overview- Products offered- Recent developments- MnM viewTHERMO FISHER SCIENTIFIC, INC.- Business overview- Products offered- MnM viewDANAHER CORPORATION- Business overview- Products offered- MnM viewAGILENT TECHNOLOGIES, INC.- Business overview- Products offered- MnM viewBIOCARE MEDICAL- Business overview- Products offered- Recent developmentsBIO-TECHNE CORPORATION- Business overview- Products offered- Recent developmentsQIAGEN N.V.- Business overview- Products offeredMERCK KGAA- Business overview- Products offeredPERKINELMER- Business overview- Products offeredENZO BIOCHEM- Business overview- Products offeredBIO-RAD LABORATORIES- Business overview- Products offeredABNOVA CORPORATION- Business overview- Products offeredBIOGENEX LABORATORIES- Business overview- Products offeredOPGEN INC.- Business overview- Products offeredBIO SB- Business overview- Products offeredABCAM- Business overview- Products offeredZYTOMED SYSTEMS GMBH- Business overview- Products offeredNEOGENOMICS LABORATORIES- Business overview- Products offeredBIOVIEW- Business overview- Products offered10X GENOMICS- Business overview- Products offered- Recent developments

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 APAC IN SITU HYBRIDIZATION MARKET: IMPACT ANALYSIS

- TABLE 2 NEW CASES OF CANCER IN ASIA, 2020 VS. 2025

- TABLE 3 APAC IN SITU HYBRIDIZATION MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 4 KEY CONFERENCES & EVENTS, 2022–2023

- TABLE 5 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 PRICING ANALYSIS OF IN SITU HYBRIDIZATION PRODUCTS

- TABLE 7 PRICING ANALYSIS OF FISH TESTS IN INDIA (2021)

- TABLE 8 APAC IN SITU HYBRIDIZATION MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 9 APAC IN SITU HYBRIDIZATION MARKET FOR CONSUMABLES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 10 APAC IN SITU HYBRIDIZATION MARKET FOR CONSUMABLES, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 11 APAC IN SITU HYBRIDIZATION MARKET FOR PROBES, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 12 APAC IN SITU HYBRIDIZATION MARKET FOR KITS & REAGENTS, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 13 APAC IN SITU HYBRIDIZATION MARKET FOR ACCESSORIES, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 14 APAC IN SITU HYBRIDIZATION MARKET FOR INSTRUMENTS, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 15 APAC IN SITU HYBRIDIZATION MARKET FOR SOFTWARE, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 16 APAC IN SITU HYBRIDIZATION MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 17 APAC IN SITU HYBRIDIZATION MARKET FOR CANCER DIAGNOSTICS, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 18 APAC IN SITU HYBRIDIZATION MARKET FOR CYTOLOGY, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 19 APAC IN SITU HYBRIDIZATION MARKET FOR INFECTIOUS DISEASE DIAGNOSTICS, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 20 APAC IN SITU HYBRIDIZATION MARKET FOR NEUROSCIENCE, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 21 APAC IN SITU HYBRIDIZATION MARKET FOR IMMUNOLOGY, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 22 APAC IN SITU HYBRIDIZATION MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

- TABLE 23 APAC FLUORESCENCE IN SITU HYBRIDIZATION MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 24 APAC FLUORESCENCE IN SITU HYBRIDIZATION MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 25 APAC DNA FLUORESCENCE IN SITU HYBRIDIZATION MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 26 APAC RNA FLUORESCENCE IN SITU HYBRIDIZATION MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 27 APAC PNA FLUORESCENCE IN SITU HYBRIDIZATION MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 28 APAC CHROMOGENIC IN SITU HYBRIDIZATION MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 29 APAC IN SITU HYBRIDIZATION MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 30 APAC IN SITU HYBRIDIZATION MARKET FOR HOSPITAL & DIAGNOSTIC LABORATORIES, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 31 APAC IN SITU HYBRIDIZATION MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 32 APAC IN SITU HYBRIDIZATION MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 33 APAC IN SITU HYBRIDIZATION MARKET FOR CONTRACT RESEARCH ORGANIZATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 34 APAC IN SITU HYBRIDIZATION MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 35 JAPAN: IN SITU HYBRIDIZATION MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

- TABLE 36 JAPAN: FLUORESCENCE IN SITU HYBRIDIZATION MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 37 JAPAN: IN SITU HYBRIDIZATION MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 38 JAPAN: IN SITU HYBRIDIZATION MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 39 JAPAN: IN SITU HYBRIDIZATION MARKET FOR CONSUMABLES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 40 JAPAN: IN SITU HYBRIDIZATION MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 41 CHINA: IN SITU HYBRIDIZATION MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

- TABLE 42 CHINA: FLUORESCENCE IN SITU HYBRIDIZATION MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 43 CHINA: IN SITU HYBRIDIZATION MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 44 CHINA: IN SITU HYBRIDIZATION MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 45 CHINA: IN SITU HYBRIDIZATION MARKET FOR CONSUMABLES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 46 CHINA: IN SITU HYBRIDIZATION MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 47 INDIA: IN SITU HYBRIDIZATION MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

- TABLE 48 INDIA: FLUORESCENCE IN SITU HYBRIDIZATION MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 49 INDIA: IN SITU HYBRIDIZATION MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 50 INDIA: IN SITU HYBRIDIZATION MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 51 INDIA: IN SITU HYBRIDIZATION MARKET FOR CONSUMABLES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 52 INDIA: IN SITU HYBRIDIZATION MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 53 SOUTH KOREA: IN SITU HYBRIDIZATION MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

- TABLE 54 SOUTH KOREA: FLUORESCENCE IN SITU HYBRIDIZATION MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 55 SOUTH KOREA: IN SITU HYBRIDIZATION MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 56 SOUTH KOREA: IN SITU HYBRIDIZATION MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 57 SOUTH KOREA: IN SITU HYBRIDIZATION MARKET FOR CONSUMABLES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 58 SOUTH KOREA: IN SITU HYBRIDIZATION MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 59 TAIWAN: IN SITU HYBRIDIZATION MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

- TABLE 60 TAIWAN: FLUORESCENCE IN SITU HYBRIDIZATION MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 61 TAIWAN: IN SITU HYBRIDIZATION MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 62 TAIWAN: IN SITU HYBRIDIZATION MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 63 TAIWAN: IN SITU HYBRIDIZATION MARKET FOR CONSUMABLES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 64 TAIWAN: IN SITU HYBRIDIZATION MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 65 SINGAPORE: IN SITU HYBRIDIZATION MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

- TABLE 66 SINGAPORE: FLUORESCENCE IN SITU HYBRIDIZATION MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 67 SINGAPORE: IN SITU HYBRIDIZATION MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 68 SINGAPORE: IN SITU HYBRIDIZATION MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 69 SINGAPORE: IN SITU HYBRIDIZATION MARKET FOR CONSUMABLES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 70 SINGAPORE: IN SITU HYBRIDIZATION MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 71 AUSTRALIA: IN SITU HYBRIDIZATION MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

- TABLE 72 AUSTRALIA: FLUORESCENCE IN SITU HYBRIDIZATION MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 73 AUSTRALIA: IN SITU HYBRIDIZATION MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 74 AUSTRALIA: IN SITU HYBRIDIZATION MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 75 AUSTRALIA: IN SITU HYBRIDIZATION MARKET FOR CONSUMABLES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 76 AUSTRALIA: IN SITU HYBRIDIZATION MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 77 NEW ZEALAND: IN SITU HYBRIDIZATION MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

- TABLE 78 NEW ZEALAND: FLUORESCENCE IN SITU HYBRIDIZATION MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 79 NEW ZEALAND: IN SITU HYBRIDIZATION MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 80 NEW ZEALAND: IN SITU HYBRIDIZATION MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 81 NEW ZEALAND: IN SITU HYBRIDIZATION MARKET FOR CONSUMABLES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 82 NEW ZEALAND: IN SITU HYBRIDIZATION MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 83 REST OF ASIA PACIFIC: IN SITU HYBRIDIZATION MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

- TABLE 84 REST OF ASIA PACIFIC: FLUORESCENCE IN SITU HYBRIDIZATION MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 85 REST OF ASIA PACIFIC: IN SITU HYBRIDIZATION MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 86 REST OF ASIA PACIFIC: IN SITU HYBRIDIZATION MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 87 REST OF ASIA PACIFIC: IN SITU HYBRIDIZATION MARKET FOR CONSUMABLES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 88 REST OF ASIA PACIFIC: IN SITU HYBRIDIZATION MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 89 APAC IN SITU HYBRIDIZATION MARKET: STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 90 APAC IN SITU HYBRIDIZATION MARKET: PRODUCT LAUNCHES, 2019–2022

- TABLE 91 APAC IN SITU HYBRIDIZATION MARKET: DEALS, 2019–2022

- TABLE 92 ABBOTT LABORATORIES: BUSINESS OVERVIEW

- TABLE 93 F. HOFFMANN-LA ROCHE AG: BUSINESS OVERVIEW

- TABLE 94 THERMO FISHER SCIENTIFIC, INC.: BUSINESS OVERVIEW

- TABLE 95 DANAHER CORPORATION: BUSINESS OVERVIEW

- TABLE 96 AGILENT TECHNOLOGIES, INC.: BUSINESS OVERVIEW

- TABLE 97 BIOCARE MEDICAL: BUSINESS OVERVIEW

- TABLE 98 BIO-TECHNE CORPORATION: BUSINESS OVERVIEW

- TABLE 99 QIAGEN N.V.: BUSINESS OVERVIEW

- TABLE 100 MERCK KGAA: BUSINESS OVERVIEW

- TABLE 101 PERKINELMER: BUSINESS OVERVIEW

- TABLE 102 ENZO BIOCHEM: BUSINESS OVERVIEW

- TABLE 103 BIO-RAD LABORATORIES: BUSINESS OVERVIEW

- TABLE 104 ABNOVA CORPORATION: BUSINESS OVERVIEW

- TABLE 105 BIOGENEX LABORATORIES: BUSINESS OVERVIEW

- TABLE 106 OPGEN INC.: BUSINESS OVERVIEW

- TABLE 107 BIO SB: BUSINESS OVERVIEW

- TABLE 108 ABCAM: BUSINESS OVERVIEW

- TABLE 109 ZYTOMED SYSTEMS GMBH: BUSINESS OVERVIEW

- TABLE 110 NEOGENOMICS LABORATORIES: BUSINESS OVERVIEW

- TABLE 111 BIOVIEW: BUSINESS OVERVIEW

- TABLE 112 10X GENOMICS: BUSINESS OVERVIEW

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 BREAKDOWN OF PRIMARIES: APAC IN SITU HYBRIDIZATION MARKET

- FIGURE 3 MARKET SIZE ESTIMATION (COMPANY REVENUE ANALYSIS-BASED ESTIMATION)

- FIGURE 4 APAC IN SITU HYBRIDIZATION MARKET SIZE, 2021 (USD MILLION)

- FIGURE 5 APAC IN SITU HYBRIDIZATION MARKET: FINAL CAGR PROJECTIONS (2022−2027)

- FIGURE 6 APAC IN SITU HYBRIDIZATION MARKET: CAGR PROJECTIONS FROM ANALYSIS OF DEMAND-SIDE DRIVERS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 7 DATA TRIANGULATION METHODOLOGY

- FIGURE 8 APAC IN SITU HYBRIDIZATION MARKET, BY PRODUCT, 2022 VS. 2027 (USD MILLION)

- FIGURE 9 APAC IN SITU HYBRIDIZATION MARKET SHARE, BY PRODUCT, 2021

- FIGURE 10 APAC IN SITU HYBRIDIZATION MARKET, BY TECHNOLOGY, 2022 VS. 2027 (USD MILLION)

- FIGURE 11 APAC FLUORESCENCE IN SITU HYBRIDIZATION MARKET SHARE, BY TYPE, 2021

- FIGURE 12 APAC IN SITU HYBRIDIZATION MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

- FIGURE 13 GROWING FOCUS ON COMPANION DIAGNOSTICS AND INCREASING CANCER INCIDENCE TO FAVOR MARKET GROWTH

- FIGURE 14 HOSPITAL & DIAGNOSTIC LABORATORIES TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 APAC IN SITU HYBRIDIZATION MARKET: DRIVERS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 16 HEMOPHILIA OCCURRENCE, BY REGION

- FIGURE 17 SUPPLY CHAIN ANALYSIS OF APAC IN SITU HYBRIDIZATION MARKET

- FIGURE 18 VALUE CHAIN ANALYSIS OF APAC IN SITU HYBRIDIZATION MARKET

- FIGURE 19 ECOSYSTEM ANALYSIS OF APAC IN SITU HYBRIDIZATION MARKET

- FIGURE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF IN SITU HYBRIDIZATION MARKET IN ASIA PACIFIC

- FIGURE 21 KEY BUYING CRITERIA FOR END USERS

- FIGURE 22 APAC IN SITU HYBRIDIZATION MARKET SNAPSHOT

- FIGURE 23 APAC IN SITU HYBRIDIZATION MARKET SHARE ANALYSIS (2021)

- FIGURE 24 REVENUE ANALYSIS OF KEY COMPANIES (2019−2021)

- FIGURE 25 APAC IN SITU HYBRIDIZATION MARKET: COMPANY EVALUATION MATRIX (2021)

- FIGURE 26 ABBOTT LABORATORIES: COMPANY SNAPSHOT (2021)

- FIGURE 27 F. HOFFMANN-LA ROCHE AG: COMPANY SNAPSHOT (2021)

- FIGURE 28 THERMO FISHER SCIENTIFIC, INC.: COMPANY SNAPSHOT (2021)

- FIGURE 29 DANAHER CORPORATION: COMPANY SNAPSHOT (2021)

- FIGURE 30 AGILENT TECHNOLOGIES, INC.: COMPANY SNAPSHOT (2021)

- FIGURE 31 BIO-TECHNE CORPORATION: COMPANY SNAPSHOT (2021)

- FIGURE 32 QIAGEN N.V.: COMPANY SNAPSHOT (2021)

- FIGURE 33 MERCK KGAA: COMPANY SNAPSHOT (2021)

- FIGURE 34 PERKINELMER: COMPANY SNAPSHOT (2021)

- FIGURE 35 ENZO BIOCHEM: COMPANY SNAPSHOT (2021)

- FIGURE 36 BIO-RAD LABORATORIES: COMPANY SNAPSHOT (2021)

- FIGURE 37 OPGEN INC.: COMPANY SNAPSHOT (2021)

- FIGURE 38 ABCAM: COMPANY SNAPSHOT (2021)

- FIGURE 39 NEOGENOMICS LABORATORIES: COMPANY SNAPSHOT (2021)

- FIGURE 40 BIOVIEW: COMPANY SNAPSHOT (2021)

- FIGURE 41 10X GENOMICS: COMPANY SNAPSHOT (2021)

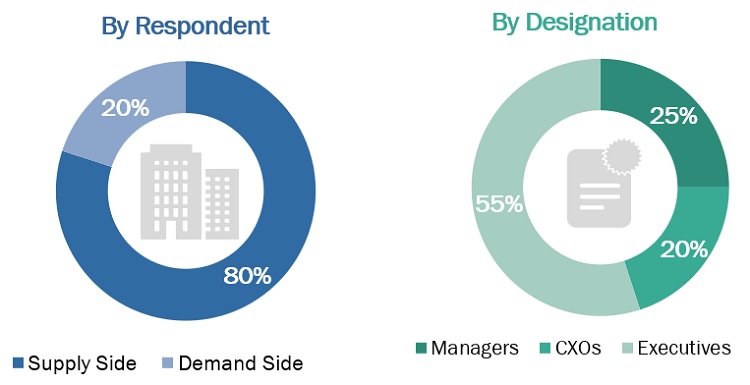

This study involved four major activities in estimating the current size of the Asia Pacific in situ hybridization market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of segments.

Secondary Research

Secondary research was used mainly to identify and collect information for the extensive, technical, market-oriented, and commercial study of the in situ hybridization market. The secondary sources used for this study include Some of the key secondary sources referred to for this study include publications from government sources World Health Organization (WHO), Organization for Economic Co-operation and Development (OECD), GLOBOCAN, World Bank, World Cancer Research Fund, Centers for Disease Control and Prevention (CDC), American Cancer Society (ACS), American Association for Clinical Chemistry, US Food and Drug Administration (FDA). These sources were also used to obtain key information about major players, market classification, and segmentation according to industry trends, country-level markets, market developments, and technology perspectives.

Primary Research

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess future prospects of the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the in situ hybridization market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research

- The revenues generated from the in situ hybridization business of leading players have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size from the market size estimation process, the total market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the Asia Pacific in situ hybridization market based on product, technology, application, end user, and country

- To provide detailed information regarding the major factors influencing the growth of the market (such as drivers, challenges, and opportunities)

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and contributions to the Asia Pacific in situ hybridization market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to eight key countries, namely, Japan, China, India, South Korea, Taiwan, Singapore, Australia, New Zealand, and Rest of Asia Pacific.

- To strategically profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze competitive developments such as acquisitions, product launches, and expansions in the Asia Pacific in situ hybridization market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Company Information

- An additional five company profiles

Global Analysis

- Breakdown of Market into North America, Europe, Asia Pacific, and Rest of the World.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in APAC In Situ Hybridization Market